2026.02.16 NEW

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on February 15th, the yen strengthened against the dollar. A landslide win by the Liberal Democratic Party (LDP) in the Lower House election boosted expectations toward stabilizing Japanese politics. The USDJPY fell throughout the week to enter the 152 yen range. Meanwhile, widespread uncertainty over the U.K.'s Starmer Cabinet sparked a sell-off of the pound.

February 9 (Mon)

Following the LDP's landslide win in the Lower House election, the USDJPY started the weekly trading session by extending its rally to the 157.6 yen range. However, expectations of political stability in Japan spurred yen buying, pushing the pair down to the 155.5 yen range.

Meanwhile, the EURUSD jumped to the 1.19 range, and the GBPUSD climbed to the 1.37 range intraday.

February 10 (Tue)

The yen continued to be preferred over the dollar. Additionally, U.S. Secretary of Commerce Howard Lutnick seemingly allowed a weak dollar. Furthermore, some media outlets reported that the Chinese government requested its banks reduce their holdings of U.S. Treasuries. As a result, the USDJPY dropped as low as 154.05 yen.

The EURUSD climbed to the 1.192 range. Conversely, political uncertainty in the U.K. caused the GBPUSD to dip to the lower 1.36 range.

February 11 (Wed)

While the Tokyo market was closed due to a national holiday, the USDJPY extended its decline earlier in the day. Later, U.S. employment figures for January propelled the pair to the 154.5 yen range. However, it then plummeted to the 152.5 yen range.

The EURUSD and GBPUSD were also sensitive to these significant fluctuations. The former plummeted to the 1.183 range, while the latter tumbled from the 1.371 range to the 1.360 range.

February 12 (Thu)

After dropping to a daily low of 152.26 yen earlier in the day, the USDJPY rebounded to temporarily enter the 153.7 yen range. However, throughout the day, the pair mainly straddled the 153.0 yen level.

The EURUSD was also directionless as the pair hovered in the upper 1.18 range. The GBPUSD rebounded to the 1.367 range but soon afterward fell back down to the lower 1.36 range.

February 13 (Fri)

The USDJPY moved steadily during Tokyo and London trading hours, reaching a daily high of 153.66 yen. However, the weaker-than-expected U.S. Consumer Price Index (CPI) for January triggered a sell-off of the dollar, pushing the pair down to the 152.6 yen range.

Meanwhile, after wild fluctuations, the EURUSD closed the daily trading session unchanged from the previous day, remaining in the upper 1.18 range. The GBPUSD halted its downtrend and rallied to the 1.365 range to conclude the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

February 15 (Sun)

- 23:50 Japan: October-December Quarterly Gross Domestic Product (preliminary GDP)

February 16 (Mon)

- Closure: U.S. (national holiday)

February 18 (Wed)

- 19:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting minutes

February 19 (Thu)

- 23:30 Japan: January Consumer Price Index (CPI, all items, year-on-year data)

- 23:30 Japan: January Consumer Price Index (CPI, all items less fresh food)

- 23:30 Japan: January Consumer Price Index (CPI, all items less fresh food and energy)

February 20 (Fri)

- 13:30 U.S.: December Personal Consumption Expenditures (PCE deflator)

- 13:30 U.S.: December Personal Consumption Expenditures (PCE core deflator, excluding food and energy)

- 13:30 U.S.: October-December quarterly real Gross Domestic Product (preliminary GDP)

- 15:00 U.S.: December new home sales

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

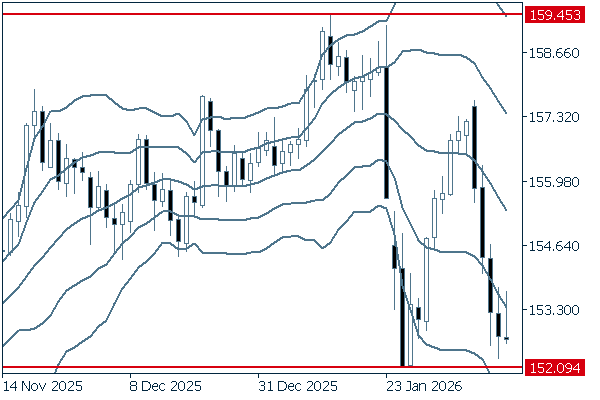

USDJPY

Japan's Takaichi Cabinet is expected to maintain its expansionist fiscal policy following its landslide electoral victory. Accordingly, the yen may face persistent selling pressure due to concerns about fiscal deterioration. Meanwhile, the USDJPY fell and entered 152 yen last week and is approaching 152.1 yen, a daily low on January 27th. If the pair drops below this crucial level, there is a possibility that it will fall to as low as 150 yen.

Next is an analysis of the USDJPY daily chart.

Five consecutive negative candlesticks appear on the daily chart. The middle line is also trending downward. The pair is now approaching the recent low of 152.09 yen. If the pair falls below this level, it may target 150 yen.

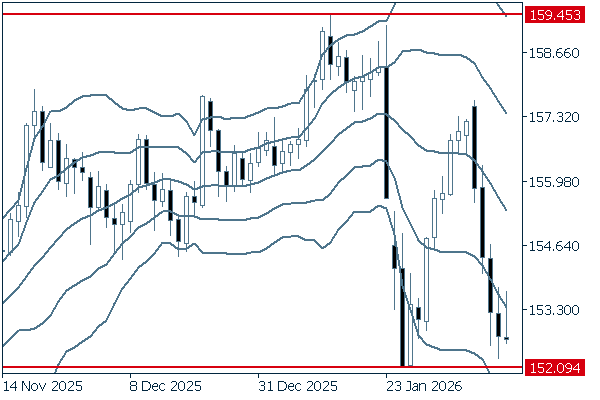

We continue with an analysis of the USDJPY weekly chart.

After the two-week rally, the pair offset it last week. If the pair fails to rebound at 152.09 yen and drops below that level instead, it will be safe to say that the downtrend will likely continue, as indicated by the daily chart.

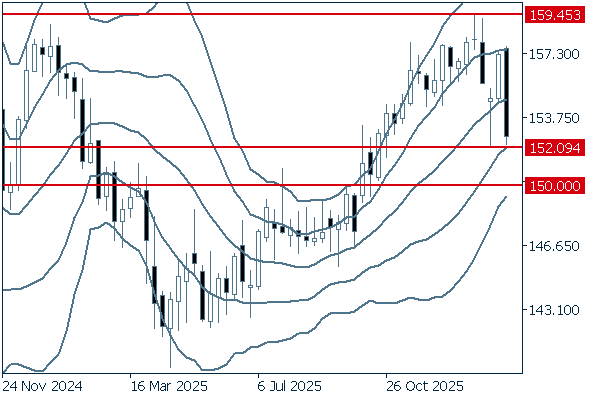

EURUSD

Officials at the European Central Bank (ECB) are split over their views on a strong euro. This makes it difficult for traders to favor the euro. However, if the eurozone business confidence improves, the trend of euro selling is expected to recede.

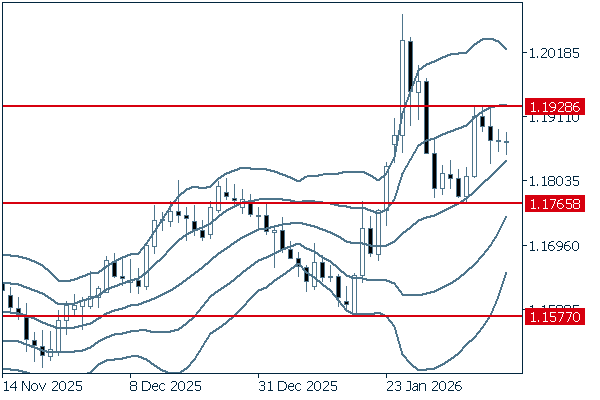

Next is an analysis of the EURUSD daily chart.

The pair is fluctuating above the middle line. Therefore, it is better to make sure to buy on dips. In the short term, it is important to focus on whether the pair can break above the 1.1928 level. If so, it will be safe to say that the uptrend will likely continue.

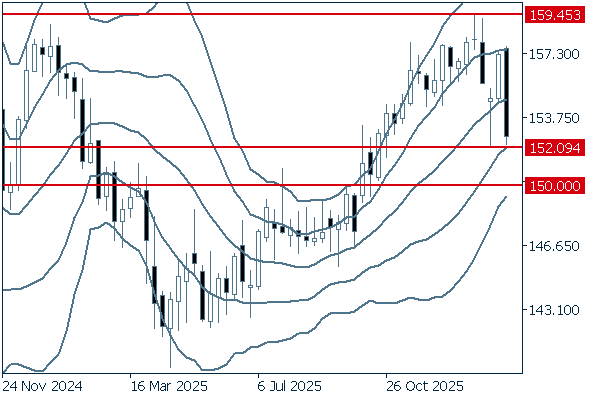

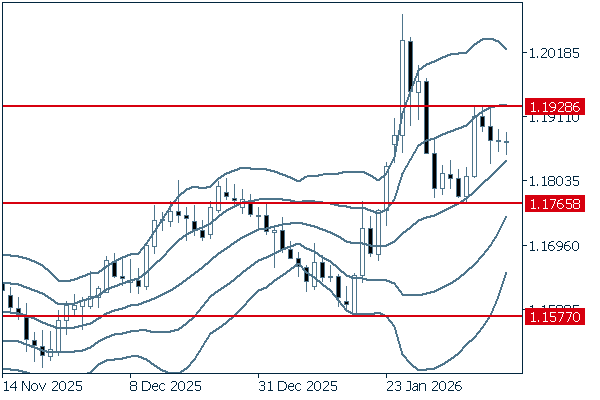

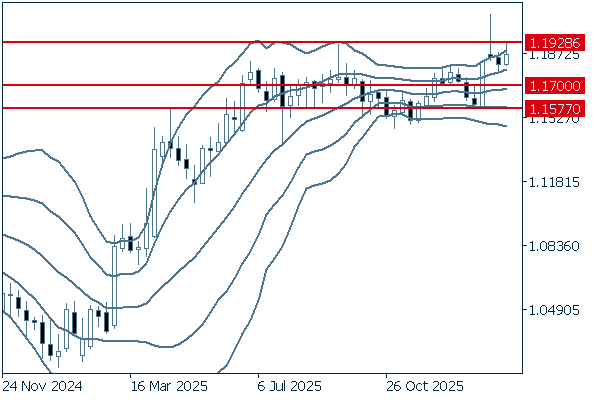

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, the pair broke above the upper limit of the fixed band but later moved back within it. Nevertheless, it can stay above +1σ. As long as the pair keeps fluctuating above the 1.17 level, it is safe to say that the uptrend will likely continue.

GBPUSD

Recent economic indexes highlight the weakness of the U.K. economy, leading to lingering concerns over an economic downturn. If the January U.K. CPI, due out on February 18th, misses expectations, the sell-off of the pound will intensify as speculation of a rate cut mounts.

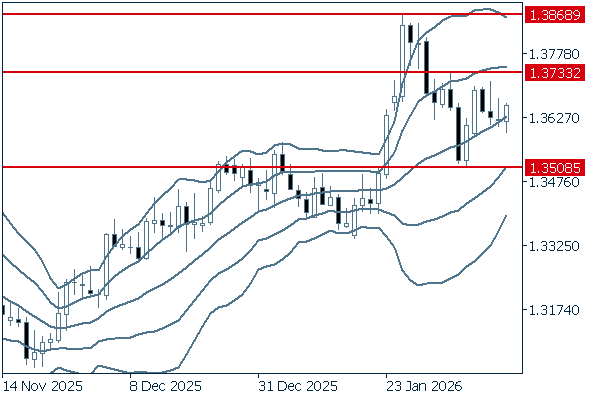

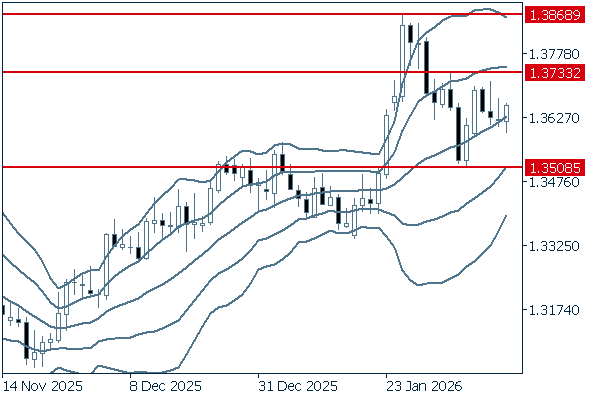

Next is an analysis of the GBPUSD daily chart.

On the daily chart, the pair appears directionless. However, the middle line is trending upward. The current target of the pair is the 1.3733 level. As long as it stays above 1.3508, it is safe to say the uptrend will likely continue.

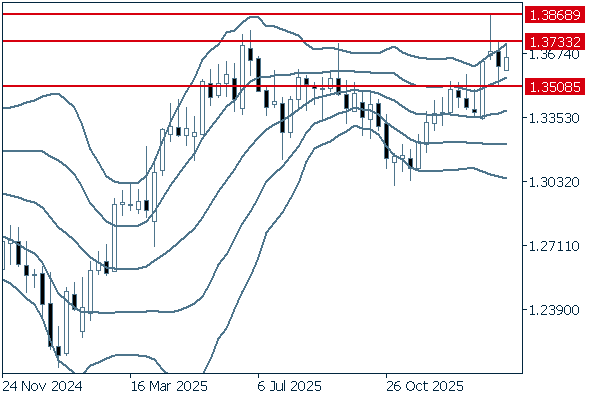

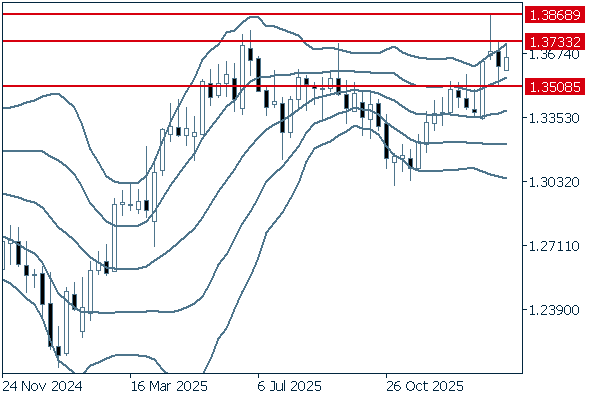

We continue with an analysis of the GBPUSD weekly chart.

After reaching the 1.3868 level, the pair came back inside the band. Nevertheless, the pair rose last week and remains above +1σ, as indicated by the most recent positive candlestick. Although selling pressure increases at high levels, it is safe to say that the uptrend will likely continue as long as the pair stays above the 1.3508 level.

Don't miss trade opportunities with a 99.9% execution rate.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy