2025.07.07

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on July 6th, the USDJPY fluctuated sensitively in response to the U.S. employment data and comments made by U.S. President Donald Trump. Consequently, the dollar strengthened slightly against the yen. While the EURUSD experienced a relatively solid fluctuation, the GBPUSD fell amid emerging U.K. political and fiscal uncertainties.

June 30 (Mon)

The USDJPY fluctuated up and down due to month-end position squaring. After dropping to the 143.7 yen range, the pair rebounded to the 144.5 yen range but subsequently fell below the 144 yen level again.

The EURUSD showed a steady uptrend and rose to the 1.178 range. The GBPUSD hovered over the 1.37 level.

July 1 (Tue)

In the Bank of Japan (BOJ) Tankan report, the large manufacturers' index showed improvement. As a result, the yen strengthened against the dollar as the USDJPY fell to the 142.7 yen range. However, during New York trading hours, the dollar was bought back and the pair rebounded to the 143.8 yen range, nearly offsetting the earlier decline.

The EURUSD rose to touch the 1.182 range. Meanwhile, the GBPUSD rose to the 1.378 range but then fell back to the 1.375 range to close the daily trading session.

July 2 (Wed)

In London time, the dollar strengthened against the yen, lifting the USDJPY to the 144.2 yen range. However, during the New York trading hours, the pair fell to the 143.4 yen range due to the weaker-than-expected ADP Employment Report. After some ups and downs, the pair closed the daily trading session in the 143.6 yen range.

The EURUSD fell to the 1.174 range but then rebounded to nearly the 1.18 level. Meanwhile, British Prime Minister Keir Starmer was reported to have avoided fully supporting Chancellor Rachel Reeves, fueling speculation about her job security. Consequently, the GBPUSD plummeted to the 1.356 range.

July 3 (Thu)

Better-than-expected U.S. employment figures for June accelerated dollar buying, pushing the USDJPY sharply higher to the 145 yen range.

As the dollar strengthened, the EURUSD almost broke below the 1.17 level. The GBPUSD also fell to the 1.358 range but then rebounded to the mid-1.36 range.

July 4 (Fri)

The U.S. market was closed for Independence Day. Meanwhile, as traders made position corrections before the weekend and Trump signed the tax and spending bill into law, the USDJPY fell to the mid-144 yen range to close the weekly trading session.

The EURUSD hovered in the 1.177 range, and the GBPUSD fluctuated over the 1.365 level.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

July 9 (Wed)

- 18:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting minutes

July 11 (Fri)

- 06:00 U.K.: May Monthly Gross Domestic Product (GDP)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The market is focusing on the development of trade talks between the U.S. and its major trading partners. If a breakdown in negotiations can be avoided, the risk-off sentiment for dollar sell-offs and yen buying will weaken. Additionally, better-than-expected U.S. employment figures reduce speculation about a U.S. interest rate cut in July. Consequently, the dollar will strengthen in the short term.

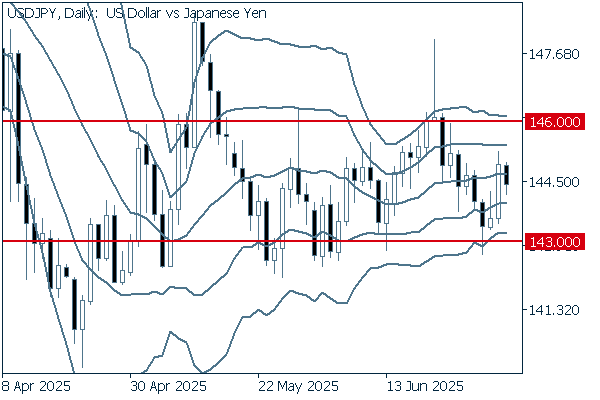

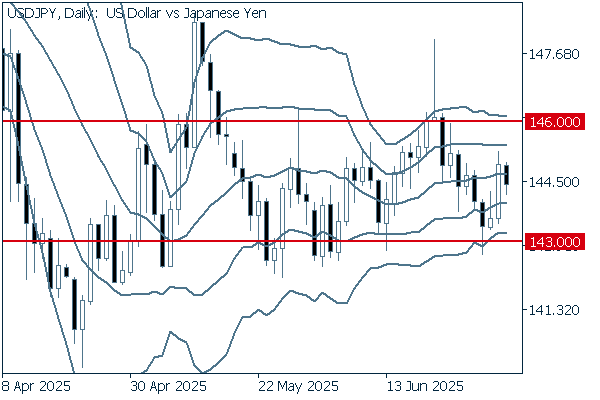

Next is an analysis of the USDJPY daily chart.

The pair is moving sideways within the narrowing bandwidth. It will be important to wait and see if the pair clearly breaks above the 146 yen level or below the 143 yen level in order to determine the direction.

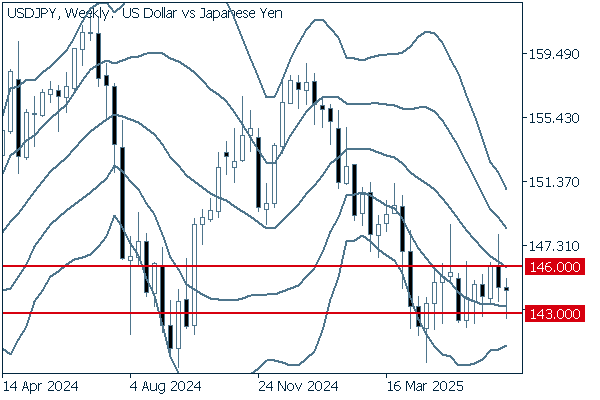

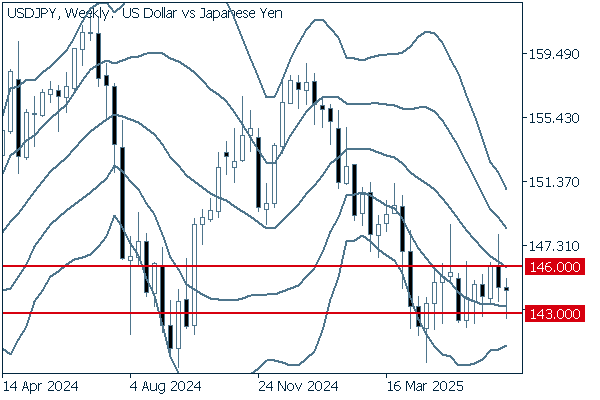

We continue with an analysis of the USDJPY weekly chart.

While the middle line is still in a downtrend, recent candlesticks do not indicate a clear direction. The pair has been forming higher lows, yet it has simultaneously failed to generate upward momentum. Currently, it is important to wait and see if the pair clearly goes up or down in order to determine its direction.

EURUSD

The persistent dollar sell-off sentiment will lift the EURUSD further. Since there are few significant economic releases in the Eurozone this week, the dollar's behavior will dominate the market.

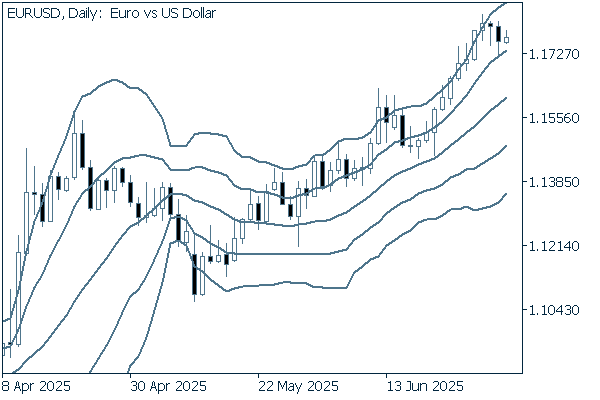

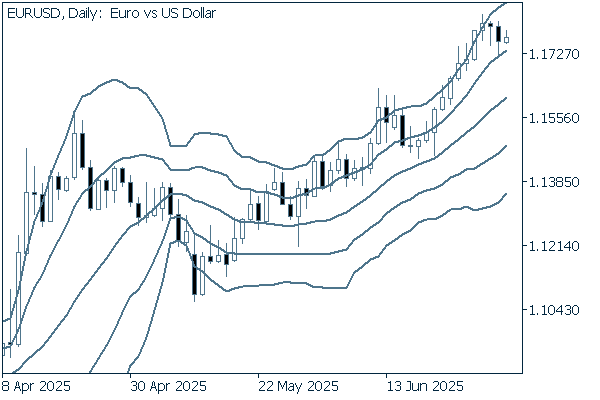

Next is an analysis of the EURUSD daily chart.

Last week, the pair moved down after surpassing +2σ. However, the upward band walk is continuing. It is safe to say that the uptrend will likely continue unless the pair breaks below the middle line.

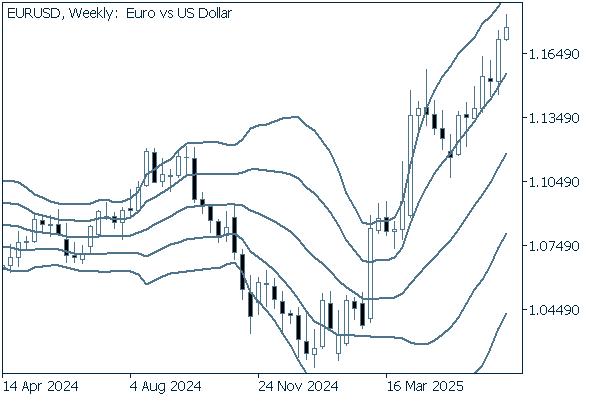

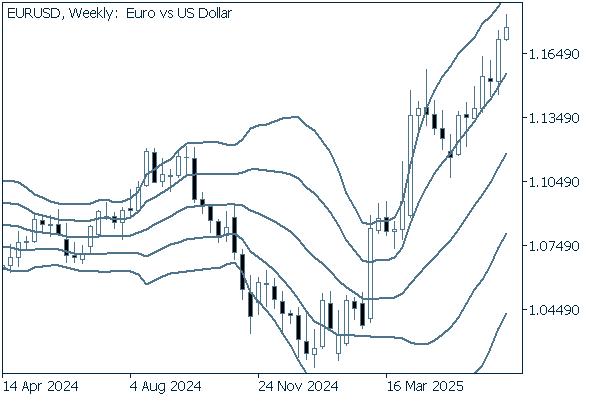

We continue with an analysis of the EURUSD weekly chart.

The weekly chart shows the continuous upward band walk as the pair is forming higher highs. Additionally, recent candlesticks have upper ticks. These factors indicate that it will be advantageous to buy on dips in a timely way.

GBPUSD

Although the GBPUSD plummeted last week, it is safe to say that the uptrend will likely continue. However, better-than-expected U.S. employment figures for June reduced speculation about a U.S. rate cut in July. Therefore, the dollar will likely strengthen against the pound this week.

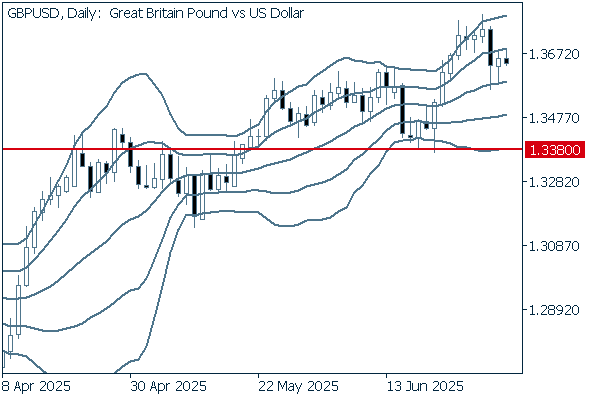

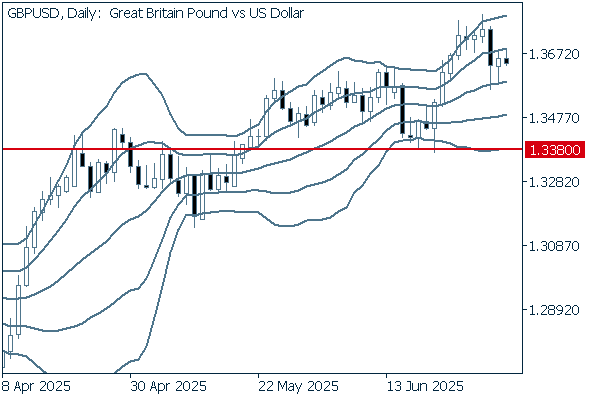

Next is an analysis of the GBPUSD daily chart.

Last week, after touching +2σ, the pair fell to the middle line and then rebounded to around +1σ. Unless the pair falls below the 1.338 level, it will be good to buy on dips.

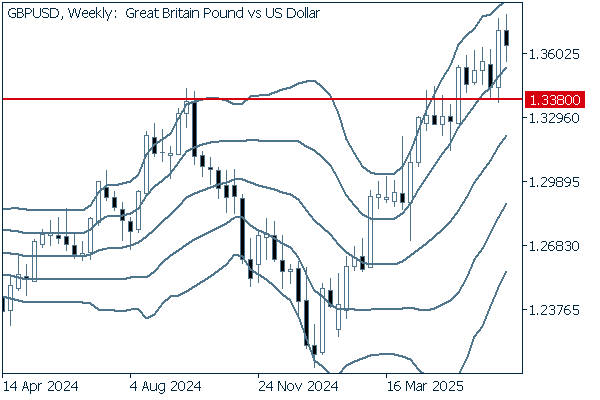

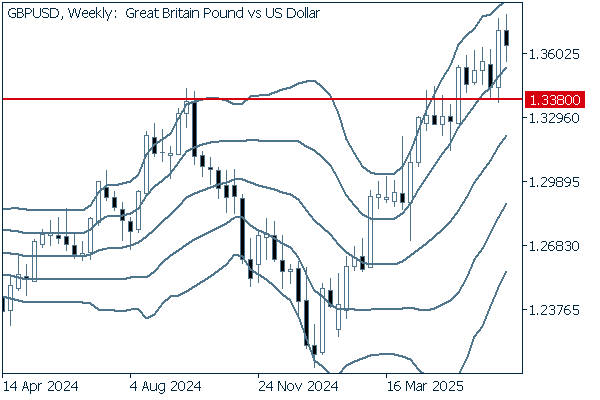

We continue with an analysis of the GBPUSD weekly chart.

Last week, selling pressure pushed the pair down. Nevertheless, the upward band walk is still continuing. Unless the pair breaks below the 1.338 level, it is safe to say that the uptrend will likely continue.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy