2025.10.13

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign currency market for the week that ended on October 12th, speculation about the Bank of Japan's (BOJ) monetary policy, following the Liberal Democratic Party (LDP) presidential election on October 4th, as well as political uncertainty in Japan, triggered a sell-off of the yen. Consequently, the USDJPY skyrocketed and broke the annual high set in February. However, the dollar was sold and the pair plummeted after U.S. President Donald Trump announced new tariffs on China on October 10th.

October 6 (Mon)

Sanae Takaichi was elected as the new leader of the LDP at the party's election on October 4th. As the market speculated that her expansionary fiscal policy would set back a rate hike by the BOJ, the yen drastically depreciated. The USDJPY skyrocketed from the 147 yen range to the 150.4 yen range.

Meanwhile, the EURUSD declined to the 1.165 range. The GBPUSD fell to the 1.341 range, but then rebounded to the 1.349 range.

October 7 (Tue)

As the yen continued to be sold off, the USDJPY rose to the 151.9 yen range. In addition to speculation that the BOJ will postpone a rate hike, many traders are believed to have turned to the yen carry trade, which has accelerated the sell-off.

Meanwhile, the resignation of French Prime Minister Sébastien Lecornu prompted a sell-off of the euro. Consequently, the EURUSD fell to the 1.164 range, offsetting the previous day's uptick. The GBPUSD fell below the 1.34 level during the day.

October 8 (Wed)

The USDJPY extended its rally to 153.00 yen. Meanwhile, the EURUSD broke below the 1.16 level but then rebounded to the 1.162 range. GBPUSD touched the 1.138 range but struggled to climb throughout the day.

October 9 (Thu)

LDP leader Takaichi commented that she would not lead to excessive yen depreciation. This comment temporarily contributed to a sell-off of the dollar. Soon afterward, however, the USDJPY resumed its rally, reaching 153.23 yen.

Meanwhile, political uncertainties in France weighed down the EURUSD to 1.154. The GBPUSD also declined to the 1.328 range.

October 10 (Fri)

After the New Komeito Party announced its decision to leave the ruling coalition, the yen temporarily rebounded. Later, President Trump insisted on a significant increase in tariffs on imports from China. Consequently, the USDJPY plummeted by more than two yen from the previous day to 151.15 yen.

As the dollar weakened, the EURUSD rose to the 1.163 range and the GBPUSD recovered to the 1.337 range during the day.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

October 13 (Mon)

- Closure: Japan and U.S. (national holiday)

October 14 (Tue)

- 16:20 U.S.: Press conference by Federal Reserve Board (FRB) Chair Jerome H. Powell

October 15 (Wed)

- 12:30 U.S.: September Consumer Price Index (CPI)

- 12:30 U.S.: September Consumer Price Index (CPI Core Index)

October 16 (Thu)

- 06:00 U.K.: August Monthly Gross Domestic Product (GDP)

- 12:30 U.S.: September Retail Sales

- 12:30 U.S.: September Retail Sales (excluding automotives)

October 17 (Fri)

- 09:00 Europe: September Harmonised Index of Consumer Prices (revised HICP)

- 09:00 Europe: September Harmonised Index of Consumer Prices (revised HICP core index)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

U.S. President Donald Trump announced that the U.S. will impose an additional 100% tariff on imports from China starting on November 1st. Meanwhile, in Japan, Komeito left the coalition with the LDP. Traders will adopt a risk-off stance to sell the dollar and buy the yen. This trend will not wane for a while.

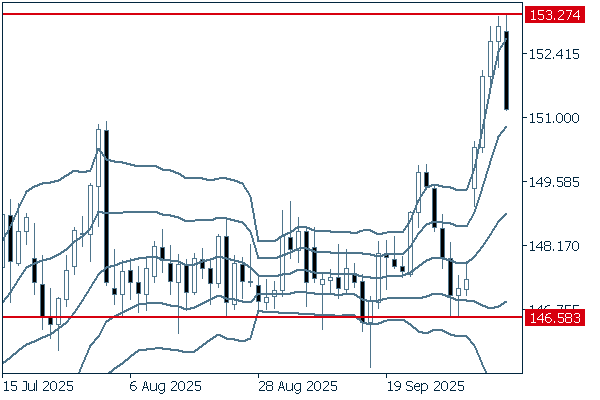

Next is an analysis of the USDJPY daily chart.

The pair broke above the band, then fell back within it to correct the early-week surge. Overall, however, the pair remains in an uptrend. As long as the pair remains above 146.58 yen, the uptrend will likely continue. Therefore, it is better to make sure to buy on dips.

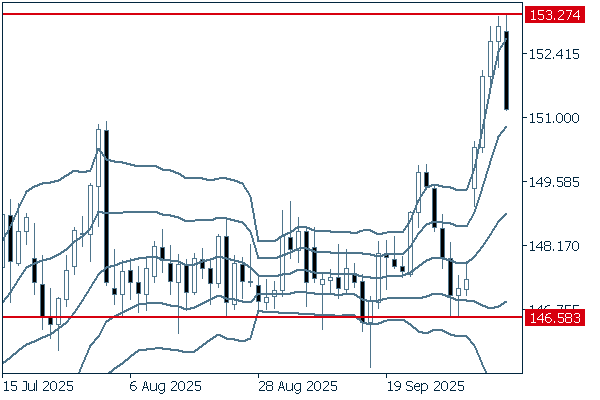

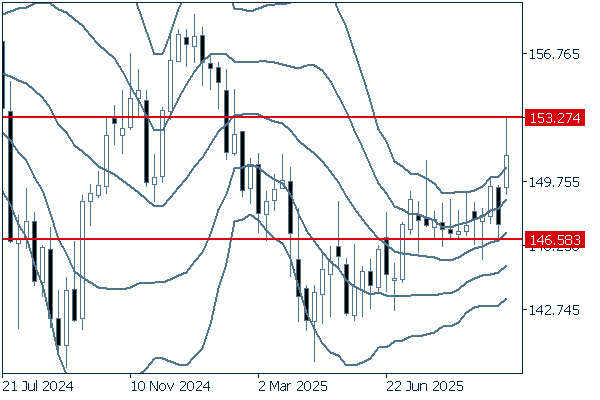

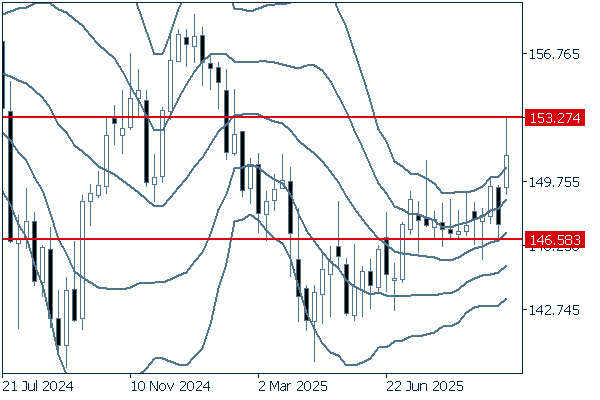

We continue with an analysis of the USDJPY weekly chart.

The middle line is turning into a gentle upward curve. Although the pair was pushed back into the band to close last week's trading session, the latest positive candlestick is staying above +1σ. The uptrend will likely continue unless the pair falls below 146.58 yen.

EURUSD

Since French political uncertainties will linger for the time being, traders will prefer a risk-off stance to sell the euro and buy the dollar. However, a deterioration in U.S.-China relations will trigger a sell-off of the dollar. Therefore, the EURUSD will not trend in one direction.

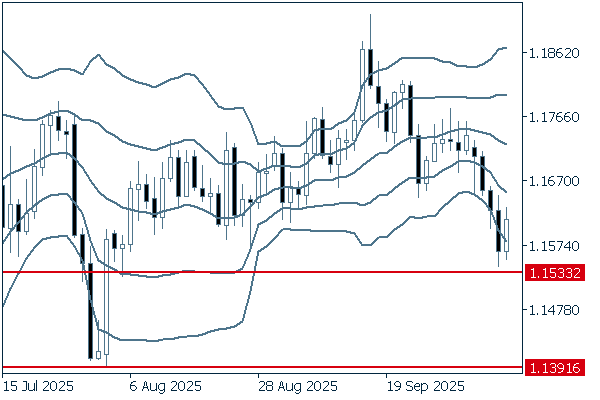

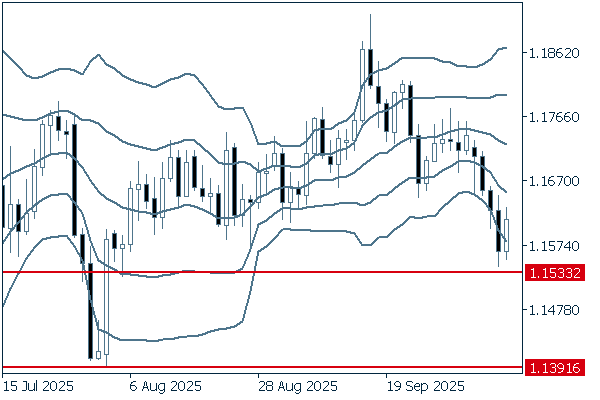

Next is an analysis of the EURUSD daily chart.

After falling below the lower limit of the band, the pair attempted to reenter it. However, mounting selling pressure blocked the attempt. If the pair crosses below 1.1533 and even falls below 1.1391, the downtrend will accelerate.

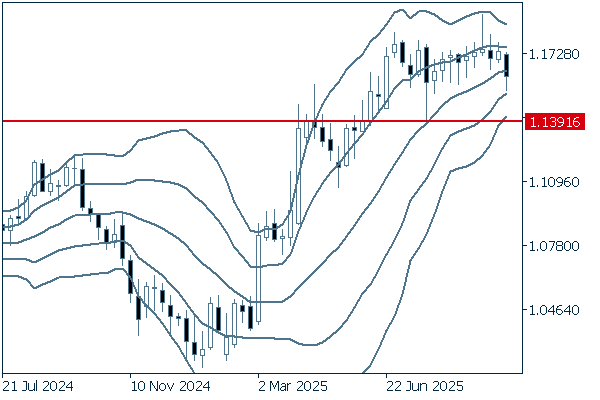

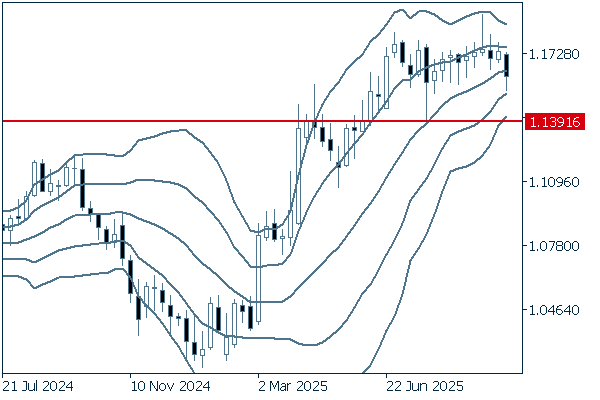

We continue with an analysis of the EURUSD weekly chart.

Buying pressure has helped the pair stay in the stratosphere. However, the weekly chart shows that the pair fell below the middle line to close last week's trading session. If the pair falls below 1.1391, a reversal to a downtrend may occur.

GBPUSD

Traders are reluctant to buy the pound because the monetary policy of the Bank of England (BOE) is unclear. Additionally, the fresh Trump tariffs are casting an increasingly dark cloud over the world economy and will weaken the dollar. Therefore, a strong pound will likely boost the GBPUSD.

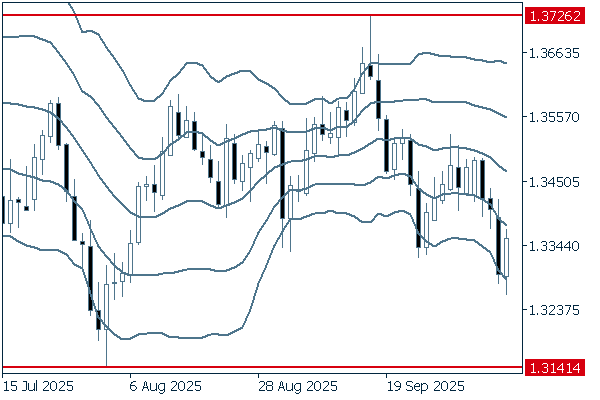

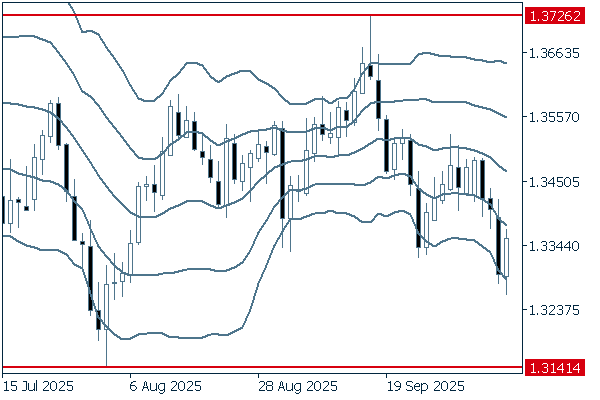

Next is an analysis of the GBPUSD daily chart.

Although the pair is in the midst of a range-bound phase, the middle line is turning downward, and the pair is inching toward making lower lows. The downtrend will likely continue unless the pair breaks above 1.3726.

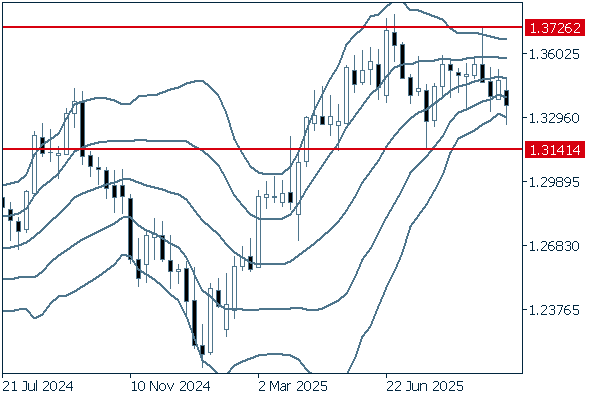

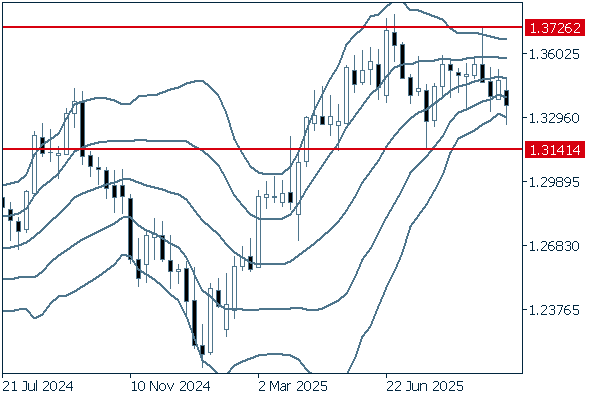

We continue with an analysis of the GBPUSD weekly chart.

The bandwidth is narrowing, and the pair is hovering within a limited range. However, as with the daily chart, the weekly chart shows that the pair has been beneath the middle line and temporarily fell below -2σ last week. It will be important to watch whether the pair declines to the recent low of 1.3141.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy