2025.10.20

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on October 19th, the dollar weakened further against the yen. As market anxiety increased over reignited U.S.-China tensions, U.S. banking panic, and U.S. monetary policy, the USDJPY fell below the 150 yen level.

October 13 (Mon)

The market regained its calm after a sharp rise in the yen the previous Friday. The USDJPY rebounded to the 152.4 yen range as traders bought back the dollar.

The EURUSD fell to the 1.154 range but later rebounded to the 1.161 range. The GBPUSD hovered within the lower 1.33 range.

October 14 (Tue)

U.S. President Donald Trump insisted that he would again strengthen tariffs on imports from China. Traders took a risk-off stance to buy the yen for fear of a deteriorating U.S.-China relationship. The USDJPY fell to the 151.6 yen range.

Meanwhile, the EURUSD rose to the 1.161 range and the GBPUSD reached the 1.332 range after falling to the 1.324 range.

October 15 (Wed)

The dollar continued to weaken against major currencies as market fears of U.S.-China friction increased.

The USDJPY fell to just above 151 yen. Meanwhile, the EURUSD rose to the 1.164 range and the GBPUSD broke above the 1.34 level during trading hours.

October 16 (Thu)

The dollar continued to weaken against the yen throughout the day. After the Liberal Democratic Party (LDP) and the Japan Innovation Party (Nippon Ishin no Kai) were reported to have reached a policy agreement, the dollar was bought back, lifting the USDJPY to 151.39 yen. However, the rally was short-lived, and the pair fell back to the 150.2 yen range.

Meanwhile, the EURUSD climbed to the 1.169 range, and the GBPUSD hovered at the mid-1.34 range.

October 17 (Fri)

While fears of an intensifying U.S.-China trade war persisted, credit uncertainty originating from bad loans held by U.S. regional banks triggered a sell-off of the dollar. During trading hours, the USDJPY dropped to the 149.3 yen range. It then rebounded to the 150.6 yen range to close the weekly session.

Meanwhile, the EURUSD rose to the 1.172 range but then fell back to the 1.164 range. The GBPUSD closed the weekly trading session at 1.341 after hitting 1.347.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

October 23 (Thu)

- 23:30 Japan: September Consumer Price Index (CPI, all items, year-on-year data)

- 23:30 Japan: September Consumer Price Index (CPI, all items less fresh food)

- 23:30 Japan: September Consumer Price Index (CPI, all items less fresh food and energy)

October 24 (Fri)

- 12:30 U.S.: September Consumer Price Index (CPI)

- 12:30 U.S.: September Consumer Price Index (CPI Core Index)

- 14:00 U.S.: September new home sales

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

In Japan, the Diet will appoint a new prime minister on October 21st. If LDP President Sanae Takaichi is elected, the market will resume the sell-off of the yen, given her expansionist fiscal policies. Additionally, President Trump's forward-looking stance on the U.S.-China relationship will contribute to dollar buying.

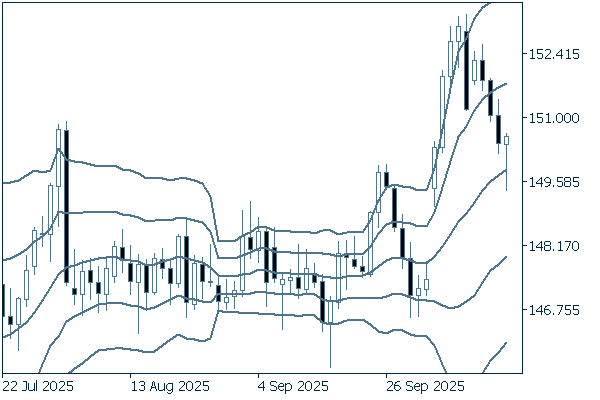

Next is an analysis of the USDJPY daily chart.

The pair snapped three consecutive losses and rebounded on October 17th, forming a positive candlestick with a long lower wick. Meanwhile, the pair concluded last week's trading session above the intraday low of October 6th, when the most recent uptrend began after a wide upside gap was formed. It can be interpreted that the current short-term downtrend came to an end. Therefore, it is safe to say that the uptrend will likely continue.

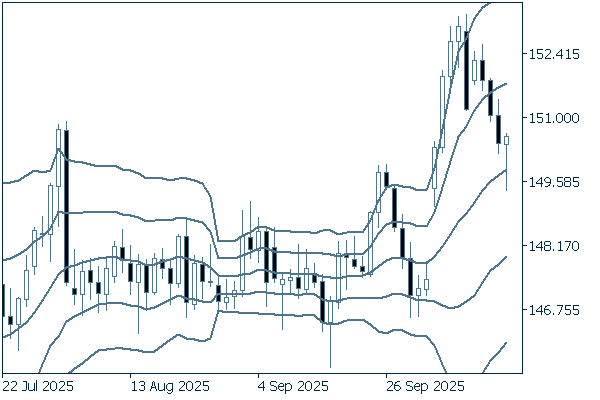

We continue with an analysis of the USDJPY weekly chart.

Last week, the pair failed to make a weekly higher high, nor did it make a weekly lower low. Additionally, the middle line is maintaining an upward curve. The weekly chart suggests that the uptrend is continuing.

EURUSD

The fragile political scene in France is feared to descend into another disarray. Therefore, traders are hesitant to buy the euro. The market will be dominated by the dollar's behavior, which will be based on the development of the U.S.-China trade war and the U.S. employment situation.

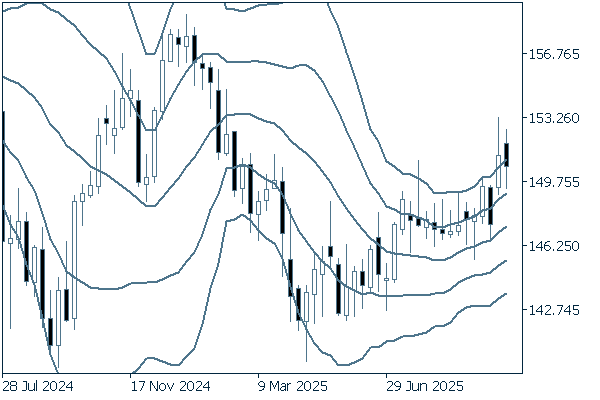

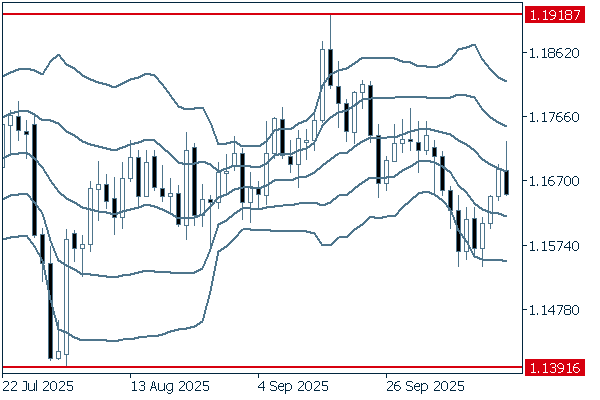

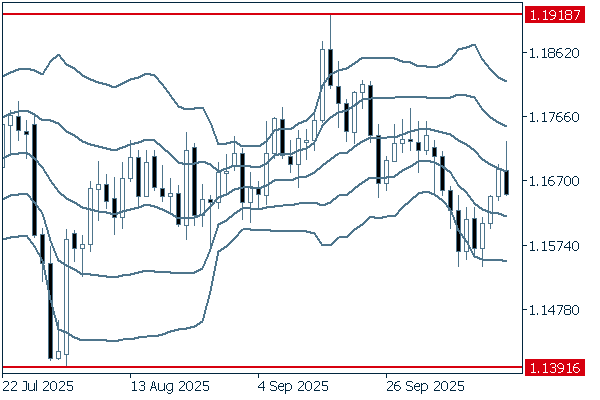

Next is an analysis of the EURUSD daily chart.

After temporarily crossing below -2σ earlier, the pair closed the weekly trading session by rebounding to the middle line. Overall, however, the pair has been fluctuating within a range. Therefore, it is currently difficult to predict whether the pair will enter an uptrend or a downtrend, as the pair does not have a clear direction.

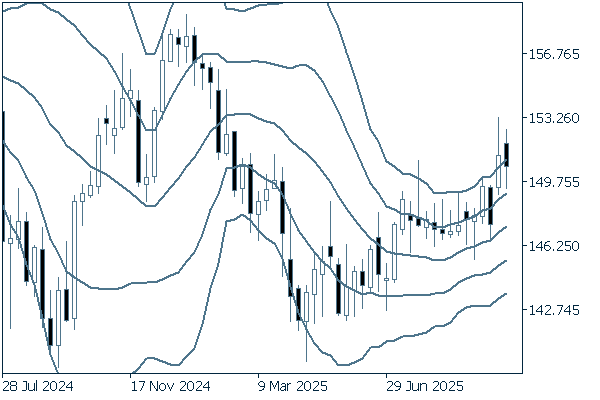

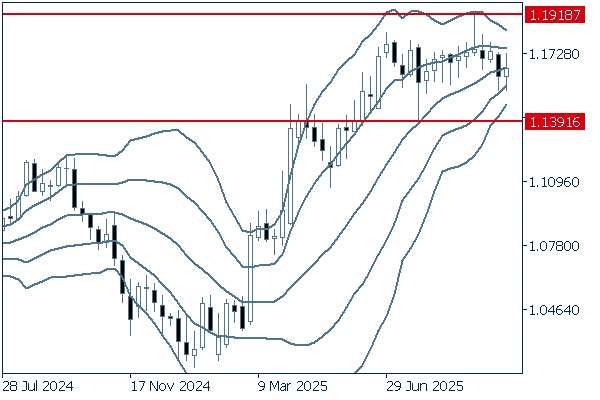

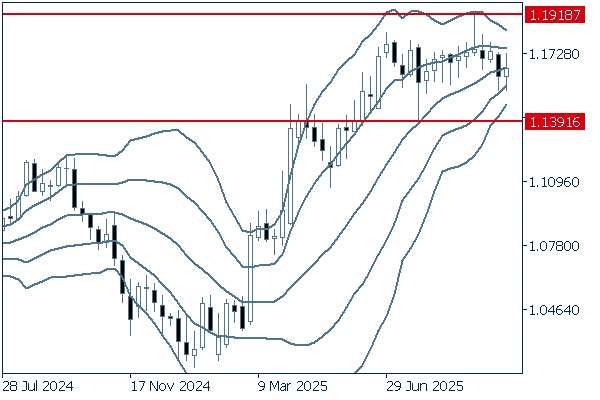

We continue with an analysis of the EURUSD weekly chart.

The bandwidth is narrowing, and the pair has been hovering within a tight range. If the pair clearly breaks above 1.1918, an uptrend will begin. Conversely, if the pair falls below 1.1391, a downtrend will begin.

GBPUSD

The U.K. CPI for September is scheduled for release on October 22nd. If it shows positive figures, the pound will be bought. However, the sell-off of the dollar triggered by the prolonged U.S. government shutdown will contribute more to the preference for the pound. The market will also focus on U.S. economic figures to forecast the dollar's direction.

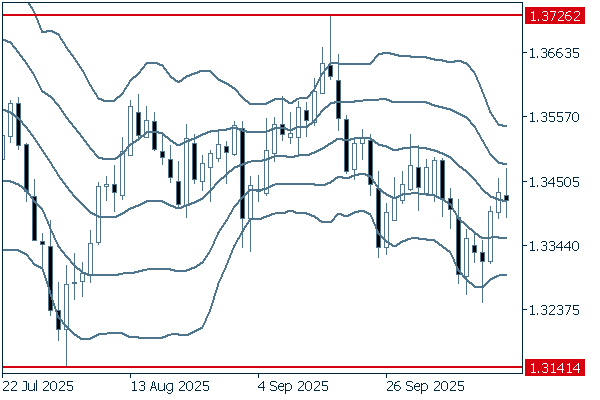

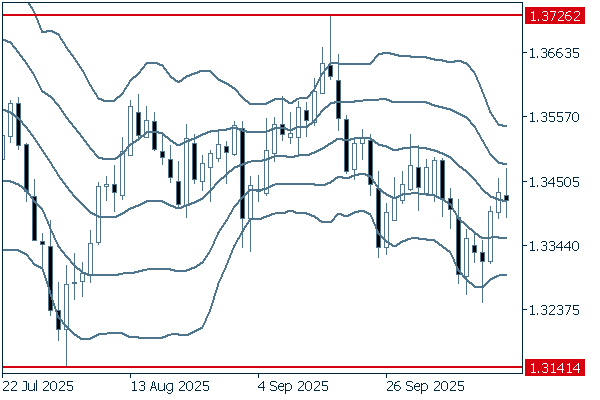

Next is an analysis of the GBPUSD daily chart.

The pair lacks a clear direction and has had a seesaw pattern for a long period. It will be good to follow the fluctuations within the band at shorter time intervals.

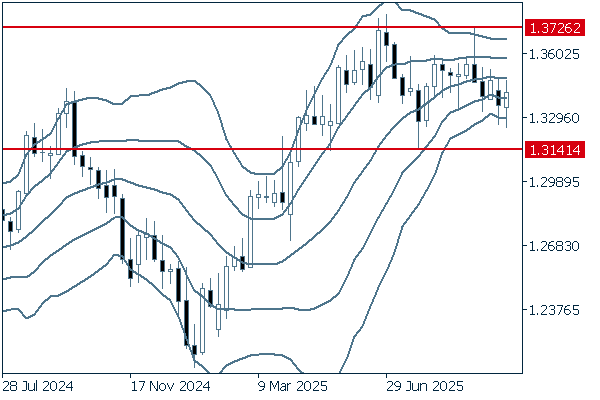

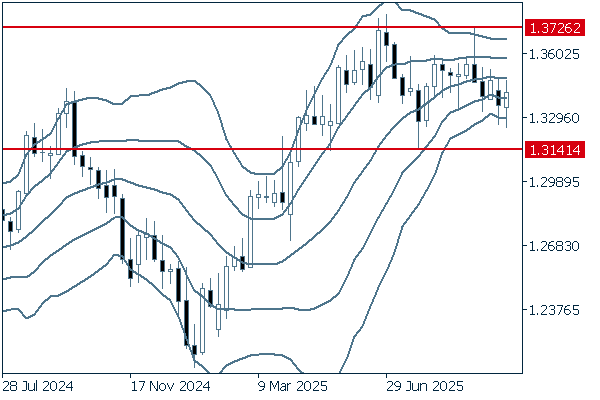

We continue with an analysis of the GBPUSD weekly chart.

As with the daily chart, the weekly chart shows that the pair lacks a clear direction. Additionally, the bandwidth is narrowing. If the pair goes below 1.3141, a downtrend could strengthen.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy