- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

On MetaTrader4 (MT4) / MetaTrader5 (MT5), you can place If-Done-OCO orders. If-Done-OCO order stands for "If Done, One Cancels the Other" and sometimes it is called the "IFDOCO" order.

If-Done-OCO order is a type of order where you place a new limit/stop/stop-limit order while setting the take-profit and stop-loss levels. Once the profit or the loss cut has been confirmed, the other order will be automatically canceled.(*1)

Here we will look at how to place an If-Done-OCO order on MT4/MT5.

Switch between MT4/MT5 tabs to check the steps for each.

(*1)Stop-limit order is only available on MT5.

Step 1

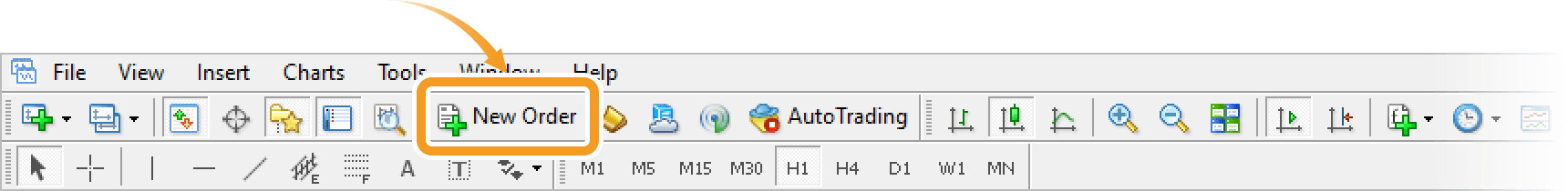

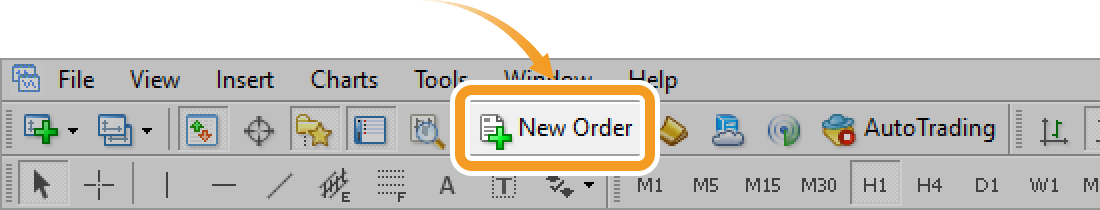

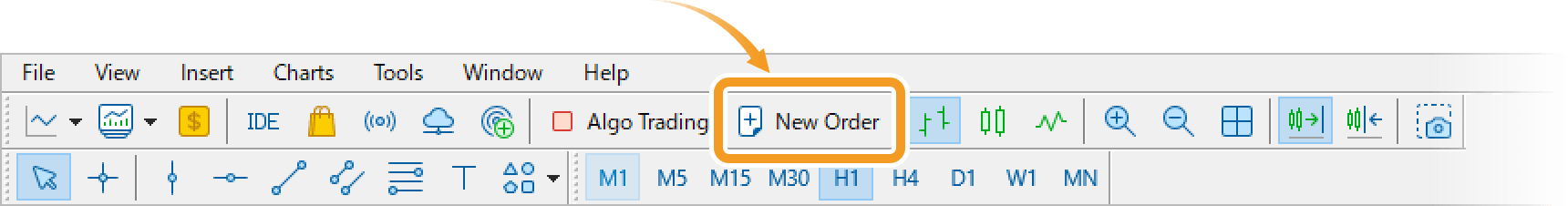

Click "New Order" in the toolbar.

Related article: Open the new order window

Step 2

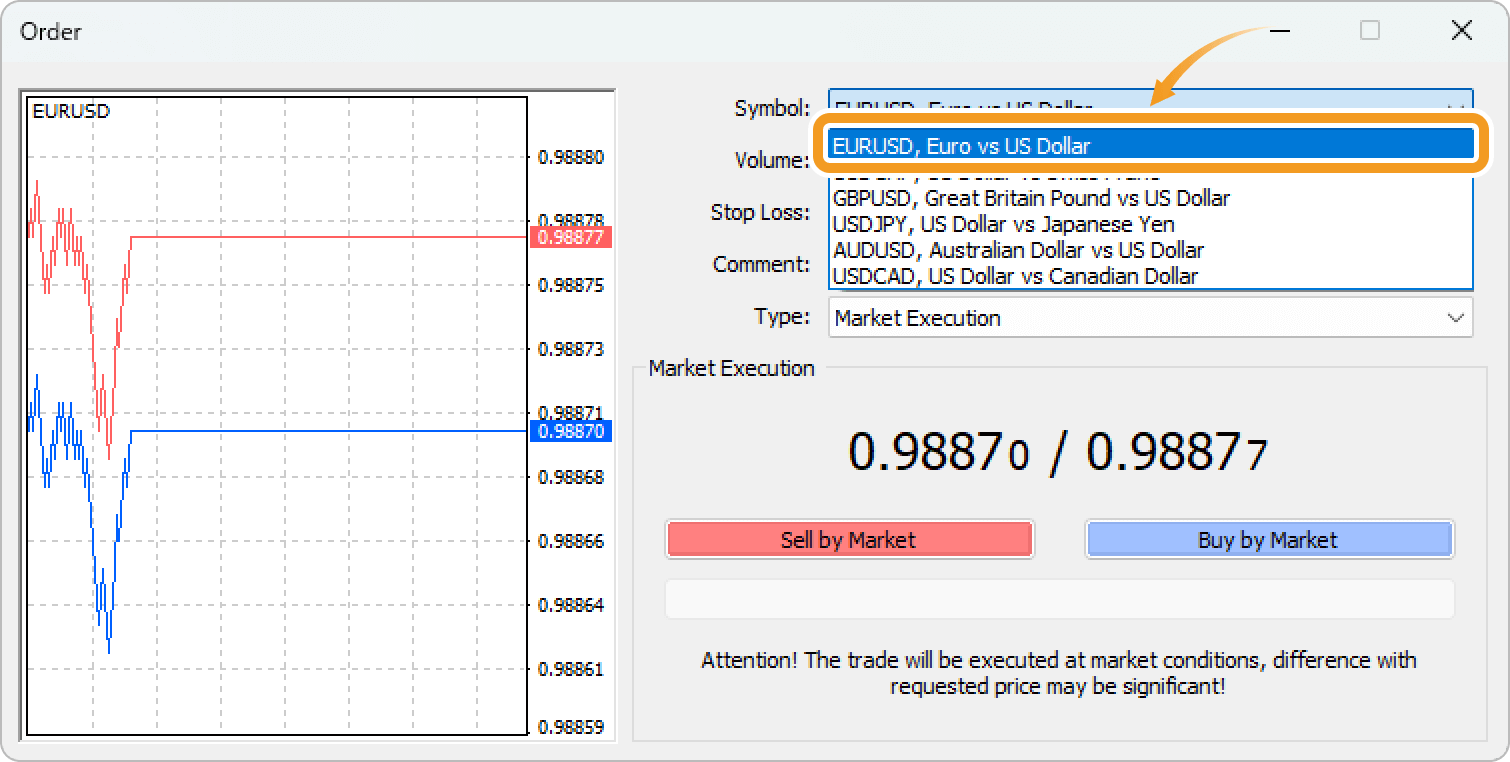

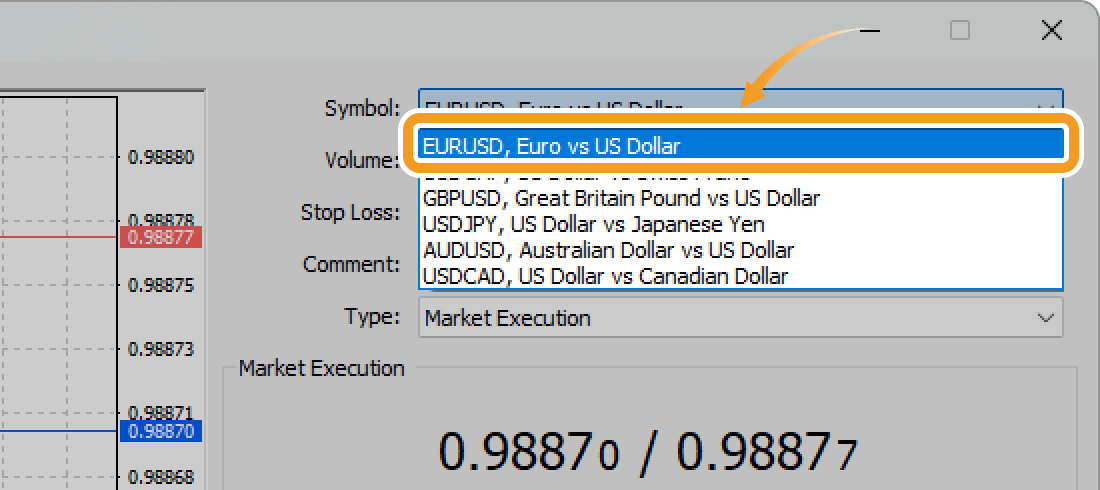

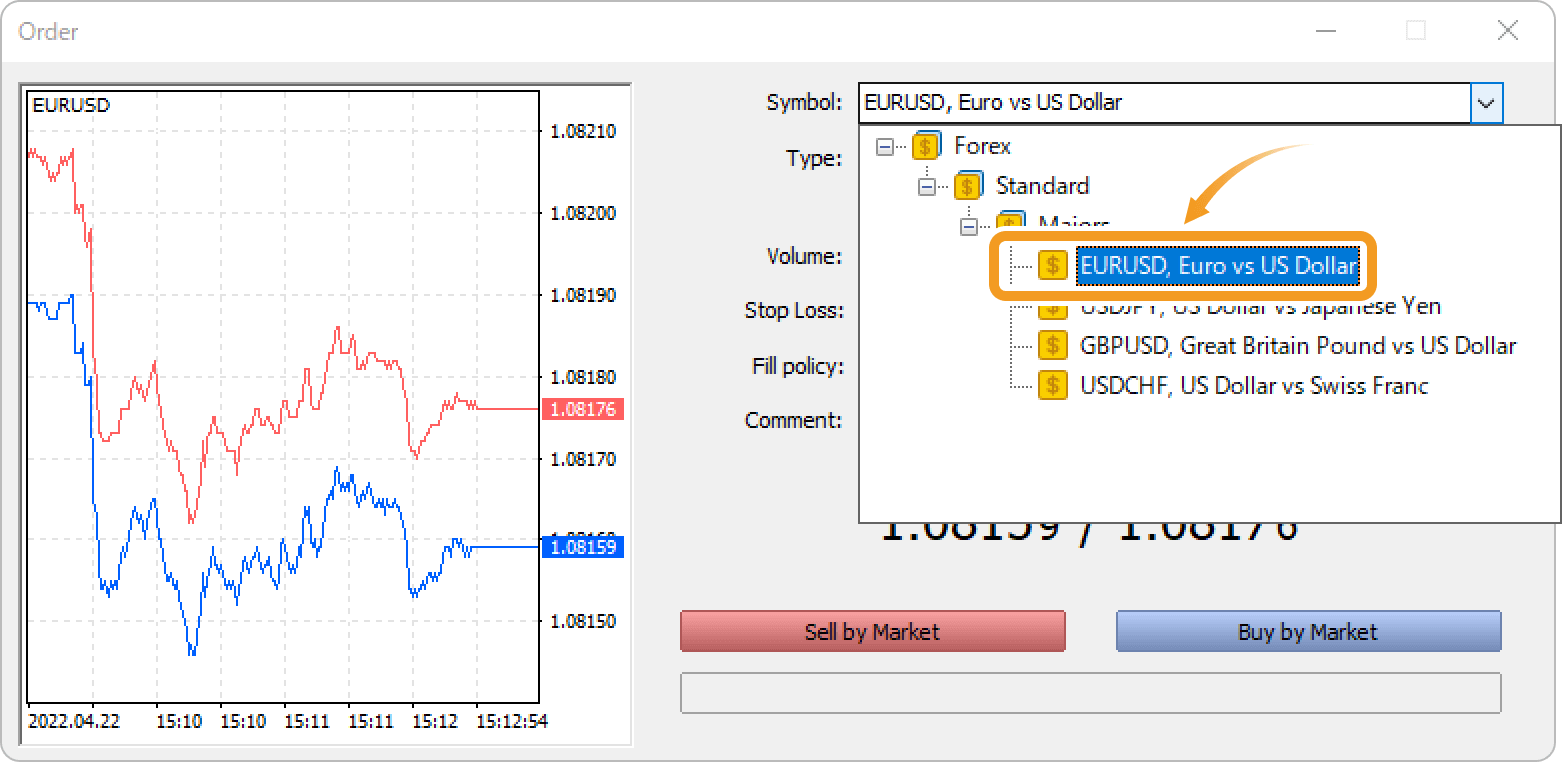

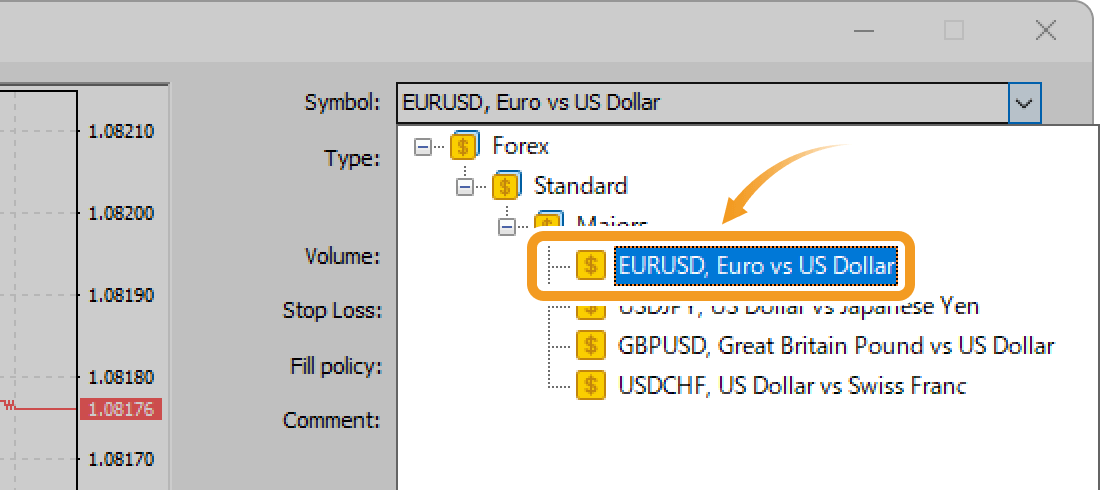

Click the "Symbol" field to choose the symbol to place an order for.

Step 3

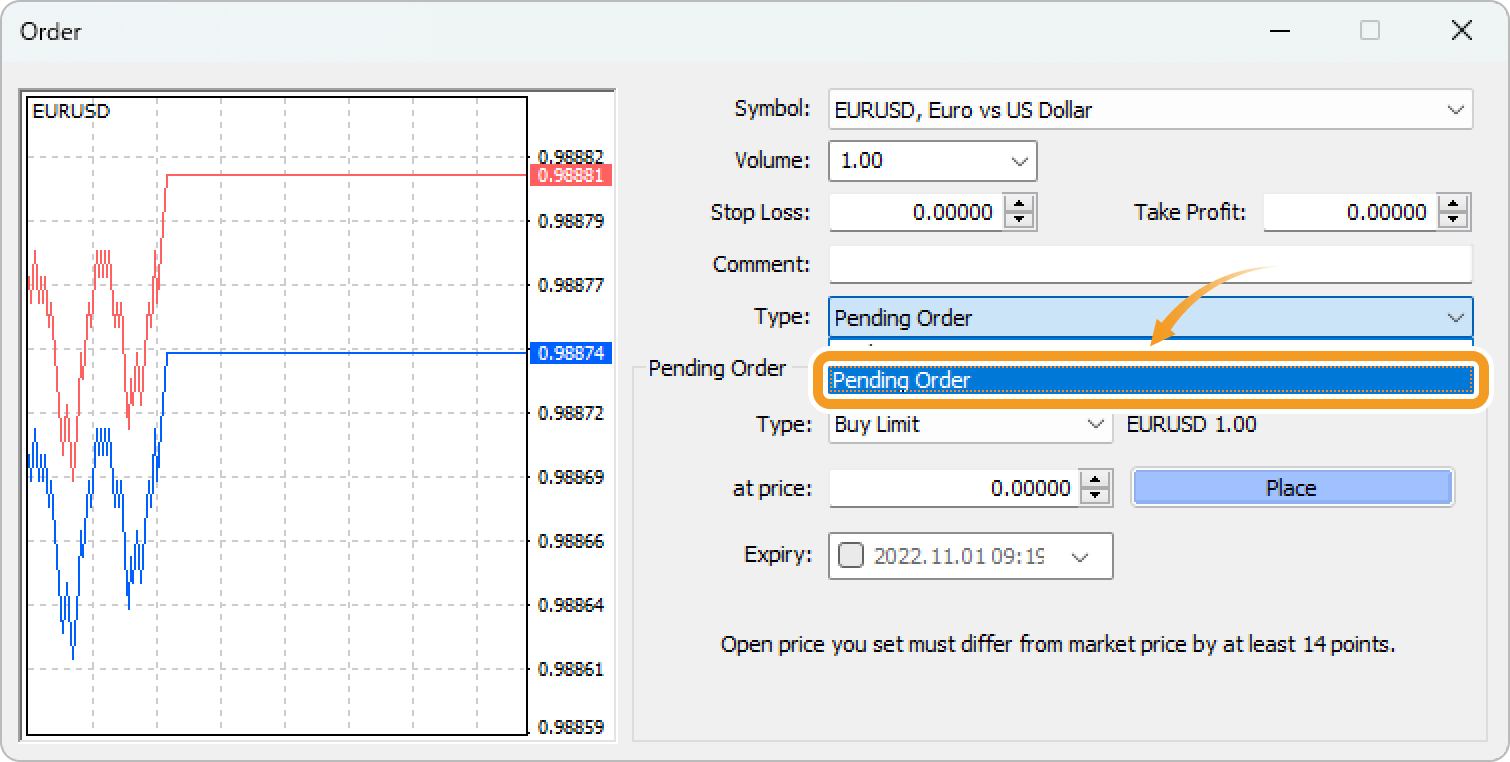

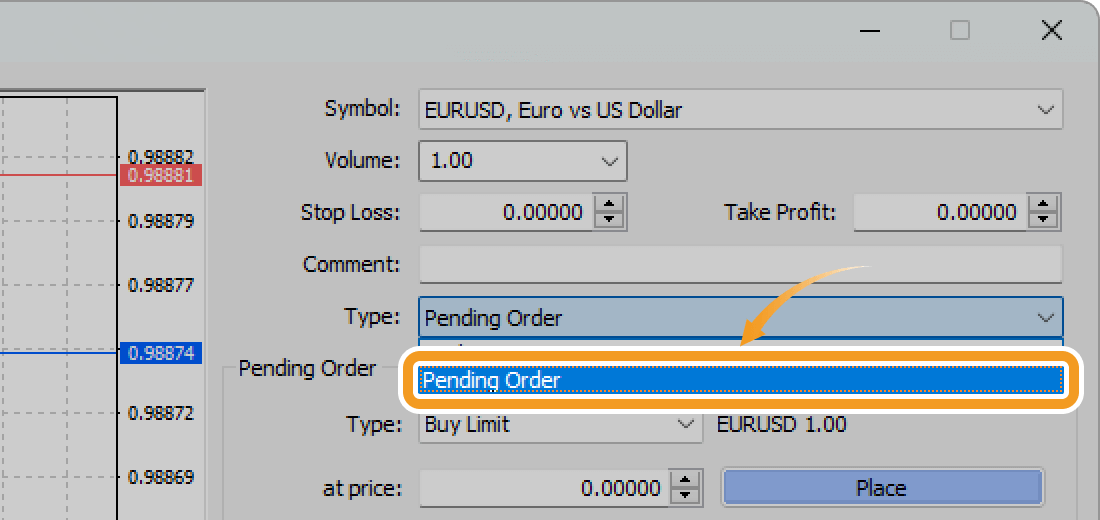

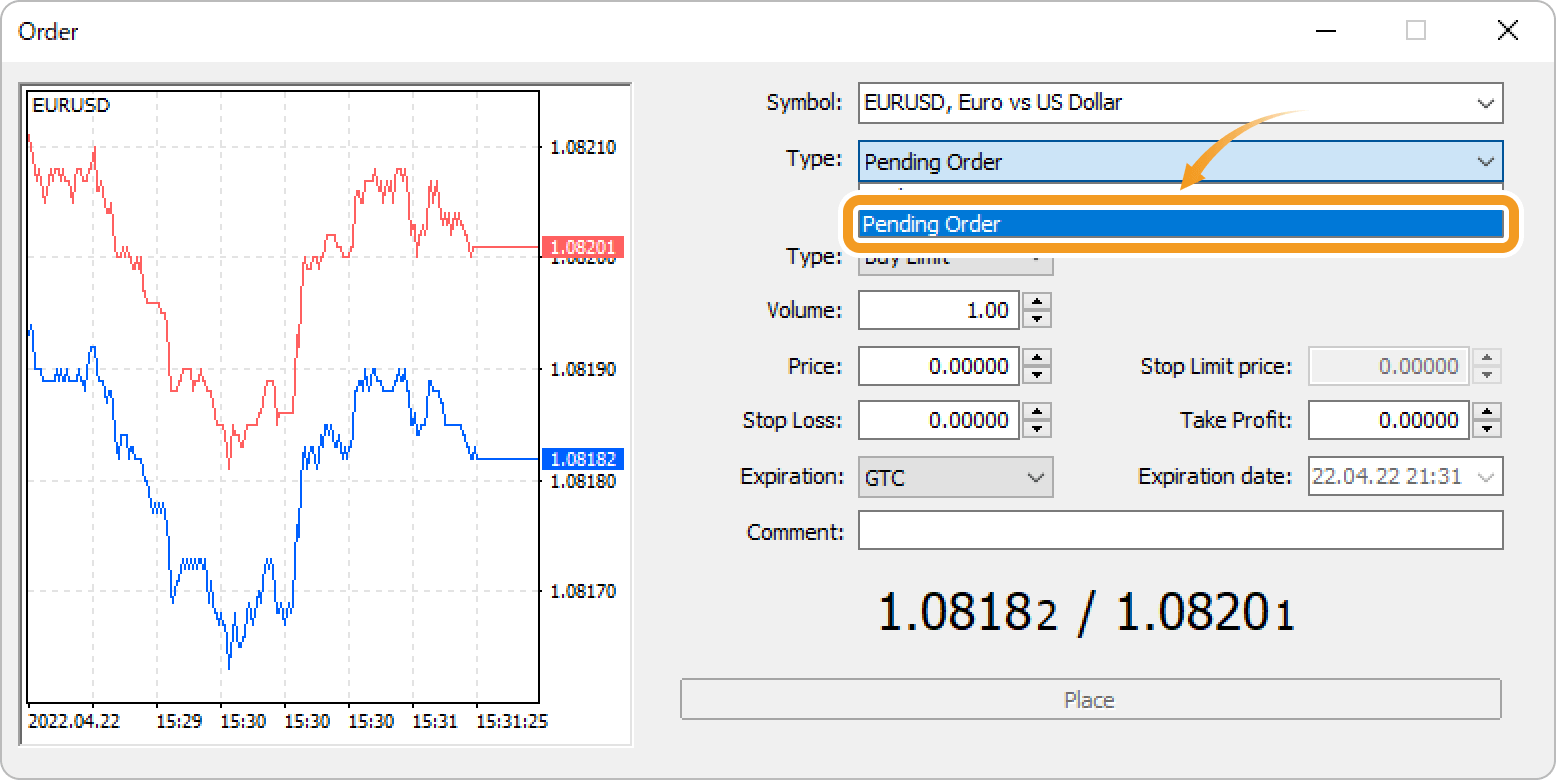

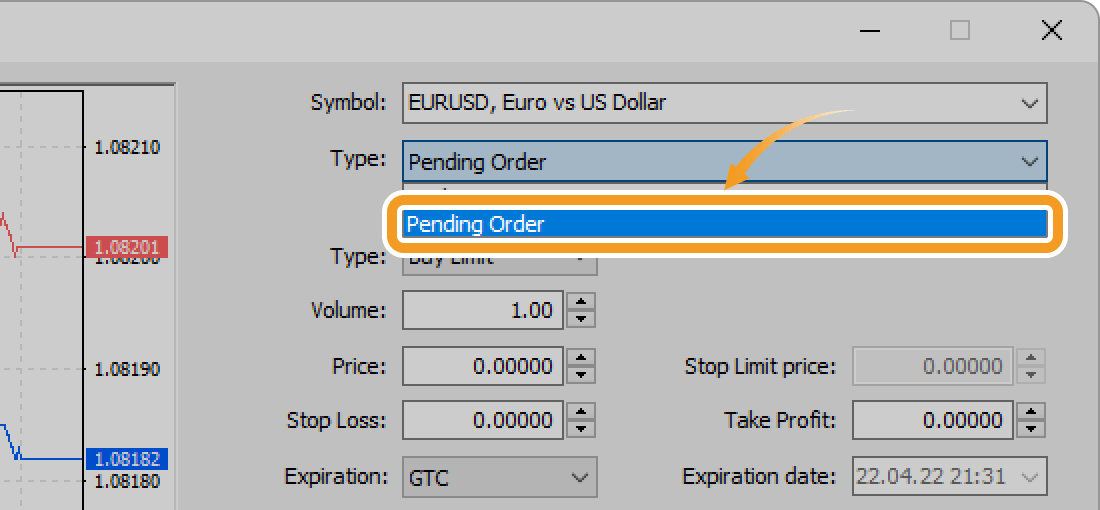

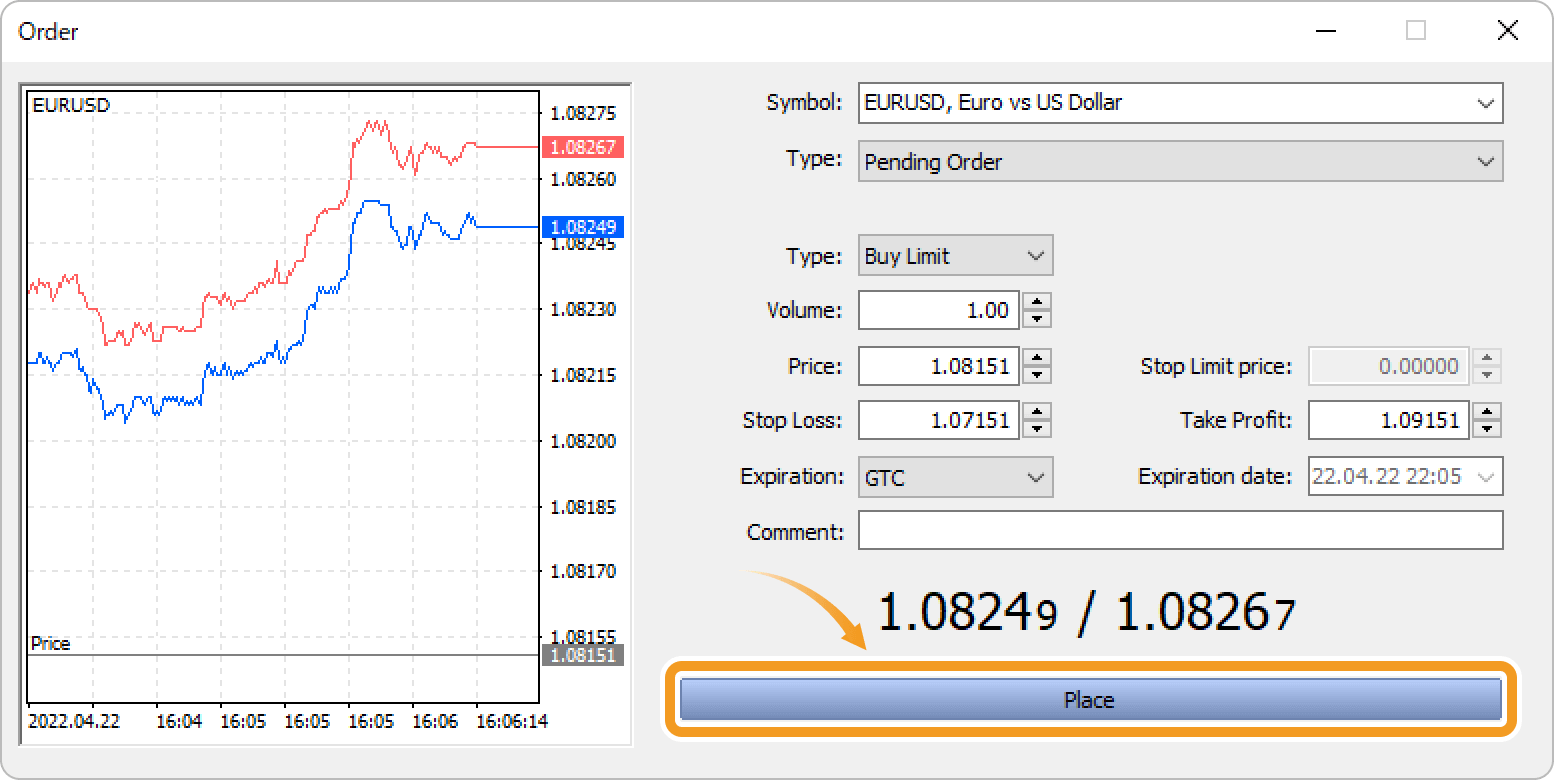

Click the "Type" field and select "Pending Order".

Step 4

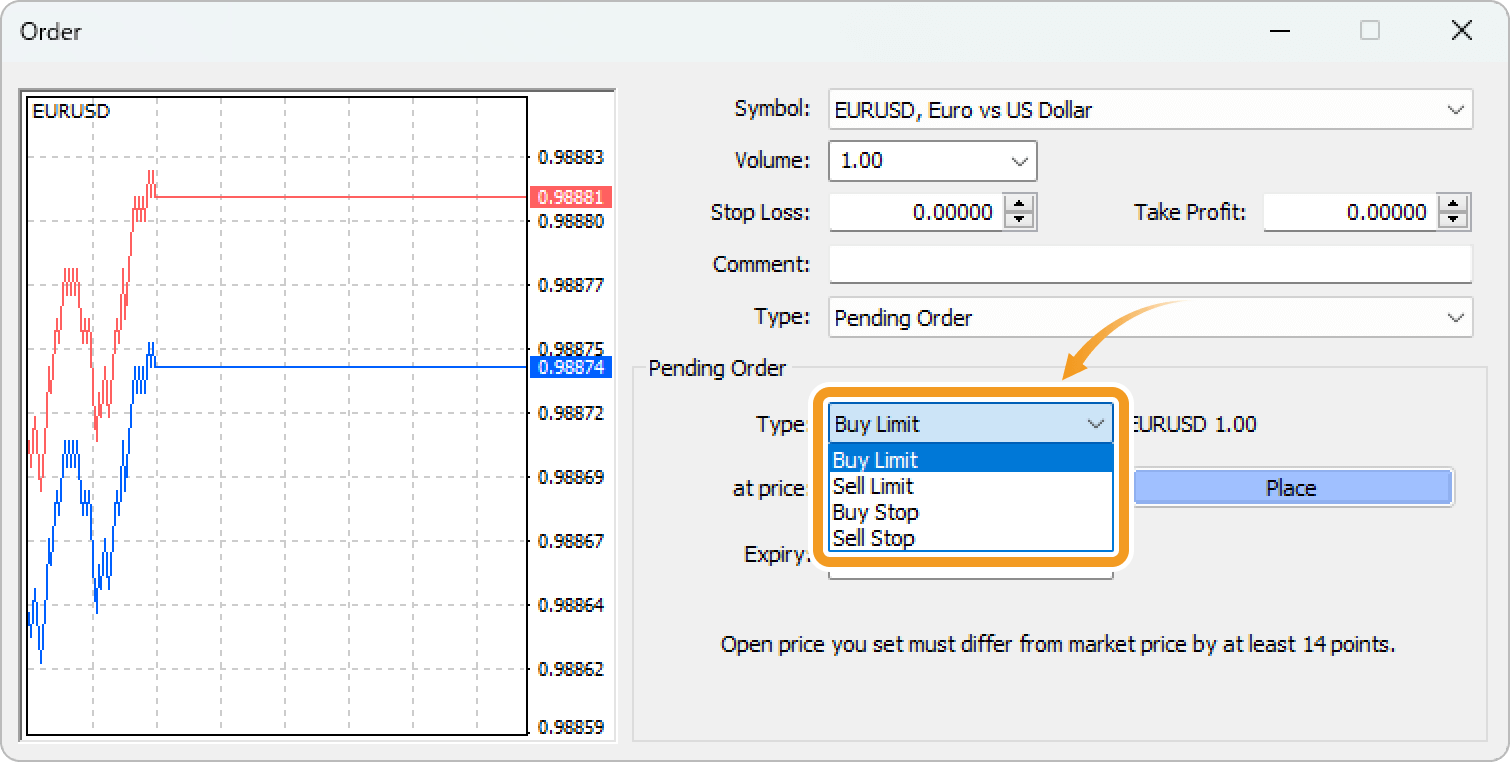

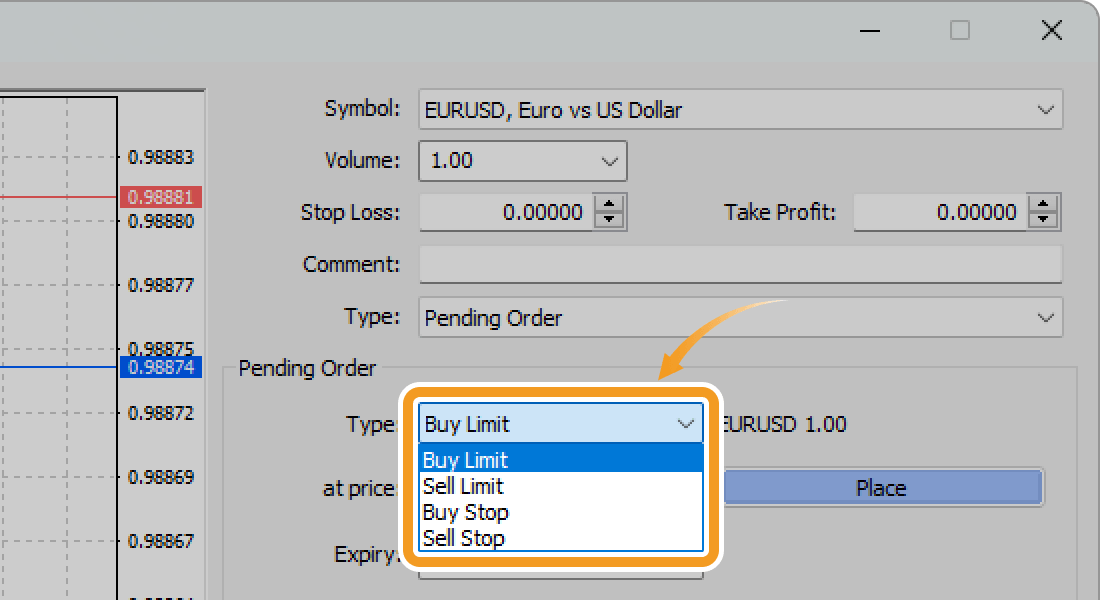

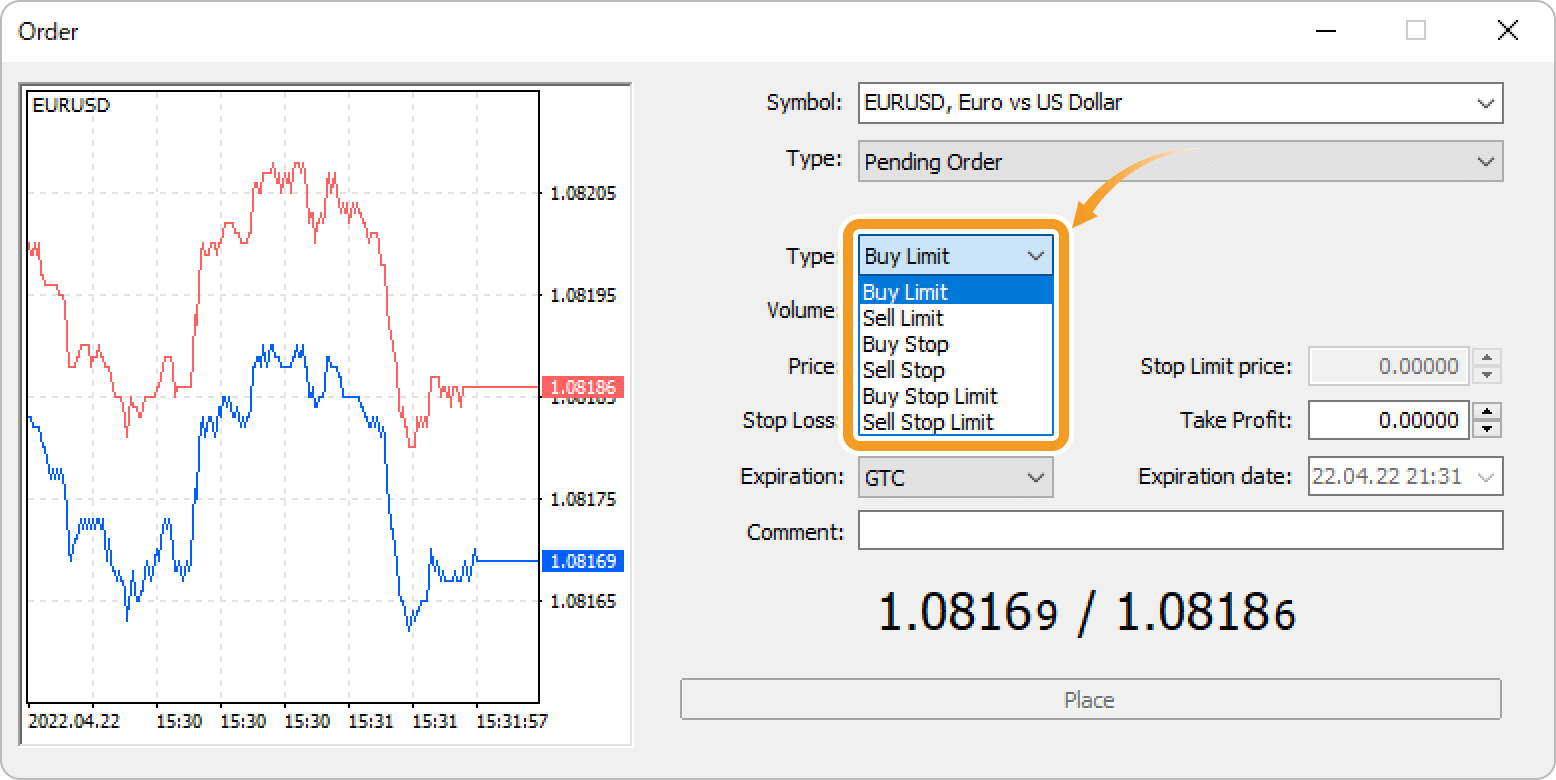

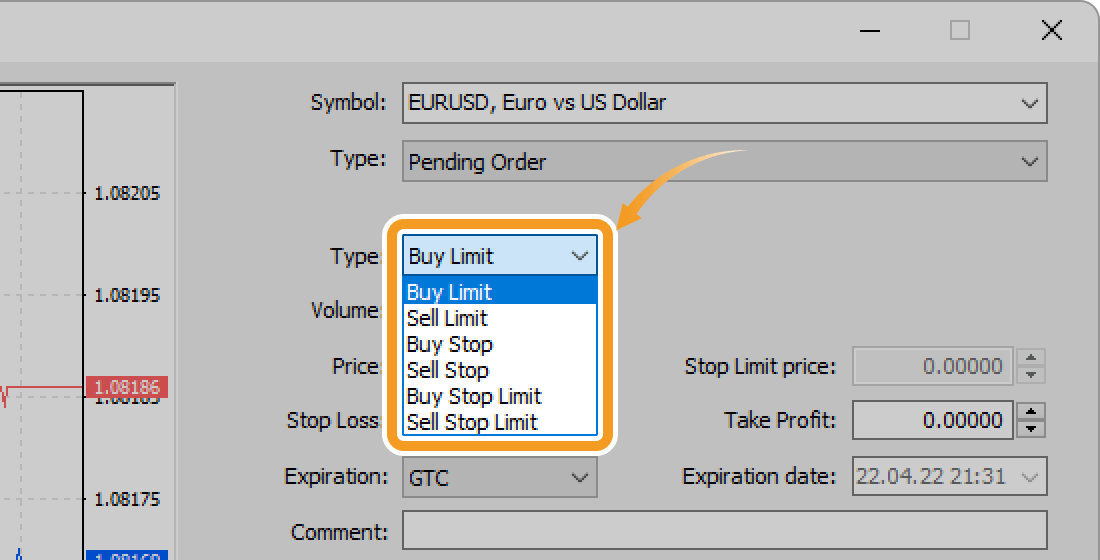

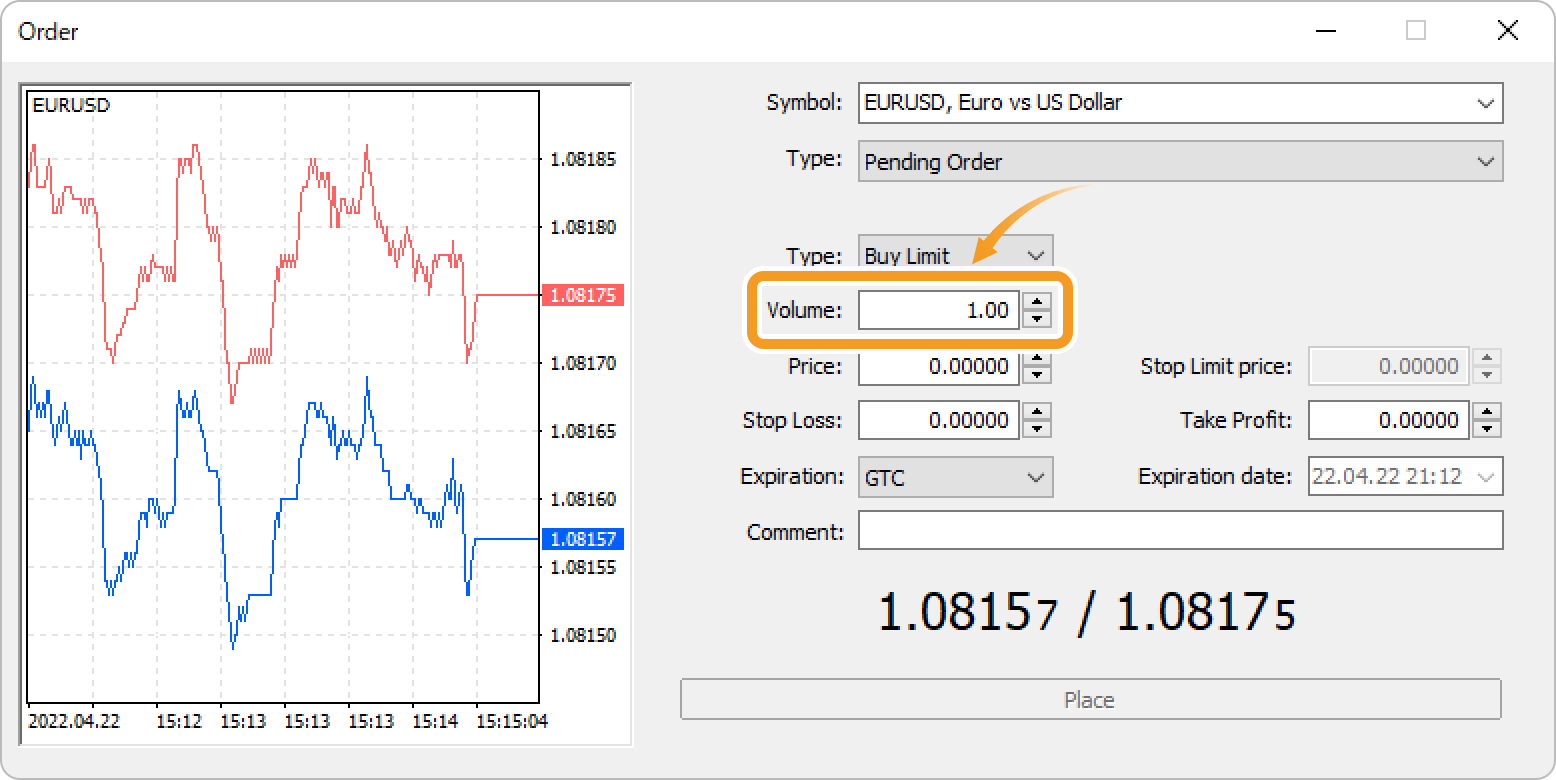

Click the "Type" field and select a type of limit/stop order.

-

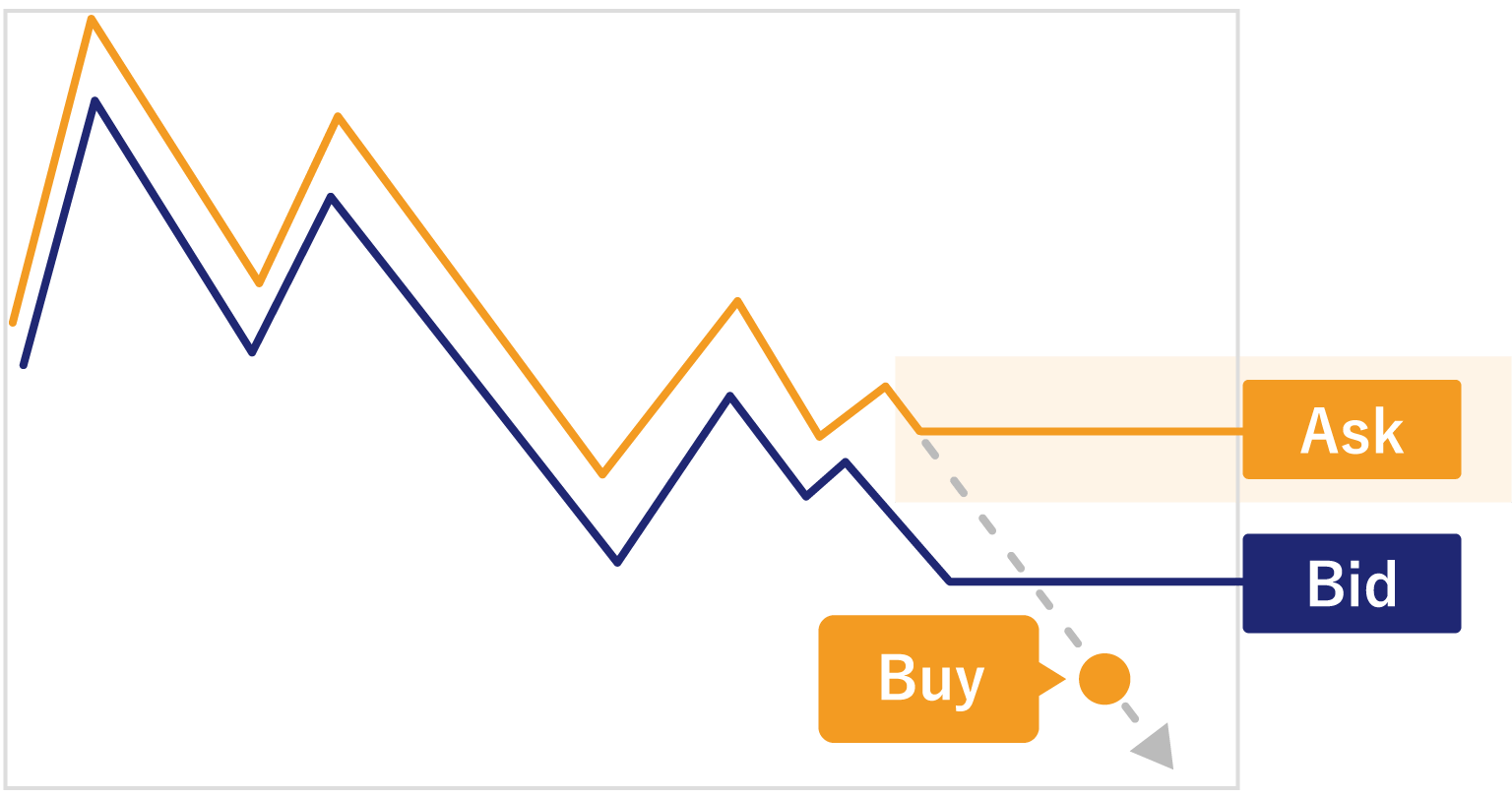

Buy Limit

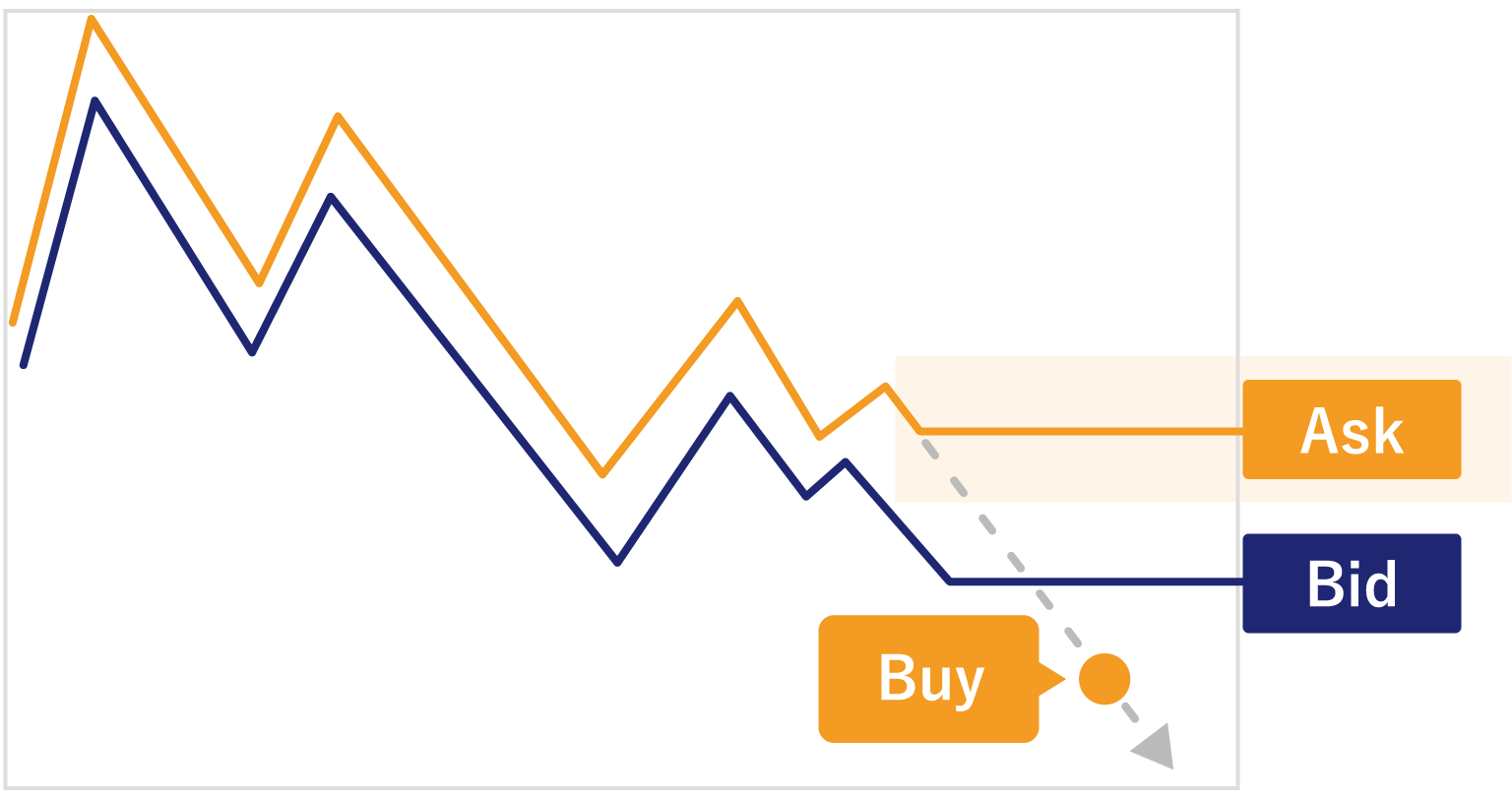

If you place a buy order by specifying a lower price than the current, select Buy Limit. Enter a price that is lower than the current Ask price.

-

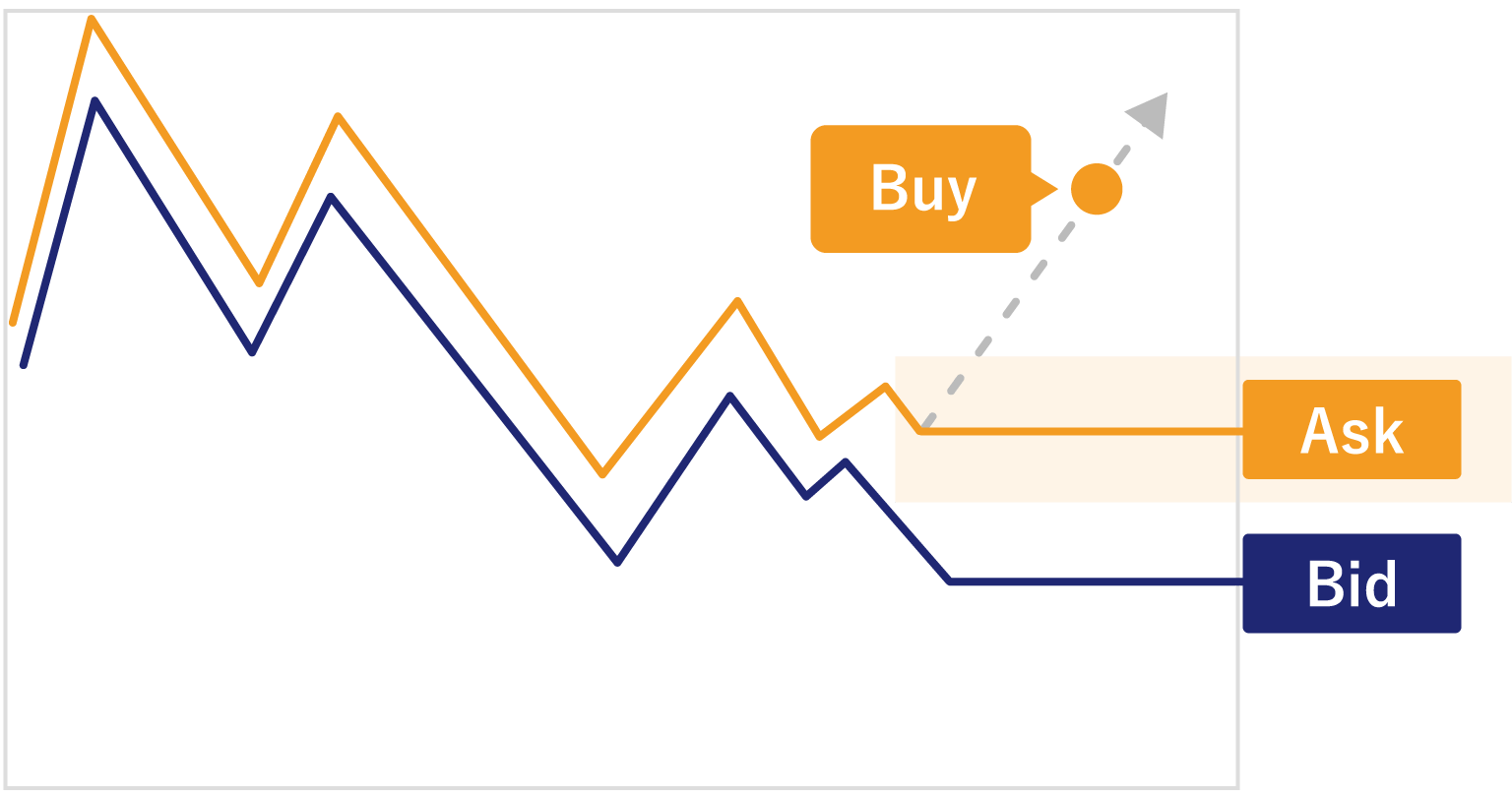

Buy Stop

If you place a buy order by specifying a higher price than the current, select Buy Stop. Enter a price that is higher than the current Ask price.

-

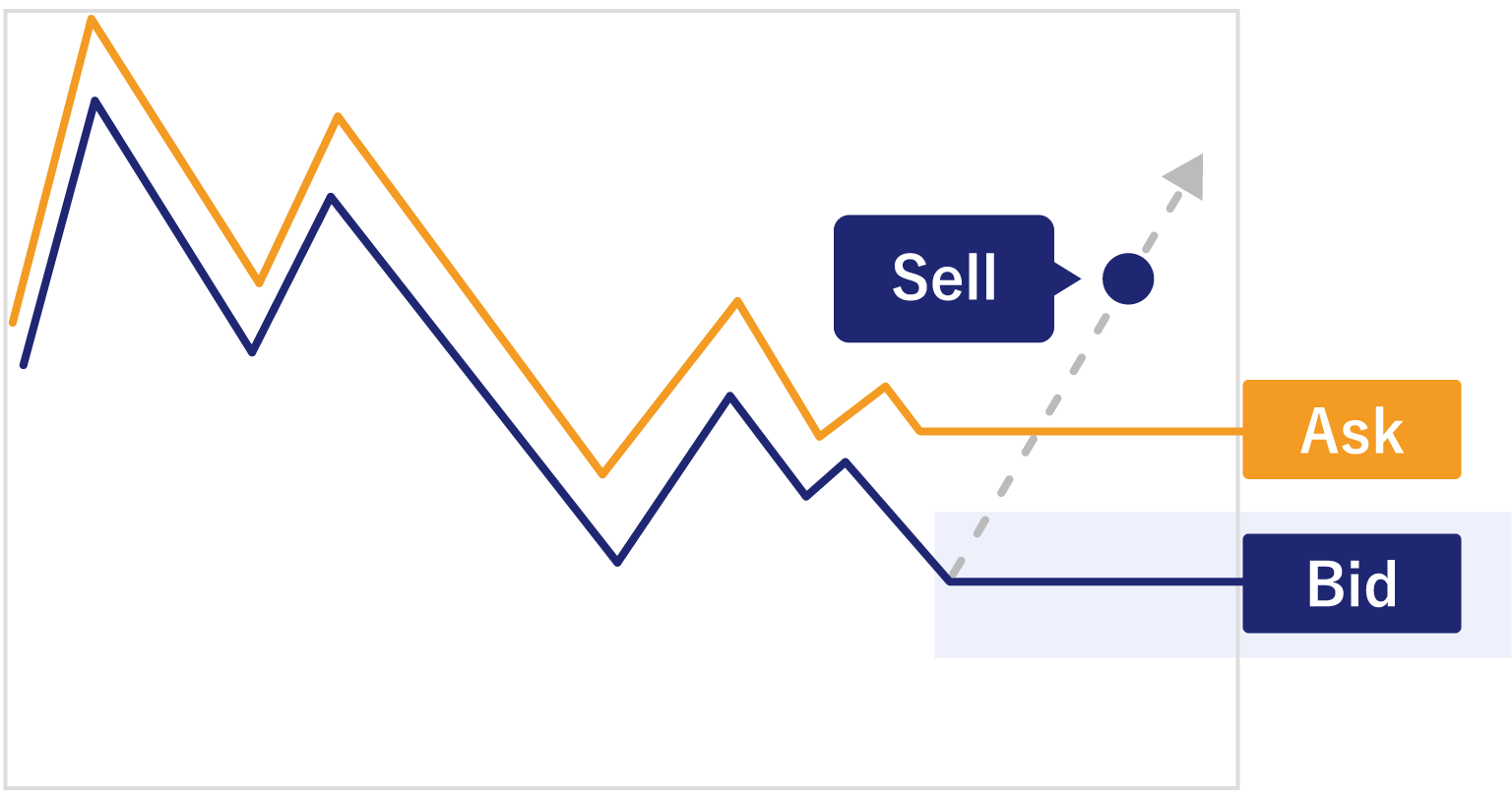

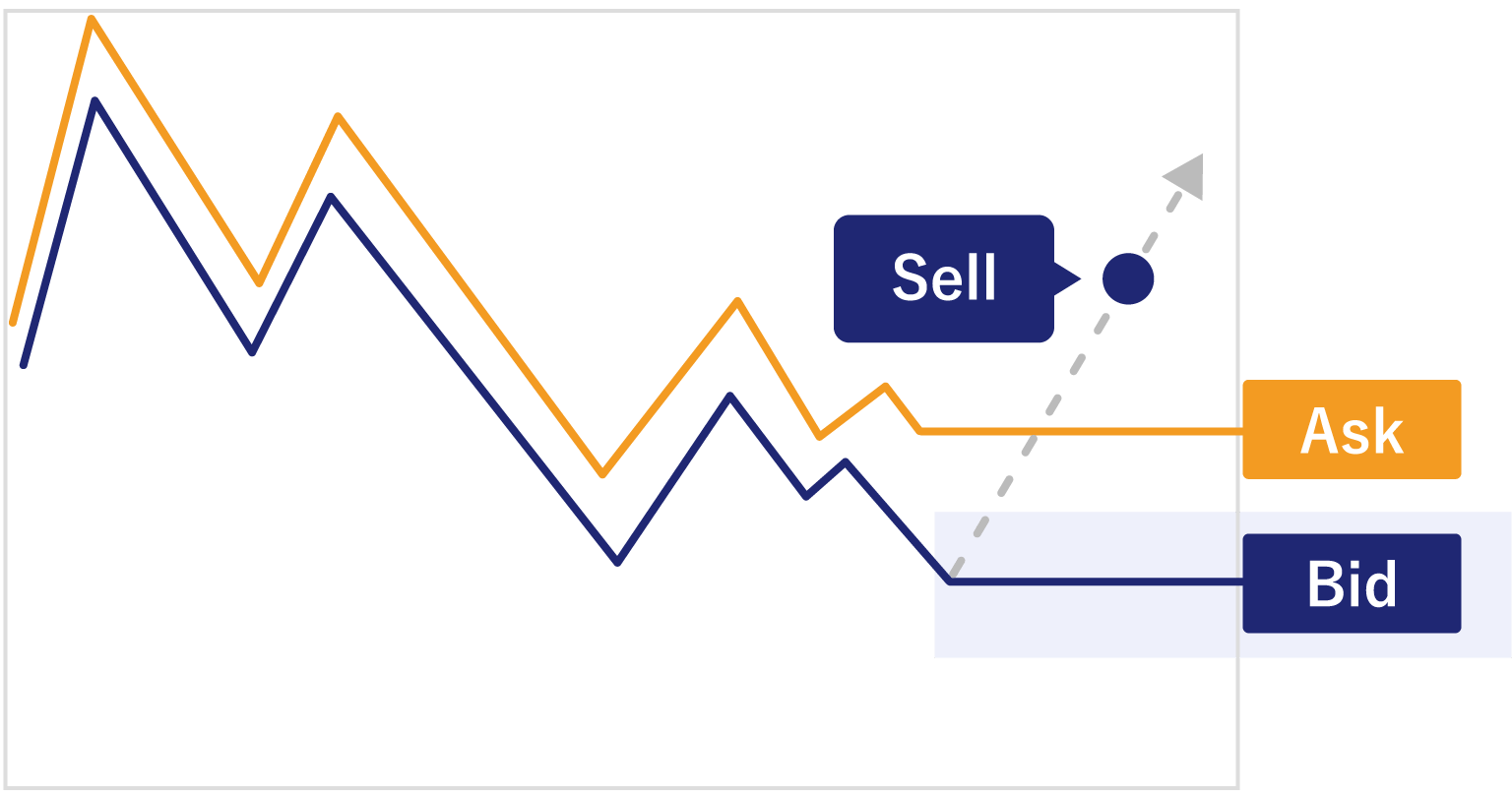

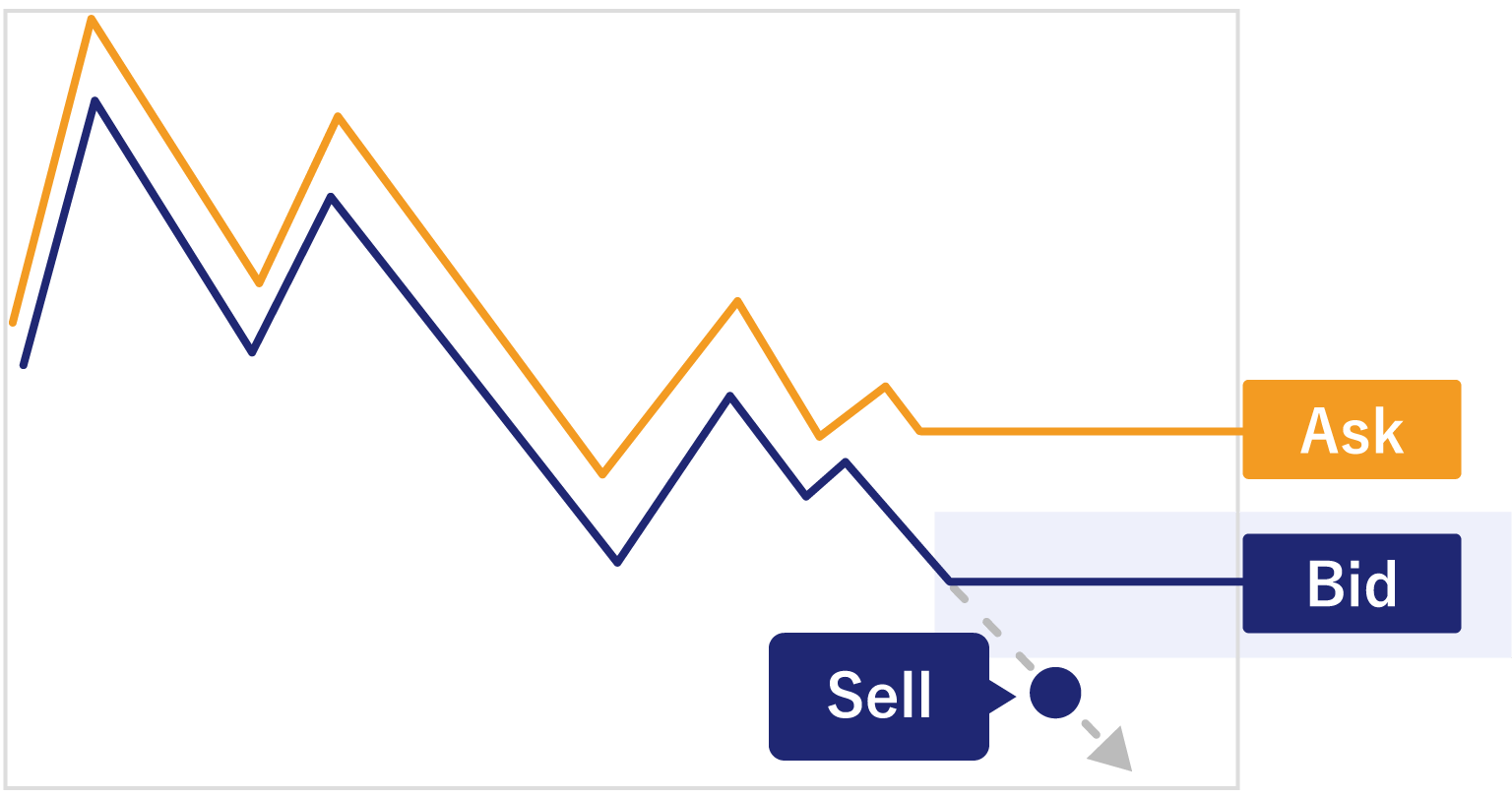

Sell Limit

If you place a sell order by specifying a higher price than the current, select Sell Limit. Enter a price that's higher than the current Bid price.

-

Sell Stop

If you place a sell order by specifying a lower price than the current, select Sell Stop. Enter a price that's lower than the current Bid price.

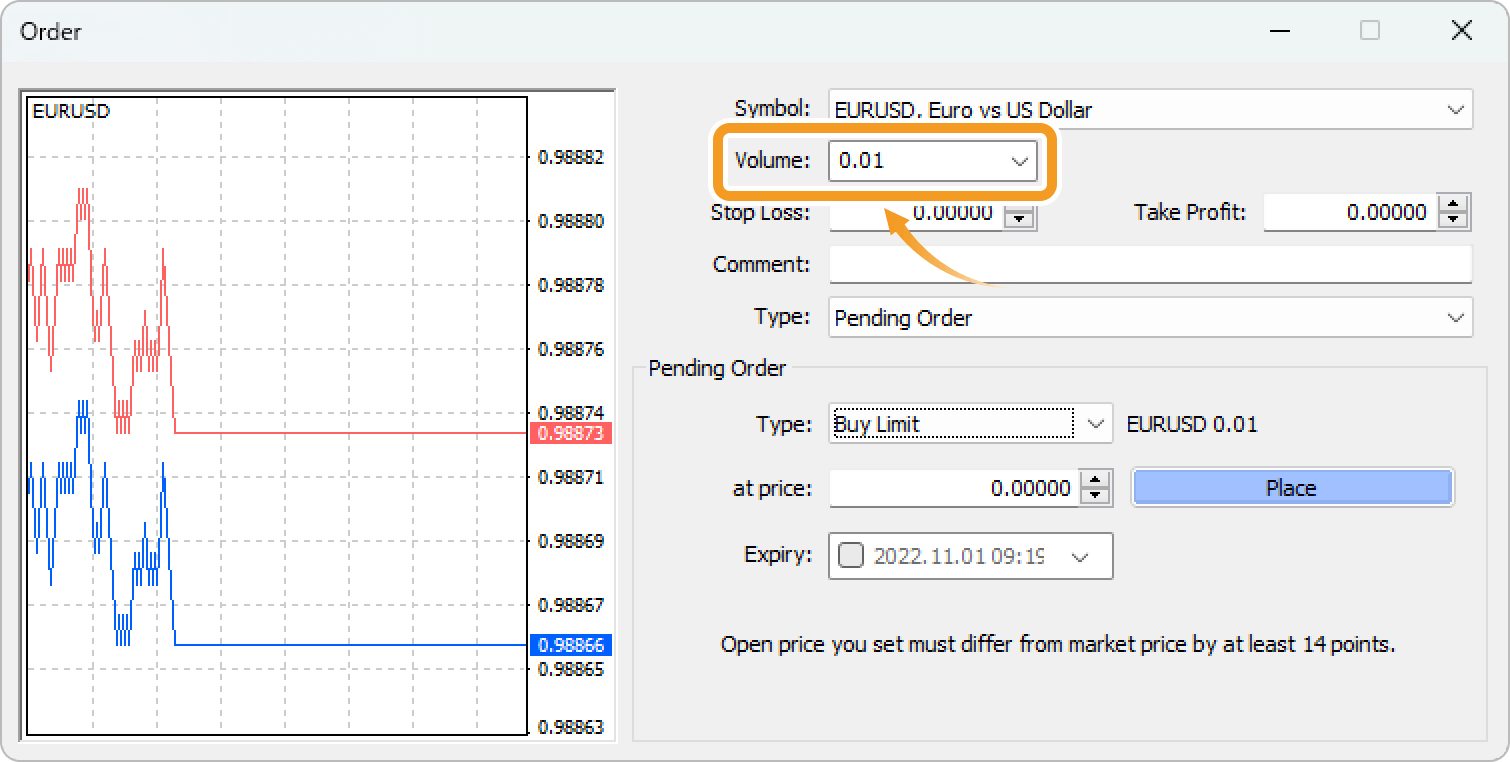

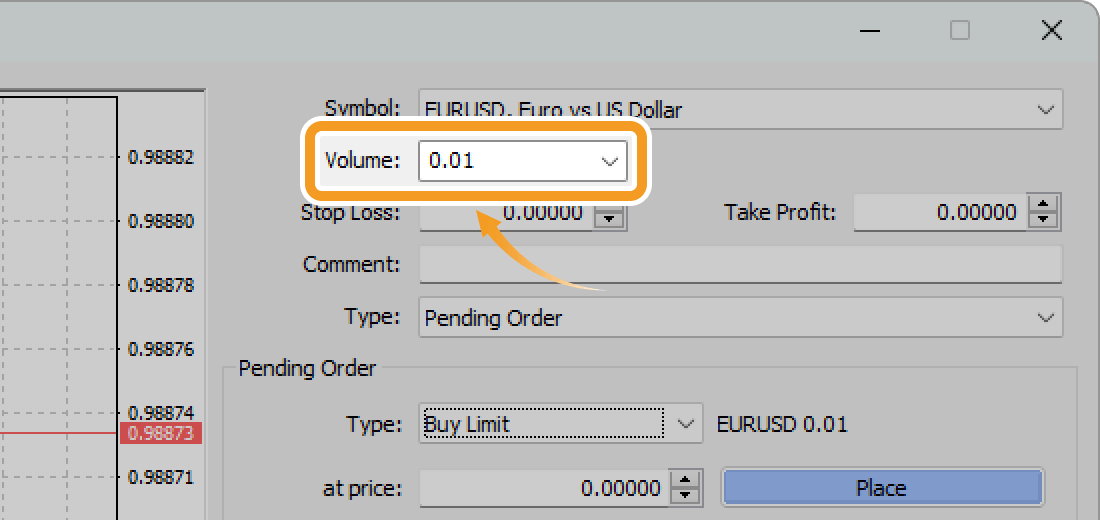

Step 5

Set the trade volume in lots in the "Volume" field. Type the volume or select from the pull-down menu.

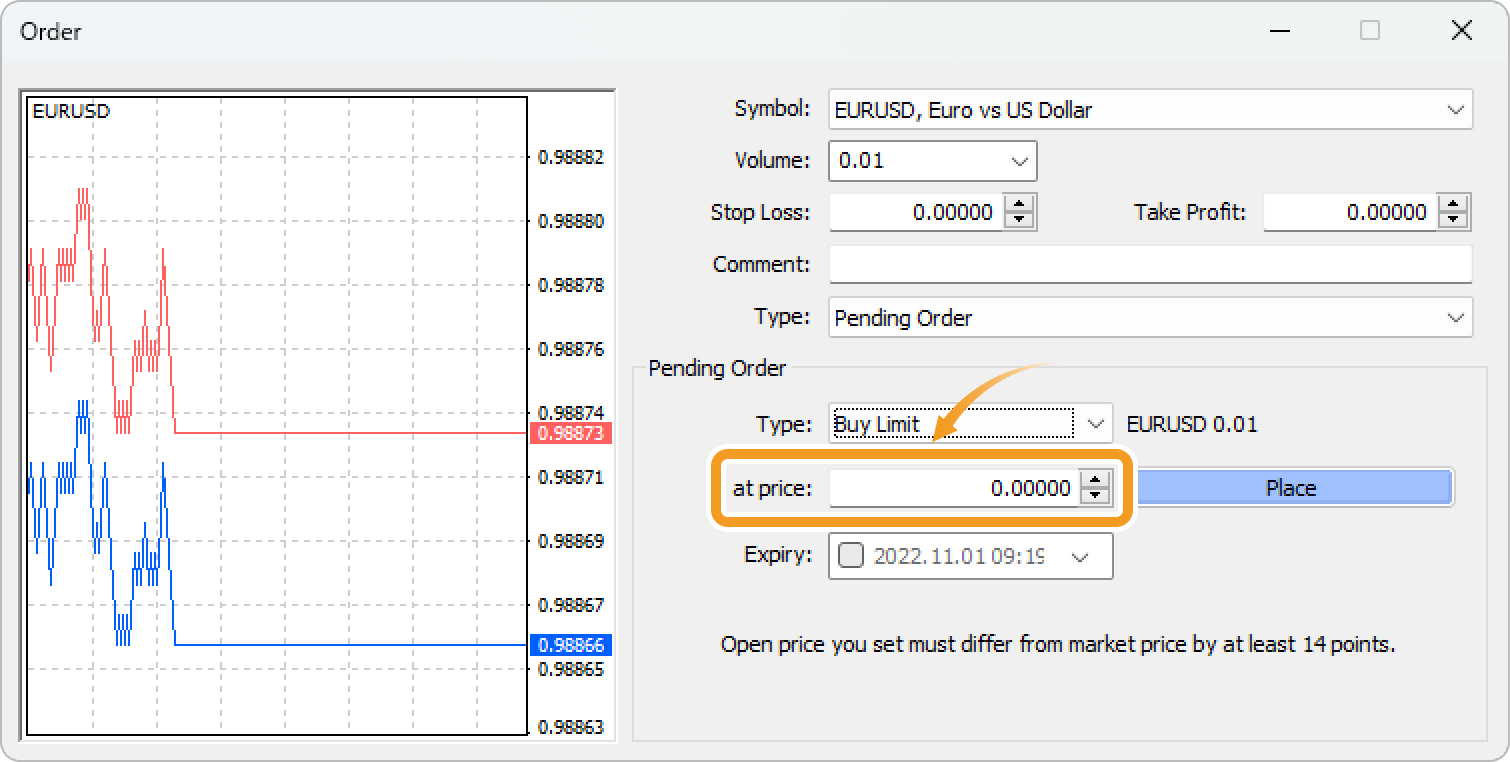

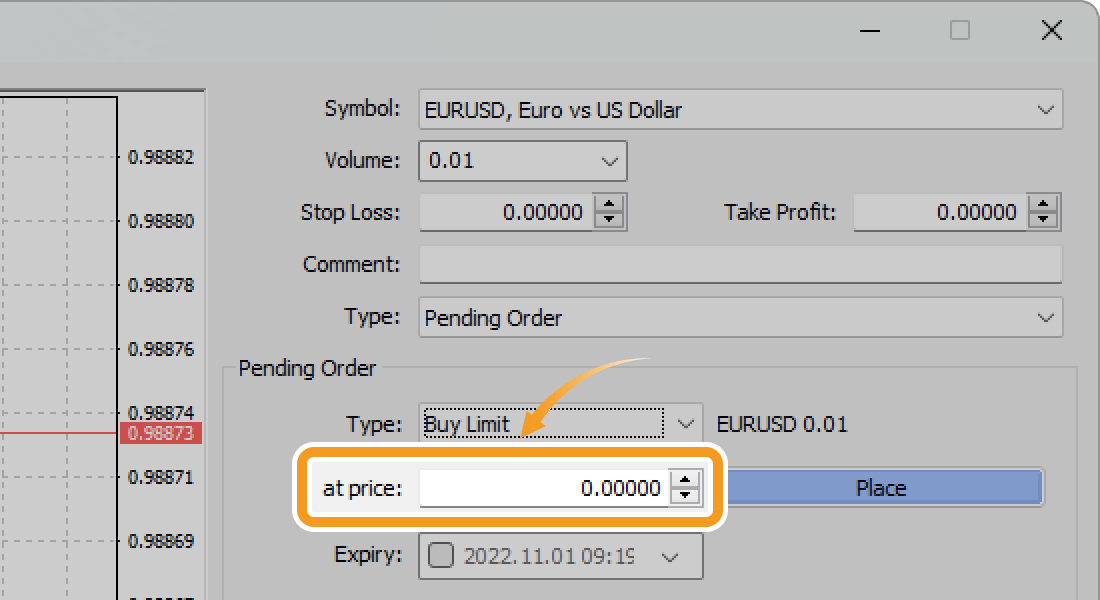

Step 6

Set the limit/stop level in the "at price" field. Type the price or use the ▼▲ marks on the right side.

Step 7

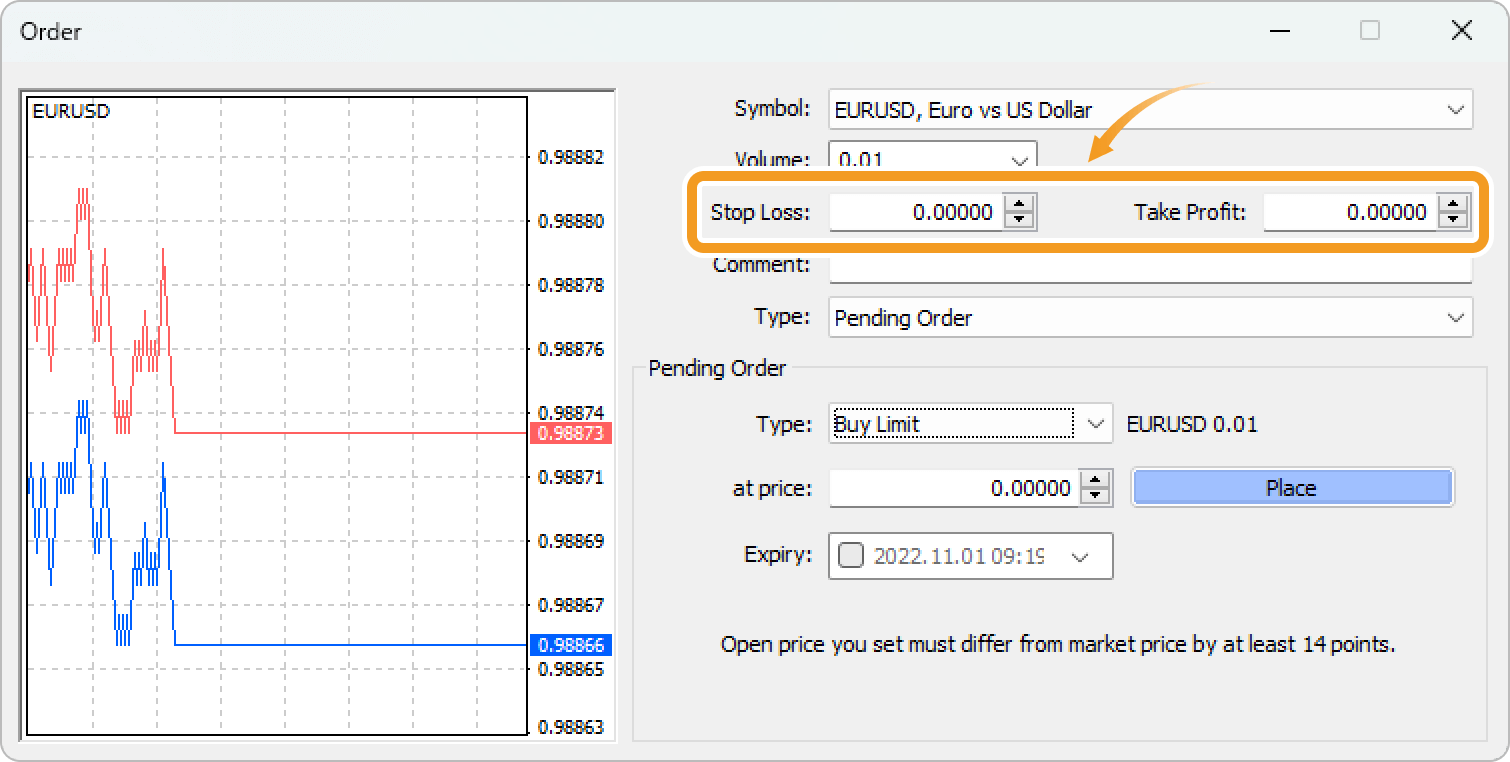

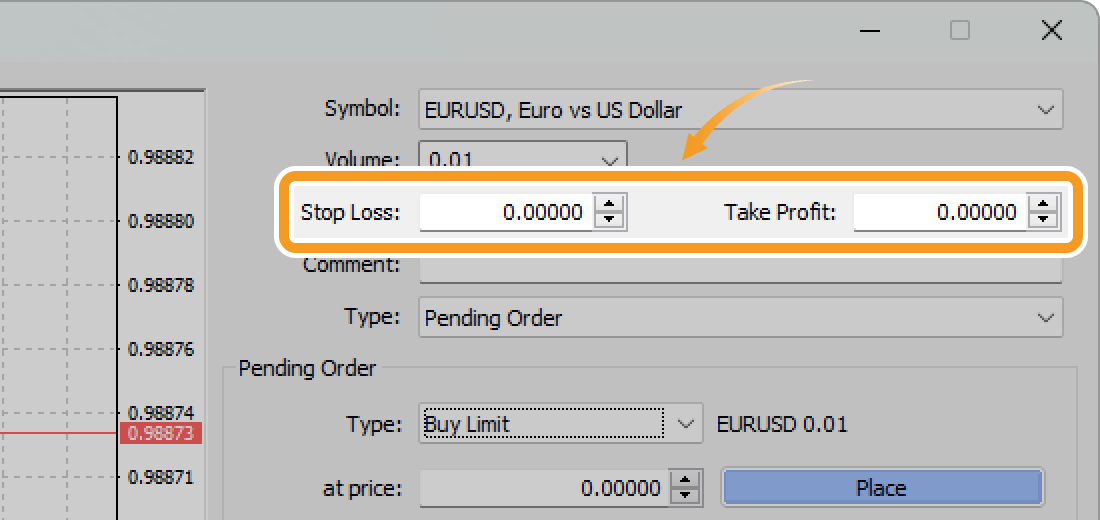

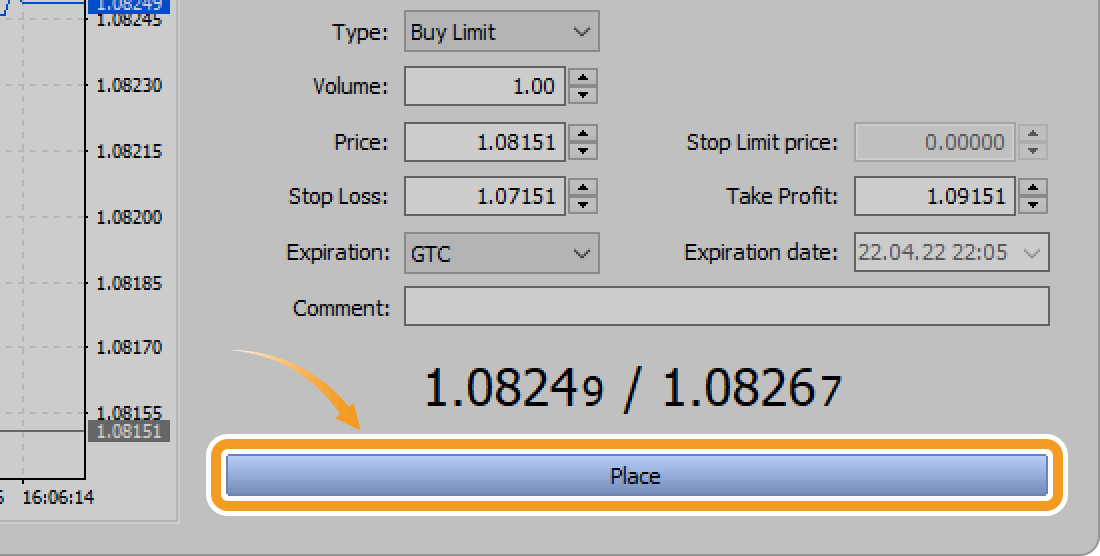

Set the stop-loss (S/L) value in the "Stop Loss" field, and the take-profit value in the "Take Profit" field. Type the value or use the ▼▲ marks on the right side.

Related article: Set or change T/P and S/L values

Step 8

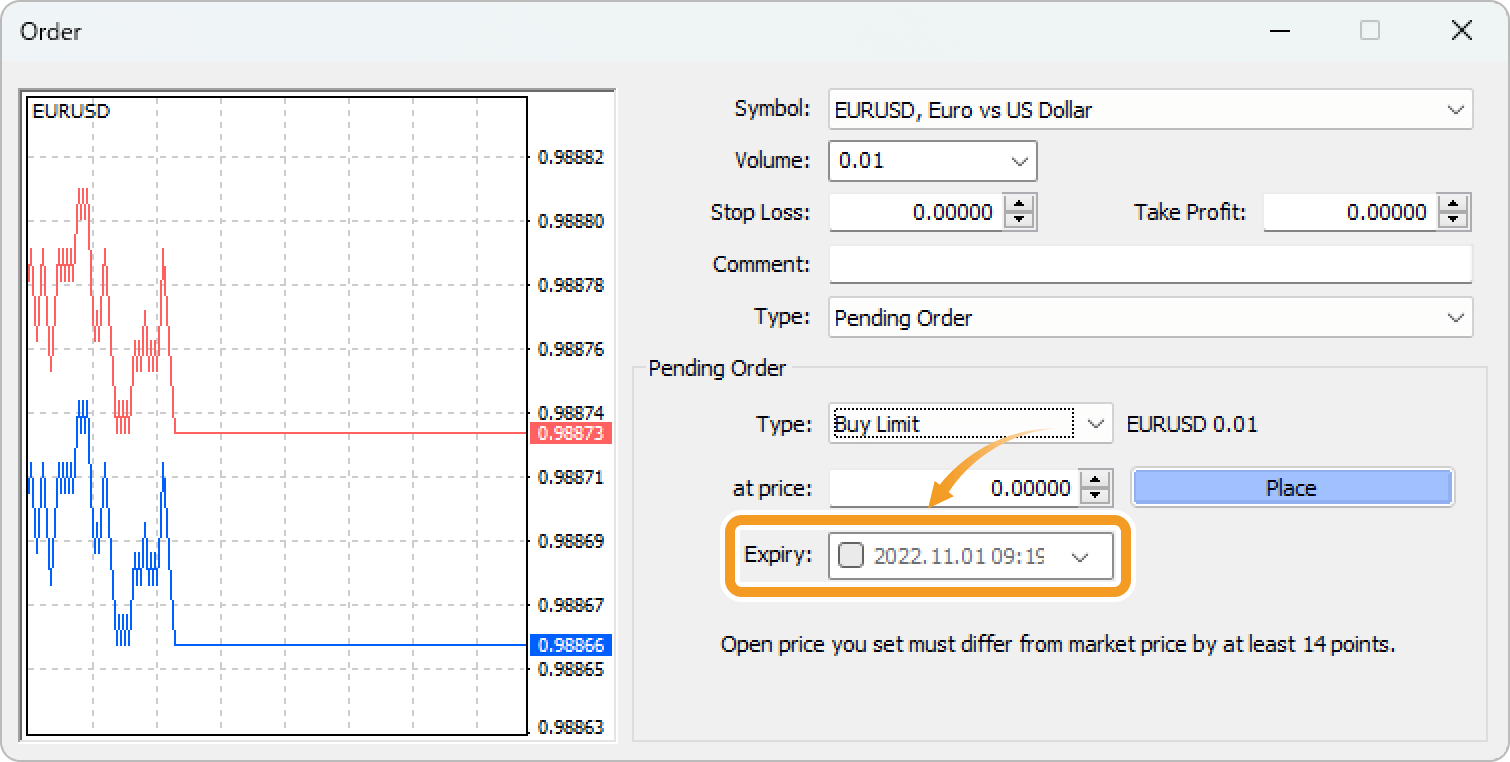

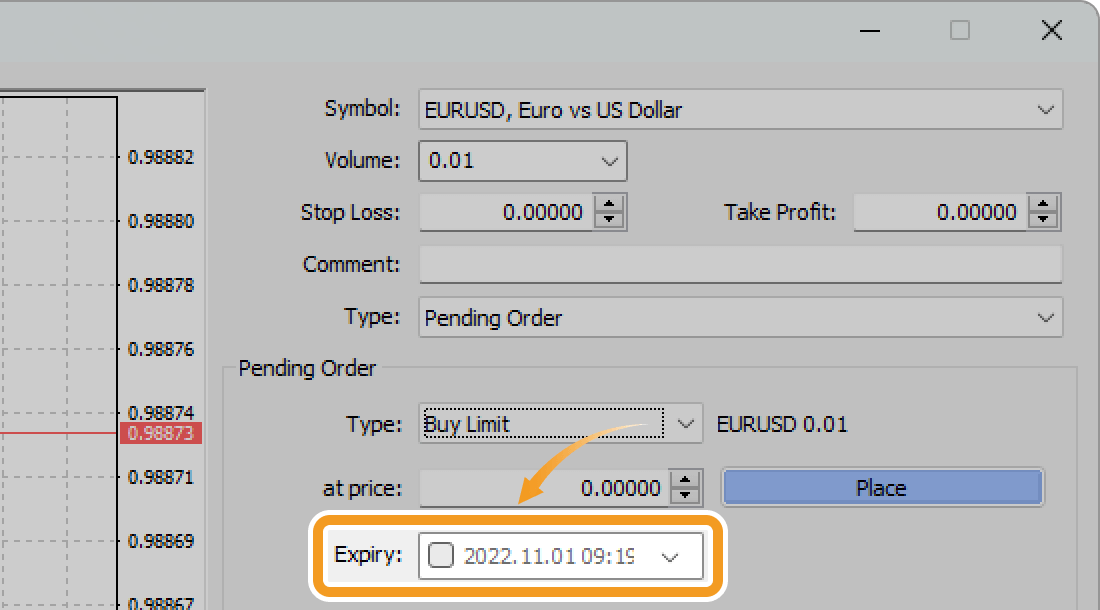

Set the expiration time for the limit/stop order in the "Expiry" field. To specify the date and time, open the calendar from the pull-down on the right side to select the date and time. Time is based on the server time.

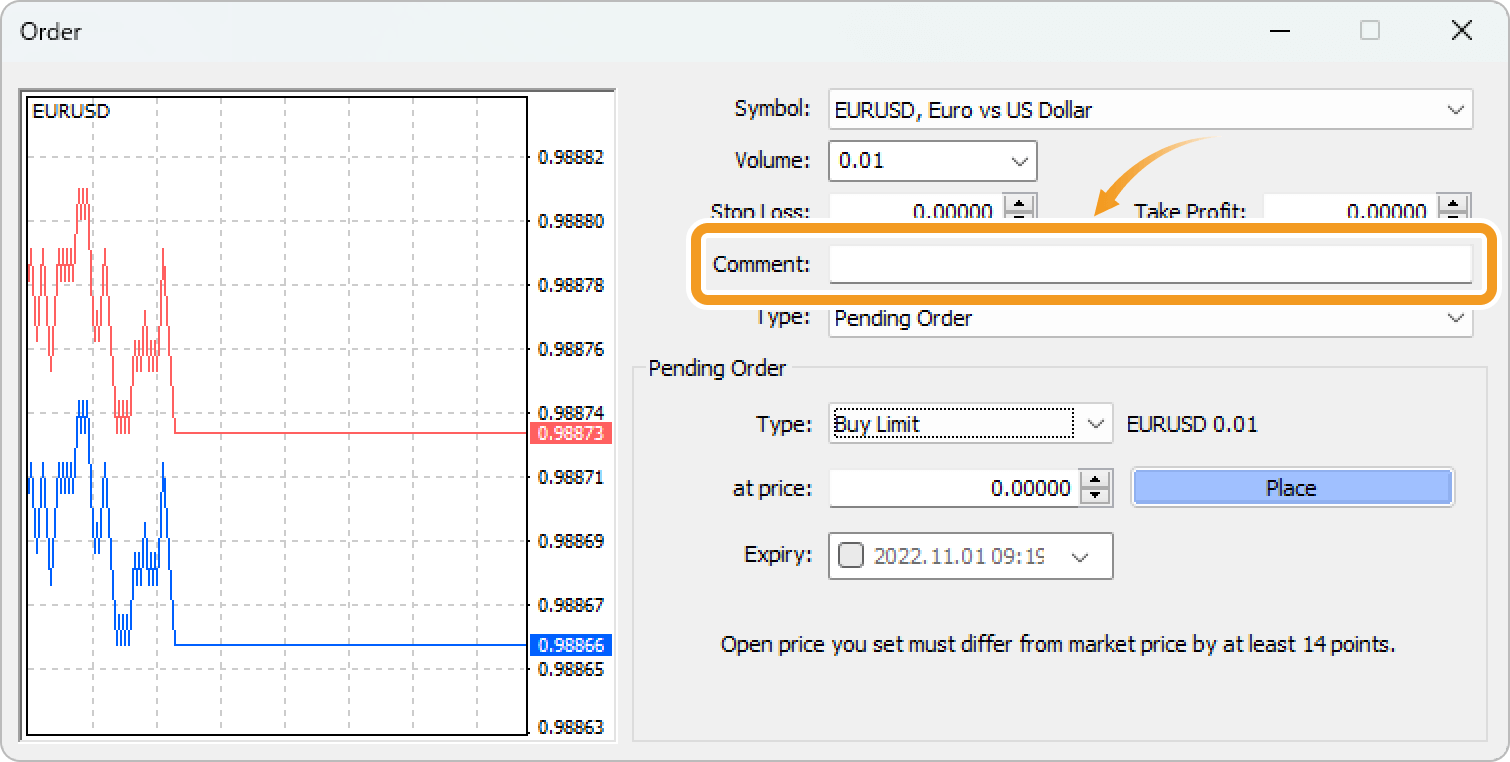

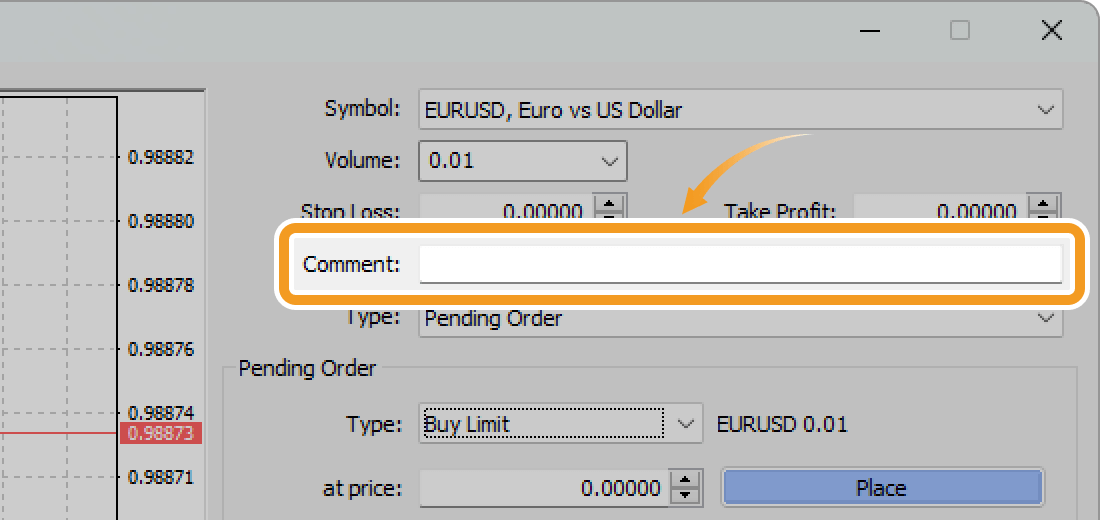

Step 9

In the "Comment" field, you can add comments to an order. Use them as notes for later reference.

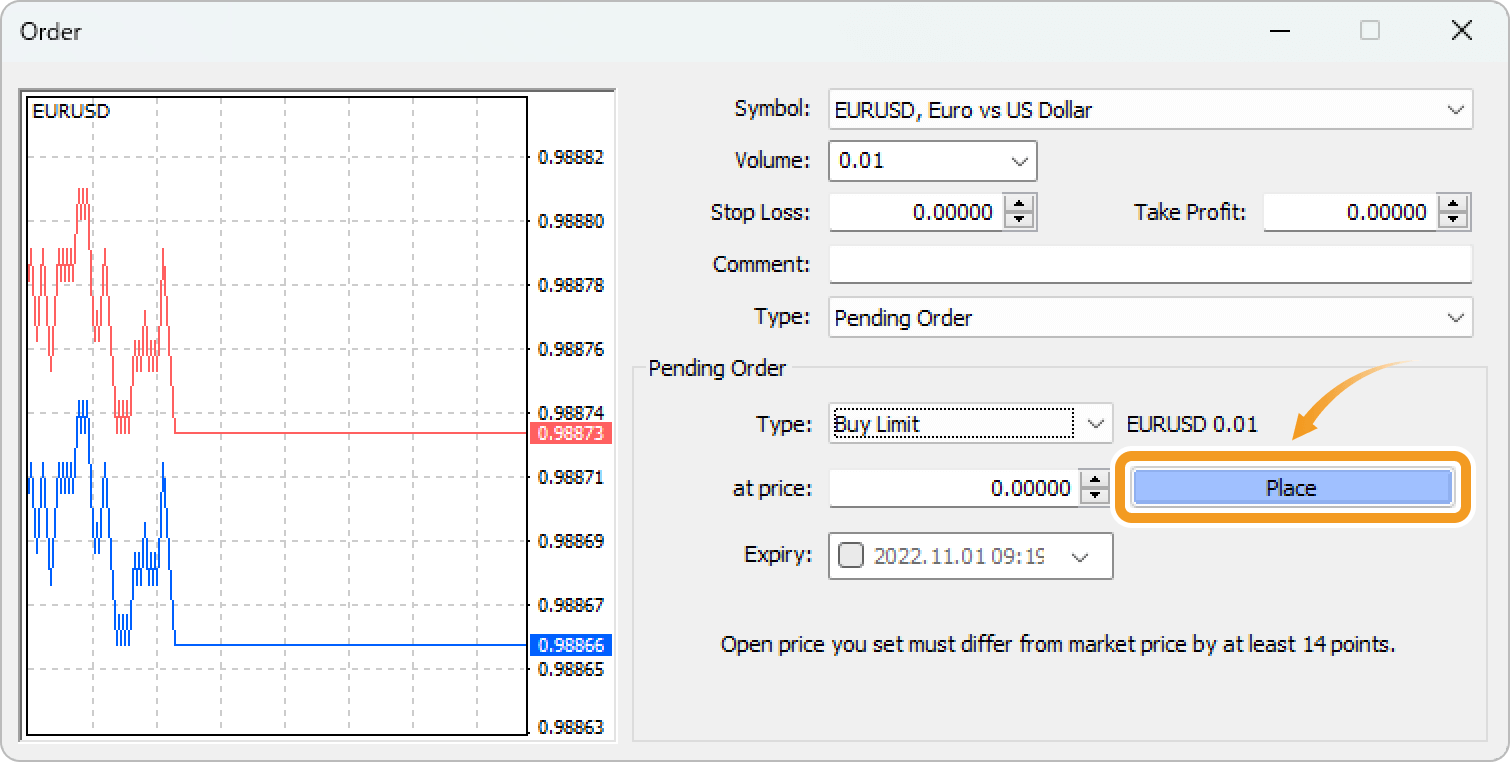

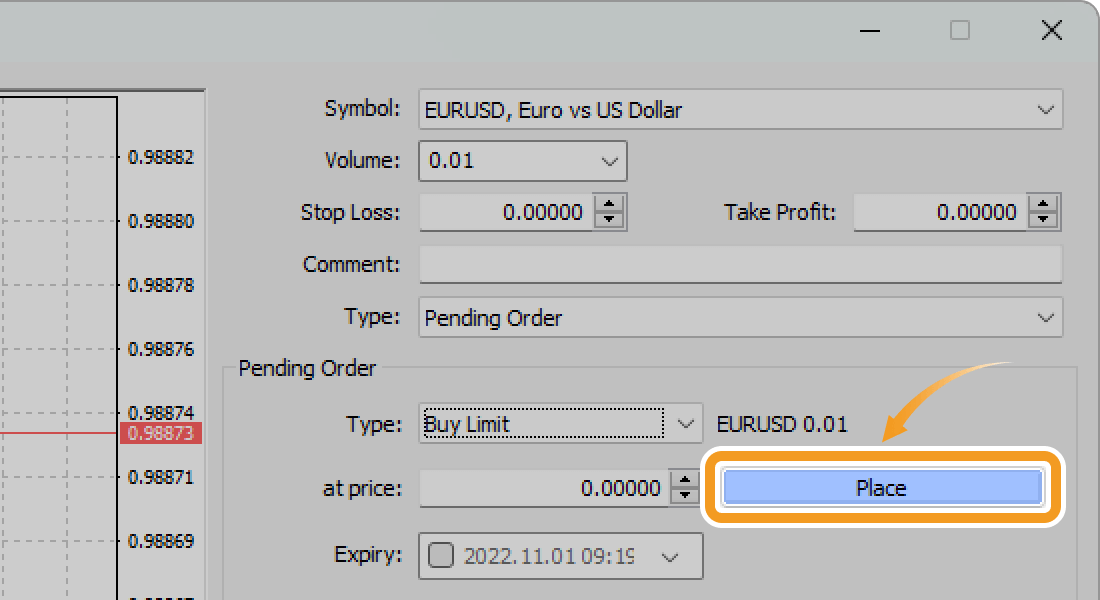

Step 10

Click "Place".

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the broker, account type, and symbol. If you can't click the "Place" button, adjust the price according to the stop level.

Related article: Check trading conditions

In the new order window, you can check the tick chart. A tick is the smallest unit of data that represents price. Tick charts detect smaller price changes than any other chart, which will help you execute well-timed orders. From the new order window's tick chart, you can check the Bid, Ask, take-profit (T/P), and stop-loss (S/L) values.

Step 11

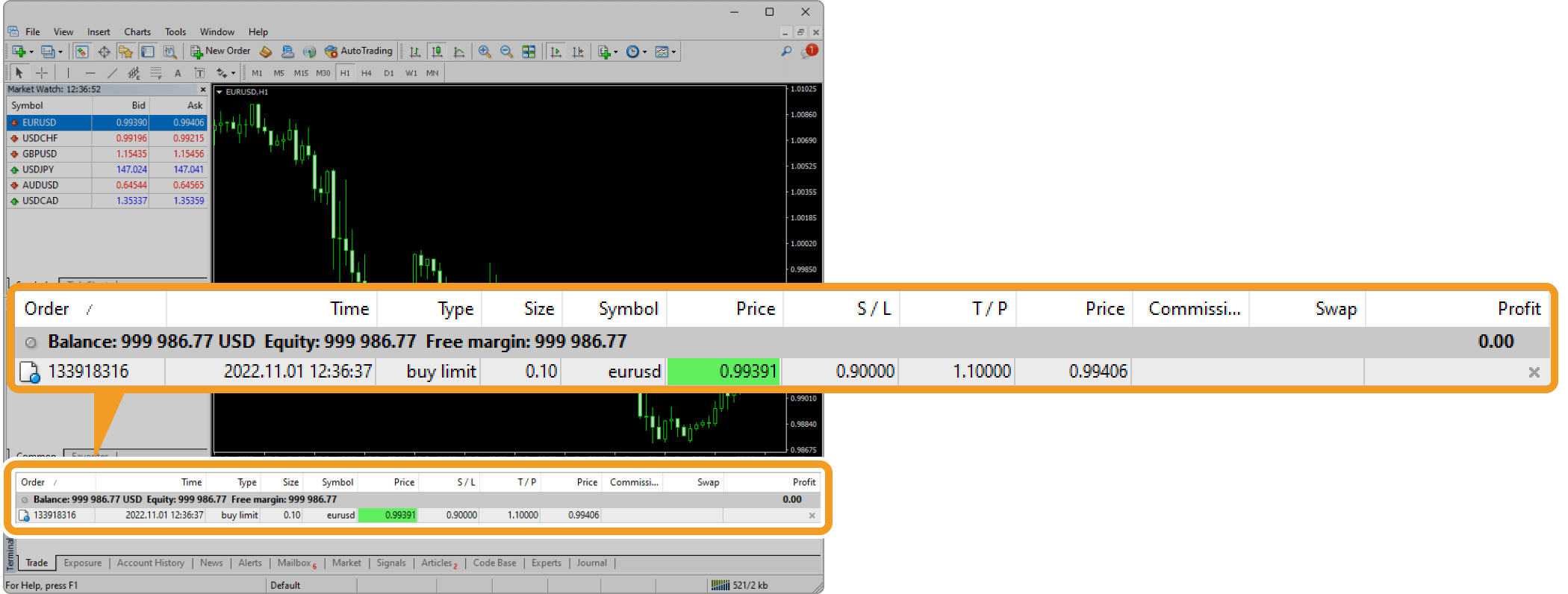

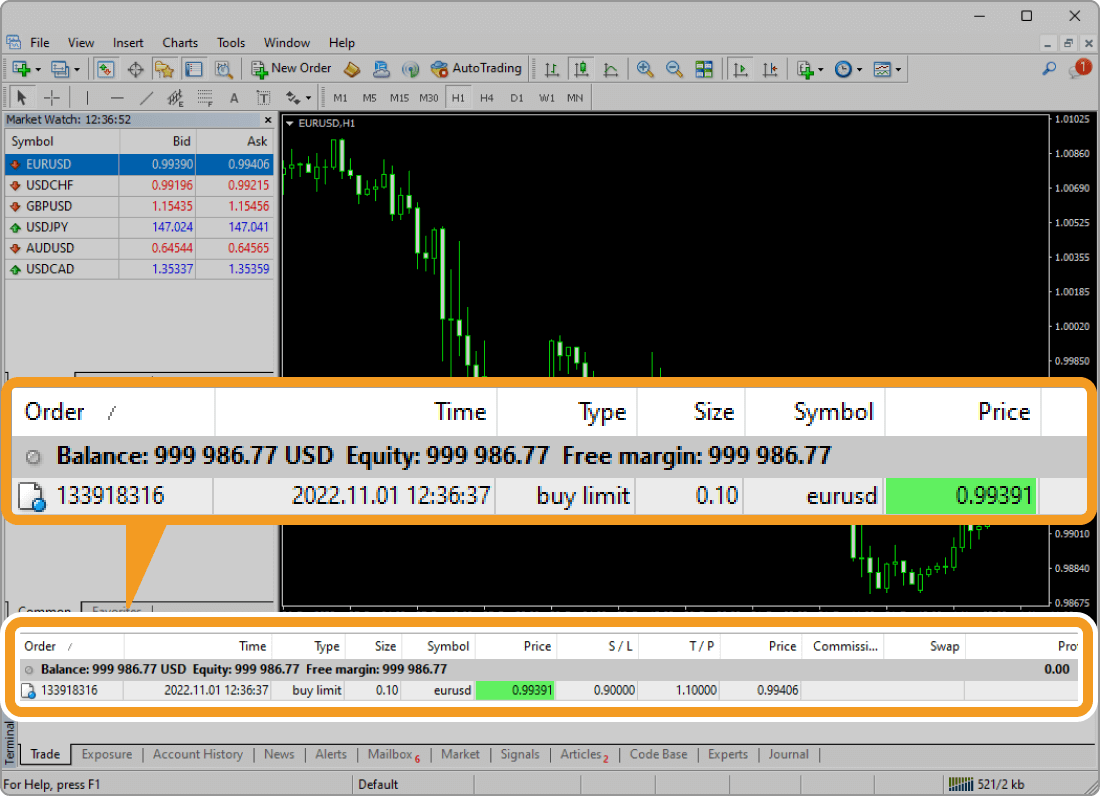

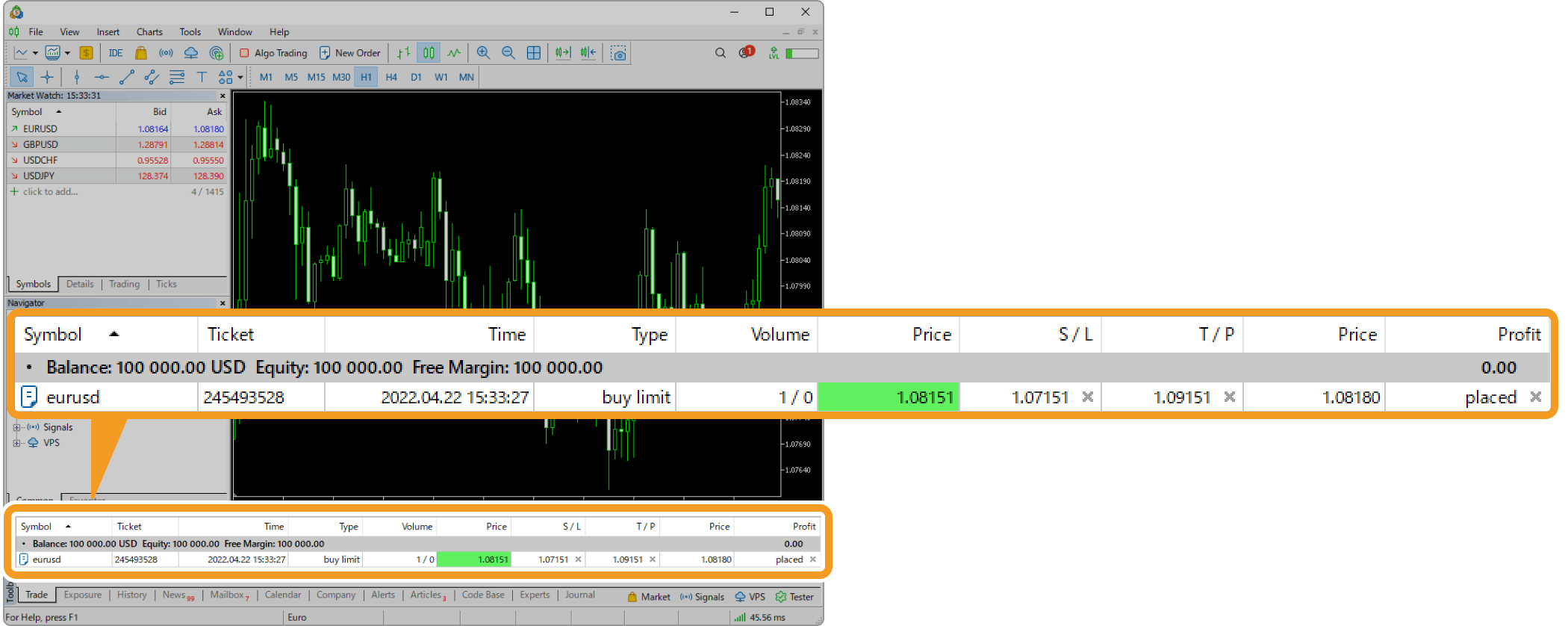

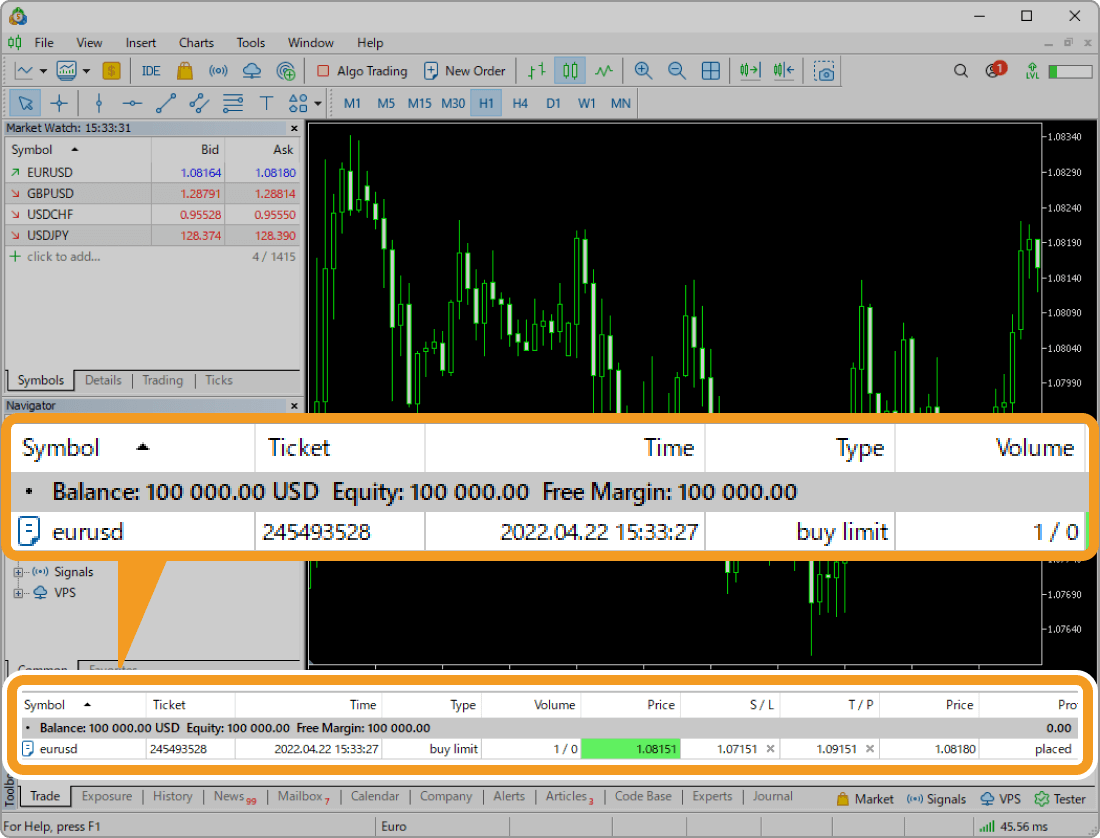

The order details will be added below the balance line in the "Trade" tab of the Terminal as a pending order.

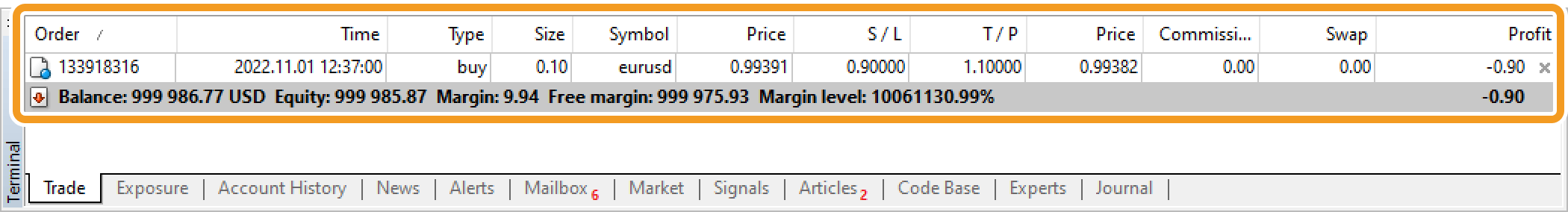

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

Step 1

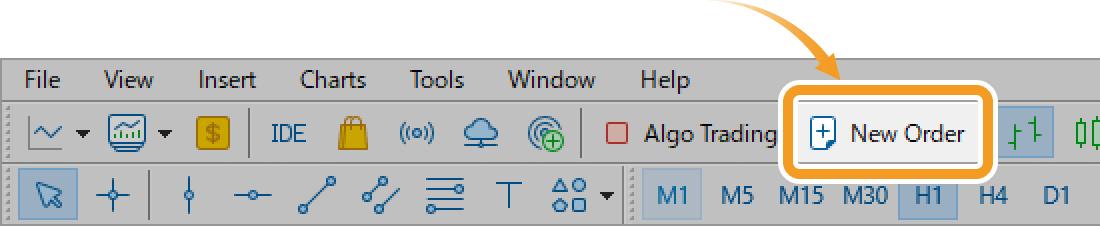

Click "New Order" in the toolbar.

Related article: Open the new order window

Step 2

Click the "Symbol" field to choose the symbol to place an order for.

Step 3

Click the "Type" field and select "Pending Order".

Step 4

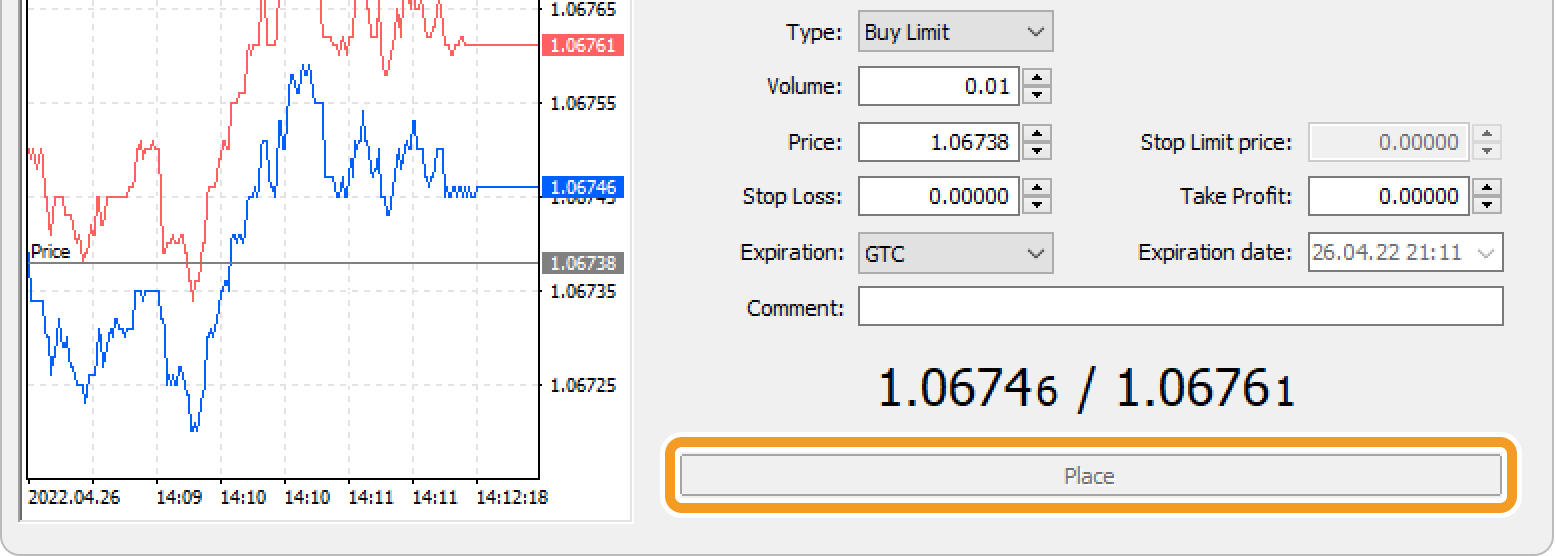

Click the "Type" field and select a type of limit/stop/stop-limit order.

-

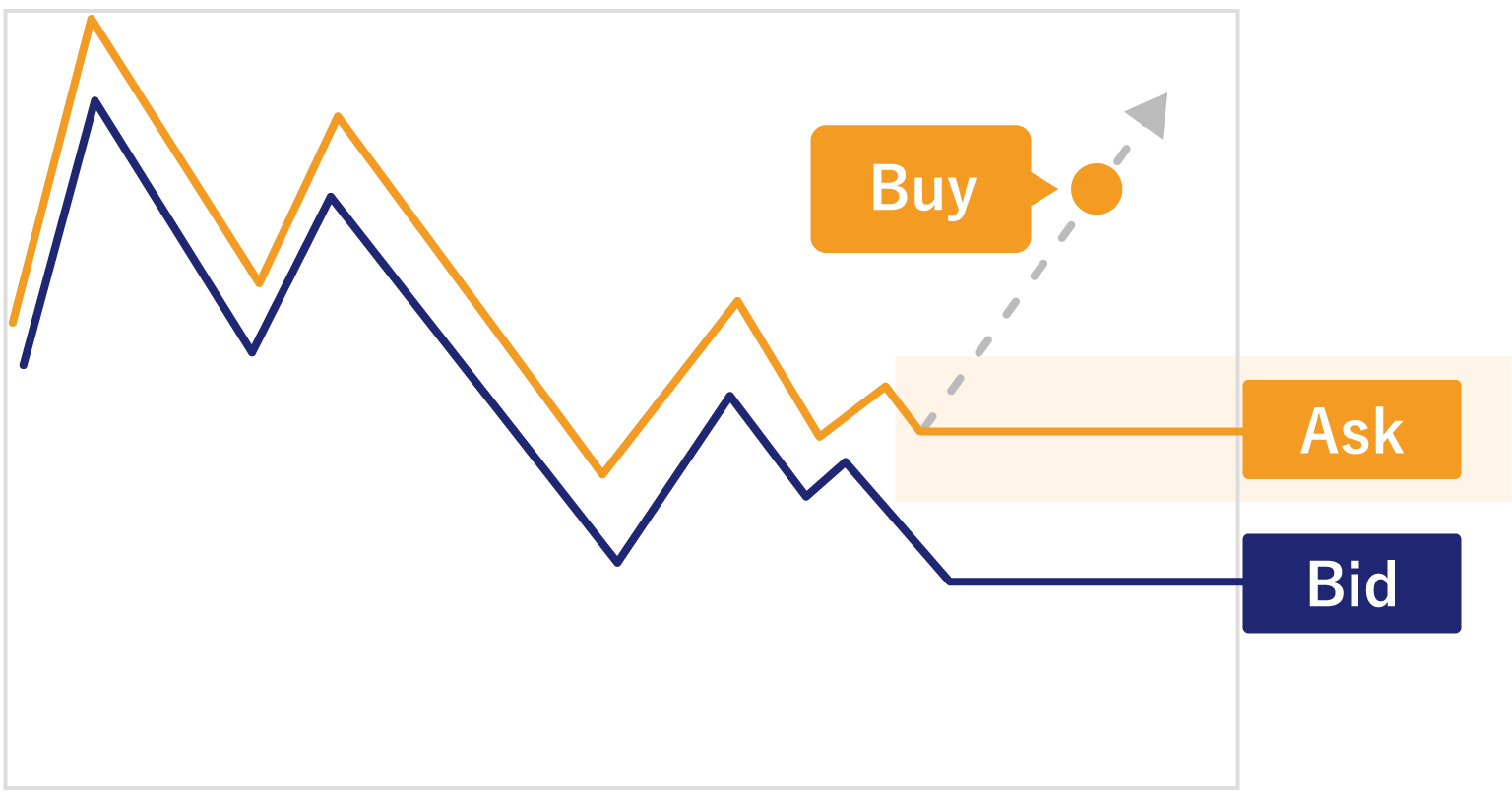

Buy Limit

If you place a buy order by specifying a lower price than the current, select Buy Limit. Enter a price that is lower than the current Ask price.

-

Buy Stop

If you place a buy order by specifying a higher price than the current, select Buy Stop. Enter a price that is higher than the current Ask price.

-

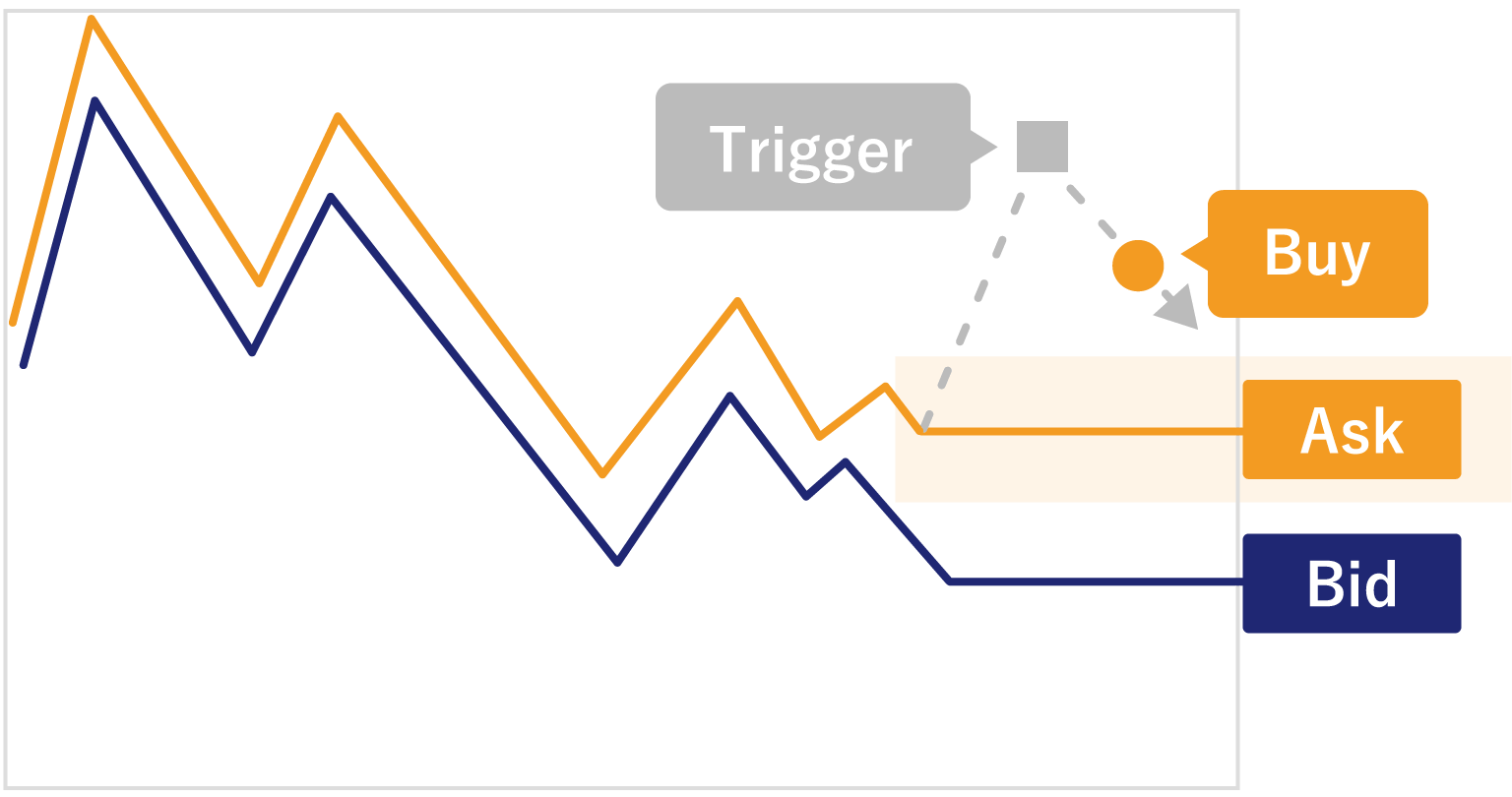

Buy Stop Limit

Select Buy Stop Limit and specify a trigger price higher than the current. Once the trigger price is achieved, a buy limit order will be placed.

-

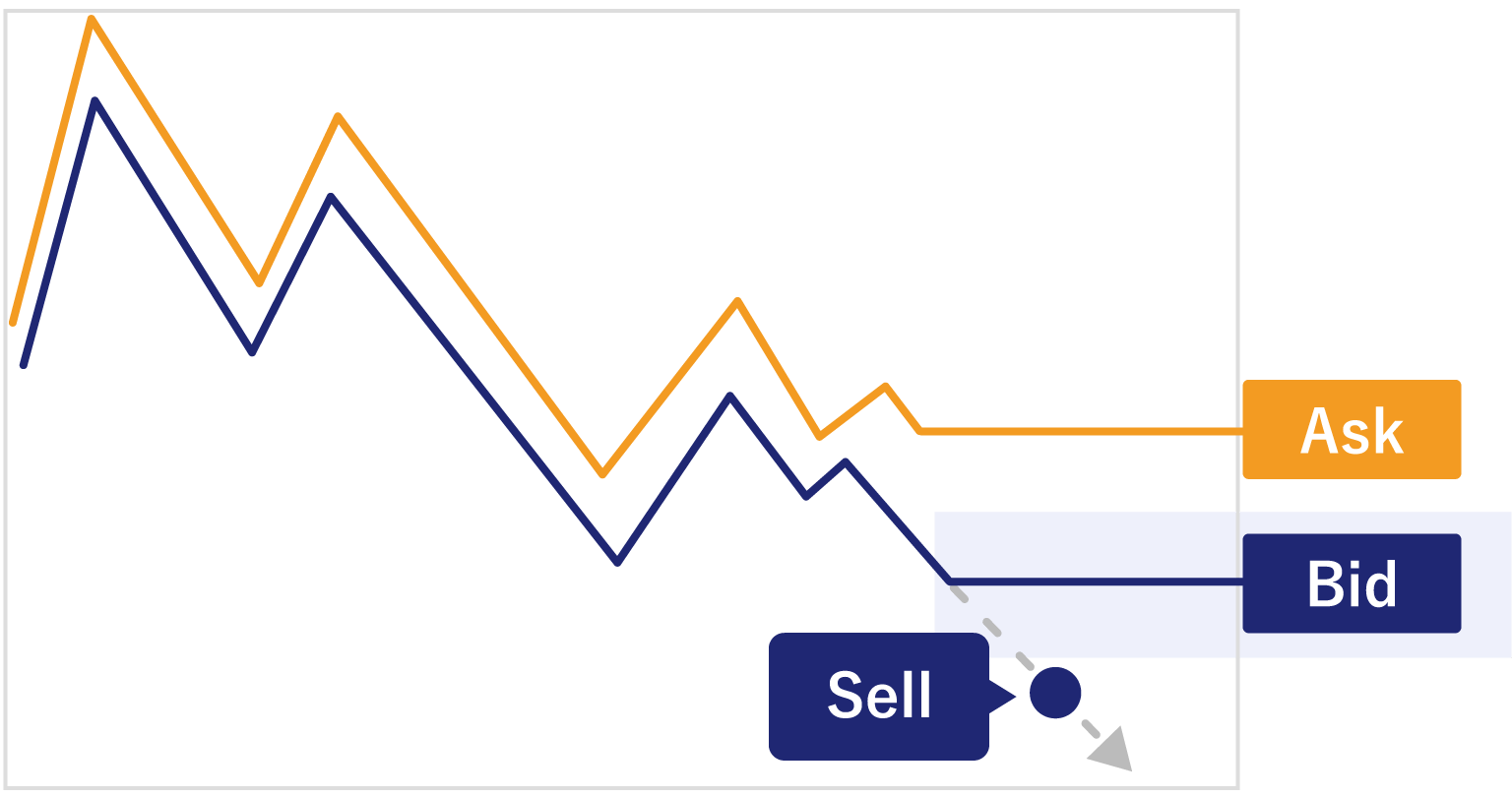

Sell Limit

If you place a sell order by specifying a higher price than the current, select Sell Limit. Enter a price that's higher than the current Bid price.

-

Sell Stop

If you place a sell order by specifying a lower price than the current, select Sell Stop. Enter a price that's lower than the current Bid price.

-

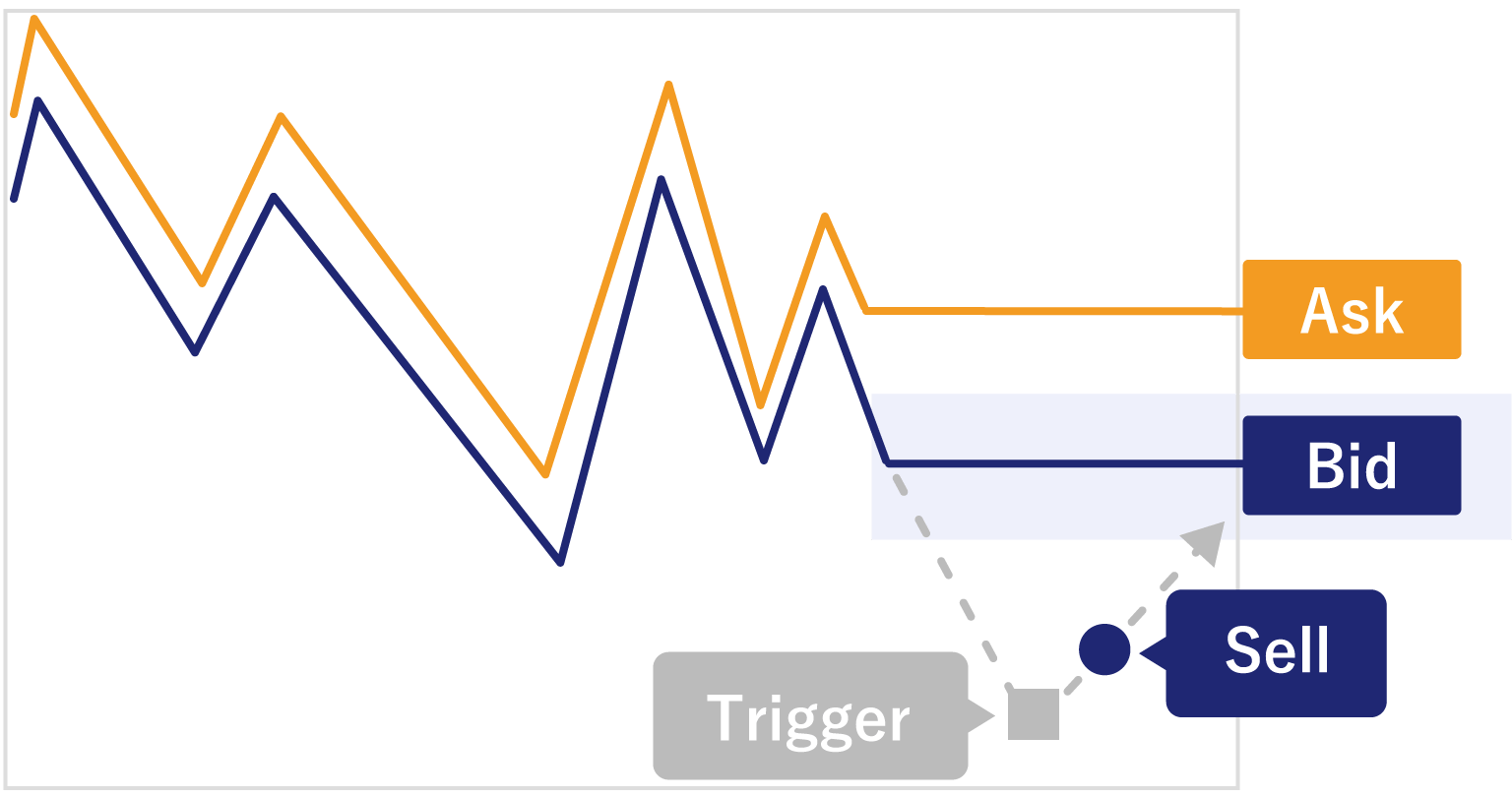

Sell Stop Limit

Select Sell Stop Limit and specify a trigger price lower than the current. Once the trigger price is achieved, a sell limit order will be placed.

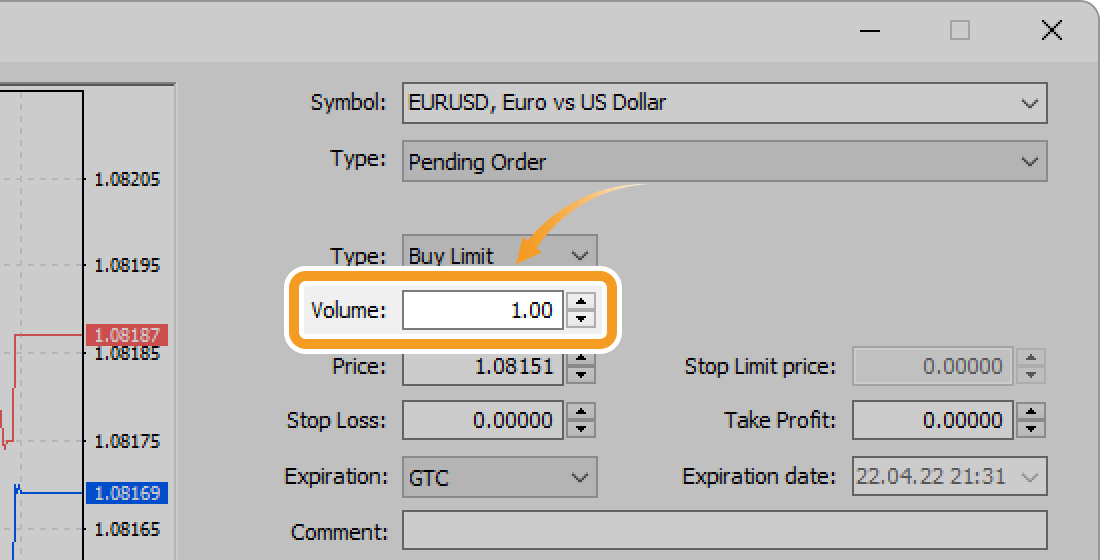

Step 5

Set the trade volume in lots in the "Volume" field. Type the volume or use the ▼▲ marks on the right side.

Step 6

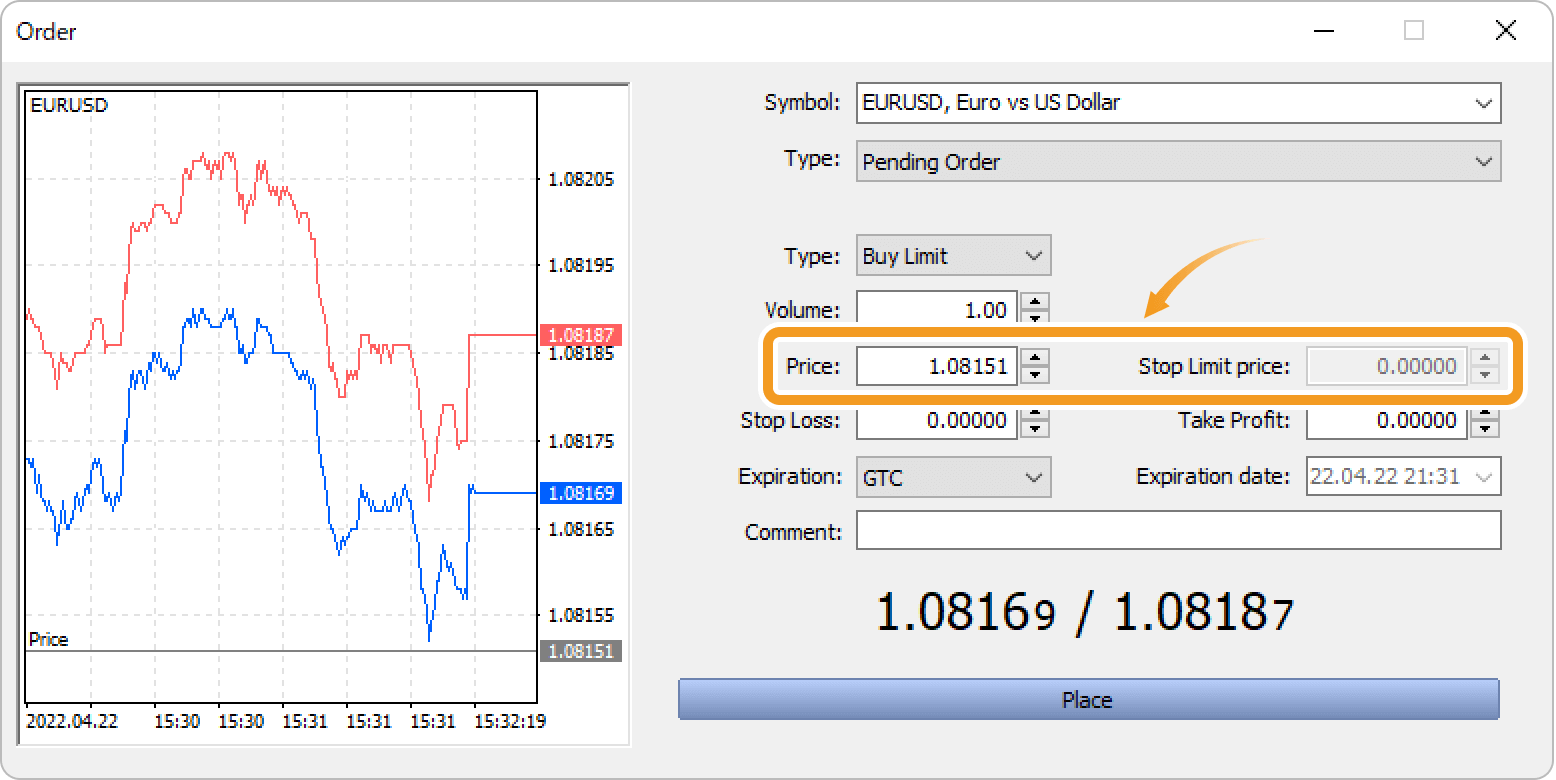

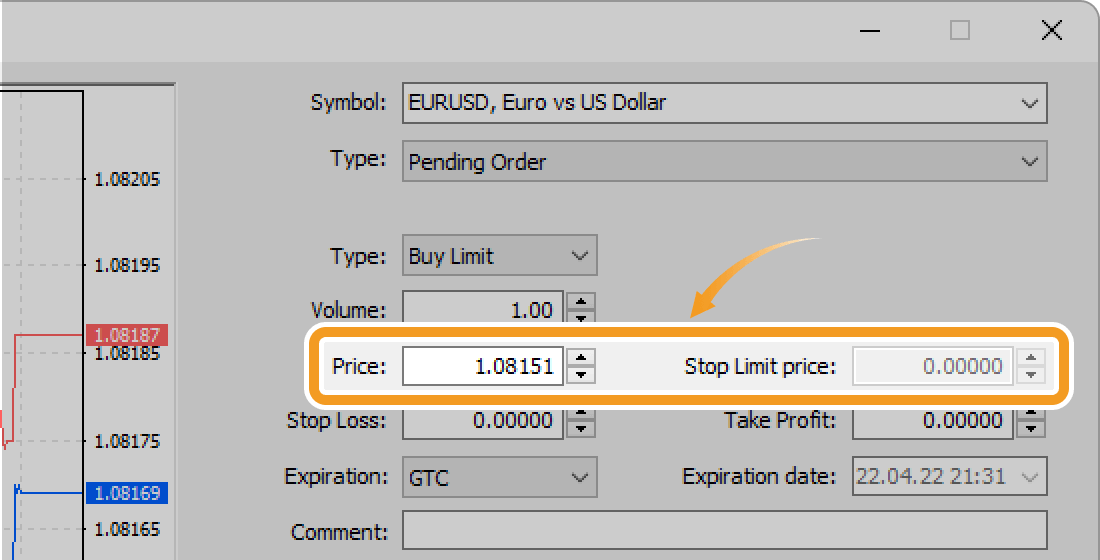

Set the limit/stop/stop-limit price (trigger price to activate stop-limit order) in the "Price" field. To place a stop-limit order, set the limit price in the "Stop Limit Price" field. Type the price or use the ▼▲ marks on the right side.

Step 7

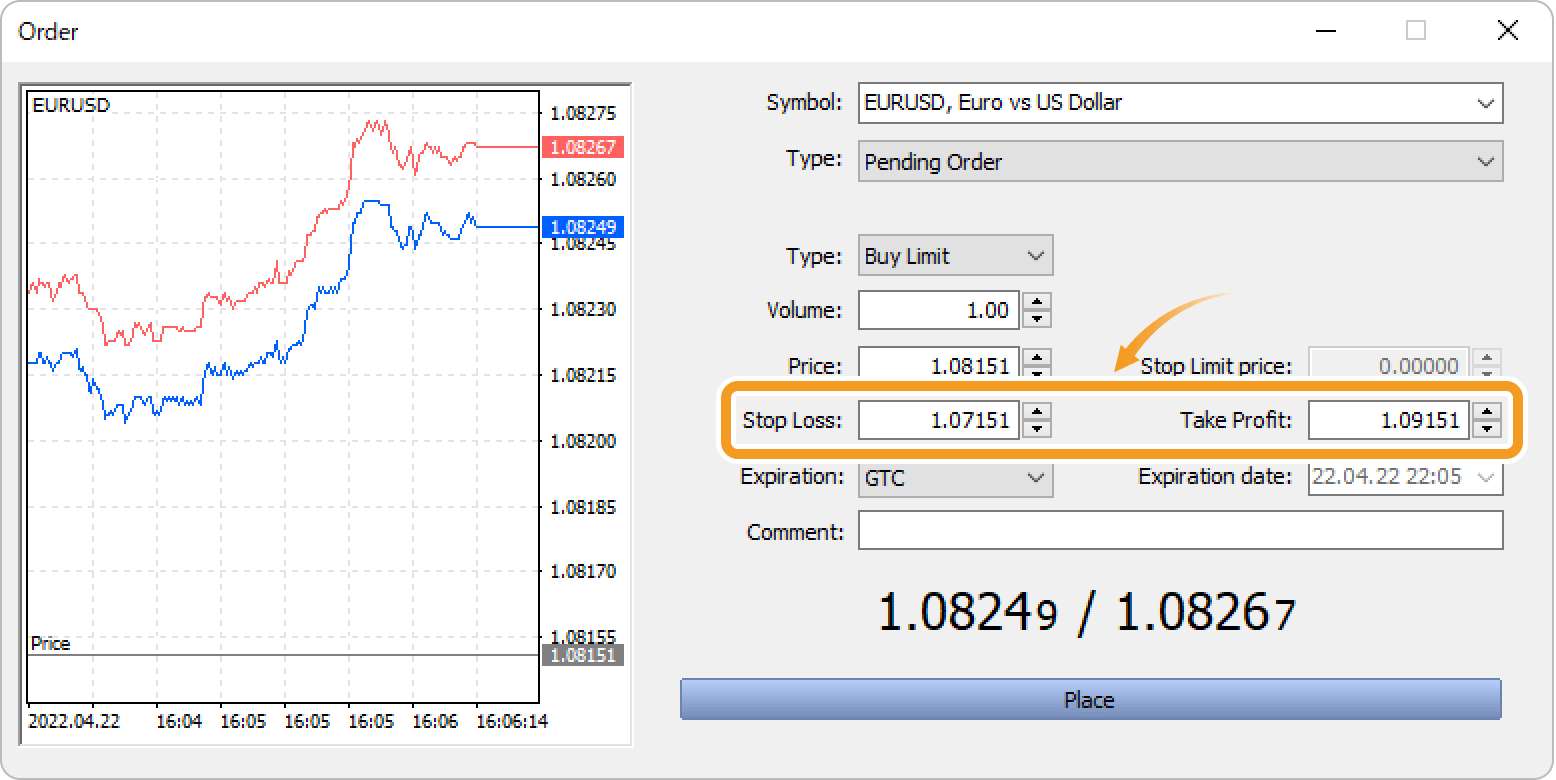

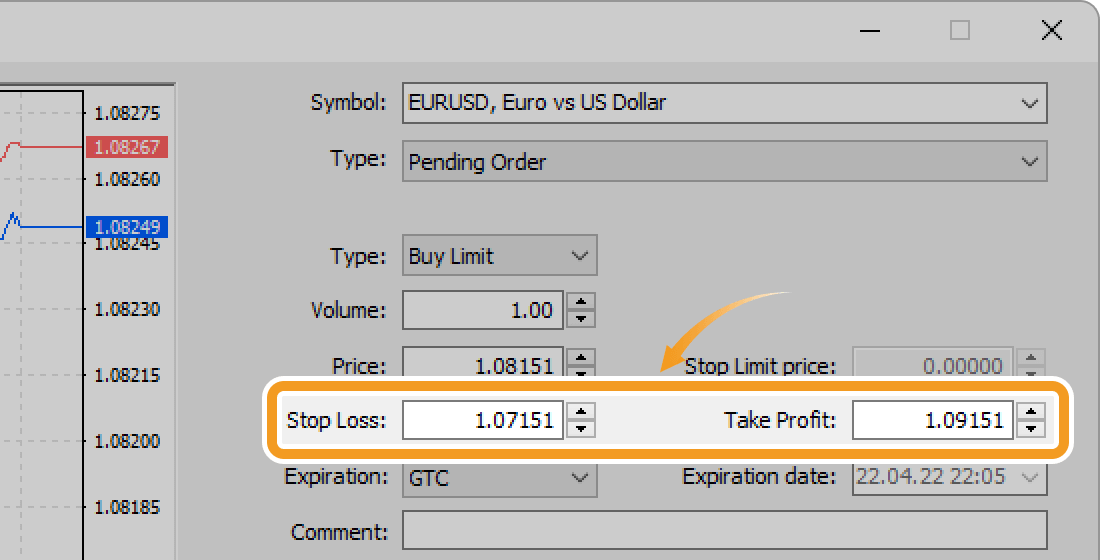

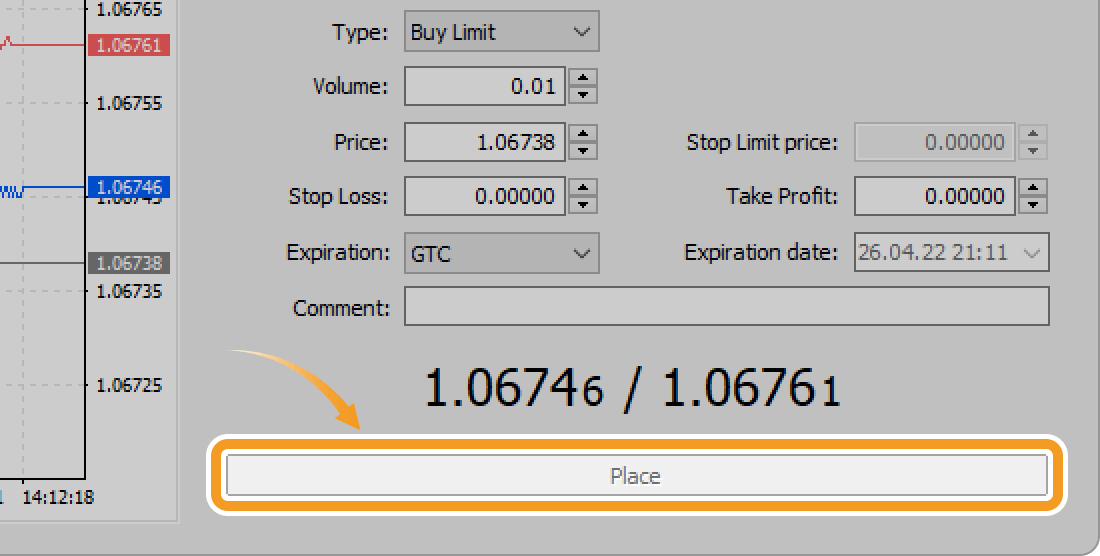

Set the stop-loss (S/L) value in the "Stop Loss" field, and the take-profit value in the "Take Profit" field. Type the value or use the ▼▲ marks on the right side.

Related article: Set or change T/P and S/L values

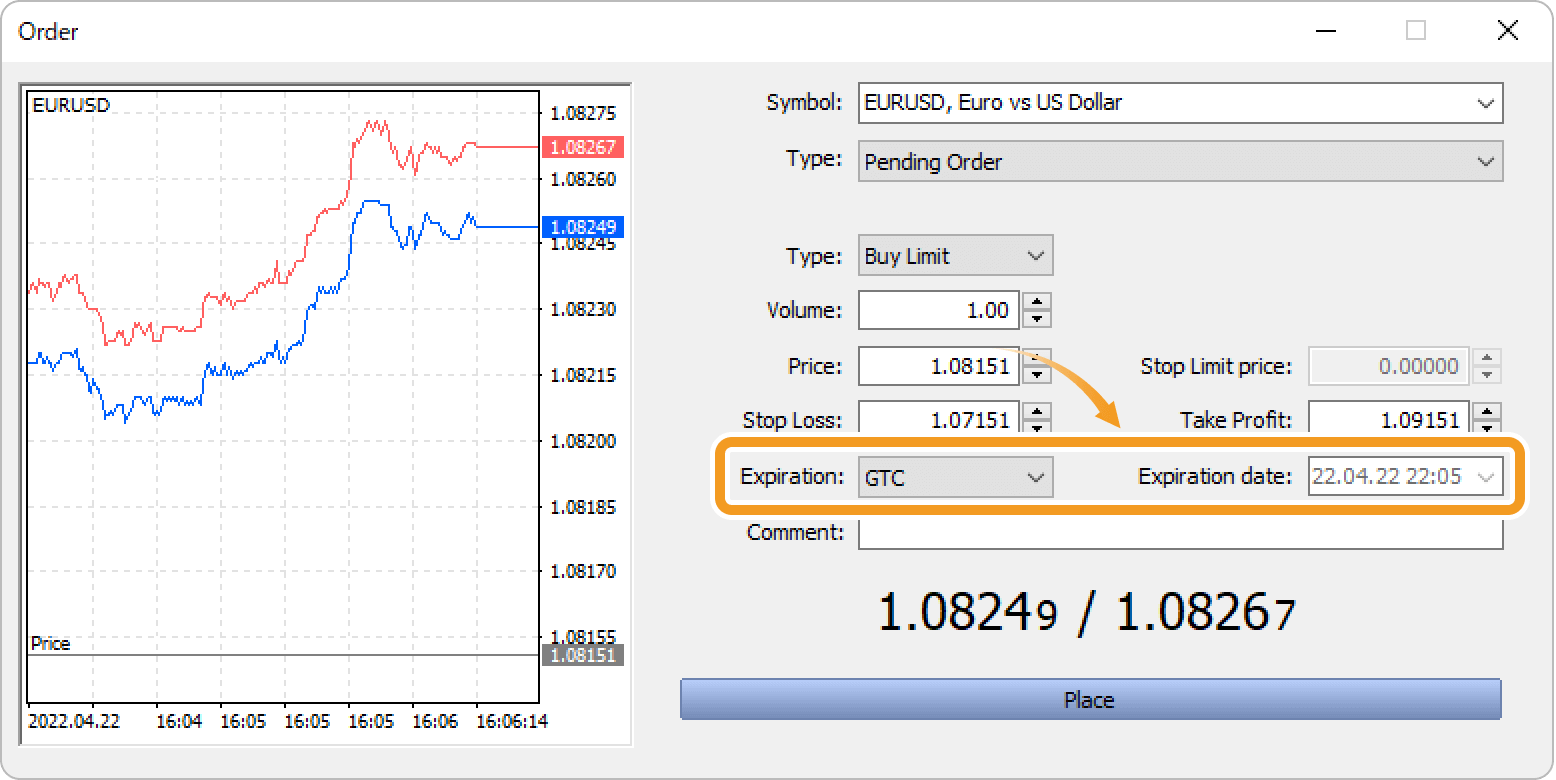

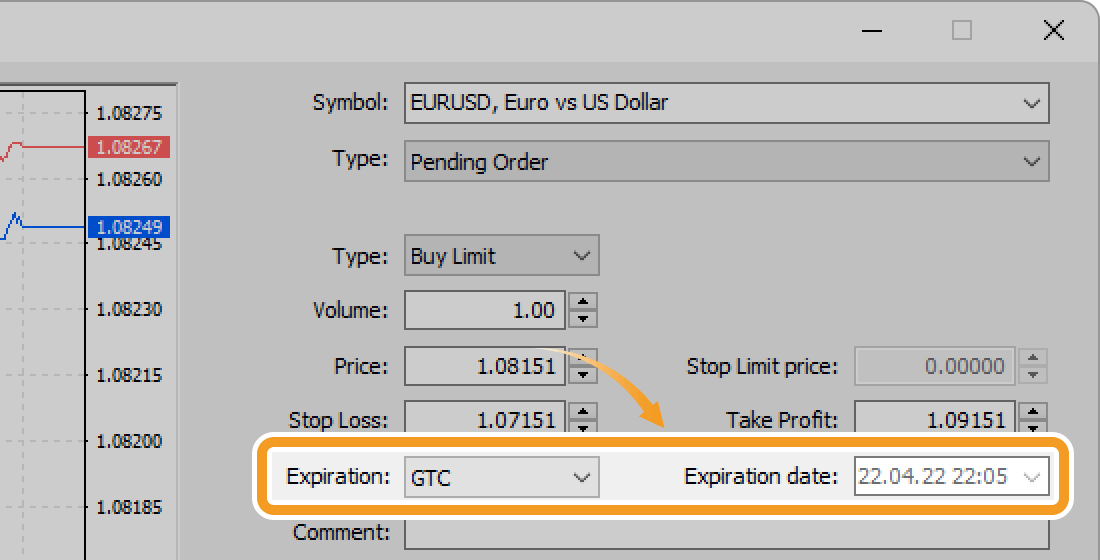

Step 8

Set the expiration type for the limit/stop order. To specify the date, select "Specified" or "Specified day" in the "Expiration" field and specify the date and time in the "Expiration date" field. Time is based on the server time.

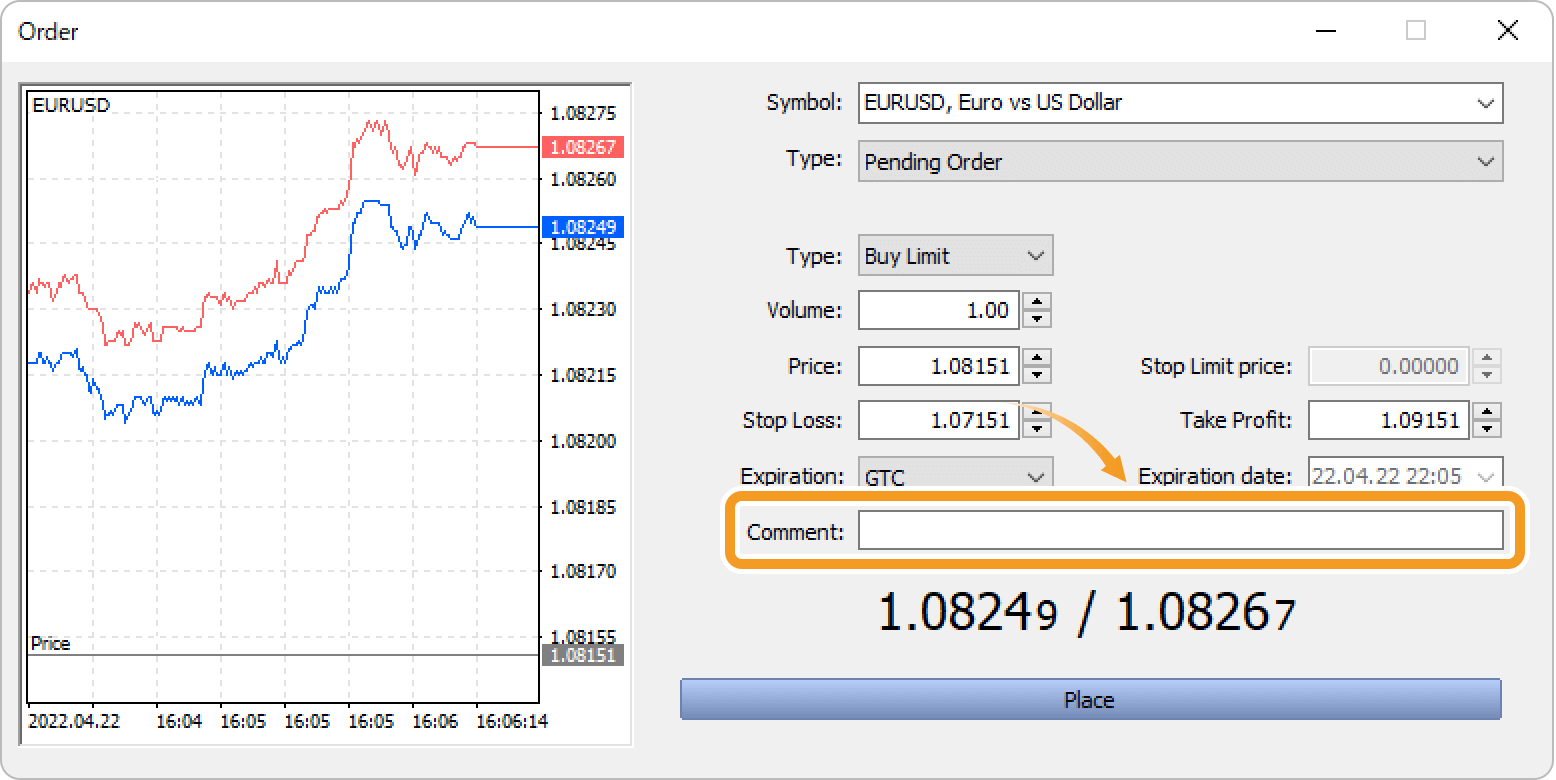

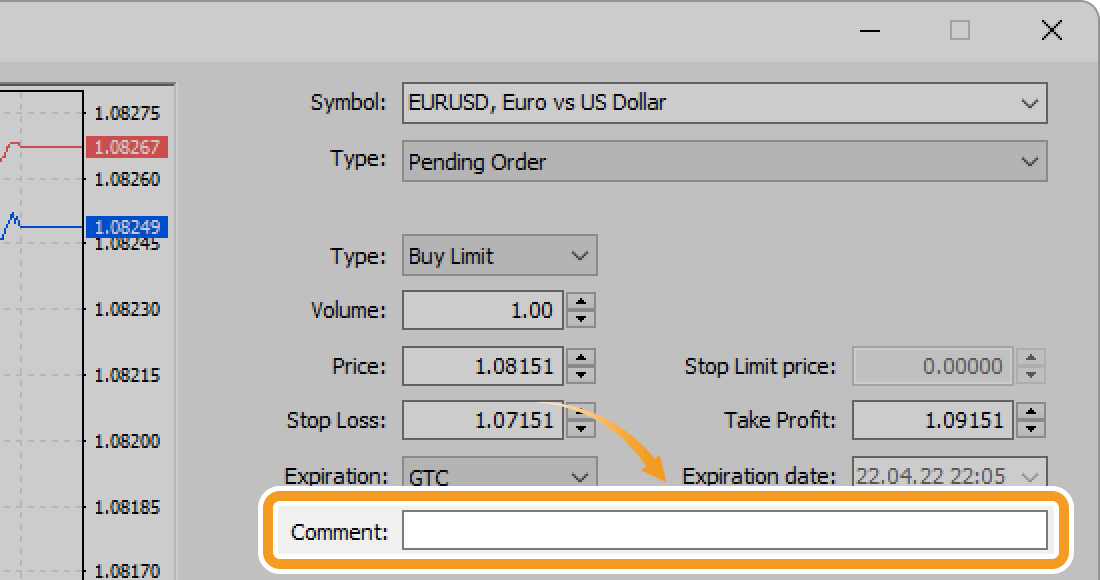

Step 9

In the "Comment" field, you can add comments to an order. Use them as notes for later reference.

Step 10

Click "Place".

When placing limit/stop orders, you have to specify a price that's certain points away from the current price. The difference between the two is called the stop level and it varies by the broker, account type, and symbol. If the "Place" button is blue or not red, check your price and make sure the deviation isn't smaller than the stop level.

Related article: Check trading conditions

In MT5's new order window, you can check the tick chart. A tick is the smallest unit of data that represents price. Tick charts detect price movement faster than any other chart, which will help you execute well-timed orders. From the new order window's tick chart, you can check the Ask, Bid, take-profit (T/P), and stop-loss (S/L) values.

Step 11

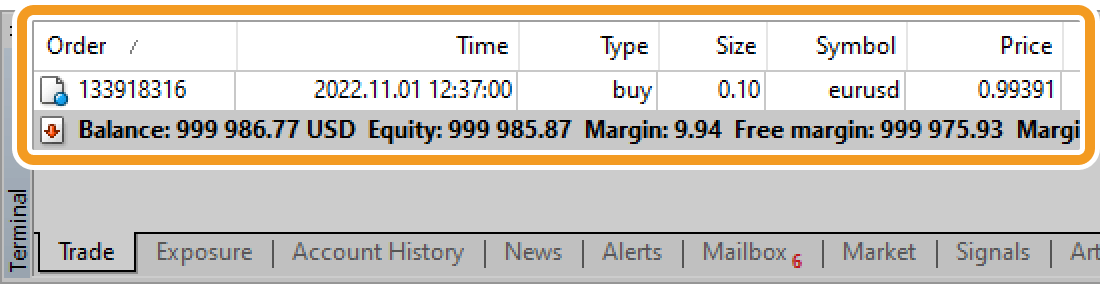

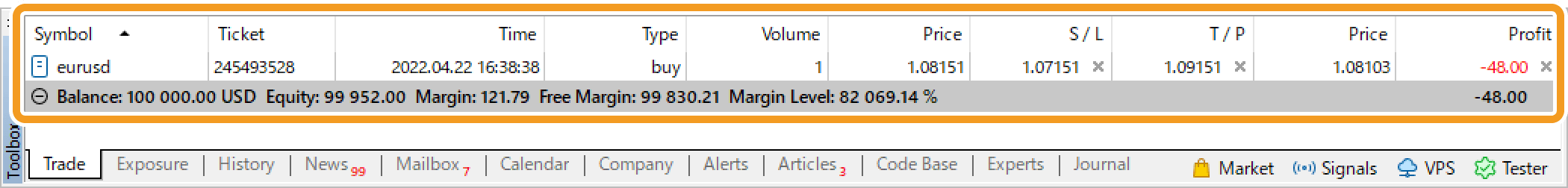

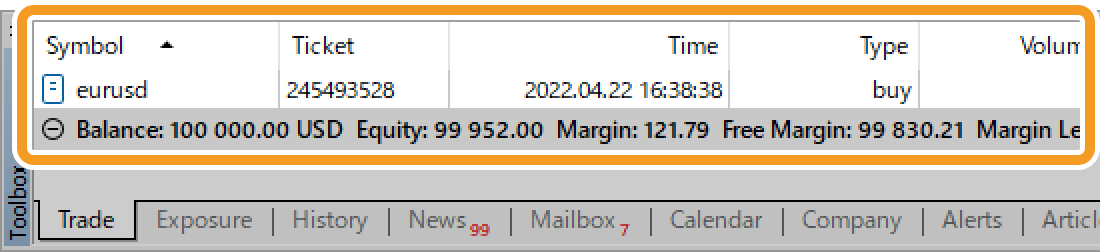

Once the order is placed, the order details will be added below the balance line in the "Trade" tab of the Toolbox as a pending order.

The order will be executed once the specified price is reached. The order details will be updated as an open position and moved above the balance line.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy