2025.10.27

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on October 26th, the dollar strengthened against the yen. The sell-off of the yen was driven by market expectations that the new Japanese Prime Minister, Sanae Takaichi, would implement an expansionary fiscal policy, while the Bank of Japan (BOJ) showed reluctance to raise interest rates. The EURUSD halted its downtrend, but the pound continued to weaken against the dollar.

October 20 (Mon)

As the market expected Takaichi to implement an expansionary fiscal policy once elected as prime minister, the USDJPY rose to around 151.20 yen during Tokyo trading hours. However, the pair then failed to advance and instead hovered within the upper 150 yen range.

Meanwhile, the EURUSD temporarily sank below the 1.164 level, and the GBPUSD almost crossed below the 1.34 level.

October 21 (Tue)

Takaichi was officially sworn in as the new prime minister. Additionally, the market reinforced speculation that the BOJ would decide not to make a rate hike in October. These factors spurred the sell-off of the yen and pushed the USDJPY up to 152.17 yen.

The strengthening dollar pushed the EURUSD down to the 1.159 range. In contrast, the GBPUSD continued to fall to the 1.336 range.

October 22 (Wed)

The USDJPY fluctuated within the upper 151 yen range throughout the day.

The EURUSD fell to the 1.157 range before rebounding to touch the 1.162 range. Meanwhile, the U.K. Consumer Price Index (CPI) for September missed market expectations. Following this, the market resumed speculation that the Bank of England (BOE) would make an additional rate cut. Consequently, the GBPUSD plummeted, hitting 1.330.

October 23 (Thu)

With little major news, the yen weakened against other major currencies. Consequently, it also weakened against the dollar, pushing the USDJPY up to the 152.79 yen range.

Meanwhile, the EURUSD halted its downtrend and rose to the 1.162 range. The GBPUSD started the daily trading session by rebounding in the wake of the previous day's decline. However, it then resumed its downtrend, reaching 1.330 again.

October 24 (Fri)

After Japanese Financial Minister Satsuki Katayama reportedly relaxed the restraint against the weak yen, the market lowered its vigilance for intervention. As a result, the USDJPY entered the 153.0 yen range. Although the lower-than-expected U.S. CPI for September pushed the pair down to 152.25 yen, it then rebounded to the upper 152 yen range.

Meanwhile, the EURUSD extended its rally to the 1.163 range. In contrast, the GBPUSD extended its downtrend to reach the 1.328 range by the end of the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

October 29 (Wed)

- 18:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting, post-meeting policy rate announcement

- 18:30 U.S.: Regular press conference by Federal Reserve Chairman Jerome Powell

October 30 (Thu)

- TBA Japan: Bank of Japan (BOJ) Monetary Policy Meeting, post-meeting policy rate announcement

- TBA Japan: BOJ Outlook for Economic Activity and Prices

- 06:30 Japan: Regular press conference by BOJ Governor Kazuo Ueda

- 10:00 Europe: July-September Quarterly Regional Gross Domestic Product (preliminary regional GDP)

- 12:30 U.S.: July-September Quarterly Gross Domestic Product (preliminary GDP)

- 13:15 Europe: European Central Bank (ECB) Governing Council policy interest rate announcement

- 13:45 Europe: Regular press conference by ECB President Christine Lagarde

October 31 (Fri)

- 10:00 Europe: October Harmonised Index of Consumer Prices (preliminary HICP)

- 10:00 Europe: October Harmonised Index of Consumer Prices (preliminary HICP core index)

- 12:30 U.S.: September Personal Consumption Expenditures (PCE deflator)

- 12:30 U.S.: September Personal Consumption Expenditures (PCE deflator, excluding food and energy)

- 12:30 U.S.: July-September Quarterly Employment Cost Index (ECI)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

It is expected that the FOMC meeting, which is being held on October 28th and 29th, will decide to lower the U.S. interest rate by a further 0.25%. However, this will not necessarily lead traders to take a risk-on stance and buy the dollar. Rather, if the BOJ decides to forgo a rate hike at its Monetary Policy Meeting on October 29th and 30th, the sell-off of the yen will accelerate, possibly resulting in higher stock prices and a weaker yen.

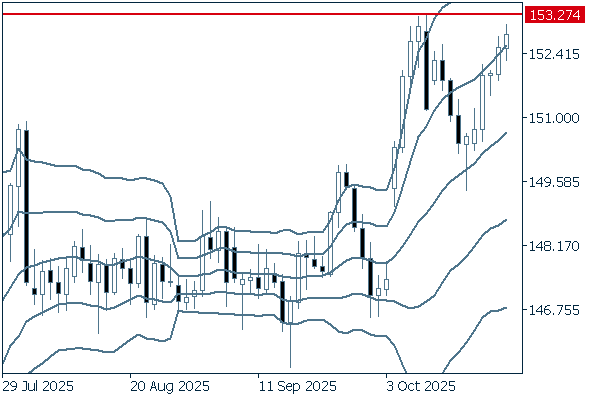

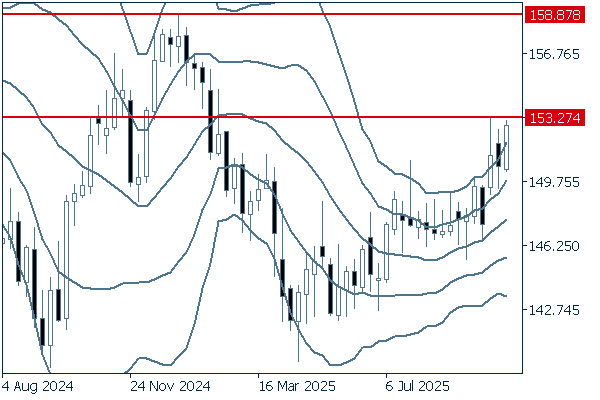

Next is an analysis of the USDJPY daily chart.

The pair crossed below the middle line during the daily trading session on October 17th. It turned out to be a buying opportunity on a dip, as the pair has been rallying for six consecutive business days since then. It is now important to see whether the pair can break above the 153.27 yen level. As the inclination of the middle line suggests, it is safe to say that the uptrend will likely continue.

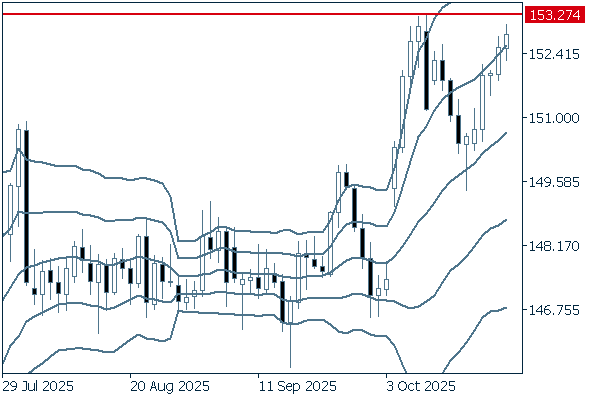

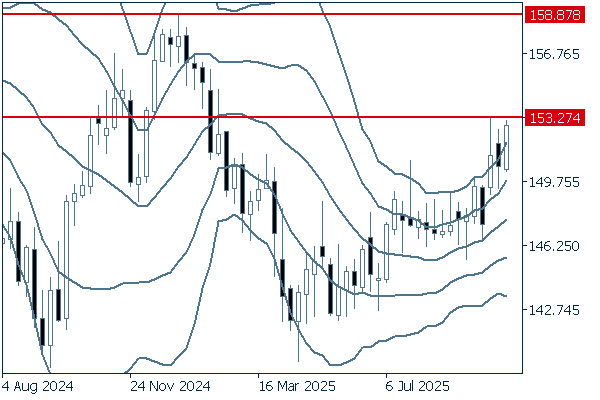

We continue with an analysis of the USDJPY weekly chart.

As with the daily chart, the weekly chart shows the upward middle line. It is safe to say that the uptrend will likely continue, with the pair potentially targeting 158.87 yen in the medium to long run.

EURUSD

This week, the market will focus on monetary policy in the U.S. and Europe. The market has already factored in a U.S. rate cut at the upcoming FOMC meeting and will then shift its focus to the Federal Reserve Board (FRB)'s subsequent monetary easing stance. Meanwhile, the ECB is expected to keep its policy interest rate unchanged. If the central bank continues to be reluctant to lower rates, traders will be less inclined to sell the euro.

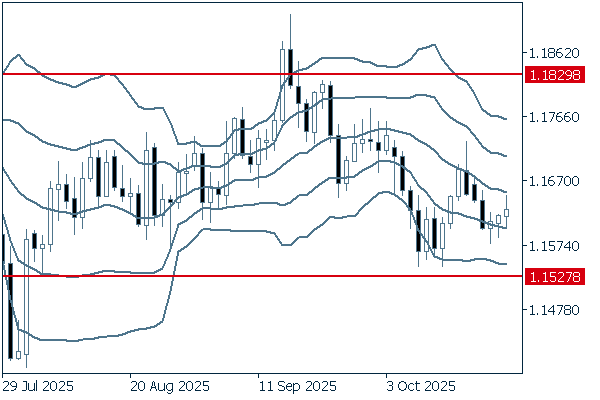

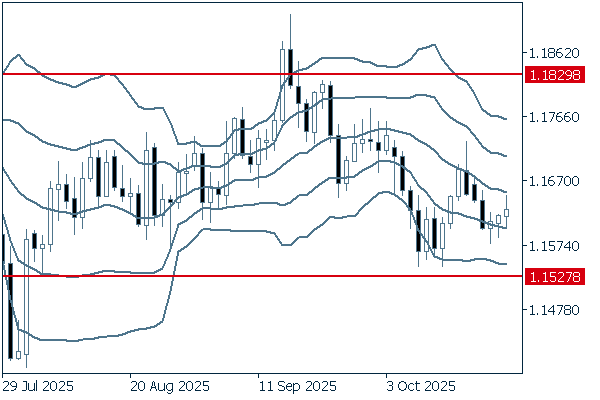

Next is an analysis of the EURUSD daily chart.

Following a period during which the pair had difficulty finding a future direction, mounting selling pressure is keeping it below the middle line. The support line appears to be located around the 1.1572 level. It is important to see whether the pair crosses below this line.

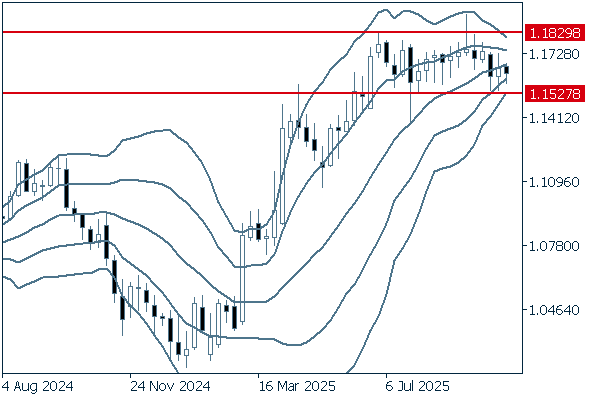

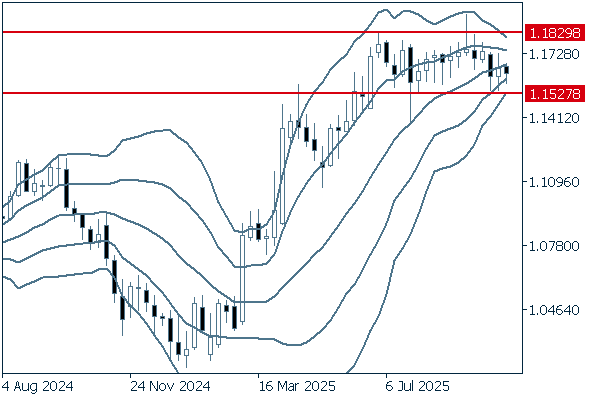

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, the pair has been fluctuating within a fixed range for a long period. However, it has been staying below the middle line for the past three weeks. If it falls below the 1.1527 level, the pair may enter a downtrend.

GBPUSD

As the prolonged U.S. government shutdown is preventing the release of accurate economic data, it is expected that the U.S. employment market is in tight conditions. The market has already taken into account that the FRB will cut interest rates again at its FOMC meeting this week. If the FRB intends to keep its monetary easing stance, the dollar will be sold off.

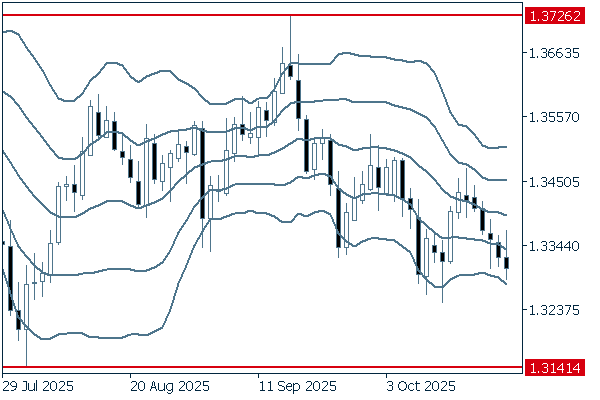

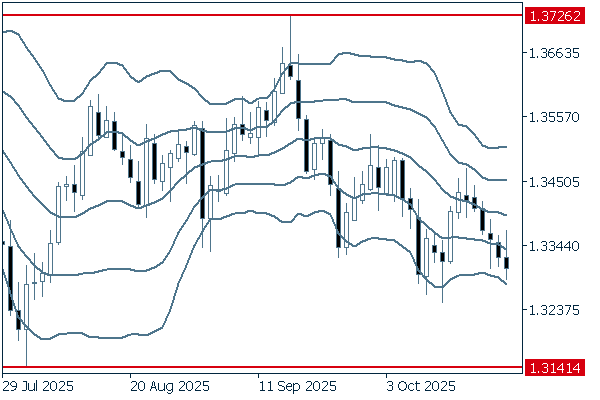

Next is an analysis of the GBPUSD daily chart.

The daily chart shows that the pair is shifting toward a mild downtrend after experiencing a long period of sideways movement. As the pair is making lower highs and lower lows, it is important to see whether it falls below the 1.3141 level. For now, it is better to make sure to sell on a rally.

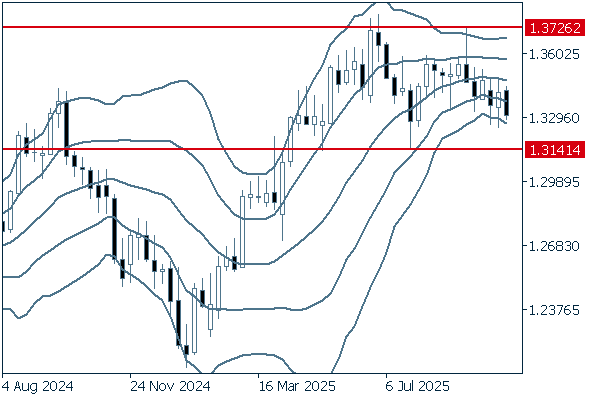

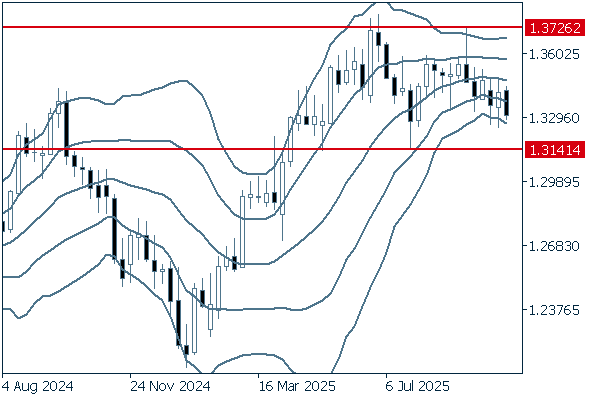

We continue with an analysis of the GBPUSD weekly chart.

Narrowing bandwidth obscures future direction. The pair has been staying beneath the middle line as it slowly declines. If the pair rebounds at the 1.3141 level, it will likely enter an uptrend in the medium term. Conversely, if the pair falls below this level, the downtrend will likely intensify.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy