2024.09.30

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

Currency markets in the week ended September 29 were marked by a range-bound USDJPY that was mostly directionless until mid-week, then volatility set in due to the events and outcome of Japan's ruling party presidential election on Friday. Ultimately, Shigeru Ishiba's victory in the presidential election led to sharp yen buying, and the USDJPY plummeted to close around 142 yen.

Let's review the market movements through the week.

September 23 (Mon)

The Tokyo market was closed for Japan's Autumnal Equinox Day holiday, with low liquidity in the market. This sent the USDJPY slightly higher, hovering around the 143 to 144 level.

September 24 (Tue)

The USDJPY temporarily rose to the upper 144 level after Bank of Japan Governor Kazuo Ueda said in a speech that the BOJ has plenty of time to consider a possible rate hike.

However, a lower-than-expected September consumer confidence index released in the U.S. led to dollar selling, with the USD dropping to the upper 142 level overnight.

September 25 (Wed)

New home sales in the U.S. came in at 716,000 in August, above the forecast of 700,000, but down 4.7% from the previous month. The USDJPY rebounded, with dollar bulls gaining momentum as U.S. long-term interest rates rose.

Also on Wednesday, the EURUSD fell from its high near 1.121 during the New York session to close at around 1.114.

September 26 (Thu)

The USDJPY rose to briefly test the 145 level, but jittery trades persisted as U.S. long-term interest rates fell and new unemployment insurance claims came in lower than expected.

September 27 (Fri)

Yen bears gained ground with the increasingly pervasive view that Sanae Takaichi, an advocate of aggressive fiscal policy, had a strong prospect of winning Japan's ruling party presidential election. The USDJPY temporarily rose to 146.49, its highest level since September 3.

However, the final votes resulted in an upset victory for Shigeru Ishiba, which triggered sharp yen appreciation. The USDJPY then plunged to the mid-143 level, after which adjustments upward were limited.

Furthermore, the U.S. personal consumption expenditures (PCE deflator) for August, released on the same day, came in at 2.2% year on year, lower than the 2.3% forecast, sending the USDJPY further downward on the view that inflationary pressures have eased. The PCE core deflator also came in at 0.1% month over month, below the 0.2% forecast, increasing selling pressure on the dollar.

The USDJPY would end the week wiping out much of any gains it made during the week, closing the week's trading in the lower 142 range.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

September 30 (Mon)

06:00, U.K.: April-June quarterly gross domestic product (revised GDP)

17:55, U.S.: Press conference by Federal Reserve Chairman Jerome Powell

23:50, Japan: Bank of Japan July-September Short-Term Economic Survey of Enterprises (Tankan)

October 1 (Tue)

09:00, Europe: September Harmonised Index of Consumer Prices (preliminary HICP, year-on-year data)

09:00, Europe: September Harmonised Index of Consumer Prices (preliminary HICP core index, year-on-year data)

14:00, U.S.: September ISM Manufacturing PMI

October 2 (Wed)

12:15, U.S.: September ADP National Employment Report (month-on-month data)

October 3 (Thu)

14:00, U.S.: September ISM Non-Manufacturing PMI (composite)

October 4 (Fri)

12:30, U.S.: September change in nonfarm payrolls (month-on-month data)

12:30, U.S.: September unemployment rate

12:30, U.S.: September average hourly earnings

This Week's Forecast

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

The results of Japan's ruling party presidential election have completely changed the direction of the USDJPY. Friday's close, leaving a tall negative candle with a long upper whisker, suggests that the yen will continue to appreciate into the open of next week.

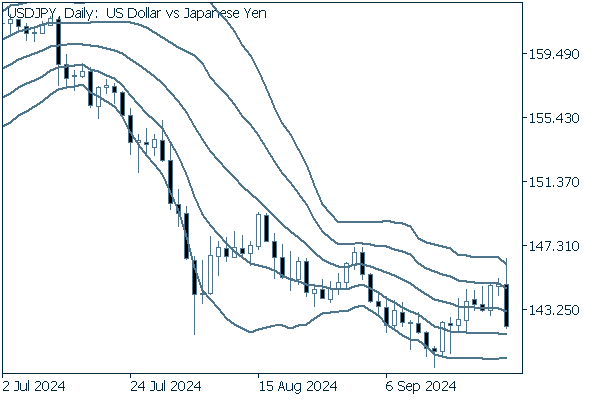

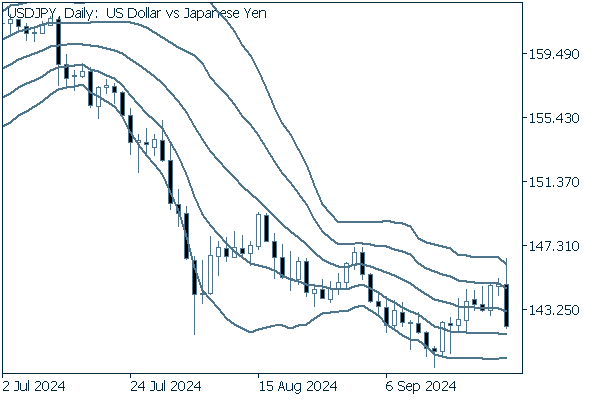

Next is an analysis of the USDJPY daily chart.

Since the pair's decline from July into early August, it had been largely directionless. However, following the results of Japan's ruling party presidential election last Friday, the pair dropped sharply from a point along the +2 standard deviation Bollinger Band to leave an upper whisker. This negative candle on Friday was tall enough to break below the middle line.

However, we note that the middle line has finally turned slightly downward, but has not yet shown a resolute directional sense.

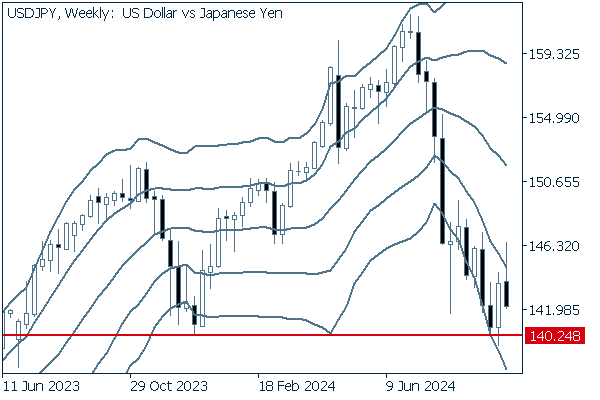

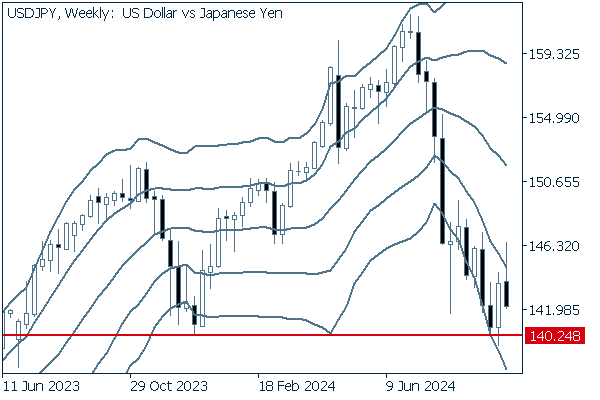

We continue with an analysis of the USDJPY weekly chart.

Though the pair attempted a break above the -1 standard deviation Bollinger Band, it eventually closed down with an upper whisker.

It is possible that the low of 140.24 and the 139 level will be tested after the next week opens.

EURUSD

If the aftermath of the yen buying and dollar selling trend spills over into the EURUSD, the EURUSD may rise in response to dollar selling.

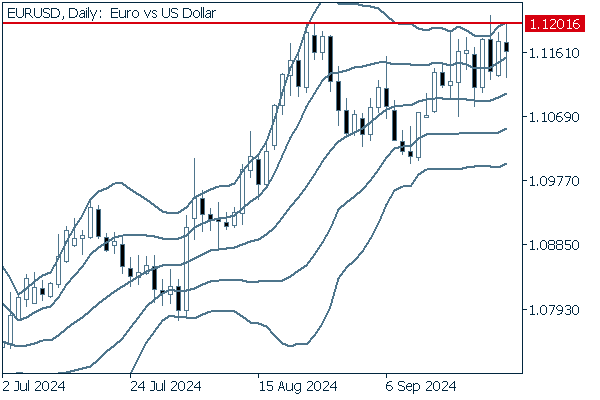

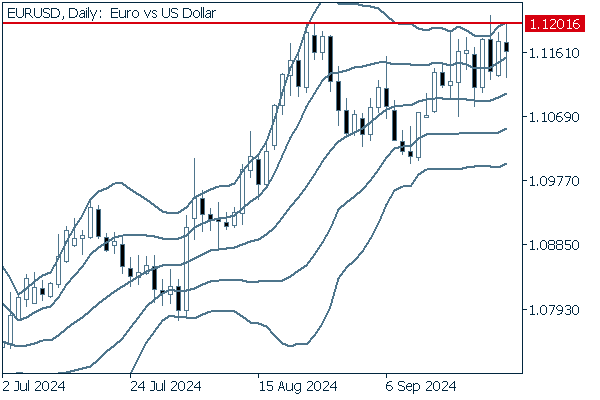

Next is an analysis of the EURUSD daily chart.

The price continues to bounce off the recent high at 1.1201. The rightmost negative candle from Friday has once again failed to close above this recent high, leaving an upper whisker.

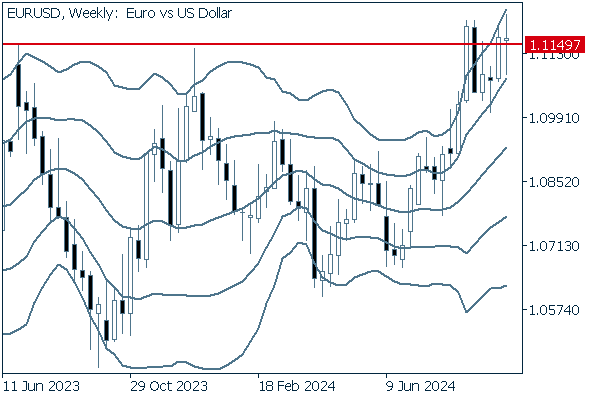

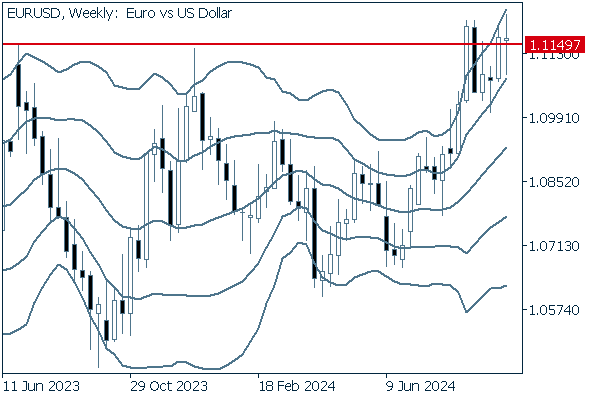

We continue with an analysis of the EURUSD weekly chart.

The weekly chart shows two consecutive closes above the 1.1149 level.

The middle line is rising steadily and the price is located between the +1 and +2 standard deviation Bollinger Bands, a chart pattern suggesting strong buying pressure.

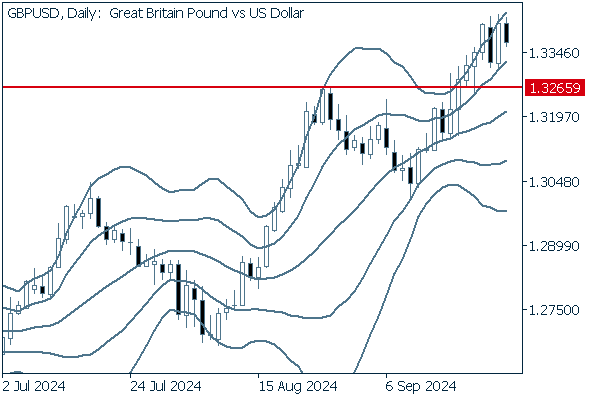

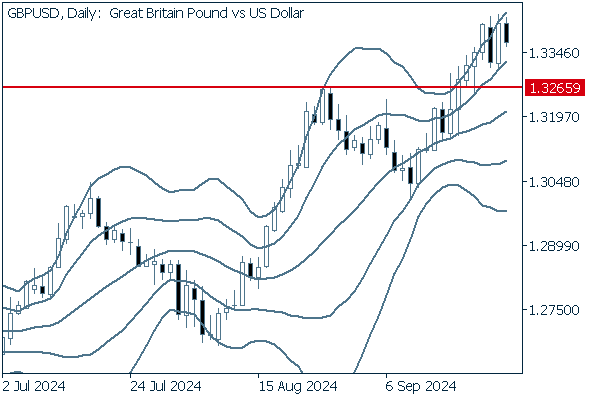

GBPUSD

The GBPUSD's chart shows a shape with glimpses of greater upward pressure compared to the EURUSD. As with the EURUSD, an upside scenario should also be assumed.

Now, we analyze the daily GBPUSD chart.

The pair has broken cleanly above the previous high of 1.3265, and we can see an instance of the 1.3265 level functioning as a resistance turned support.

The middle line is also rising steadily, which can be read as a predominantly buying phase for the pair.

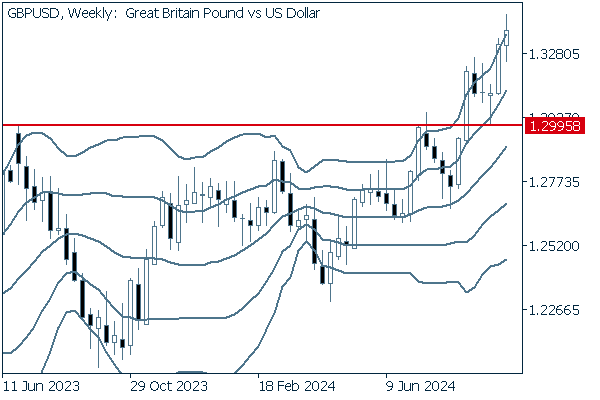

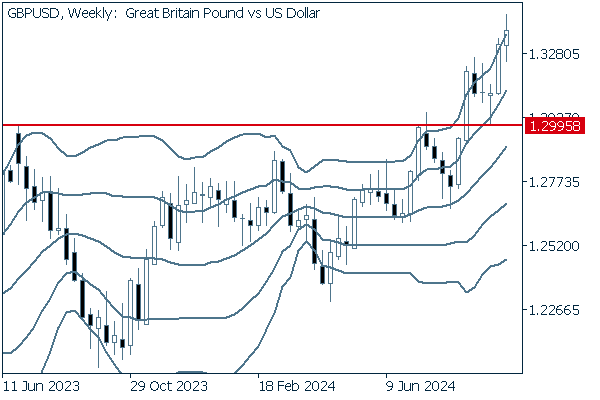

We continue with an analysis of the GBPUSD weekly chart.

Even on a weekly basis, the 1.2995 resistance, extremely close to the milestone 1.300 level, has also turned to function as a support now that the pair has broken above.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy