FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

Downloaded:

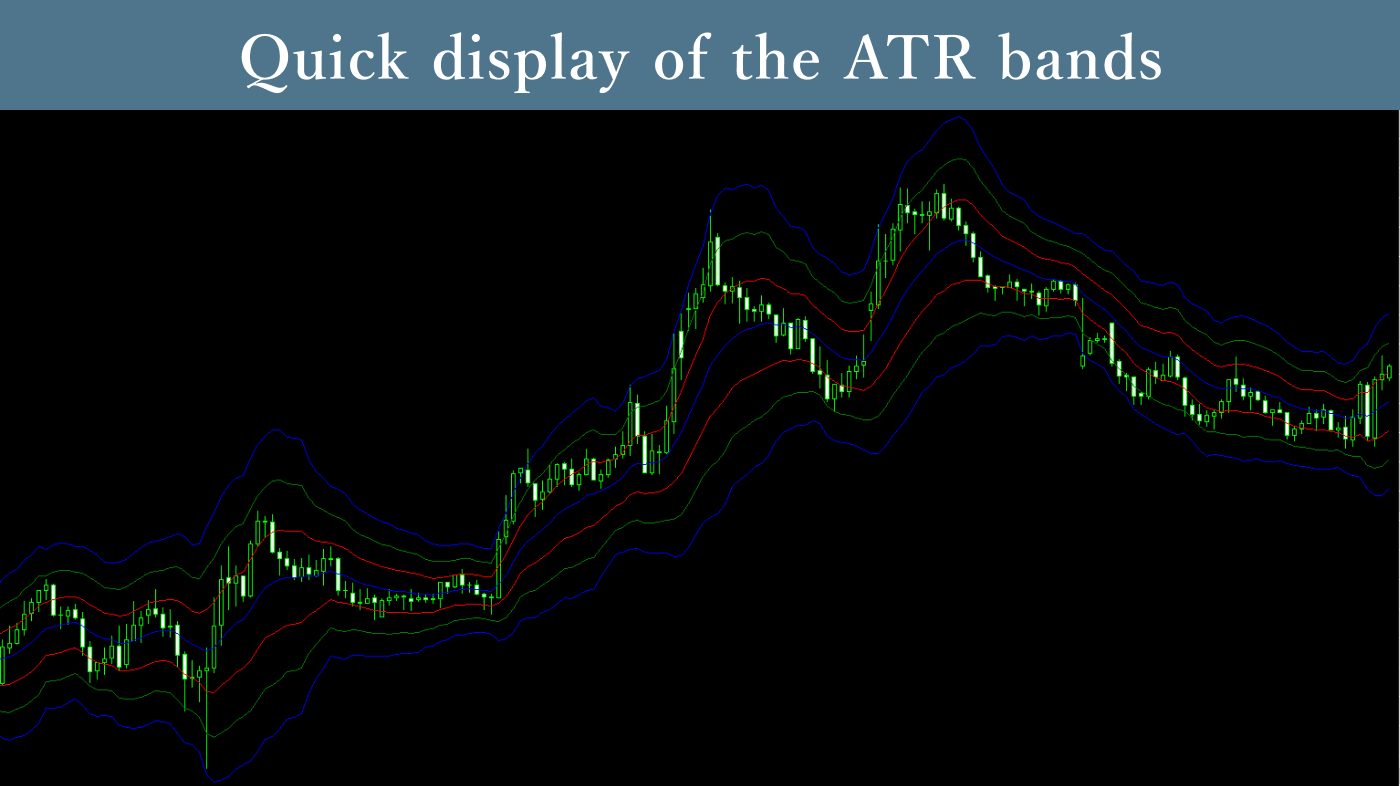

The ATR Bands Indicator adds and subtracts moving averages to ATR values for any set period and displays them as band-shaped graphs on the chart. By knowing the timing when prices cross ATR bands, you can use this as a guide for profit-taking or counter-trend entry.*1

*1Some users are experiencing issues when running custom indicators on MT5 build 5572 (released around February 1, 2026), including display errors and platform freezing. These problems can be resolved either by downgrading to build 5430 (or any earlier build) or by updating to the beta version. The latest beta version is available from the MT5 toolbar by navigating to Help > Check For Updates > Latest Beta Version.

Downloaded:

Usage scenarios

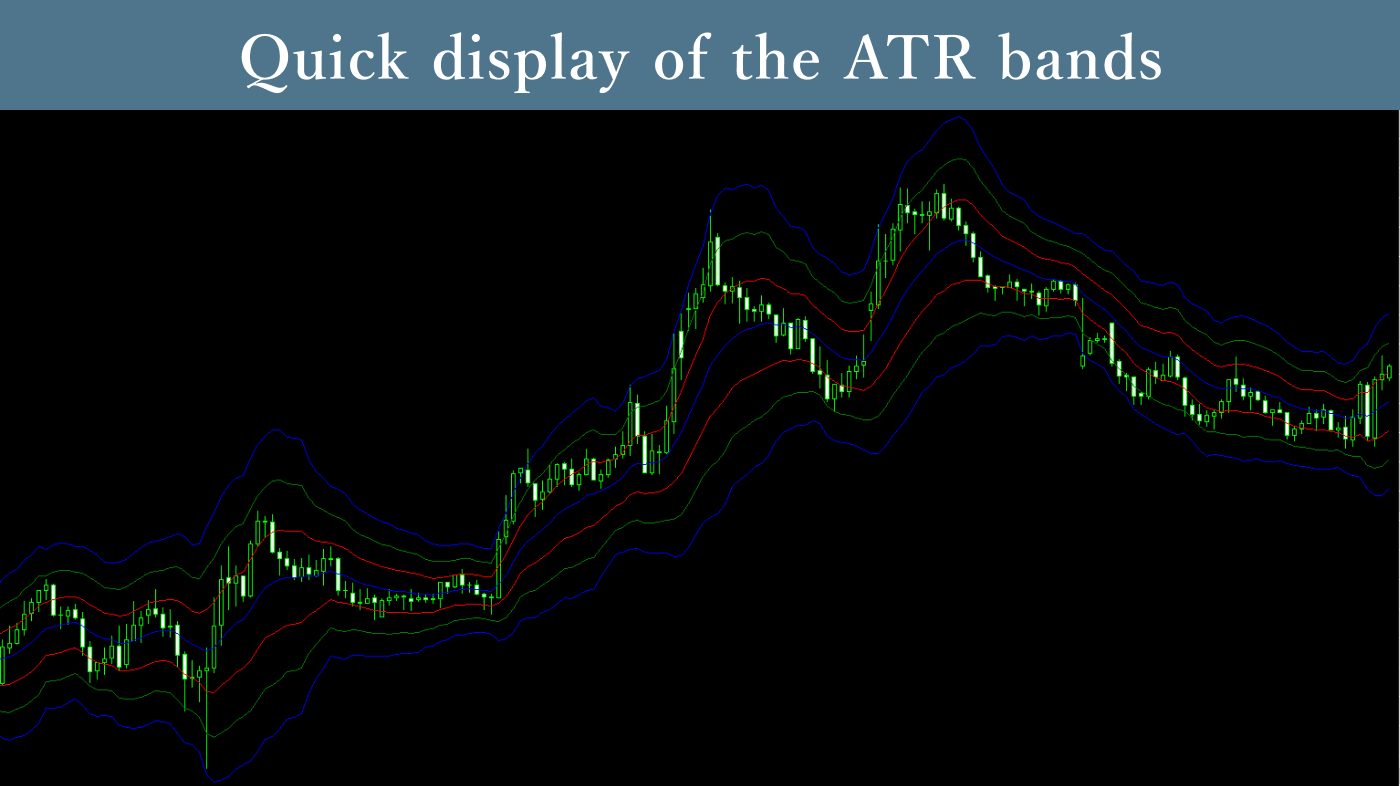

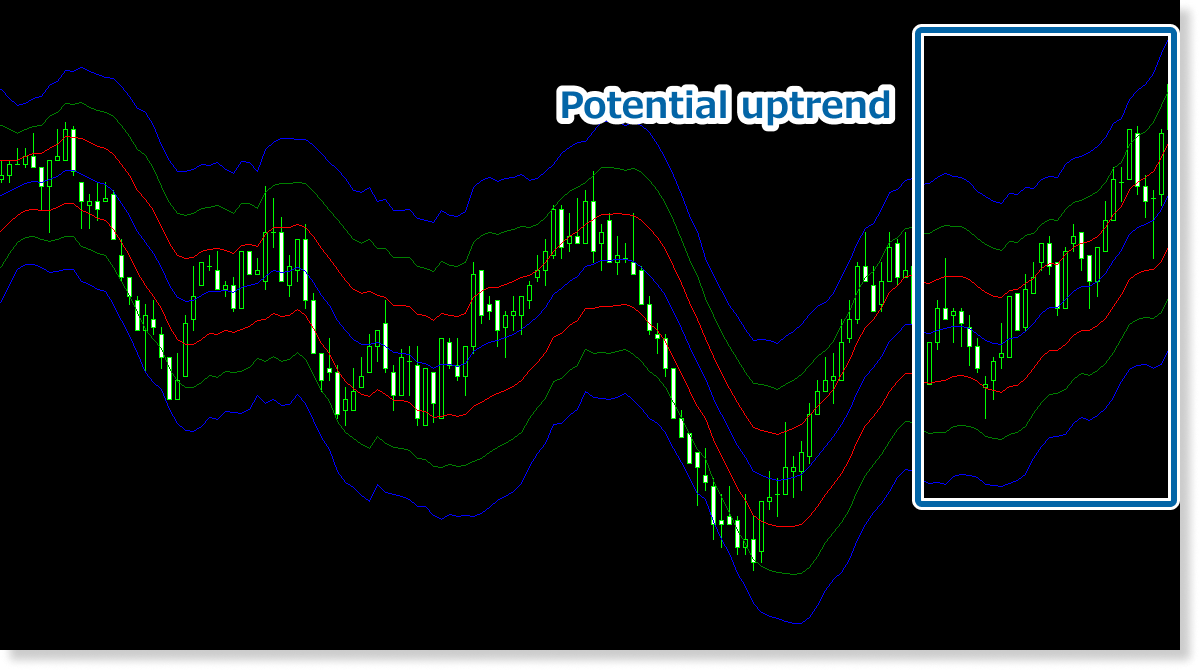

For initiating trend-following trades

With ATR bands, when the entire band is rising or when prices are positioned at the upper part of the band, it can be judged that buying pressure is strong and an upward trend is possible. It can be used as material for determining current trends along with other trend-based technical indicators such as RSI and MACD.

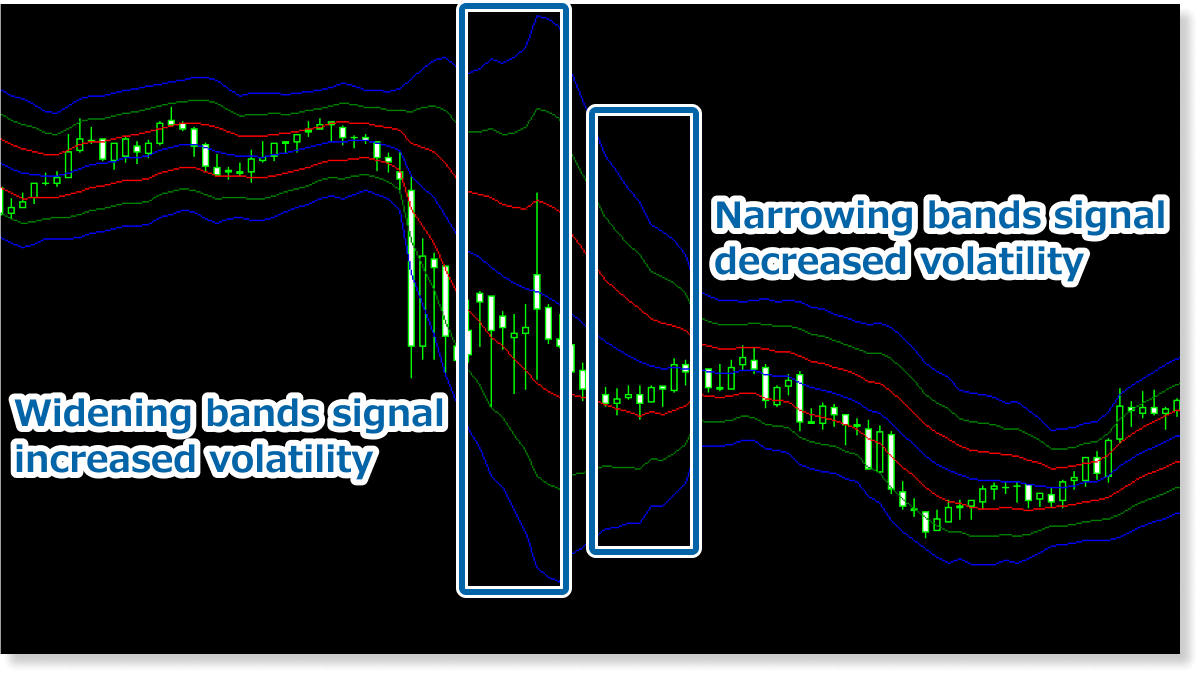

For exit decisions based on volatility decline

A situation where ATR bands are continuously narrowing means volatility is decreasing. As large price movements become less frequent and spreads may widen significantly depending on the broker, making trading unfavorable, this is a time to consider closing held positions while refraining from new entries.

Aiming for rebounds from prices that deviate from bands

When prices deviate outside the ATR bands, they tend to show reactive movements trying to return inside the ATR bands. When such price movements are observed, one approach is to enter counter-trend trades aiming for profit, with the center of the band as the profit-taking line.

For selecting profit-taking and stop-loss lines

Entry decisions can be made using other technical indicators, while the ATR Bands Indicator can be utilized solely for exit decisions, such as using the outer edges of the ATR bands as profit-taking or stop-loss lines, or using the width of the ATR bands to determine the number of points for profit-taking or stop-loss levels.

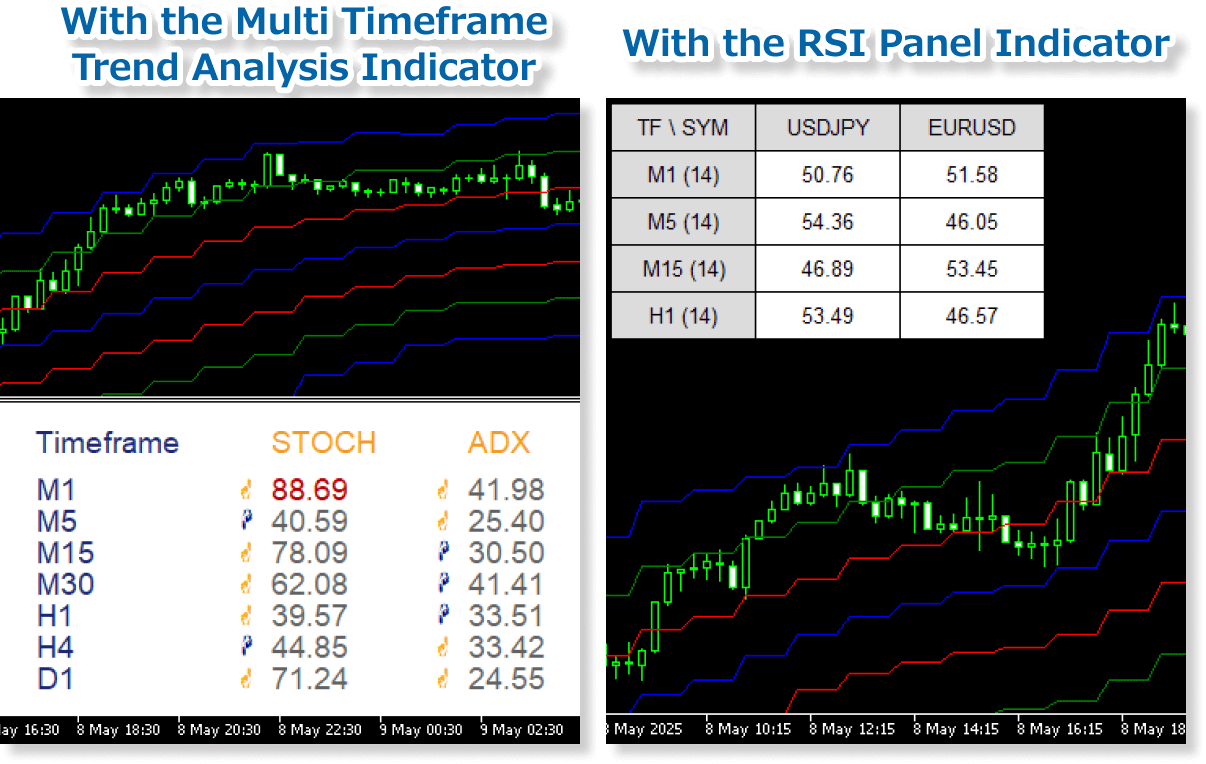

Use with other indicators

Pair this indicator with our Multi-Timeframe Trend Analysis Indicator to add technical signals across multiple timeframes to your chart for broader analysis. For RSI-focused strategies, the RSI Panel Indicator provides key data in a single view.

The strength of the ATR Bands Indicator is that it can display finely customized ATR bands at once using multi-timeframe settings, ATR multiplier settings, and alert settings. If you currently incorporate or are planning to incorporate ATR bands into your trading strategy, please give it a try.

How to install

To use the ATR Bands Indicator, follow the steps below to download and install it.

Step 1

Click the button below to download the indicator for MT4/MT5.

Step 2

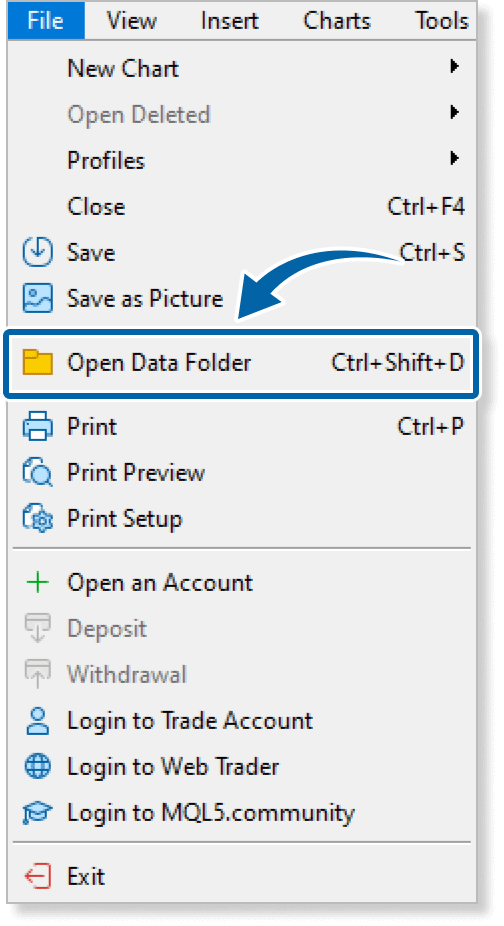

Click File > Open Data Folder in the top menu of MT4/MT5.

Step 3

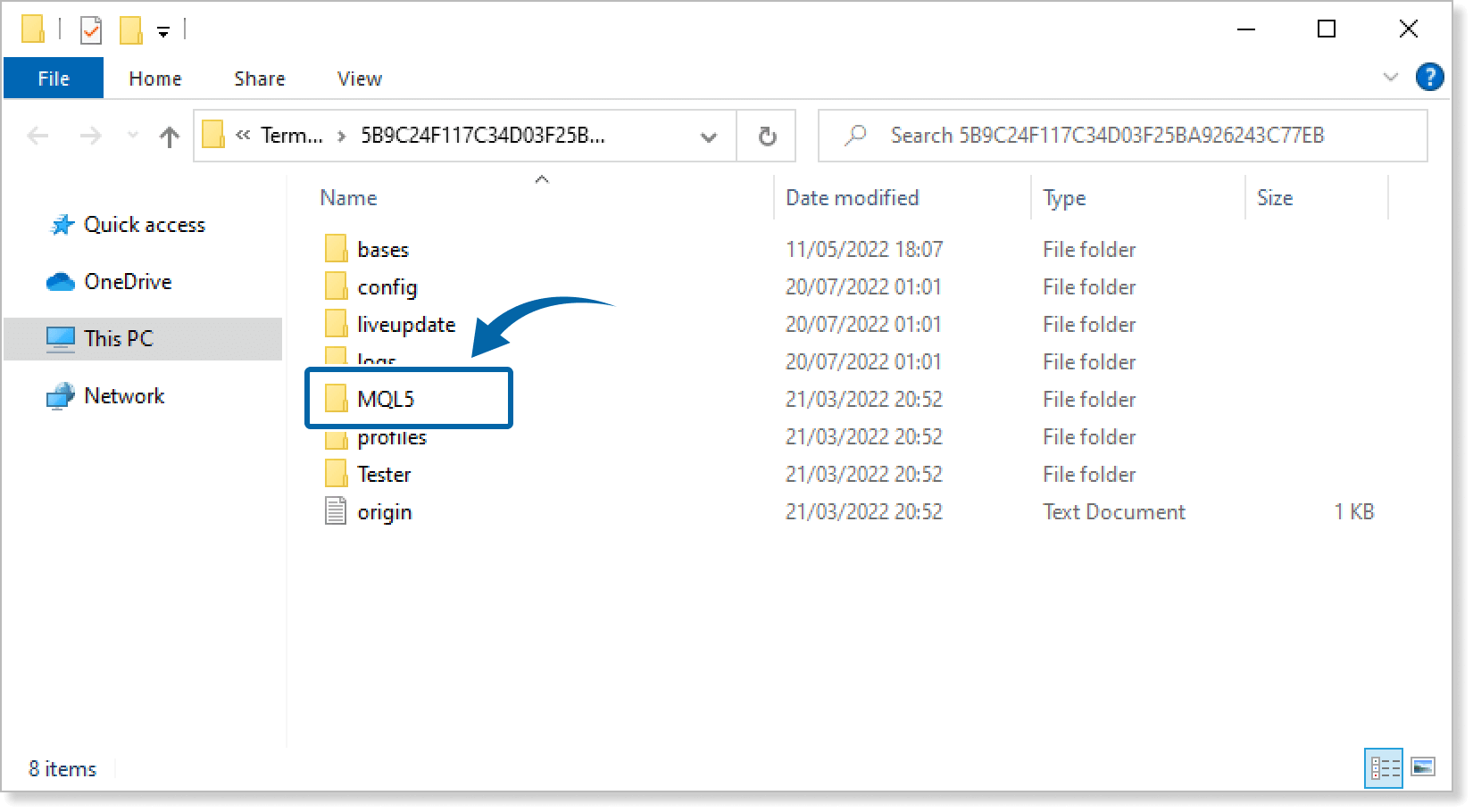

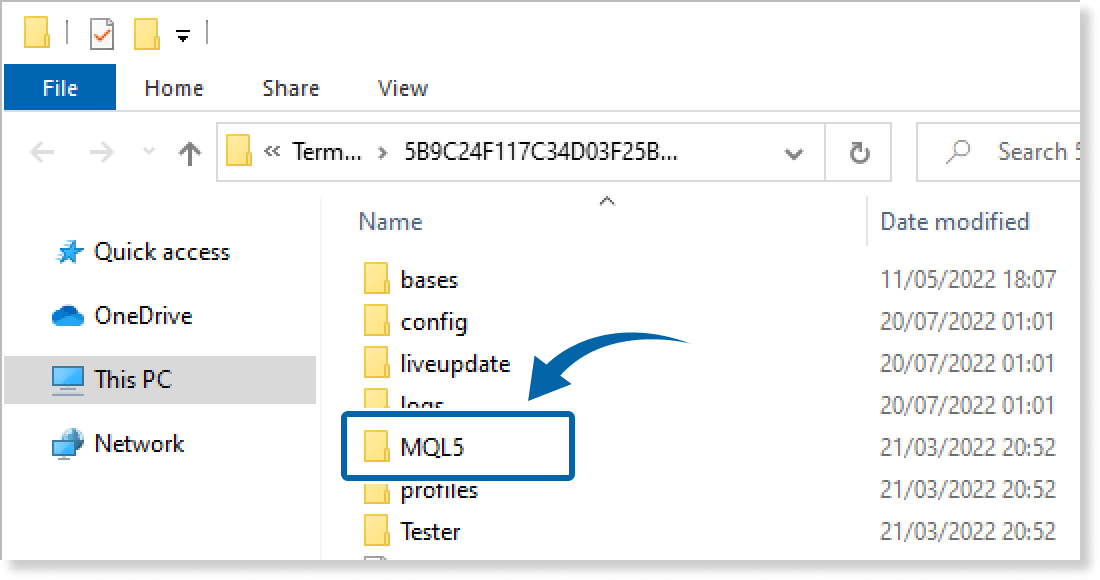

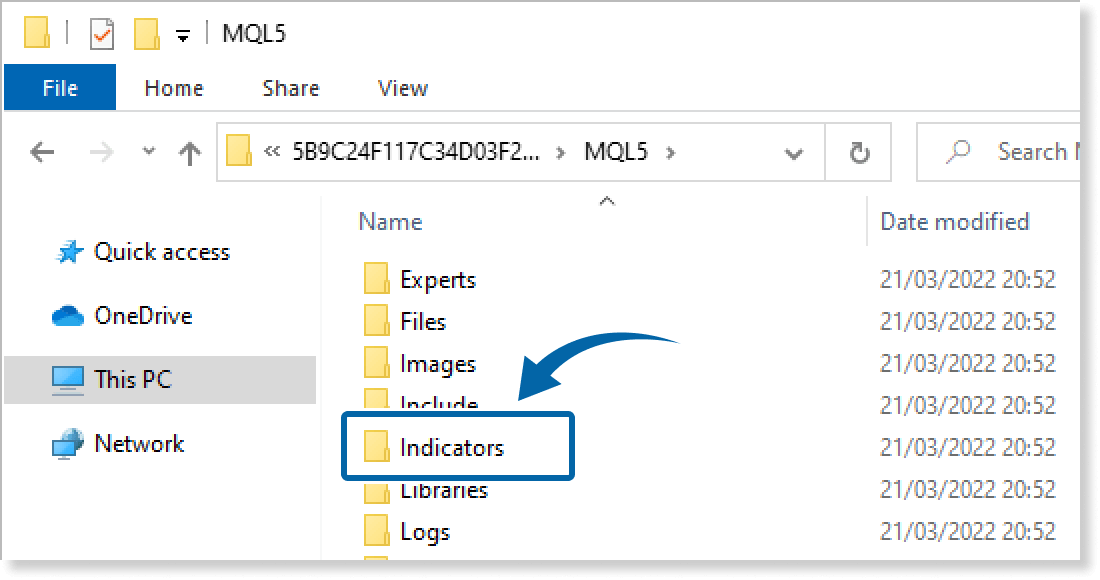

In the data folder, double-click the MQL4 or MQL5 folder.

Step 4

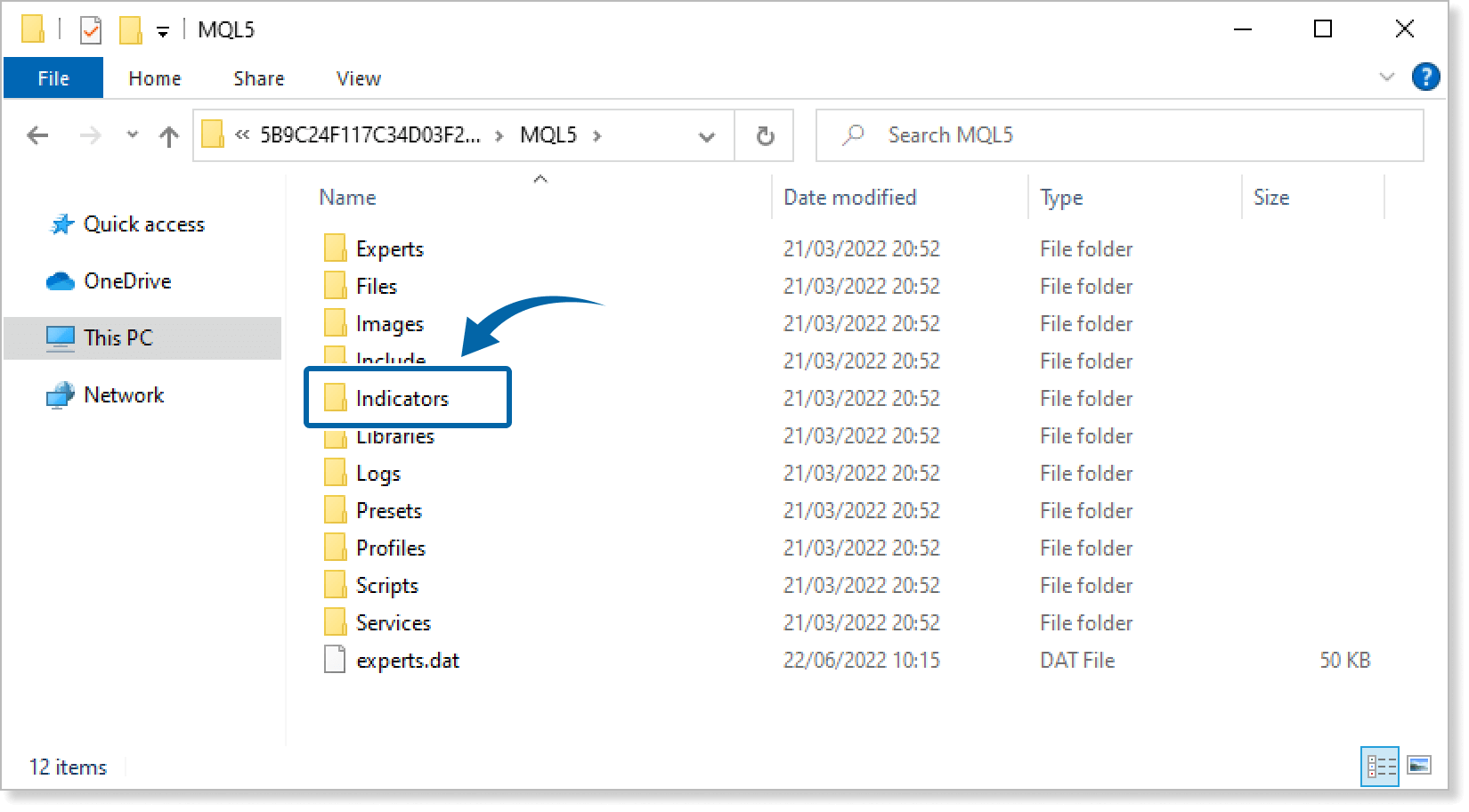

In the MQL4/MQL5 folder, double-click the Indicators folder.

Step 5

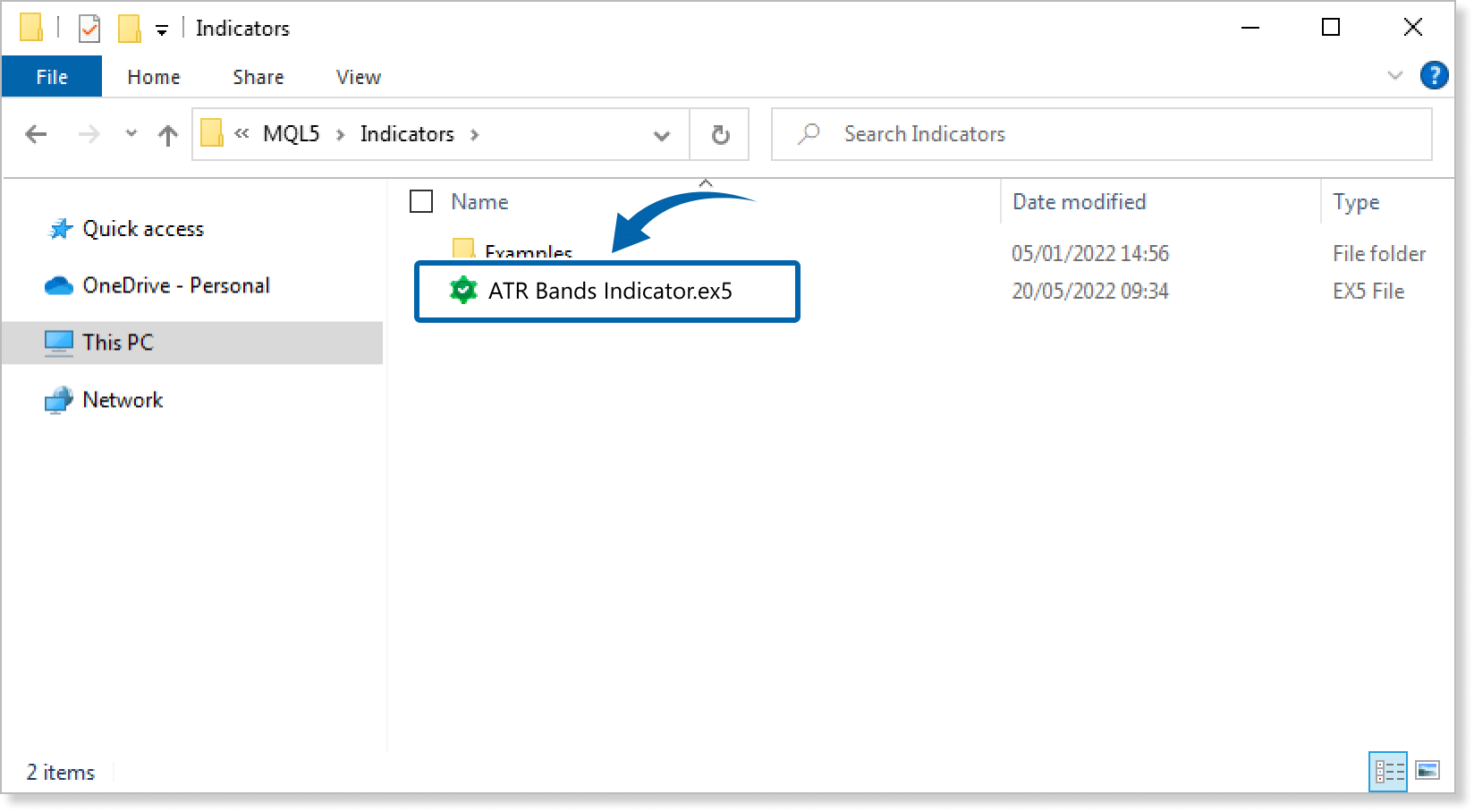

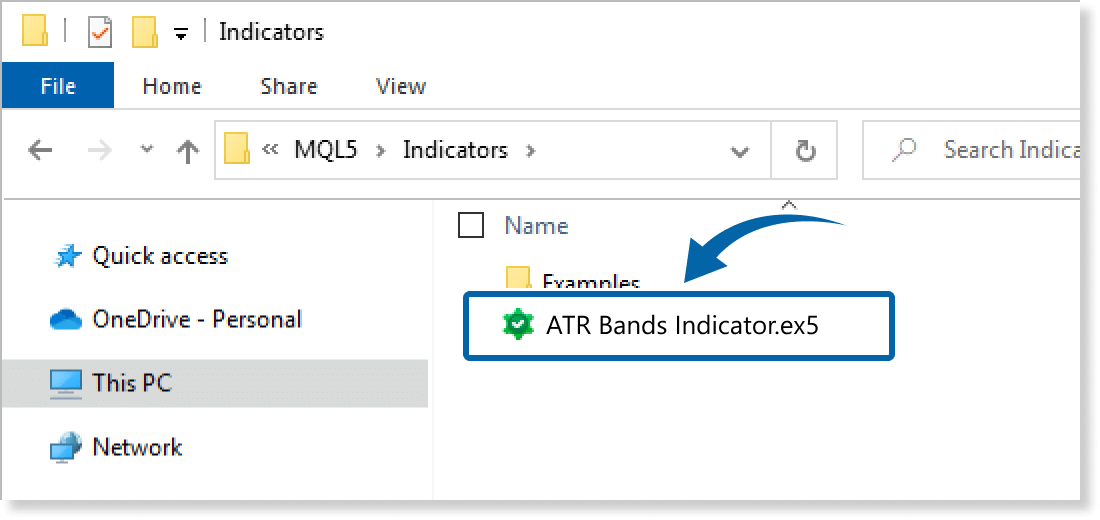

Save the ATR Bands Indicator in the Indicators folder.

Step 6

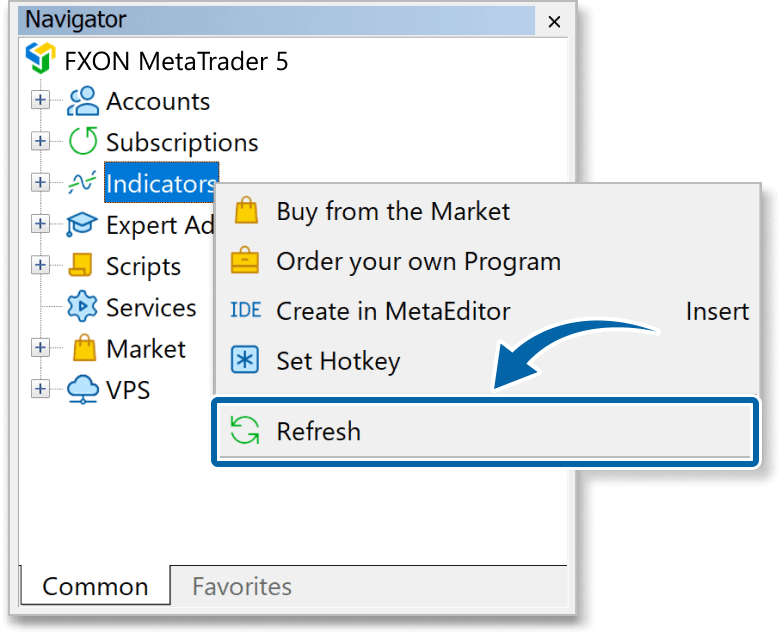

Go back to the MT4/MT5. Right-click Indicators in the Navigator, and click Refresh.

Step 7

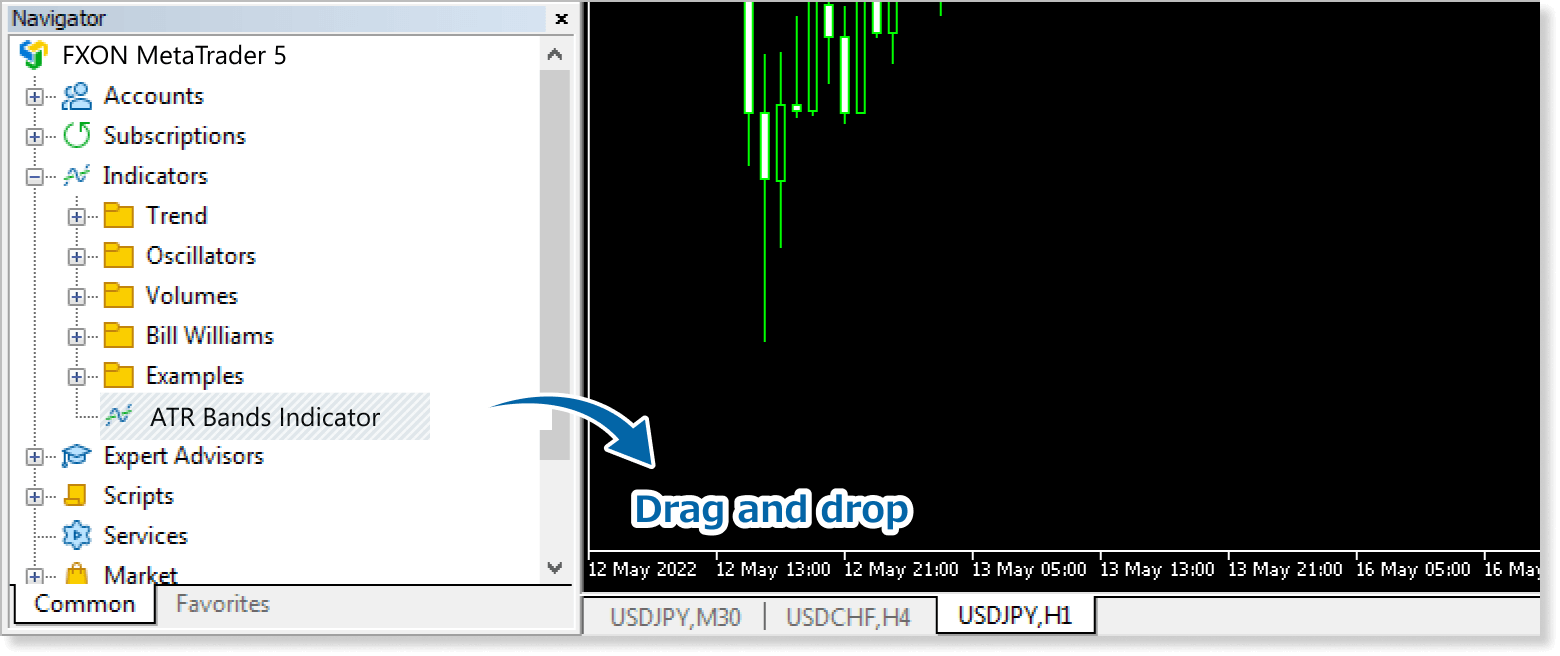

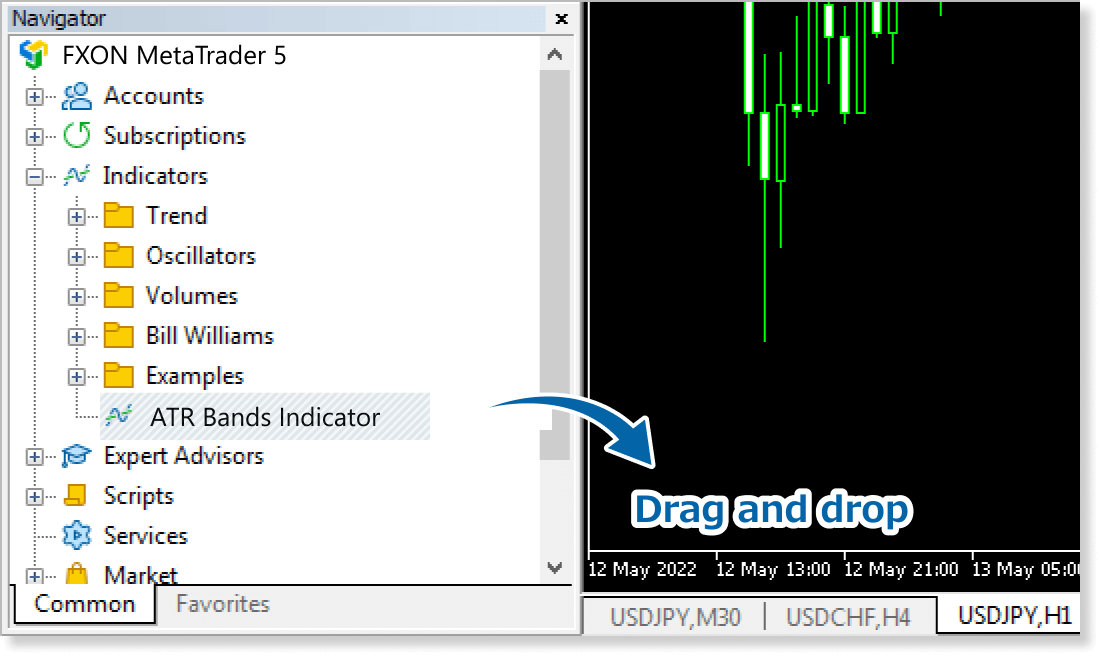

In the Navigator, click the + icon next to Indicators. Find the ATR Bands Indicator, then either double-click it or drag it onto a chart.

Step 8

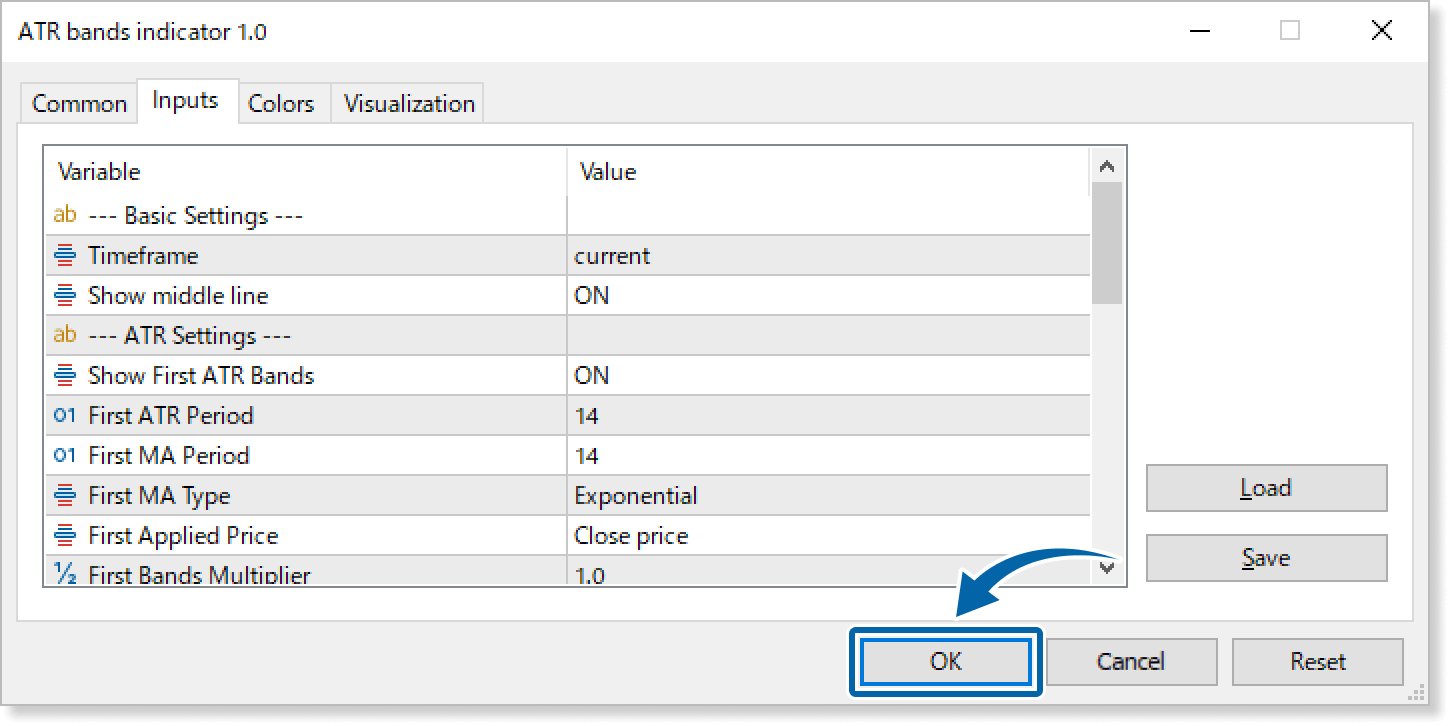

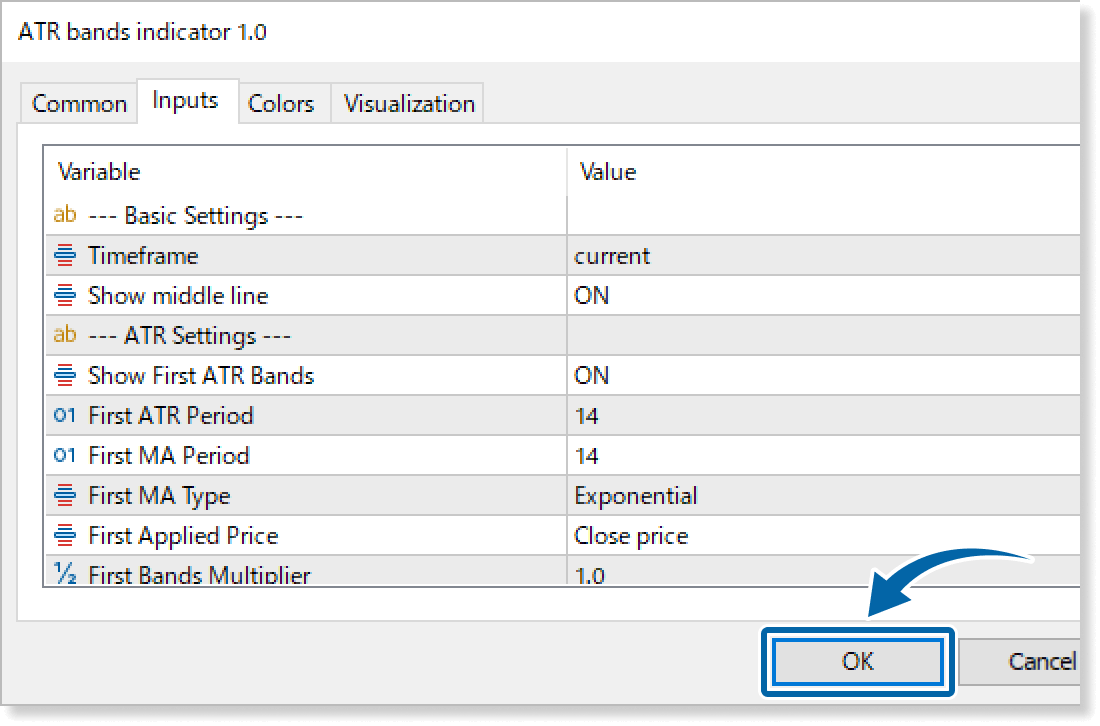

In the indicator settings window, customize the settings on the Inputs tab according to the How to set up page, then click OK.

Step 9

The ATR Bands Indicator is applied to the chart, showing bands on it.

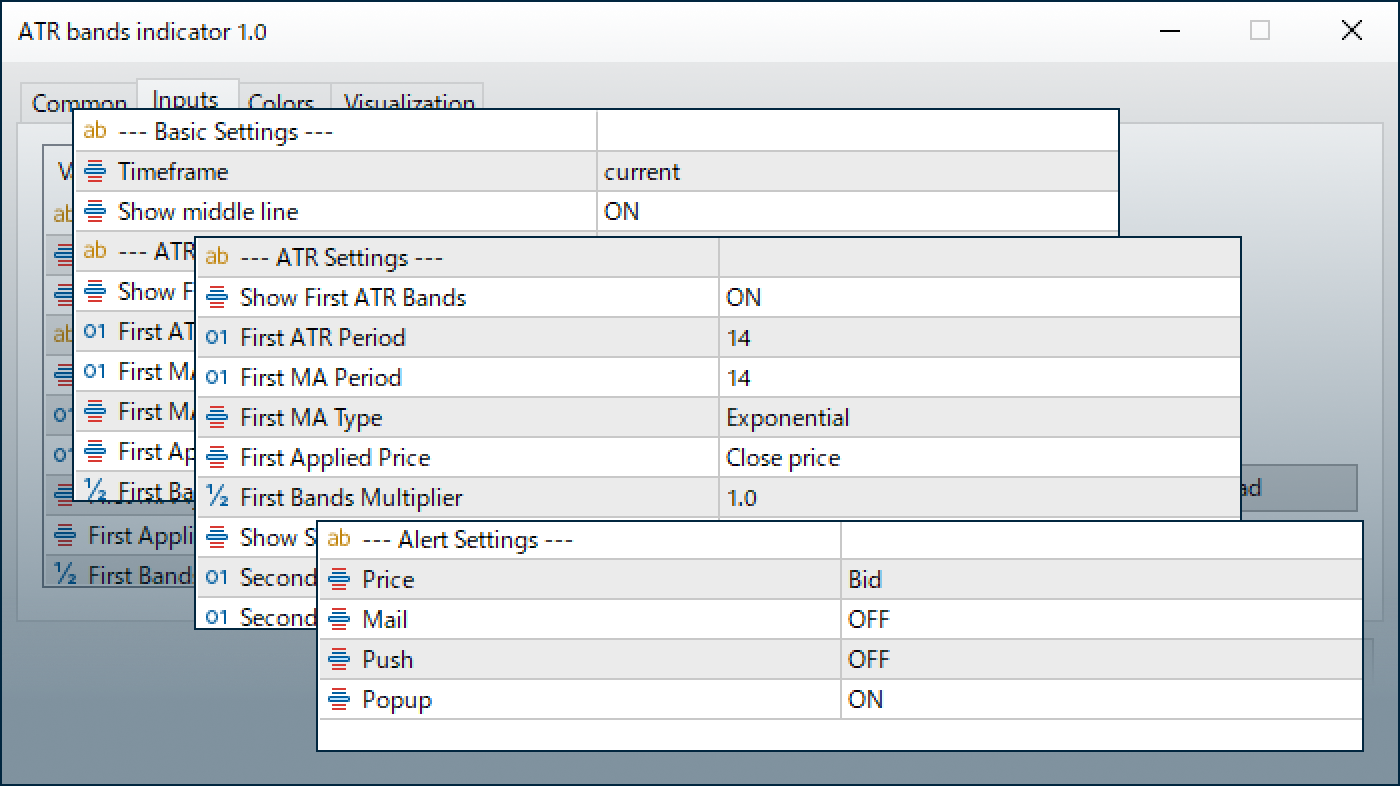

How to set up

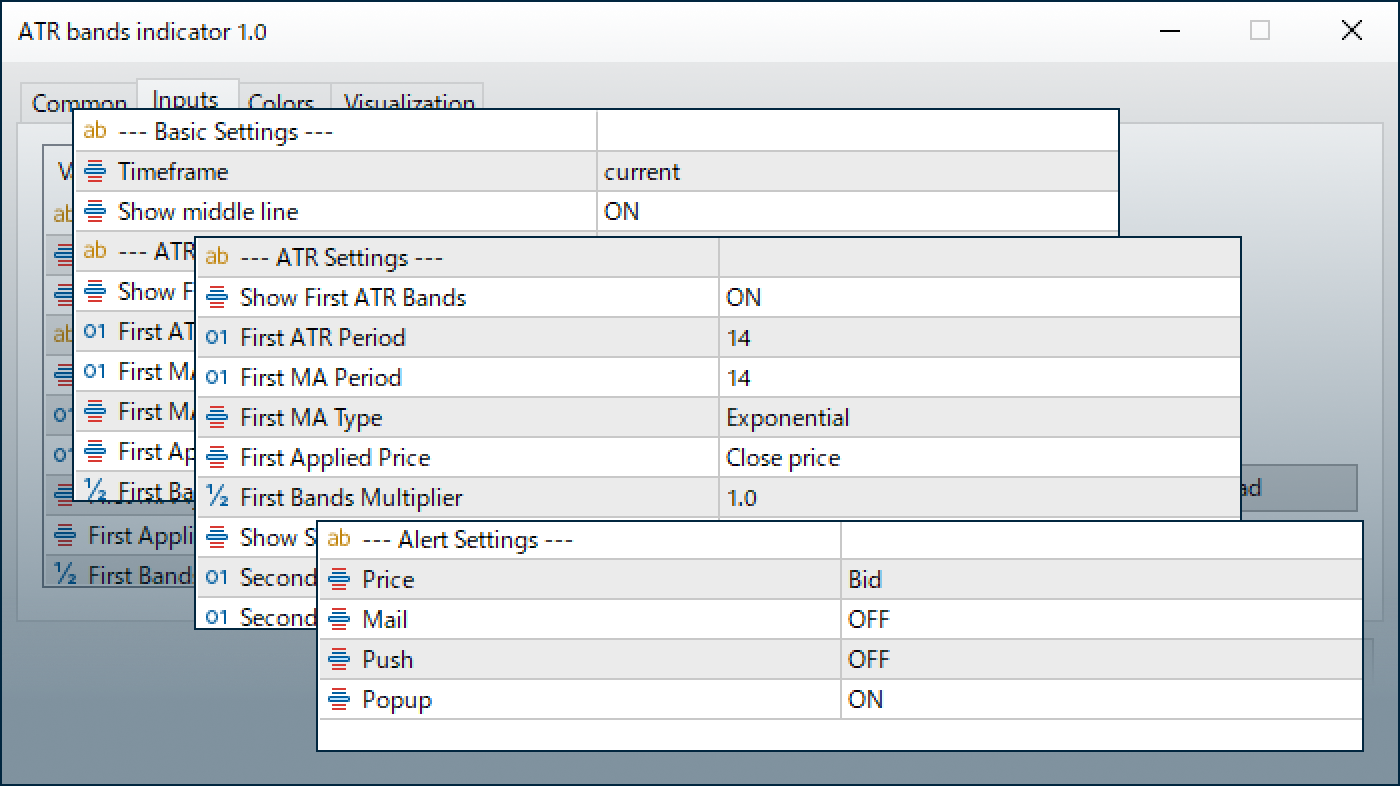

After applying the indicator to the chart, set the parameters according to your style.

Step 1

First, open the Inputs tab.

Step 2

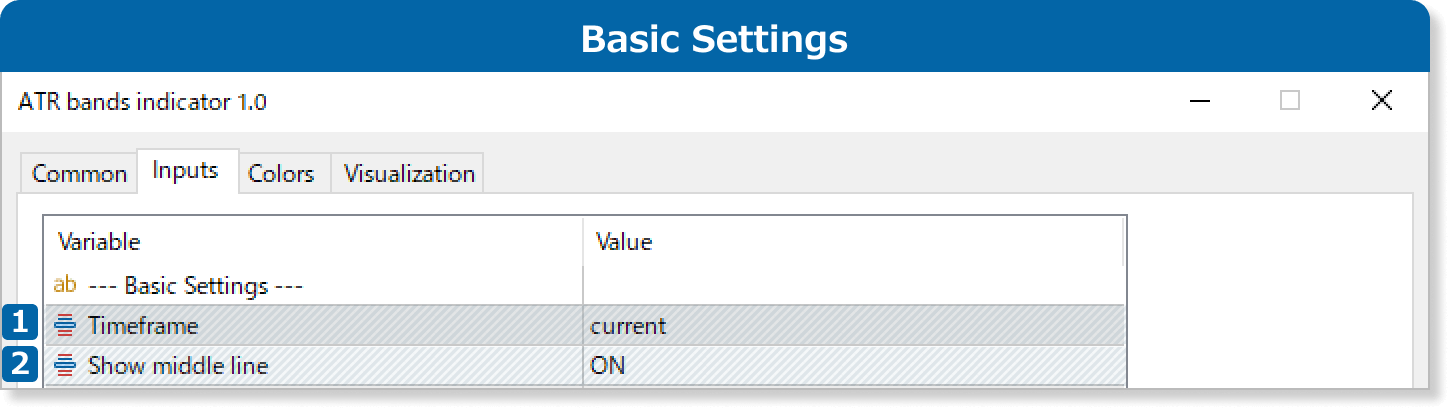

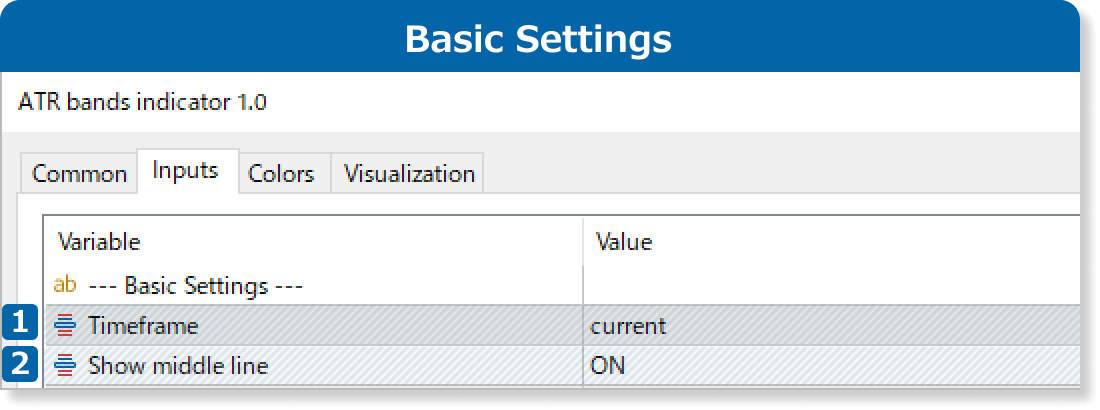

Set the parameters as follows.

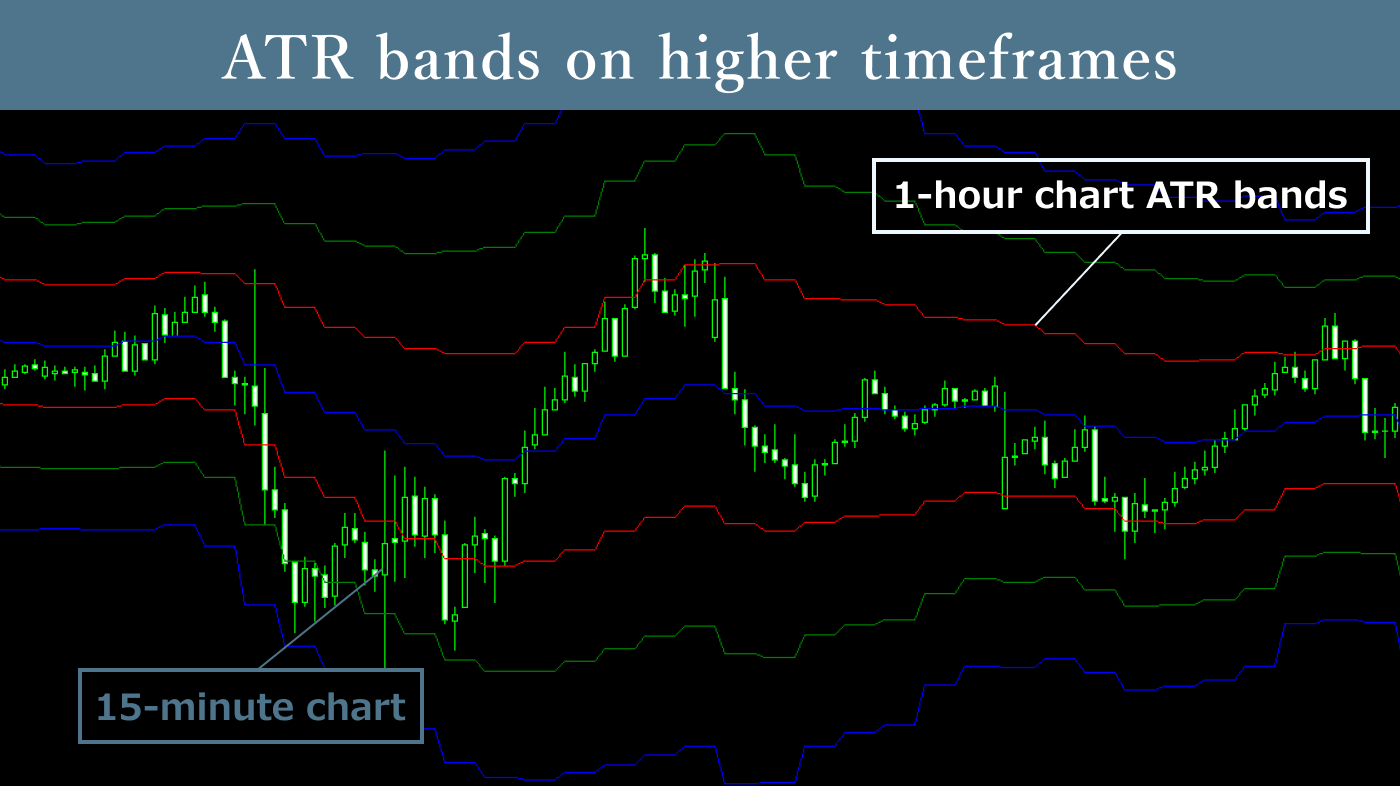

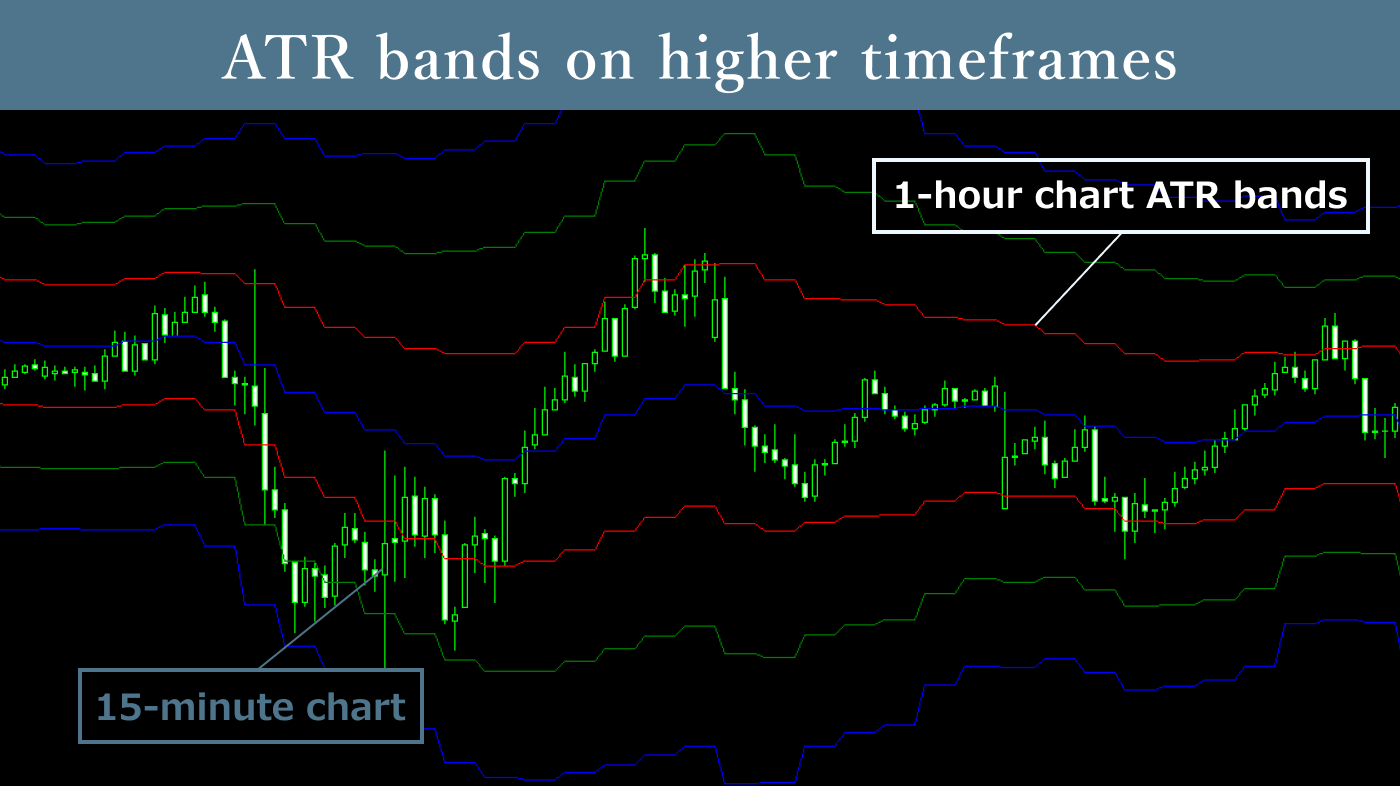

Select the timeframe for the ATR bands. If 'Current' is chosen, the bands will match the chart's timeframe. If a specific timeframe is selected, the ATR bands will be displayed using that timeframe, independent of the chart's timeframe.

Show or hide the middle line (moving average).

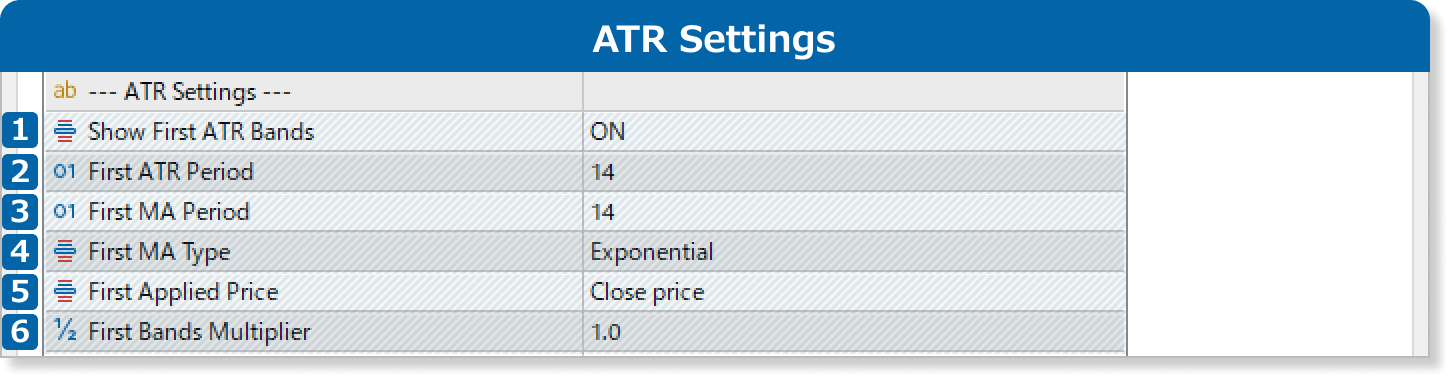

Show or hide the ATR bands 1.

Specify the number of recent bars used to calculate the ATR for ATR bands. For example, if set to "14," the ATR is calculated from the last 14 bars.

Specify the number of recent bars used to calculate the MA for ATR bands. For example, if set to "14," the MA is calculated from the last 14 bars.

Select the MA used to calculate ATR bands.

・Simple: simple moving average

・Exponential: exponential moving average

・Smoothed: smoothed moving average

・Linear weighted: linear weighted moving average

Select the price used to calculate the ATR bands.

・Close price

・Open price

・High price

・Low price

・Median price: (high price + low price) ÷2

・Typical price: (high price + low price + close price) ÷3

・Weighted price: (high price + low price + close price×2) ÷4

Specify the multiplier applied to the MA added to/subtracted from the ATR. For example, if set to "2.0," the ATR bands will be twice as wide as when set to "1.0."

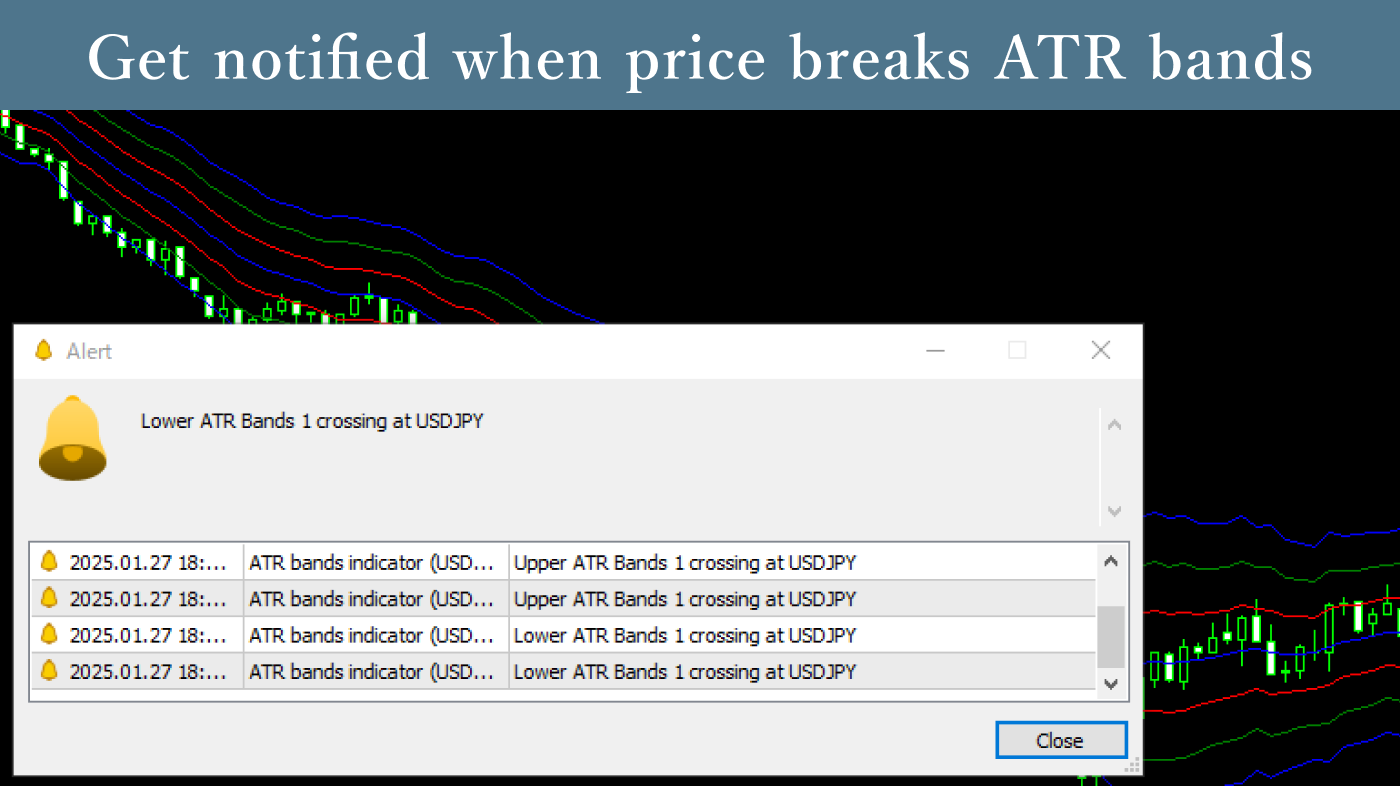

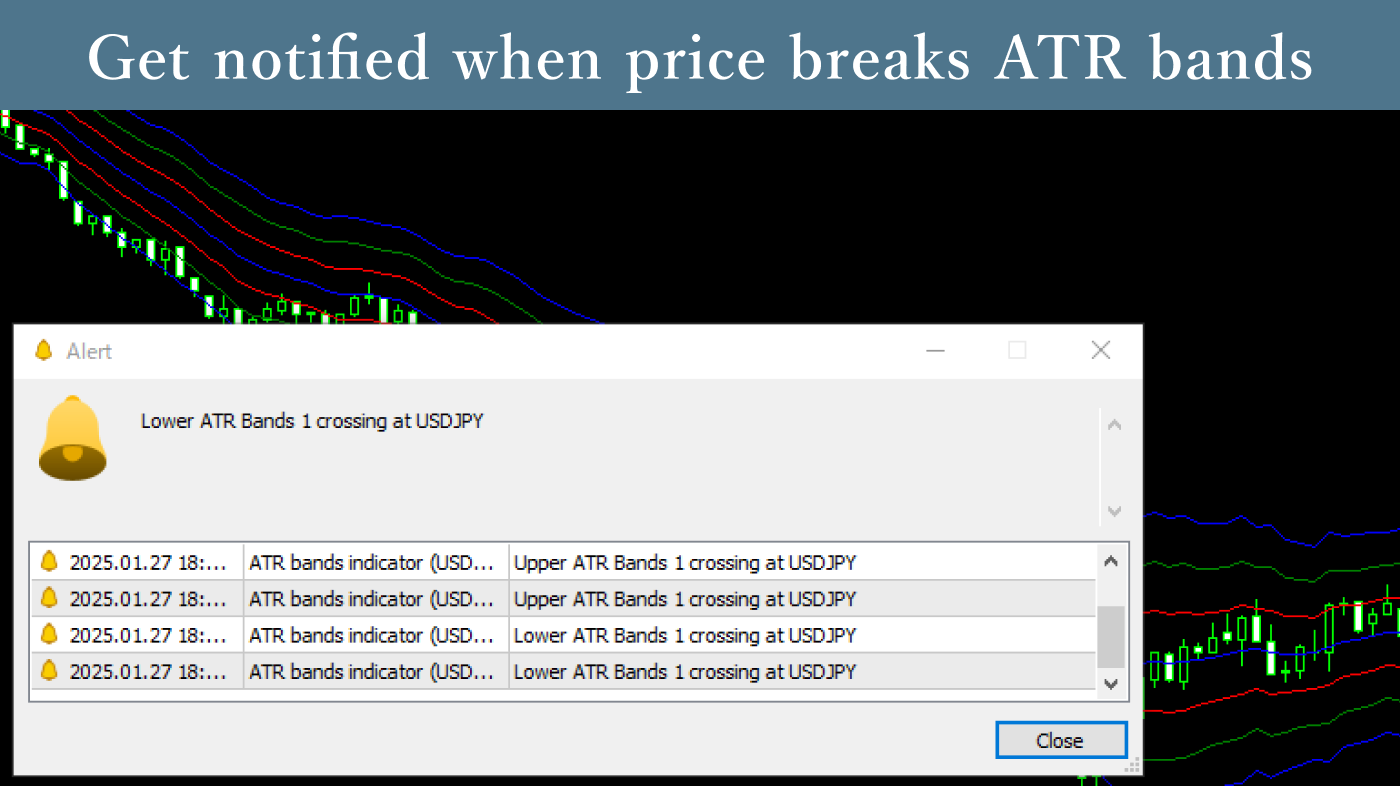

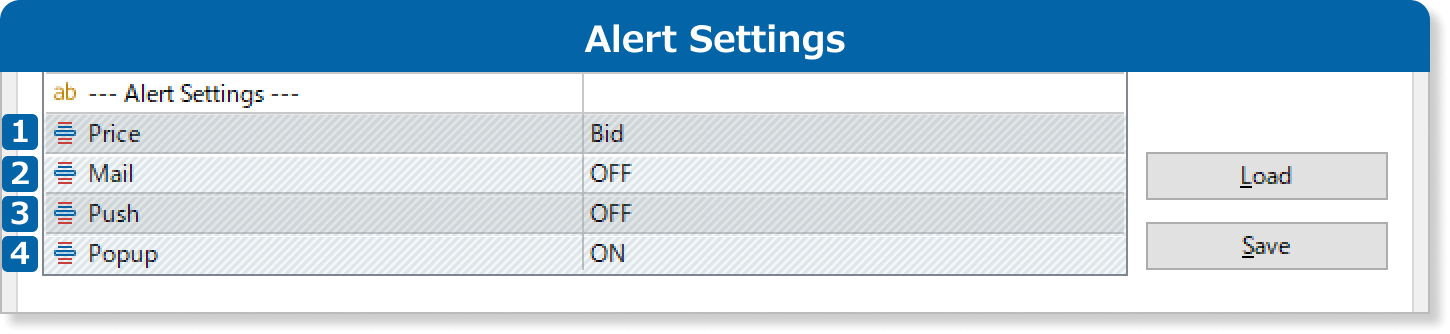

Select the price used for ATR band alerts. If set to "Bid," alerts trigger when the real-time bid price crosses the bands. If set to "Close price," alerts trigger when the close price crosses the bands.

Enable or disable email notifications. When ON, alerts are sent to the specified email when the price crosses the bands.

Enable or disable push notifications. When ON, alerts are sent via the MT4/MT5 mobile app when the price crosses the bands.

Enable or disable popup notifications. When ON, alerts appear in the MT4/MT5 desktop platform when the price crosses the bands.

Updates

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy