2025.03.24

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week ending March 23rd, the USDJPY lacked direction as it fluctuated widely between the 148 and 150 yen ranges throughout the week. Although the central banks in the U.S., Japan, and the U.K. made monetary policy announcements, they all remained unchanged, as expected by the market.

March 17 (Mon)

The foreign exchange market moved slightly at the beginning of the week as traders awaited monetary policy announcements from the major central banks. However, U.S. President Donald Trump's announcement that he would meet with Russian President Vladimir Putin on March 18 eased the market's concerns about the situation in the Russia-Ukraine conflict.

The USDJPY rose above the 149 yen level after hovering in the 148 yen range. The EURUSD broke above 1.09, and the GBPUSD hovered around 1.299.

March 18 (Tue)

The German parliament passed the fiscal reform bill, allowing the government to increase its borrowing. Traders bought the euro on the expectation that the bill would boost the country's economy. However, the pair's rally stalled just before the 1.10 level.

The USDJPY approached the 150 yen level but mostly fluctuated in the 149 yen range. The GBPUSD touched the 1.30 range.

March 19 (Wed)

In Turkey, Ekrem Imamoglu, the mayor of Istanbul and a political rival of Turkish President Recep Tayyip Erdogan, was detained. This news shattered confidence in the government and sent the Turkish Lira into a nosedive. As a result, dollar buying pressure increased, pushing the EURUSD and GBPUSD down to the 1.086 and 1.295 ranges, respectively.

Meanwhile, as expected, the Bank of Japan (BOJ) announced at its Monetary Policy Meeting that it would keep its policy interest rate unchanged. The predictable outcome had little impact on the market. Likewise, in the U.S., the FOMC also left its policy interest rate unchanged. However, while the Federal Reserve Board (FRB) maintained its outlook for two rate cuts in 2025, it downgraded its economic growth outlook. The latter triggered dollar selling, and the USDJPY plummeted from the 150 yen range to the 148.6 yen range.

March 20 (Thu)

The aftermath of the previous day's FOMC announcement persisted as the USDJPY fell to the lower 148 yen range. However, traders then bought back the dollar, lifting the pair back into the 148.9 yen range.

The EURUSD fell to the 1.081 range as traders took profits. Meanwhile, the GBPUSD hovered around the middle of the 1.29 range.

March 21 (Fri)

With no other news to affect the market, the USDJPY hovered in the lower 149 yen range throughout the day, although it briefly dropped to the 148.6 yen range. The EURUSD weakened and touched the 1.08 range. The GBPUSD also gradually fell and touched the 1.288 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

March 24 (Mon)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

March 25 (Tue)

- 14:00 U.S.: February new home sales

March 27 (Thu)

- 12:30 U.S.: October-December quarterly real gross domestic product (finalized GDP)

March 28 (Fri)

- 07:00 U.K.: October-December quarterly gross domestic product (revised GDP)

- 12:30 U.S.: February personal consumption expenditures (PCE deflator)

- 12:30 U.S.: February personal consumption expenditures (core PCE deflator, excluding food and energy)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

Both central banks maintained their policy interest rates. Meanwhile, the FOMC indicated the economic slowdown in the U.S. The market will watch for the February PCE data to be released on March 28th.

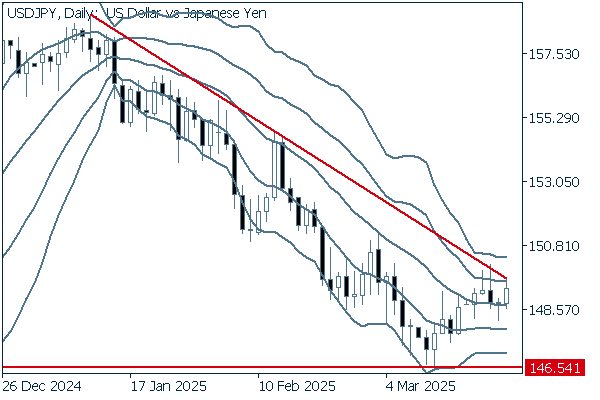

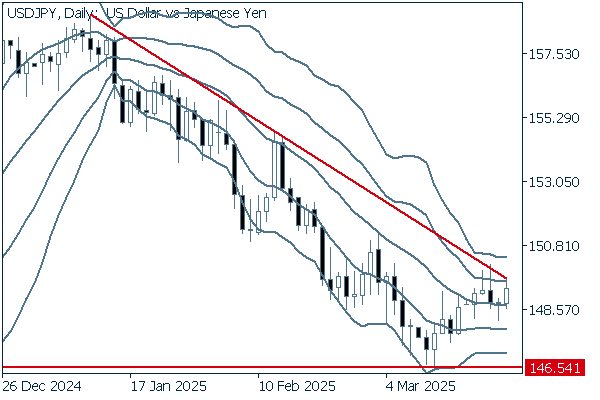

Next is an analysis of the USDJPY daily chart.

The pair has been pushed back by the extended resistance line formed by connecting the highs after January 10th. If it can break above this line, the pair will reach 150 yen and move higher. Otherwise, the downtrend may strengthen, and the pair may fall to the recent low of 145 yen.

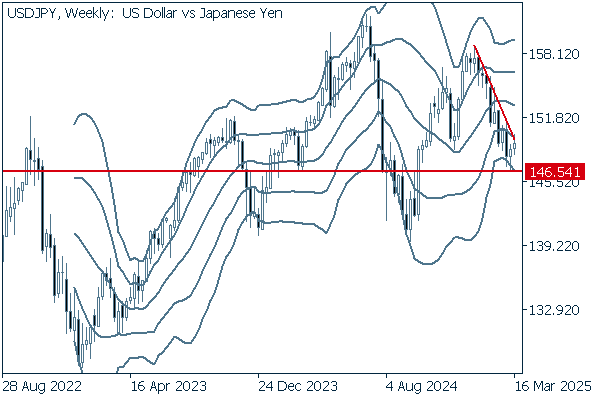

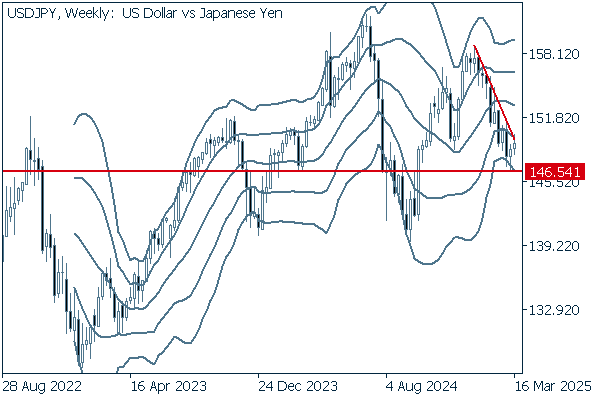

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair broke above -2σ and is approaching -1σ. Nevertheless, it is still difficult to determine the direction. In the longer term, the candlesticks are about to form an inverted N-shape. If the current rally stalls at this level and fails to push the pair higher, there is a possibility that the pair will fall to around 140 yen.

EURUSD

After reaching the 1.095 level, the EURUSD's rally stalled as traders corrected their positions and pushed the pair down. Although the European PMI will be released this week, the dollar's behavior will dominate the market.

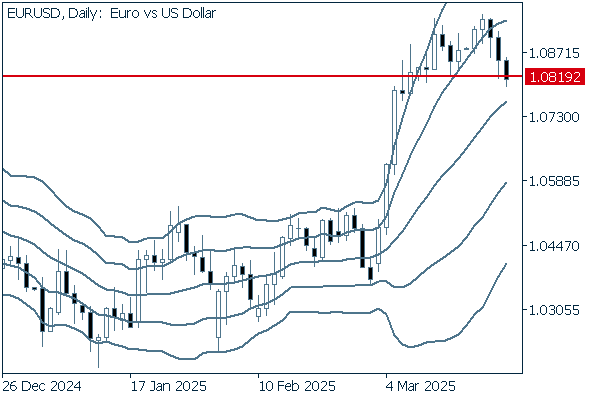

Next is an analysis of the EURUSD daily chart.

The double tops have formed on the daily chart. In addition, as indicated by the real body of last Friday's negative candlestick, the pair broke well below the neckline drawn at 1.0819. If the pair falls below the 1.08 level, the downtrend may strengthen.

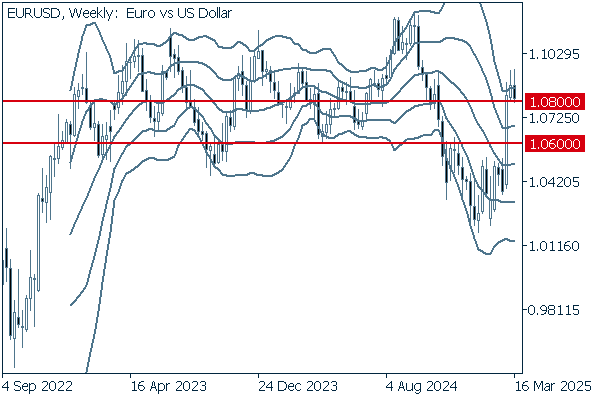

We continue with an analysis of the EURUSD weekly chart.

After reaching +2σ, the pair is facing increasing selling pressure. If it breaks below the 1.08 level, it may fall to the 1.06 level, the yearly low for 2023.

GBPUSD

Concerns over U.S. tariff policy have eased. As a result, the dollar's buying momentum has increased, while the GBPUSD's uptrend has paused. The pair has returned to its March 16 level. However, it is becoming difficult to predict the direction of the pair.

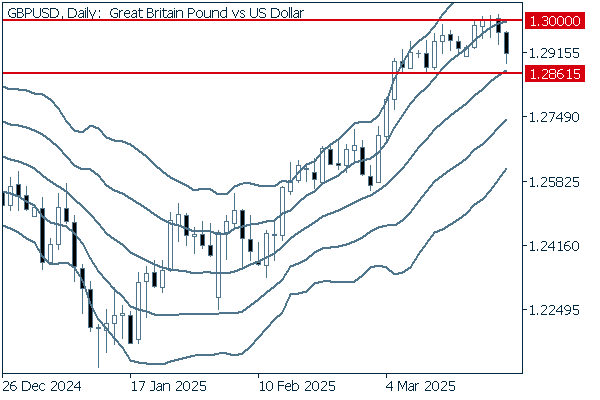

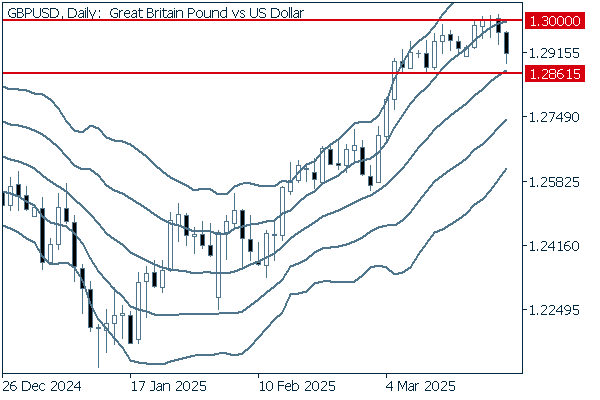

Now, we analyze the daily GBPUSD chart.

Last week, the pair was pushed back by the resistance line drawn around the 1.30 level. Also, the long lower wicks have appeared. Although the middle line remains in an uptrend, if the pair falls below the recent low of 1.2861, it may be time to consider a downtrend.

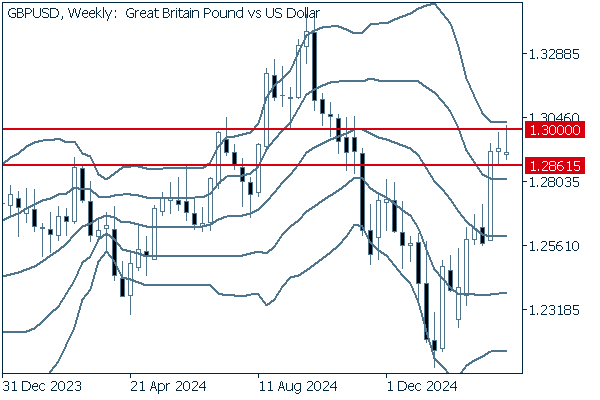

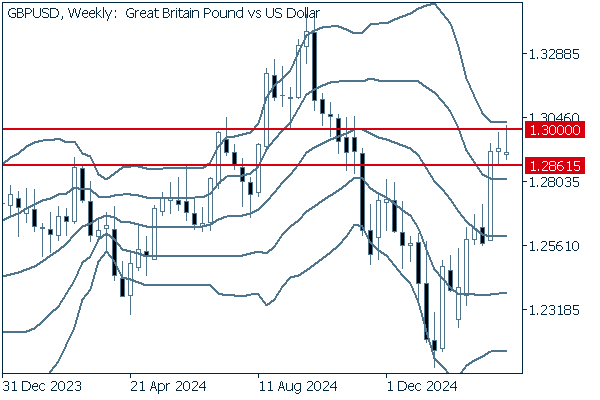

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, three consecutive positive candlesticks have appeared. However, the middle line is almost flat. Also, the long upper wicks indicate the selling pressure against the pound. Unless the pair breaks above the 1.30 level, it will be good to take the downtrend into consideration in the short term.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy