2025.03.17

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week ending March 16th, the dollar continued to weaken against the yen and the euro. However, the market lacked a clear direction as it was swayed by reports of ceasefire talks with Russia over the Russia-Ukraine conflict and U.S. President Donald Trump's tariff policy. Traders remain cautious about developments in Ukraine and Trump's tariff policy.

March 10 (Mon)

During the Tokyo session, the USDJPY fell as President Trump did not rule out the possibility of a U.S. recession. The pair then rebounded to around the opening level. However, during the New York session, the pair fell again to the 146.6 yen range. Tariff policies and government spending cuts increased uncertainty.

The EURUSD paused its rally and hovered within the 1.08 range. The GBPUSD touched the 1.294 range but then fell back to the 1.28 range.

March 11 (Tue)

As the risk-off sentiment lingered, the USDJPY fell to the 146.5 yen range for the first time since October 4th, 2024. However, the pair rebounded and briefly broke above the 148 yen level.

Meanwhile, the rise in German bond yields and reports that Ukraine would accept the U.S. ceasefire plan boosted the EURUSD above the 1.09 level. The GBPUSD reached the upper 1.29 range.

March 12 (Wed)

The USDJPY held steady. Shortly after the weaker-than-expected U.S. CPI pushed the dollar sharply down to the lower 148 yen range, the pair rebounded to the 149.1 yen range.

The EURUSD weakened slightly, breaking below the 1.09 level. The GBPUSD approached 1.30 but remained in the middle of the 1.29 range.

March 13 (Thu)

The yen was bought on expectations of further rate hikes from the Bank of Japan (BOJ). Meanwhile, growing expectations of a ceasefire in Ukraine led to dollar buying. However, uncertainty over the future of the U.S. economy led to dollar selling. The USDJPY briefly fell to the 147.4 yen range but mostly hovered around the 148.0 yen level.

The euro, which had risen sharply, continued to weaken against the dollar as the EURUSD briefly fell to the 1.082 range. The GBPUSD also weakened to the 1.292 range.

March 14 (Fri)

The momentum for a stronger yen eased as the yen selling slightly dominated the USDJPY, which reached the 149 yen range. However, the pair failed to establish a clear direction. Meanwhile, gold broke above the USD 3,000/oz level to hit a new record high.

The weakening EURUSD regained solidity and touched the 1.09 range after Germany's Christian Democrats (CDU) and Social Democrats (SPD) agreed on a major financial package with the Greens. The GBPUSD gradually fell to the lower 1.29 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

March 17 (Mon)

- 12:30 U.S.: February retails sales

- 12:30 U.S.: February retails sales (excluding automotives)

March 19 (Wed)

- TBA Japan: Bank of Japan Monetary Policy Meeting, post-meeting policy rate announcement

- 06:30 Japan: Regular press conference by Bank of Japan Governor Kazuo Ueda

- 10:00 Europe: February Harmonised Index of Consumer Prices (revised HICP)

- 10:00 Europe: February Harmonised Index of Consumer Prices (revised HICP core index)

- 18:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting, post-meeting policy rate announcement

- 18:30 U.S.: Regular press conference by Federal Reserve Chairman Jerome Powell

March 20 (Thu)

- Noon U.K.: Bank of England (BOE) policy interest rate announcement

- 23:30 Japan: February Consumer Price Index, Japan (CPI, all items)

- 23:30 Japan: February Consumer Price Index, Japan (all items less fresh food)

- 23:30 Japan: February Consumer Price Index, Japan (all items less fresh food and energy)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The BOJ holds its Monetary Policy Meeting on March 19th, while the Federal Reserve Board (FRB) holds its FOMC meeting later the same day. The BOJ is widely expected to hold off on raising interest rates at its meeting, and the FOMC is also expected to follow suit. However, the market will be watching closely to see whether the central bank is leaning towards additional rate hikes following the release of Japan's February CPI figures on March 21st (Tokyo time).

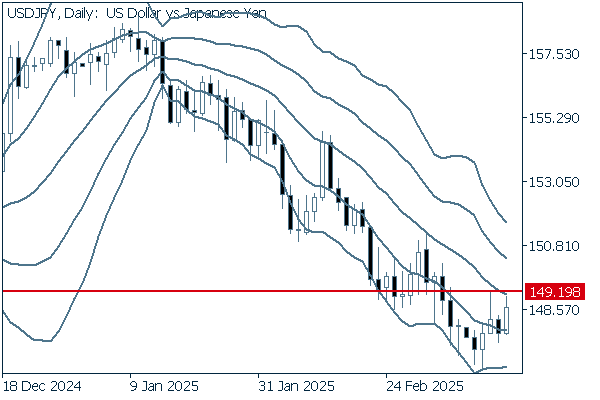

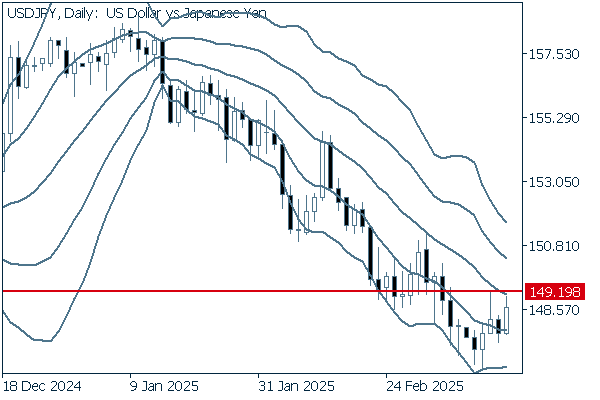

Next is an analysis of the USDJPY daily chart.

After hitting -2σ, the pair has turned upward and is approaching the middle line. However, the resistance line lies at around 149.2 yen. If the pair succeeds in breaking above this line, it will likely be able to target 150 yen.

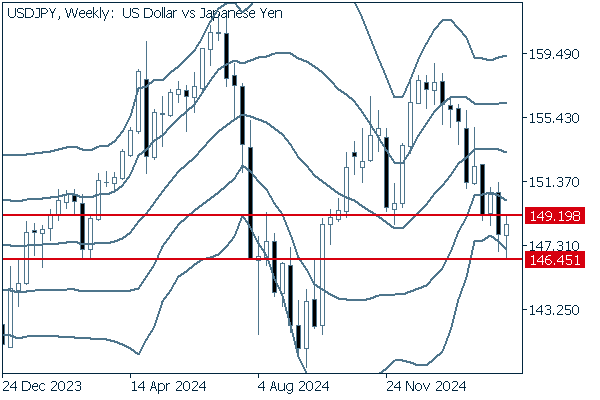

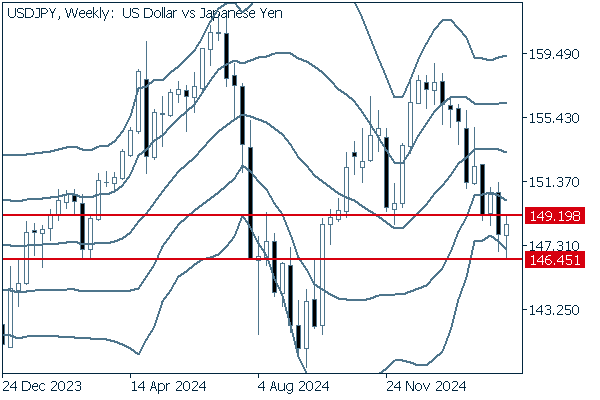

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair continues to fall as positive and negative candlesticks alternate. The dollar buying dominated last week. However, as the middle line is almost flat, it is difficult to predict the direction. It is better to follow the behavior of the pair to see if it breaks above the recent high or below the recent low.

EURUSD

If U.S. economic indicators show weakness, the dollar will be sold. Conversely, if the Ukraine ceasefire negotiations make positive progress, the euro may be bought. However, uncertainty looms over the tariff conflict between the U.S. and Europe. This week, the market will try to determine the European Central Bank's (ECB) stance on additional interest rate cuts and the FRB's monetary policy.

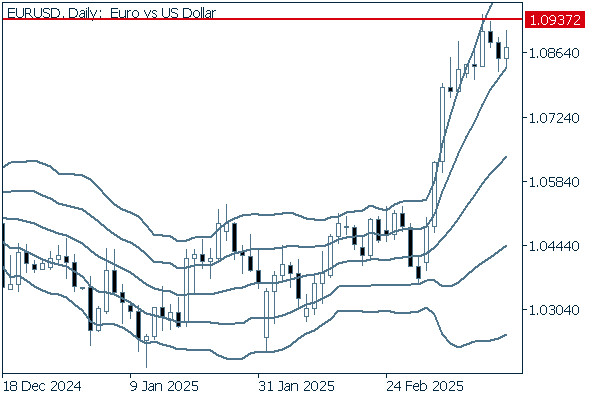

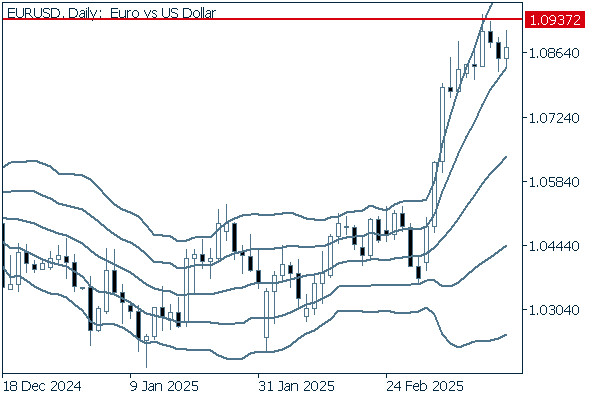

Next is an analysis of the EURUSD daily chart.

Last week, the pair momentarily exceeded 1.093, the high set in October 2024. If the pair breaks above this line again, it is likely to break above the 1.10 level. In this case, it would be better to assume that the uptrend will continue.

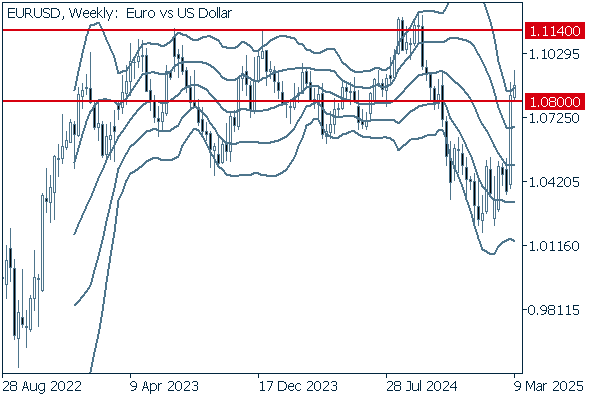

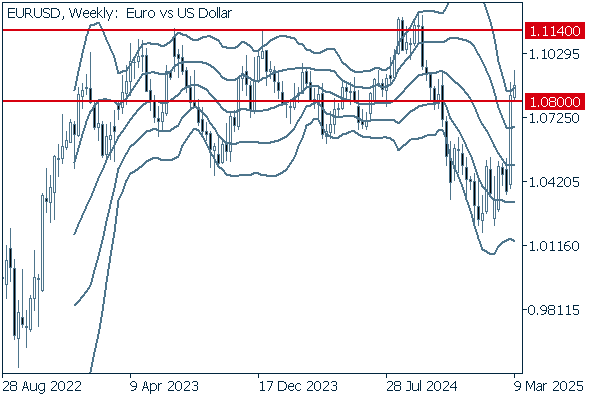

We continue with an analysis of the EURUSD weekly chart.

From a longer-term perspective, even if the pair continues to rise, the rally will likely be halted at the resistance line around the 1.114 level. However, following the rally of the past two weeks, selling pressure is mounting. It is possible that the pair will start to fall from now on. The bottom line is that if the pair breaks below the 1.08 level, it is better to switch to the downtrend. Otherwise, the uptrend is likely to continue.

GBPUSD

The BOE will announce its policy rate on March 20th, which will indicate the direction of future rate cuts. The dollar will be affected by the tariff conflict and the Russia-Ukraine conflict. The dollar is likely to dominate the GBPUSD this week.

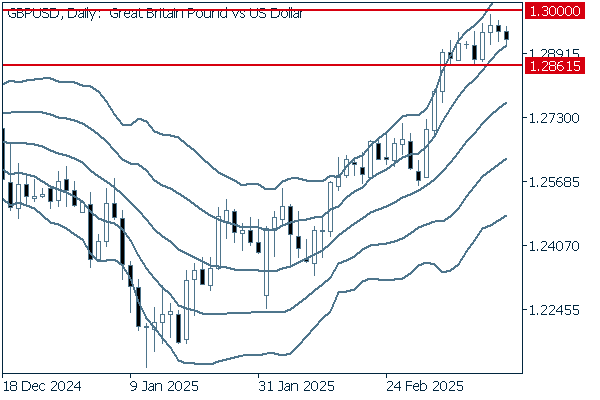

Now, we analyze the daily GBPUSD chart.

Although the middle line shows an upward trend, the pair has repeatedly been pushed back beneath 1.30. In the past, the pair has started to rise after hovering neutrally. However, if the pair breaks below the recent low, it would be better to abandon the uptrend assumption.

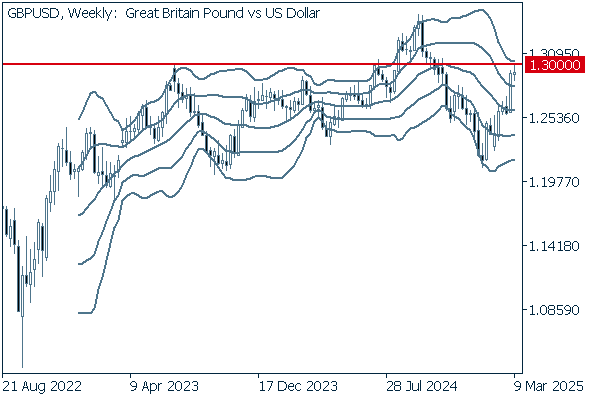

We continue with an analysis of the GBPUSD weekly chart.

From a long-term perspective, the pair had been pushed back beneath 1.30. In 2024, it broke below this support line, strengthening the downtrend. If the pair breaks above this level, it is likely to continue to advance higher.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy