FSA license rules compliant segregated management Reliable Management

Financial license-mandated segregated management and visualization of withdrawal transactions for fund management rules.

FSA license rules compliant segregated management Reliable Management

Financial license-mandated segregated management and visualization of withdrawal transactions for fund management rules.

FSA-compliant client fund management, insurance coverage, and dispute resolution membership

At FXON, we hold a financial license from the Financial Services Authority Seychelles (FSA) and operate under its strict rules. The FSA establishes trust obligations for client funds, and while complying with these regulations, we have strengthened our internal management system to ensure users can participate with peace of mind by securing healthy service operations and transparency through additional measures such as damage insurance for data leaks and disasters, and membership in arbitration organizations for resolving client disputes.

Client funds managed at Barclays Group’s Absa Bank

FSA licensed operators are required to maintain soundness and consumer protection in accordance with the Financial Consumer Protection Act (FCPA) and prudential regulations (*1) at financial institutions where client funds are deposited. At FXON, we have opened an account with Barclays Group's Absa Bank and maintain segregated management from assets related to corporate operations.

We have independently defined safety lines for handling client funds, expanding the scope of client funds to strictly manage unrealized liabilities (including unrealized profits) and unachieved liabilities (funds in transit according to user withdrawals) within the category of client funds to secure user safety.

In the event of bankruptcy or being deemed bankrupt by the audit institution, the trust account will be separated from our company's management by a third-party property manager, and the full amount of client funds will be returned directly to clients who are creditors.

*1Prudential regulation refers to policies to maintain the soundness and stability of the financial system (the overall financial markets and financial institutions used by various economic entities to conduct various financial transactions).

*1 Prudential regulation refers to policies to maintain the soundness and stability of the financial system (the overall financial markets and financial institutions used by various economic entities to conduct various financial transactions).

Membership in third-party arbitration organization for client dispute resolution

If customers cannot resolve issues after filing complaints with FXON regarding all services (trading, fund management, etc.), they can file complaints with the Financial Commission, a third-party organization specializing in resolving disputes between investors and brokers.

The purpose is to resolve disputes between investors and brokers neutrally, quickly, and professionally, investigating dispute factors and, if member companies are at fault, executing direct compensation for damages to customers up to 20,000 euros per complaint from a special compensation fund consisting of member company funds.

Transparent deposit/withdrawal process for a safe experience

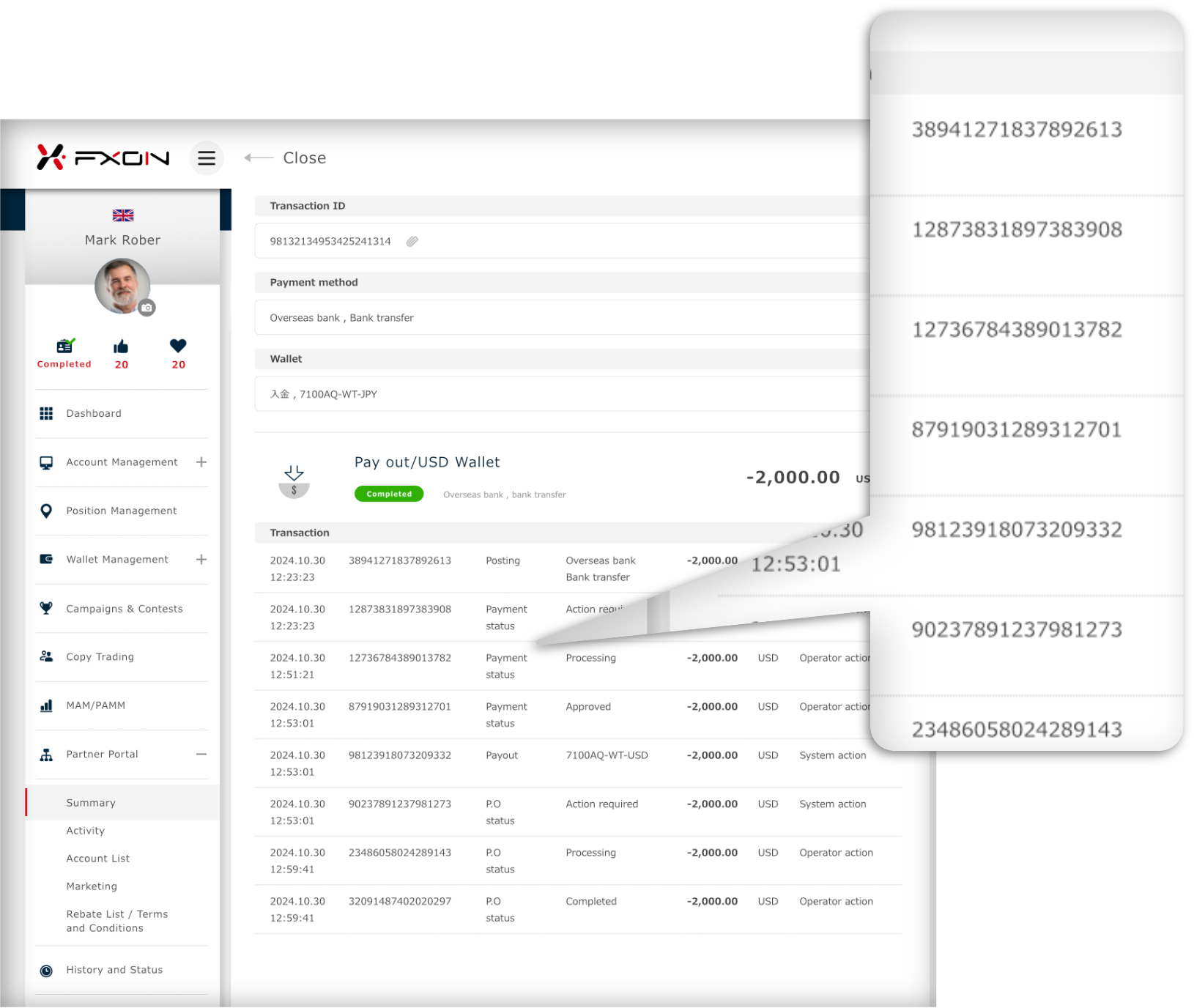

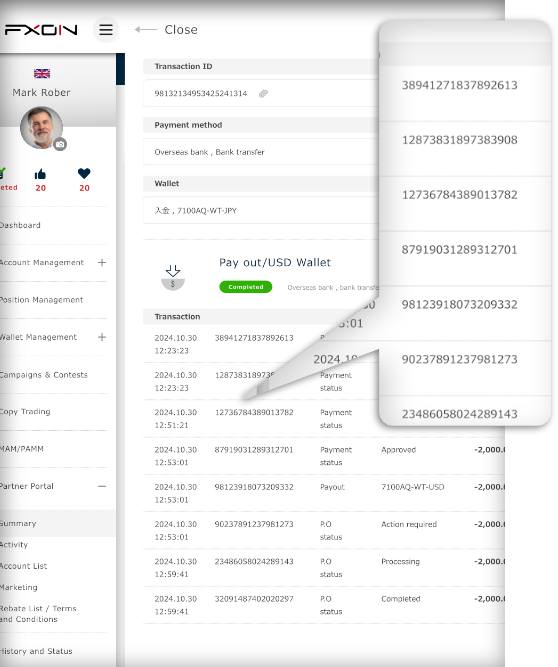

Assign traceable "ProcessID" during fund transfers

Statistics show that the most common procedure that users feel anxious about when participating with FX brokers is related to withdrawals (*1). Therefore, at FXON, we have assigned a 17-digit ProcessID to visualize the processing (deposits, withdrawals, fund transfers) of fund movements, which many users feel anxious about.

ProcessID was developed with the same concept as cryptocurrency blockchain transactions and is data (numbers) that describes value (asset) transfers, namely "transactions involving funds" according to prescribed rules.

ProcessIDs are assigned to each transaction accompanying value transfer, and users can confirm what process and status their funds are currently in using the ProcessID.

For example, when making a withdrawal to your bank account, a ProcessID is assigned from the moment you request the withdrawal.

Next, ProcessIDs are assigned to all processes, such as whether our back office is confirming the user's withdrawal request, whether that withdrawal has been approved, whether bank procedures for withdrawal have been conducted, etc., making the withdrawal process transparent for users and allowing us to provide accurate information quickly in response to user inquiries.

Currently, ProcessID can be checked from users' own Client Portal, but we are preparing to make this an open platform where third parties can also view value transfers. This will allow third parties to monitor whether deposits and withdrawals for FXON participants are functioning normally. For withdrawals, third parties will be able to monitor value transfer processes such as how long it takes for other users to complete collection procedures.

By making such fund-related aspects transparent, we aim to provide a service that users can participate in with peace of mind.