2025.08.11

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on August 10th, the dollar weakened due to the previous week's weaker-than-expected U.S. employment figures, which increased speculation about a U.S. interest rate cut. Meanwhile, the pound strengthened against the dollar following the Bank of England's (BoE) monetary policy decision. Dovish comments from Federal Reserve Board (FRB) executives pushed the USDJPY down. The weakening dollar helped the EURUSD climb and the GBPUSD rebound sharply.

August 4 (Mon)

After falling sharply due to weaker-than-expected U.S. employment data at the end of the previous week, the USDJPY started the weekly trading session by rebounding from the lower 147 yen range to the 148 yen range. However, the pair fell again to as low as 146.86 yen during New York trading hours.

Meanwhile, the EURUSD hovered within the 1.15 range, and the GBPUSD hovered around the 1.33 level.

August 5 (Tue)

The USDJPY fell to the mid-146 yen range after San Francisco FRB President Mary C. Daly suggested the possibility of an accelerated rate cut. Subsequently, the buyback of the dollar lifted the pair to the upper 147 yen range.

The EURUSD fell to the 1.152 range but then came back to the 1.158 range. Meanwhile, the GBPUSD remained almost unchanged at around the 1.33 level.

August 6 (Wed)

Earlier, the USDJPY lacked direction. However, during New York trading hours, comments from Neel Kashkari, president of the Minneapolis FRB, and Lisa D. Cook, member of the Board of Governors, as well as growing concern over the U.S. economic slowdown, triggered a sell-off of the dollar. The pair fell below the 147 yen level.

As the dollar weakened, the EURUSD rose to the 1.16 range, and the GBPUSD advanced to the upper 1.33 range.

August 7 (Thu)

The USDJPY briefly fell below the 147 yen level but fluctuated within the lower 147 yen range throughout the day.

Meanwhile, as expected, the BoE decided to lower the interest rate. However, the central bank's Monetary Policy Committee's unexpectedly narrow 5-4 vote increased market speculation that it would be difficult for the BoE to make an additional rate cut. As a result, the pound strengthened against the dollar, lifting the GBPUSD to the 1.34 range. The EURUSD rose to touch the 1.169 range.

August 8 (Fri)

The summary of opinions at last month's Bank of Japan (BoJ) Monetary Policy Meetings revealed that the central bank was reluctant to an early rate increase. Consequently, the yen was sold, causing the USDJPY to rise to the upper 147 yen range. However, the pair then failed to reach the 148 yen range.

Meanwhile, the EURUSD fluctuated within the 1.16 range, and the GBPUSD remained within the 1.34 range to close the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

August 12 (Tue)

- 12:30 U.S.: July Consumer Price Index (CPI)

- 12:30 U.S.: July Consumer Price Index (CPI Core Index)

August 14 (Thu)

- 06:00 U.K.: April-June Quarterly Gross Domestic Product (preliminary GDP)

- 06:00 U.K.: June Monthly Gross Domestic Product (GDP)

- 09:00 Europe: April-June Quarterly Regional Gross Domestic Product (preliminary regional GDP)

- 23:50 Japan: April-June Quarterly Gross Domestic Product (preliminary GDP)

August 15 (Fri)

- 12:30 U.S.: July Retail Sales

- 12:30 U.S.: July Retail Sales (excluding automotives)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

As Stephen Miran, the chair of the Council of Economic Advisers and proponent of monetary easing policies, is expected to join the FOMC, the market is increasing speculation that the U.S. may mark a monetary policy shift. If the July retail sales, due to be announced on August 15th, miss market expectations, speculation about a rate cut will increase.

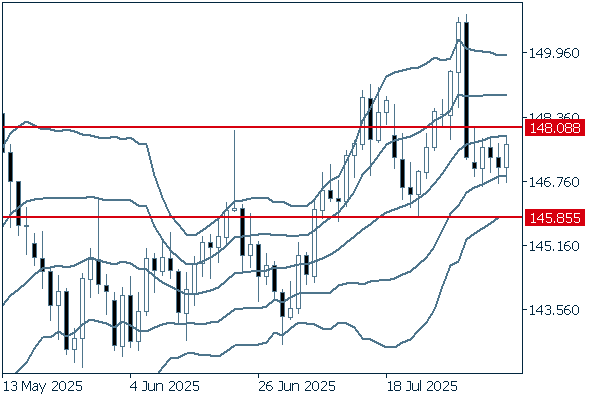

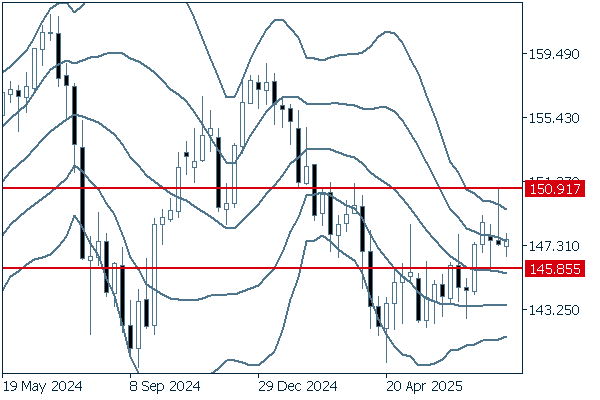

Next is an analysis of the USDJPY daily chart.

Amid this directionless situation, it is important to monitor whether the pair will break above 148.08 yen or below 145.85 yen to determine its future direction.

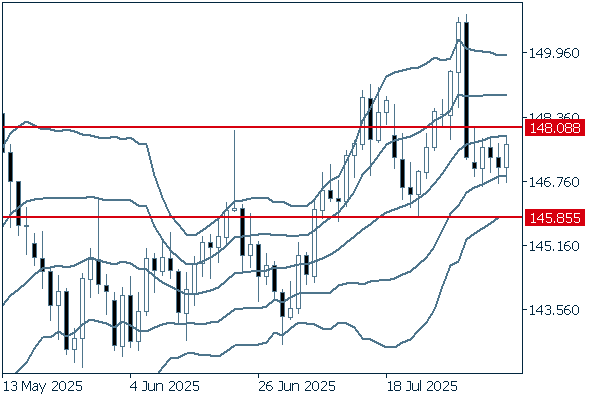

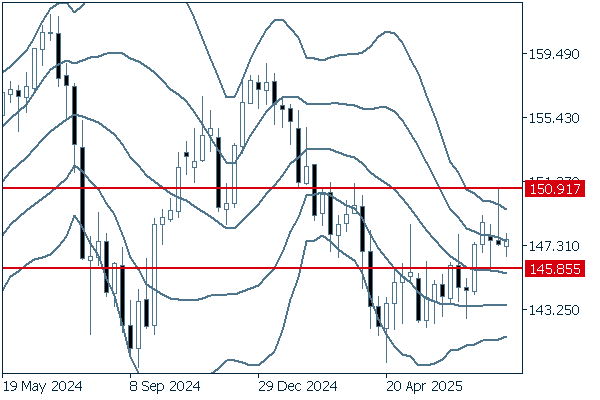

We continue with an analysis of the USDJPY weekly chart.

The pair closed last week's trading session with minimal fluctuation, providing little indication of its future direction. If the pair advances to break above the 150.91 yen level, the uptrend will likely continue. On the other hand, if it falls below 145.85 yen, it will likely return to a downtrend.

EURUSD

Following a period during which a strong dollar pushed the EURUSD down, increasing speculation of a U.S. interest rate cut in September and favoring the euro among traders. It is important to keep an eye on U.S. economic indicators related to inflation and consumption in order to predict the future of the pair.

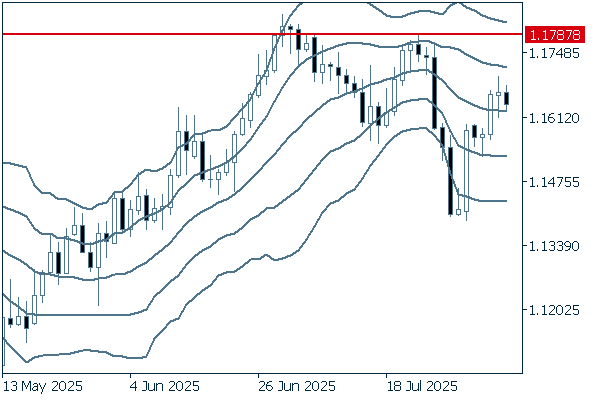

Next is an analysis of the EURUSD daily chart.

After experiencing a sharp drop the previous week, the pair rebounded to break above the middle line. However, increasing selling pressure against the euro hindered its advance to the +1σ level. Additionally, the narrowing spread may lead to a triangle formation on the daily chart. It will be important to monitor whether the pair breaks above the current high or drops below the current low to determine the future direction.

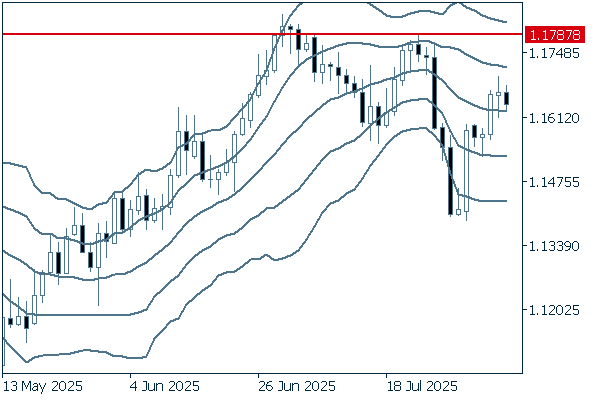

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, the euro has been weakening against the dollar since the pair reached its annual high. If the pair breaks above +1σ and climbs higher, it will be safe to say that the uptrend will continue.

GBPUSD

The GBPUSD kept climbing last week. After last week's Monetary Policy Committee backpedaled on market speculation about an additional rate cut by the BoE, the pound strengthened against the dollar. Weaker-than-expected U.S. employment figures also bolstered the pound against the dollar. As the upward trend paused on August 8th, the dollar's next behavior will determine the pair's future.

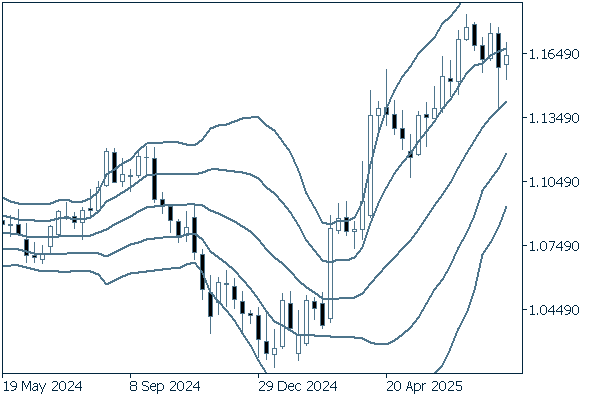

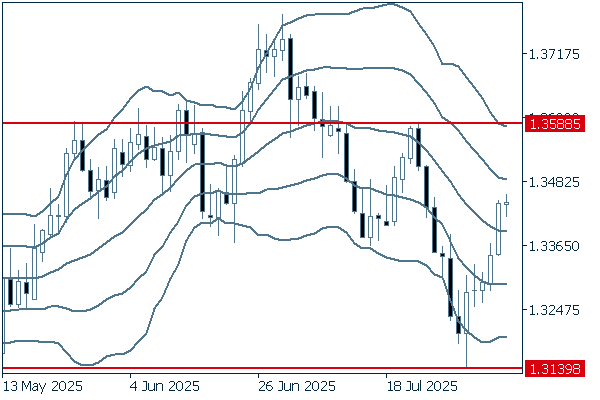

Next is an analysis of the GBPUSD daily chart.

The pair has climbed since dropping below -2σ and has now returned above the middle line to close last week's trading session. If the pair breaks above 1.3588, where the most recent downtrend began last month, the uptrend will likely continue.

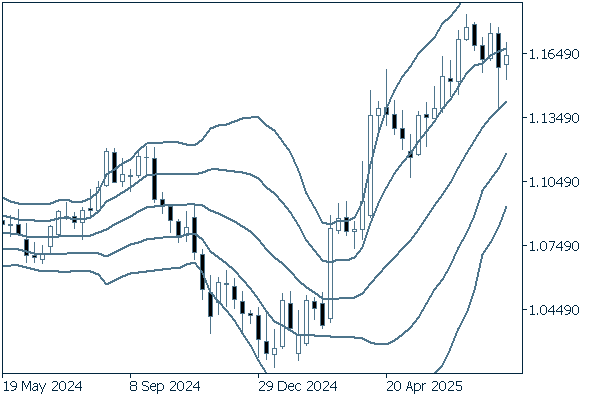

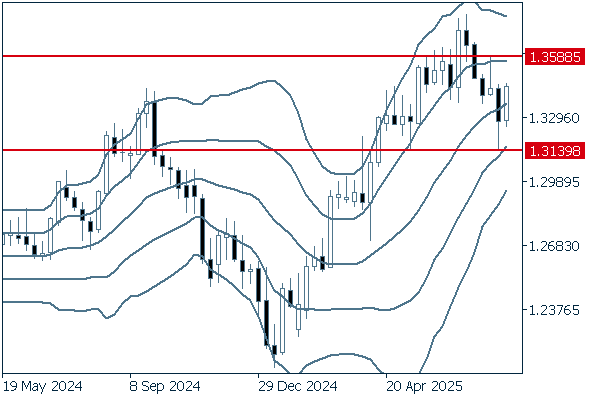

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, increasing buying pressure for the pound has halted the downtrend and pushed the pair up to the middle line. It is now important to monitor whether the pair can break above the 1.3588 level.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy