2024.03.18

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

Through the past week, the USDJPY rose while the EURUSD and GBPUSD moved to correct upward momentum. The USDJPY traded in the range of 146.48 to 149.16, with a break above 150 once again in sight.

There has been a sudden and new flood of media coverage about the Bank of Japan reversing from its negative interest rate policy, and some reports suggest this may be timed to coincide with the central bank's monetary policy meeting, to take place on March 18 and 19. However, since the USD continued to rise even after this news broke, it is highly likely that markets had already factored in a policy reversal by last week.

On March 11, the Japanese government released the country's quarterly real gross domestic product (revised values) for October to December. Year on year, quarterly real GDP rose 0.1% versus a forecast of 0.3%, while the annualized increase was 0.4% versus a forecast of 1.1%.

On March 12, much-awaited U.S. Consumer Price Index (CPI) data was released. The core index rose 0.4% month on month versus a 0.3% forecast, and was up 3.8% year on year versus a 3.7% forecast. Overall, the CPI data was generally in line with expectations, with only transitory fluctuation.

On March 13, the U.K. released its month-on-month GDP data for January. Data showed a 0.2% increase, matching a forecast of 0.2%.

On March 14, data was released for U.S. retail sales and the wholesale pricing index (Producer Price Index, or PPI). Month-on-month, retail sales rose 0.6% versus a forecast of 0.8%. When excluding the automotive sector, retail sales rose 0.3% month on month versus a 0.5% forecast.

The PPI rose 0.6% month on month versus a 0.3% forecast, and was up 1.6% year on year versus a 1.1% forecast. The PPI core index rose 0.3% month on month versus a 0.2% forecast, and was up 2.0% year on year versus a 1.9% forecast.

・ Economic Releases and Statements to Watch this Week

(All times are in GMT)

March 18 (Mon)

10:00 Europe: February Harmonised Index of Consumer Prices (revised HICP, year on year data)

10:00 Europe: February Harmonised Index of Consumer Prices (revised HICP core index, year on year data)

March 19 (Tue)

TBD (Japan) Bank of Japan monetary policy meeting, post-meeting policy rate announcement

06:30 (Japan) Regular press conference by Bank of Japan Governor Kazuo Ueda

18:00 (U.S.) Federal Reserve Open Market Committee (FOMC) meeting, post-meeting policy rate announcement

18:30 (U.S.) Regular press conference by Federal Reserve Chairman Jerome Powell

March 21 (Wed)

12:00 (U.K.) Bank of England (BOE, U.K. central bank) interest rate announcement

12:00 (U.K.) Bank of England Monetary Policy Committee (MPC) meeting

23:30 (Japan) February Consumer Price Index, Japan (CPI, all items, year on year data)

23:30 (Japan) February Consumer Price Index, Japan (CPI, all items less fresh food, year on year data)

23:30 (Japan) February Consumer Price Index, Japan (CPI, all items less fresh food and energy, year on year data)

While the reversal from negative interest rates in Japan is seen as a strong possibility, the market has incorporated a near-zero chance that U.S. rates will change, given the 98% probability that the FOMC will leave rates unchanged at its closest upcoming meeting on Wednesday the 20th according to the CME FedWatch tool.

This Week's Forecast

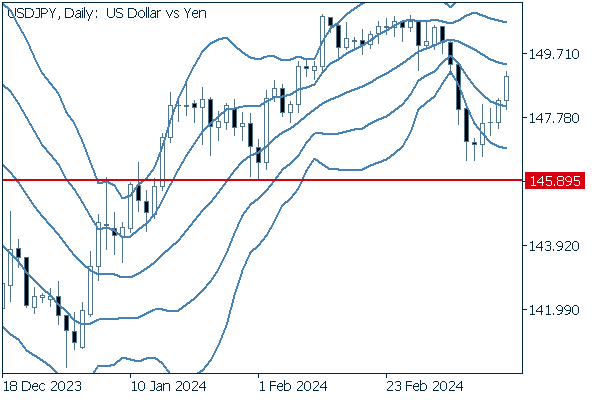

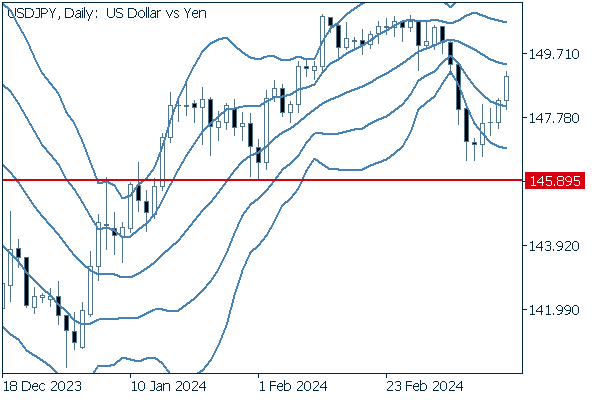

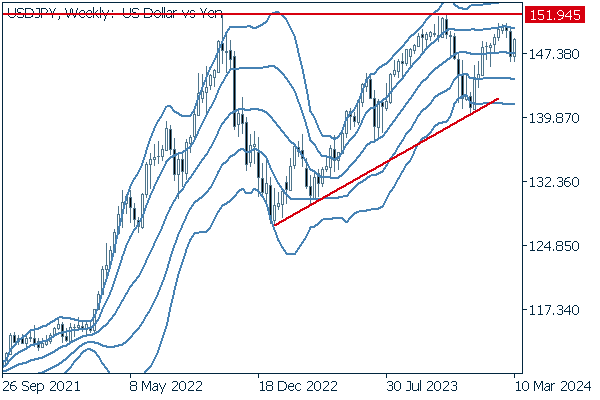

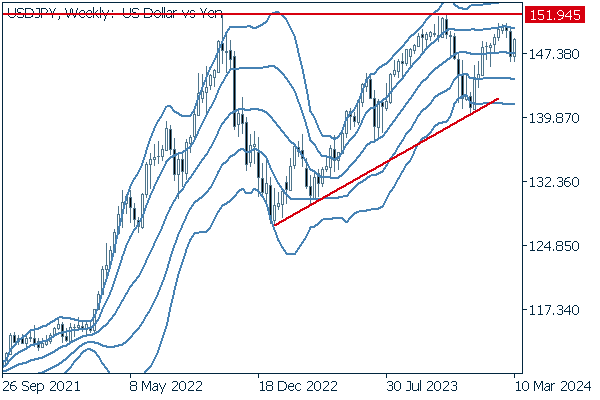

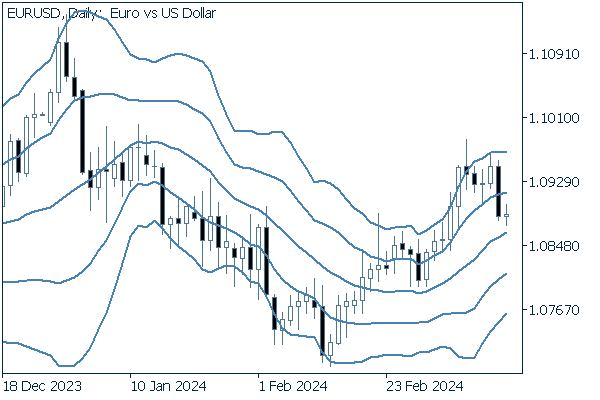

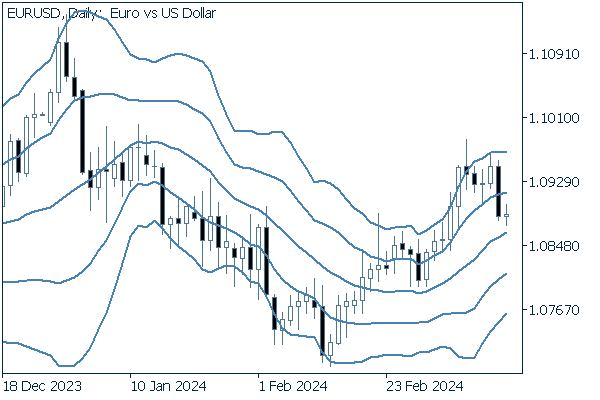

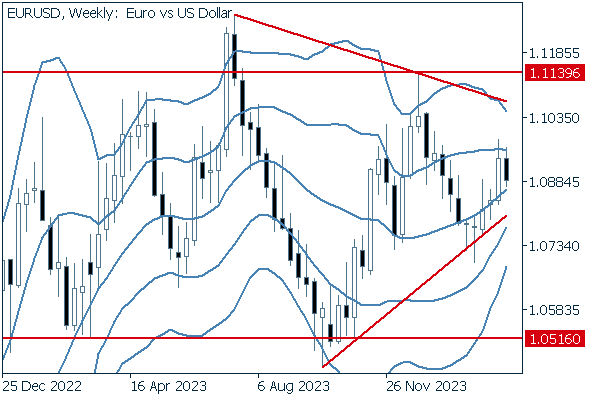

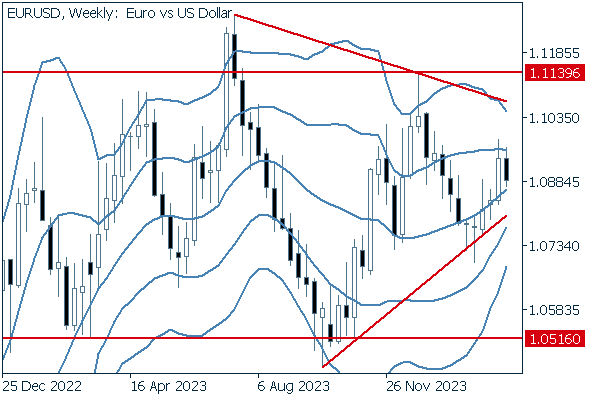

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

If the reversal of Japan's negative interest rate policy, i.e. an interest rate hike, is priced into the market, there would be little grounds to buy JPY. Conversely, since there is a strong expectation that there will be no USD interest rate cuts for some time, a case can be made for the USDJPY to re-enter a buying phase.

Traders may need to position themselves to incorporate a third attempt at a record high. Next is an analysis of the USDJPY daily chart.

Daily values suggest remaining upward momentum in the USDJPY due to the upward reversal beginning before touching the low of 145.89, the starting point from which the currency pair reached the year-to-date high for 2024.

The most recent candlestick above the -1 standard deviation Bollinger Band can also be interpreted as a sign selling momentum has weakened. Traders should be prepared for movement attempting to break above 150.

We continue with an analysis of the USDJPY weekly chart.

The weekly chart shows new support levels building above previous lows, and it would not be surprising to see the pair test highs one more time.

Looking at the Bollinger Bands, the pair rebounded after touching the middle line.

EURUSD

At 10:00 GMT today, Europe will release revised data for its consumer price index, the Harmonised Index of Consumer Prices. The forecast for the year-on-year change remains the same as for the previous release.

Next is an analysis of the EURUSD daily chart.

The EURUSD is in corrective retreat after reaching the +2 standard deviation Bollinger Band. The closing price falling below the +1 standard deviation band suggests a slowdown in upward momentum, presenting the possibility of a drop of some degree just ahead.

We continue with an analysis of the EURUSD weekly chart.

Though the pair continues to trade in a single range, the chart has created a triangle formation with descending support levels and rising resistance levels. This creates a situation of great interest, as it offers a breakout in either direction.

GBPUSD

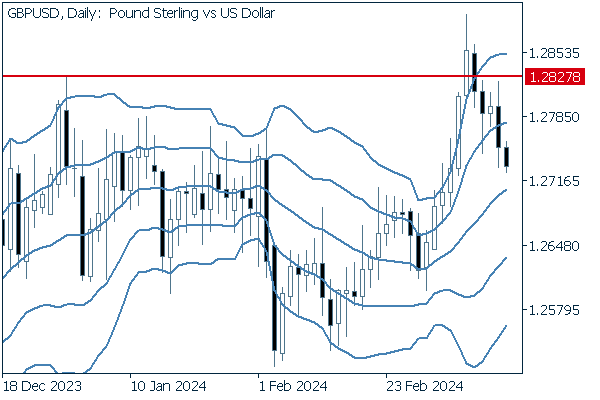

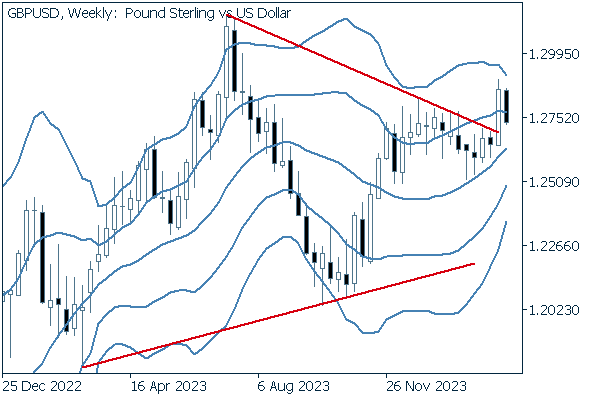

This week, the Bank of England is to make a policy rate announcement on Thursday the 21st. Forecasts suggest an unchanged rate at 5.25%, with a low likelihood of a surprise. Now, we analyze the daily GBPUSD chart.

Despite exceeding recent highs, the GBPUSD retreated to trade inside the existing bands in a false breakout. The pair falling below the +1 standard deviation Bollinger Band suggests that upward momentum has been at least temporarily reset.

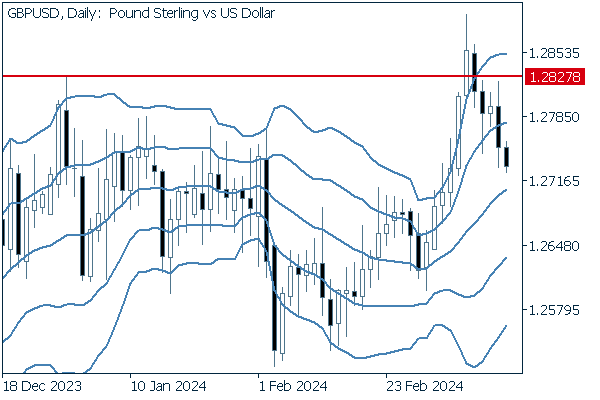

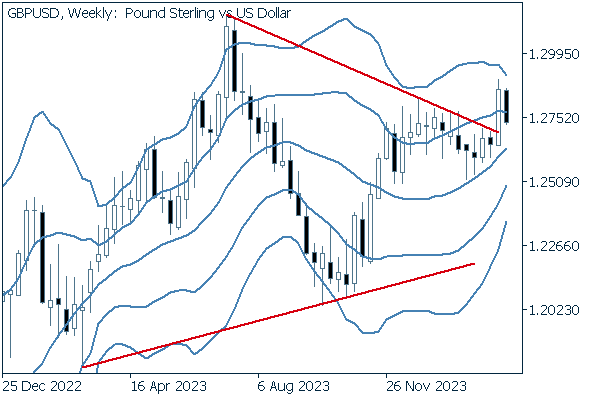

We continue with an analysis of the GBPUSD weekly chart.

Looking at the weekly trend, though the pair has broken above the upper line of a triangle formation and returned to said upper line, it remains above the triangle. It would not be unreasonable to assume a case where the old line becomes a support.

Was this article helpful?

28 out of 29 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy