2025.01.20

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on January 18th, the USDJPY broke above the 158 yen level at the beginning of the week following the release of the U.S. employment figures on January 10th.

However, later in the week, the yen strengthened against the dollar due to increased expectations for a Bank of Japan (BOJ) rate hike and weaker-than-expected U.S. economic data. As a result, the pair temporarily traded below the 155 yen level on January 17th.

Meanwhile, the EURUSD moved steadily. The GBPUSD moved in a limited range while reacting to the release of the U.K.'s monthly GDP and Consumer Price Index (CPI).

January 13 (Mon)

The USDJPY climbed to just under 158 yen at the start of the week following the release of the strong U.S. December employment figures on January 10th. The higher-than-expected Non-Farm Payrolls report lowered expectations for further interest rate cuts by the Federal Reserve Board (FRB).

However, traders took a risk-off stance as the U.S. stock market plunged. The USDJPY also plunged, touching 156.90 yen. However, the market maintained relatively calm, with no major U.S. economic releases on the day.

January 14 (Tue)

The USDJPY fluctuated slightly in the early hours of the Tokyo session. However, BOJ Deputy Governor Ryozo Himino's comments spurred traders to buy the Yen. He said that the BOJ would discuss raising interest rates at its monetary policy meeting next week.

The USDJPY fell to the lower 157 yen range. However, as he added that it would be important to examine the timing of a rate hike thoroughly, the cautious view on further rate hikes spread. As a result, the pair rebounded to the 158 yen range and closed the day in the upper 157 yen range.

Meanwhile, the EURUSD temporarily rose to the 1.03 level despite a lack of direction, and the GBPUSD hovered around 1.22.

January 15 (Wed)

The USDJPY was volatile throughout the day. First, BOJ Governor Kazuo Ueda commented that the central bank would discuss raising interest rates at its Monetary Policy Meeting in the coming week. His comment helped strengthen the yen against the dollar, as more market participants took it as a sign that the BOJ would accelerate monetary policy normalization. The USDJPY fell to the middle of the 156 yen range during the afternoon Tokyo session.

In addition, the December U.S. CPI report showed that the core CPI increased by 3.2% year on year. The milder-than-expected figure confirmed a slowdown in U.S. inflation and reinforced the selling of the dollar. The USDJPY briefly broke below the 156-yen level.

The weakening dollar drove up the EURUSD to the 1.035 range, while the steady GBPUSD briefly rose to 1.23.

January 16 (Thu)

Federal Reserve Governor Christopher Waller, considered one of the hawkish governors, indicated that the FRB might make an additional rate cut in the first half of 2025. His comment helped the USDJPY fall further, reaching the lower 155 yen range.

Also, the U.S. retail sales for December registered an increase of 0.4% from the previous month (forecast: +0.6%). The weaker-than-expected figure increased concerns about a slowdown in the U.S. economy and pushed the dollar lower.

Meanwhile, the EURUSD remained steady, hovering around the 1.029 level. The U.K.'s November GDP rose by 0.1% from the previous month, slightly missing forecasts for a 0.2% increase. However, the impact on the GBPUSD was limited, as the pair remained around the 1.22 level.

January 17 (Fri)

As the impact of Governor Waller's comments and the weak U.S. retail sales figures persisted, the USDJPY fell to 154.90 yen during the Tokyo morning session. However, the resumed dollar buying later in the day helped the pair rebound to the lower 156 yen range.

The EURUSD touched 1.033 but fluctuated around the 1.030 level throughout the day. The GBPUSD hovered tightly around 1.22.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

January 23 (Thu)

- 23:30 Japan: December Consumer Price Index (CPI)

January 24 (Fri)

- TBA Japan: Bank of Japan Monetary Policy Meeting, post-meeting policy rate announcement

- TBA Japan: Bank of Japan Outlook Report

- 06:30 Japan: Regular press conference by Bank of Japan Governor Kazuo Ueda

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

Donald Trump is sworn in as President of the United States on January 20. It is reported that, unless there is any confusion in the wake of the inauguration, the BOJ will most likely raise interest rates at its Monetary Policy Meeting on January 24th, which the market seems to have already factored in.

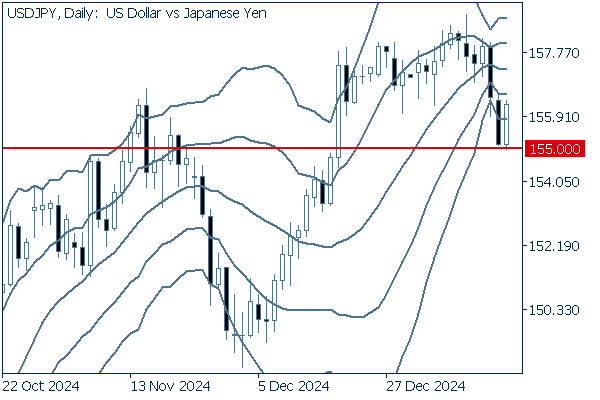

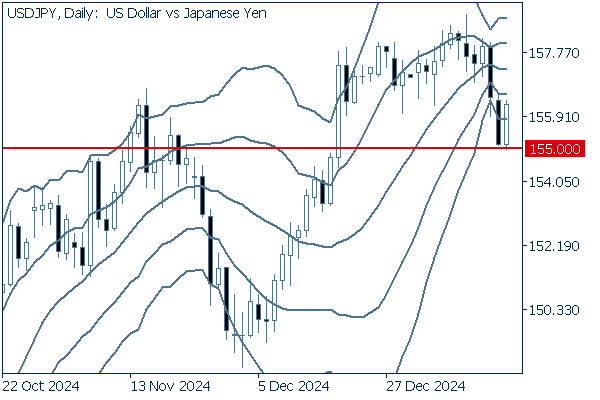

Next is an analysis of the USDJPY daily chart.

The pair plunged from the 158 yen range and even broke below -2σ. Indeed, it closed the trading session of January 17th with a positive candlestick. However, if it continues to fall even after breaking below the 155 yen level, it could fall as low as 150 yen.

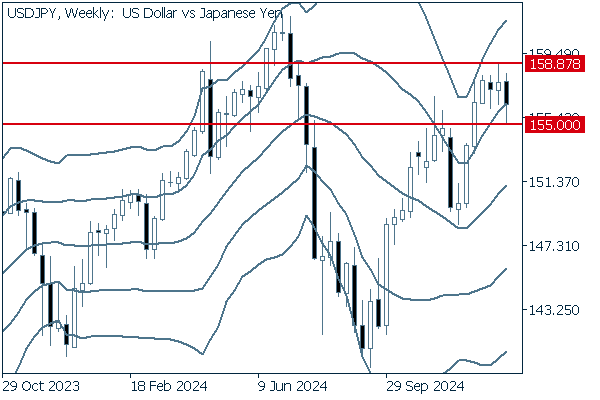

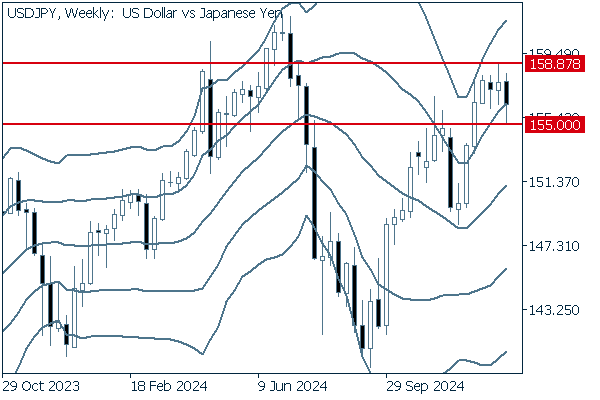

We continue with an analysis of the USDJPY weekly chart.

The weekly chart shows that the pair had fluctuated within a small box-shaped range since the first week of January. However, it temporarily broke below the range last week. Nevertheless, it is still possible to say that the uptrend will continue from the weekly chart's perspective, as the pair has been fluctuating around the upward +1σ.

EURUSD

Last week, the EURUSD rebounded to around 1.033. However, it has since fallen back to the 1.02 range. The weak upward momentum is keeping the pair in a gradual decline. In addition, the European Central Bank is expected to announce a 0.25% interest rate cut at its Governing Council on January 30th.

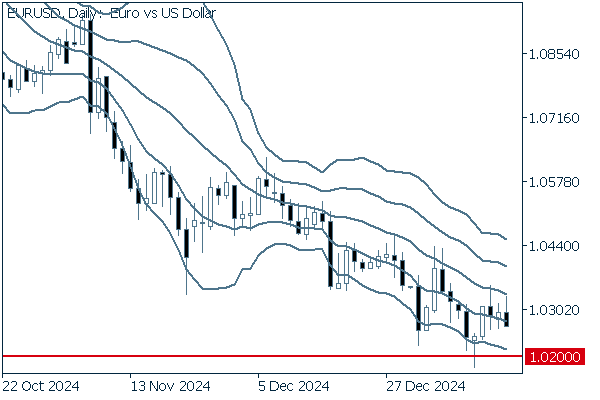

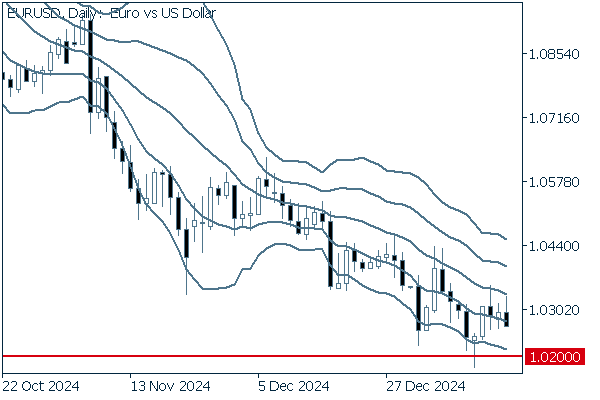

Next is an analysis of the EURUSD daily chart.

The pair rebounded to the 1.03 range after breaking below the 1.02 level. However, the downward middle line indicates that the downtrend will continue. It is better to expect that the pair may break below 1.02.

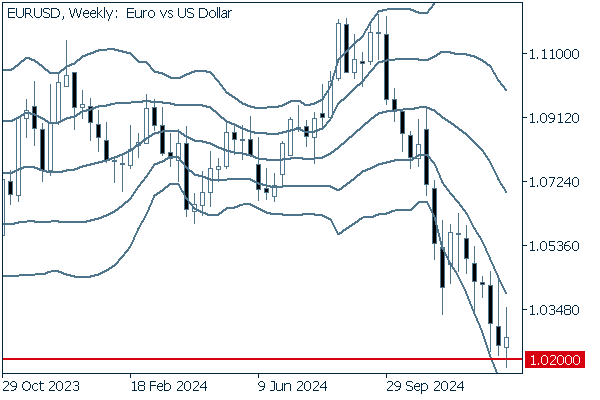

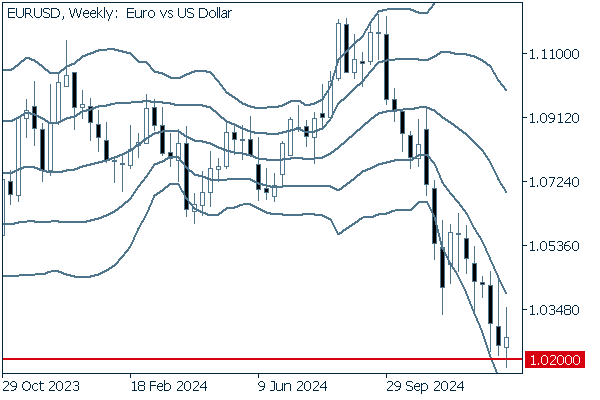

We continue with an analysis of the EURUSD weekly chart.

The last week's session concluded with a positive candlestick on the weekly chart. However, the pair has broken below the previous week's low for three consecutive weeks. It has also formed a downward band, as the pair has been hovering between the declining -1σ and -2σ. It is safe to say that the downtrend will continue.

GBPUSD

The weak U.K. retail sales figures released on January 17th reinforce the possibility that the Bank of England will decide to make an interest rate cut in February. The GBPUSD is likely to continue to fall to as low as the psychologically important 1.20 level.

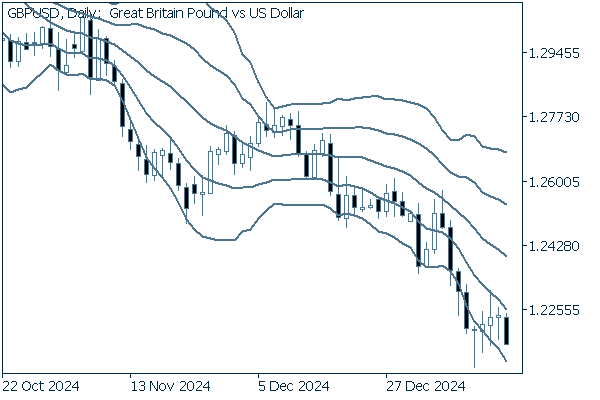

Now, we analyze the daily GBPUSD chart.

Although the pair broke above -2σ, it failed to break above -1σ and instead fell back. It is safe to say that the downtrend is strengthening and will continue for the time being.

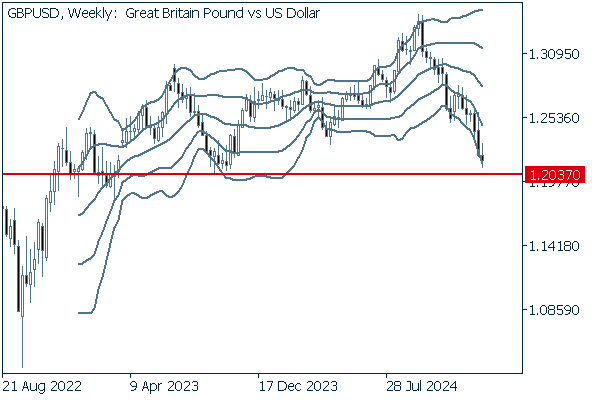

We continue with an analysis of the GBPUSD weekly chart.

The weekly chart shows that the pair has formed three consecutive negative candlesticks as the downtrend continues. It will test 1.2037, the low set in October 2023.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy