A Game-Changer

for Traders Worldwide

25' FXON New Release

- Popular

- FX Pair

- Crypto

- Indices

- Metals

Standard Account

Elite Account

Standard

Account

Account

Elite

Account

Account

NEWS

Show All

-

2025.12.08Trading Schedule

Notice of Change to Trading Hours in December 2025

-

2025.11.28Important Notices

Market Instability in Precious Metals, U.S. Indices, and Other Related Markets, and the Widening of Spreads

-

2025.11.19Important Notices

Notice of Regular System Maintenance on November 22, 2025

-

2025.11.10Important Notices

Notice Regarding Changes Due to Netflix Stock Split Effective November 17, 2025

Promotion

Service and Products

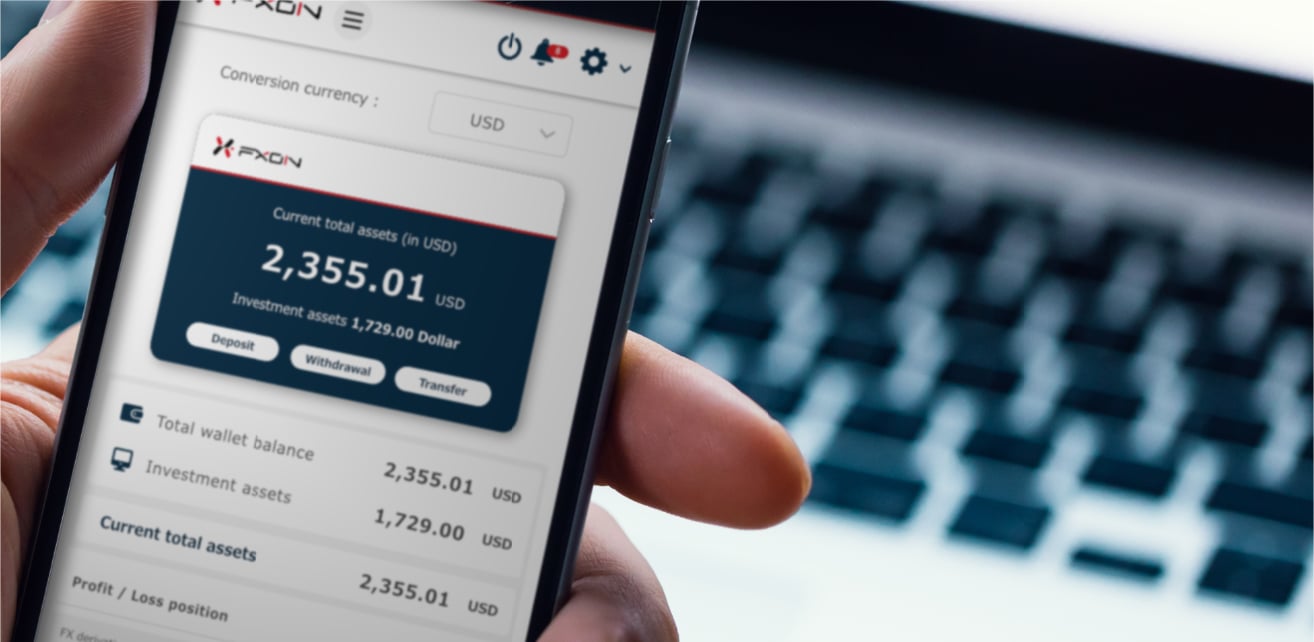

Exceptionally stable standard platform

For Elite accounts

MetaTrader 4 is the standard trading tool that has gained long-standing support as the platform with the most users worldwide and abundant accumulated trader knowledge. MetaTrader 4 is a platform exclusive to Elite account holders and comes with about 20 free FXON-exclusive indicators added on at installation.

Intuitive operation and new functions

Standard and Elite accounts

MetaTrader 5 is a high-functionality trading platform born as the successor to MetaTrader 4. MetaTrader 5, characterized by high-speed operation supporting 64-bit and updated multi-functional interface, comes with about 20 free FXON-exclusive indicators added on at installation.

Trading Tools

A Decision that Stands Up for You

At FXON, we hold a financial license from the Financial Services Authority Seychelles (FSA) and operate under its strict rules.

Customer funds are thoroughly segregated and managed by financial institutions affiliated with the Barclays Group, and we have independently obtained damage insurance in the event of a data leakage or disaster, and joined an arbitration organization for dispute resolution with customers, to ensure sound service operation and transparency, so that users can participate with peace of mind. We are strengthening our internal management system.

FXON does not allow the whereabouts of users' deposits to become a mystery due to the operator's financial difficulties.

Trader's Market

Forex Report

Market Rates & Charts

Top 5 Symbols

Volatility Analysis

USDJPY

Market Rates & Charts

View market rates and real-time charts for all FX pairs on FXON.

USDJPY

EURUSD

AUDUSD

GBPJPY

EURJPY

Volatility Analysis

The fluctuation range (highs and lows) for a specified period is shown in pips, with data available for each day, hour, and day of the week.

USDJPY

EURUSD

AUDUSD

GBPJPY

EURJPY

-

2025.12.08

NEWFXON Market Analysis (December 1 to December 7)

Differences in monetary policy between the U.S. and Japan came into focus in the foreign exchange market for the week that ended on December 7th. Traders preferred the yen over the dollar, especially due to increasing speculation about a rate hike by the Bank of Japan (BOJ). Consequently, the USDJPY declined and briefly entered the mid-154 yen range during the week. Meanwhile, the euro and the pound strengthened against the dollar.

-

2025.12.01

FXON Market Analysis (November 24 to November 30)

In the foreign exchange market for the week that ended on November 30th, trading volume decreased ahead of the Thanksgiving holidays. Amid the corrective mood, there was mixed speculation about December rate cuts in the U.S. and Japanese fiscal and monetary policies. Thus, the USDJPY fell to the mid-155 yen range.

-

2025.11.24

FXON Market Analysis (November 17 to November 23)

In the foreign exchange market for the week that ended on November 23rd, the dollar continued to strengthen against the yen, and the USDJPY reached 157.89 yen. The dollar also strengthened against the euro and the pound, pushing down both the EURUSD and GBPUSD.

Trader's Market

Trader's Market offers traders a wide range of content that they can use in practice, as well as publicly available portfolios and other information that is unique to FXON and useful for trading.

Trader's Market

Beyond Expectations, Beyond Limits

FXON was designed and launched over a five-year period by a team of consumer service experts, including not only FX brokerage operations specialists and dealing professionals, but also tech specialists and IT content producers.

Our goal is to be a broker with whom traders, partners, and our management company can build stable, sustainable relationships.

We've been preparing to enhance our trader community (share) function, treat all users as partners, build an affiliate rebate model, and offer many other features not found at other brokers.

We aim to be a broker that traders can feel comfortable with and continue to participate in.

Beyond Expectations, Beyond Limits

FXON was designed and launched over a five-year period by a team of consumer service experts, including not only FX brokerage operations specialists and dealing professionals, but also tech specialists and IT content producers.

Our goal is to be a broker with whom traders, partners, and our management company can build stable, sustainable relationships.

We've been preparing to enhance our trader community (share) function, treat all users as partners, build an affiliate rebate model, and offer many other features not found at other brokers.

We aim to be a broker that traders can feel comfortable with and continue to participate in.

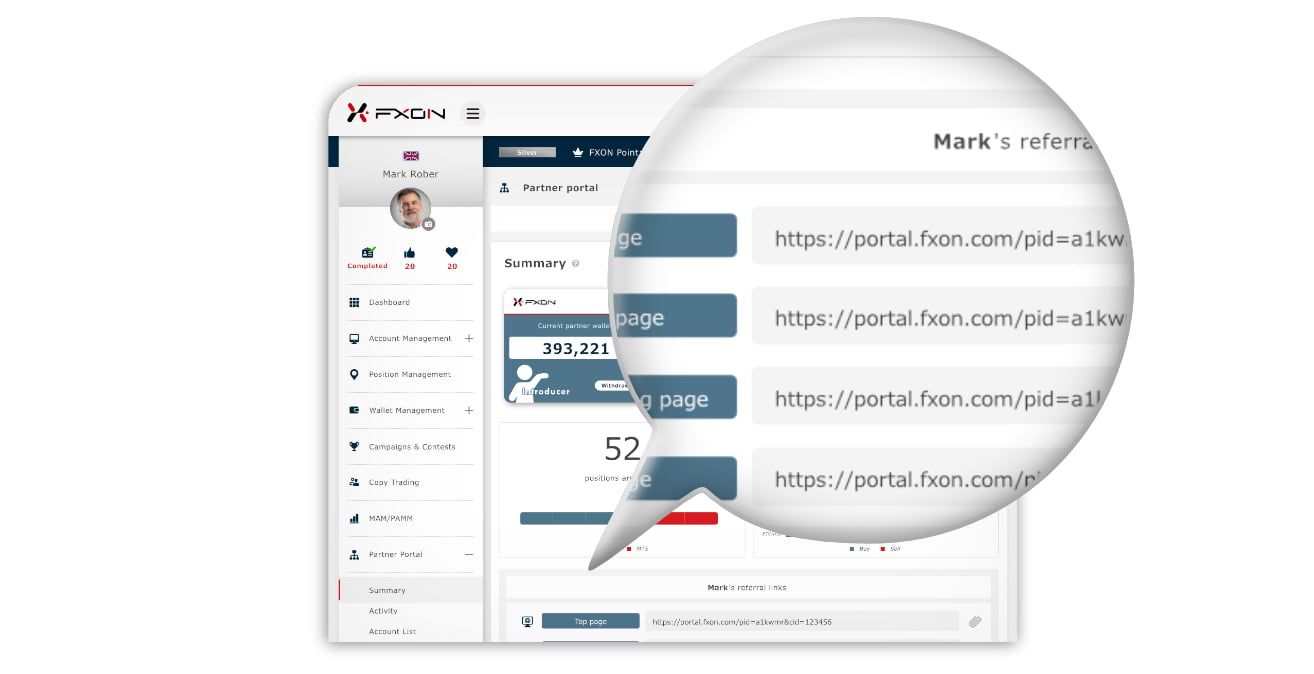

FXON

Affiliate and

Partner program

Those with real accounts can start affiliate activities immediately

Dear FX Affiliates

In fact, “about 40%” of your efforts

do not lead to rebates...

The reason is...

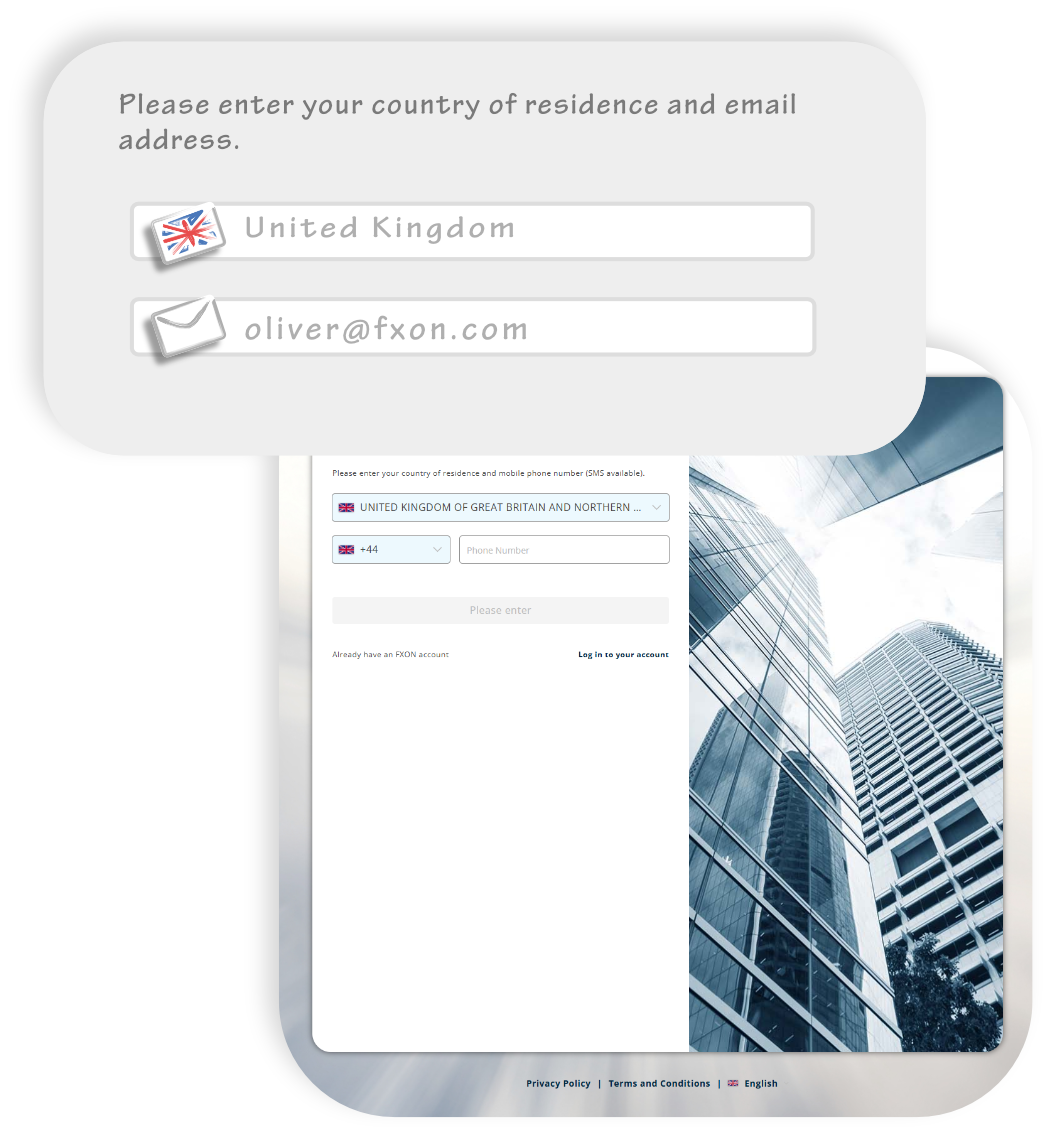

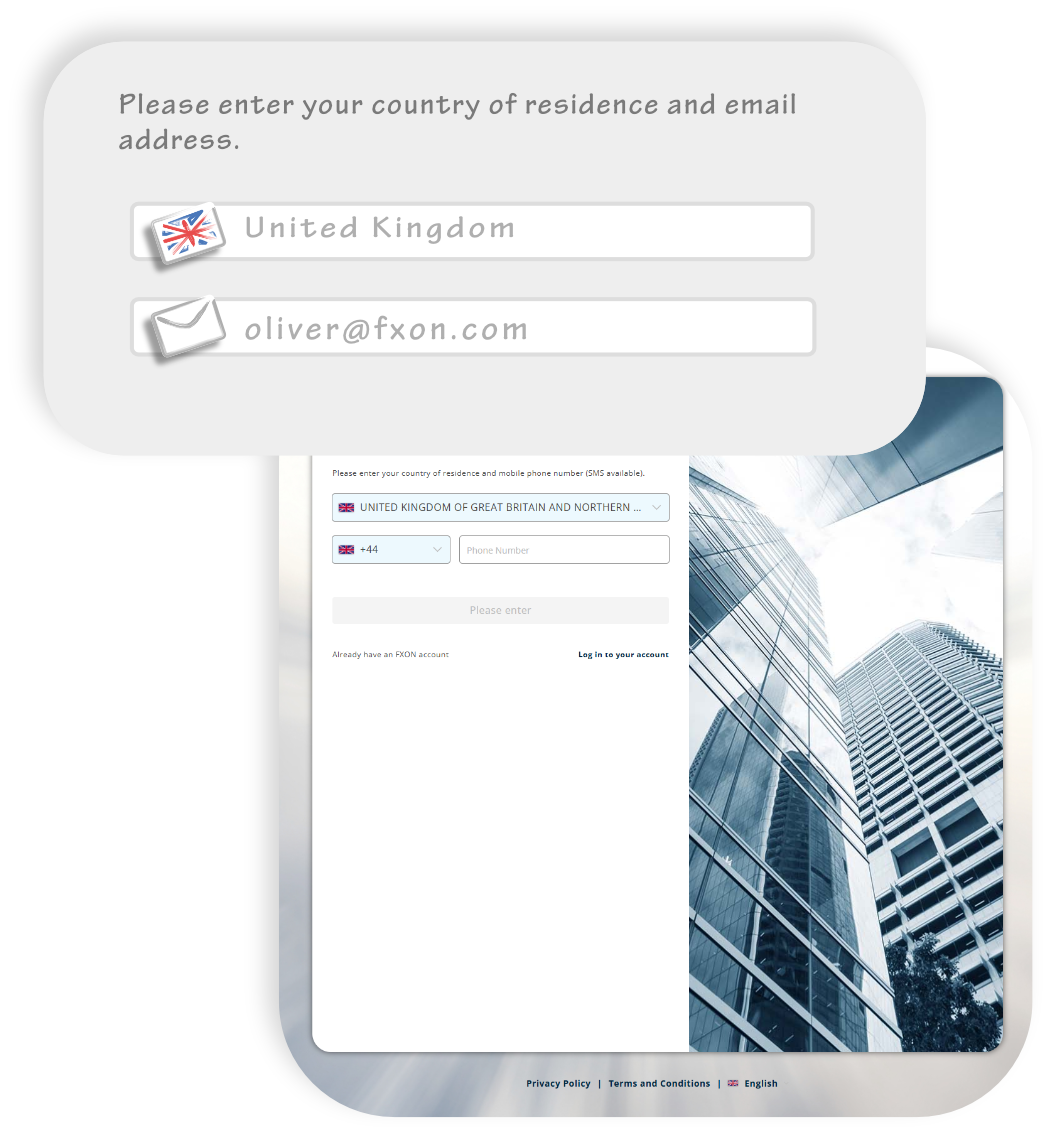

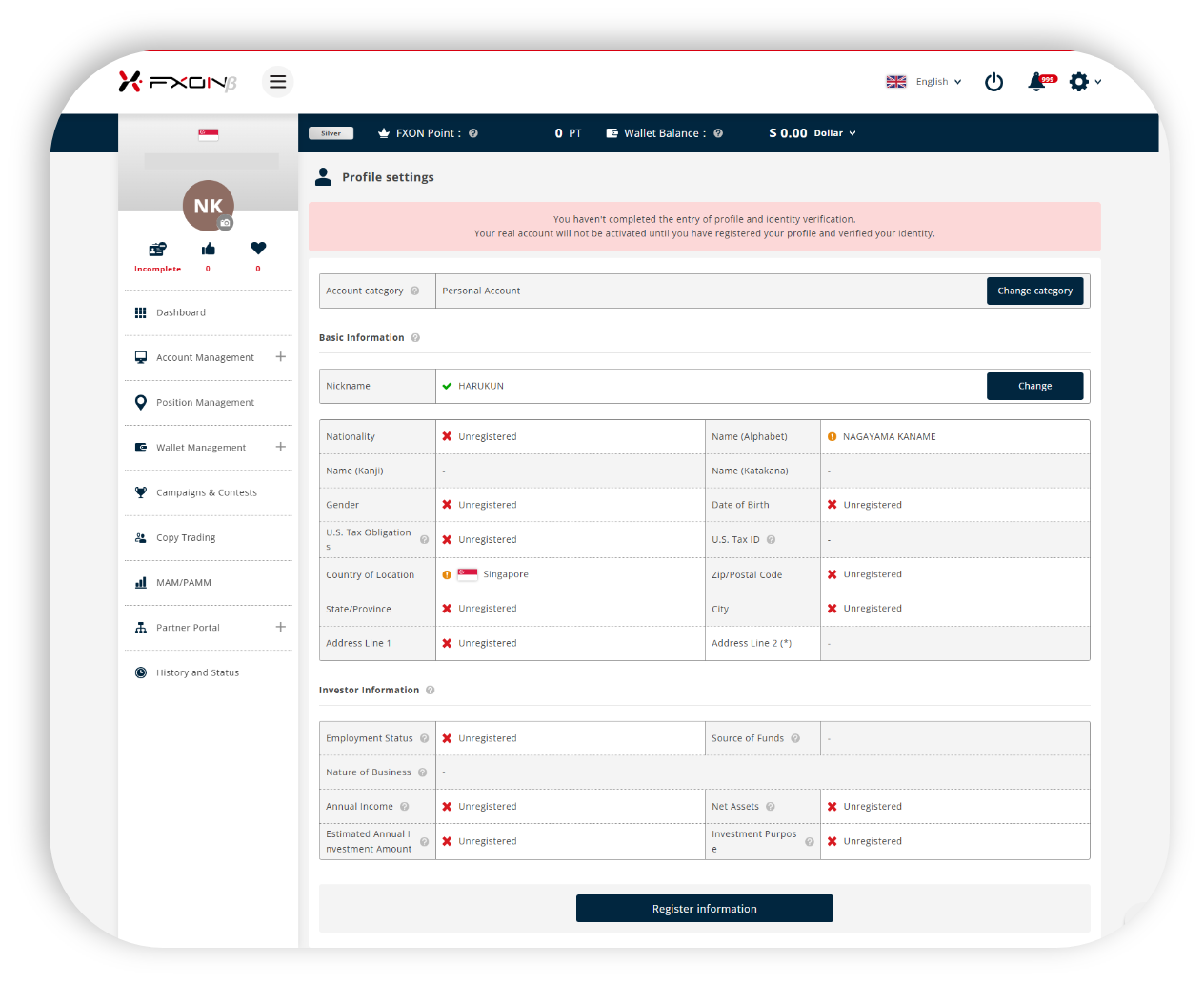

Open an Account in just 10 minutes!

Easy Account Opening in 3 steps

STEP 1

Email Address Authentication

Register your region of residence (country of residence) and e-mail address.

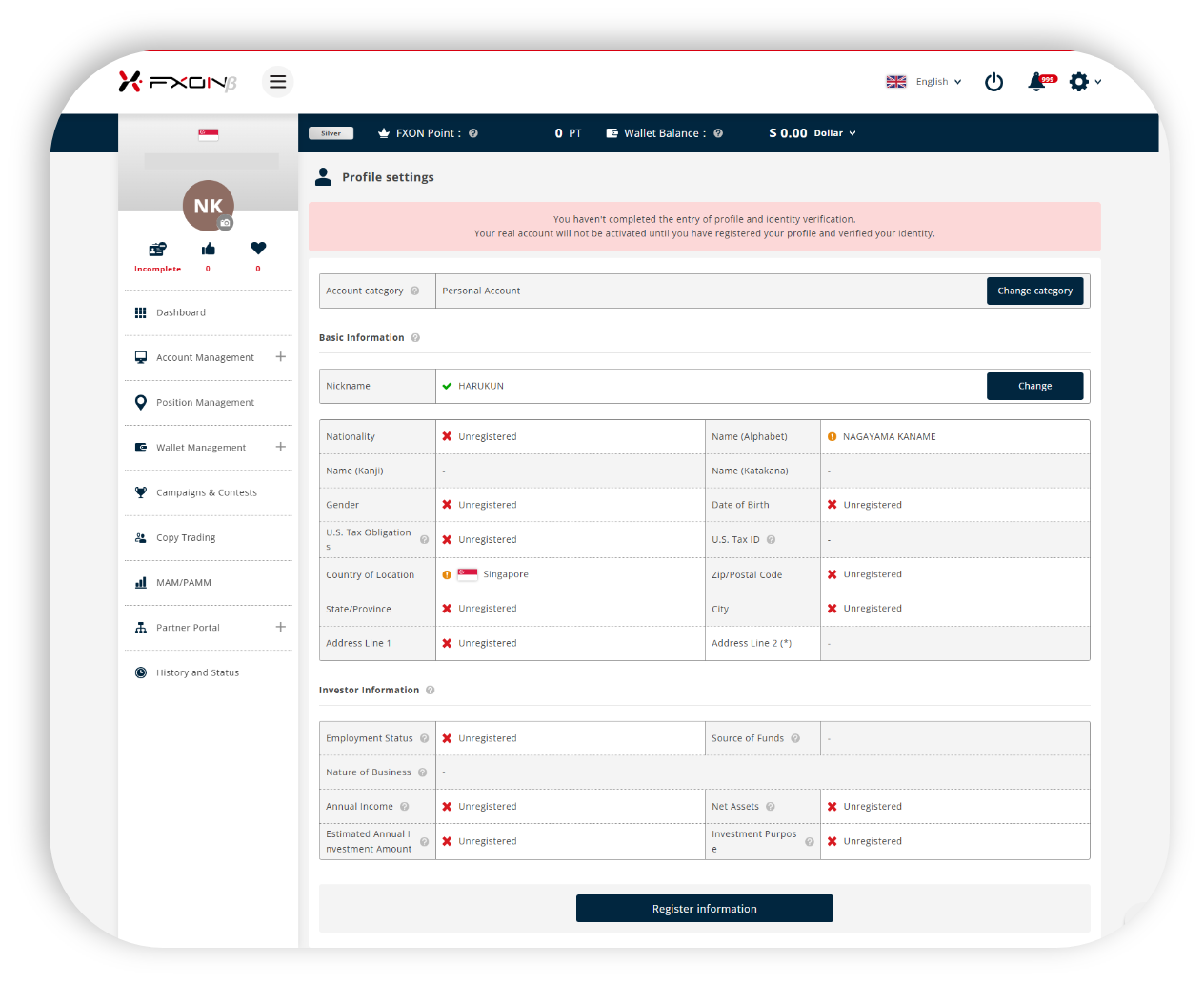

STEP 2

Register Details and

Select Account Type

Register your name, date of birth, address and other customer details.

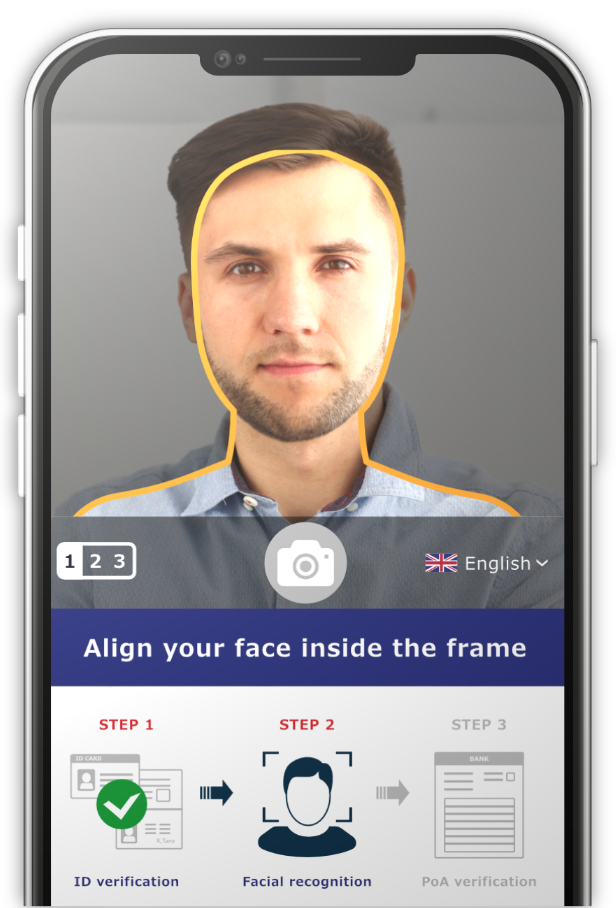

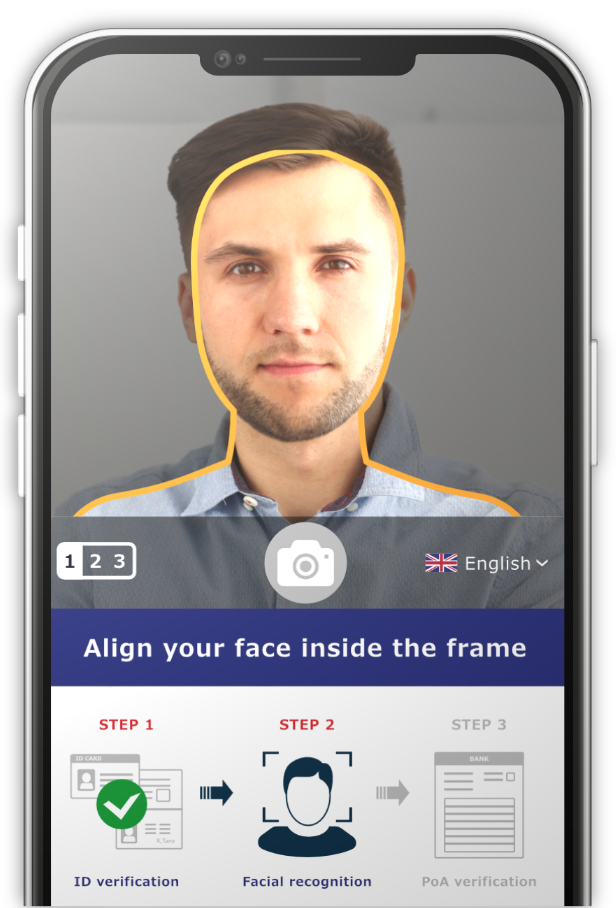

STEP 3

Submission of Certification Documents

< ID Auth >

< Face Auth >

< PoA Auth >

Photo ID and proof of current address will be verified. (In the case of identification verification procedures at eKYC, “ID Selfie” will be taken.) Five submission methods are available.

An Account Opened

STEP 1

Email Address Authentication

Register your region of residence (country of residence) and e-mail address.

STEP 2

Register Details and Select Account Type

Register your name, date of birth, address and other customer details.

STEP 3

Submission of Certification Documents

Photo ID and proof of current address will be verified. (In the case of identification verification procedures at eKYC, “ID Selfie” will be taken.) Five submission methods are available.

< ID Auth >

< ID Auth >

< Face Auth >

< Face Auth >

< PoA Auth >

< PoA Auth >

An Account Opened