2024.07.22

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

Currency markets in the week ended July 21 were notable in the relative weakness of the dollar, with the USDJPY temporarily falling below 156. Let's review the market movements through the week.

On Tuesday, July 16, the U.S. released its retail data for June, with flat (0.0%) month-on-month growth beating a negative 0.3% forecast. When excluding the automotive sector, retail sales painted a stronger picture, with 0.4% month-on-month beating a 0.0% forecast.

On Wednesday, July 17, the USDJPY fell to around 156 after former U.S. President Donald Trump made comments about the yen's weakness and Japan's Digital Minister Taro Kono reportedly requested that the Bank of Japan raise interest rates to correct the yen's weakness.

On the same day, the Eurozone's Harmonised Index of Consumer Prices (HICP, revised data) was released for June. This was a no-surprise release, with data in line with expectations, including for the core index.

Note that Wednesday was the day that the EURUSD and GBPUSD topped out before beginning a decline through the rest of the week.

In Tokyo morning trading on Thursday, the USDJPY hit a low around 155.50, after which it began a rebound that would be sustained into the end of the week's trading.

Thursday also marked the European Central Bank's (ECB) policy interest rate announcement, holding steady at 4.25% and meeting market expectations. Looking ahead to the next ECB Governing Council meeting in September, there was an open attitude emphasized, with no clear indicators regarding the interest rate.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

July 24 (Wed)

14:00, U.S.: June new home sales

14:00, U.S.: June new home sales (month-on-month data)

July 25 (Thu)

12:30, United States: April-June quarterly real gross domestic product (preliminary GDP)

July 26 (Fri)

12:30, U.S.: June personal consumption expenditures (PCE deflator)

12:30, U.S.: June personal consumption expenditures (core PCE deflator, excluding food and energy, month-on-month data)

12:30, U.S.: June personal consumption expenditures (core PCE deflator, excluding food and energy)

This week, eyes will be on the U.S. personal consumption expenditures release on Friday the 26th.

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

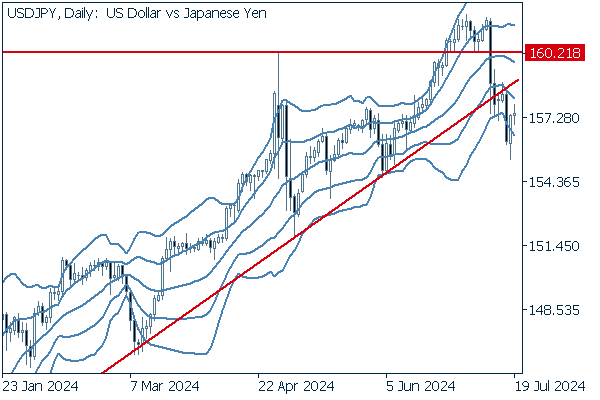

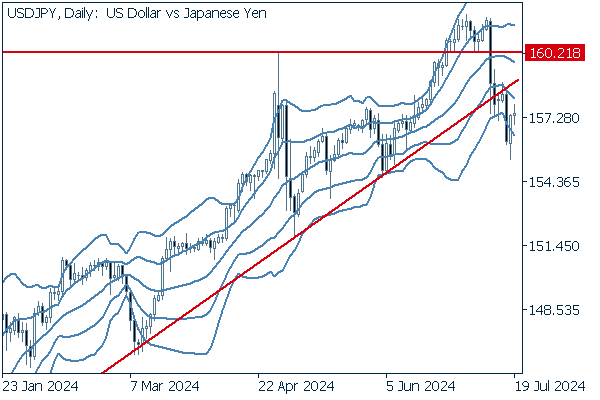

USDJPY

There has been a clear shift in attitudes toward the USDJPY since mid-July. On July 11, the U.S. Consumer Price Index (CPI) release, combined with the Bank of Japan's currency intervention, sent the pair plummeting from its highs above 160. That weekend, former U.S. President Trump made great strides toward recapturing the presidency after surviving an attempted assassination.

Trump expressed caution that yen weakening had progressed too far, heightening interest in the fall presidential election in the United States with respect to currency developments.

The CME FedWatch tool shows a 95.9% probability that the interest rate will remain unchanged at the July FOMC meeting, showing little room for surprises. From the weekend, Federal Reserve Bank officials will enter a blackout period where they cannot make public statements.

For the September FOMC meeting, the probability of an unchanged rate is 1.9%, showing that we are on a near-certain path to a rate cut.

In addition, the Bank of Japan will hold its monetary policy meeting on July 31. Since the USDJPY fluctuated dramatically during this event last year, caution should be exercised when trading during this period.

Next is an analysis of the USDJPY daily chart.

The uptrend line, cleanly drawn from the low at the end of 2023, has been broken by the bearish trend that began two weeks ago. The pair has also touched the -2 standard deviation Bollinger Band, and may have moved into a descending bandwalk between the -1 and -2 standard deviation bands. The middle line has also turned downward.

We can also see that since the day of the CPI release, there have been extremely long negative candles, in contrast to notably short positive candles. This appears to be a textbook downtrend, where upticks are gentle until dramatic falls take over.

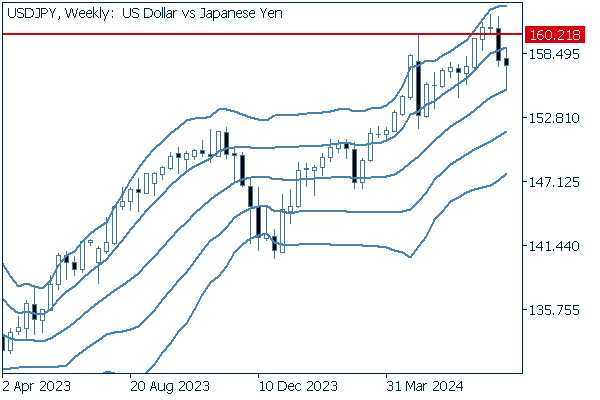

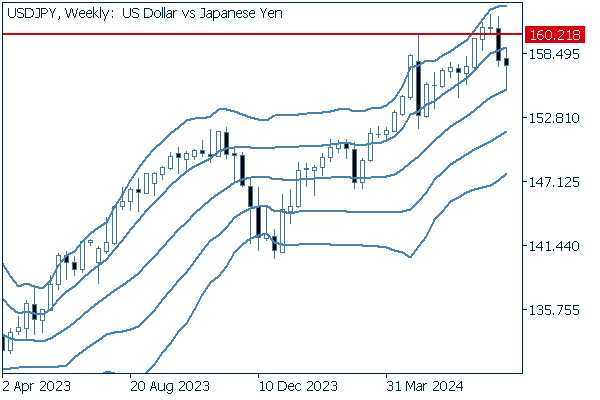

We continue with an analysis of the USDJPY weekly chart.

The pair appears to have traced an evening star-like formation, a pattern often found at the beginning of a bearish trend. At the close two trading weeks ago, the price was below the +1 standard deviation Bollinger Band, with the whiskers in the following week of trading reaching the middle line during fluctuating trades.

This is also only the second time in 2024 that there have been two consecutive weekly negative candles. Three consecutive negative weeks would be the first time since the decline that took place in November and December of 2023, indicating a turn in the tides for the currency pair.

EURUSD

As expected, the euro received no interest rate cut in July. As mentioned above, there is currently no clear direction ahead of the September ECB Governing Council meeting.

Lately, dollar bears have demonstrated strong momentum, resulting in a climbing EURUSD.

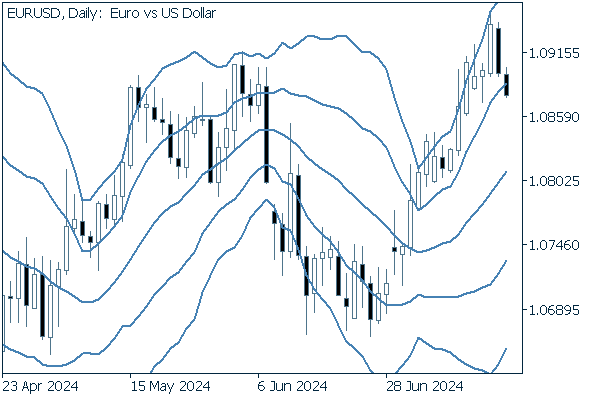

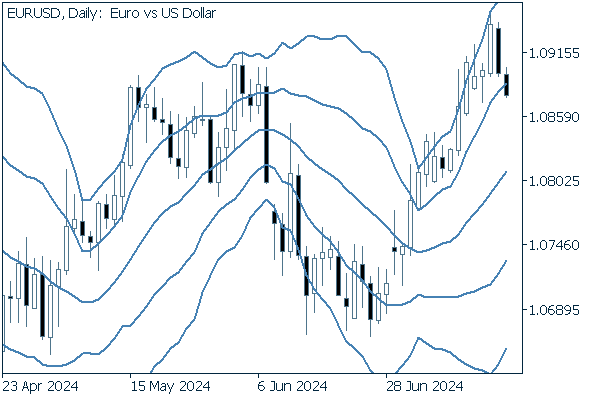

Next is an analysis of the EURUSD daily chart.

Despite six straight rallies, two days of losses have sent the pair below the +1 standard deviation Bollinger Band. This suggests a potential temporary retrace.

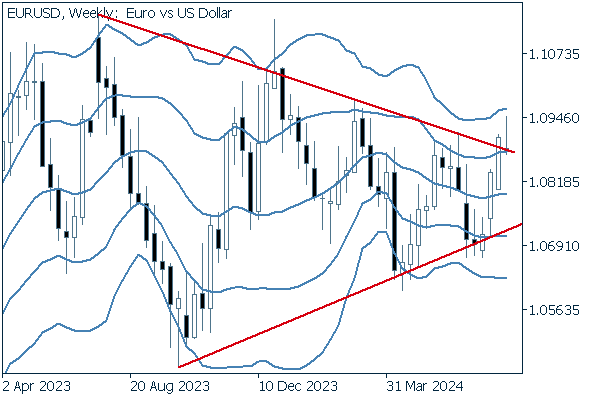

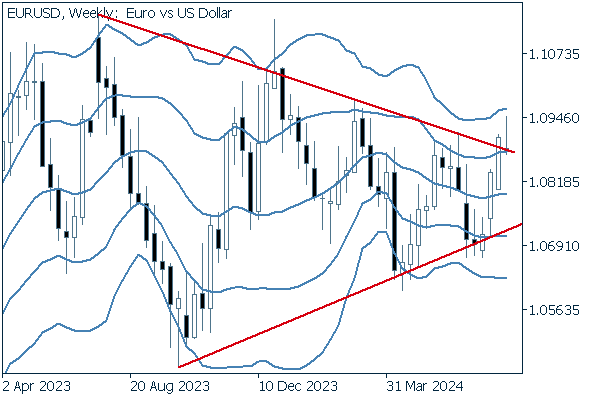

We continue with an analysis of the EURUSD weekly chart.

The pair appeared to breach the upper edge of the triangle formation, but returned in the most recent week of trading to leave only upper whiskers above.

GBPUSD

Though pound-watchers have expectations for an August interest rate cut, there is disorganization in direction from conflicting inflation and employment conditions, leading to an unclear outlook.

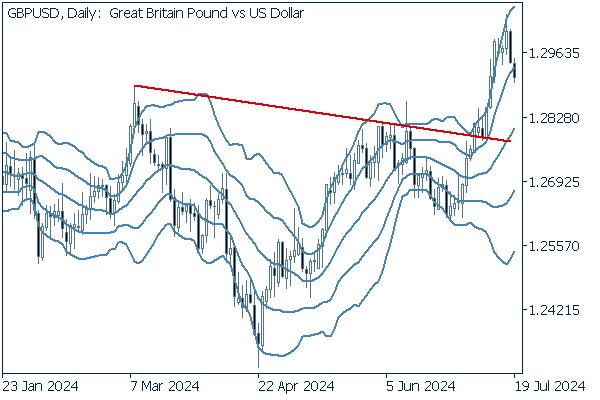

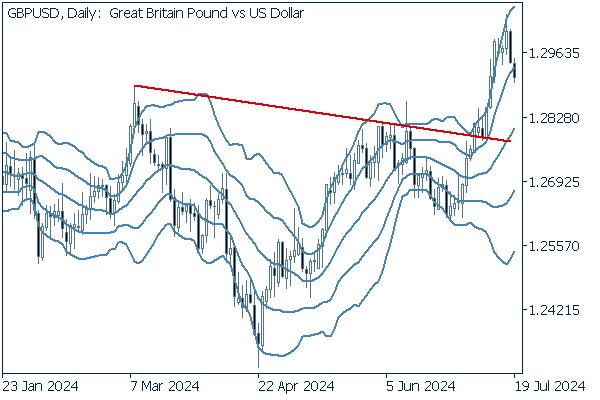

Now, we analyze the daily GBPUSD chart.

Although the pair has made a clean break above its upper trend line, it has fallen below the +1 standard deviation Bollinger Band, suggesting a phase of further downward adjustment, if temporary. With a middle line on an upward slope, the overall trend still appears to favor the bulls.

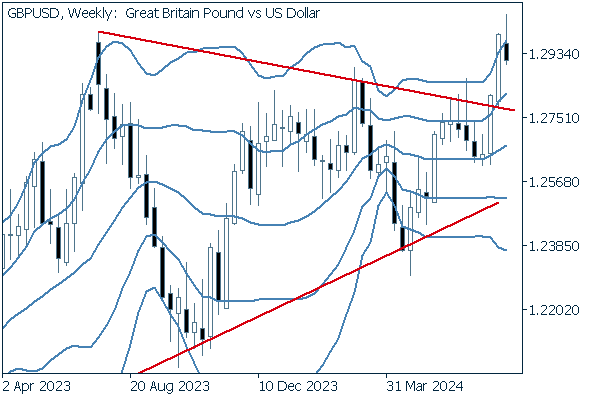

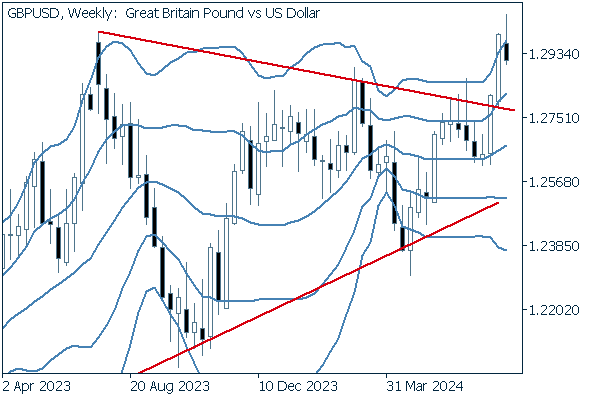

We continue with an analysis of the GBPUSD weekly chart.

The pair has entered an uptrend, breaking through the upper edge of its triangle formation. A bullish eye on this pair appears justified so long as it remains above the +1 standard deviation Bollinger Band.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy