- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

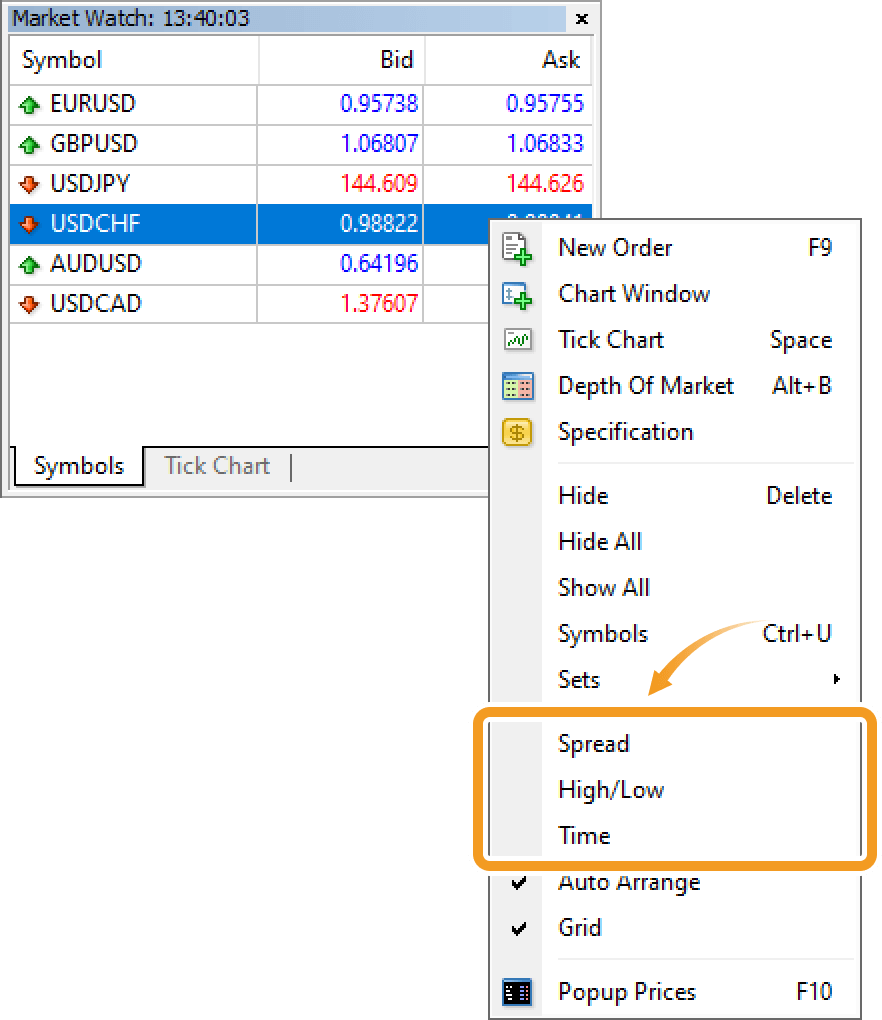

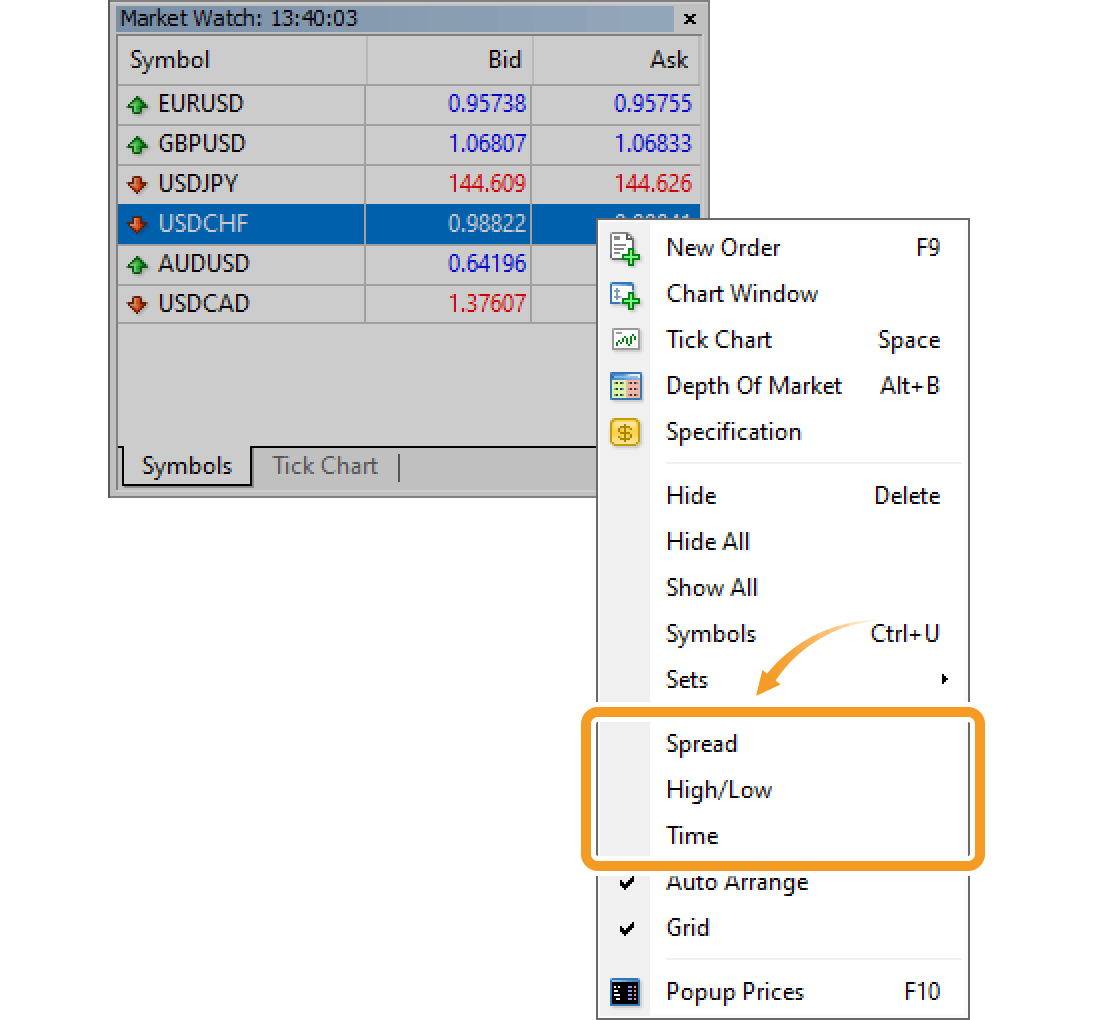

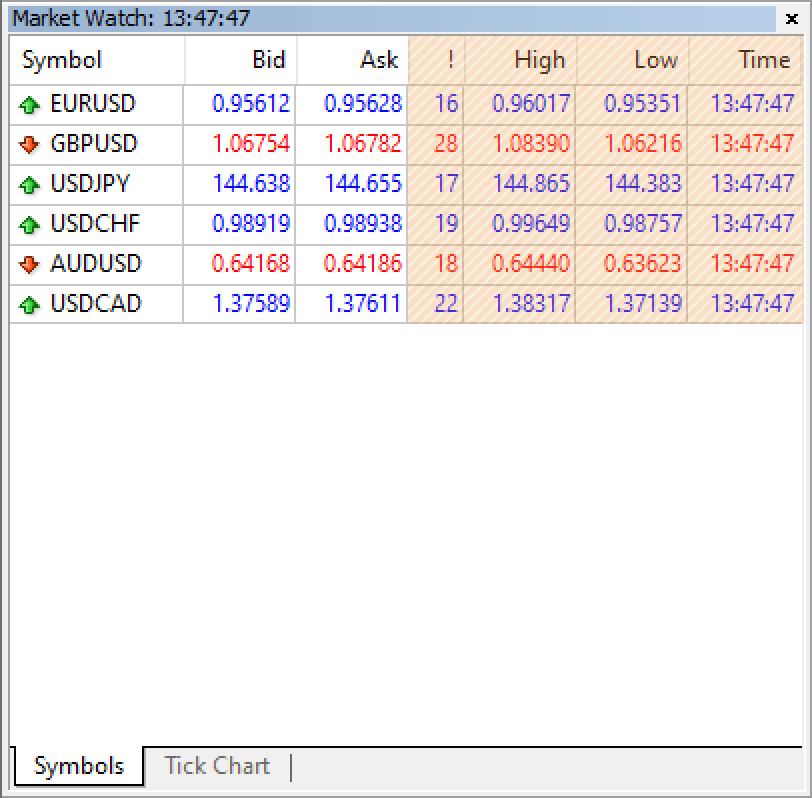

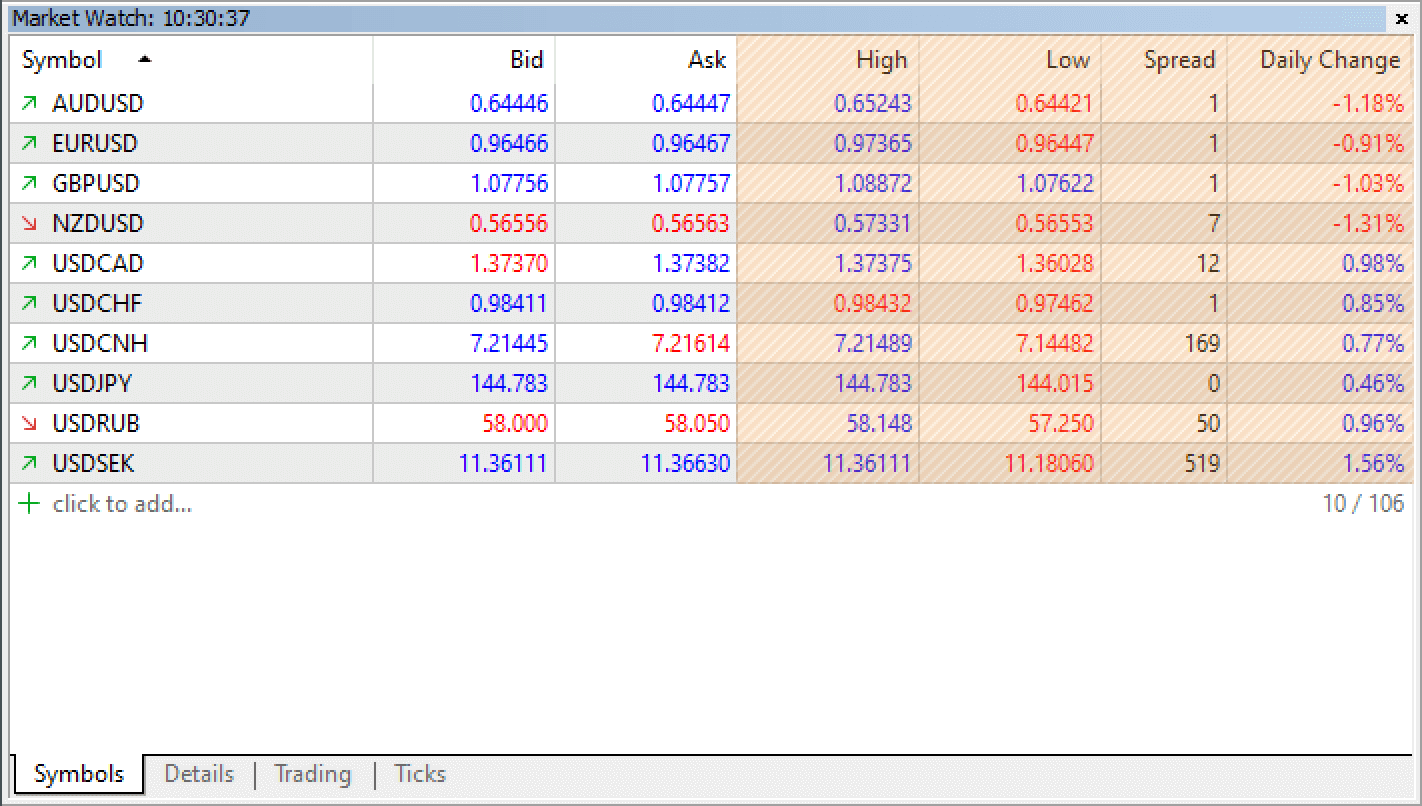

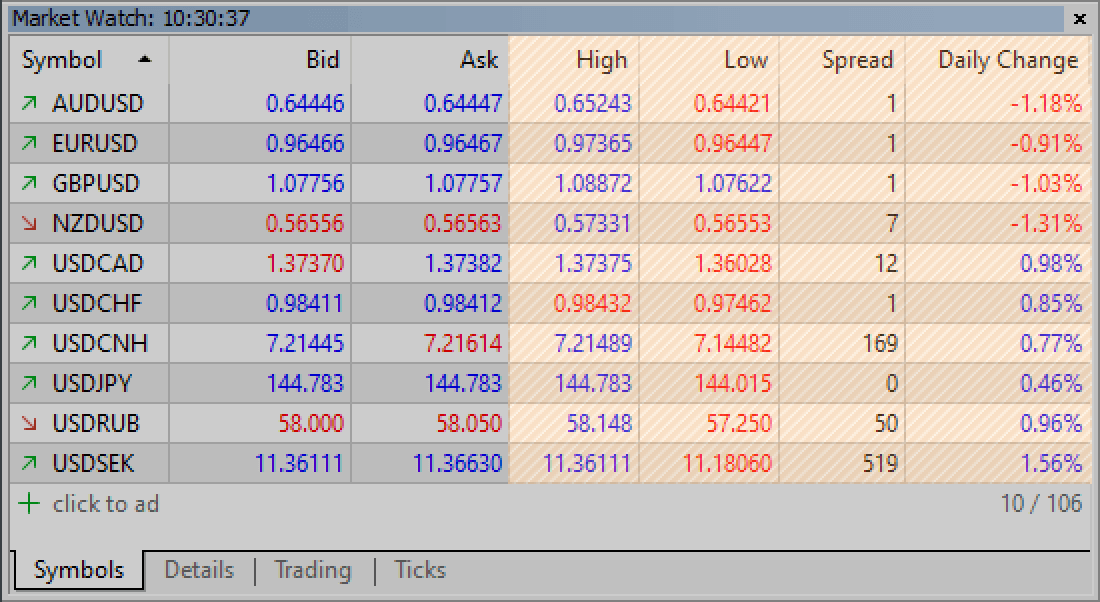

On MetaTrader4 (MT4) / MetaTrader5 (MT5), you can get additional information such as spread, low and high prices, and more in the "Symbols" tab of the Market Watch. While MT4 has only 3 types of information, MT5 allows you to choose from 46 types. Items not provided by the forex broker will not be displayed.

Here we'll take a look at how to change the items displayed on the Market Watch in MT4/MT5.

Switch between MT4/MT5 tabs to check the steps for each.

Step 1

Right-click in the "Symbols" tab of the Market Watch and three options will be shown: "Spread", "High/Low", and "Time". Items with "✓" are already in the Market Watch. If you click an item without "✓", it will appear in the Market Watch. If you click an item with "✓", it will be removed from the Market Watch.

| Item name | Description |

|---|---|

| Spread | The gap between the current ask and bid prices in points. |

| High/Low | The high and low bid prices for the current day. |

| Time | The time when the price was last updated. |

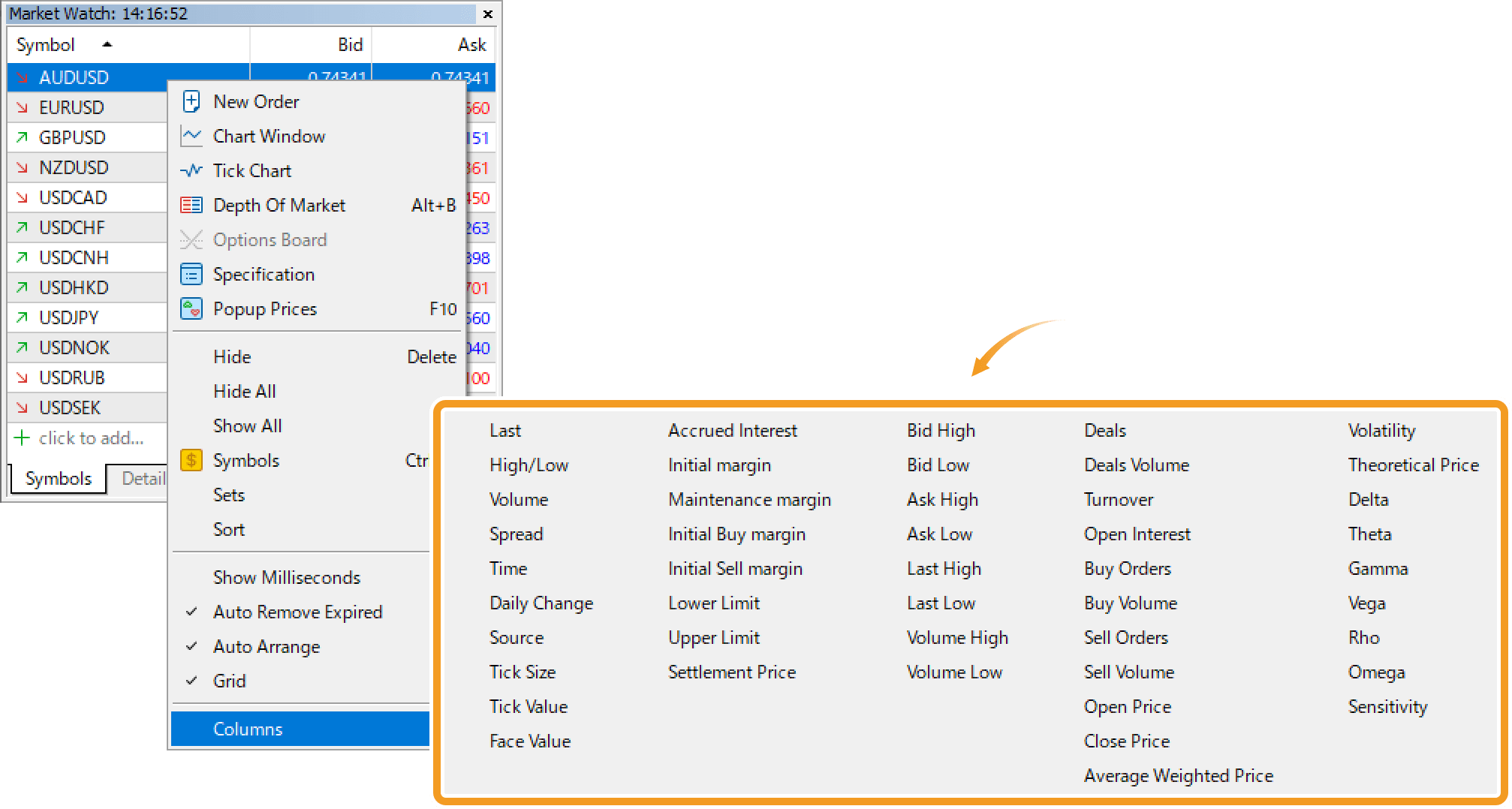

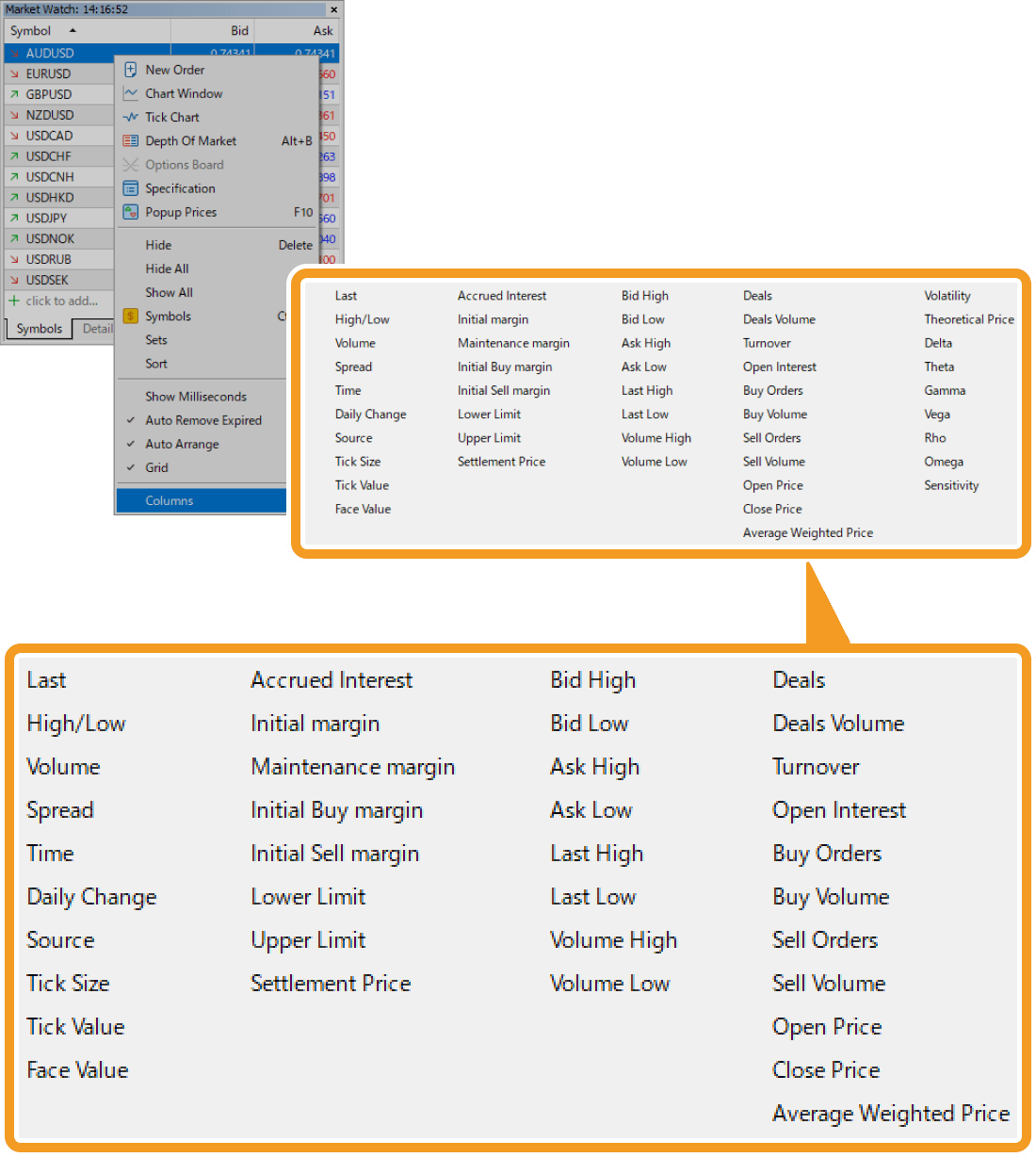

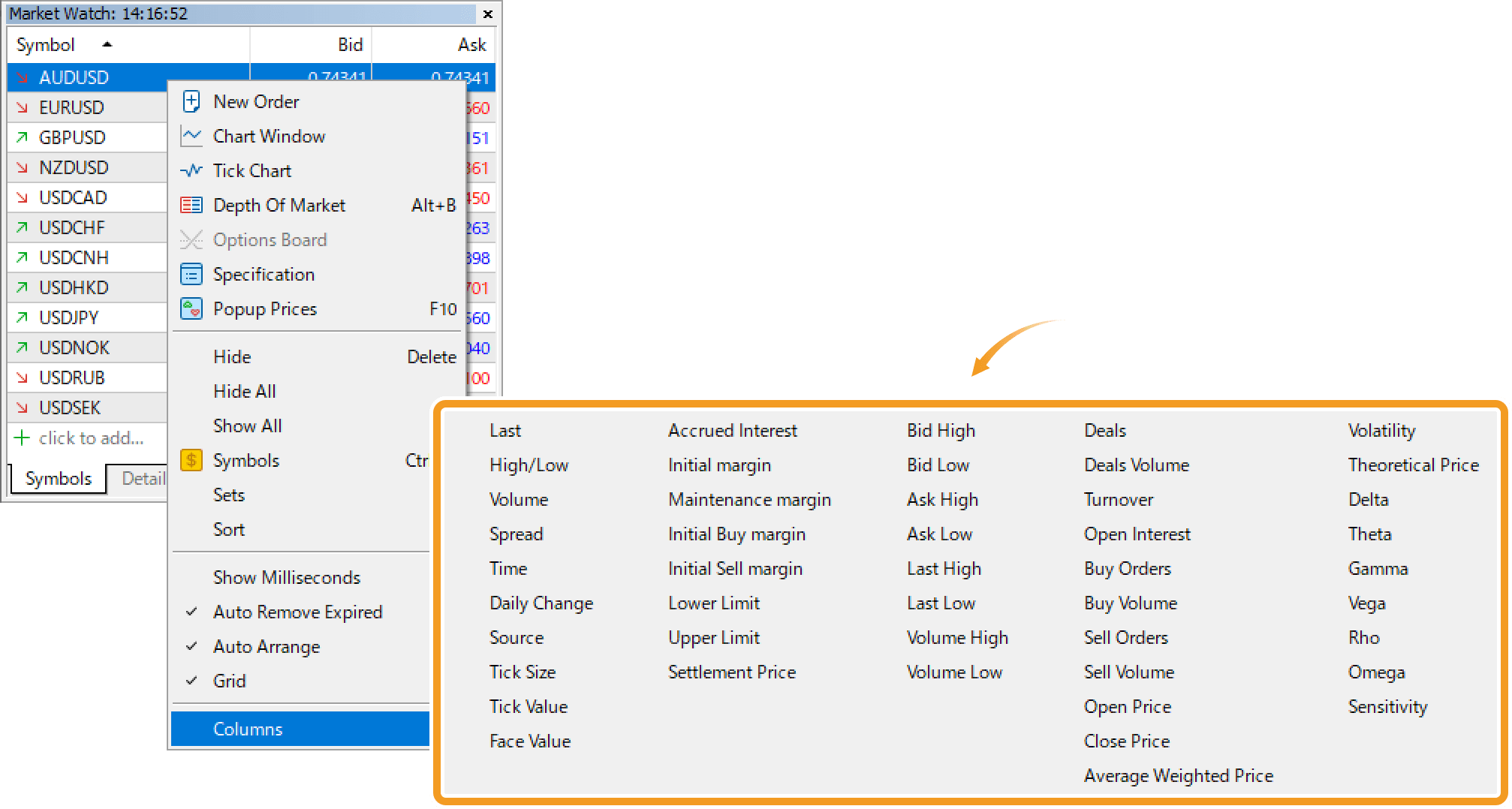

On MT5, you can choose from 46 items such as "Initial margin", "Maintenance margin", "Turnover", "Volatility", etc., besides "Spread", "High/Low". and "Time".

Step 2

Items with "✓" will appear in the Market Watch.

Step 1

Right-click in the "Symbols" tab of the Market Watch and select "Columns".

| Item name | Description |

|---|---|

| Last | The last price at which the last trade occurred. |

| High/Low | The high and low bid prices for the current day. |

| Volume | The volume of the last trade. |

| Spread | The gap between the current ask and bid prices in points. |

| Time | The time when the price was last updated. |

| Daily Change | Change from the previous day's close price. |

| Source | Liquidity provider. |

| Tick Size | The smallest size for the price movement. |

| Tick Value | The currency amount of the smallest size for the price movement. |

| Face Value | Minimum trade amount of the bond. |

| Accrued Interest | The interest on the coupon calculated from the number of days since the issue date or since the previous coupon payment. |

| Initial margin | The margin required to hold a position. |

| Maintenance margin | The margin required to maintain a position aside from the initial margin. |

| Initial Buy margin | The margin required to hold a long position. |

| Initial Sell margin | The margin required to hold a short position. |

| Lower Limit | The lowest price for futures. |

| Upper Limit | The highest price for futures. |

| Settlement Price | The clearing price used to calculate margins and profit/loss in futures/options trading. |

| Bid High | The highest bid price for the current day. |

| Bid Low | The lowest bid price for the current day. |

| Ask High | The highest ask price for the current day. |

| Ask Low | The lowest ask price for the current day. |

| Last High | The highest traded price for the current day. |

| Last Low | The lowest traded price for the current day. |

| Volume High | The highest traded volume for the current day. |

| Volume Low | The lowest traded volume for the current day. |

| Deals | The latest number of trades. |

| Deals Volume | The latest volume of trades. |

| Turnover | The turnover (traded volume). |

| Open Interest | The volume of positions held. |

| Buy Orders | The number of buy orders. |

| Buy Volume | The volume of buy orders. |

| Sell Orders | The number of sell orders. |

| Sell Volume | The volume of sell orders. |

| Open Price | The open price for the current day. |

| Close Price | The close price for the previous day. |

| Average Weighted Price | The weighted average of the price. |

| Volatility | The implied volatility (in percentage), the expected rate of change of the underlying asset price. |

| Theoretical Price | Theoretical price of an option calculated by Black-Scholes model. |

| Delta | Delta, a risk indicator for options, quantifies the change in option's price relative to the change in underlying asset price. |

| Theta | Theta, a risk indicator for options, quantifies the risk that time poses to option buyers. |

| Gamma | Gamma, a risk indicator for options, quantifies the change in Delta value relative to the change in underlying asset price. |

| Vega | Vega, a risk indicator for options, quantifies the change in option's price relative to the change in implied volatility. |

| Rho | Rho, a risk indicator for options, quantifies the change in option's price relative to the change in interest rates. |

| Omega | Omega, a risk indicator for options, quantifies the percentage change in option's price relative to the percent change in underlying asset price. |

| Sensitivity | The change in underlying asset price per one point change in option's price. |

Step 2

Items with "✓" will appear in the Market Watch.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy