2024.04.01

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

Currency markets last week sent the USDJPY to a high of 151.96, barely breaching the yen's 2022 high of 151.94. However, the pair quickly retreated, spending the remainder of the week within a tight range around the 151 price level. Let's review the market movements through the week.

On Tuesday, March 25, data was released for U.S. new home sales in February. Annualized new home sales were 662,000 vs. 675,000 expected, with an underwhelming month-on-month change of -0.3% vs. 2.1% expected.

On Tuesday, March 26, there were no economic events of note, resulting in subdued movements for the USDJPY, EURUSD, and GBPUSD.

Then, Wednesday, March 27 witnessed a surge in USDJPY beginning from 01:00 (GMT), briefly marking a high of 151.96 before retreating, as mentioned earlier. This marks the third consecutive year, including 2022, 2023, and 2024, that the pair has failed to break the 152 barrier.

On Thursday, March 28, the U.K. released its quarterly gross domestic product (revised values) for October to December. Both quarter-on-quarter and year-on-year data were in line with expectations. Later, during New York trading hours, the U.S. released its annualized quarter-on-quarter data for quarterly real GDP (finalized values), showing an increase of 3.4% vs. 3.2% expected.

On Friday, March 29, markets were closed in both the U.S. and the U.K. for the Good Friday holiday. Anticipation for the release of personal consumption expenditures (PCE) data led to an increasingly cautious mood in market movements toward the end of the week.

The PCE deflator year-on-year data for February personal consumption expenditures came in at 2.5% vs. 2.5% expected. The PCE core deflator, which excludes food and energy, showed a 0.3% month-on-month increase vs. 0.3% expected, and was up 2.8% year on year vs. 2.8% expected.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

April 1 (Mon)

23:50 (Sunday night), Japan: Bank of Japan January-March Short-Term Economic Survey of Enterprises (Tankan)

14:00, U.S.: March ISM Manufacturing PMI

April 3 (Wed)

09:00, Europe: March Harmonised Index of Consumer Prices (preliminary HICP, year on year data)

09:00, Europe: March Harmonised Index of Consumer Prices (preliminary HICP core index, year on year data)

12:15, U.S.: March ADP National Employment Report (month on month data)

14:00, U.S.: March ISM Non-Manufacturing PMI (composite)

16:10, U.S.: Press conference by Federal Reserve Chairman Jerome Powell

April 4 (Thu)

11:30, Europe: European Central Bank (ECB) Governing Council meeting agenda

April 5 (Fri)

12:30, U.S.: March change in nonfarm payrolls (month on month data)

12:30, U.S.: March unemployment rate

12:30, U.S.: March average hourly earnings (month on month data)

12:30, U.S.: March average hourly earnings (year on year data)

This week, the U.S. employment report on Friday will be in focus. Will the USDJPY take aim at the 152 level once again?

This Week's Forecast

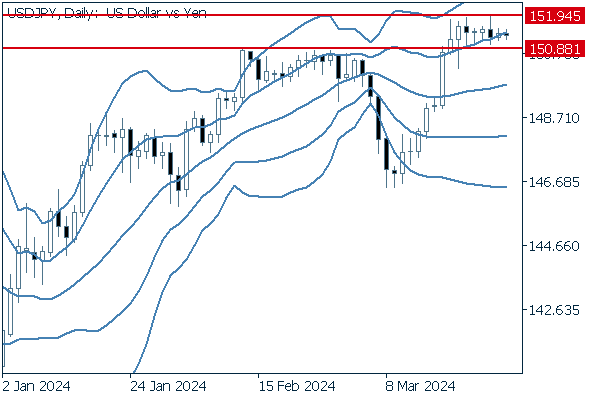

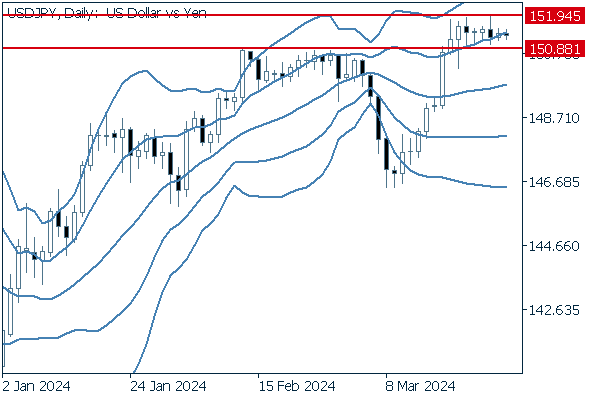

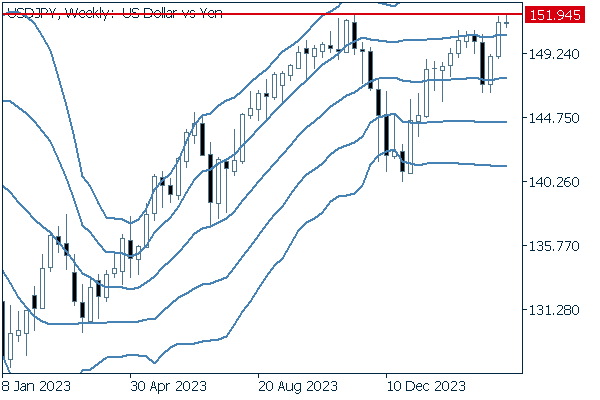

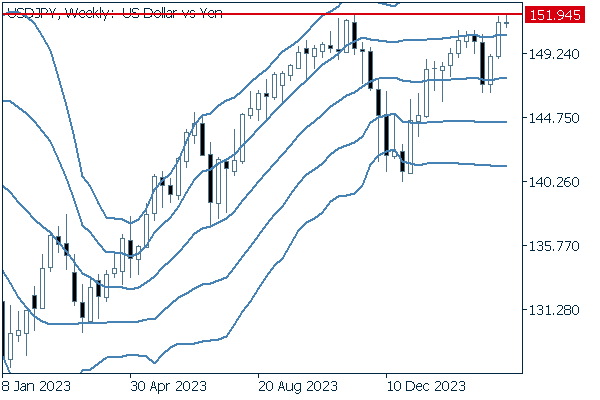

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

The dollar remains poised to target recent highs, but also sits at a level requiring caution for possible currency intervention by the Bank of Japan.

On the 27th, in Tokyo afternoon trading, the market reacted with strong yen-buying after a short-lived recent USDJPY high when it was reported that a tripartite meeting of the Ministry of Finance, the Financial Services Agency, and the Bank of Japan was to be held. The buying spree sent the pair plunging to the low 151-yen range. After the meeting, Japan's top currency diplomat, Masato Kanda, held a press conference, saying that the yen's depreciation was clearly driven by speculative movements, and indicating disapproval of excessive fluctuations, suggesting the Bank of Japan may take "all possible steps" toward currency intervention.

Going forward, expect to once again see various moves by Bank of Japan officials to keep the yen's depreciation in check. Around 152, the USDJPY is expected to be laden with orders, necessitating caution for potential rapid price movements caused by their bulk execution.

Next is an analysis of the USDJPY daily chart.

The pair remains within a narrow price range above the February peak of 150.88 but below the 2022 high of 151.94. The presence of short candlesticks suggests an imminent and potentially significant move.

We continue with an analysis of the USDJPY weekly chart.

The Bollinger Bands' middle line remains nearly horizontal, indicating stability. Prepare for movements following a potential breakthrough into the 152 range.

EURUSD

On Wednesday, April 3, the Eurozone's March Harmonised Index of Consumer Prices will be released.The EURUSD was on a downtrend last week, primarily due to the dollar's strength.

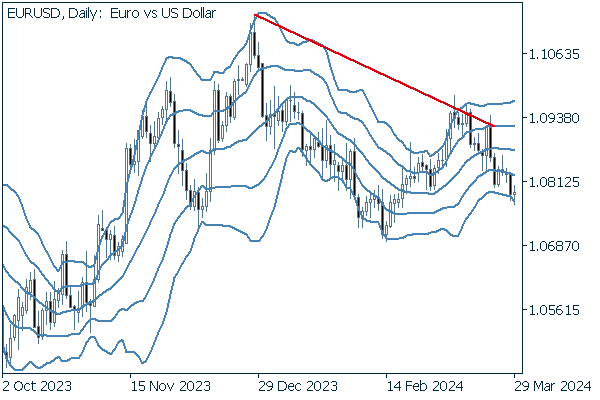

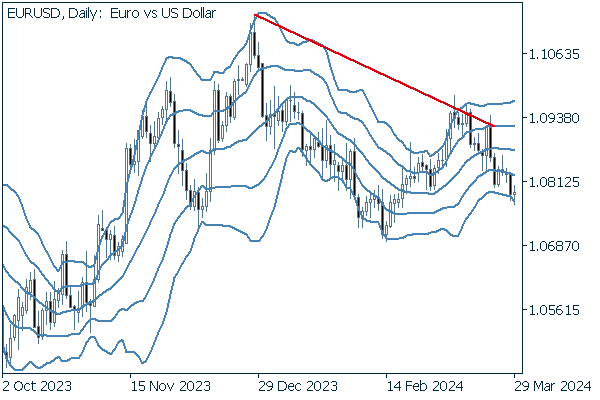

Next is an analysis of the EURUSD daily chart.

The decline continues along the previously established trend line, reaching the -2 standard deviation Bollinger Band.

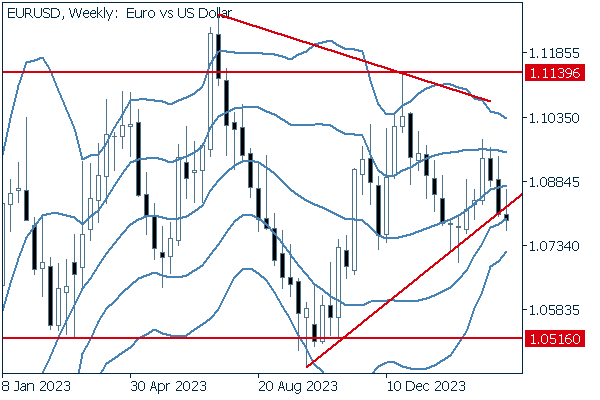

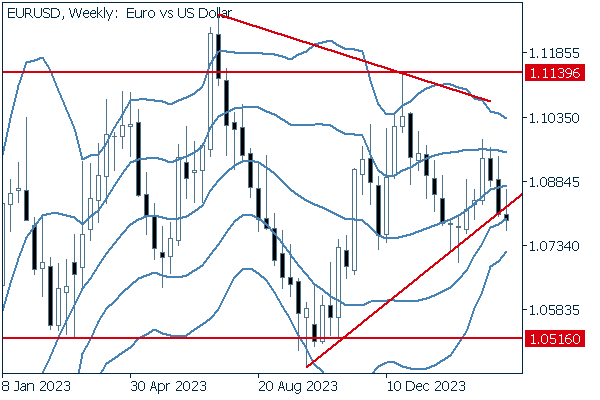

We continue with an analysis of the EURUSD weekly chart.

Despite closing outside the lower boundary of a triangle formation, lows are progressively rising for the pair, indicating the need for a stronger downward move to confirm a downtrend.

GBPUSD

No significant news affecting the pound is expected this week, with GBPUSD likely to remain reactionary to the dollar's movements.

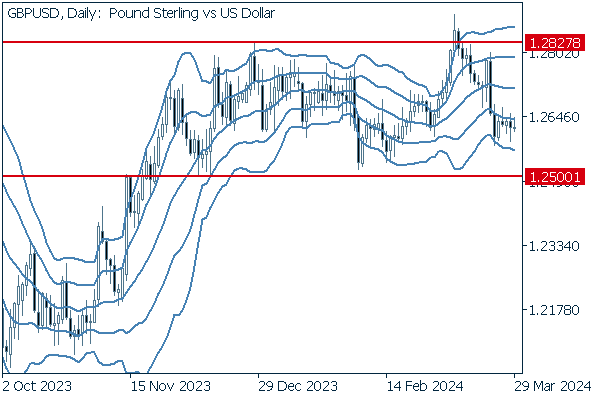

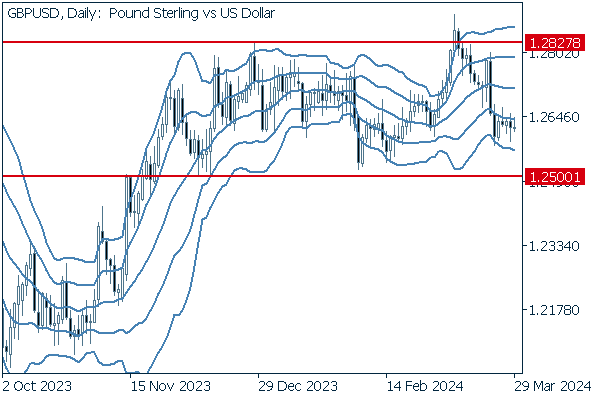

Now, we analyze the daily GBPUSD chart.

The pair continues to oscillate within a range, with no inclination on the Bollinger Bands' middle line, indicating a prelude to a potential trend formation.

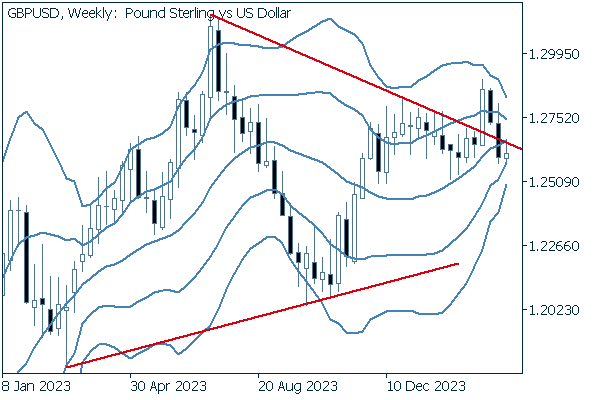

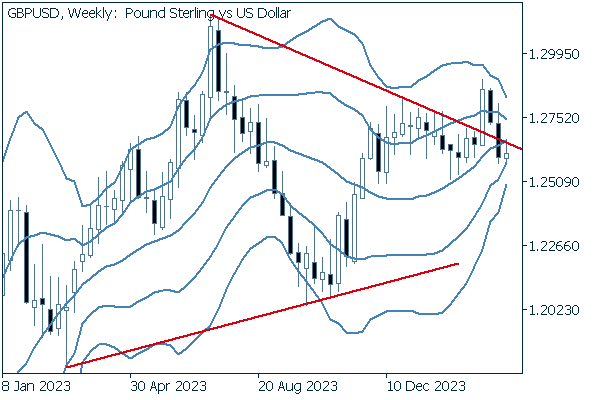

We continue with an analysis of the GBPUSD weekly chart.

After breaking above the upper line of a triangle formation, the pair retracted in a false breakout.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy