Fulfill traders' needs through active listening

FXON is a brokerage firm with a focus on maximizing traders' profit. Our platform has been crafted through meticulous attention to diverse needs and aspirations of traders spanning from novices to seasoned professionals. Our close dialogue between the FXON development team and traders allows us to continuously develop and refine our trading environment and offer cutting-edge features essential for consistent profit generation. Here at FXON, we invest heavily in fortifying the infrastructure of our trading ecosystems for the benefit of all traders, with a promise to support traders every step of their way.

INNOVATION INSPIRED BY TRADERS' VOICES

FXON offers an unparalleled trading environment, where our customers' voice takes precedence. Our unwavering commitment is to build a space that maximizes your profits, with features such as industry-leading lowest variable spreads, maximum leverage of 1:1000, support by our dedicated staff and interactive platforms for exchanging insights.

Services

FXON offers an unparalleled trading environment, where our customers' voice takes precedence. Our unwavering commitment is to build a space that maximizes your profits, with features such as industry-leading lowest variable spreads, maximum leverage of 1:1000, support by our dedicated staff and interactive platforms for exchanging insights.

MUCH MORE THAN YOU'D EXPECT

01

Maximum Leverage 1000:1

We plan to offer a competitive leverage environment of up to 1:1000 for major Forex currency pairs like dollar straight and yen crosses, and up to 1:500 for metal tradings, including gold. Whether you seek a thrilling high-stakes, high-volume excitement or risk-controlled tradings with minimum capital, we're there to support your trading journey.

02

99% of traders executed

We commit to achieving a fill rate exceeding 99% by deploying multiple trading servers across data centers in New York, London, and Tokyo, with redundant failover mechanisms in place. Adopting a hybrid order system that blends exchange marry and cover transactions, we aim to maximize your profit with the best prices and lightning-fast fill speeds.

03

Competitive Spreads

Driven by our passion for delivering thrilling trading experiences, we constantly strive to enhance our trading environment. Our soon-to-be-launched 2 account types are characterized by competitive spreads that are achieved by minimizing operational costs. With the account type that allows commissions to be itemized separately, you can enjoy trading at low commissions and raw spreads with no markups.

04

Trade as you wish

At FXON, we are dedicated to creating a trading environment that empowers our customers with maximum freedom, tailored to their needs. We do not impose temporary leverage restrictions around indicators or events, nor do we limit leverage at an individual level. Additionally, we maintain minimal regulations on trading methods, allowing our customers to profit efficiently while preserving their unique trading styles.

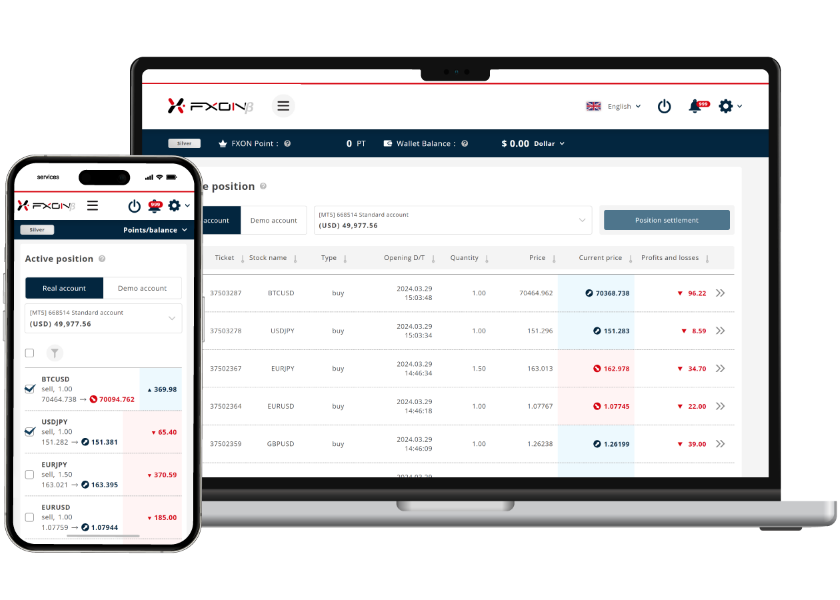

DO EVERYTHING EASIER

FXON has built a stress-free portal with meticulous attention to detail, addressing our customers' hidden needs.

On our Client Portal, you can execute deposits and withdrawals while staying informed on real-time trading activities. Upon login, you will have instant visibility into vital metrics such as unrealized profits/losses, profit/loss ratios per position, and available margin, facilitating rapid comprehension of your trading performance. The Client Portal also enables swift position closures, allowing you to make adjustments to your positions any time based on market changes.

Additionally, our portal will also include FXON's proprietary "Portfolio" functionality which will graphically show you your trading performance, serving to be a powerful tool in enhancing your trading skills.

At FXON, we strive to offer an exhilarating trading journey, with meticulously crafted functionality and convenience, delivered in the optimal format.

ENHANCE TRANSPARENCY

TO BUILD TRUST

We believe that information gathering and trial-and-error practice are necessary to grow as a trader. The journey to establishing your own trading style can sometimes be hard and lonely. At such times, you can find help from experienced professionals and fellow traders who share similar challenges.

We plan to launch a community feature, such as forums and portfolios, in phases to provide a place for users to gather information. In the community, open to traders of all levels, not only will you be able to share insights with others, but you will find tips for sharpening your skills by being exposed to the market views and mindsets of diverse traders.

At FXON, we strive to provide a community that motivates traders and accelerates their growth.

LEADS TO SUCCESS

To ensure the success of traders, FXON's dedicated assistants are here to provide personalized support.

At FXON, we engage in active dialogue with our customers to understand their needs and desires, to deliver learning resources and content tailored to their skills. Additionally, our dedicated assistants support you at every step of your trading journey, guiding through your career path and fostering motivation as a trader.

If you've ever felt overwhelmed by the complexities of forex trading or unsure of where to begin, no more worries. We're here to guide you. Through open communication with our team, you will get personalized support from us. No matter your level of experience, profession, or age, FXON is dedicated to assisting you to achieve your goal of becoming a successful investor.

UNITE AND ACCELERATE PROGRESS

Beyond facilitating quick withdrawal processes, FXON aspires to be a transparent and trustworthy broker by disclosing performance metrics such as coverage ratio, fill speed, slippage rate, and requote ratio, all based on historical data of actual tradings.

These data exemplify FXON's trading performance and serve as fundamental factors for traders in choosing a reputable broker. They are also essential pieces of information for traders to optimize their trading strategies.

In an industry where many brokers withhold information by citing confidentiality reasons, FXON prioritizes creating an environment where customers can concentrate on trading with utmost peace of mind. This is why we disclose all relevant information, and will stay committed to disclosing information of many traders' interest, to foster a transparent trading environment.

FXON'S EVOLVING PROGRESS

Road Map

FXON'S EVOLVING PROGRESS

FXON'S EVOLVING PROGRESS

PHASE 01

April 2024

COMPLETED

April 2024

Beta launch of our website and Client Portal with demo account opening and trade activity monitoring capabilities (operation of positions held, trading history, portfolio). MT4®/MT5® will also be accessible from various devices. Pricing adjustment and stabilization will take place toward the launch of the official version.

Early-June 2024

Launch of the official version of Client Portal, integrated with eKYC system; The official version will also accommodate opening real trading accounts, complemented by full support for all associated functionalities; Additionally, an industry-leading trading environment and stable prices will become available.

PHASE 02

Early-June 2024

ONGOING

PHASE 03

July 2024

UPCOMING

July 2024

Launch of the official version of the website and commencement of opening corporate account with support; The Client Portal will feature real-time deposits and withdrawals, as well as a loyalty program; In addition to the launch of a forum where users can connect and exchange information, special campaigns targeting all our customers are planned to start.

TBD in 2024

July onwards, new services such as a partner program, copy trading, cryptocurrency deposits and withdrawals, as well as new platforms will be rolled out.

PHASE 04

TBD in 2024

UPCOMING

TRADE ANYTIME ANYWHERE

While MT4®, which stores rich knowledge of traders, excels at customization flexibility, its successor MT5® delivers a dramatically lighter operating environment, resulting in a smoother trading experience. Moreover, MT5®, while retaining MT4®'s basic functionality, delivers a wide range of new functionality that enables more accurate chart analyses and risk management.

Scan MT5®

Download

MORE COMPETITIVE,

MORE POWEFUL

Price Board

coming soon

-

Forex

-

Crypto

-

Indices

-

Stocks

-

Metals

-

Energy

-

Forex

-

Crypto

-

Indices

-

Stocks

-

Metals

-

Energy

POSSIBILITY IS LIMITLESS

Account

FXON offers two types of accounts "Standard Account" and "Elite Account," both catering to a diverse range of traders, from beginners to seasoned professionals. In order to ensure that all traders can aim for profits with ease and clarity in using our services, we carefully crafted these accounts with only differing fee structures and spreads. We also chose the hybrid model that blends A-book and B-book for both accounts to maintain transparency in the trading environment.

Our Standard Account with its zero commission is ideal for traders of all experience levels. With trading costs limited only to spreads, this account type will simplify and make your trading cost management effortless. Its trading tool is compatible solely with MT5®, catering to both manual and automated traders alike.

Trading Platforms

MT5®

Spreads for Major Instruments

1.5 - 2.5pips

Maximum Leverage

1:1000

Commission*1

None

Our Elite Account offers industry-leading tightest variable spreads starting from as low as 0.0 pips, providing you with unparalleled trading conditions. While a commission of $3 (one-way trading) per lot traded applies, trading costs can be kept low with spreads close to zero. Our Elite Account is compatible not only with MT4® but also with MT5®, ensuring an innovative trading experience in a lightning-fast environment.

Trading Platforms

MT4®/MT5®

Spreads for Major Instruments

0.0 - 0.8pips

Maximum Leverage

1:1000

Commission*1

$3 / Lot (One-Way Trading)

*1 Commissions apply to forex currency pairs and metal CFDs only; There is no commission for non-metal CFD.

Open a demo account on our Client Portal following your FXON account registration. No personal verification or deposits required. Immerse yourself in the same trading environment as our real accounts offer, risk-free. Feeling unsure about trading with your own funds on a real account? Gain confidence by making the most of our demo account capabilities, training yourself in trading and familiarizing yourself with MT4®/MT5® navigation.