FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

In MetaTrader 4 (MT4) and MetaTrader 5 (MT5), you can display the Moving Average (MA), one of the most commonly used technical indicators. There are several types of MAs, including the Simple Moving Average (SMA), as wel as the Exponential Moving Average (EMA), which places more emphasis on recent prices.

Here we will look at how to add MA to charts on MT4/MT5.

Switch between MT4/MT5 tabs to check the steps for each.

Step 1

You can add MA from the menu and the Navigator.

Add MA from the menu

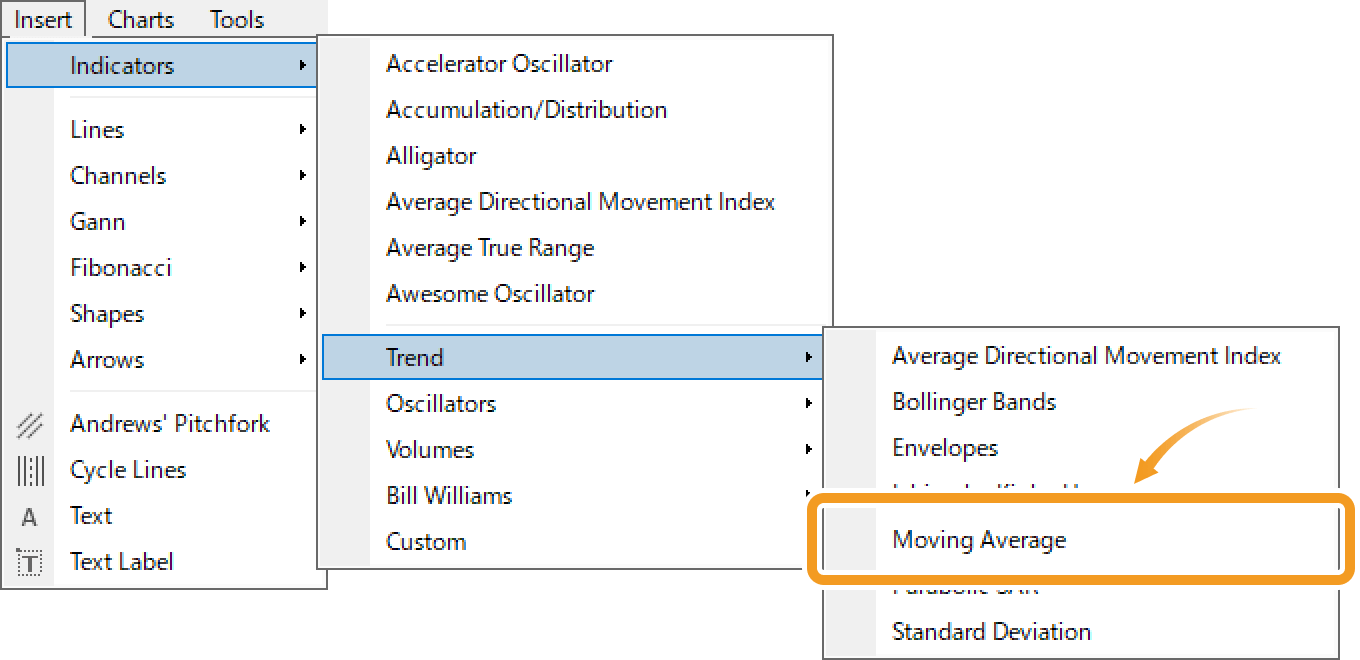

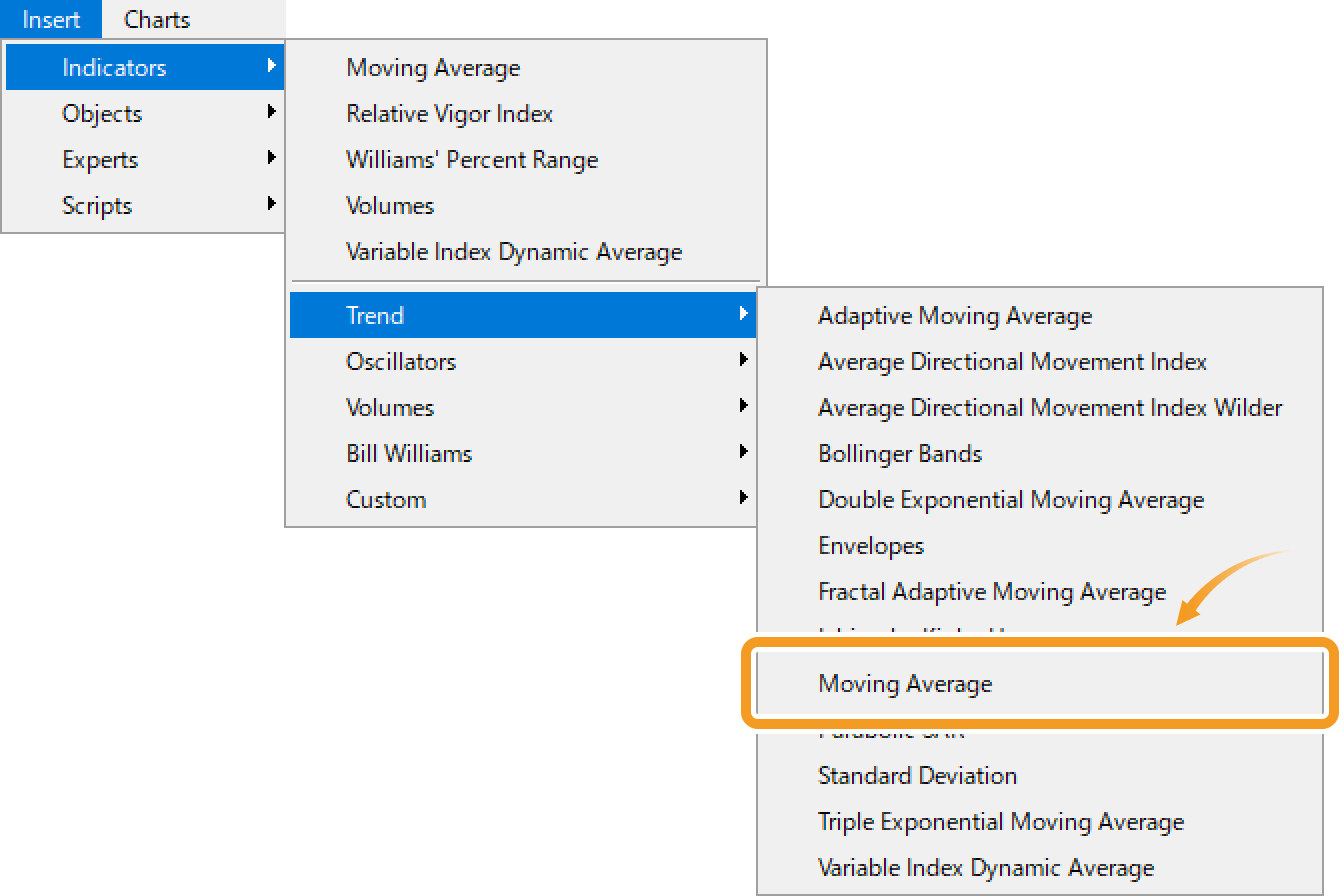

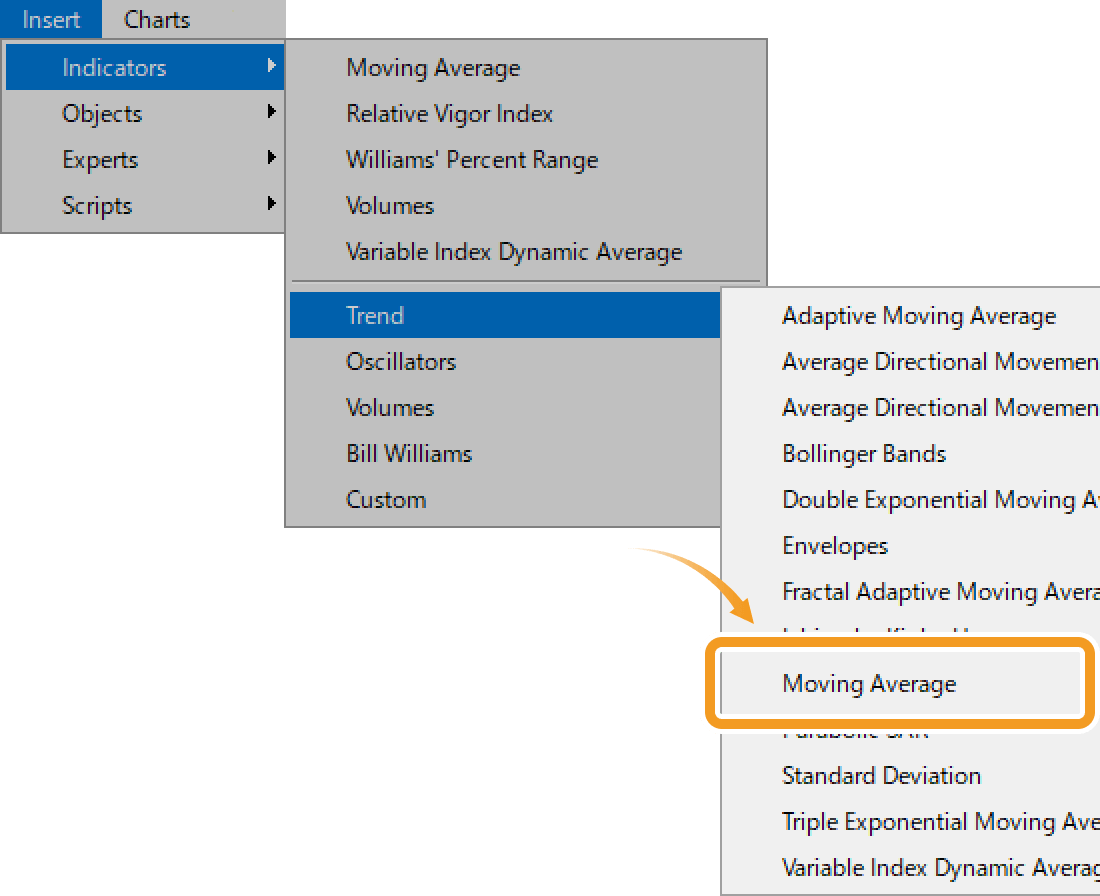

Click "Insert" in the menu. Hover the pointer over "Indicators" > "Trend" and select "Moving Average".

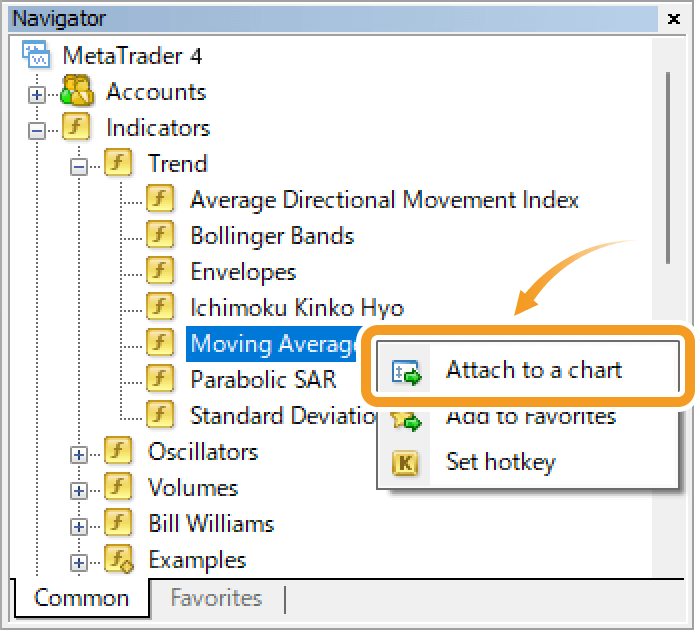

Add MA from the Navigator

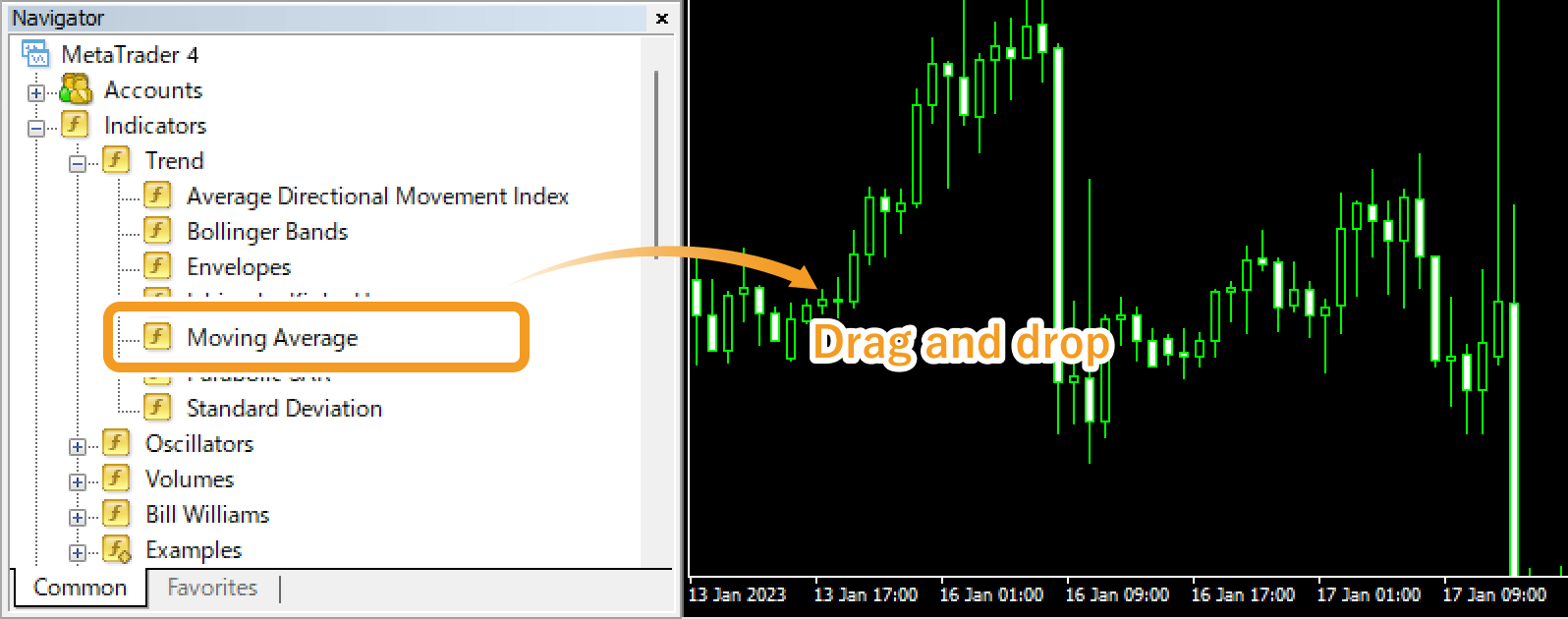

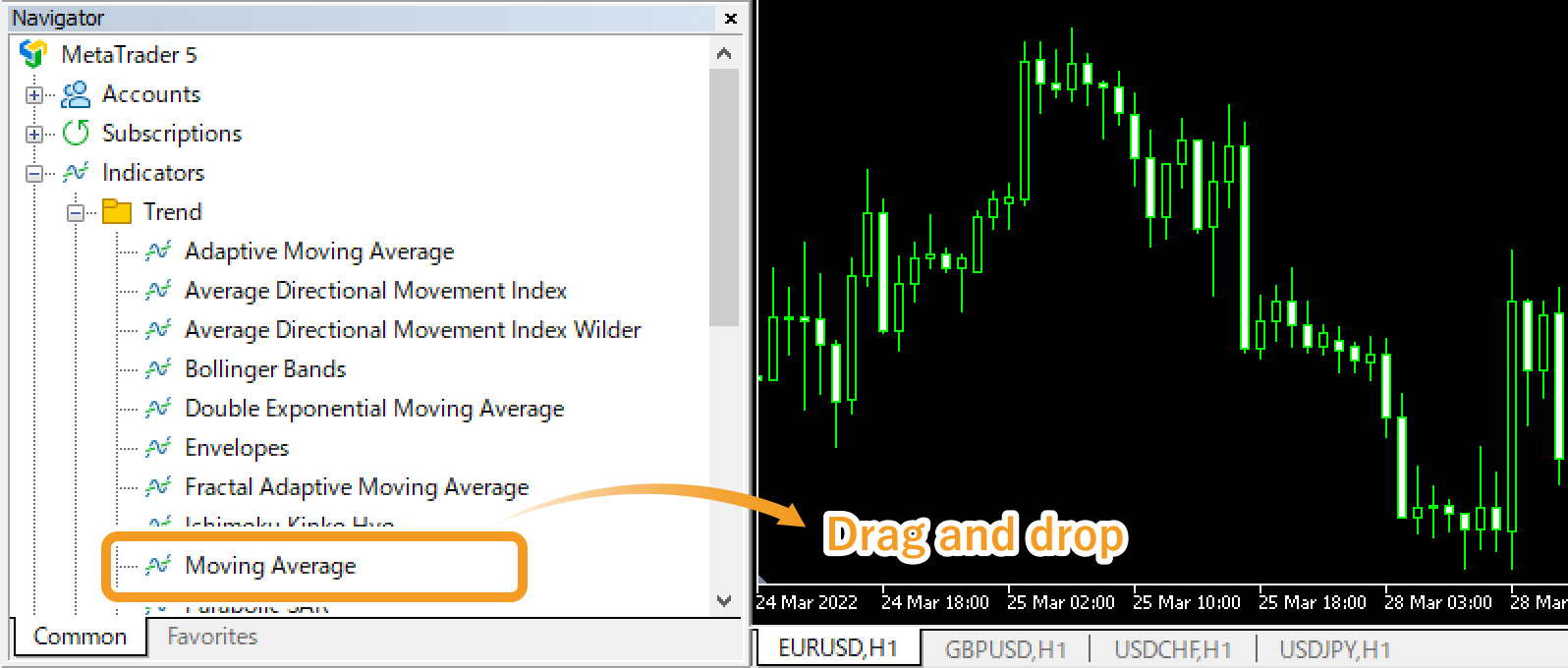

On the Navigator, click on the "+" sign next to "Indicators" and then "Trend". Select "Moving Average" and drag it onto the chart you wish to apply it to.

Or, right-click on "Moving Average" and select "Attach to a chart".

Step 2

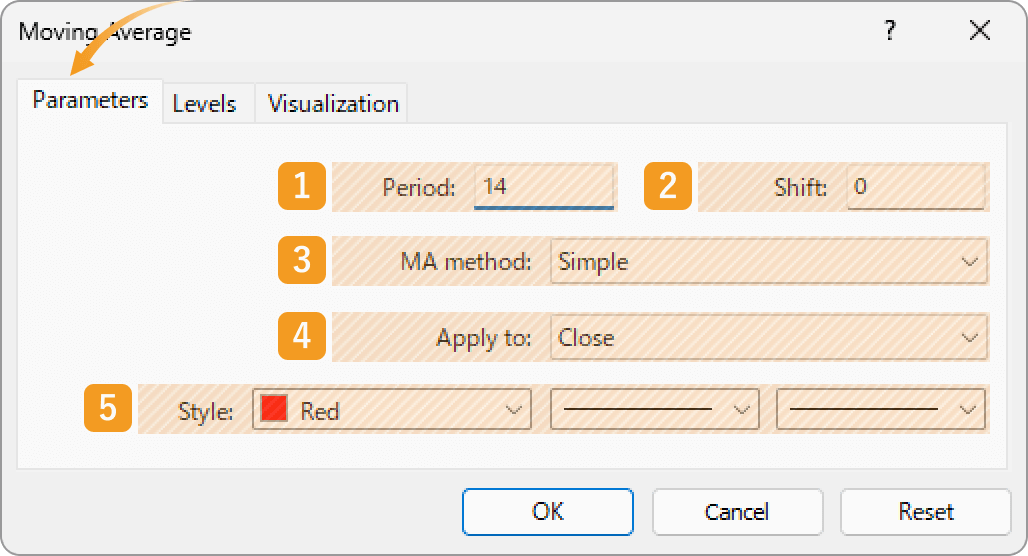

The setting window for MA will appear. Set the parameters in the "Parameters", "Levels", and "Visualization" tab and click "OK".

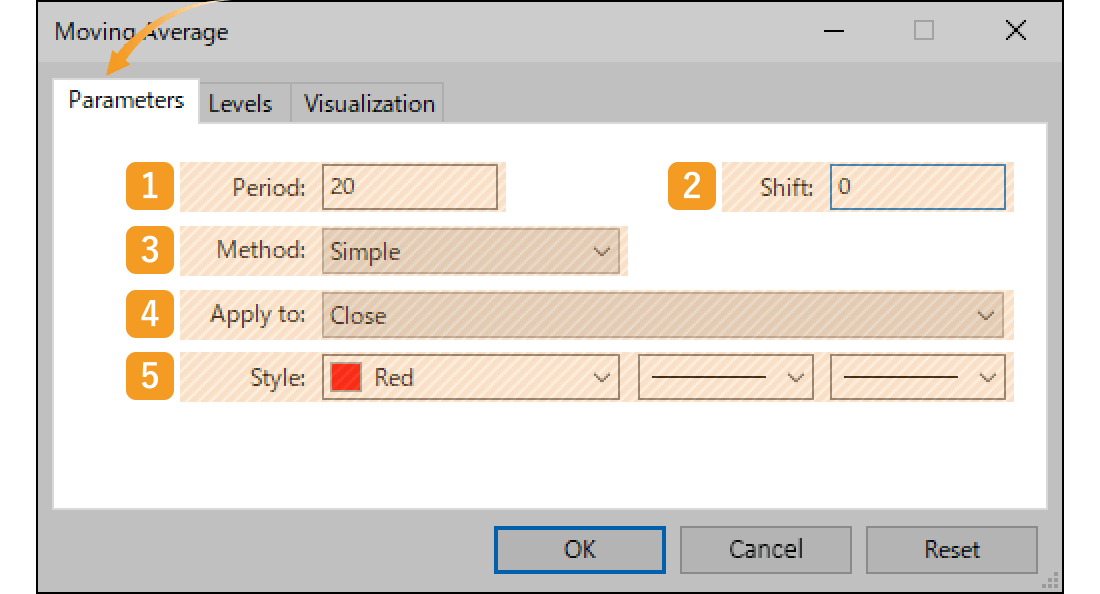

"Parameters" tab

|

Number |

Item name |

Descriptions |

|---|---|---|

|

1 |

Period |

Set the period for the MA. The unit here is the number of candlesticks. If you select the daily chart and set it to "20", the MA for the past 20 days will be generated. |

|

2 |

Shift |

You can shift the placement of the MA to the left or right. The unit is the number of candles. Type a positive value to move it to the right, and a negative value to move it to the left. |

|

3 |

MA method |

Select the type of moving average to display. Simple: simple moving average (SMA) Exponential: exponential moving average (EMA) Smoothed: smoothed moving average (SMMA) Linear Weighted: linear weighted moving average (LWMA) |

|

4 |

Apply to |

Price to use for calculating MA. Close: close price Open: open price High: high price Low: low price Median Price (HL/2): (high price + low price) ÷2 Typical Price (HLC/3): (high price + low price + close price) ÷3 Weighted Close (HLCC/4): (high price + low price + close price×2) ÷4 Previous Indicator's Data: the value of the indicator displayed last First Indicator's Data: the value of the indicator displayed first |

|

5 |

Style |

Set the color, line type, and line thickness for MA. |

Among the options in the "Apply to" field, "Previous Indicator's Data" and "First Indicator's Data" use the values of an indicator displayed in a sub-window, rather than the price of the chart's symbol.

For example, if volume is shown as the first indicator in a sub-window and you select First Indicator's Data, the MA will be calculated based on the volume.

On MT4, these options remain visible even when not available, but if selected in such cases, they will automatically default to Close.

Granville, famous for "Granville's Law," categorized the correlations between price movements and the 200-day MA into 8 different patterns. This approach, which popularized the use of the 200-day MA on daily charts, laid the foundation for the widespread use of moving averages.

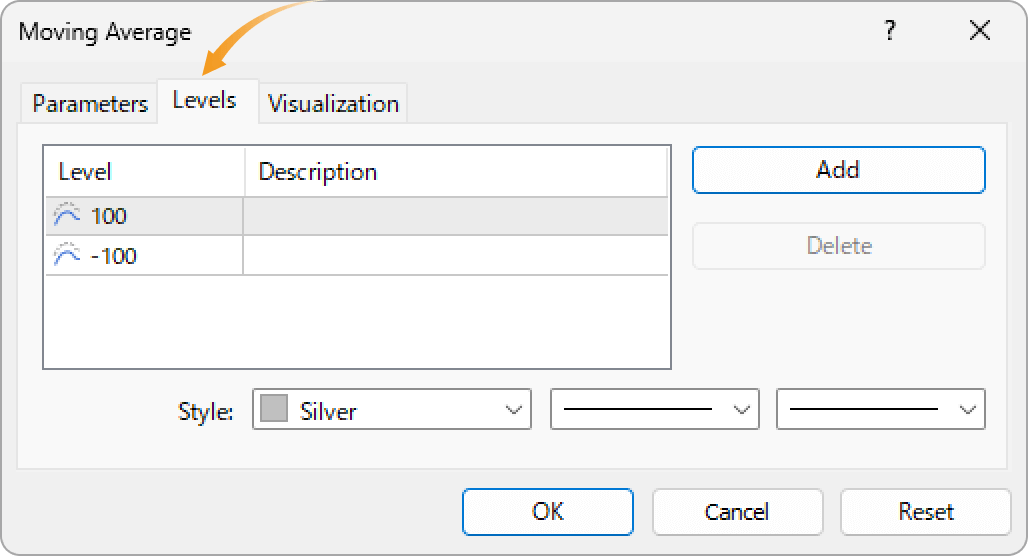

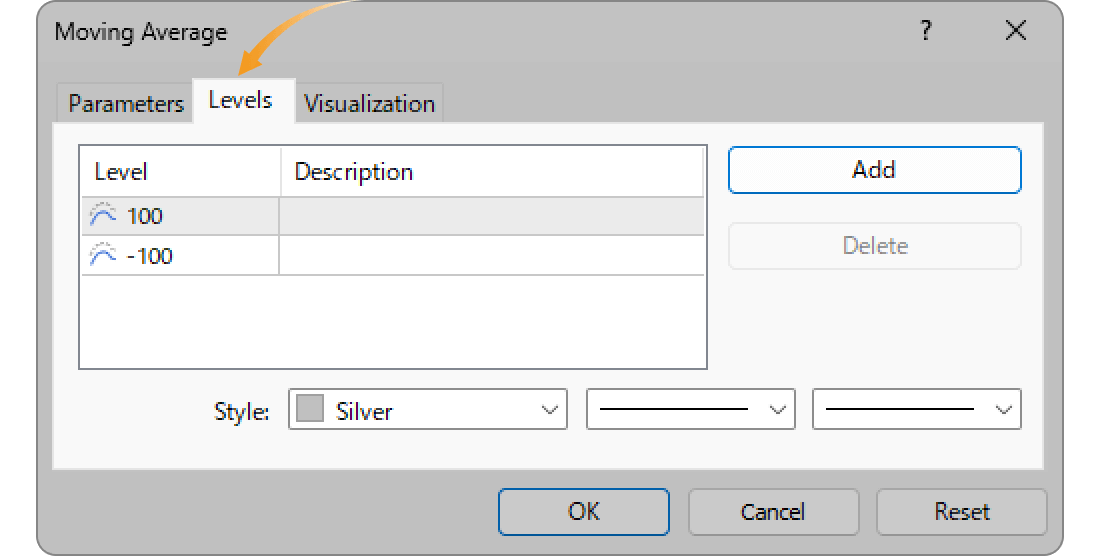

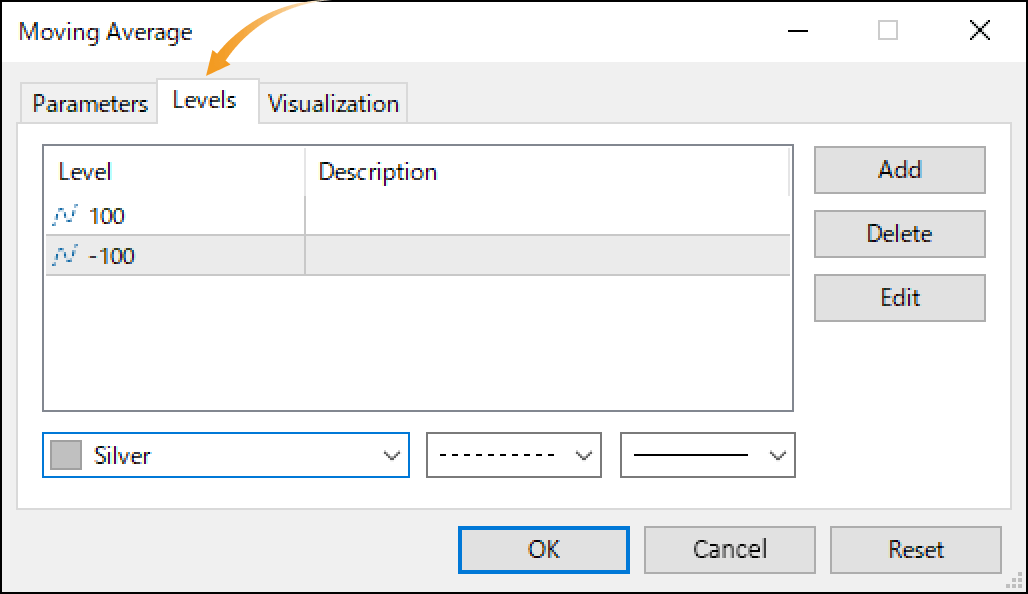

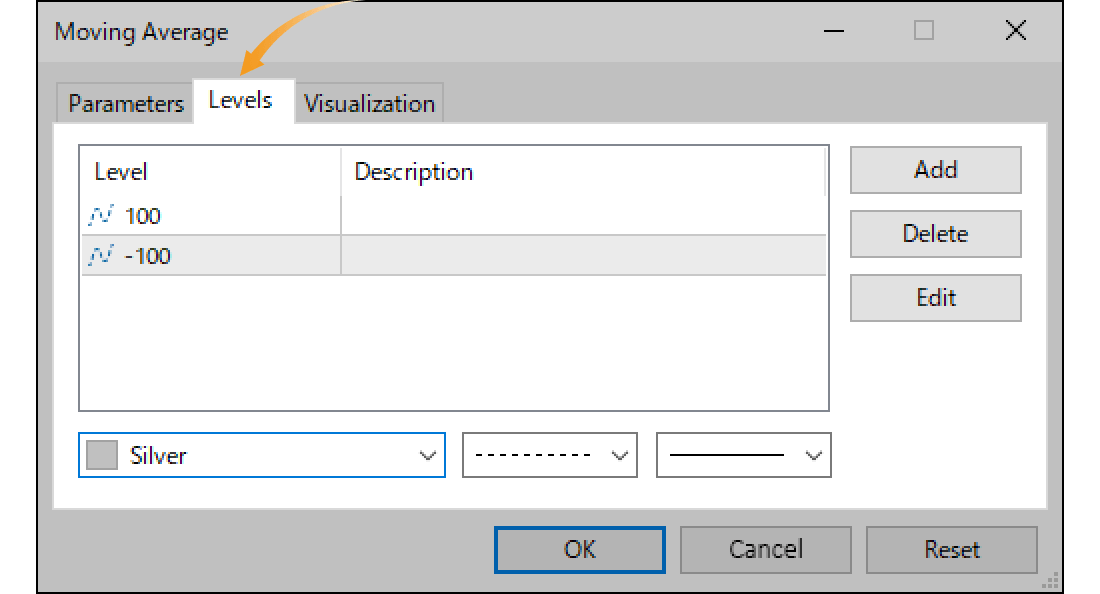

"Levels" tab

Go to the "Levels" tab and click "Add". Enter a positive number (unit: points) to show a new MA on top, and a negative number to show a new MA on the bottom of the current MA.

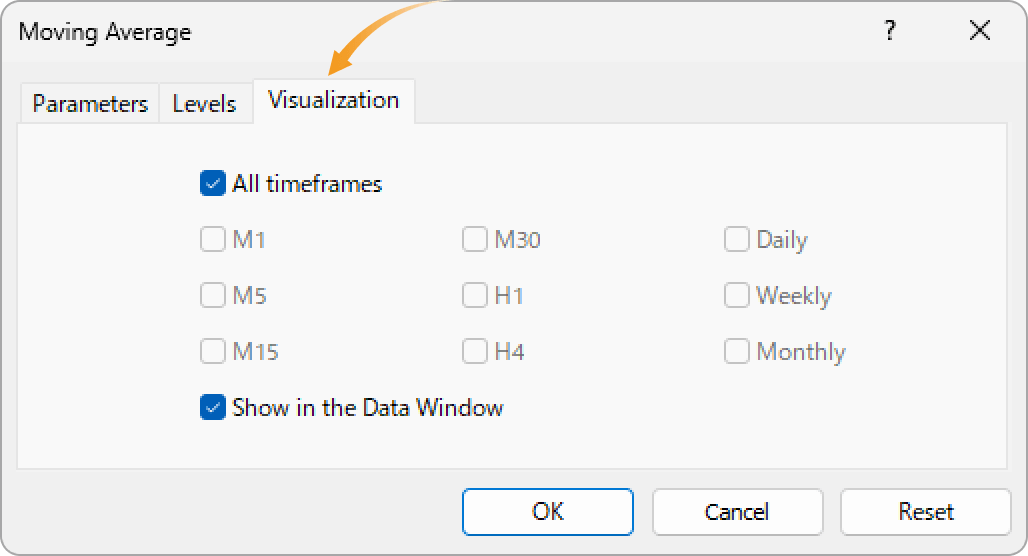

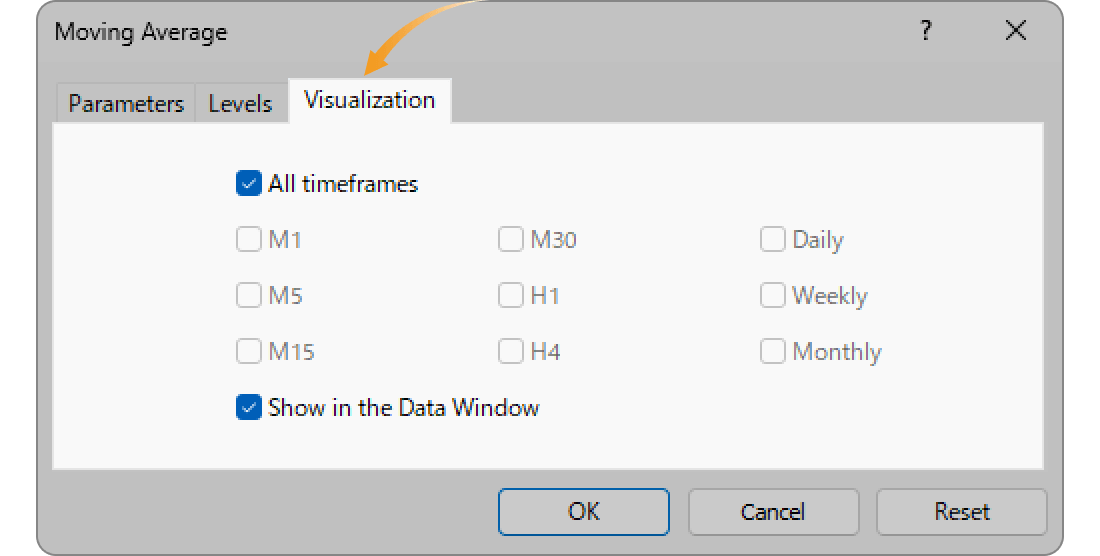

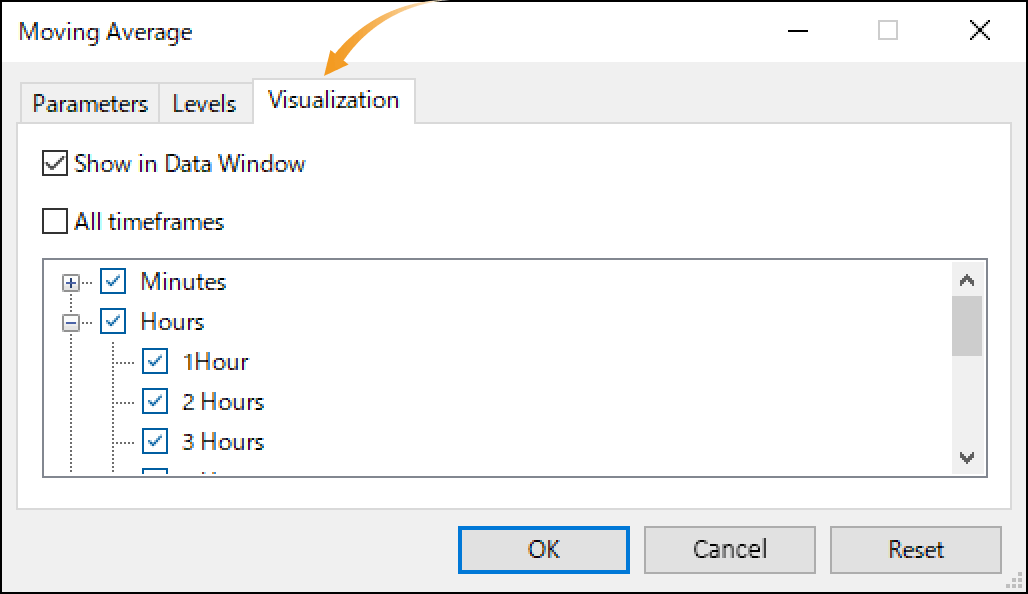

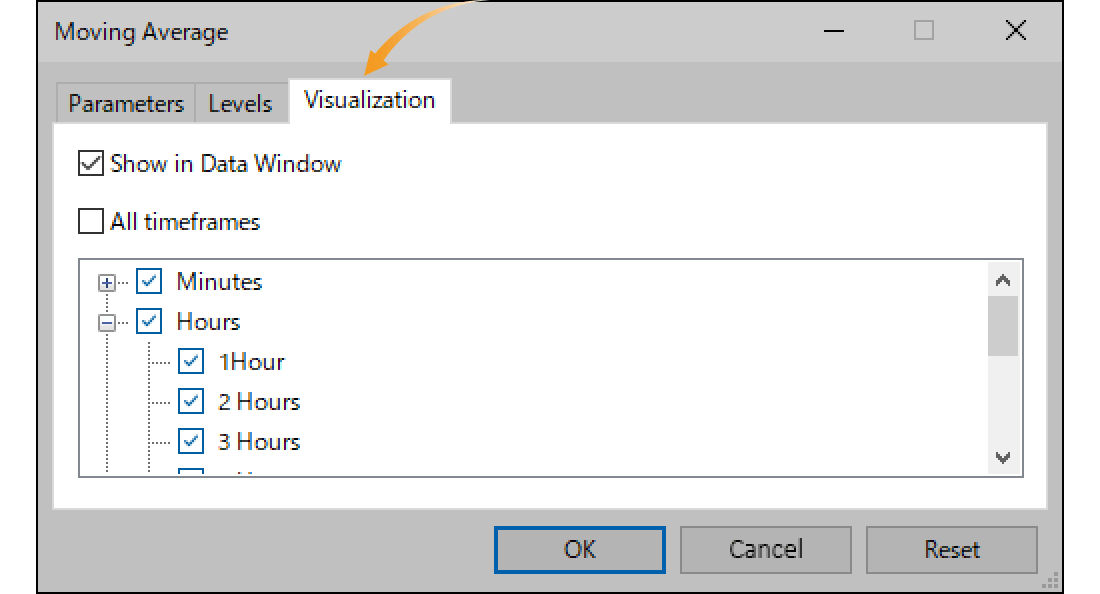

"Visualization" tab

On the "Visualization" tab, you can show/hide MA in the Data Window and specify the timeframes to use MA with.

Step 3

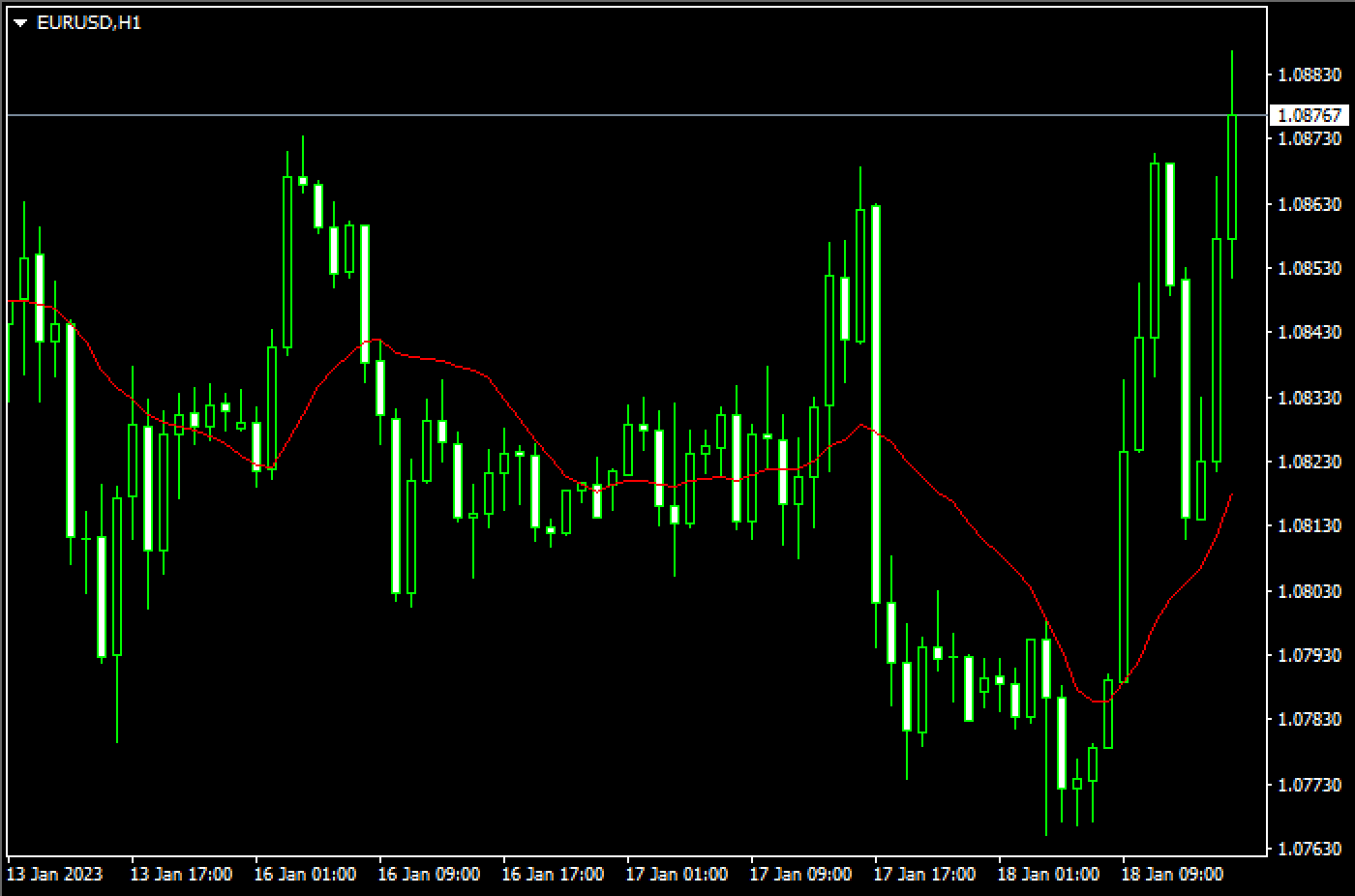

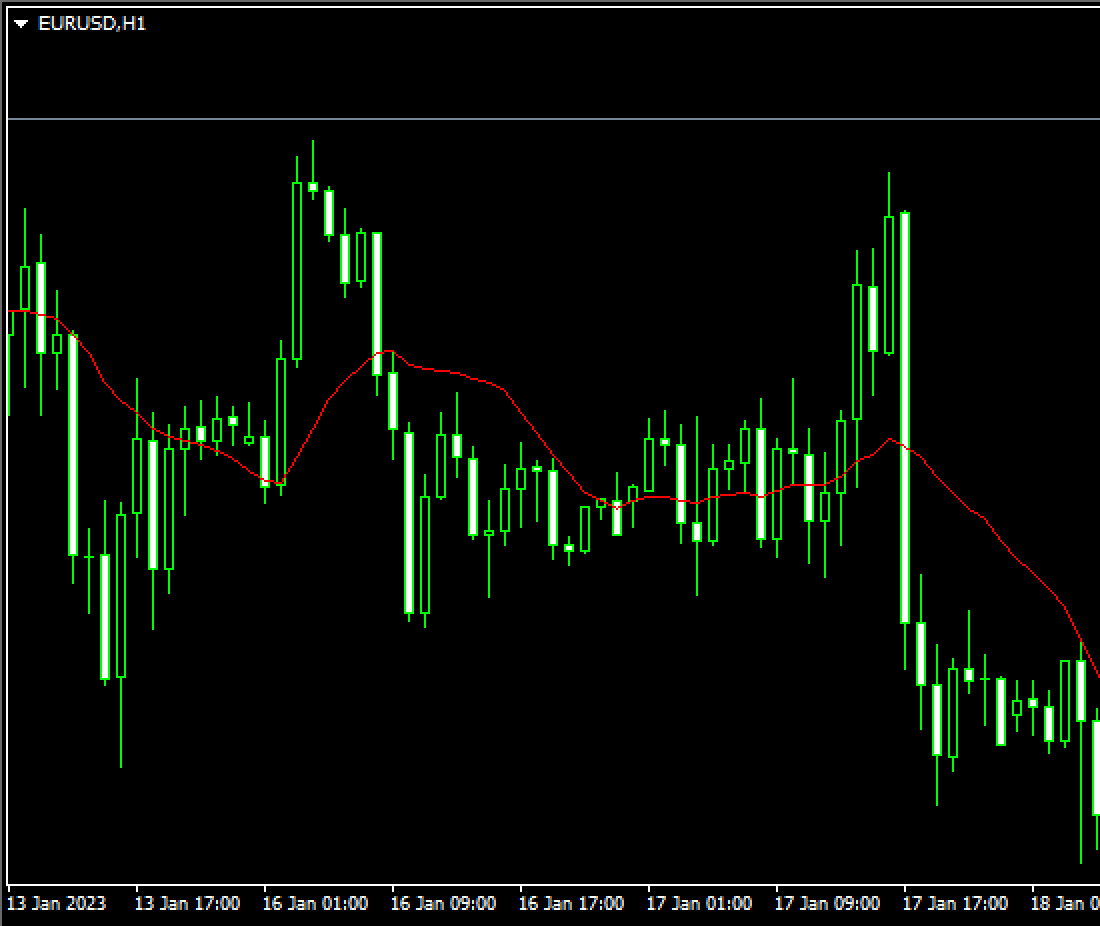

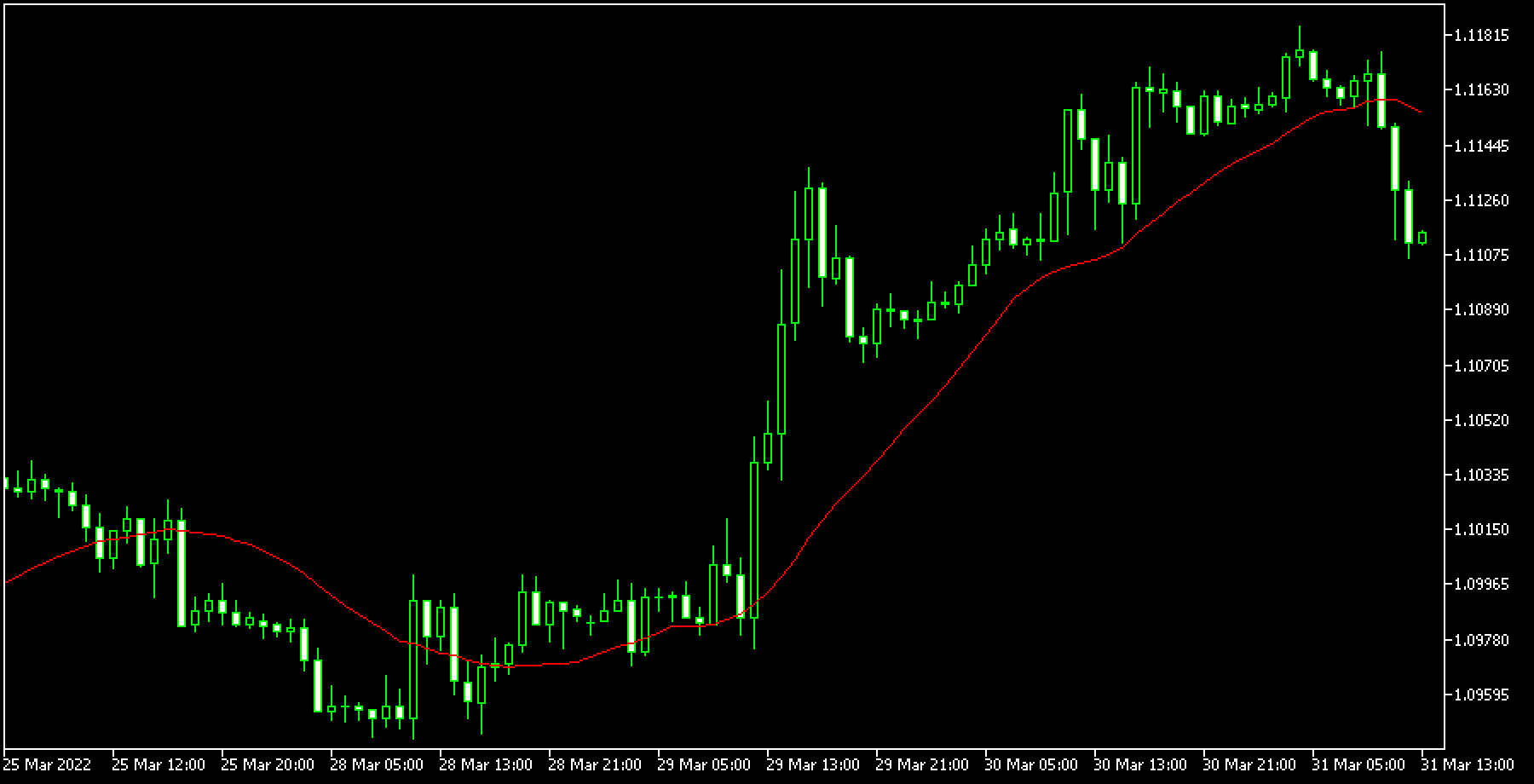

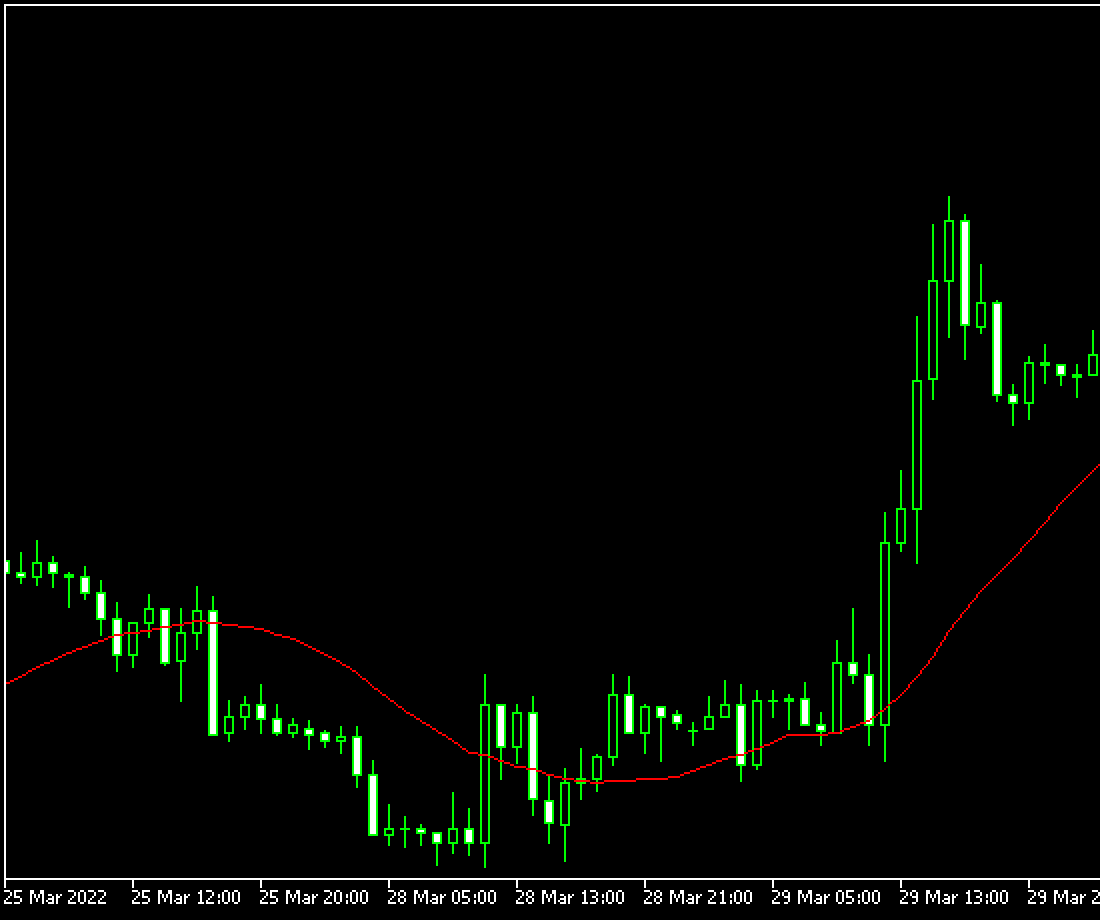

MA will be displayed on the chart.

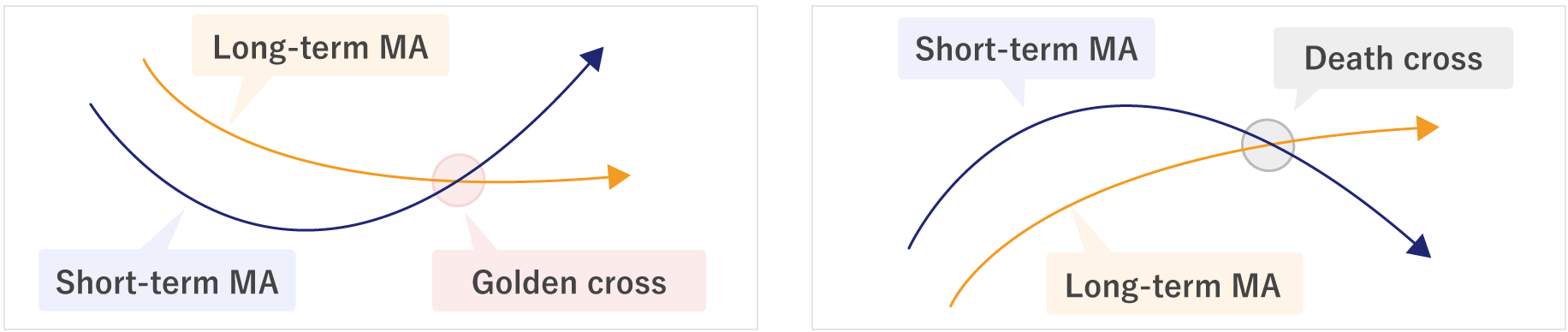

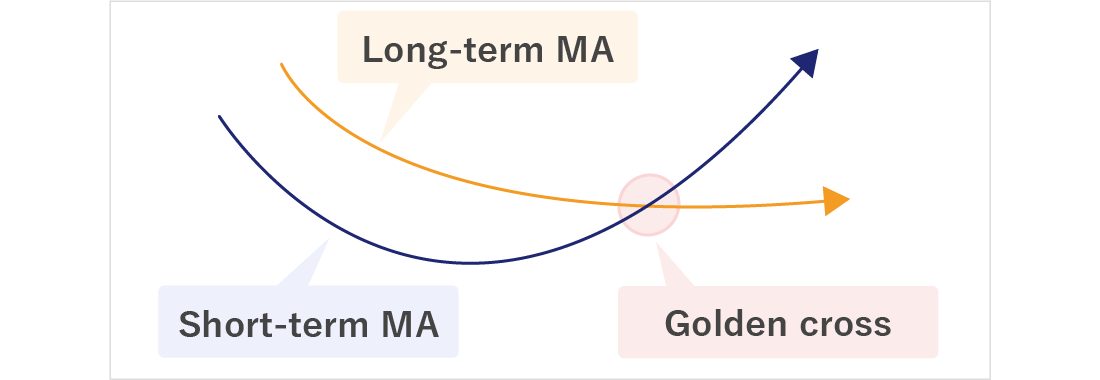

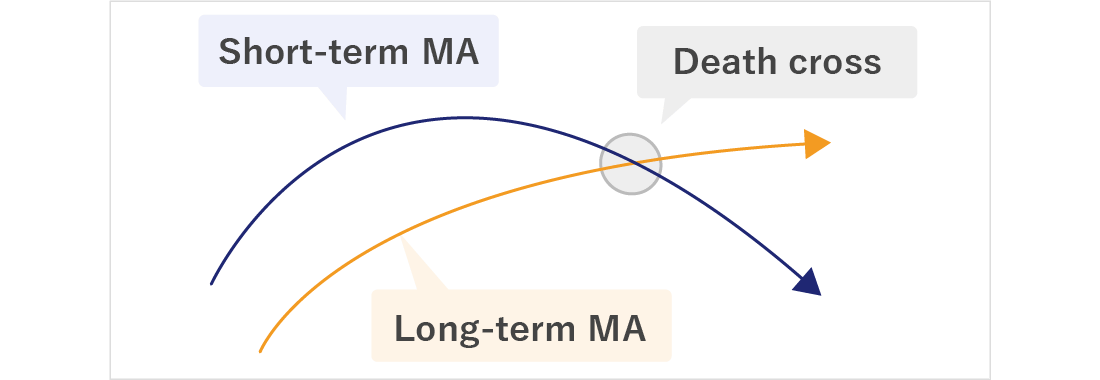

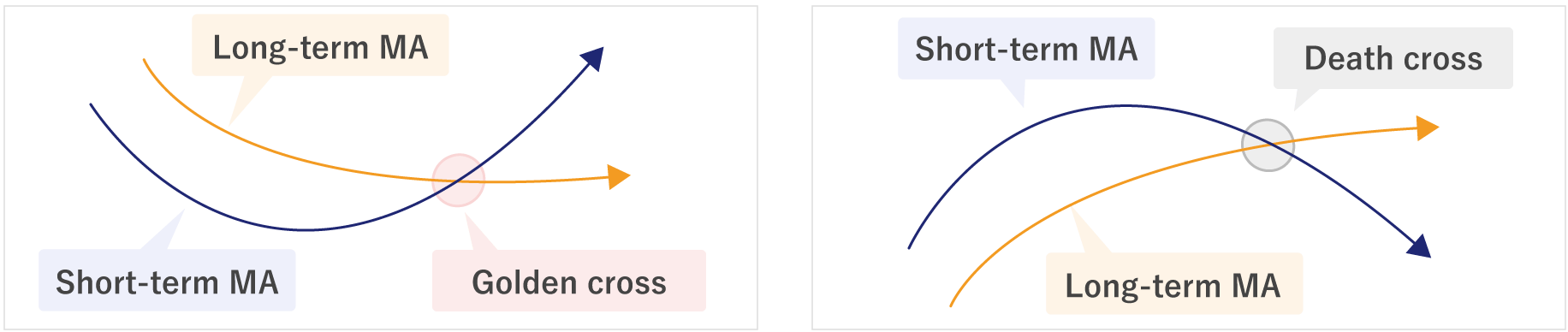

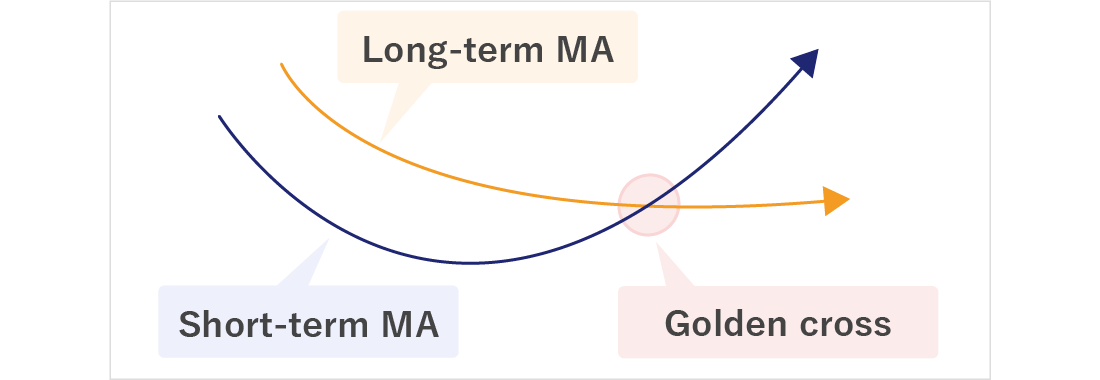

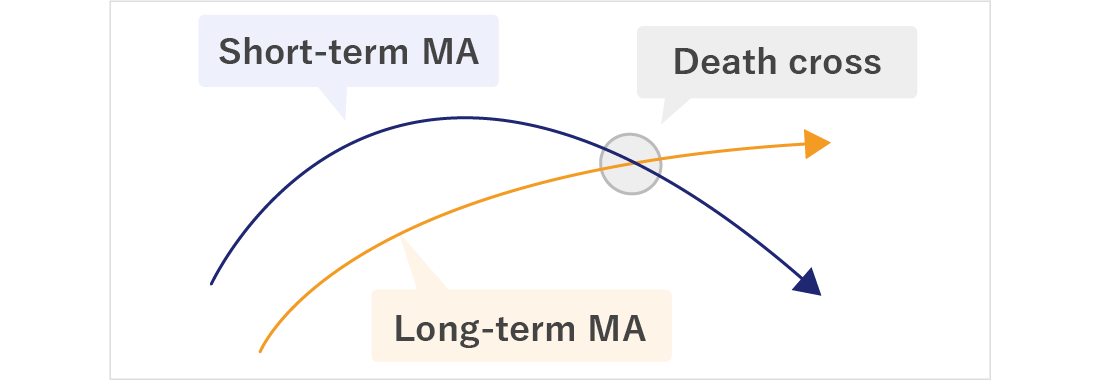

MA is classified into short/medium/long term and they're often used together. When the short-term MA crosses the long-term MA from the bottom up, it's called the "golden cross" which indicates a bull market. And when the short-term MA crosses the long-term MA from top to bottom, it's referred to as the "death cross", which indicates a bear market.

Step 1

You can add MA from the menu and the Navigator.

Add MA from the menu

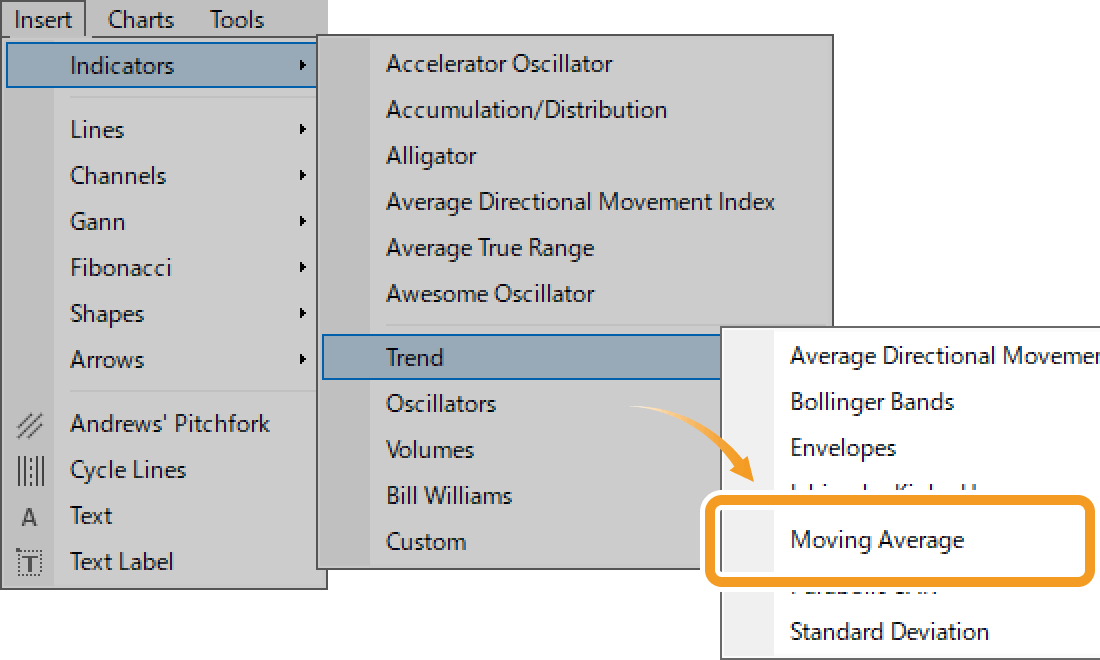

Click "Insert" in the menu. Hover the pointer over "Indicators" > "Trend" and select "Moving Average".

Add MA from the Navigator

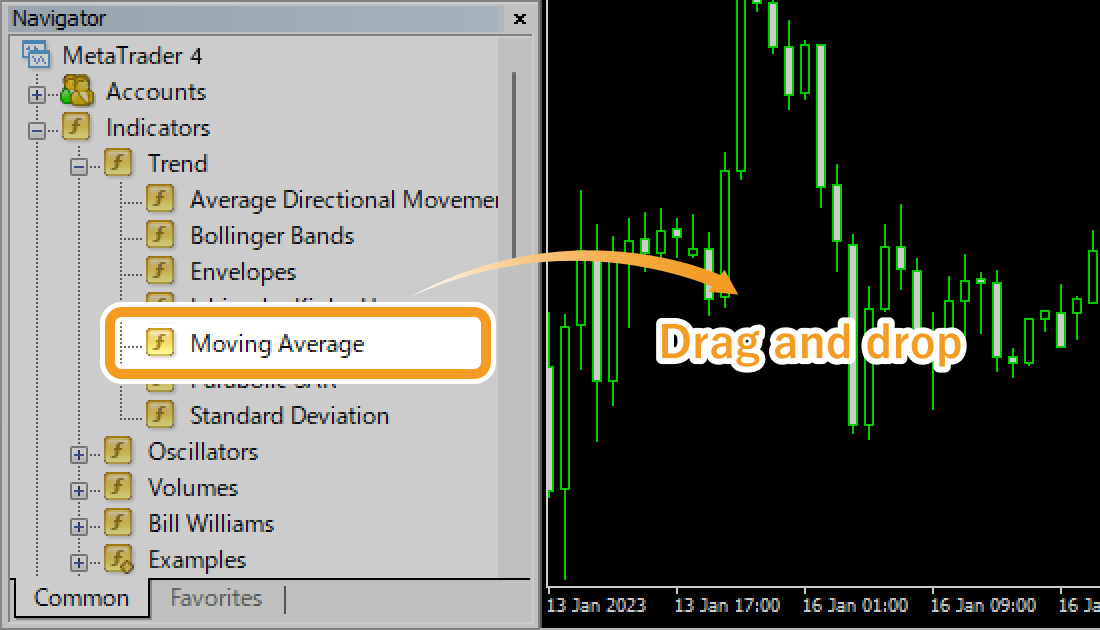

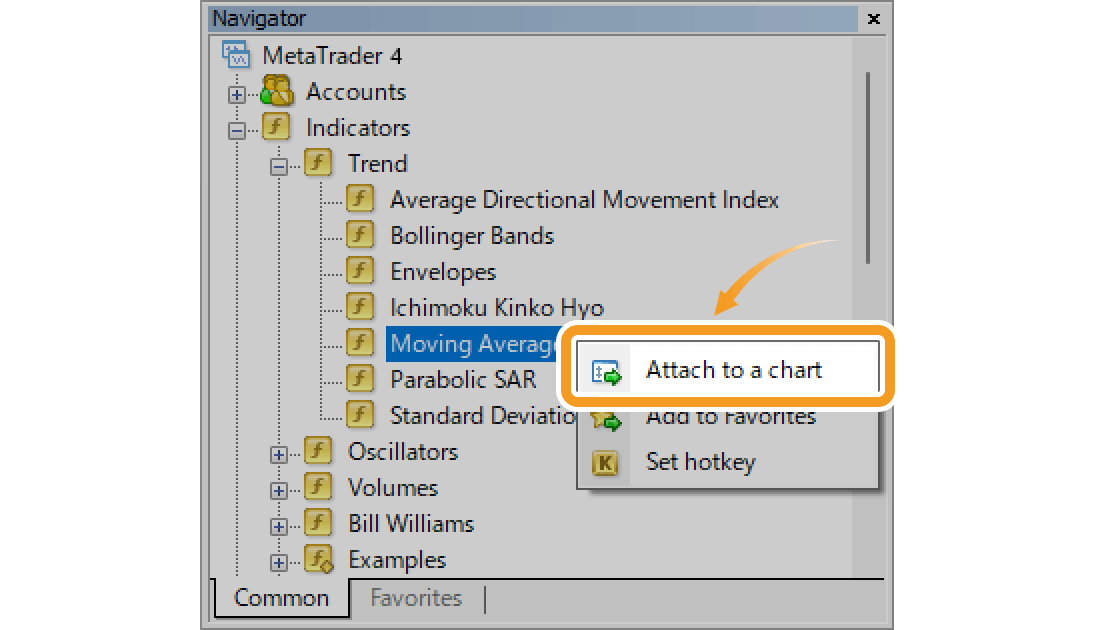

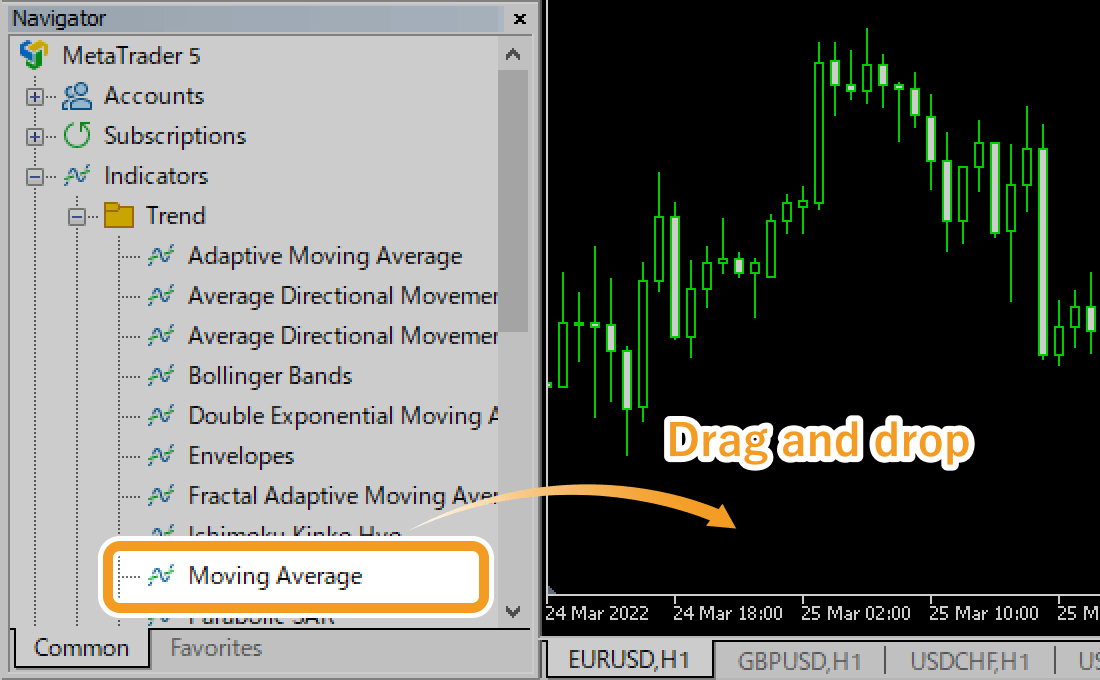

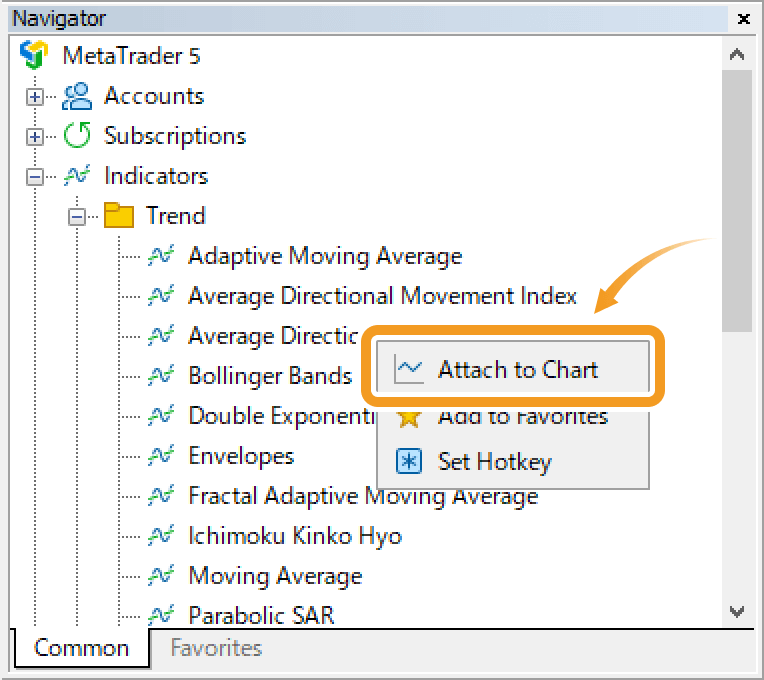

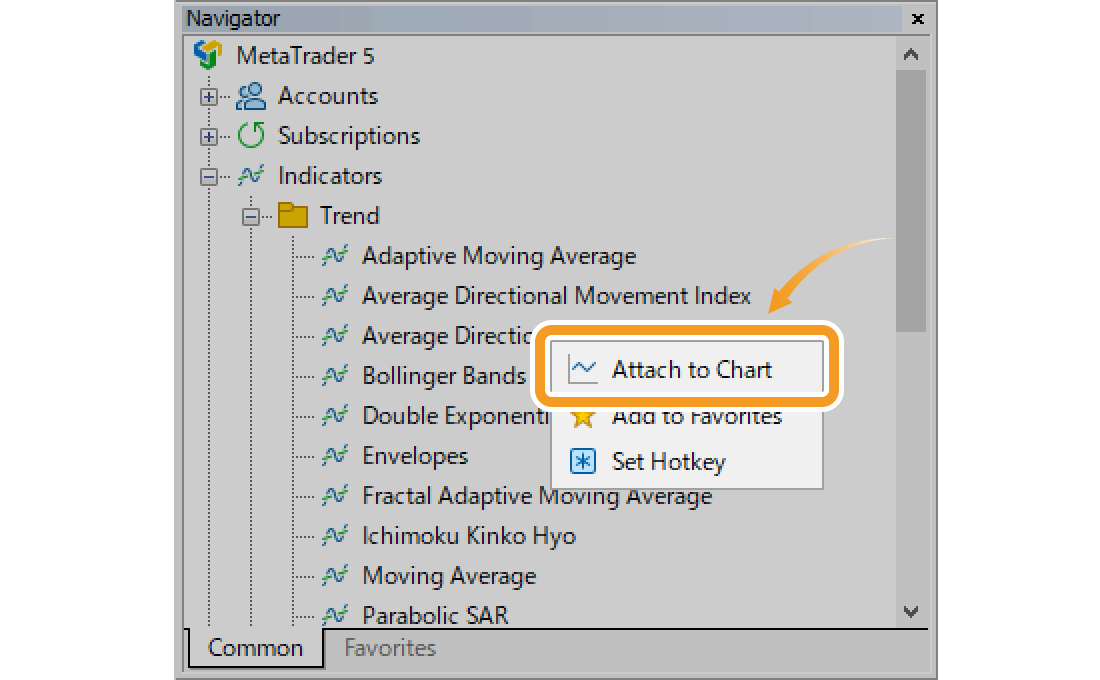

On the Navigator, go to "Indicators" and click on the "+" sign next to "Trend". Select "Moving Average" and drag it onto the chart you wish to apply it to.

Or, right-click on "Moving Average" and select "Attach to Chart".

Step 2

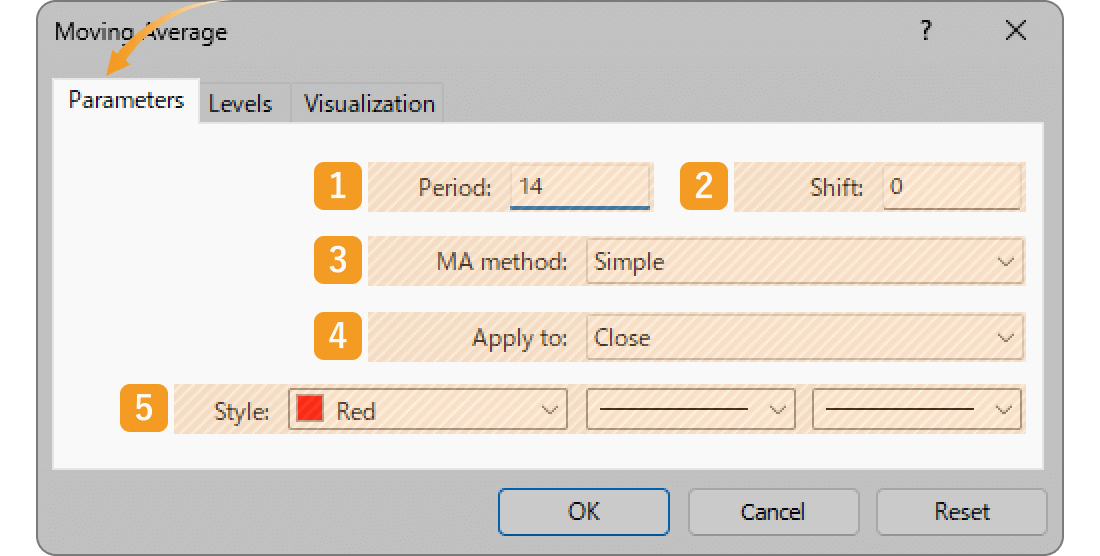

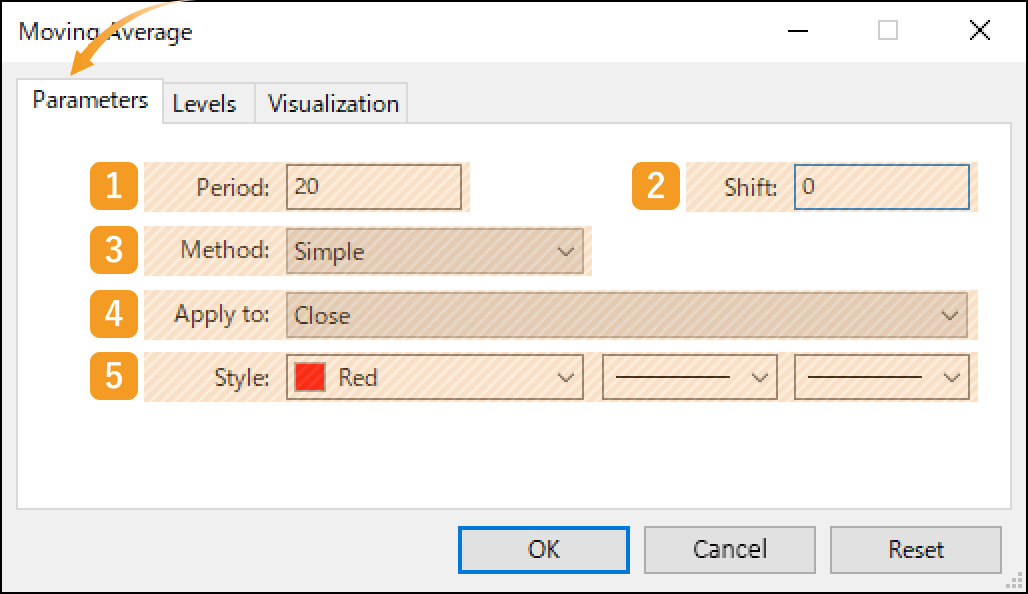

The setting window for MA will appear. Set the parameters in the "Parameters", "Levels", and "Visualization" tab and click "OK".

"Parameters" tab

|

Number |

Item name |

Descriptions |

|---|---|---|

|

1 |

Period |

Set the period for the MA. The unit here is the number of candlesticks. If you select the daily chart and set it to "20", the MA for the past 20 days will be generated. |

|

2 |

Shift |

You can shift the placement of the MA to the left or right. The unit is the number of candles. Type a positive value to move it to the right, and a negative value to move it to the left. |

|

3 |

Method |

Select the type of moving average to display. Simple: simple moving average (SMA) Exponential: exponential moving average (EMA) Smoothed: smoothed moving average (SMMA) Linear Weighted: linear weighted moving average (LWMA) |

|

4 |

Apply to |

Price to use for calculating MA. Close: close price Open: open price High: high price Low: low price Median Price (HL/2): (high price + low price) ÷2 Typical Price (HLC/3): (high price + low price + close price) ÷3 Weighted Close (HLCC/4): (high price + low price + close price×2) ÷4 Previous Indicator's Data: the value of the indicator displayed last First Indicator's Data: the value of the indicator displayed first |

|

5 |

Style |

Set the color, line type, and line thickness for MA. |

Among the options in the "Apply to" field, "Previous Indicator's Data" and "First Indicator's Data" use the values of an indicator displayed in a sub-window, rather than the price of the chart's symbol.

For example, if volume is shown as the first indicator in a sub-window and you select First Indicator's Data, the MA will be calculated based on the volume.

Granville, famous for "Granville's Law," categorized the correlations between price movements and the 200-day MA into 8 different patterns. This approach, which popularized the use of the 200-day MA on daily charts, laid the foundation for the widespread use of moving averages.

"Levels" tab

Go to the "Levels" tab and click "Add". Enter a positive number (unit: points) to show a new MA on top, and a negative number to show a new MA on the bottom of the current MA.

"Visualization" tab

On the "Visualization" tab, you can show/hide MA in the Data Window and specify the timeframes to use MA with.

Step 3

MA will be displayed on the chart.

MA is classified into short/medium/long term and they're often used together. When the short-term MA crosses the long-term MA from the bottom up, it's called the "golden cross" which indicates a bull market. And when the short-term MA crosses the long-term MA from top to bottom, it's referred to as the "death cross", which indicates a bear market.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy