2025.08.04

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

The foreign exchange market faced a series of important events during the week that ended on August 2nd, including the Federal Open Market Committee (FOMC) meeting, the Bank of Japan (BOJ) Monetary Policy Meeting, the announcement of U.S. employment figures, and the tariff agreement between the U.S. and the E.U. The dollar had previously strengthened against the yen and the euro. However, the much weaker-than-expected U.S. employment figures greatly pushed the USDJPY down before the close of the weekly trading session.

July 28 (Mon)

The USDJPY started the weekly trading session by edging up from the 147 yen range to the 148.5 yen range.

Meanwhile, the euro weakened against the dollar as France, Germany, and other European countries expressed discontent with the U.S.-E.U. tariff agreement concluded at the end of the previous week. The EURUSD broke below the 1.16 level. The GBPUSD followed suit, dropping below the 1.34 level.

July 29 (Tue)

The market remained quiet ahead of the FOMC meeting in the U.S. and the Monetary Policy Meeting in Japan. The USDJPY remained in the upper 148 yen range.

The EURUSD pair continued to fall, reaching the 1.151 range. Meanwhile, the GBPUSD remained within the 1.33 range.

July 30 (Wed)

The FOMC decided to keep U.S. interest rates unchanged. At the post-meeting press conference, Federal Reserve Board Chair Jerome Powell expressed reluctance about a rate cut. Consequently, the dollar strengthened against the yen, with the USDJPY rising to the mid-149 yen range.

The EURUSD continued to fall as traders preferred to buy the dollar, almost breaking below the 1.14 level. Meanwhile, the GBPUSD declined to the 1.322 range.

July 31 (Thu)

At its Monetary Policy Meeting, the BOJ decided to keep its fiscal policy unchanged. Additionally, Governor Kazuo Ueda expressed reluctance about an early rate hike. As a result, the yen continued to weaken against the dollar, and the USDJPY surpassed the 150 yen level.

The EURUSD resisted the decline to remain above the 1.14 level but struggled to advance, hovering around the 1.144 level. The pound weakened against the dollar, pushing the GBPUSD down to the 1.31 range during trading hours.

August 1 (Fri)

The closely watched U.S. employment figures for July negatively surprised the market, as the total nonfarm payroll employment (NFP) missed predictions. It instantly reignited speculation in the market about a U.S. rate cut by the end of the year. The USDJPY plummeted from the 150 yen range to the lower 147 yen range.

Meanwhile, after falling below 1.14, the EURUSD rebounded to the 1.159 range. The GBPUSD also rebounded to the upper 1.32 range to close the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

August 4 (Mon)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

August 5 (Tue)

- 14:00 U.S.: July ISM Non-Manufacturing PMI (composite)

August 7 (Thu)

- 11:00 U.K.: Bank of England (BOE) policy interest rate announcement

- 11:00 U.K.: Minutes of Bank of England Monetary Policy Committee (MPC) meeting

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The weaker-than-expected U.S. employment figures for July reversed the trend of a strong dollar. Additionally, President Donald Trump has repeatedly threatened to dismiss Federal Reserve Chair Jerome Powell. With speculation about a U.S. rate cut reigniting, market speculation about U.S. monetary policy will dominate the pair.

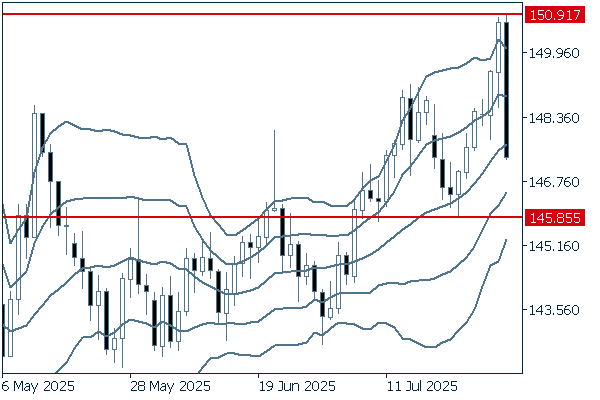

Next is an analysis of the USDJPY daily chart.

Earlier last week, the pair was on its way to reaching 151 yen. However, it nosedived on August 1st. Meanwhile, the middle line remains upward. The latest uptrend started at 148.75 yen. If the pair falls below this level, it could indicate an entry into a downtrend. Nevertheless, it is safe to say that the uptrend will likely continue.

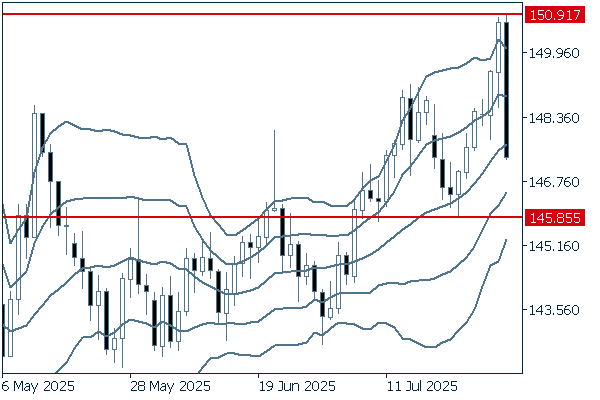

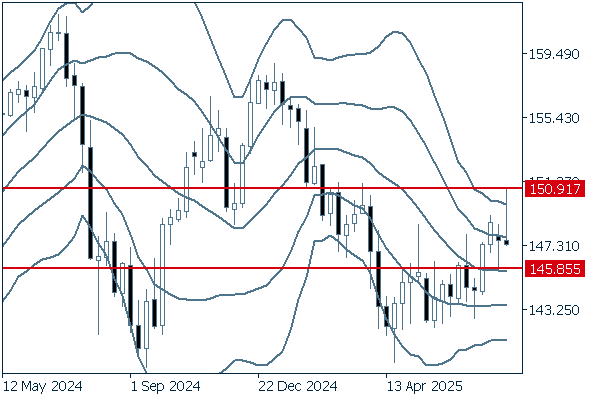

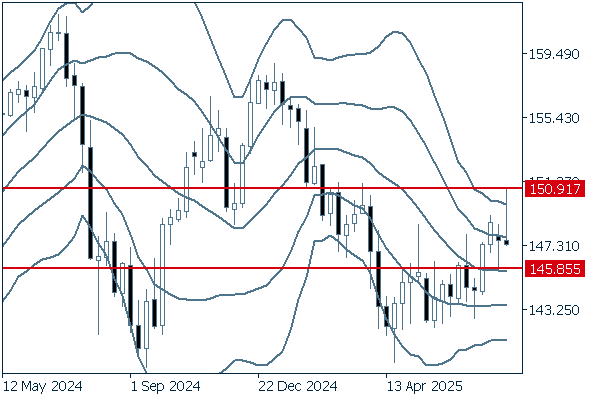

We continue with an analysis of the USDJPY weekly chart.

The middle line of the weekly chart is about to flatten, which suggests that the pair is losing direction. The current candlestick alignment apparently suggests a good opportunity to buy on the dip. However, if the pair breaks below 145.85 yen, it could signal a return to the downtrend.

EURUSD

Earlier last week, the euro weakened against the dollar because some E.U. countries expressed concern about the negative economic effects triggered by the Trump tariffs. However, negative surprises brought by the U.S. employment figures for July suddenly turned the tables for both currencies. As a new week begins, the dollar's behavior will dominate the market.

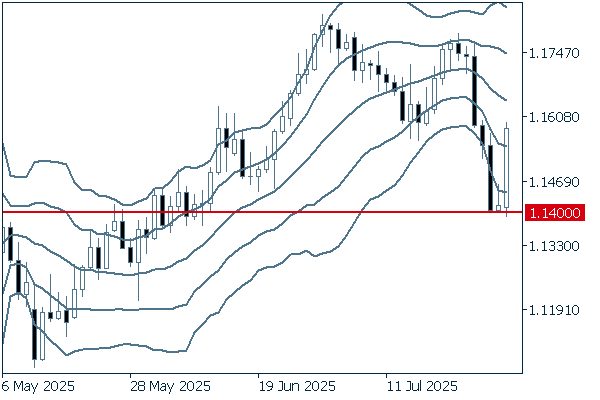

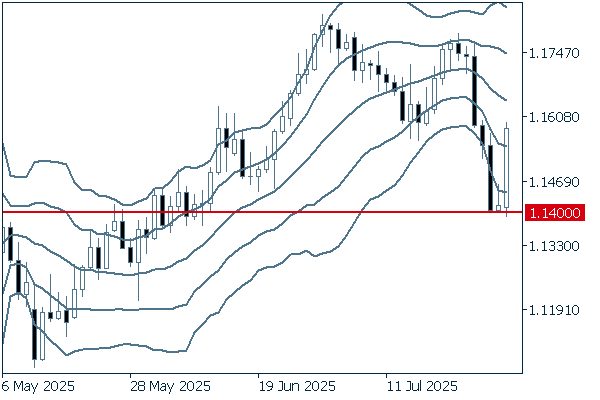

Next is an analysis of the EURUSD daily chart.

Last week, the euro faced an increase in selling pressure, causing the pair to fall below -2σ. Then, on August 1st, the pair rebounded to break above -1σ. Nevertheless, it is still possible that if the pair falls below the current resistance line, which is located around 1.14, the downtrend could strengthen.

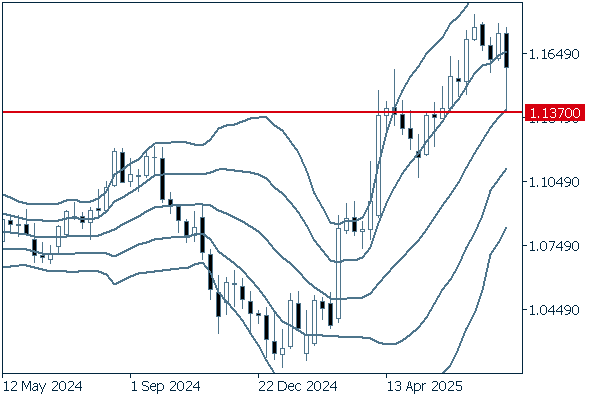

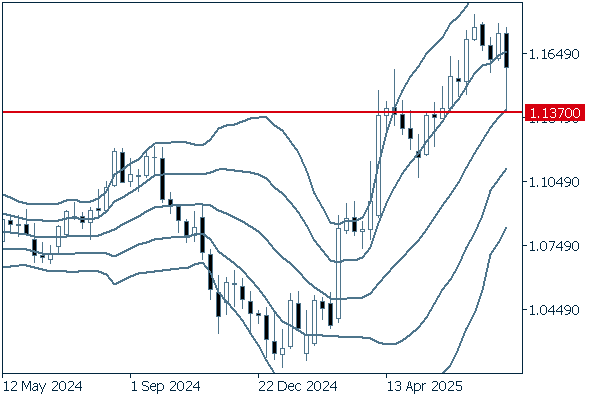

We continue with an analysis of the EURUSD weekly chart.

The middle line of the weekly chart remains upward. Last week, as shown by the real body of the latest candlestick, the pair neared the level of the recent high. However, at the same time, it failed to reach a new high. These factors can lead to the conclusion that the uptrend has paused. If the pair clearly breaks below the 1.137 level, where the upward middle line reached last week, it could signal a trend reversal.

GBPUSD

The BOE is scheduled to announce its policy interest rate this week. While the market believes with a high degree of certainty that the Monetary Policy Committee will decide to make a rate cut, this decision appears to have already been factored in. The wildly fluctuating dollar will dominate the market.

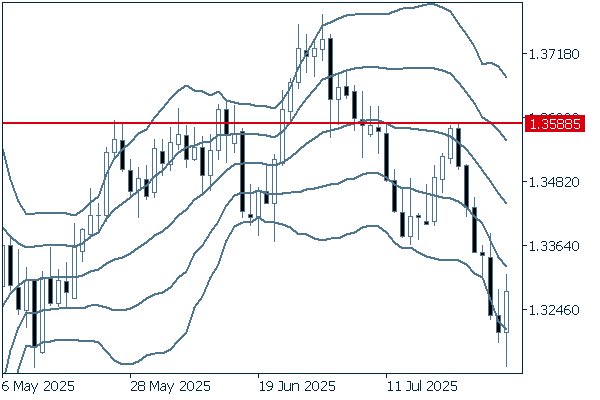

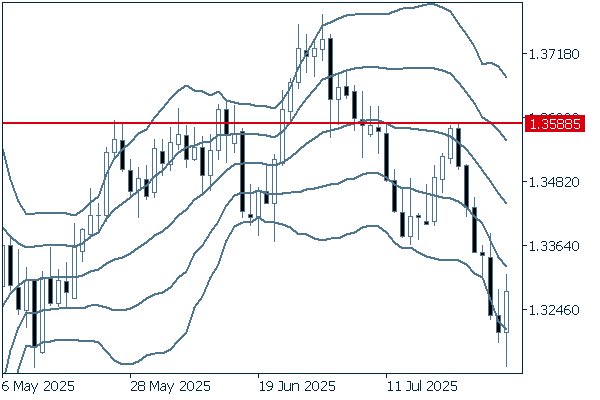

Next is an analysis of the GBPUSD daily chart.

The middle line has turned downward. This indicates that the pair is about to experience a downtrend reversal. It is safe to say that the pair will likely continue to fall unless it breaks above the 1.3588 level.

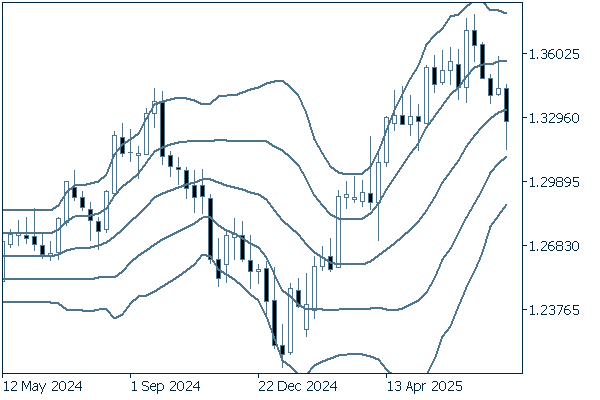

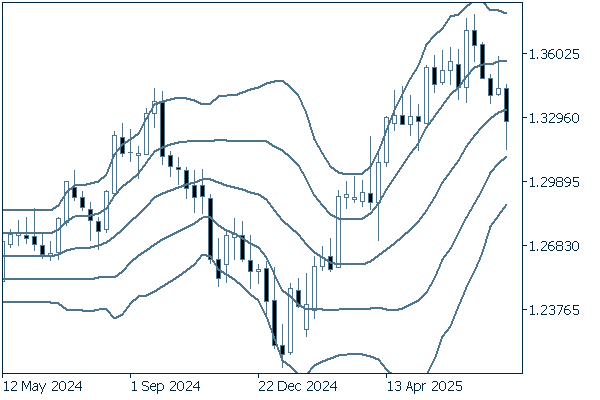

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, the middle line remains upward. However, it turned out that the positive candlestick two weeks ago prompted traders to sell during the rally. As a result, the pair is inching toward a downtrend. It is safe to conclude that a downtrend has begun if the pair falls below -1σ and continues to decline.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy