2024.10.14

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the most recent trading week ended October 13, the dollar continued its bull run on the foreign exchange market partly due to expectations on U.S. monetary policy, despite more smoke than fire in the government's policies. However, though the strength of U.S. jobs data and the Consumer Price Index release was notable from the previous week, the increase in the number of new unemployment insurance claims would then trigger bearish momentum in the dollar.

The EURUSD and GBPUSD demonstrated a downtrend through the week, affected by dollar strength.

Let's review the market movements through the week.

October 7 (Mon)

In the U.S. employment statistics released the previous Friday, the number of non-farm payrolls exceeded expectations, demonstrating strength in the U.S. economy, and this led to bull supremacy in the dollar, sending the USDJPY as high as the low 149 range.

As the week opened after this trend, though the USDJPY began trades in the upper 148 yen range, it would tick nervously downward to the lower 148 range.

October 8 (Tue)

On Tuesday, the USDJPY temporarily fell to the low 147 range from Tokyo trading hours into London trading hours. However, some buying pressure on the lower end of the range sent the pair back up to close above 148.

October 9 (Wed)

Into the following morning, the minutes of the Federal Open Market Committee (FOMC) were released, and as expectations of a significant interest rate cut receded, dollar buying strengthened again.

The minutes revealed that several members supported a 25 basis point interest rate cut, leading to a more pervasive view that the pace of future interest rate cuts would be a gradual one. These fundamentals put traders in bull mode, sending the USDJPY up once again to the lower 149 range.

October 10 (Thu)

Newly-released minutes from the European Central Bank (ECB)'s Governing Council hinted at the possibility of a rate cut in October, putting the EURUSD in a downtrend. The EURUSD would fall again to 1.09.

In addition, the U.S. Consumer Price Index (CPI) for September was released, and the results were slightly better than expected, with a 0.2% month-on-month increase versus a 0.1% forecast and a 2.4% year-on-year increase versus a forecast of 2.3%. In contrast, the USDJPY fluctuated wildly as the number of new unemployment insurance claims in the U.S. increased much more than expected.

October 11 (Fri)

Although the U.K.'s GDP for August was 0.2% higher than the previous month, as expected, the GBPUSD did not appreciate significantly amid lingering concerns about the U.K. economy. The GBPUSD has continued to be weighed down by dovish comments from Bank of England (BOE) Governor Andrew Bailey.

In addition, the U.S. September PPI was 0.0% month on month, lower than the forecast of 0.1%, indicating a decline in inflationary pressure.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

October 17 (Thu)

09:00, Europe: September Harmonised Index of Consumer Prices (revised HICP)

09:00, Europe: September Harmonised Index of Consumer Prices (revised HICP, core index)

12:15, Europe: European Central Bank (ECB) Governing Council policy interest rate announcement

12:30, U.S.: September retail sales

12:30, U.S.: September retail sales (excluding automotive)

12:45, Europe: Regular press conference by European Central Bank (ECB) President Christine Lagarde

23:30, Japan: September Consumer Price Index, Japan (CPI, all items)

23:30, Japan: September Consumer Price Index, Japan (CPI, all items less fresh food)

23:30, Japan: September Consumer Price Index, Japan (CPI, all items less fresh food and energy)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

The USDJPY has snuck up on the milestone of 150 with little fanfare, reaching a point where it may be better to keep an eye on comments from Bank of Japan officials.

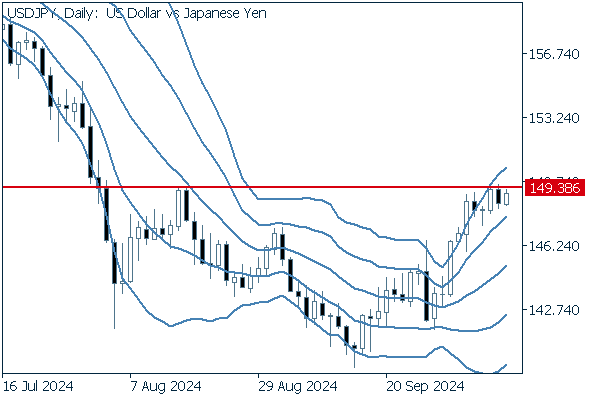

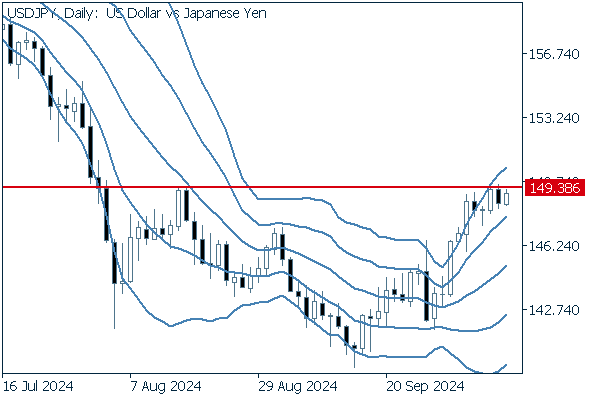

Next is an analysis of the USDJPY daily chart.

The pair is on pace to test the high it reached before falling sharply in August. From this point, there is a great possibility of overall trend divergence based on whether it results in a further rise beyond this high or falling back.

The daily chart shows an upward-tilting middle line, with the pair in a bandwalk between the +1 and +2 standard deviation Bollinger Band and showing the potential for strong bullish pressure in the near term.

A quick move to capture a breakout above 149.38 would be wise, but buying on dips also offers benefits in the expectation that this line will turn from resistance to support.

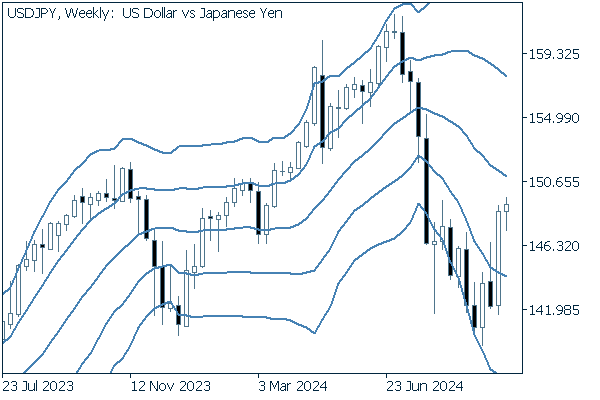

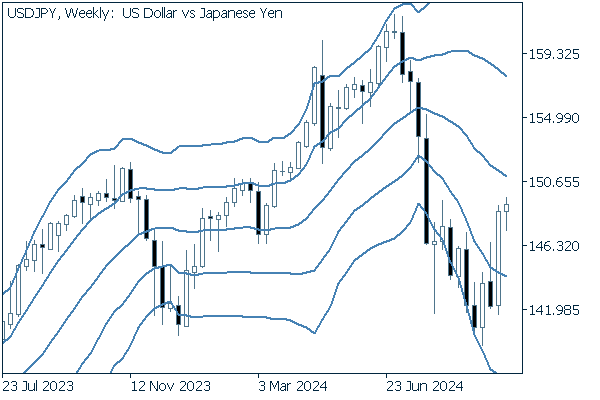

We continue with an analysis of the USDJPY weekly chart.

The pair has concluded its descending bandwalk to stay above the -1 standard deviation Bollinger Band with a positive candle, even if with a long whisker.

The weekly chart appears to be leaning in a bullish direction.

EURUSD

With the dollar strengthening, and there being no fundamental factors supporting euro bulls, it is possible that selling pressure will increase for this pair.

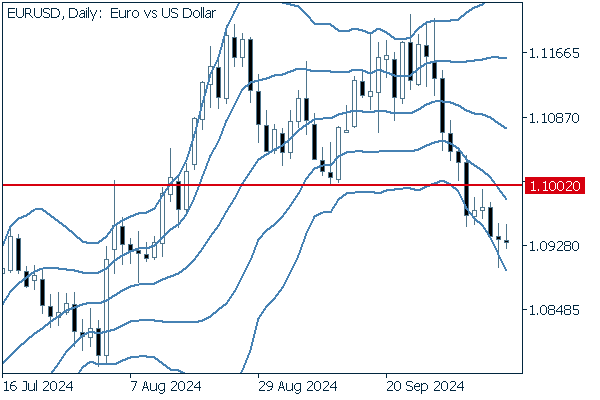

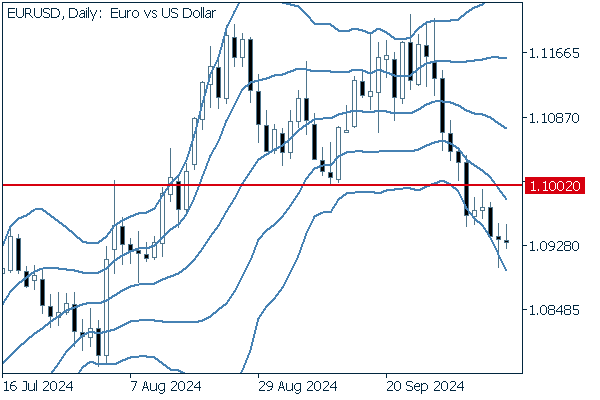

Next is an analysis of the EURUSD daily chart.

The pair has stayed clearly below the 1.10 mark after leaving a double-top neckline, now beginning a descending bandwalk.

Short trades appear simple and effective.

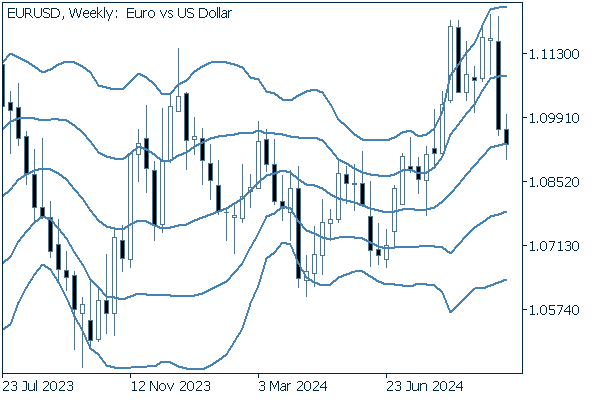

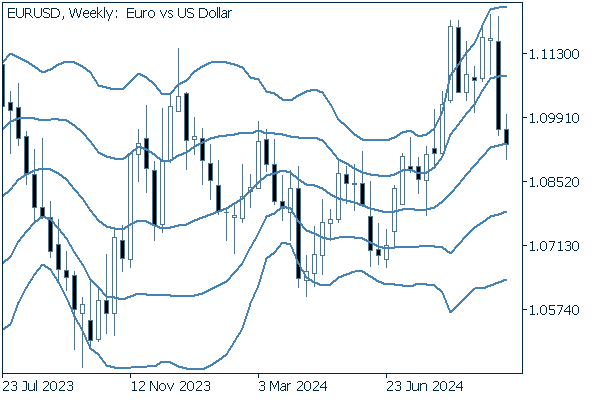

We continue with an analysis of the EURUSD weekly chart.

The pair has fallen further after breaking below the +1 standard deviation Bollinger Band, reaching the middle line. Contrary to its USDJPY cousin, we can see that bears are dominant.

GBPUSD

Like the EURUSD, the dollar is strong and there are no buy-side fundamentals working in the pound's favor, so this pair is expected to favor the downside as well.

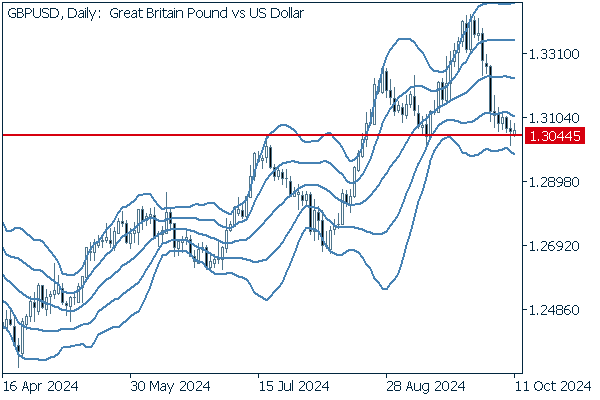

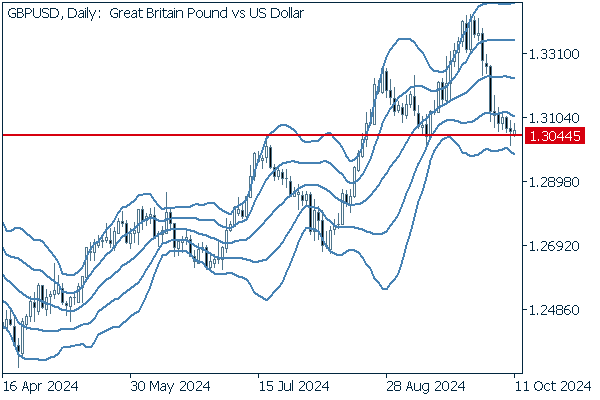

Now, we analyze the daily GBPUSD chart.

Since 1.3044 was the starting point for the most recent rise, a break below this level will make further drops a nearly assured outcome, a sell signal as dictated by Dow theory.

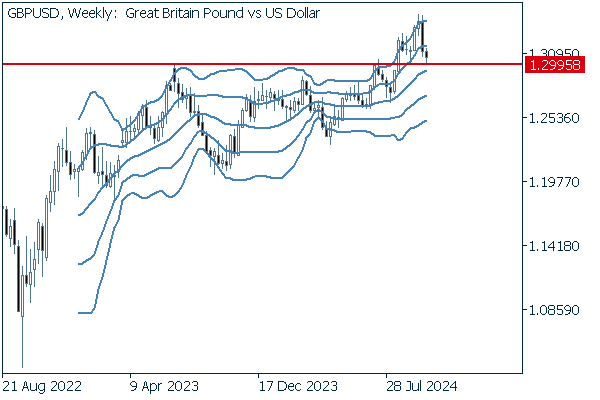

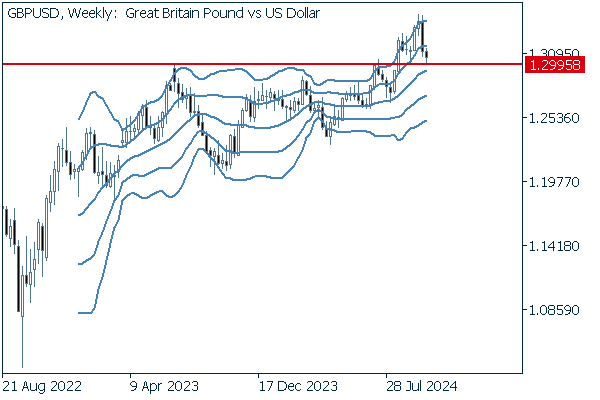

We continue with an analysis of the GBPUSD weekly chart.

If the support line around the 1.3 milestone is broken, short trades may be a winning option in the expectation of the support line turning into a resistance.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy