Risk management for margin losses and open positions Margin Call and Stop Out

At FXON, we minimize customer losses through our stop out and zero cut (negative balance protection) systems, providing a safe trading environment.

Margin Call and Stop Out

At FXON, we issue a notification called a "Margin Call" to help prevent margin losses for our customers when the losses on a trader's open positions reach a certain threshold, alerting them to the reduction in their margin balance.

In addition, if the losses surpass a certain threshold, we execute a “Stop Out”, forcefully closing all open positions. We will not charge customers for losses exceeding their assets.

Margin level

The margin level is calculated by dividing trader’s assets by the margin requirement for open positions and multiplying the result by 100.Margin level is an important indicator to assess trading security in forex/CFD transactions. Risk management rules, such as margin calls and stop outs, will be triggered based on this margin level.

■ How to calculate the margin level

Margin level (%)

Available funds

Equity

To hold positions To hold positions To hold positions

Margin requirement

100

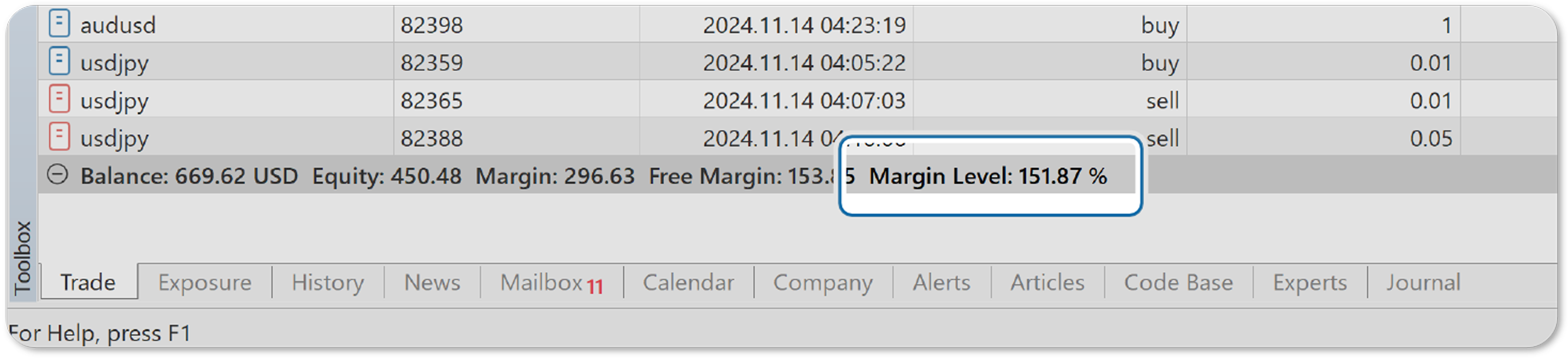

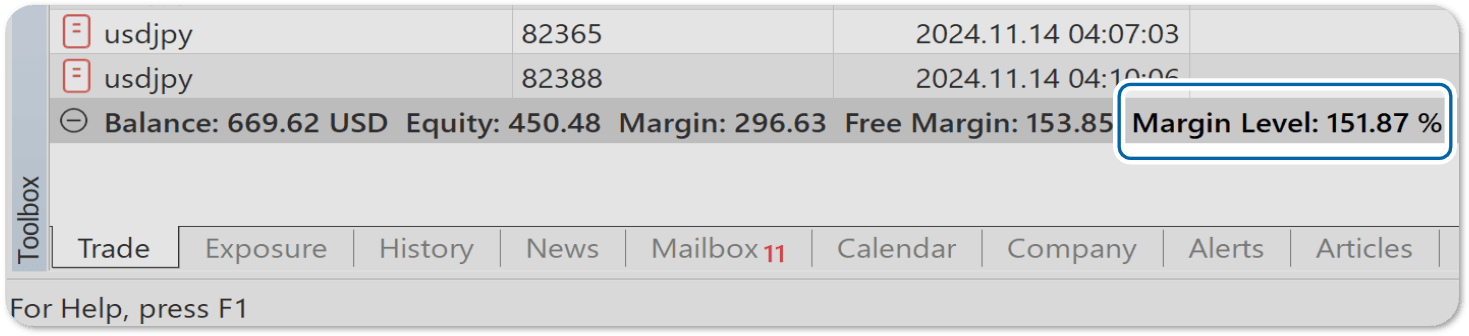

The Margin level is displayed in the terminal window of MetaTrader 4/5.

The necessity of preventing loss expansion

In forex and CFD trading, market prices can sometimes move sharply in unexpected directions due to changes in economic conditions or social events in various countries. In such volatile markets, the stop out serves to prevent further losses and protect traders' assets.

The execution of a stop out indicates that the positions in the trading account are incurring significant unrealized losses. The margin call system is designed to issue warnings to help traders avoid reaching this state.

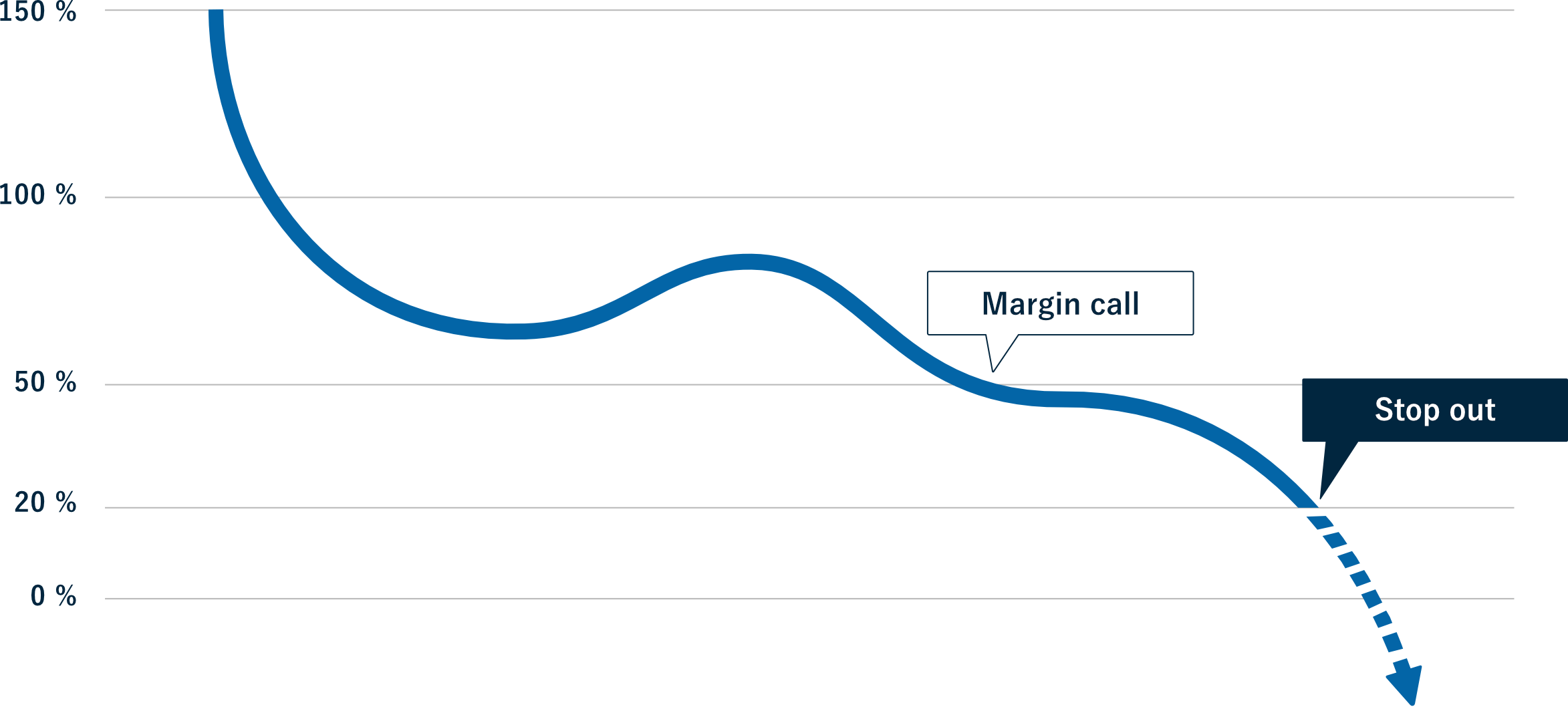

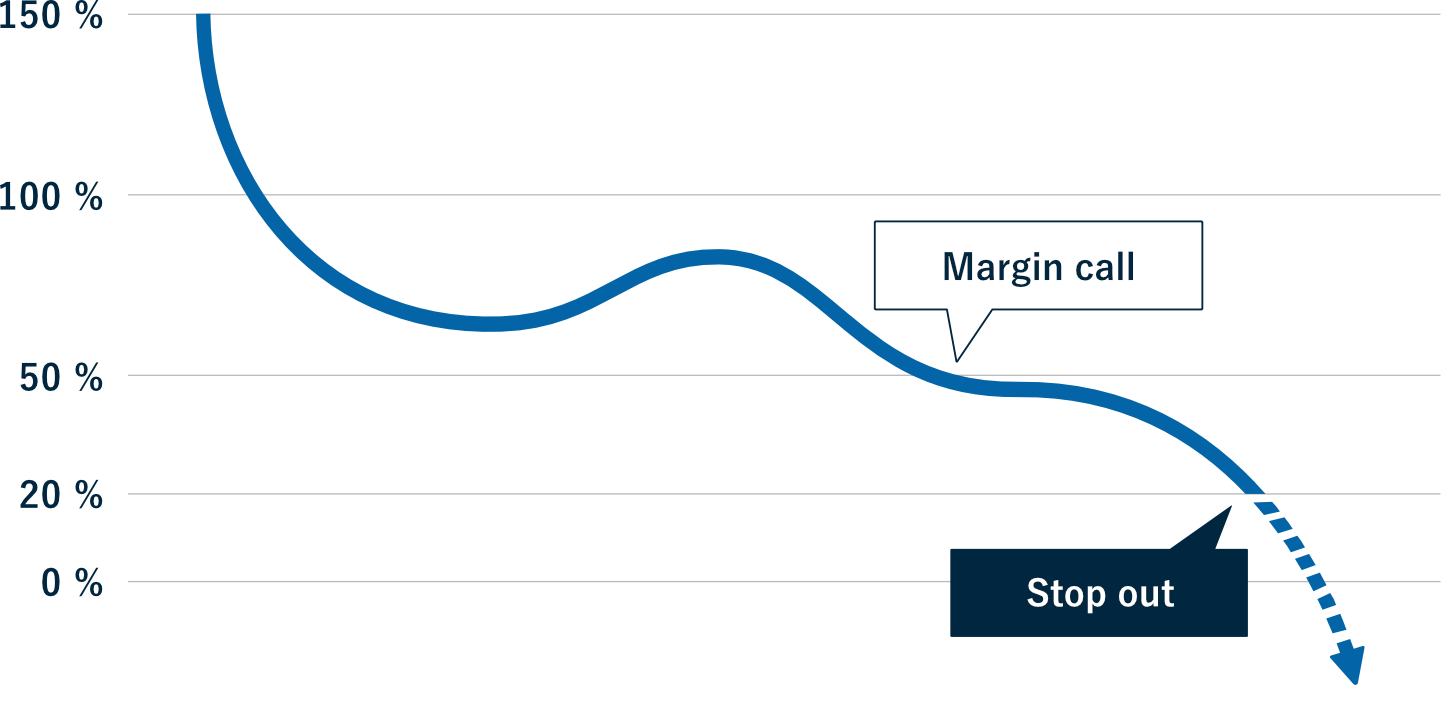

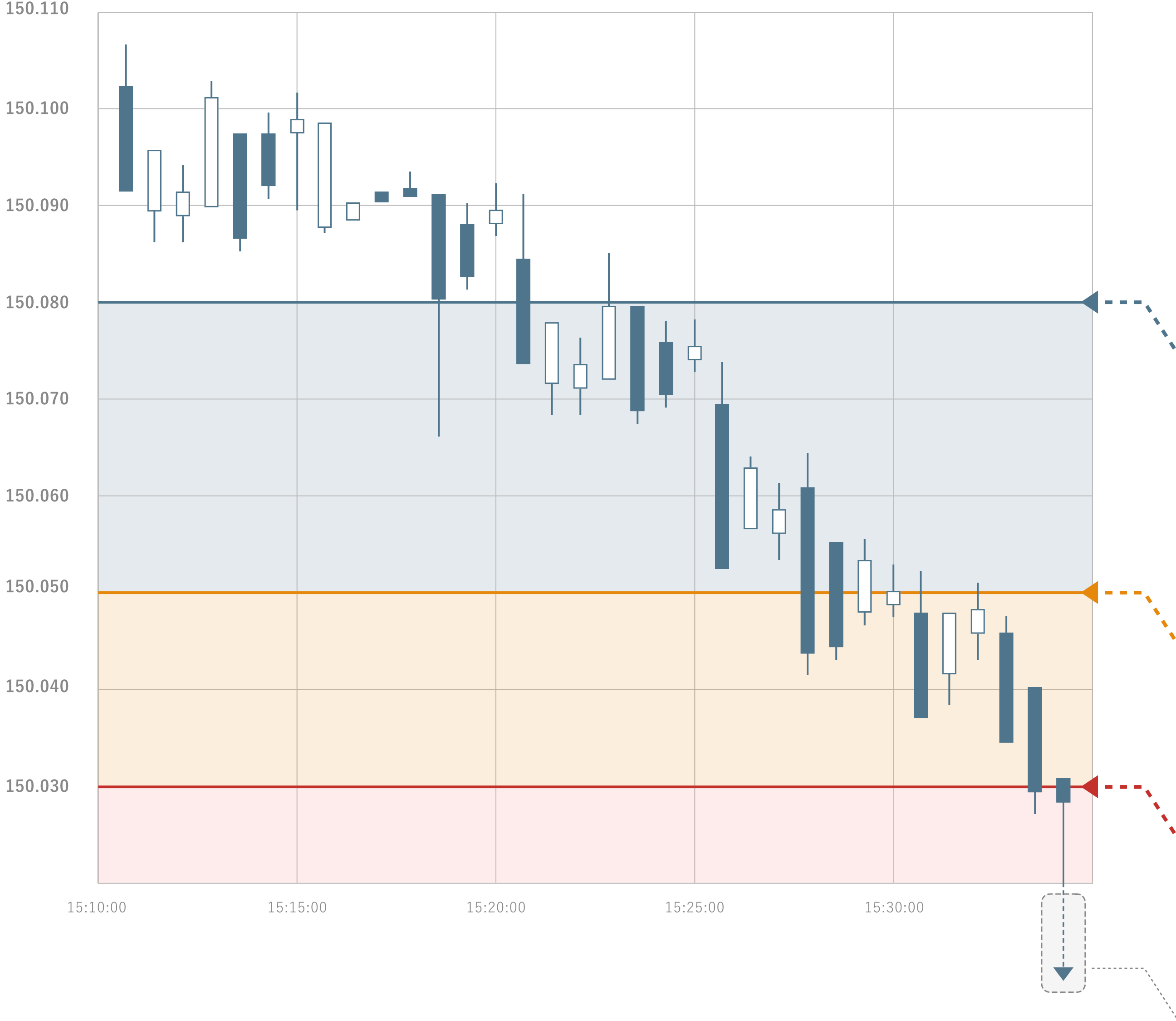

Case: Margin call 50%, stop out 20%

Rules for margin levels at FXON

We have established several trading rules based on the margin level to minimize our customers' loss expansion as much as possible and to ensure a secure and safe trading experience. As the first stage, when the margin level falls below 100%, new orders will be prohibited. As the second stage, if the margin level drops below 50%, a margin call will be triggered. As the third stage, if the margin level falls below 20%, positions will be forcibly closed in accordance with the stop out rules. If the balance of a trader's account becomes negative despite these loss prevention measures, it will be subject to the "zero-cut" (negative balance protection) system.

Margin level ≥ 100%

New orders allowed

A

Margin level < 100%

No new orders allowed

B

Margin level < 50%

Margin call

C

Margin level < 20%

Stop out

D

E

Zero cut

(Negative Balance Protection)

The zero cut system applies when the stop out process fails to execute offsetting trades due to sudden market volatility, resulting in a negative account balance for the trader.

A. Margin level ≥ 100% = New orders allowed

B. Margin level < 100% = No new orders allowed

C. Margin level < 50% = Margin call

D. Margin level < 20% = Stop out

E. Zero cut (Negative Balance Protection)

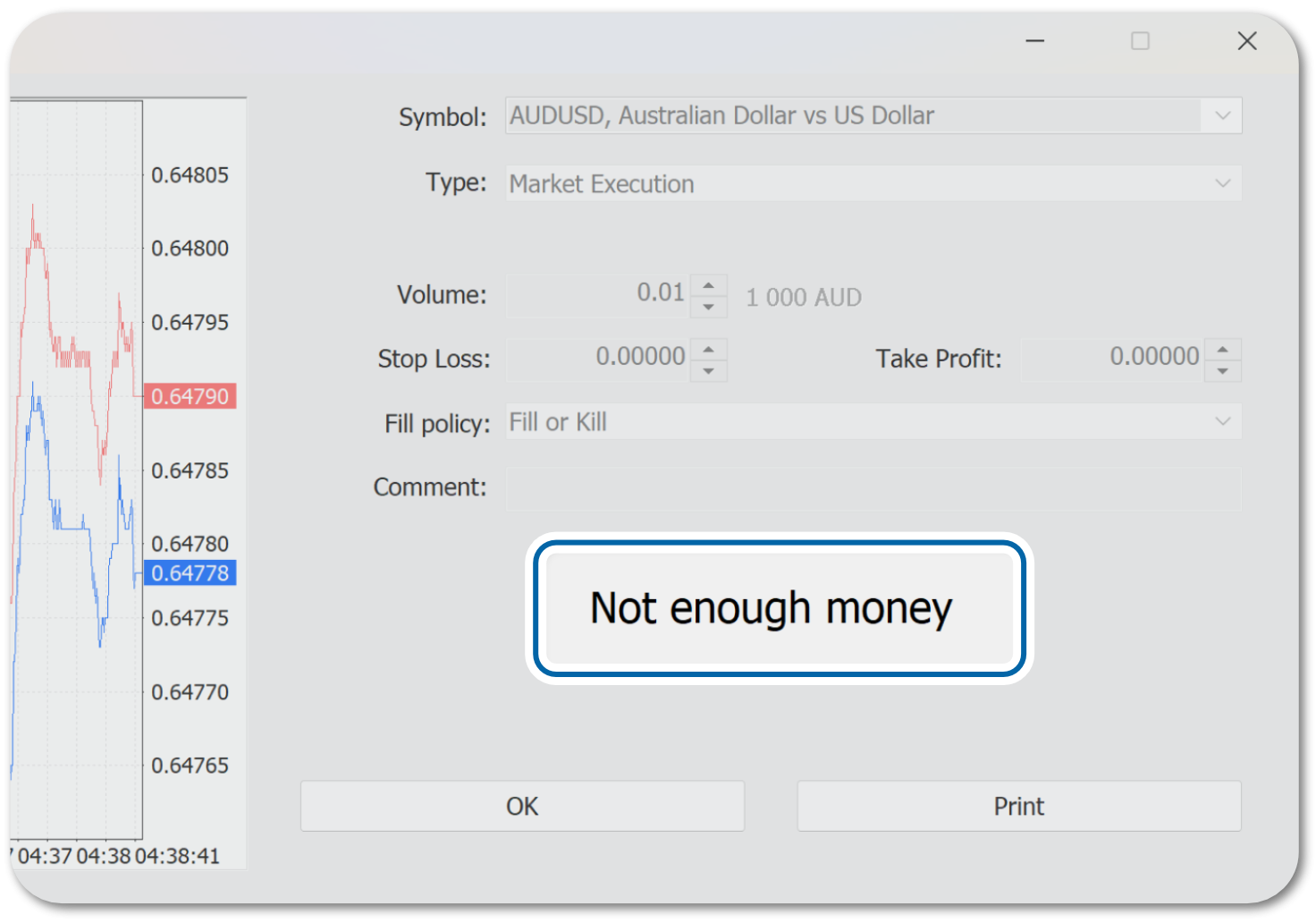

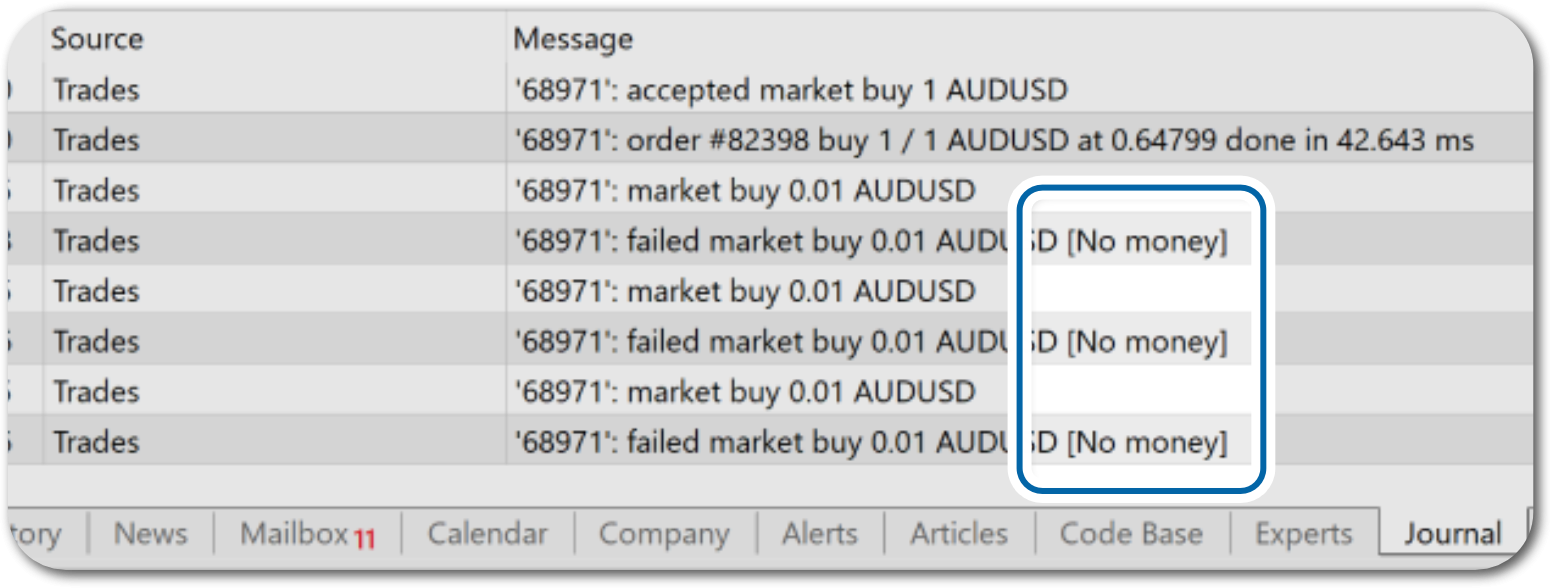

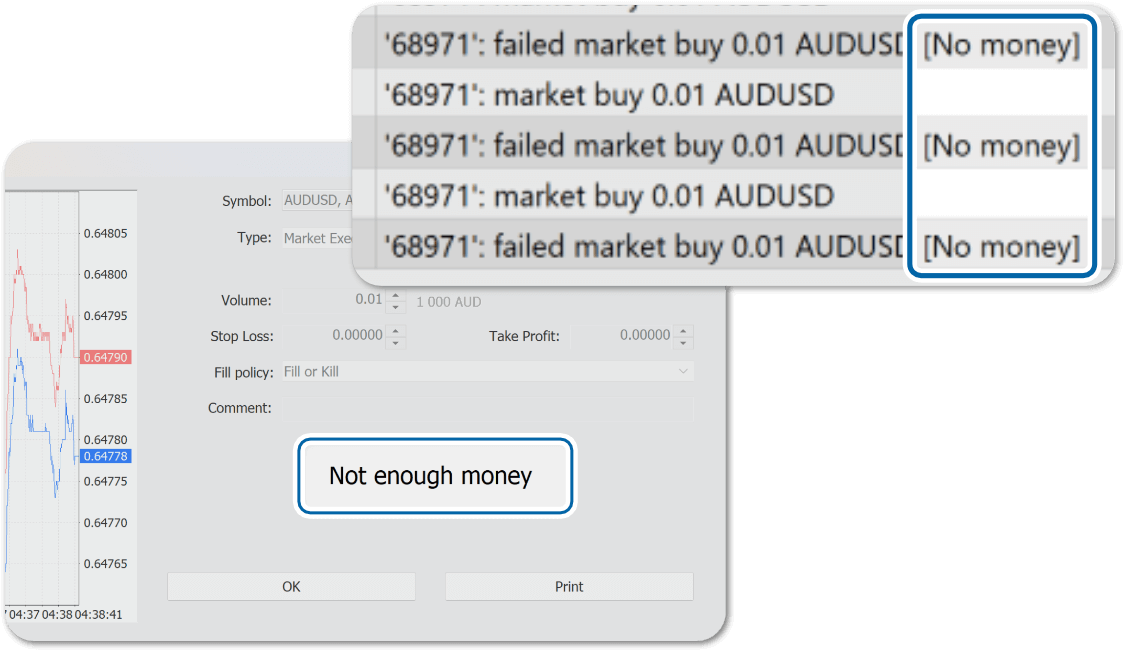

Prohibition on new positions

When the margin level falls below 100%, new orders to open positions will be automatically rejected. This safeguard prevents unexpected stop outs, as opening a new position would further reduce the margin level.

If you attempt to place a new order on the Client Terminal while the margin level is below 100%, the system will reject the order. You will see the message "Not enough money" in the order window and "No money" in the Terminal.

Triggering of a margin call

When the margin level falls below 50%, a margin call will be triggered to warn that there are insufficient funds to maintain the positions.

Margin call is a message warning that there is a high possibility traders may not be able to maintain the positions. If a margin call is triggered, risk management measures such as adding more funds or closing some positions will be necessary.

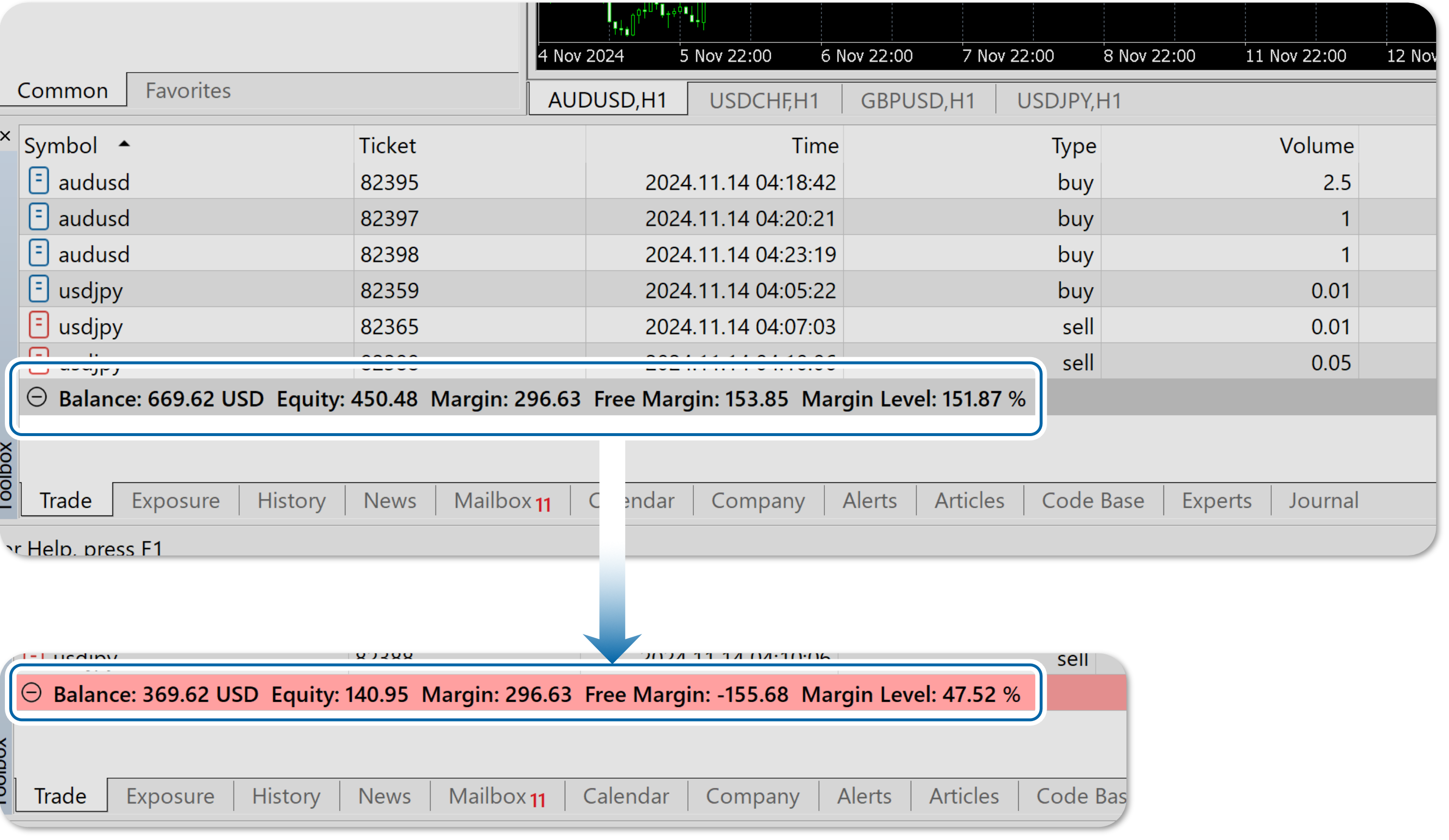

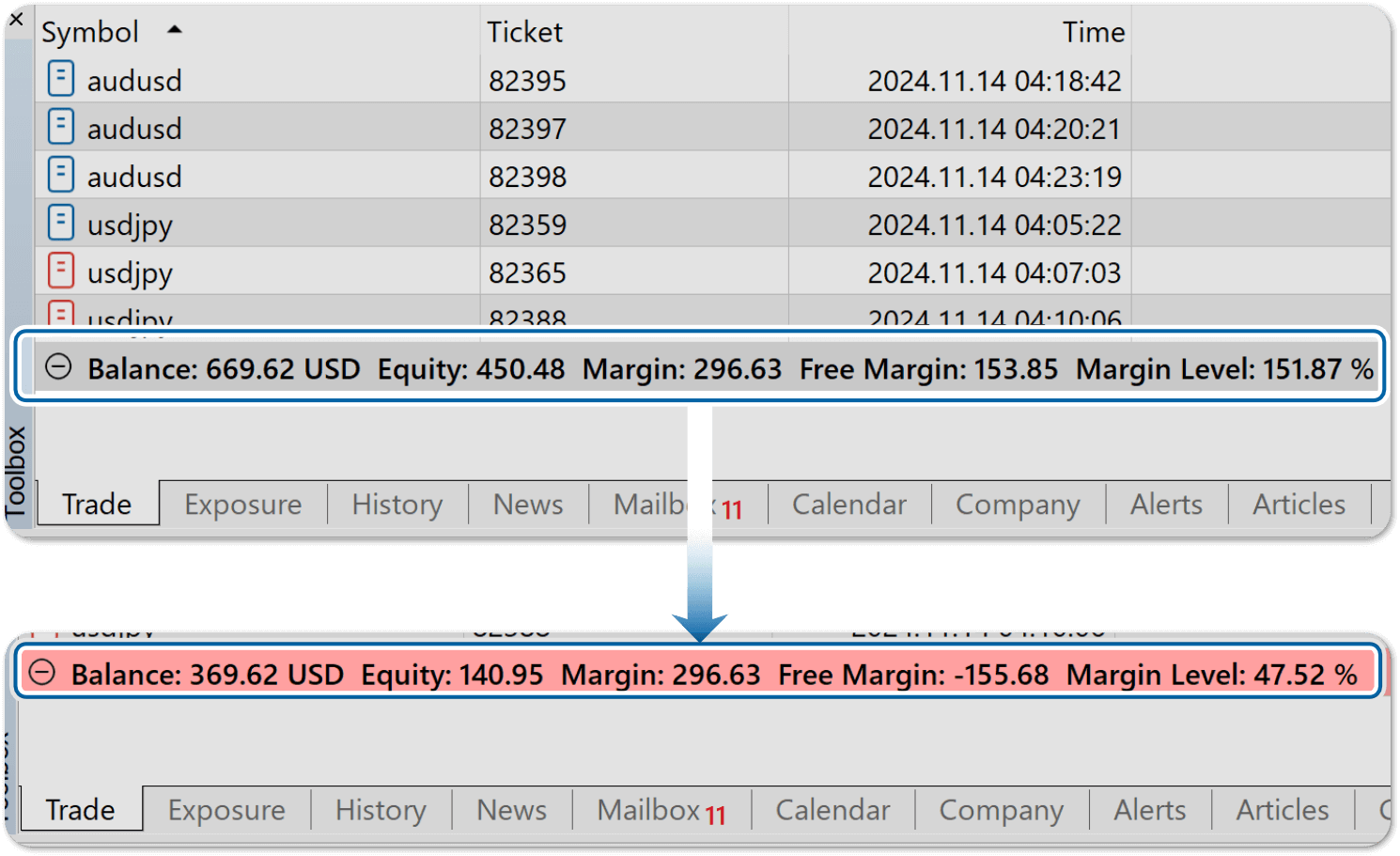

If a margin call is triggered, the profit and loss section in the terminal window will be displayed in red on MetaTrader 4/5.

Forced position liquidation (stop out)

If the margin level falls below the margin call threshold (50%) and further drops below 20%, the system will forcibly close open positions (stop out) through offsetting trades to prevent further loss expansion. While stop out finalizes the trader's losses, it ensures the protection of a minimum amount of the assets.

Rules for stop out (liquidation order)

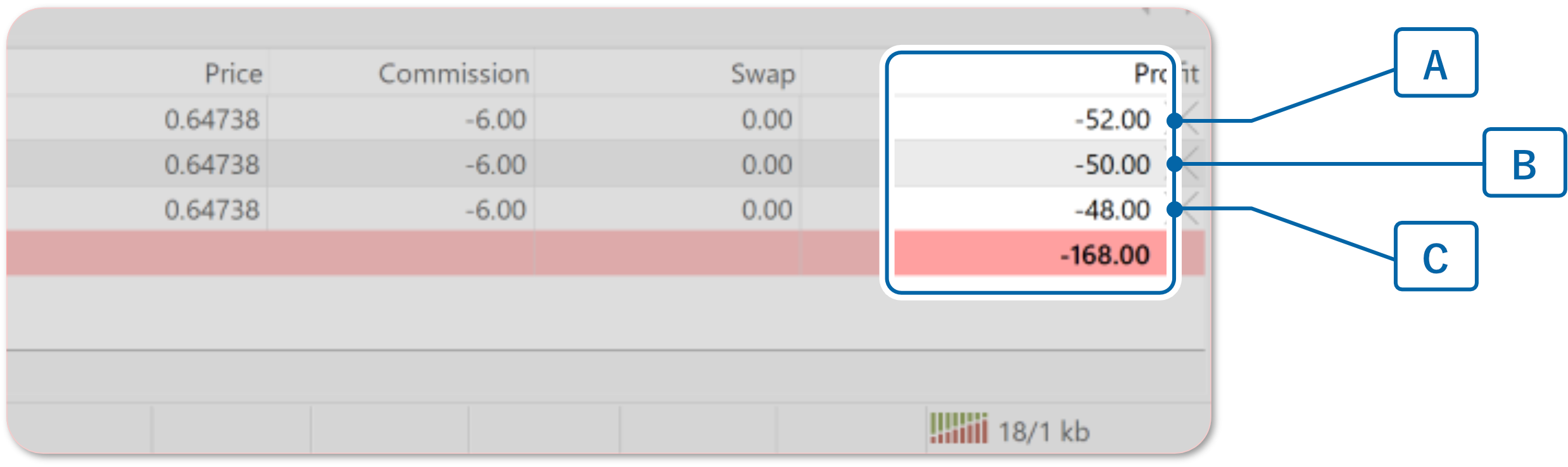

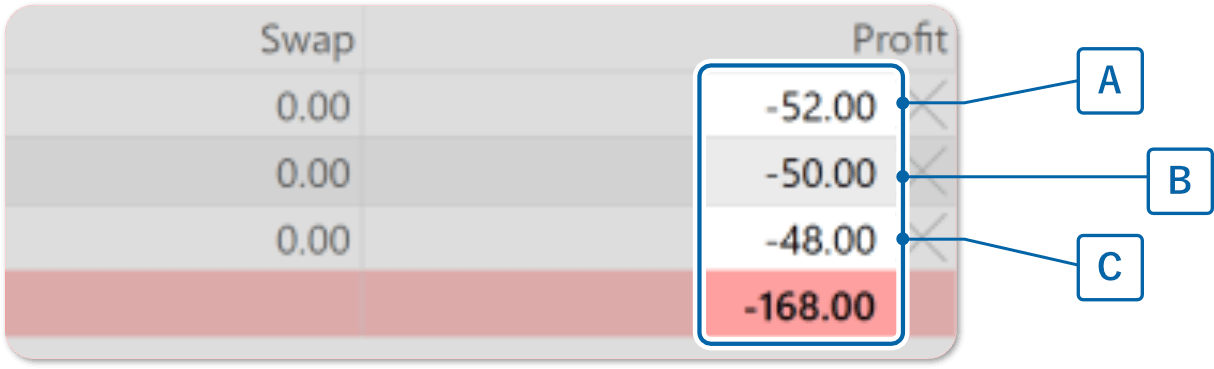

Once a stop out is triggered, positions will be automatically closed through offsetting trades, starting with positions showing the largest unrealized losses (negative profit) based on their loss-cut rank.

When a stop out is triggered, positions will be liquidated in order of the largest unrealized losses (negative profit), following the loss cut rank*1as described below.

| Date of Entries | Unrealized Losses | Stop Out Order | |

| Position A | September 1, 11:00 | -$52.00 | First |

| Position B | September 2, 14:00 | -$50.00 | Third |

| Position C | September 3, 16:00 | -$48.00 | Second |

| Stop Out Order | ||

| 1. Position A | September 1, 11:00 | -$52.00 |

| 2. Position B | September 2, 14:00 | -$50.00 |

| 3. Position C | September 3, 16:00 | -$48.00 |

*1Due to a decline in liquidity from counterparties or the market, stop out executions may not proceed in the specified order.

Zero cut (negative balance protection system)

If market liquidity increases beyond expectations and offsetting trades are not executed in accordance with stop out rules, the client’s margin may result in a negative balance. At FXON, in irregular situations such as when there is a high concentration of market orders, we implement a zero cut guarantee, ensuring that losses exceeding the assets are not charged to the customer. Negative balances in the margin are resolved within 24 hours, and the customer's balance is reset to 0.

While leveraged trading allows for the potential of significant profits with a small amount of funds, it also carries the risk of potential losses exceeding the margin.

When engaging in leveraged trading, the potential maximum loss can be significantly greater compared to the initial investment ratio. While it allows for the possibility of earning substantial profits with a small amount of funds, it also carries the risk of losing the entire assets.

We will implement protection measures, such as lowering leverage temporarily, to safeguard traders’ assets from sudden market volatility. However, please note that higher leverage increases the likelihood of losing assets even with small market movements.