2025.06.16

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on June 15th, the dollar weakened against other major currencies due to weaker-than-expected U.S. inflation data early in the week. Later, however, rising tensions in the Middle East and uncertainty surrounding U.S. tariff policies prompted traders to take a risk-off stance and buy both the dollar and the yen.

The EURUSD remained firm because the market speculated that the European Central Bank (ECB) would halt the rate cuts. The GBPUSD faced growing selling pressure on the pound due to weak U.K. economic data and concerns over U.K. financial problems.

June 9 (Mon)

The USDJPY started the weekly trading session with a dominant dollar sell-off. The pair dipped below the 144 yen level during London trading hours but then rebounded to the upper 144 yen range. Meanwhile, the EURUSD hovered around 1.14, while the GBPUSD reached a high of 1.358 and then remained unchanged.

June 10 (Tue)

Comments from Bank of Japan (BOJ) Governor Kazuo Ueda sparked a sell-off of the yen. The USDJPY climbed to 145.29 yen. However, amid speculation about China-related progress in U.S.-China trade negotiations, the yen was bought, and the pair fell back. Later, during New York trading hours, the pair recovered to the 145 yen range.

As the dollar strengthened, the EURUSD fell below the 1.14 level but then rebounded to the 1.144 range. The GBPUSD remained weak, falling to the 1.345 range before recovering to the 1.353 range.

June 11 (Wed)

U.S. and Chinese officials reportedly reached an agreement on a framework to implement the Geneva Consensus on trade. This news helped the USDJPY fluctuate steadily within the 145 yen range. However, weaker-than-expected U.S. CPI pushed the pair down to the 144.3 yen range.

The weakening dollar pushed the EURUSD up just below the 1.15 level and helped the GBPUSD rebound from the 1.348 range to 1.356.

June 12 (Thu)

President Donald Trump stated that the U.S. would impose tariffs as planned if its counterparts showed reluctance to negotiate. Furthermore, tensions in the Middle East were growing. These factors prompted traders to strengthen their risk-off stance and buy the yen while selling the dollar. As a result, the USDJPY fell to the 143.1 yen range.

Meanwhile, the EURUSD remained steady and rose to the 1.16 range. The GBPUSD rose and touched the 1.362 range.

June 13 (Fri)

Israel launched a military operation against Iran. Traders strengthened their risk-off stance, favoring the simultaneous purchase of two safe assets: the dollar and the yen. The USDJPY rebounded sharply from the 142.9 yen range to recover to the mid-144 yen range.

Conversely, the EURUSD temporarily fell below the 1.15 range. The GBPUSD fluctuated widely, falling from the 1.363 range to the 1.351 range before closing the weekly trading session in the mid-1.35 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

June 17 (Tue)

- TBA Japan: Bank of Japan (BOJ) Monetary Policy Meeting, post-meeting policy rate announcement

- 06:30 Japan: Regular press conference by BOJ Governor Kazuo Ueda

- 12:30 U.S.: May retail sales

- 12:30 U.S.: May retail sales (excluding automotives)

June 18 (Wed)

- 09:00 Europe: May Harmonised Index of Consumer Prices (revised HICP)

- 09:00 Europe: May Harmonised Index of Consumer Prices (revised HICP core index)

- 18:00 U.S.: Federal Reserve Open Market Committee (FOMC) meeting, post-meeting policy rate announcement

- 18:30 U.S.: Regular press conference by Federal Reserve Chairman Jerome Powell

June 19 (Thu)

- 11:00 U.K.: Bank of England (BOE) policy interest rate announcement

- 11:00 U.K.: Minutes of Bank of England Monetary Policy Committee (MPC) meeting

- 23:30 Japan: May Consumer Price Index (CPI, all items, year-on-year data)

- 23:30 Japan: May Consumer Price Index (CPI, all items less fresh food)

- 23:30 Japan: May Consumer Price Index (CPI, all items less fresh food and energy)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

For the time being, market participants will maintain a risk-off stance as fears of an Israeli-Iranian military conflict linger. Additionally, the U.S. and Japanese central banks will announce their monetary policies. If the BOJ keeps its monetary policy unchanged, the yen will be sold. Conversely, if the FOMC changes its stance and hints at further rate cuts, the dollar will be sold.

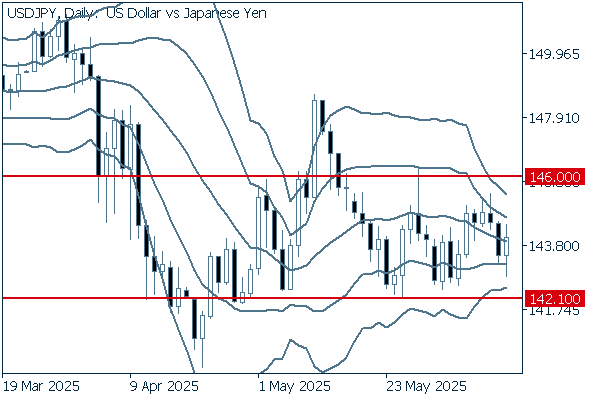

Next is an analysis of the USDJPY daily chart.

The pair remains within a range bounded by the resistance level located around 146.0 yen and the support level located around 142.1 yen. As the bandwidth narrows, it becomes important to watch for signs that the pair moves closer to breaking above the resistance level or below the support level, as this will determine the momentum.

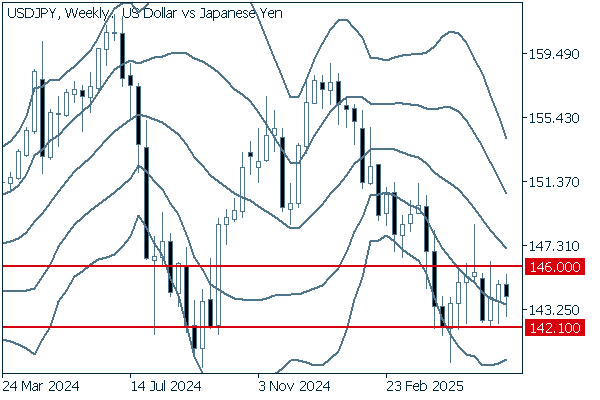

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair is hovering around -1σ with a range between 142.1 and 146.0 yen. This makes it difficult to predict the short-term direction. Although buying pressure has been increasing, the declining middle line indicates that traders are likely to sell on any rallies.

EURUSD

The weakening dollar helped the EURUSD break above the 1.16 level last week. However, rising tensions in the Middle East led traders to buy the dollar and the yen. Consequently, the euro's upward momentum is poised to slow down. The market will likely remain cautious until the outcome of the FOMC meeting is announced.

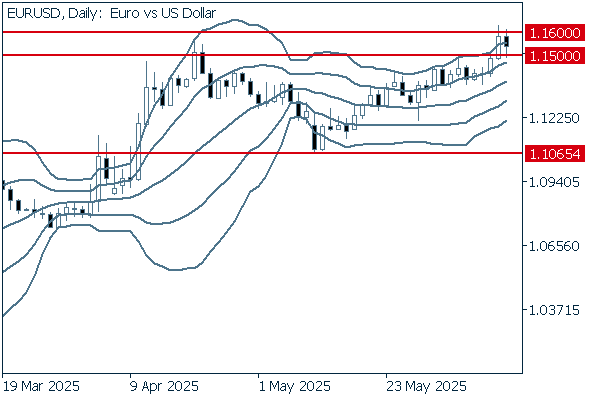

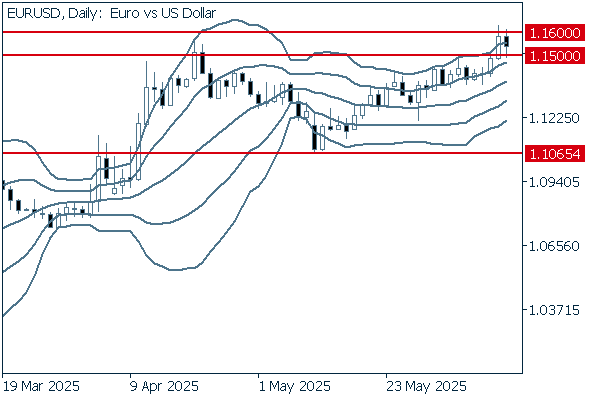

Next is an analysis of the EURUSD daily chart.

The pair has maintained its upward momentum since rebounding at the 1.1065 level in early May. However, it was pushed back after surpassing this April's monthly high. As the pair approaches the upper limit of the band, it might enter a short-term downtrend. Nevertheless, it is safe to say that the uptrend will likely continue.

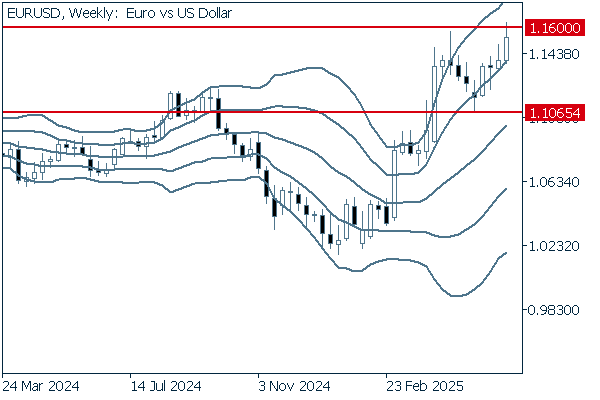

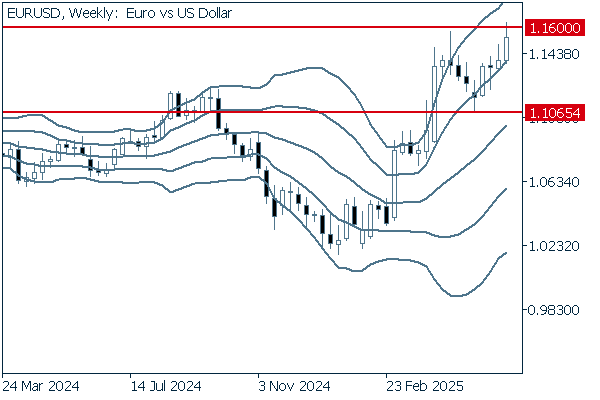

We continue with an analysis of the EURUSD weekly chart.

The weekly chart shows the upward band walk as the pair continues to climb along +1σ. Although there seems to be mounting selling pressure in the near term, it is safe to say that the current uptrend will likely continue. If the pair breaks above the 1.16 level, it will rise further.

GBPUSD

The BOE is scheduled to announce its interest rate policy on June 19. In the near term, however, the market will be affected by volatile dollar fluctuations due to rising tensions in the Middle East. While it is difficult to predict the direction of the pair, it will trend upward if the dollar weakens again.

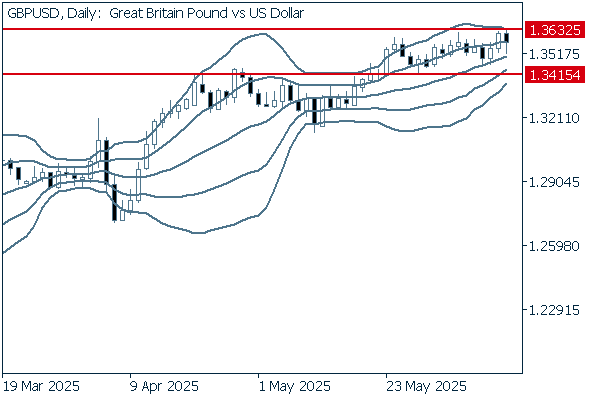

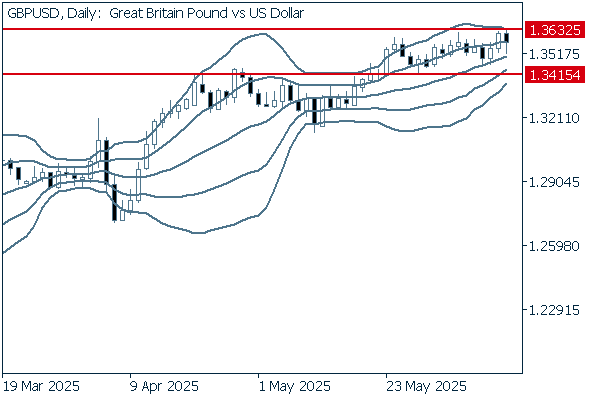

Next is an analysis of the GBPUSD daily chart.

The pair has been on an uptrend since bouncing back at the -2σ level in early May, fluctuating above the middle line. The line at 1.3415, which used to be a resistance line, will now serve as a support line, or the lower limit for dip buying.

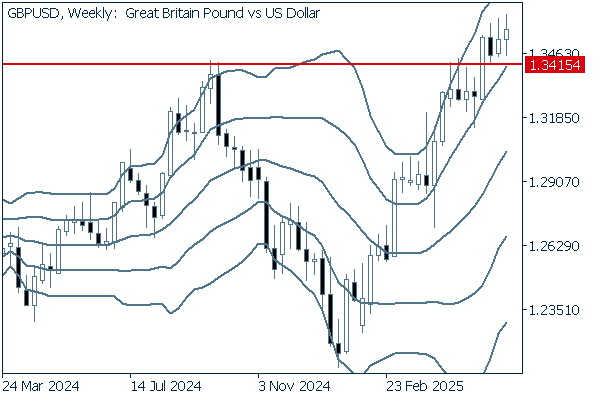

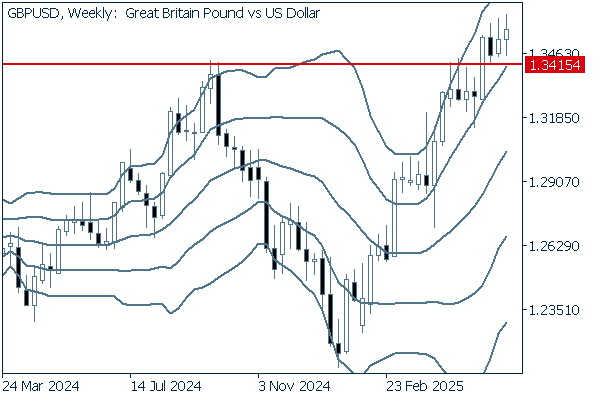

We continue with an analysis of the GBPUSD weekly chart.

The weekly chart shows the upward band walk as the pair continues to climb, though it experienced a short-lived range-bound phase during the rally. In last week's trading session, the pair dropped to around 1.3415. This level, a yearly high in 2024, is now considered a support line. Unless the pair falls below that level, it would be good to follow the trend.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy