2024.12.23

FXON services will be temporarily suspended due to phased system upgrades and a platform redesign. (Details here)

FXON services will be temporarily suspended due to a full platform redesign. (Details here)

- Features

-

Services/ProductsServices/ProductsServices/Products

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Trading Platforms Trading Platforms Trading Platforms

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Trading Account Types Trading Account Types Trading Account Types

Introducing FXON's Standard and Elite accounts.

close close

-

SupportSupportSupport

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Account Opening Account Opening Account Opening

Detailed explanation of everything from how to open a real account to the deposit process.

MetaTrader4/5 User Guide MetaTrader4/5 User Guide MetaTrader4/5 User Guide

The most detailed explanation of how to install and operate MetaTrader anywhere.

FAQ FAQ FAQ

Do you have a question? All the answers are here.

Coming Soon

Glossary Glossary GlossaryGlossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

News News News

Company and License Company and License Company and License

Sitemap Sitemap Sitemap

Contact Us Contact Us Contact Us

General, personal information and privacy inquiries.

close close

- Promotion

- Trader's Market

- Partner

-

close close

Learn more about the retail trading conditions, platforms, and products available for trading that FXON offers as a currency broker.

You can't start without it.

Features and functionality comparison of MetaTrader 4/5, and correspondence table of each function by OS

Two account types to choose

Introducing FXON's Standard and Elite accounts.

Support information for customers, including how to open an account, how to use the trading tools, and a collection of QAs from the help desk.

Recommended for beginner!

Detailed explanation of everything from how to open a real account to the deposit process.

The most detailed explanation of how to install and operate MetaTrader anywhere.

Do you have a question? All the answers are here.

Coming Soon

Glossary of terms related to trading and investing in general, including FX, virtual currencies and CFDs.

General, personal information and privacy inquiries.

Useful information for trading and market information is posted here. You can also view trader-to-trader trading performance portfolios.

Find a trading buddy!

Share trading results among traders. Share operational results and trading methods.

- Legal Documents TOP

- Client Agreement

- Risk Disclosure and Warning Notice

- Order and Execution Policy

- Complaints Procedure Policy

- AML/CFT and KYC Policy

- Privacy Policy

- eKYC Usage Policy

- Cookies Policy

- Website Access and Usage Policy

- Introducer Agreement

- Business Partner Agreement

- VPS Service Terms and Condition

This article was :

published

updated

Weekly FX Market Review and Key Points for the Week Ahead

In the foreign exchange market for the week that ended on December 22nd, traders focused on monetary policy announcements from major central banks and various economic indicators. As a result, the currency markets, especially the USDJPY, experienced significant volatility.

In the U.S., the Federal Open Market Committee (FOMC) took a cautious stance on further interest rate cuts, while the Bank of Japan (BOJ) decided not to raise interest rates. These decisions had a significant impact on the USDJPY, which soared throughout the week.

December 16 (Mon)

As the market became more convinced that the BOJ would not raise interest rates at its upcoming meeting, the dollar strengthened against the yen. The USDJPY rose to the middle of the 154 yen range, indicating the yen's downtrend.

There were no major economic releases on the day. However, traders corrected their positions ahead of the major events later in the week.

December 17 (Tue)

The market became more cautious as monetary policy announcements in Japan and the U.S. approached. The USDJPY briefly fell to the lower 153 yen range.

In addition, U.S. retail sales for November showed a strong result with an increase of 0.7% compared to the previous month (forecast: +0.5%, October: +0.4%).

The EURUSD continued to be weighed down by the dollar's strength.

December 18 (Wed)

Before the FOMC policy announcement, the USDJPY held firm.

The revised Eurozone HICP for November missed expectations with an increase of 2.2% year-on-year (forecasts: +2.3%). Consequently, the EURUSD remained weak ahead of the FOMC meeting.

In the U.S., the FOMC announced a 0.25% rate cut. Meanwhile, Fed officials projected that they would make two rate cuts in 2025, down from the four rate cuts they had previously projected. As this news was seen as a sign of a slowdown in the pace of rate cuts, dollar buying was boosted.

As a result, the USDJPY surged to the upper 154 yen range. In contrast, the EURUSD and GBPUSD fell sharply.

December 19 (Thu)

As expected, the BOJ's Monetary Policy Meeting decided to leave its key interest rate unchanged.

In the press conference following the meeting, Governor Kazuo Ueda expressed no intention of raising interest rates at the January 2025 meeting, stating that he wanted to " scrutinize more information on the outlook for wages, including the momentum of next year's wage negotiations." This stance accelerated the selling of the yen, and the USDJPY crossed above the 157 yen line.

In addition, the U.S. GDP for the July-September quarter was revised to a 3.1% increase year-on-year (forecast: +2.8%, previous quarter: +2.8%). The better-than-expected figure led to dollar buying, with the USDJPY reaching the upper 157 yen range.

Meanwhile, the BOE announced that it would maintain its policy rate at 4.75%. However, as more members of the Monetary Policy Committee voted in favor of the rate cut, the GBPUSD sold off.

December 20 (Fri)

Japan's nationwide CPI rose 2.9% year-on-year in November (forecast: +2.9%, October: +2.3%). However, its impact on markets was limited.

Meanwhile, the U.S. PCE indices posted weaker-than-expected results. The PCE deflator rose 2.4% year-on-year in November (forecast: +2.5%, October: +2.3%), and the core PCE rose 2.8% (forecast: +2.9%, October: +2.8%).

The USDJPY ended the week in the lower 156 yen range as the market unwound the large gains.

Economic Indicators and Statements to Watch this Week

(All times are in GMT)

December 23 (Mon)

- 07:00 U.K.: July-September quarterly gross domestic product (revised GDP)

- 15:00 U.S.: November new home sales (annualized data)

- 15:00 U.S.: November new home sales (month-on-month data)

- 23:50 Japan: Summary of Opinions at the Monetary Policy Meeting

This Week's Forecast

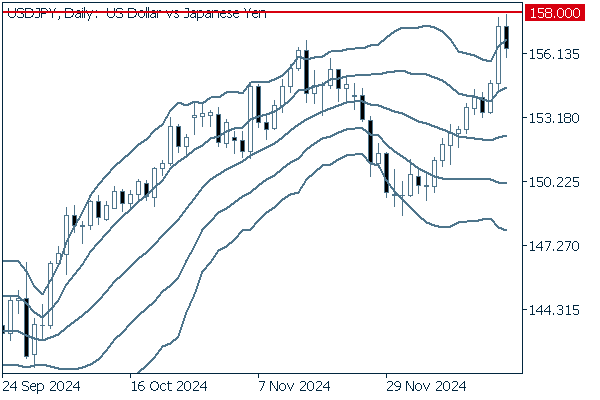

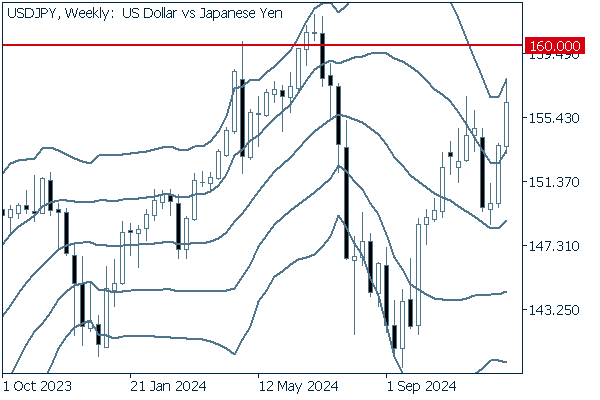

The following currency pair charts are analyzed using an overlay of the ±1 and ±2 standard deviation Bollinger Bands, with a period of 20 days.

USDJPY

The USDJPY has broken above the high set in November and is approaching the 158 yen level. The pair will likely continue rising while the market remains cautious about possible intervention. As the major events for the year are over, volatility is expected to decrease towards the end of the year. Therefore, it is important to be aware of sudden market fluctuations.

Next is an analysis of the USDJPY daily chart.

On the daily chart, the pair crossed above the middle line and then broke above +2σ last Thursday. Although it fell back the following day, the pair is likely to continue rising further if it crosses above the 158 yen level.

We continue with an analysis of the USDJPY weekly chart.

On the weekly chart, the pair rebounded just above the middle line to break above the high set in November. The pair is likely to continue to rise with a target of the 160 yen level. It is safe to say that the uptrend will continue.

EURUSD

As Christmas week approaches, no major indicators will be released by the end of the year. It seems that the market will lack the momentum to move. For the time being, it is worth watching to see if the pair can recover to the 1.05 level.

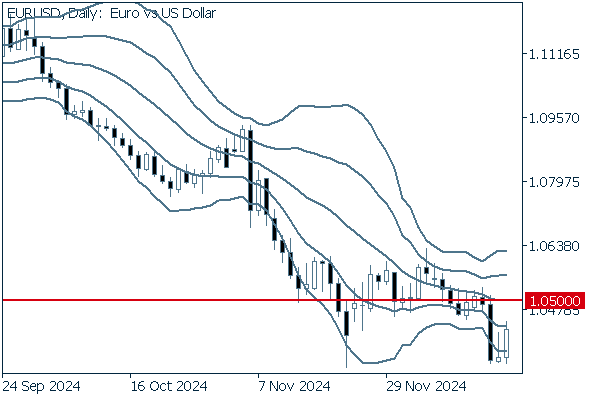

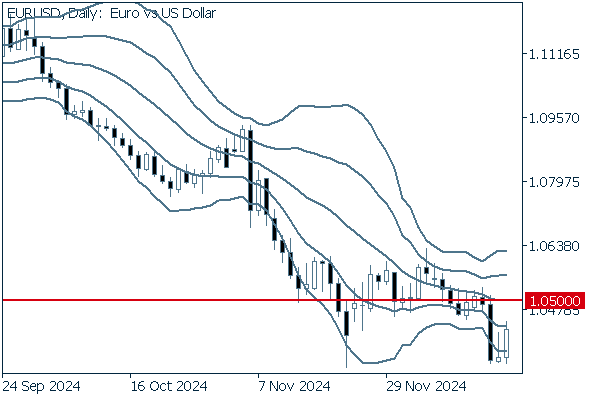

Next is an analysis of the EURUSD daily chart.

After falling below -2σ, the pair has rebounded to around -1σ. If the pair maintains this uptrend and breaks above -1σ, it is likely to target 1.05, equivalent to the middle line.

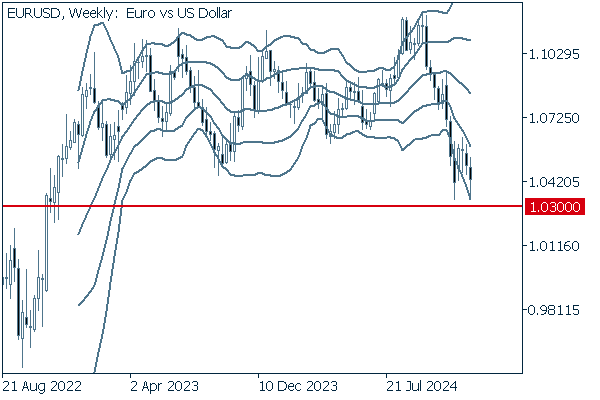

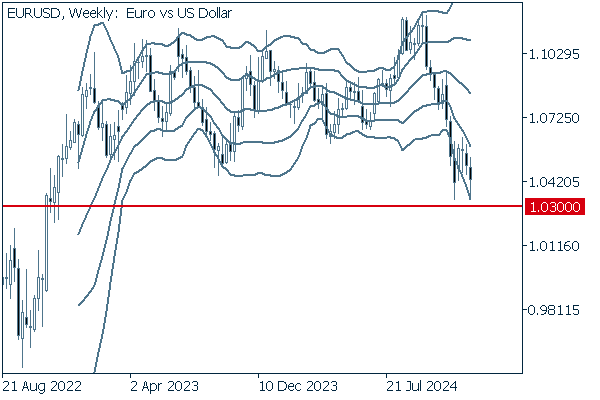

We continue with an analysis of the EURUSD weekly chart.

The downward band walk continues, and the pair has broken below the range formed by the fluctuation after 2023. The next support line seems to be 1.03. However, if the pair breaks below this line, the downtrend may accelerate towards 1.00.

GBPUSD

The BOE decided to hold interest rates. However, three members of the Monetary Policy Committee voted for a rate cut. Additionally, Governor Andrew Bailey's comments hinted at the possibility of another rate cut in February 2025. After the release of the revised U.K. GDP figure on December 23rd, the market will run out of news for the rest of the year.

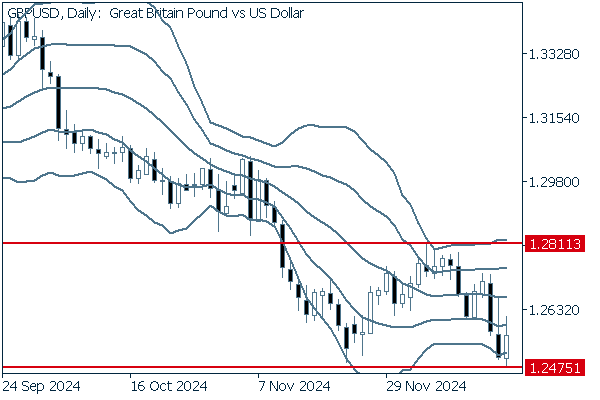

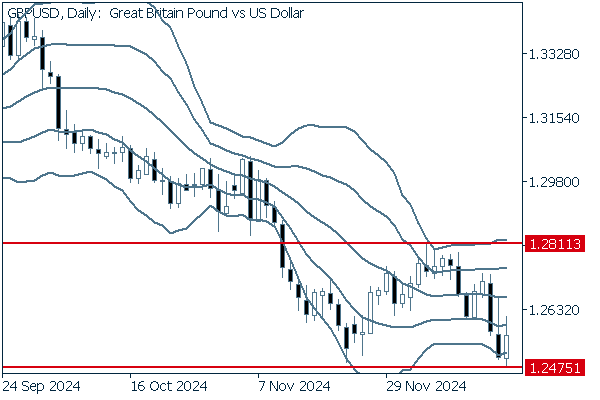

Now, we analyze the daily GBPUSD chart.

While the pair rebounded from -2σ to -1σ, the middle line ran almost flat. The pair is likely to fluctuate within the range of 1.281 and 1.247. However, if it breaks below 1.247, the downtrend may accelerate.

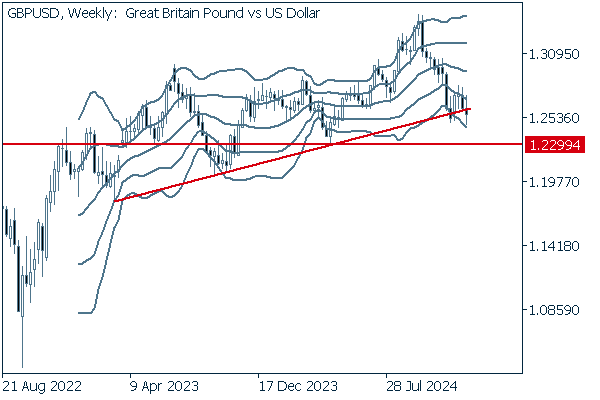

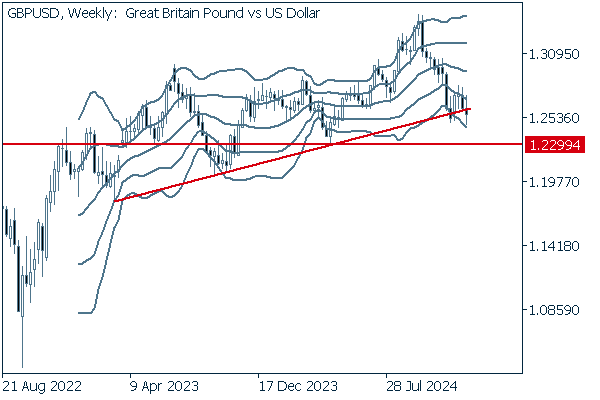

We continue with an analysis of the GBPUSD weekly chart.

On the weekly chart, the pair has drawn the upward support line from the low in 2023, as it never broke below the previous low. The pair hit the support line once and then rebounded. However, it finally broke below the line last week. If it approaches -2σ, the 1.229 level, the low set in April 2024, will become the fresh support line.

Was this article helpful?

0 out of 0 people found this article helpful.

Thank you for your feedback.

FXON uses cookies to enhance the functionality of the website and your experience on it. This website may also use cookies from third parties (advertisers, log analyzers, etc.) for the purpose of tracking your activities. Cookie Policy