2026.02.02

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on February 1st, a trend that favored the yen over the dollar has ended, and the dollar strengthened against other major currencies. The rate check speculation pushed the USDJPY down to the 152 yen range. However, after Kevin Warsh was nominated to succeed Jerome Powell as Chair of the Federal Reserve Board (FRB), the dollar strengthened against the yen. Consequently, the pair surged to the 154 yen range as traders increased their preference for the dollar.

Meanwhile, both the EURUSD and GBPUSD surged to recent highs of 1.20 and 1.38, respectively, before being pushed down.

January 26 (Mon)

The decline of the USDJPY from the end of the previous week paused at around 153.30 yen. Later, the pair rebounded to form higher lows. However, the rally was limited. Instead, the pair went flat afterward.

On the other hand, the EURUSD rose to the 1.19 range but then fell to the upper 1.18 range. The GBPUSD formed another lower high and reached the 1.37 range.

January 27 (Tue)

Earlier, the USDJPY fluctuated steadily and reached 154.87 yen. However, renewed caution over the rate check triggered a sharp drop in the pair. Additionally, after U.S. President Donald Trump said he did not worry about a weak dollar, the sell-off of the dollar accelerated. The pair hit a daily low of 152.09 yen just before the close of the New York trading session.

As the dollar weakened, the EURUSD rose above the 1.20 level. The GBPUSD followed suit, advancing to the upper 1.38 range.

January 28 (Wed)

The USDJPY started the daily trading session by rebounding from the previous day's low. However, caution over potential market intervention to buy the yen limited the rally during Tokyo trading hours. Later, after Treasury Secretary Scott Bessent stated that he would uphold the strong-dollar policy, dollar buying resumed. Additionally, the FRB decided to keep its interest rate unchanged at its Federal Open Market Committee (FOMC) meeting. As a result, the pair rose to the 154.0 yen range.

Meanwhile, the EURUSD erased the previous day's surge and fell below the 1.19 level. The GBPUSD failed to extend its advance, hovering in the upper 1.37 range.

January 29 (Thu)

Traders increased their risk-off stance due to reignited concerns over a U.S. government shutdown and heightened tensions in the Middle East. The USDJPY sagged to the 152.8 yen range during the day.

The EURUSD hovered within the 1.19 range. The GBPUSD temporarily fell to the 1.374 range but hovered around the 1.38 level throughout the day.

January 30 (Fri)

In the U.S., President Trump and the Democrats reached an agreement to avert a government shutdown. Trump also reportedly picked Kevin Warsh, a hawkish economist, as the next FRB Chair. Consequently, the dollar strengthened against other major currencies.

The USDJPY rose to its daily high of 154.79 yen. Conversely, the EURUSD and GBPUSD fell to the 1.184 and 1.367 ranges, respectively, to conclude the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

February 2 (Mon)

- 15:00 U.S.: January ISM Manufacturing PMI

February 4 (Wed)

- 10:00 Europe: January Harmonised Index of Consumer Prices (preliminary HICP)

- 10:00 Europe: January Harmonised Index of Consumer Prices (preliminary HICP core index)

- 13:15 U.S.: January ADP National Employment Report

- 15:00 U.S.: January ISM Non-Manufacturing PMI (composite)

February 5 (Thu)

- Noon: U.K.: Bank of England (BOE) policy interest rate announcement

- Noon: U.K.: Minutes of Bank of England Monetary Policy Committee (MPC) meeting

- 13:15 Europe: European Central Bank (ECB) Governing Council policy interest rate announcement

- 13:45 Europe: Regular press conference by ECB President Christine Lagarde

February 6 (Fri)

- 22:30 U.S.: January change in nonfarm payrolls

- 22:30 U.S.: January unemployment rate

- 22:30 U.S.: January average hourly earnings

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The market continues to speculate that both the U.S. and Japanese monetary authorities are keeping a close eye on an excessively weak yen. However, they are unlikely to intervene in the market as long as the USDJPY stays beneath 155 yen. Additionally, if the Liberal Democratic Party wins the upcoming Lower House election, concerns over Japanese fiscal expansionism will increase, possibly accelerating the yen sell-off.

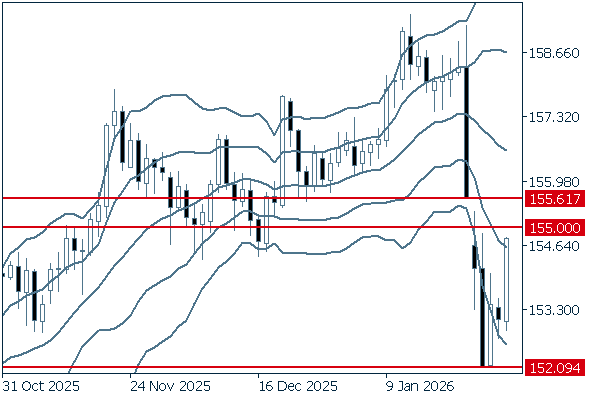

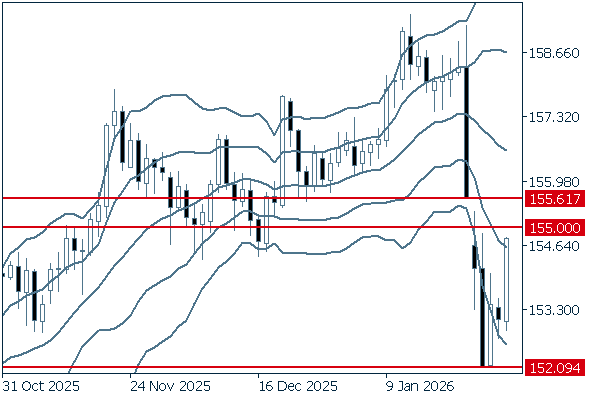

Next is an analysis of the USDJPY daily chart.

The pair rebounded rapidly from 152.09 yen to the upper 154 yen range. If the pair breaks above the 155.0 yen level, it will seek to fill the downward gap to target the 155.61 yen range.

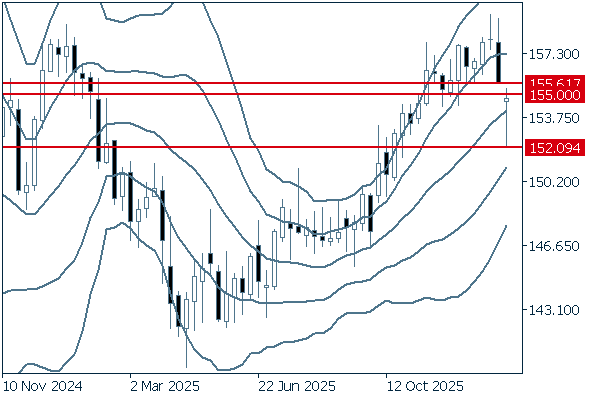

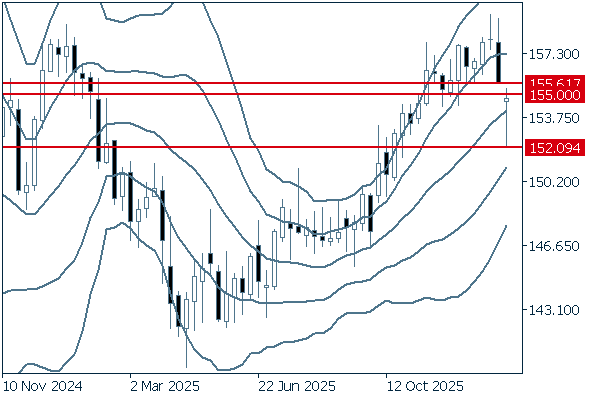

We continue with an analysis of the USDJPY weekly chart.

Last week, the pair fell below the middle line. However, it rebounded to conclude the weekly trading session, as indicated by a positive candlestick with a long lower wick. If the pair extends its rally to break above the 155 yen level, it may return to the uptrend and target the 159 yen range again.

EURUSD

The U.S.'s apparent tendency toward isolationism has led to a preference for the euro over the dollar. However, the selection of the next Federal Reserve Chair and the avoidance of a U.S. government shutdown have reduced the anticipation of a downtrend in the dollar. Meanwhile, the upcoming ECB Governing Council meeting is expected to leave its monetary policy unchanged. Therefore, traders are less inclined to sell the euro.

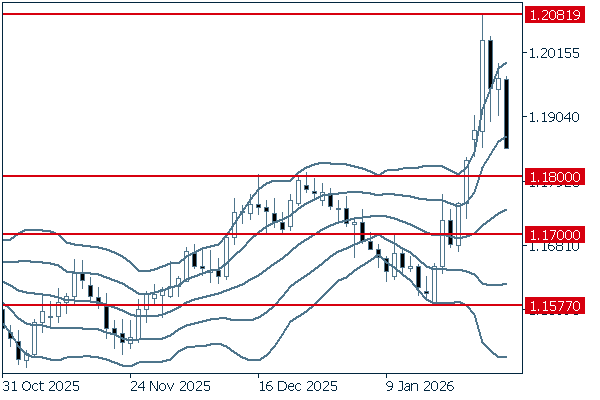

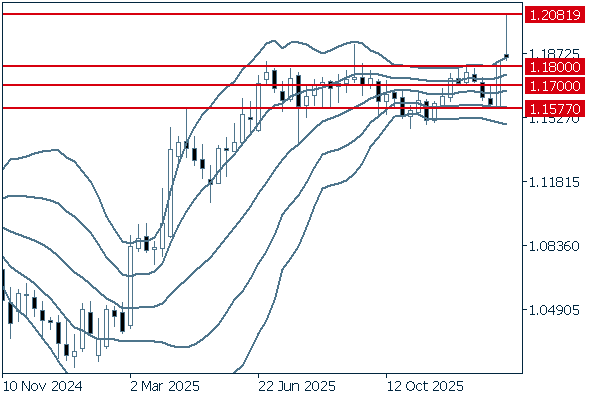

Next is an analysis of the EURUSD daily chart.

Last week, the pair temporarily broke above the 1.20 level. Afterward, however, the pair was pushed down below +1σ. It seems like a good opportunity to take advantage of this decline to buy the euro. However, it should be noted that the pair could enter a downtrend if it falls below the 1.17 level. Therefore, it would be best to avoid following the trend too closely.

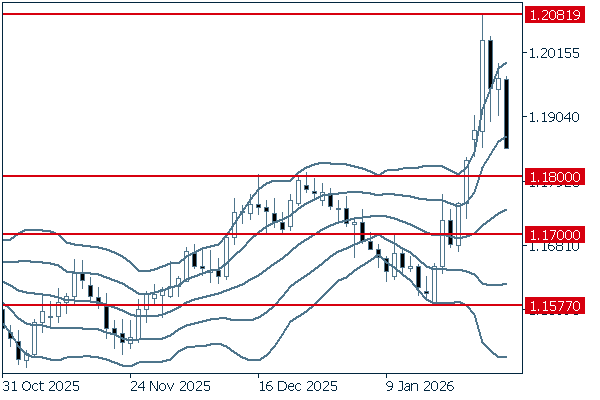

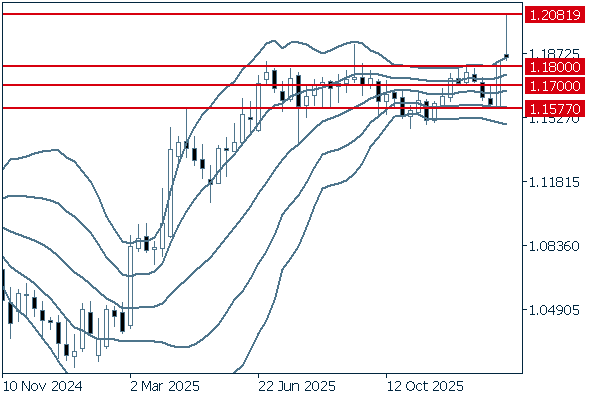

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, the pair broke above the upper limit of the range at around 1.18. However, it concluded the weekly trading session by erasing an early surge, as indicated by a negative candlestick with a long upper wick. If the line lying around 1.18 functions as a support line, the pair will be able to extend its uptrend. However, if the pair drops below the 1.17 level, it would be a sign that the pair has entered a downtrend.

GBPUSD

After Kevin Warsh was nominated as the successor to the Federal Reserve Chair, the trend of buying the pound over the dollar weakened. In contrast to last week's surge, the GBPUSD will likely struggle to extend its uptick as traders are expected to adjust their positions.

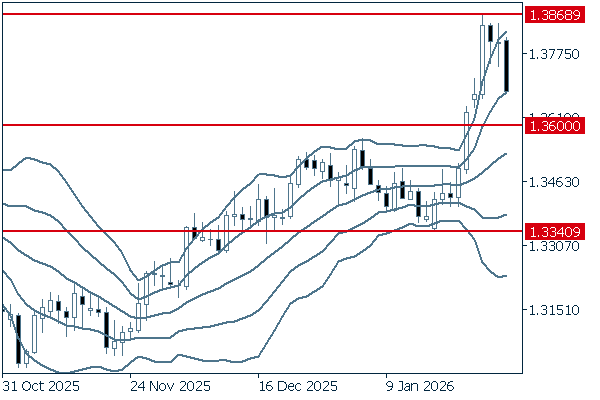

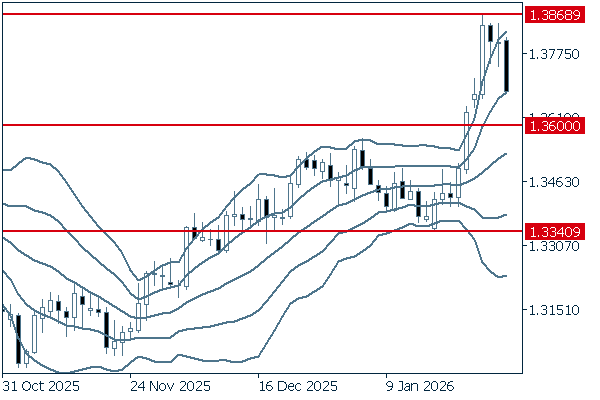

Next is an analysis of the GBPUSD daily chart.

Last week, the pair surged before being pushed back into the band. As long as the pair stays above the 1.36 level, it would be better to utilize brief dips to buy the pound.

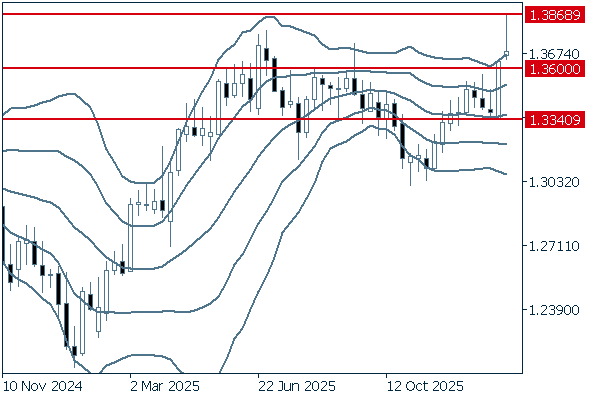

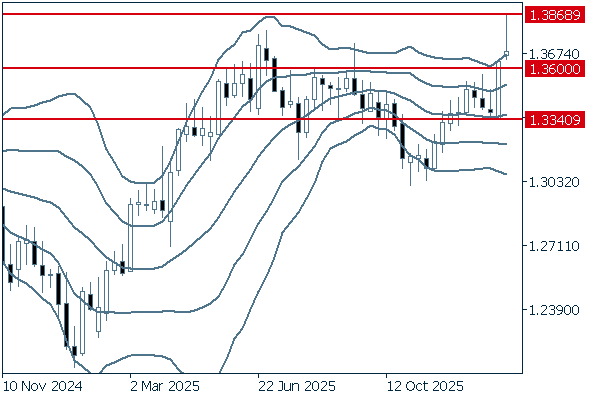

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, the pair has surged over the past two weeks. However, as indicated by the most recent candlestick with a long upper wick, the pair was pushed down to +2σ after the surge, signaling an increase in selling pressure. Nevertheless, as long as the pair stays above the middle line, it is safe to say that the uptrend will likely continue.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy