2024.06.17

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

Stop-and-go action was the theme for the USDJPY pair this week, while the EURUSD and GBPUSD pairs were in a bearish trend.

Factors driving the USDJPY included weak U.S. CPI results leading to dollar selling, but these were counteracted by a subsequent downward revision to one rate cut at the FOMC, reversing the trend toward dollar buying. As for the yen, there were no new actionable fundamentals at Friday's BOJ monetary policy meeting, and a rally in the pair after midday Tokyo time was offset by a decline in the afternoon.

As for the euro, not only has there been a rate cut, but far-right parties have gained several seats in the recent European Parliamentary elections, eating away at the majority for ruling factions in Germany and France. French President Emmanuel Macron dissolved parliament as a result for snap elections, indicating a suddenly unstable political landscape in that country. These developments led the EURUSD, and similarly its GBPUSD cousin, into a bearish pattern.

Let's review the market movements through the week.

On Monday, June 10, the Japanese government released the country's revised quarterly real gross domestic product for January to March, revealing 0.5% negative growth quarter on quarter matching expectations, and 1.8% negative growth when annualized versus 1.9% negative growth expected.

On Wednesday, June 12, the U.K. released its month-on-month GDP data for April, with 0.0% growth matching a 0.0% forecast.

On the same day, the U.S. Consumer Price Index (CPI) was also released, showing weak results as already mentioned and indicating receding inflation overall.

Data showed 0.0% month-on-month growth versus a 0.1% forecast, and 3.3% year-on-year growth versus a 3.4% forecast. In addition, the core index showed month-on-month growth of 0.2% versus a 0.3% forecast, and year-on-year growth of 3.4% versus a 3.5% forecast.

At the FOMC meeting held later on the same day (U.S. time), the policy rate was left unchanged as expected. However, the members' outlook for policy rates for the year (Fed dot plot) shows a median of one rate cut remaining before the end of the year. Since this was less than the two expected interest rate cuts, the dollar was bought back.

On Friday, June 14, shortly after noon Tokyo time, the Bank of Japan announced an unchanged policy rate, as widely expected, at the conclusion of its monetary policy meeting.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

June 18 (Tue)

09:00, Europe: May Harmonised Index of Consumer Prices (revised HICP, year-on-year data)

09:00, Europe: May Harmonised Index of Consumer Prices (revised HICP core index, year-on-year data)

12:30, U.S.: May retail sales (month-on-month data)

12:30, U.S.: May retail sales (month-on-month data, excluding automobiles)

23:50, Japan: Bank of Japan monetary policy meeting agenda

June 20 (Thu)

11:00, U.K.: Bank of England (BOE) policy interest rate announcement

11:00, U.K.: Bank of England Monetary Policy Committee (MPC) meeting

23:30, Japan: May Consumer Price Index, Japan (CPI, all items, year-on-year data)

23:30, Japan: May Consumer Price Index, Japan (CPI, all items less fresh food, year-on-year data)

23:30, Japan: May Consumer Price Index, Japan (CPI, all items less fresh food and energy, year-on-year data)

This week, the focus will be on Tuesday's retail sales figures. This is another U.S. economic indicator alongside the Consumer Price Index (CPI) that allows economists to determine the degree of inflation.

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

The USDJPY tends to jitter nervously when any news comes out relating to either currency, and this jitter may be on display with the retail sales release on the 18th.

After the most recent FOMC meeting, the CME's FedWatch tool shows the probability of a FOMC meeting with a rate cut exceeding that of an unchanged rate on September 18.

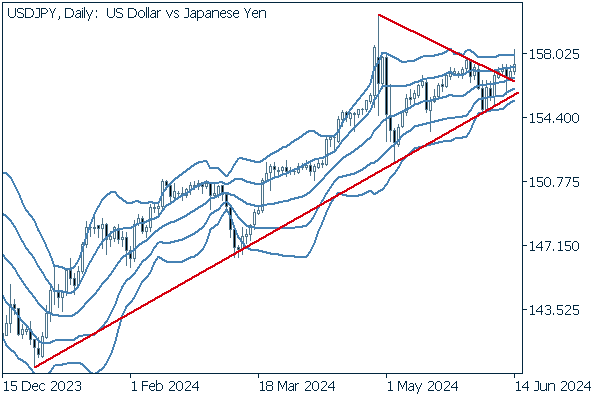

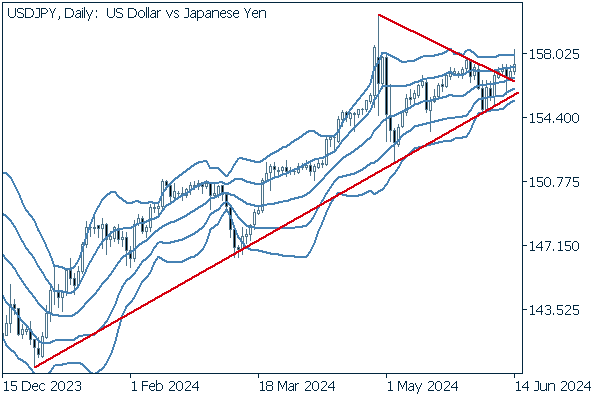

Next is an analysis of the USDJPY daily chart.

Though the pair has broken through the upper edge of the triangle that we had been watching, it has found limited upside, leaving only long upper whiskers. This may end up being a false breakout, with the price falling back below the upper edge of the triangle.

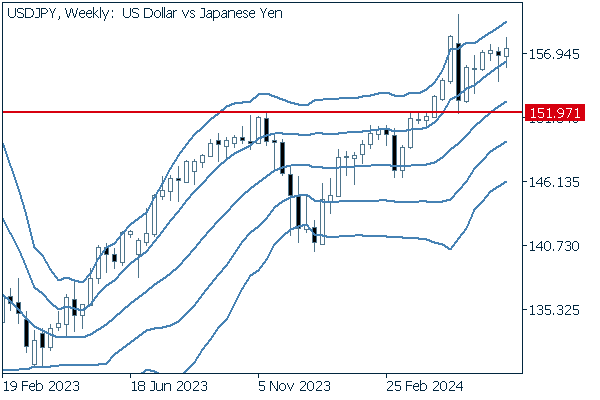

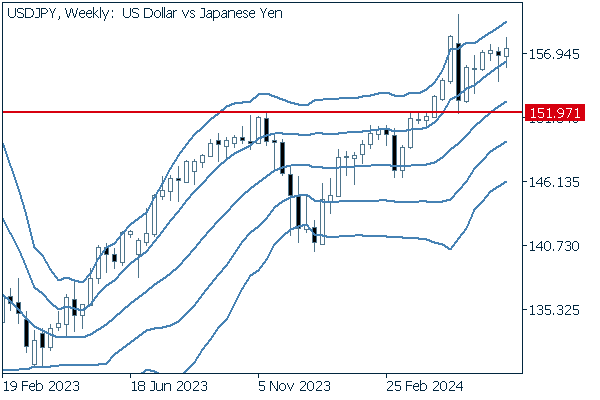

We continue with an analysis of the USDJPY weekly chart.

The pair holds its bandwalk between the +1 and +2 standard deviation Bollinger Bands. For the time being, a key watershed will be whether or not it breaks below the +1 standard deviation band.

EURUSD

Interest rate cuts and political instability have started to put significant downward pressure on the euro vis-a-vis the dollar. A similar trend is also visible for the EURJPY.

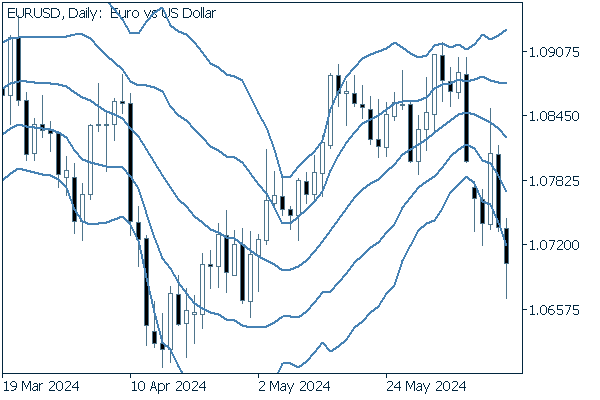

Next is an analysis of the EURUSD daily chart.

We can clearly see a greater number of bearish candles mixing into the daily trades, with a sloping decline beginning to follow the -2 standard deviation Bollinger Band.

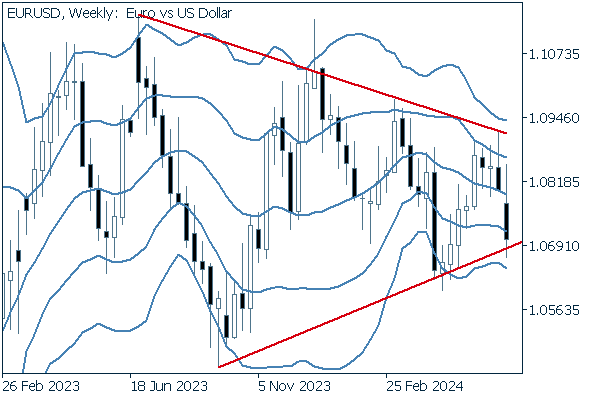

We continue with an analysis of the EURUSD weekly chart.

Though the pair temporarily broke below the lower edge of the large triangle formation in the most recent week of trading, the pair closed only leaving a lower whisker below the triangle.

GBPUSD

The pound's policy rate will be announced on June 20, and is expected to remain unchanged. As Europe as a whole is shifting to a risk-off stance, it is also necessary to watch the pound for sell-offs.

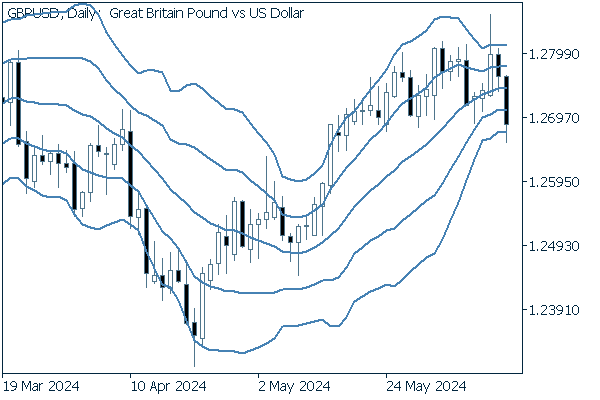

Now, we analyze the daily GBPUSD chart.

During Friday's decline, the pair plummeted even below the -2 standard deviation Bollinger Band in intraday trading. Keep a close eye on a possible descending bandwalk.

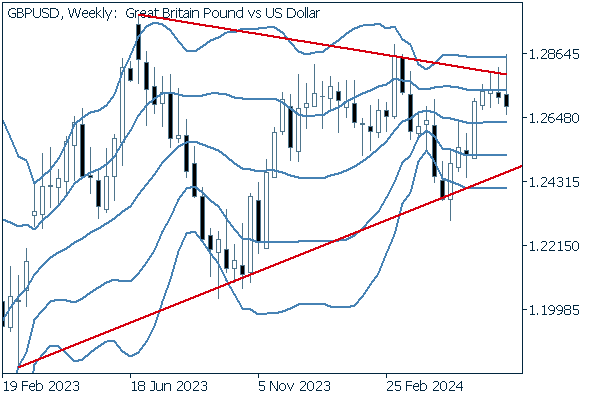

We continue with an analysis of the GBPUSD weekly chart.

The rally early in the most recent week of trading briefly led the pair above the upper edge of its large triangle formation, but was driven back into the triangle with an upper whisker.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy