2025.11.03

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on November 1st, the dollar continued to strengthen against the yen following major monetary policy events in both countries. The USDJPY reached the 154 yen range. The dollar also strengthened against other major currencies. Both the EURUSD and the GBPUSD declined.

October 27 (Mon)

Although the Nikkei 225 Index reached the 50,000 yen milestone for the first time, it had no impact on the foreign currency market. The USDJPY hovered around the 153.0 yen level. Meanwhile, the EURUSD rose to the 1.165 range and the GBPUSD climbed to touch the 1.335 range.

October 28 (Tue)

During his visit to Japan, Secretary of the Treasury Scott Bessent apparently offered a soft warning against the weak yen. Consequently, traders preferred the yen, and the USDJPY fell to 151.76.

The EURUSD remained within the 1.166 range throughout the day. Meanwhile, financial concerns in the U.K. pushed the GBPUSD down to the 1.324 range.

October 29 (Wed)

After hitting an intraday low of 151.53 yen at the start of the daily trading session, the USDJPY rebounded as the dollar was bought back. As expected, the Federal Open Market Committee (FOMC) decided to lower the U.S. interest rate by 0.25%. However, following the post-meeting press conference by Federal Reserve Board (FRB) Chair Jerome Powell, the market lowered speculation that the FRB would make another rate cut in December. Consequently, the USDJPY rose to 153.06 yen.

As the dollar strengthened, the EURUSD fell to the 1.157 range and the GBPUSD extended its decline to the 1.314 range.

October 30 (Thu)

The Bank of Japan (BOJ) decided to keep interest rates unchanged at its Monetary Policy Meeting. At the post-meeting press conference, BOJ Governor Kazuo Ueda did not mention an early rate hike. As the monetary policy events in the U.S. and Japan concluded, traders sold the yen, pushing the USDJPY up to 154.44 yen.

As the dollar continued to strengthen, the EURUSD extended its decline to the 1.154 range, and the GBPUSD fell to 1.311.

October 31 (Fri)

Following the previous day's surge, the USDJPY fell to 153.65 yen as traders adjusted their positions. However, the pair subsequently rebounded to 154.41 yen and closed the weekly trading session by hovering around this level.

The EURUSD fell to the 1.152 range after a period of minimal fluctuation. The GBPUSD temporarily fell below the 1.31 level.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

November 3 (Mon)

- Closure: Japan (national holiday)

- 15:00 U.S.: October ISM Manufacturing PMI

November 4 (Tue)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

November 5 (Wed)

- 13:15 U.S.: October ADP National Employment Report

- 15:00 U.S.: October ISM Non-Manufacturing PMI (composite)

November 6 (Thu)

- 12:00 U.K.: Bank of England (BOE) policy interest rate announcement

- 12:00 U.K.: Minutes of Bank of England Monetary Policy Committee (MPC) meeting

November 7 (Fri)

- 13:30 U.S.: October change in nonfarm payrolls

- 13:30 U.S.: October unemployment rate

- 13:30 U.S.: October average hourly earnings

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The release of some important economic data has been postponed due to the ongoing partial shutdown of the U.S. government. As a result, there is a lack of fresh news in the market. Meanwhile, it seems difficult for the USDJPY to extend the uptick, as warnings were issued about a weak yen after the pair reached around 154 yen. However, if the U.S. employment figures released on November 7th are positive, the dollar will strengthen.

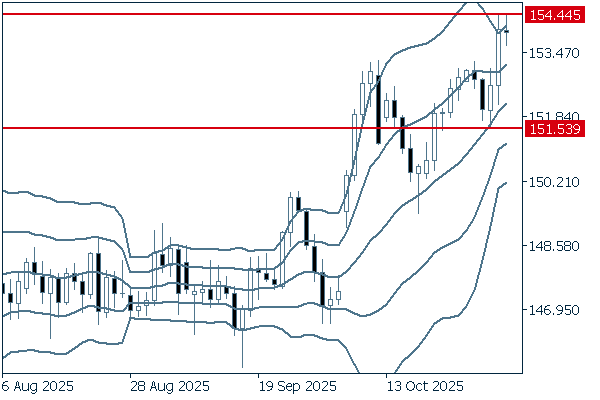

Next is an analysis of the USDJPY daily chart.

After a period of minimal movement, the pair showed a strong uptrend. However, the pair experienced selling pressure upon reaching the +2σ level. Nevertheless, it is safe to say this uptrend will likely continue unless the pair falls below 151.53 yen, where the current rally started last Wednesday.

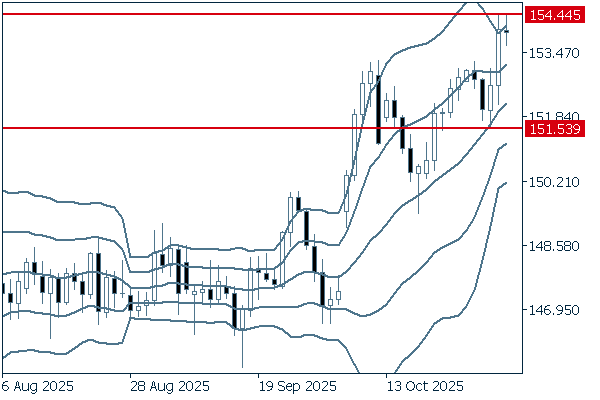

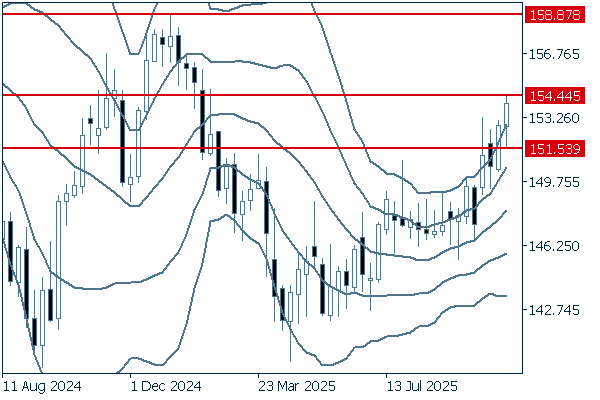

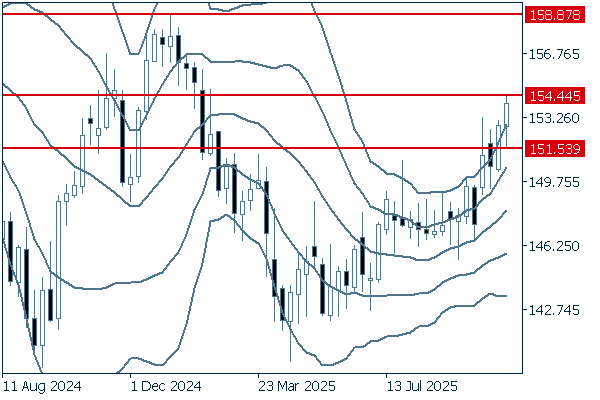

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair broke above the upper limit of the range. Also, a long lower wick on the latest candlestick indicates an increase in buying pressure. In the medium term, the pair will target 158.87 yen. Although the pair may experience a temporary decline, it is safe to say that this uptrend will likely continue as long as the pair stays above 151.53 yen.

EURUSD

Although the European Central Bank (ECB) decided to maintain the status quo of the current monetary policy, the direction of its future policy remains unclear. While the FRB is not expected to cut rates in December, the dollar is therefore expected to continue strengthening, which will affect the market.

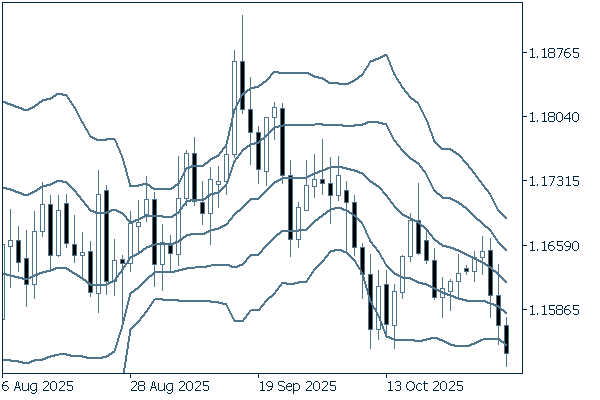

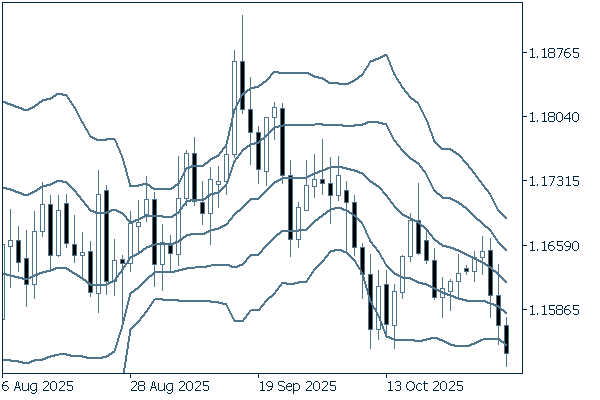

Next is an analysis of the EURUSD daily chart.

Last week, the pair fell below the bottom of the narrow range. Meanwhile, the middle line is moving downwards. Unless the pair reaches the +1σ level, it is safe to say that the downtrend will likely continue.

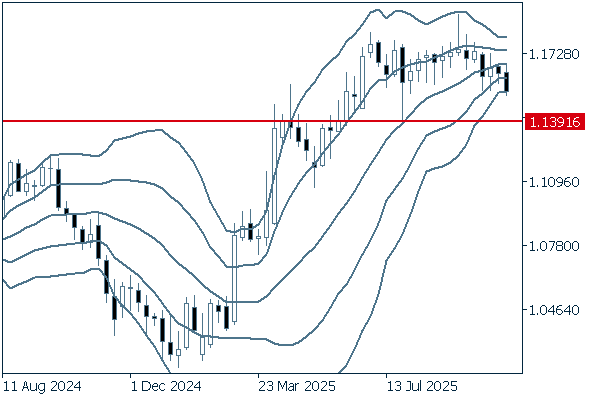

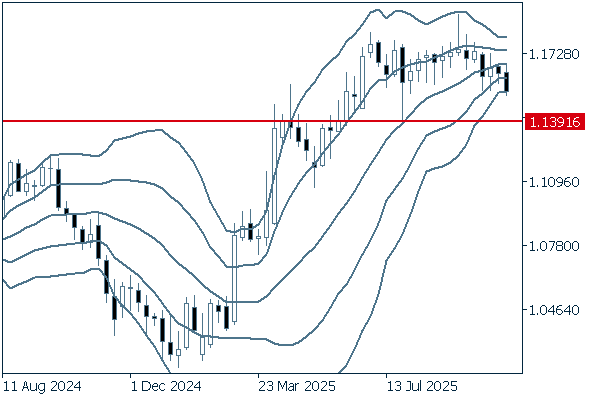

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, the pair declined and touched -2σ, indicating a potential reversal from an uptrend to a downtrend. If the pair falls below 1.1391, the downtrend will intensify.

GBPUSD

The GBPUSD concluded last week's trading session amid mounting selling pressure on the pound due to financial concerns in the U.K. and speculation of an interest rate cut by the Bank of England (BOE). At its Monetary Policy Committee meeting on November 6th, the central bank is expected to decide to keep its policy interest rate unchanged. However, there is a little possibility of an unexpected announcement of a rate cut.

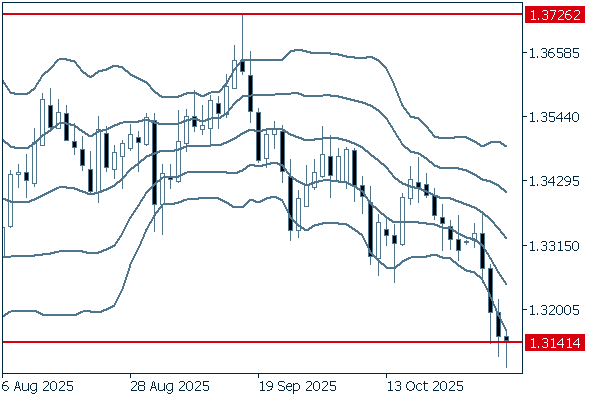

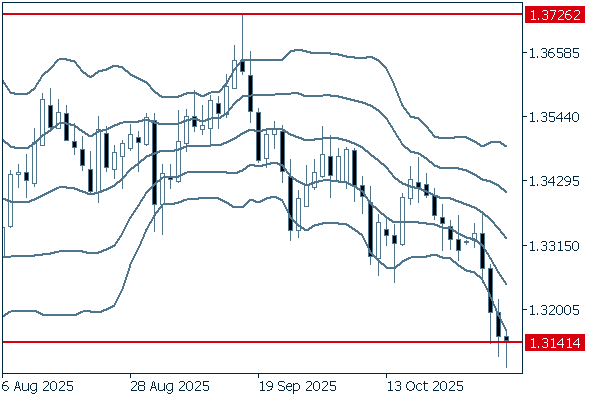

Next is an analysis of the GBPUSD daily chart.

As the downtrend continues, the pair is making lower highs and lower lows. Although the buying pressure on the pound temporarily increased after falling below -2σ, it is safe to say that the downtrend will likely continue.

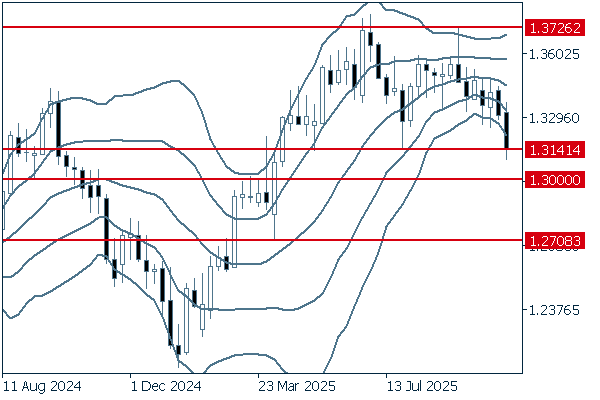

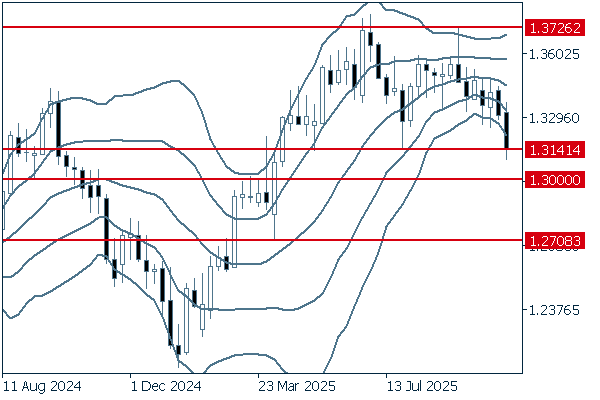

We continue with an analysis of the GBPUSD weekly chart.

Last week, the pair temporarily fell below the 1.3141 level, which had been considered a support line. If the decline continues, the pair will first target 1.30, and in the medium term, it may fall to around 1.2708.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy