2024.08.19

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the trading week ended August 18, yen bears were the predominant force, the markets were primarily moved by economic indicators out of the United States. Inflation indicators in the form of the U.S. wholesale pricing index (Producer Price Index, or PPI) and the U.S. Consumer Price Index (CPI) demonstrated some weakness, but the market's reaction was relatively tame to these underperforming indicators due to the determination that inflation was subdued.

However, U.S. retail sales and new unemployment insurance claims exceeded expectations, confirming the continued strength of the U.S. economy, and this led to risk-on behavior as traders sold the yen.

Let's review the market movements through the week.

On Monday, August 12, with the Tokyo market closed for a national holiday, the market started the week quietly in the high 146 range. Though price movements were dulled, the trend was toward yen-selling and dollar-buying, temporarily pushing the USDJPY to the low 148 range. However, with influence from tensions in the Middle East, the pair fell back to near 147.

On Tuesday, August 13, the USDJPY briefly rose to just below 148 alongside a sharply rising Nikkei 225 index, but was pushed back to below 147 again after underwhelming results in the U.S. PPI release.

On Wednesday, August 14, Prime Minister Kishida announced his intention not to run for president of his ruling party, triggering yen bulls that sent the USDJPY falling further, to the low 146 range. However, with the U.S. CPI released on the same day falling slightly below expectations, the USDJPY entered a state of oscillation.

On Thursday, August 15, as already mentioned, U.S. retail sales came in much higher than expected. The strong month-on-month growth of 1.0% versus 0.3% expected and, when excluding the automotive sector, 0.4% versus 0.1% expected helped drive dollar-buying momentum.

Furthermore, declines in the number of new unemployment insurance claims and the number of ongoing beneficiaries to the same reaffirmed the resilience of the U.S. economy, and the USDJPY surged to the low 149 range.

On Friday, August 16, the market unwound the previous night's surge, with the USDJPY falling to the mid-147 range to close the week's trading.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

August 20 (Tue)

09:00, Europe: July Harmonised Index of Consumer Prices (revised HICP, year-on-year data)

09:00, Europe: July Harmonised Index of Consumer Prices (revised HICP core index, year-on-year data)

August 21 (Wed)

18:00, U.S.: Federal Reserve Open Market Committee (FOMC) meeting minutes

August 22 (Thu)

11:30, Europe: European Central Bank (ECB) Governing Council meeting minutes

23:30, Japan: July Consumer Price Index, Japan (CPI, all items, year-on-year data)

23:30, Japan: July Consumer Price Index, Japan (CPI, all items less fresh food, year-on-year data)

23:30, Japan: July Consumer Price Index, Japan (CPI, all items less fresh food and Energy, year-on-year data)

August 23 (Fri)

14:00, U.S.: July new home sales

14:00, U.S.: Conference by Federal Reserve Chairman Jerome Powell

The coming week holds a number of important events, including the release of the FOMC meeting minutes and Japan's July National Consumer Price Index (CPI).

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

While the market still expects a rate cut at the September U.S. FOMC meeting, expectations of a 0.5% rate cut have been halved from 51% to 25% in the past week.

There has been a very significant trend ongoing from July into August, and the current movements reflect that the market has placed particular focus on the dollar and yen, with any new fundamental being nervously reflected in the USDJPY.

Even if a trade matches the overall direction of the pair, a single oscillation can result in a large unrealized loss. Traders should consider shallow stop-losses or, conversely, reducing order sizes and widening the stop-loss range.

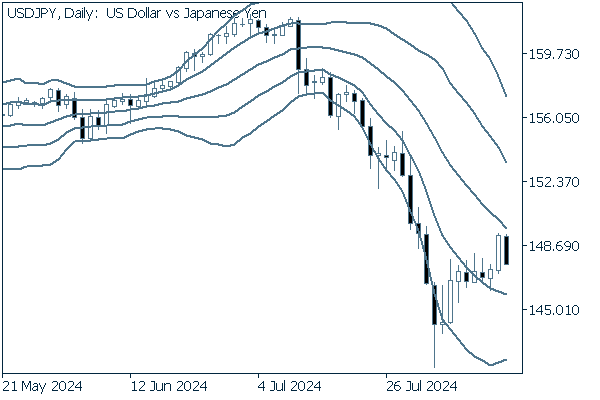

Next is an analysis of the USDJPY daily chart.

Though the pair had been in a sustained descending bandwalk, it has since rebounded and is now above the -1 standard deviation Bollinger Band. It remains to be seen whether the trend will reverse in the long term, but since there is a possibility that the adjustment rally will continue to some extent, it may be beneficial to adopt a strategy targeting this uptrend in the short-term.

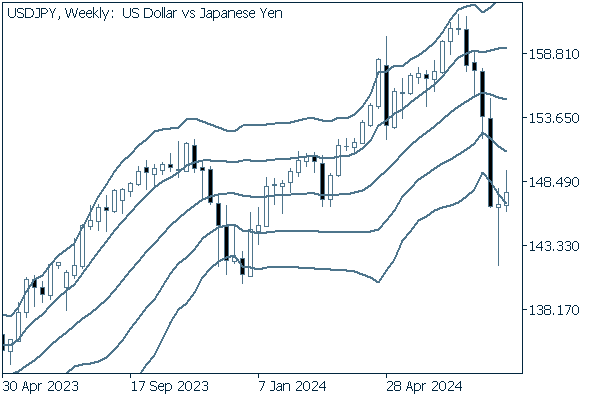

We continue with an analysis of the USDJPY weekly chart.

The emergence of a short positive candle with a long lower mustache after four negative candles resembles the Morning Doji Star variant of the morning star bullish reversal formation. Since this shape often rebounds to the upside, a buy-minded strategy may pay benefits over the near term.

EURUSD

The pair continues to fluctuate in response to the dollar's movements.

In the coming week, the Eurozone will release its Harmonised Index of Consumer Prices on Tuesday the 20th, and the ECB Governing Council meeting will be held on Thursday the 22nd.

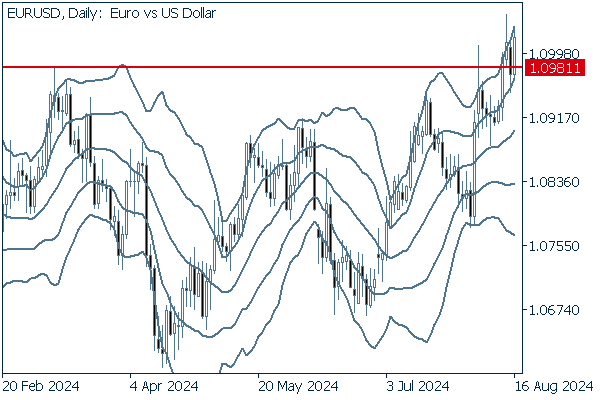

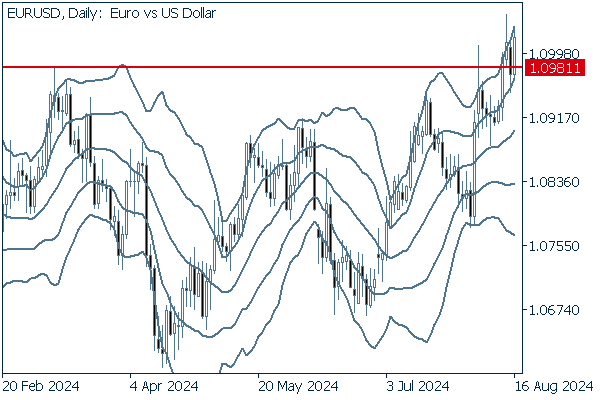

Next is an analysis of the EURUSD daily chart.

After some twists and turns, the March high of 1.09811 was broken at the close. If the trend of dollar depreciation due to a U.S. interest rate cut continues, traders may target a rising trend from this point.

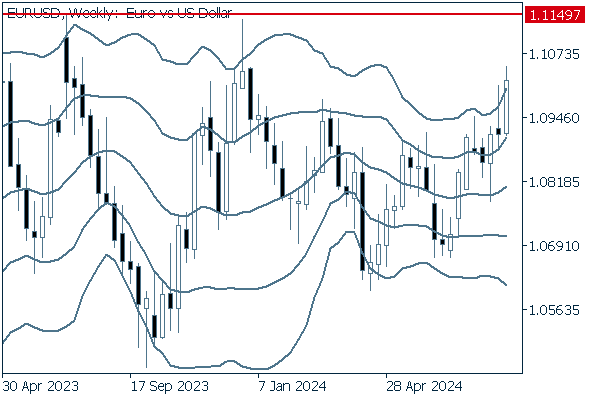

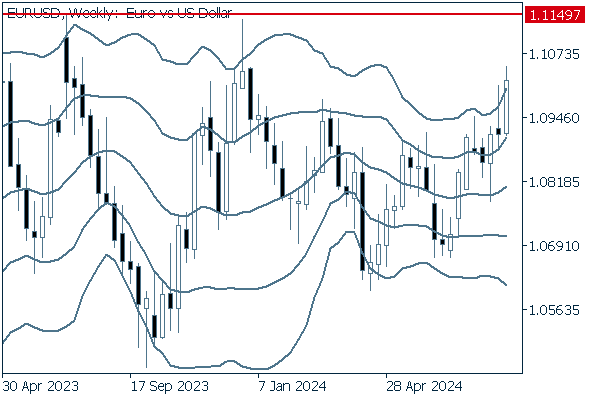

We continue with an analysis of the EURUSD weekly chart.

The chart hints at a new ascending bandwalk, with a shape creating great interest over a potential test of the July 2023 high at 1.11497.

GBPUSD

There are no high-profile economic releases related to the pound in the coming week, suggesting traders are better off following news related to the U.S.

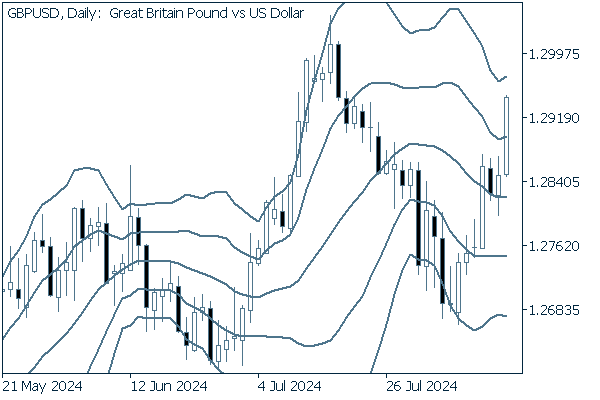

Now, we analyze the daily GBPUSD chart.

With several long positive candles, the pair is approaching the +2 standard deviation Bollinger Band. However, the middle line remains mostly horizontal.

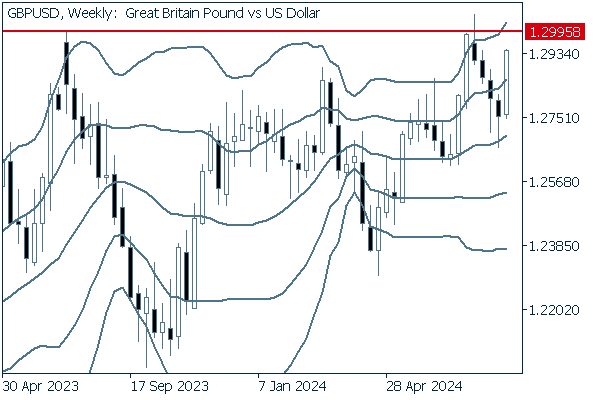

We continue with an analysis of the GBPUSD weekly chart.

The current focus on this pair is whether it will be able to close above the recent high of 1.29958, a stone's throw from 1.3.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy