2025.08.25

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign currency market for the week that ended on August 24th, traders maintained a wait-and-see attitude as Federal Reserve Bank (FRB) Chair Jerome Powell's speech at the Jackson Hole Economic Policy Symposium approached. Powell's speech triggered a sell-off of the dollar, causing the USDJPY to experience a significant fall. Meanwhile, the euro and the pound strengthened against the dollar.

August 18 (Mon)

The foreign exchange market started the weekly trading session as the dollar strengthened against major currencies amid a lack of significant news. The USDJPY rose to the 147.9 yen range. Meanwhile, the EURUSD fell to the 1.165 range, and the GBPUSD nearly broke below the 1.35 level.

August 19 (Tue)

Standard & Poor's (S&P) Global Ratings reaffirmed its AA+/A-1+ credit rating for the U.S. Following this announcement, the USDJPY rose above the 148 yen level but then fell back to the upper 147 yen range. The EURUSD reached the 1.169 range but then declined to the 1.164 range. The GBPUSD followed suit, dropping to the 1.347 range after reaching the 1.353 range.

August 20 (Wed)

As the Jackson Hole Symposium approached, a wait-and-see atmosphere dominated the market. Traders' risk-off stance and the increase in Japanese bond yields triggered buying of the yen, sending the USDJPY below the 147 yen level.

Meanwhile, the EURUSD rebounded to touch the 1.167 range. The GBPUSD recovered to the 1.35 range before falling to the 1.344 range.

August 21 (Thu)

The stronger-than-predicted U.S. preliminary PMI for August lowered speculation about a U.S. rate cut.

Consequently, the dollar was bought back, and the USDJPY rose to the 148.4 yen range. Conversely, the EURUSD almost broke below the 1.16 level, and the GBPUSD fell near the 1.34 level.

August 22 (Fri)

Soon after FRB Chair Powell indicated at the Jackson Hole Symposium that the central bank would cut interest rates soon, the dollar sell-off intensified. The USDJPY dropped by about two yen before his speech to the 146.5 yen range.

Both the euro and the pound strengthened against the dollar. The EURUSD jumped to 1.174, and the GBPUSD rebounded to the 1.354 range to close the weekly trading session.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

August 25 (Mon)

- 14:00 U.S.: July new home sales

August 28 (Thu)

- 11:30 Europe: European Central Bank (ECB) Governing Council meeting minutes

- 12:30 U.S.: April-June quarterly real Gross Domestic Product (revised GDP)

August 29 (Fri)

- 12:30 U.S.: July Personal Consumption Expenditures (PCE deflator)

- 12:30 U.S.: July Personal Consumption Expenditures (PCE core deflator, excluding food and energy)

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

Powell's speech increased the likelihood of an interest rate cut by the FRB in September. However, it is also pointed out that the Trump tariffs may prolong inflation. Whether the inflation will last will be indicated by the U.S. PCE core deflator, to be announced on August 29th.

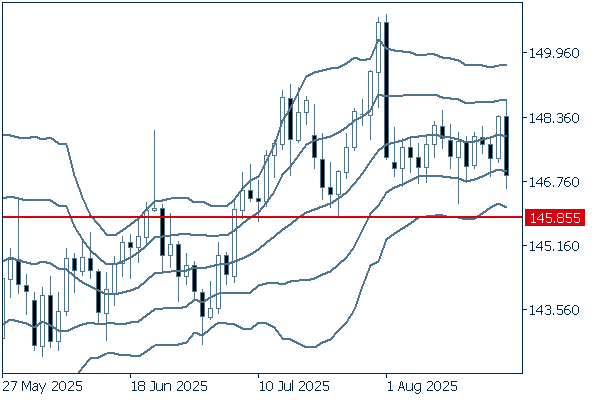

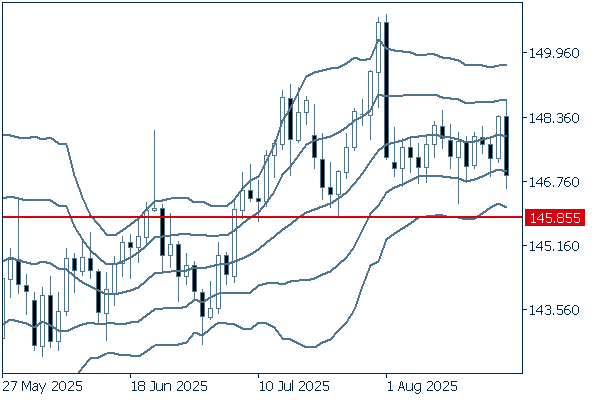

Next is an analysis of the USDJPY daily chart.

Last Friday, the pair touched +1σ but then closed the weekly trading session by touching -1σ. Overall, the pair has been fluctuating within a range. Although the higher low trend is confirmed, if the pair clearly breaks below 145.85 yen, it would be better to consider the pair to be in a downtrend.

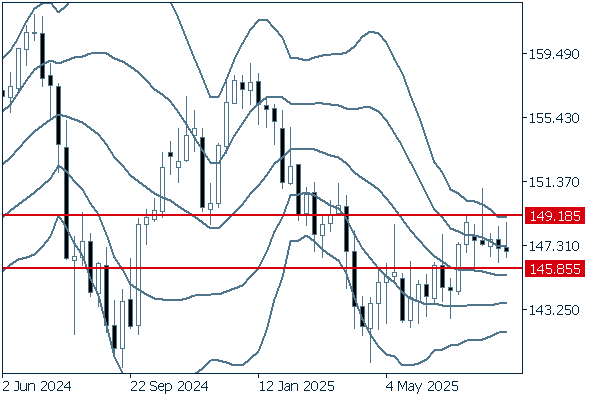

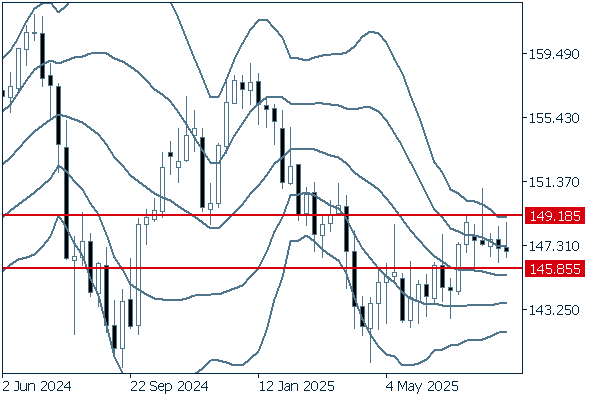

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair is hovering on the downward +1σ, indicating mounting selling pressure. It would be better to follow the trend. If the pair rises above 149.18 yen, it will enter an uptrend. Conversely, if it crosses below 145.85 yen, a downtrend will begin.

EURUSD

Powell's speech increased the likelihood of a U.S. interest rate cut and triggered a dollar sell-off. If this trend continues, the euro will strengthen against the dollar. However, there is also a risk of a sudden decline due to developments in U.S. tariff policies, the situation in Ukraine, and other geopolitical risks.

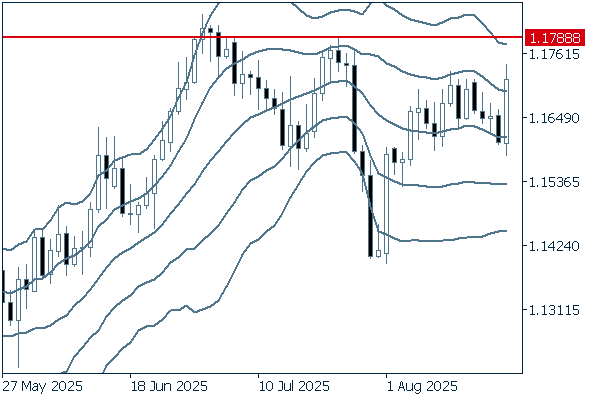

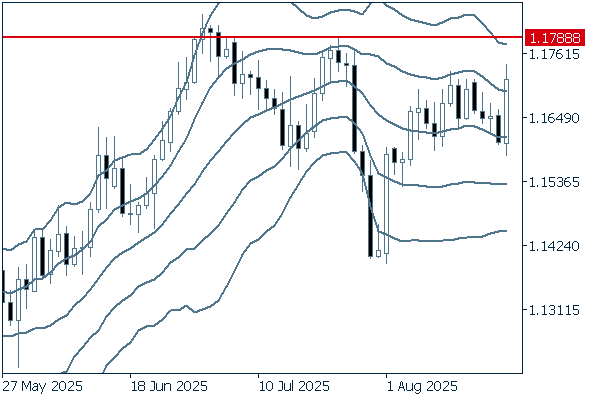

Next is an analysis of the EURUSD daily chart.

After fluctuating between +1σ and the middle line, the pair broke a recent high last Friday. If it breaks above 1.1788, it will continue to rise.

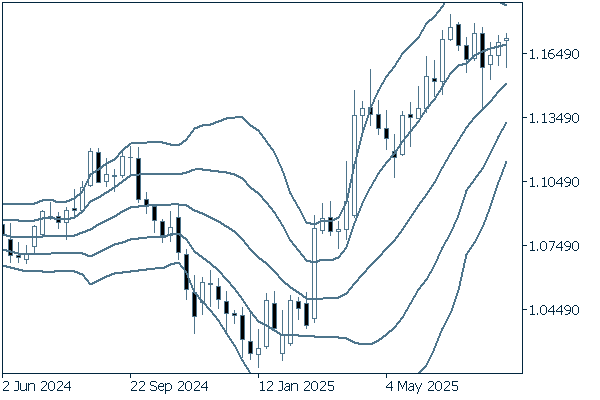

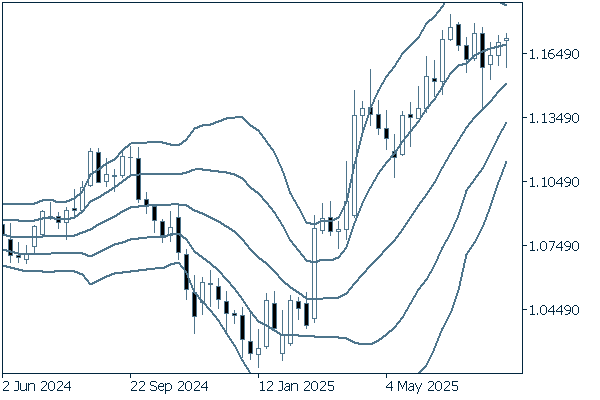

We continue with an analysis of the EURUSD weekly chart.

On the weekly chart, three consecutive positive candlesticks appeared. The latest candlestick has a long lower wick, indicating strong buying pressure. Since the middle line is trending upward, it is safe to say that the pair's uptrend will likely continue.

GBPUSD

At the end of last week, speculation about a U.S. interest rate cut triggered a dollar sell-off. It halted the decline of the pound. It will be important to watch whether the pair breaks above 1.36. The U.S. PCE deflator, to be announced on August 29th, will signal the trend of U.S. inflation.

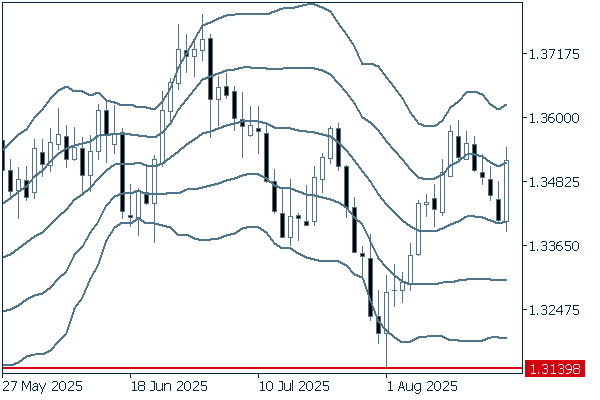

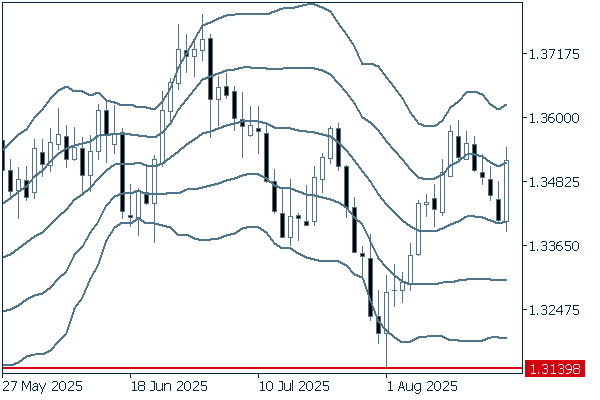

Next is an analysis of the GBPUSD daily chart.

The pair dropped after reaching 1.36. Then, just before the pair broke below the middle line, the pound was bought back. It will be important to watch whether the pair can break above the resistance line located at around 1.36. Unless the pair falls below 1.3139, it is safe to say that it will likely continue to rise.

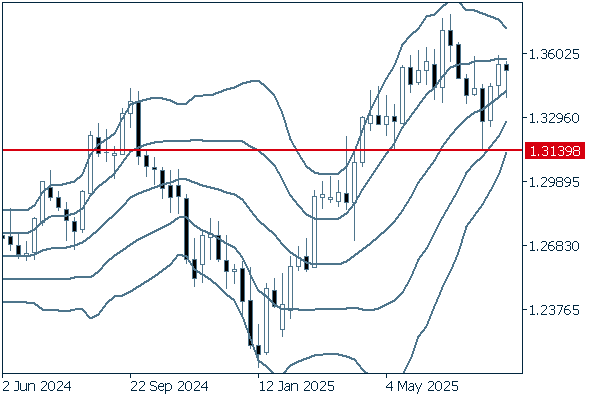

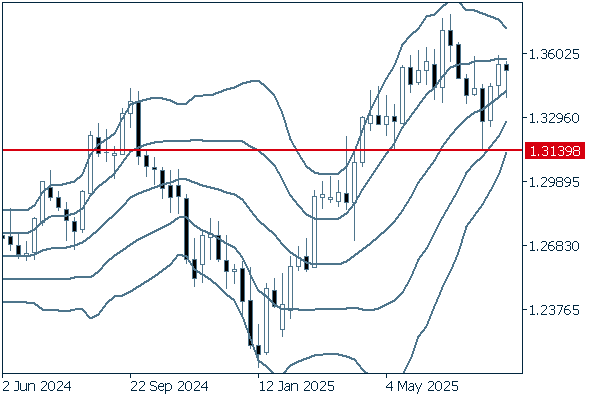

We continue with an analysis of the GBPUSD weekly chart.

The pair continues to rally after hitting 1.3139. The upward middle line on the weekly chart indicates an ongoing uptrend. It will now be important to watch whether the pair can break above the 1.36 level.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy