2025.06.02

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

The development of the Trump tariffs dominated the foreign exchange market for the week that ended on June 1st. The USDJPY reached the 146 yen range but was later pushed back to the 143 yen range to close the weekly trading session. Both EURUSD and GBPUSD followed the dollar's behavior but were slightly sensitive to caution over political risk.

May 26 (Mon)

President Donald Trump announced that the U.S. would postpone the imposition of a 50% tariff on products imported from the E.U. until July 9th. However, this announcement increased uncertainty surrounding the tariff talks, causing the yen to strengthen against the dollar. The USDJPY fell to the 142.2 yen range during the daily trading session.

Following this behavior of the dollar, the EURUSD advanced to the 1.141 range before being pushed down. The GBPUSD also sagged after advancing to the 1.359 range.

May 27 (Tue)

Amid concerns over the U.S. government budget deficit, the USDJPY fell to around 142.10 yen. However, the pair then rebounded, rising to the 144.4 yen range, as the Japanese long-term bond yield plummeted.

In the meantime, the euro continued to weaken against the dollar, and the EURUSD fell to the 1.132 range. Also, the GBPUSD sagged to the 1.350 range after reaching the 1.358 range.

May 28 (Wed)

The USDJPY fluctuated wildly following statements from Kazuo Ueda, the governor of the Bank of Japan (BOJ), and John Williams, the president of the New York Federal Reserve. However, after President Trump announced the postponement of the tariff hike on imports from the E.U., the pair reached the 145 yen range.

Both the EURUSD and GBPUSD experienced sell-offs on the rally, with the former falling to the 1.128 range and the latter dropping to the 1.344 range.

May 29 (Thu)

The U.S. Court of International Trade (C.I.T.) ordered the Trump administration to suspend part of the Trump tariffs. This ruling eased market concerns about the trade wars and prompted traders to buy the dollar. As a result, the USDJPY jumped to 146.28 yen. However, the pair was pushed back down to 143.9 yen after the administration appealed the C.I.T. ruling to a federal appeals court and a weaker U.S. economic index was released.

Meanwhile, the EURUSD rose back to the 1.138 range, and the GBPUSD recovered to the 1.35 range.

May 30 (Fri)

Traders took a risk-off stance and bought the yen after media reports that the Trump administration was preparing a "Plan B" for the Liberation Day tariffs, which the C.I.T. had ruled illegal. Additionally, the strong Tokyo area CPI further weakened the dollar against the yen. The USDJPY fell to the 143.4 yen range before rebounding. The pair concluded the weekly trading session by hovering around the 144 yen level.

The euro weakened against the dollar as the EURUSD fell to the 1.134 range. Likewise, the GBPUSD fell to the 1.345 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

June 2 (Mon)

- 14:00 U.S.: May ISM Manufacturing PMI

- 17:00 U.S.: Statement by Federal Reserve Board (FRB) Chair Jerome H. Powell

June 3 (Tue)

- 09:00 Europe: May Harmonised Index of Consumer Prices (preliminary HICP)

- 09:00 Europe: May Harmonised Index of Consumer Prices (preliminary HICP core index)

June 4 (Wed)

- 12:15 U.S.: May ADP National Employment Report

- 14:00 U.S.: May ISM Non-Manufacturing PMI (composite)

June 5 (Thu)

- 12:15 Europe: European Central Bank (ECB) Governing Council policy interest rate announcement

- 12:15 Europe: Regular press conference by ECB President Christine Lagarde

June 6 (Fri)

- 09:00 Europe: January-March quarterly regional gross domestic product (revised regional GDP)

- 12:30 U.S.: May change in nonfarm payrolls

- 12:30 U.S.: May unemployment rate

- 12:30 U.S.: May average hourly earnings

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1σ and ±2σ standard deviation Bollinger Bands, with a 20-period moving average.

USDJPY

While the C.I.T. had ruled the Trump tariffs illegal, the Trump administration challenged the ruling. The market will be sensitive to the outcome of the court battle. Additionally, persistent concerns about a potential triple sell-off of bonds, stocks, and the dollar seem to be preventing traders from taking a risk-on stance and buying the dollar.

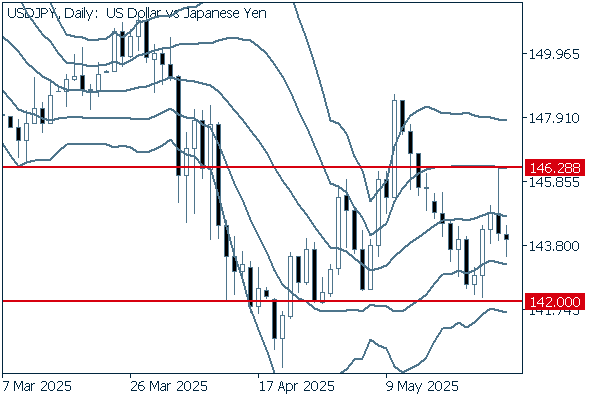

Next is an analysis of the USDJPY daily chart.

There is no clear direction yet, but it seems that the pair is trending downward from 146.28 yen. Meanwhile, the pair has experienced several rebounds at around 142 yen. If it falls below this level, it will likely drop to 140 yen.

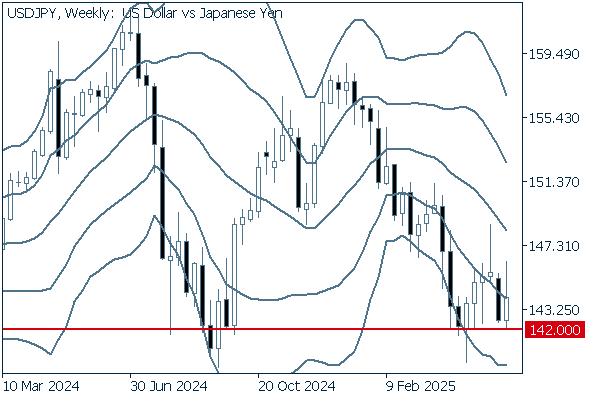

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair had edged toward the middle line before being pushed down again. Even the most recent positive candlestick indicates strong selling pressure. It will be important to see whether the pair falls below 142 yen to conclude the weekly trading session.

EURUSD

The ECB is expected to cut its key policy interest rate by 0.25% at the Governing Council meeting on June 5th. However, some council members are reluctant to make additional rate cuts. The uncertainty surrounding U.S. tariff policy will likely contribute to a weaker dollar, which will put upward pressure on the EURUSD.

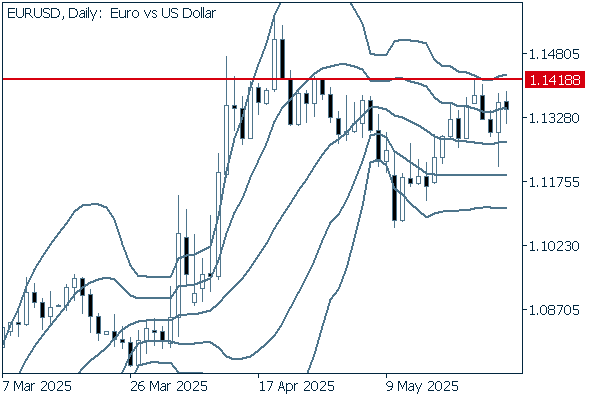

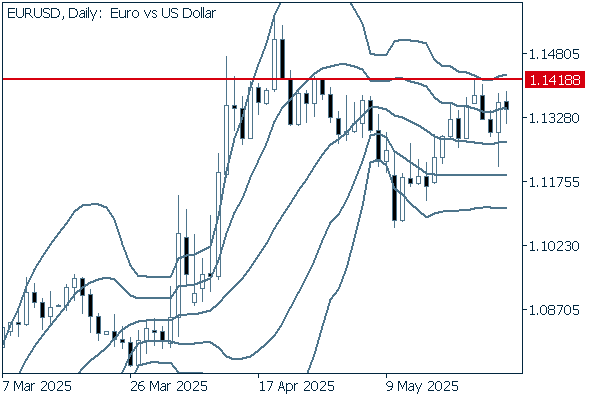

Next is an analysis of the EURUSD daily chart.

The daily chart shows that the pair has experienced rebounds when falling below the middle line. Currently, it is hovering in the stratosphere. If it breaks above the current resistance level lying at 1.1418, it may rise toward 1.15.

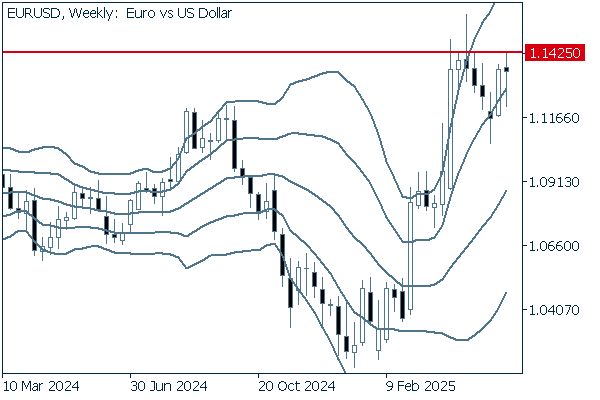

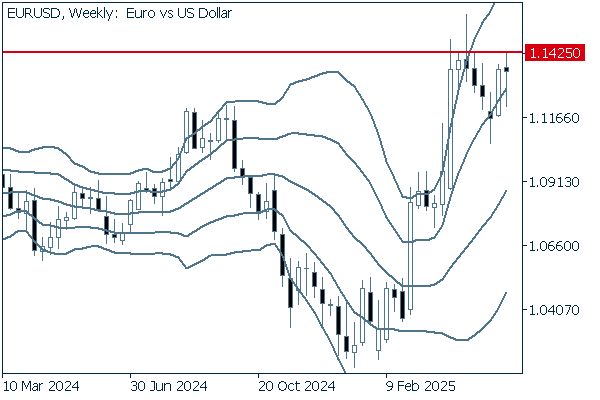

We continue with an analysis of the EURUSD weekly chart.

The pair broke above +2σ then fell back into the bandwidth. However, it is now attempting to move higher again after finding a bottom. If it clearly breaks above the recent high of 1.1425, it will likely signal a continuation of the uptrend.

GBPUSD

The C.I.T. ruling and the resulting controversy in the U.S. are expected to trigger a sell-off of the dollar as uncertainty mounts. Meanwhile, solid British economic indicators and the BOE's cautious stance on interest rate cuts are likely to strengthen the pound.

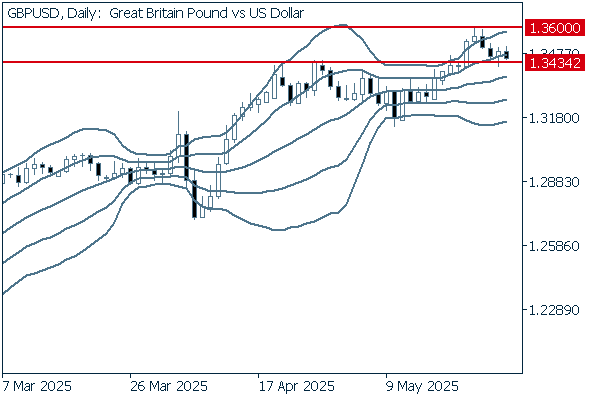

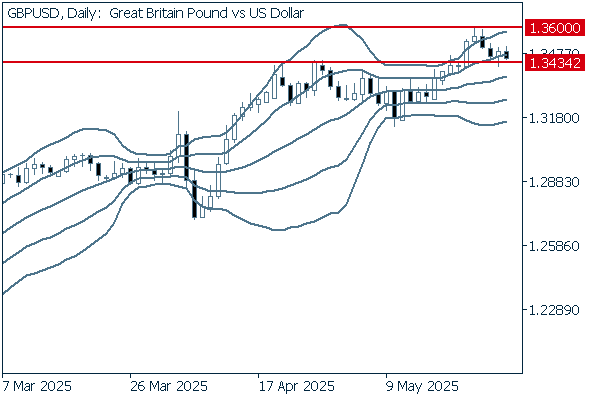

Next is an analysis of the GBPUSD daily chart.

The pair continues to hover above the middle line. A dip below +1σ indicates a potential buying opportunity. If the pair clearly breaks below 1.3434, it will likely decline to the level of the middle line. However, it is safe to say that the uptrend will likely continue.

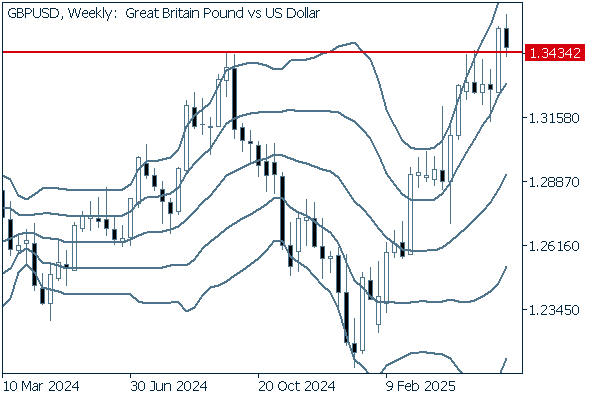

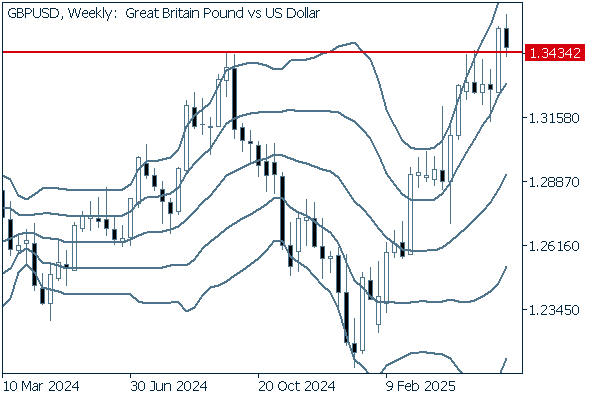

We continue with an analysis of the GBPUSD weekly chart.

The pair is rising along the upward band walk. The line lying at 1.3434, the yearly high in 2024 and formerly a resistance line, is now seen as a support line. Unless the pair clearly breaks below this line, it is safe to assume that the uptrend will continue.

Don't miss trade opportunities with a 99.9% execution rate

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy