Best conditions supported by back office Superior Trading Conditions

Our dealing desk's efforts to present the best conditions to end users as a retail broker.

Best conditions supported by back office Superior Trading Conditions

Our dealing desk's efforts to present the best conditions to end users as a retail broker.

Meeting many traders' demands with industry-leading spreads and maximum 1,000x leverage

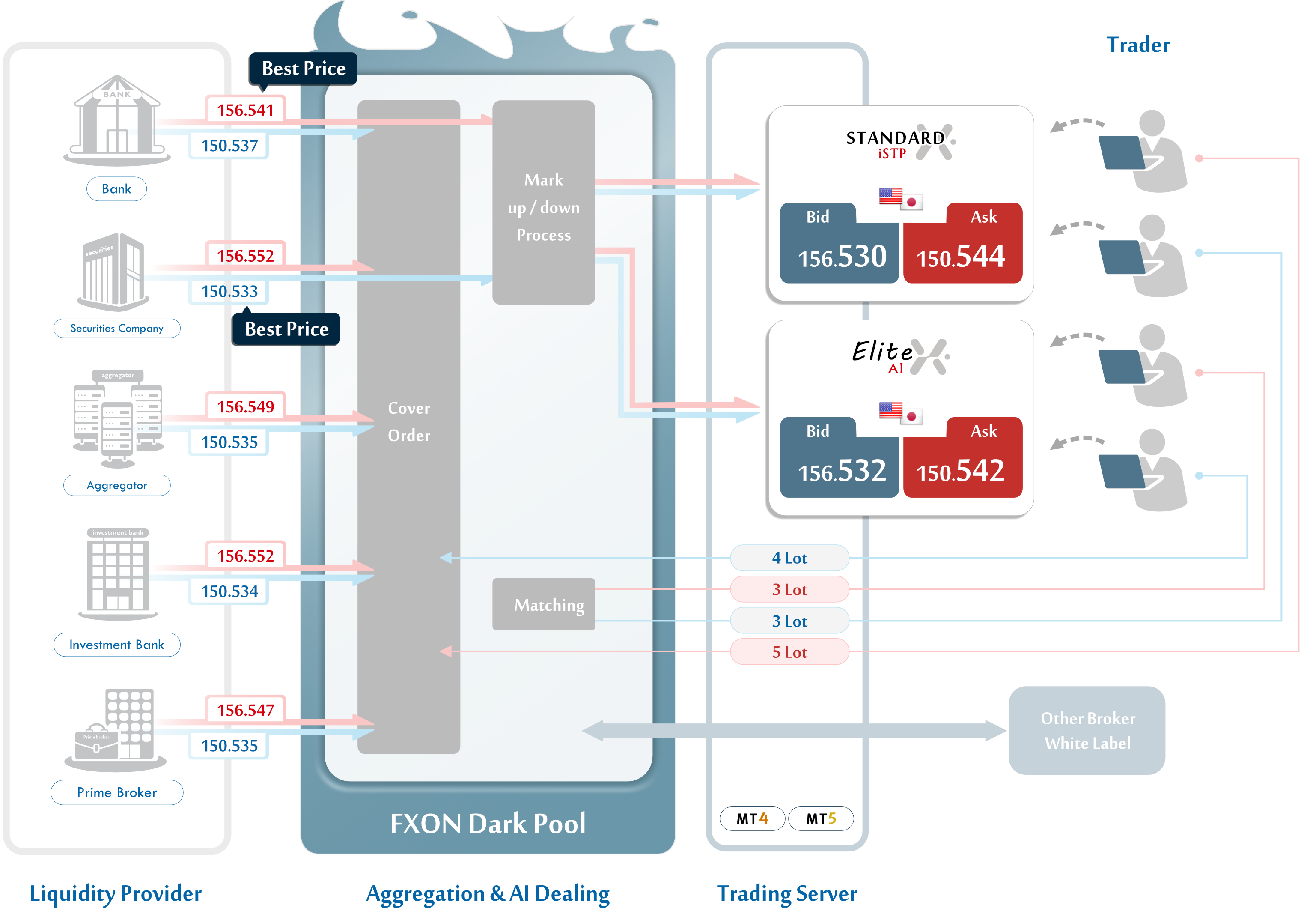

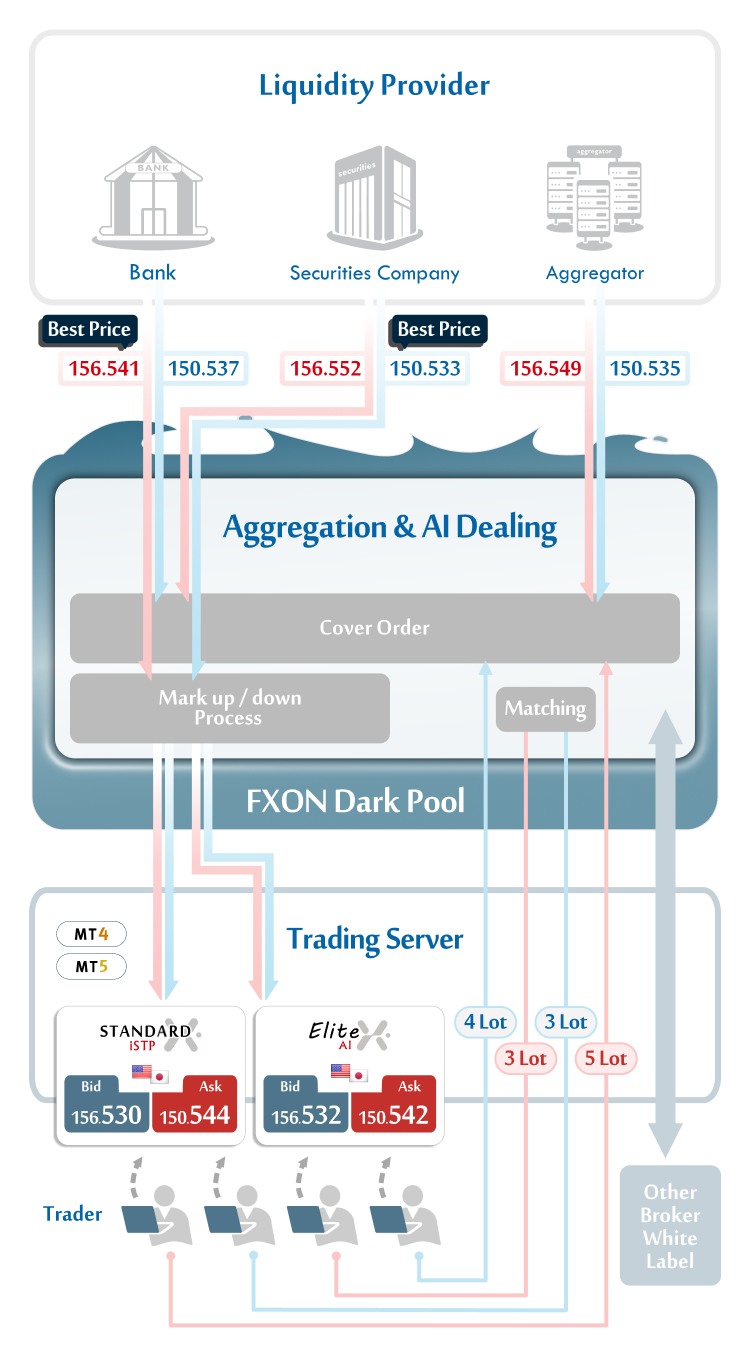

FXON has partnered with dozens of liquidity providers to secure high liquidity and has formed its own dark pools to consistently provide the best prices to users. The liquidity pool includes participation from financial institutions such as hedge funds, major prime brokers, and aggregators, functioning to provide traders with the best trading conditions through matching orders and offsetting trades. FXON opens these large-scale dark pools to affiliated small retail brokers and white labels, and through this scalability, we can offer traders high leverage and industry-leading spreads.

AI technology in dealing desk

The dealing desk has digitized and accumulated trader orders for analysis over many years. By parameterizing this trade data and liquidity provider liquidity, AI has learned through deep learning. We have succeeded in pattern-matching time periods, trading volumes, and trading product trends. As a result, traders can execute trades quickly at the best possible prices during any time period.

Eliminated all human intervention in dealing through eight years of pattern analysis

Attempts to give AI dealing decision authority through algorithms and pattern analysis began in 2017. FXON began conceptualizing and developing applications and collecting data for AI machine learning and big data analysis more than 8 years before service launch, aiming to build a dealing desk without human intervention.

In 2020, we released a beta version of the AI dealing system incorporating certain patterns, and after repeated updates, in late 2024, we completed a highly fair dealing system free from unfair human intent and conflicts of interest pressures.

Then in 2025, FXON finally launched its service as a retail broker.

Achieved spreads as low as 0.0 Pips(*1) for USD pairs and JPY crosses

Through partnerships with numerous liquidity providers and forming a network where many participants use dark pools, FXON provides traders with the most advantageous spreads.

For currency pairs with high trading volume (as of January 2025, targeting USD pairs and JPY crosses), we achieve spreads as low as 0.00 pips during high liquidity periods, offering advantageous trades unavailable elsewhere.

At FXON, spikes showing prices far from the market due to liquidity depletion during large price movements and requotes due to significantly reduced execution are extremely rare, providing an accurate and stable trading environment during trading hours.

*1 Based on minimum values measured during European market hours to the US market opening for USD/JPY and EUR/USD currency pairs. All account types (Standard and Elite) have variable spreads.

Offering over 210 industry-leading symbols through high liquidity

Through securing high liquidity, FXON provides over 210 symbols including not just forex pairs but also metals, energies, cryptocurrencies, indices, and stocks.(*1)

Popular stock indices like the Dow Jones and Nikkei 225 can be traded under advantageous conditions with high liquidity. Additionally, 23 types of highly volatile cryptocurrency products including Bitcoin and Ethereum are available for 24-hour trading with high leverage. (*2)

■ All available products (common to Standard and Elite accounts)

| Category | Symbol count | Symbols |

| Forex pairs | 71 | 7 major pairs, 41 minor pairs, 23 exotic pairs |

| Metal CFD | 6 | Gold, Silver, Palladium, Platinum |

| Index CFD | 12 | Nikkei 225 Index (Japan), NASDAQ 100 Index (US), NY Dow Jones Average Index (US), FTSE 100 Index (UK), FTSE China A50 Index (China), and others |

| Energy CFD | 3 | Natural Gas, Oil |

| Cryptocurrency CFD | 25 | Bitcoin, Ethereum, Litecoin, Dogecoin, Litecoin, TRON, Monero, and others |

| Stock CFD | 104 | (US Market 53 symbols) Amazon, Apple, Nvidia, Netflix, Tesla, etc. (EU Market 20 symbols) Airbus Group, BNP Paribas, Mercedes-Benz Group AG, Unilever, etc. (Asia Market 31 symbols) Xiaomi, KDDI, Softbank, Lenovo Group, HSBC Holdings, etc.US Market 53 symbols, EU Market 20 symbols, Asia Market 31 symbols |

| Category Symbol count |

Symbols |

| Forex pairs 71 symbols |

7 major pairs, 41 minor pairs, 23 exotic pairs |

| Metal CFD 6 symbols |

Gold, Silver, Palladium, Platinum |

| Index CFD 12 symbols |

Nikkei 225 Index (Japan), NASDAQ 100 Index (US), NY Dow Jones Average Index (US), FTSE 100 Index (UK), FTSE China A50 Index (China), and others |

| Energy CFD 3 symbols |

Natural Gas, Oil |

| Cryptocurrency CFD 25 symbols |

Bitcoin, Ethereum, Litecoin, Dogecoin, Litecoin, TRON, Monero, and others |

| Stock CFD 104 symbols |

(US Market 53 symbols) Amazon, Apple, Nvidia, Netflix, Tesla, etc. (EU Market 20 symbols) Airbus Group, BNP Paribas, Mercedes-Benz Group AG, Unilever, etc. (Asia Market 31 symbols) Xiaomi, KDDI, Softbank, Lenovo Group, HSBC Holdings, etc.US Market 53 symbols, EU Market 20 symbols, Asia Market 31 symbols |

*1 Metals, energies, cryptocurrencies, indices, and stocks are CFD trading.

*2 Trading hours vary by product. Please check individual product trading hours for details.