2025.02.10

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on February 9th, the yen strengthened against the dollar as President Donald Trump's tariff policy rattled the market and speculation of another interest rate hike by the Bank of Japan (BOJ) increased. As a result, the USDJPY briefly dipped into the 150 yen range.

The weak U.S. economic data also helped the yen strengthen against the dollar. Meanwhile, the pound selling accelerated after the Monetary Policy Committee (MPC) decided to cut interest rates by 25 basis points (bp).

February 3 (Mon)

The USDJPY started the week trading at the 154.70 yen range. Following President Trump's decision to impose a 25% tariff on imports from Mexico and Canada and an additional 10% tariff on imports from China, traders took a risk-averse stance to buy the dollar and the yen.

The USDJPY rose to the 155.80 yen range before falling to around 154.00 yen on reports that the tariffs had been delayed.

Meanwhile, the EURUSD started the week trading much lower and then rose to the middle of the 1.03 range. Likewise, the GBPUSD gapped up and climbed to the middle of the 1.24 range.

February 4 (Tue)

As the Chinese government announced countermeasures against additional tariffs by the U.S., the market raised fears of a trade war. In addition, weak U.S. economic data accelerated the selling of the dollar. The USDJPY fell to the lower 154 yen range.

Meanwhile, the EURUSD reached the 1.038 range, and the GBPUSD rose to the upper 1.24 range.

February 5 (Wed)

In addition to the continued selling of the dollar, the yen buying accelerated as Japanese wage and income growth exceeded expectations, reinforcing the market's expectations for more BOJ rate hikes. Policy Board member Naoki Tamura's hawkish stance also boosted the yen. As a result, the USDJPY fell to the lower 152 yen range.

The EURUSD broke above 1.04, and the GBPUSD rose to the middle of the 1.25 range. However, both later fell back.

February 6 (Thu)

As expected, the MPC cut rates by 25 bp, lowering the Bank Rate to 4.50%. At its meeting, two Committee members, Catherine L. Mann and Swati Dhingra, voted against the original rate cut proposition and preferred the 50 basis point rate cut instead. Consequently, the pound sell-off accelerated, and the GBPUSD fell to the middle of the 1.23 range.

Meanwhile, the yen continued to dominate the USDJPY, which fell to the lower 151 yen range. The uptrend in the EURUSD faded as the pair fell to the upper 1.03 range.

February 7 (Fri)

The yen strengthened against the dollar as the USDJPY fell to around 150.96 yen on growing speculation that the BOJ will make an additional interest rate hike. Solid figures for the unemployment rate and average hourly earnings in the U.S. employment report helped the Federal Reserve Board (FRB) take a cautious stance on interest rate cuts.

The USDJPY closed the weekly trading session at the 151.30 yen range. The EURUSD climbed back to the 1.04 range but then fell back to the 1.030 range. The GBPUSD rebounded and touched just below 1.25.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

February 12 (Wed)

- 13:30 U.S.: January Consumer Price Index (CPI)

- 13:30 U.S.: January Consumer Price Index (CPI Core Index)

- 15:00 U.S.: Semiannual Monetary Policy Report to the Congress by Federal Reserve Board Chairman Jerome H. Powell

February 13 (Thu)

- 07:00 U.K.: December Monthly Gross Domestic Product (GDP)

- 07:00 U.K.: October-December Quarterly Gross Domestic Product (preliminary GDP)

February 14 (Fri)

- 13:30 U.S.: January retail sales

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The market is focusing on two major events on February 12th, the release of the U.S. CPI for January and the congressional testimony of Federal Reserve Chair Jerome H. Powell, in order to forecast the pace of future interest rate cuts. Meanwhile, growing speculation of an interest rate hike by the BOJ may help the pair break below the 150 yen level.

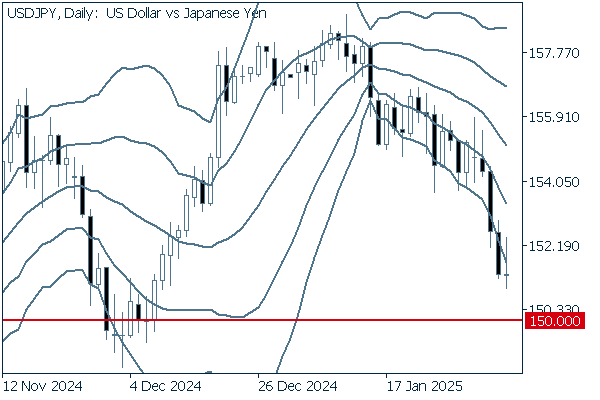

Next is an analysis of the USDJPY daily chart.

The band walk has maintained its downtrend. It is safe to assume that the downtrend will continue as the pair may fall as low as 150 yen.

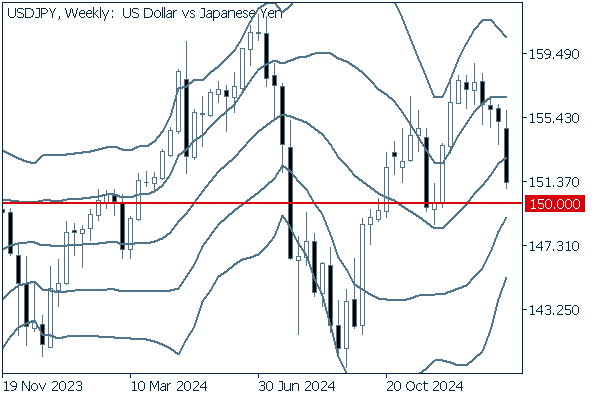

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, four consecutive negative candlesticks have appeared. Also, the pair crossed below the middle line last week. Although it seems likely that the pair will continue to fall, it is also hard to ignore the possibility of a rebound, as has been the case in the past. For now, it is best to maintain a downward outlook until the pair reaches 150 yen.

EURUSD

As traders bought back the euro, the downside risk seems to have faded. However, there is persistent speculation in the market that the European Central Bank will make another interest rate cut. For the time being, the market is focusing on whether the pair can rally back to the 1.05 range.

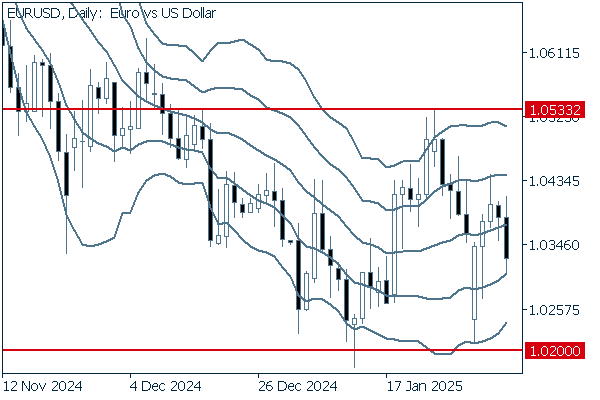

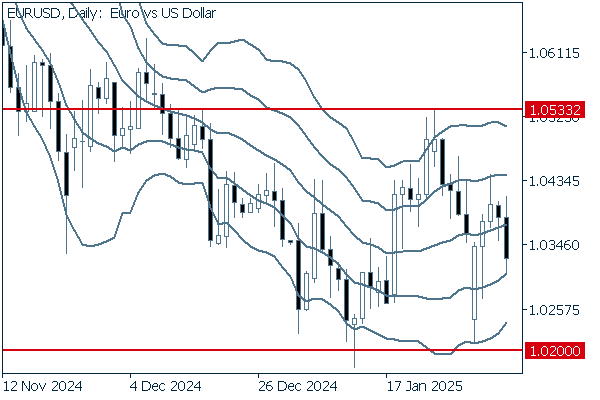

Next is an analysis of the EURUSD daily chart.

After hitting the bottom at around 1.02, the pair entered a box-shaped range whose ceiling lies around 1.053. On the other hand, the middle line has a gentle upward angle. If the pair breaks above 1.05 again, it may be time to switch the outlook to an uptrend.

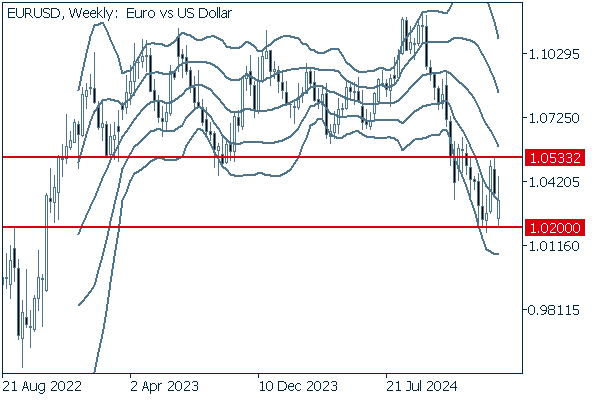

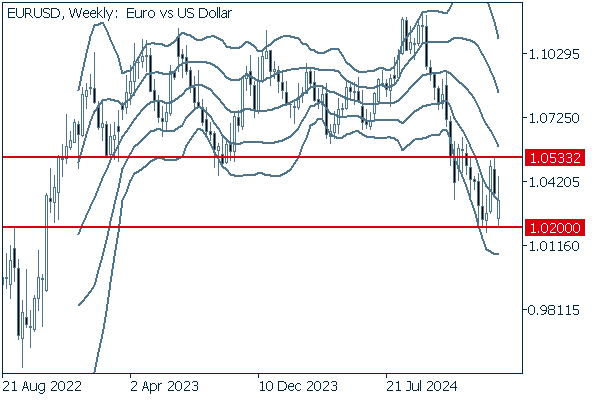

We continue with an analysis of the EURUSD weekly chart.

Although it has not yet reached the middle line, the pair hit the bottom at around 1.02 and is now hovering around -1σ. If it breaks above 1.05, the pair is likely to enter the box-shaped range formed by the fluctuation since 2022.

GBPUSD

At last week's MPC meeting, Mann, who has been seen as a leading hawk, argued for a larger rate cut, while BOE Governor Andrew Bailey tried to calm the excessive expectations for a rate cut. The market is now strongly expecting two or three additional rate cuts within this year.

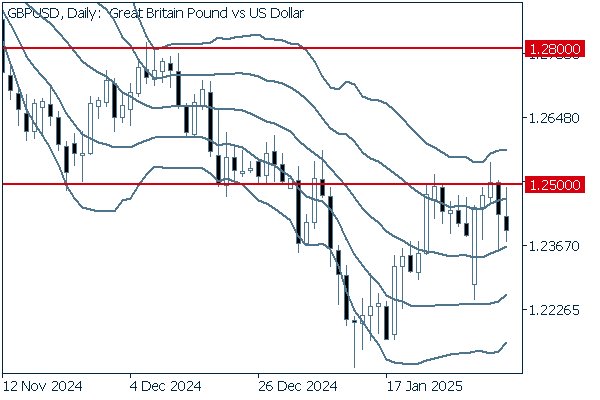

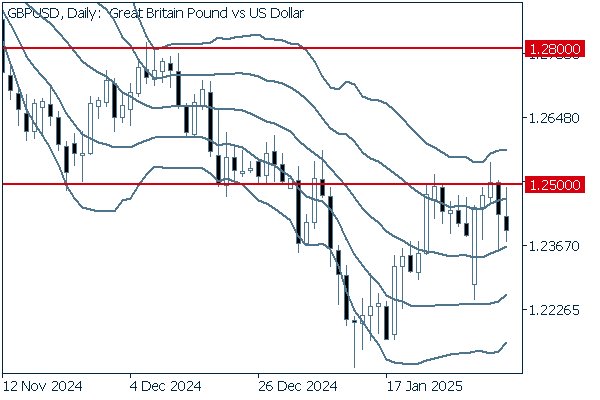

Now, we analyze the daily GBPUSD chart.

The middle line turned up while the pair is hovering around +1σ. If it is confirmed on the daily chart that the real body breaks above 1.25, the pair is likely to target as high as 1.28.

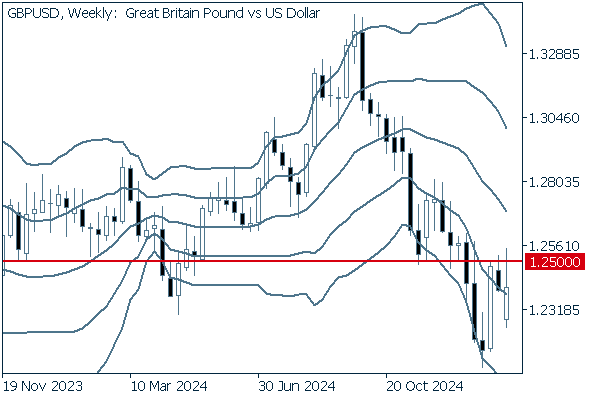

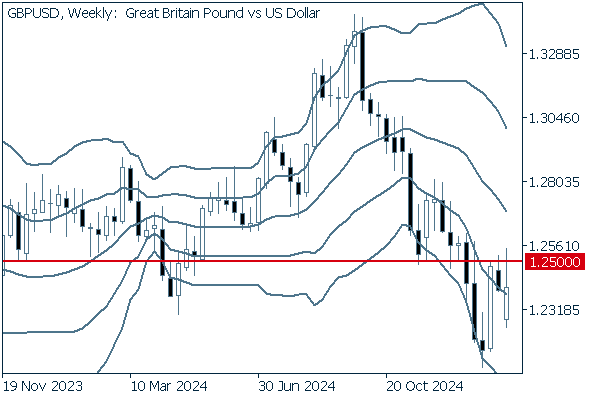

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, the pair has broken above the previous week's high for four consecutive weeks. However, the middle line remains downward, and the pair is fluctuating around -1σ. If the pair breaks above the 1.25 level, it may be high time to switch the outlook to an uptrend.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy