2025.02.03

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

A mixture of a strong yen and a strong dollar characterized the foreign exchange market for the week that ended on February 2nd. Traders also took a risk-averse stance as the market was concerned about President Donald Trump's comments on tariff policy, as well as news of a new AI model developed by a Chinese startup.

The USDJPY saw a wide and erratic fluctuation between the 156 and 153 yen ranges. The market closely followed the outcome of the Federal Open Market Committee (FOMC) and European Central Bank (ECB) monetary policy announcements. However, they had little impact on the market.

January 27(Mon)

Traders took a risk-averse stance after President Trump announced that he would impose a 25% tariff on imports from Colombia. The yen also strengthened against the dollar on news of a new AI model developed by a Chinese startup. The USDJPY fell sharply from the lower 156 yen range to the upper 153 yen range during the day's session.

The EURUSD hovered around the 1.050 level. The GBPUSD moved steadily around the 1.250 level.

January 28(Tue)

The USDJPY attempted to make up for the previous day's plunge, helped by widespread speculation that the Bank of Japan (BOJ) will hold off on raising interest rates due to concerns over the Trump tariff policy. However, the rally stalled at around the 155.90 yen level and failed to reach 156 yen.

The strengthening dollar pushed the EURUSD down to the lower 1.04 range, and the GBPUSD fell to the lower 1.24 range.

January 29(Wed)

The USDJPY waited for the outcome of the FOMC meeting and traded in the 155 yen range, although it touched 154.90 yen.

The Fed decided to keep interest rates on hold. The predictable outcome did not affect market volatility, as the EURUSD briefly fell below the 1.04 level, and the GBPUSD broke below 1.24.

January 30(Thu)

Traders adjusted their positions to buy the yen ahead of a speech by BOJ Deputy Governor Ryozo Himino. Subsequently, the USDJPY fell to the 153.80 yen level.

Meanwhile, the European Central Bank (ECB) decided to cut interest rates by 0.25%. The EURUSD temporarily rebounded to 1.046 but then fell below 1.04. The GBPUSD hovered within the 1.24 range.

January 31(Fri)

President Trump announced that, effective February 1st, the U.S. would impose a 25% tariff on imports from Mexico and Canada. He also mentioned a plan to impose tariffs on imports from China and the BRICS countries, which prompted traders to become risk-averse.

The USDJPY rebounded after touching 153.90 yen to close the weekly session in the lower 155 yen range. The EURUSD briefly dropped to 1.035, and the GBPUSD also fell to 1.238.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

February 3(Mon)

- 10:00 Europe: January Harmonised Index of Consumer Prices (preliminary HICP)

- 15:00 U.S.: January ISM Manufacturing PMI

February 5(Wed)

- 13:15 U.S.: January ADP National Employment Report

- 15:00 U.S.: November ISM Non-Manufacturing PMI (composite)

February 6(Thu)

- 12:00 U.K.: Bank of England (BOE) policy interest rate announcement

February 7(Fri)

- 13:30 U.S.: January change in nonfarm payrolls

- 13:30 U.S.: January unemployment rate

- 13:30 U.S.: November average hourly earnings

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

The Fed decided not to make another interest rate cut on January 29th. However, if the January U.S. employment figures, which will be released on February 7th, show strength in the labor market, the dollar is expected to be bought back. In addition, President Trump's comments seem to affect the market.

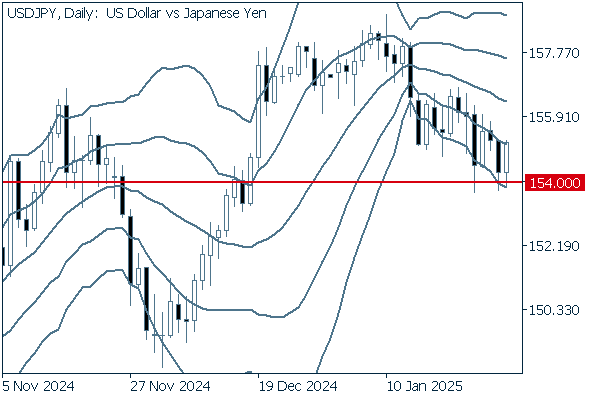

Next is an analysis of the USDJPY daily chart.

Last week, the pair rebounded after breaking below 154 yen. Meanwhile, its upward momentum is fading. A break below -2σ may accelerate the downward trend.

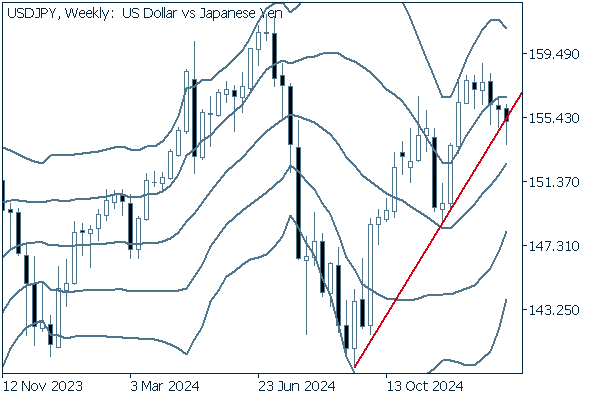

We continue with an analysis of the USDJPY weekly chart.

While the middle line is maintaining its upward trend, the pair is about to break below the extended trend line formed by connecting the two previous trend reversal points. It may be high time to start expecting a downward trend.

EURUSD

In the Eurozone, there are no major economic releases this week other than the HICP on February 3rd. It is necessary to watch the behavior of the dollar as important U.S. economic releases await.

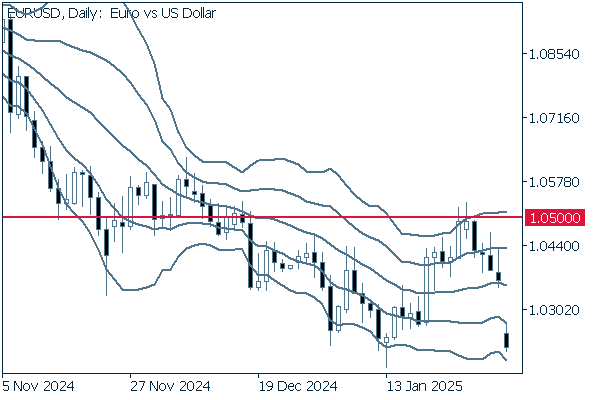

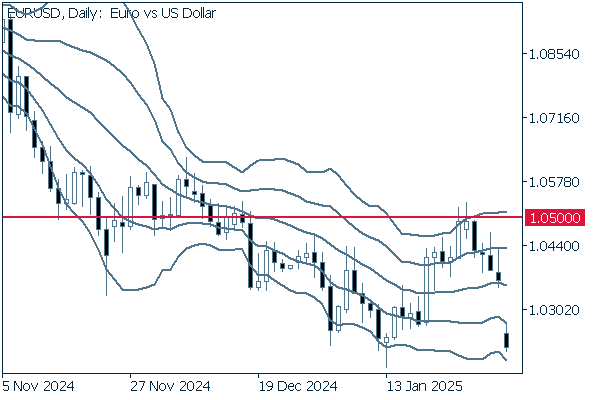

Next is an analysis of the EURUSD daily chart.

On the daily chart, the pair has fallen since touching +2σ and is about to break clearly below the middle line. Nevertheless, it is still difficult to say that it now has a clear direction. If the pair can rebound to the 1.05 level, it can be said that the pair is forming a box-shaped range. On the other hand, if it breaks clearly below the middle line, the downtrend will gain momentum.

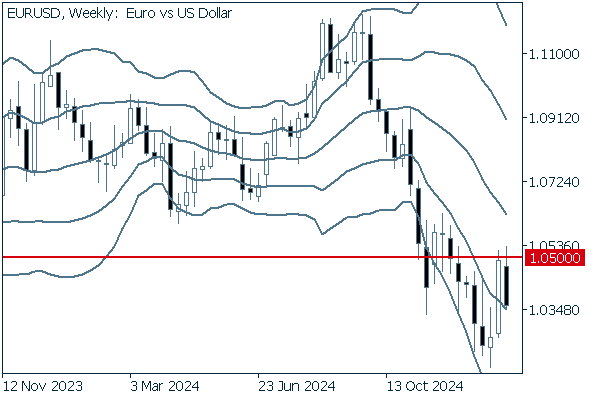

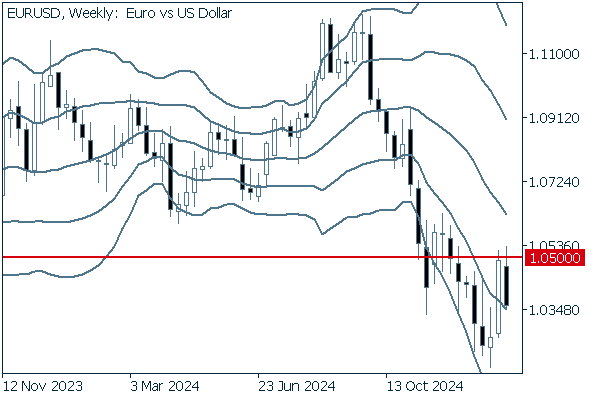

We continue with an analysis of the EURUSD weekly chart.

The weekly chart shows a negative candlestick with an upper whisker after two consecutive positive candlesticks. If the pair rebounds but fails to cross above the 1.05 level, this small and short-lived rally could trigger a sharp decline.

GBPUSD

The BOE is expected to announce a 0.25% rate cut on February 6th. If the dollar holds steady, downward pressure could intensify.

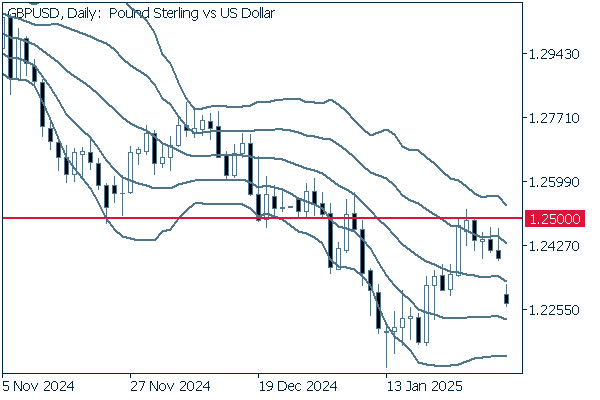

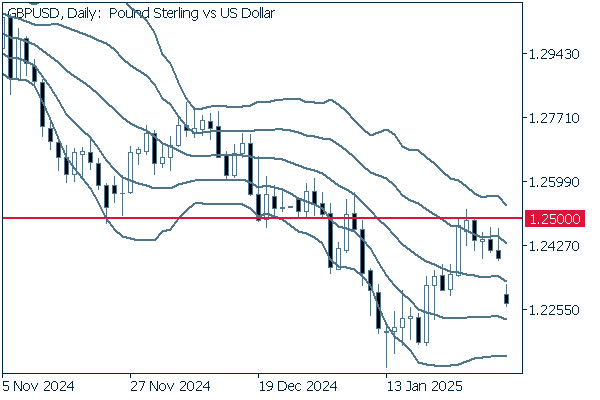

Now, we analyze the daily GBPUSD chart.

Last week, the pair was pushed back by +1σ and is now approaching the middle line. Although it is difficult to determine the direction, if the pair fails to break above 1.25, the current rally will likely be offset, and the downtrend will strengthen.

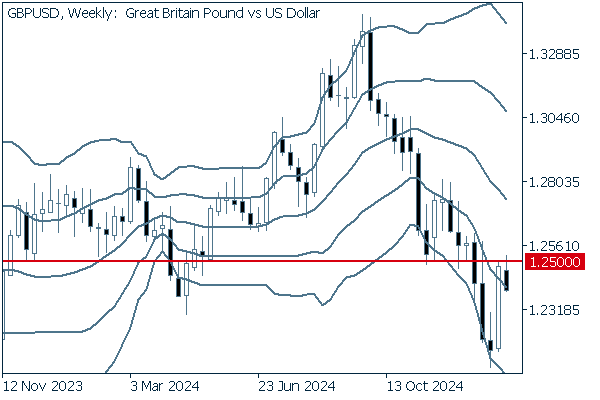

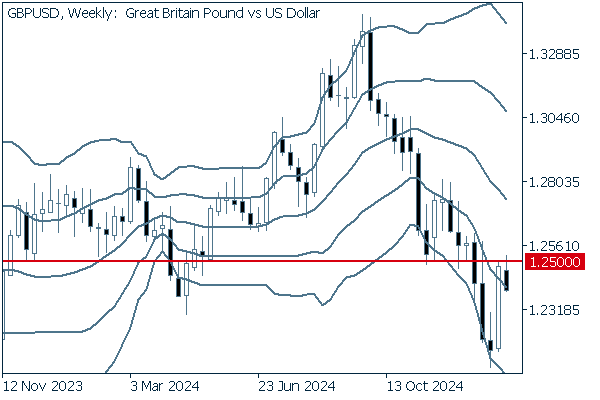

We continue with an analysis of the GBPUSD weekly chart.

After skyrocketing two weeks ago, the pair formed a negative candlestick with an upper whisker last week. If it breaks above 1.25, the pair could extend its uptrend. However, the downward middle line indicates that the downtrend is likely to continue.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy