2026.01.26

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on January 25th, the USDJPY became highly volatile due to uncertainties over the political events in Japan and "rate check" speculation. After reaching the 159.2 yen range, the pair nosedived to the upper 155 yen range. As this volatility set a tone of weakness for the dollar, both the EURUSD and the GBPUSD jumped to the 1.18 and 1.36 ranges, respectively.

January 19 (Mon)

The U.S. market was closed due to Martin Luther King Jr. Day. In Japan, Prime Minister Sanae Takaichi announced her decision to dissolve the Lower House at the outset of the regular Diet session on January 23rd. The market reacted to it by selling yen, as concerns over Japan's potential fiscal expansionism mounted. As a result, the USDJPY reached the 158 yen range.

Meanwhile, the EURUSD rose to the lower 1.16 range. The GBPUSD climbed to the lower 1.34 range.

January 20 (Tue)

Initially, the USDJPY extended its uptick to 158.6 yen. However, comments from U.S. Treasury Secretary Scott Bessent, as well as the escalation of U.S.-Europe tensions, pushed the pair down to the 157.4 yen range.

The EURUSD and GBPUSD followed the downward trend of the dollar. The former rose to the upper 1.17 range during trading hours, while the latter advanced to just below the 1.35 level.

January 21 (Wed)

The U.S.-Europe tensions over Greenland eased after U.S. President Donald Trump's speech. Consequently, traders bought back the dollar, lifting the USDJPY back up to the 158.5 yen range.

In contrast, the EURUSD fell to the 1.168 range. The GBPUSD hovered in the 1.34 range.

January 22 (Thu)

The market remained concerned that the Takaichi Cabinet's fiscal policy would lead to financial deterioration. Additionally, speculation mounted that the Bank of Japan (BOJ) would leave the interest rate unchanged. Consequently, the yen continued to be sold off as the USDJPY rose to 158.89 yen.

The EURUSD rose to the mid-1.17 range, and the GBPUSD climbed into the 1.35 range.

January 23 (Fri)

As expected, the BOJ left the policy interest rate unchanged. At the post-meeting press conference, Governor Kazuo Ueda did not insist on an early rate hike. As a result, the yen further weakened against the dollar, lifting the USDJPY to a weekly high of 159.22 yen. However, the pair subsequently nosedived to a daily low of 155.61 yen during New York trading hours amid speculation that the Japanese government was preparing for intervention.

Meanwhile, the EURUSD surged to the 1.183 range and the GBPUSD rose to the 1.364 range to conclude the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

January 27 (Tue)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

January 28 (Wed)

- 19:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting, post-meeting policy rate announcement

- 19:00 U.S.: Regular press conference by Federal Reserve Chairman Jerome Powell

January 30 (Fri)

- 10:00 Europe: October-December quarterly regional Gross Domestic Product (preliminary regional GDP)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

Market sources say that a rate check executed by the Federal Reserve Bank of New York triggered the plummet on January 23rd. It revealed that both the U.S. and Japanese monetary authorities are questioning the recent weak yen. Therefore, the trend of a strong dollar and a weak yen will be curtailed.

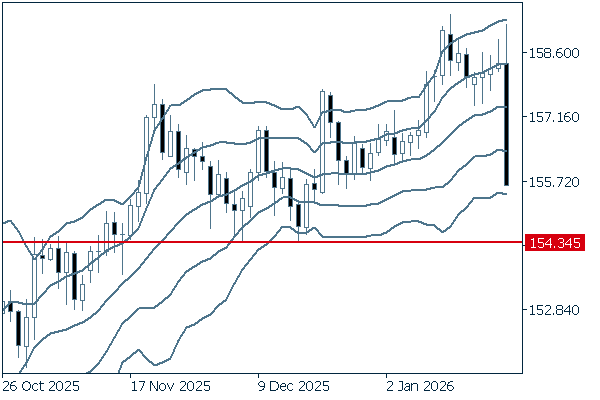

Next is an analysis of the USDJPY daily chart.

During the long uptrend, the pair formed higher lows. However, last Friday's plummet eliminated the uptrend. If the pair falls below 154.34 yen, it would be safe to say that it has just entered a downtrend.

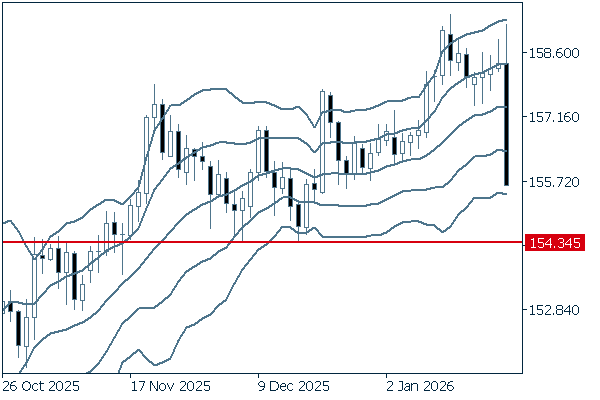

We continue with an analysis of the USDJPY weekly chart.

After advancing along the upward bandwalk, the pair plummeted below +1σ last week, as a long negative candlestick appeared on the weekly chart. As with the daily chart, it is important to watch whether the pair manages to stay above or falls below the 154.34 yen level. In the former case, the uptrend will likely continue. In the latter case, a trend reversal will occur.

EURUSD

President Trump vowed to impose tariffs on imports from Europe as a countermeasure to the Greenland conflict. However, since he retracted this threat, the dollar-buying trend has weakened. Additionally, the behaviors of the U.S. and Japanese monetary authorities are capping the uptick of the dollar. Therefore, the euro will strengthen against the dollar.

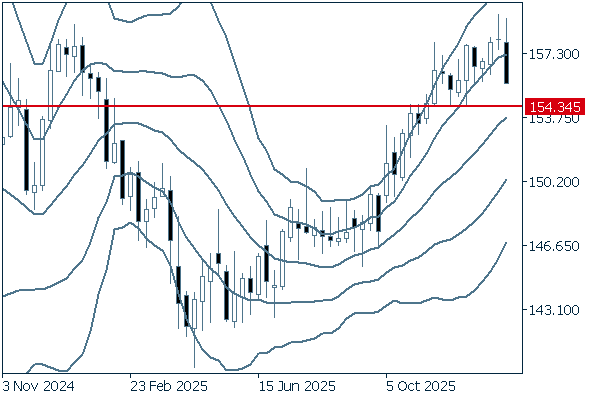

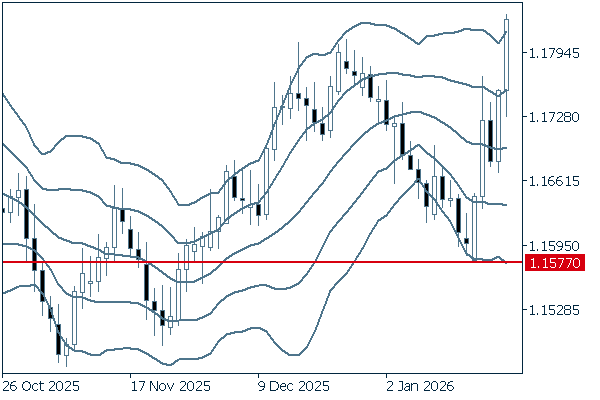

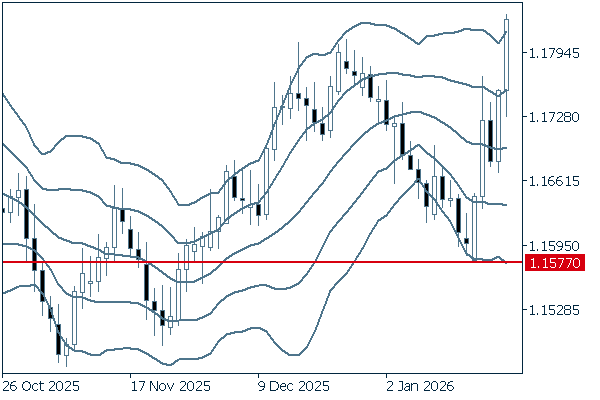

Next is an analysis of the EURUSD daily chart.

Last week, the pair skyrocketed from -2σ to +2σ. There is a possibility that the pair may be pushed down, as it broke above the upper limit of the band. However, as long as the pair stays above the 1.1577 level, it is time to consider that the pair has transitioned to an uptrend.

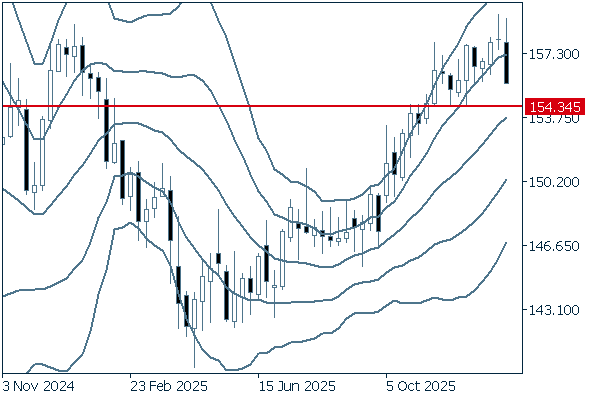

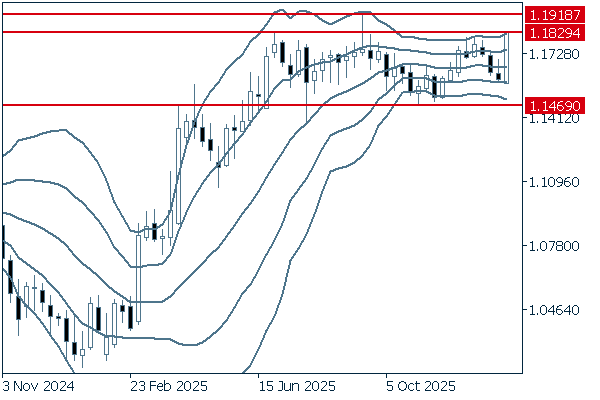

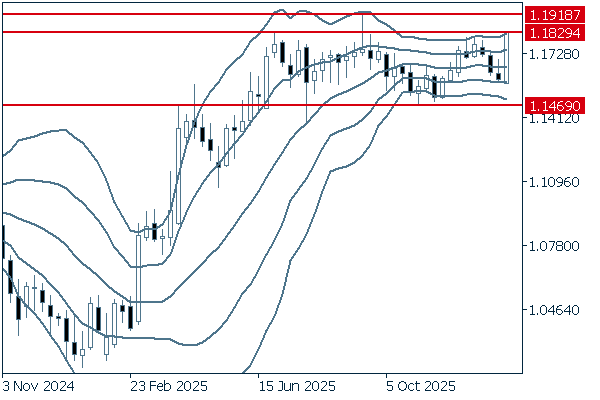

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, after three consecutive negative candlesticks, the pair surged above +2σ as a long positive candlestick appeared. The line lying around the 1.182 level is considered a resistance line. If the pair clearly breaks above it, it would be a sign that the pair has just gotten out of the plateau to enter an uptrend.

GBPUSD

Speculation over a rate check in the USDJPY triggered a sell-off of the dollar. In turn, the pound is strengthening against the dollar. The FRB is expected to leave the policy rate unchanged at its FOMC meeting on January 27th and 28th. The behavior of the USDJPY will affect the GBPUSD.

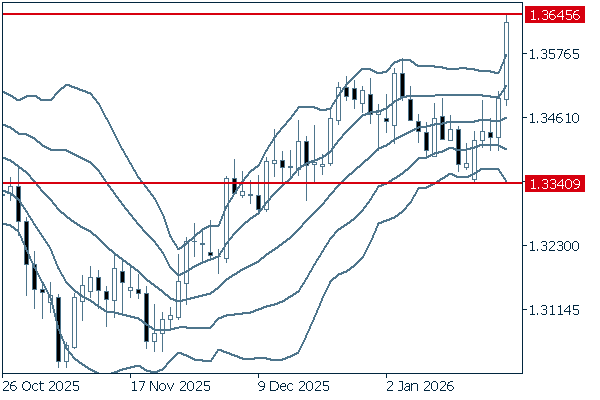

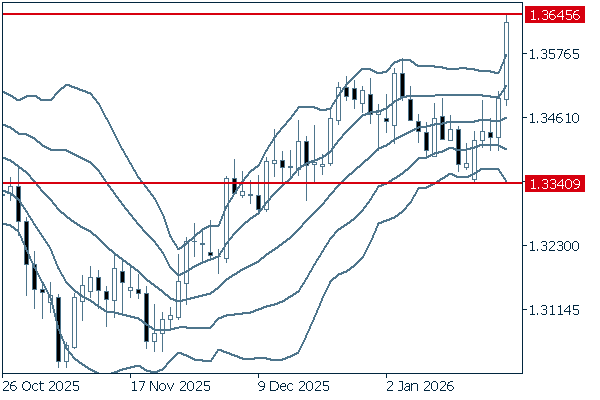

Next is an analysis of the GBPUSD daily chart.

In a sudden transition from a downtrend, the pair shot up to break above the upper limit of the band last week. Despite a potential temporary decline, as long as the pair remains above the 1.334 level, it is high time to consider that the pair has just entered an uptrend.

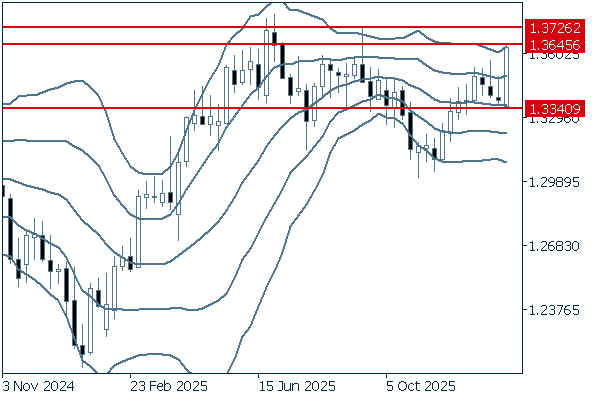

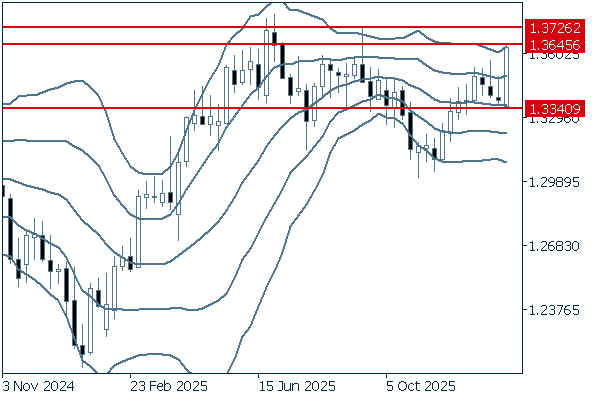

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, the pair rebounded significantly after three consecutive weeks of decline. If the pair clearly breaks above the 1.3726 level, the rally will likely extend.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy