2025.06.30

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on June 29th, the dollar weakened against other major currencies following the ceasefire agreement between Iran and Israel, which came after an escalation of geopolitical tensions in the Middle East. Political comments regarding U.S. monetary policy and weak U.S. economic indicators also contributed to the dollar's decline.

At the start of the week, the dollar was favored as a safe-haven currency. However, the ceasefire and growing speculation about an early interest rate cut in the U.S. accelerated the sell-off of the dollar. While the USDJPY fell sharply, the EURUSD and GBPUSD rose to their yearly highs.

June 23 (Mon)

At the end of the previous week, the U.S. attacked Iranian nuclear facilities, spurring traders to take a risk-off stance and buy the dollar. The USDJPY shot up and touched the 148 yen range during the day. The EURUSD recovered to the 1.158 range, and the GBPUSD bounced back to the 1.35 range.

June 24 (Tue)

Geopolitical tensions in the Middle East eased slightly, as U.S. President Donald Trump insisted on a ceasefire agreement between Iran and Israel. The dollar weakened against the yen, pushing the USDJPY down to the 145.0 yen range. Meanwhile, the EURUSD rose to the 1.164 range, and the GBPUSD reached the 1.364 range.

June 25 (Wed)

The speech delivered by Naoki Tamura, a member of the Policy Board of the Bank of Japan (BOJ), triggered yen buying, extending the decline of the USDJPY to 144.61 yen. However, during London trading hours, traders sold off the yen, causing the pair to rebound to 145.95 yen. Nevertheless, it failed to reach the 146 yen range and instead was pushed down to close the daily trading session.

The EURUSD and GBPUSD extended their rallies, reaching the 1.166 and 1.367 ranges, respectively.

June 26 (Thu)

President Trump once again expressed his frustration with Federal Reserve Board (FRB) Chair Jerome H. Powell, saying he could replace Powell with a new chair as soon as possible. This prompted traders to speculate about an early rate cut and sell the dollar. The USDJPY fell to the 143.7 yen range.

As the dollar weakened, the EURUSD extended the uptick to touch the 1.174 range, and the GBPUSD rose to the 1.377 range during the day.

June 27 (Fri)

The market was quiet with the weekend and the end of the month approaching. The USDJPY fluctuated steadily, reaching 144.94 yen. However, it failed to surpass the 145 yen level and instead was pushed down to close the weekly trading session.

The EURUSD rose to touch the 1.175 range, while the pound slightly weakened against the dollar, pushing the GBPUSD down to the 1.372 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

June 30 (Mon)

- 06:00 U.K.: January-March Quarterly Gross Domestic Product (revised GDP)

- 23:50 Japan: Bank of Japan (BOJ) April-June Short-Term Economic Survey of Enterprises (Tankan)

July 1 (Tue)

- 09:00 Europe: June Harmonised Index of Consumer Prices (preliminary HICP)

- 09:00 Europe: June Harmonised Index of Consumer Prices (preliminary HICP core index)

- 13:30 U.S.: Speech by Federal Reserve Board (FRB) Chair Jerome H. Powell

- 14:00 U.S.: June ISM Manufacturing PMI

July 2 (Wed)

- 12:15 U.S.: June ADP National Employment Report

July 3 (Thu)

- 11:30 Europe: European Central Bank (ECB) Governing Council meeting minutes

- 12:30 U.S.: June change in nonfarm payrolls

- 12:30 U.S.: June unemployment rate

- 12:30 U.S.: June average hourly earnings

- 14:00 U.S.: June ISM Non-Manufacturing PMI (composite)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The market was relieved that Iran and Israel reached a ceasefire agreement. Nevertheless, the possibility of re-escalating tensions in the Middle East lingers. Although the dollar could be favored as a safe-haven currency in the event of a contingency, speculation about an early rate cut in the U.S. could weigh down the dollar.

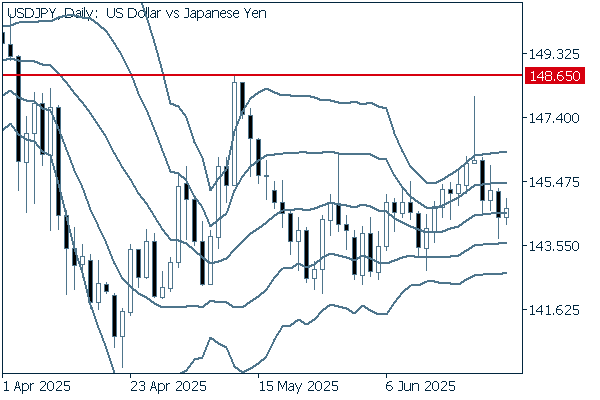

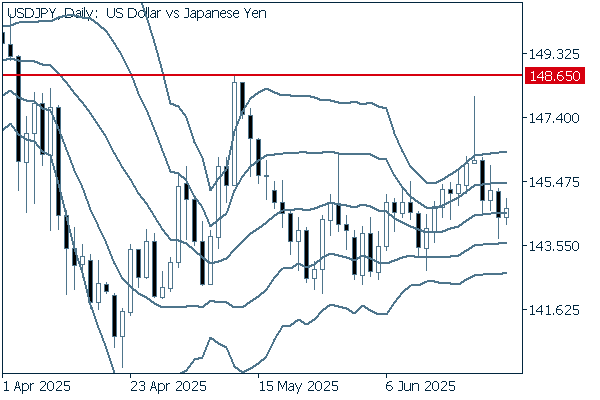

Next is an analysis of the USDJPY daily chart.

As the middle line is about to flatten, it is difficult to determine the clear direction. However, thanks to the increasing buying pressure, the pair has been forming higher lows. It is important to observe whether it can surpass the current high of 148.65 yen.

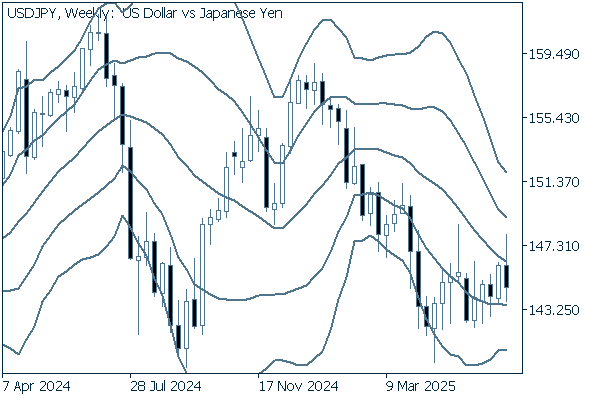

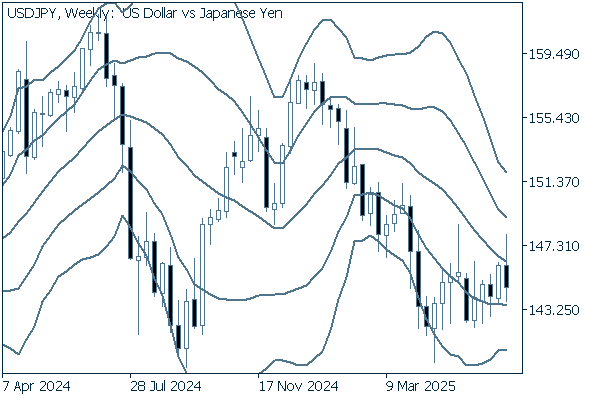

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the middle line has a downtrend. However, as with the daily chart, the pair has been forming higher lows. If a phase of higher highs follows, the pair may enter an uptrend.

EURUSD

Last week, the EURUSD hit its yearly high. Nevertheless, it is safe to say that the dollar will continue to be sold off, pushing the pair even higher. However, as the pair extends its rally, it should exercise caution about entering the correction phase and consider taking profits in a timely fashion.

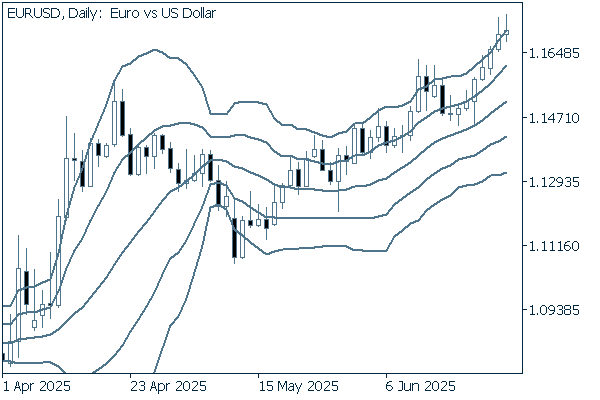

Next is an analysis of the EURUSD daily chart.

The pair has a strong uptrend and has been climbing along the continuous upward band walk without dipping below the middle line. It is safe to say that the uptrend will likely continue unless the pair falls below the middle line.

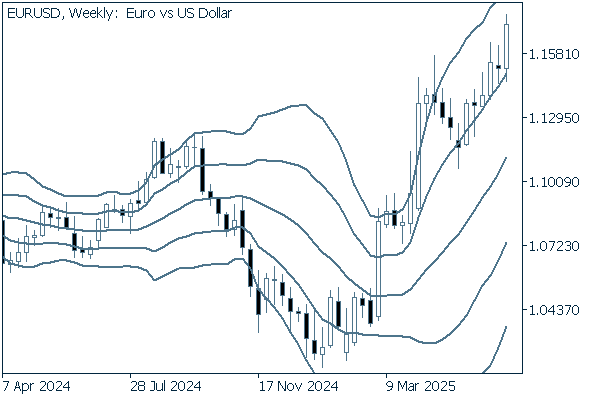

We continue with an analysis of the EURUSD weekly chart.

The pair has continued to climb since falling below -1σ. Also, the weekly chart shows the continuous upward band walk. Additionally, the pair is extending the rally and attempting to reach higher highs, as recent candlesticks have upper wicks. It would be favorable to buy on dips in a timely manner.

GBPUSD

The escalation of the Middle East situation accelerated the buy-in of the dollar as a safe-haven currency. However, in the wake of the situation change, traders chose to sell the dollar, lifting the GBPUSD. Although the market is calm for now, the dollar's behavior will continue to dominate this week.

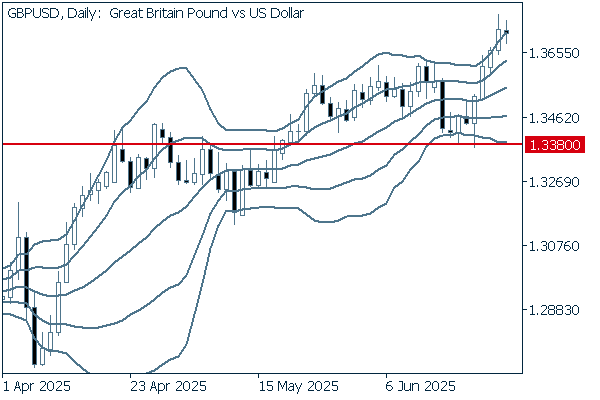

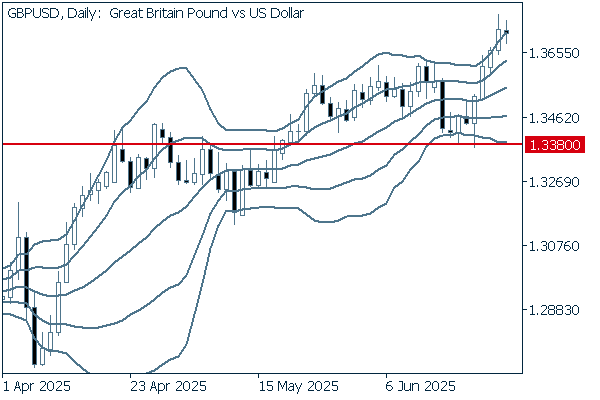

Next is an analysis of the GBPUSD daily chart.

After plummeting two weeks ago, the pair rebounded to resume the uptrend. However, after reaching +2σ and breaking the yearly high last week, increasing selling pressure pushed the pair down. For now, it is good to buy on dips.

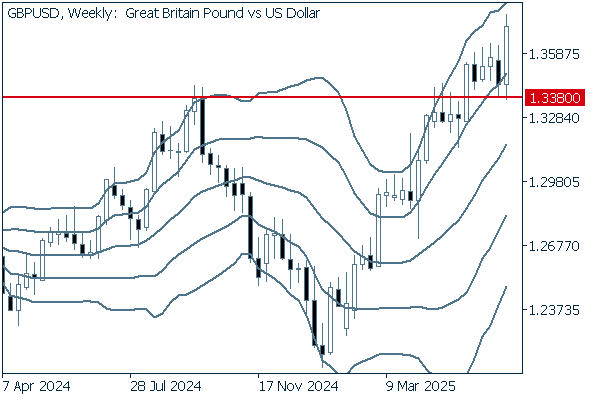

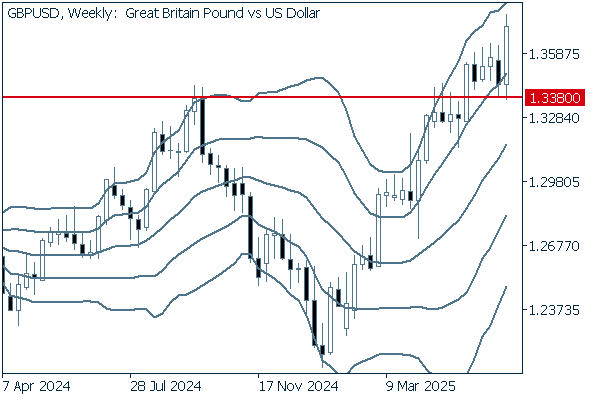

We continue with an analysis of the GBPUSD weekly chart.

The pair has been climbing since bottoming out at the end of 2024. Last week, it broke the yearly high. It is safe to say that the uptrend will likely continue unless it falls below the 1.138 level.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy