Execute your orders in the best and fairest way Best Execution Policy

We utilize our proprietary dark pool and diverse liquidity providers to execute your orders under optimal conditions.

Best Execution Policy

At FXON, we have established a best execution policy to execute your orders in the best and fairest way. We strive to execute buy and sell orders from customers according to the following policies.

Execute with the best trading conditions and hedge excessive risks

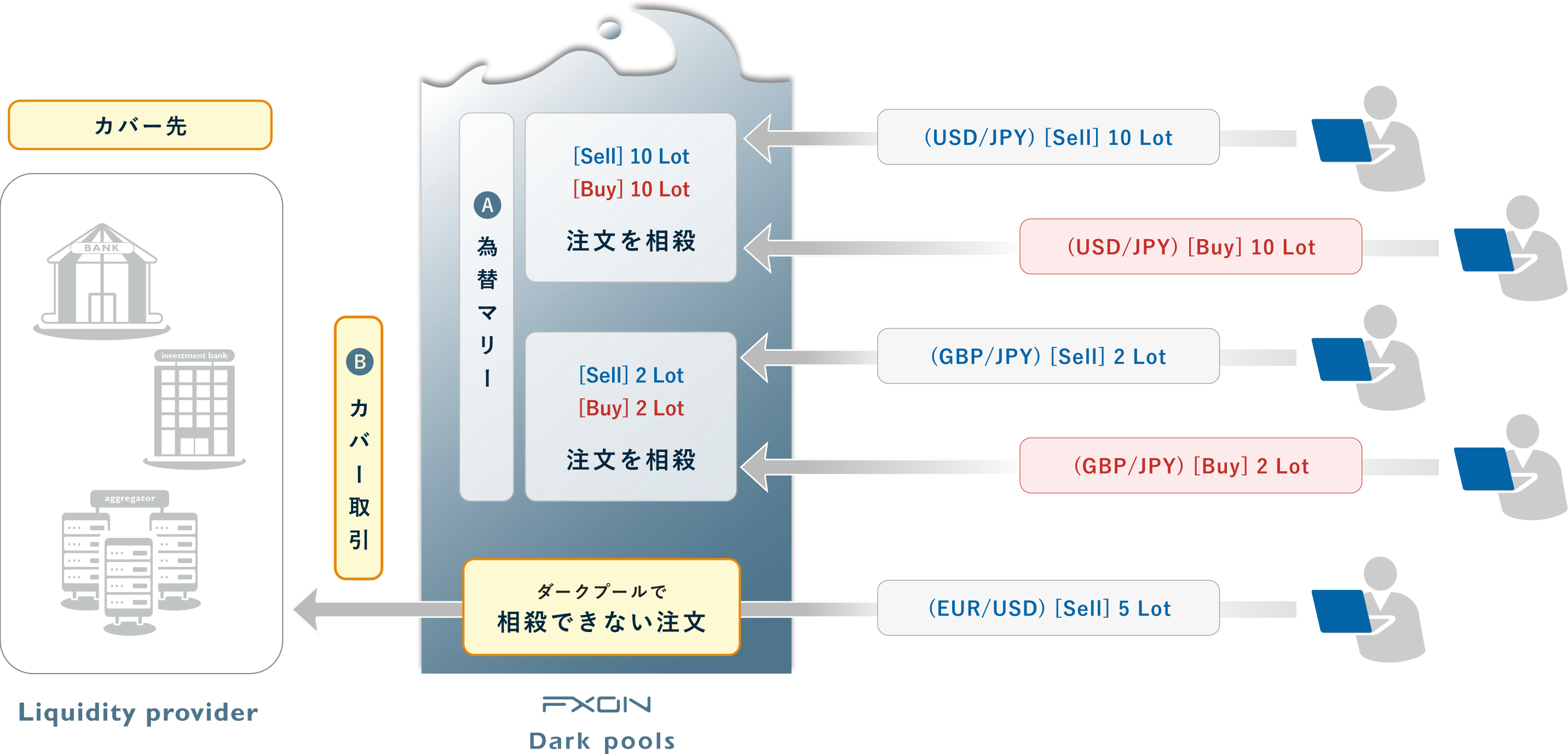

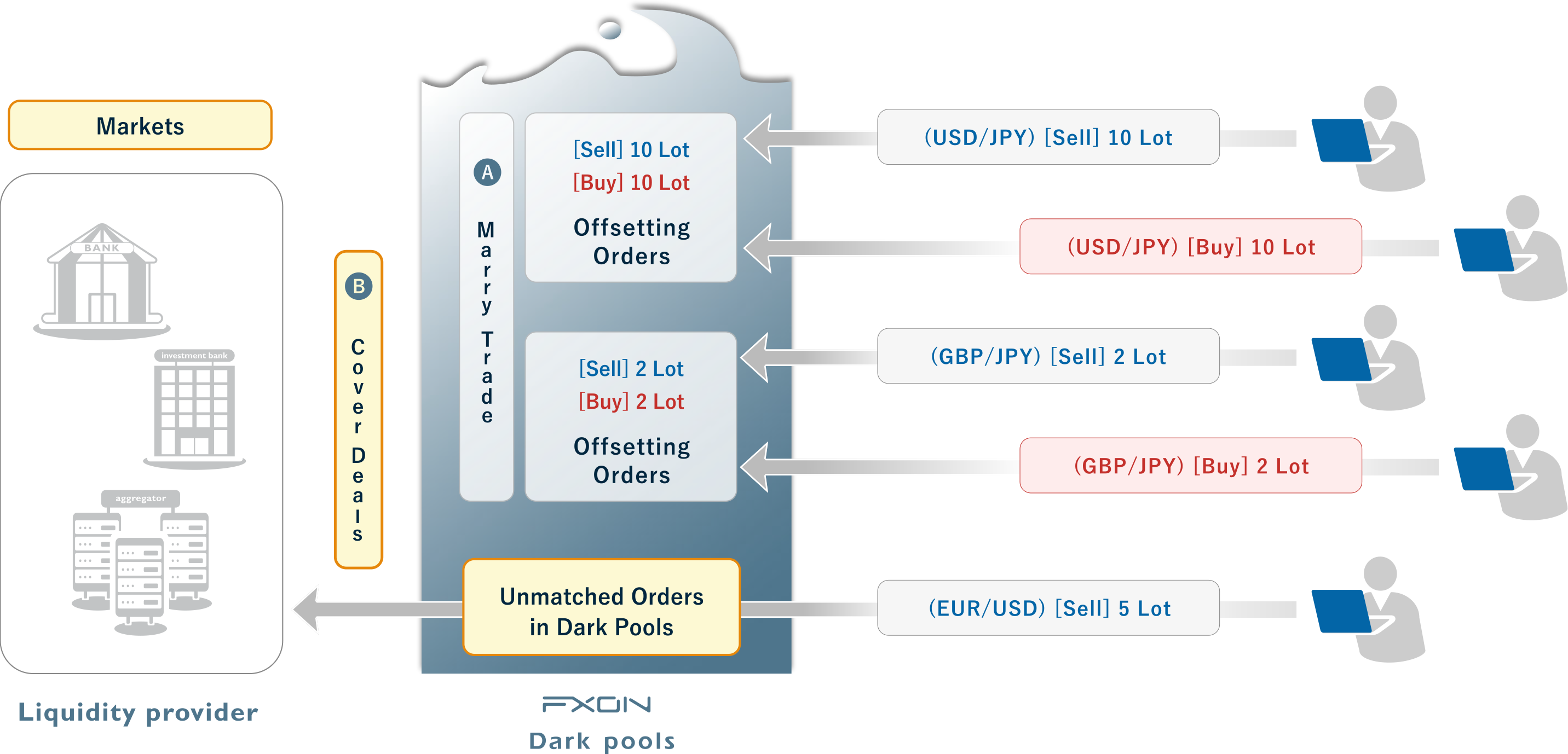

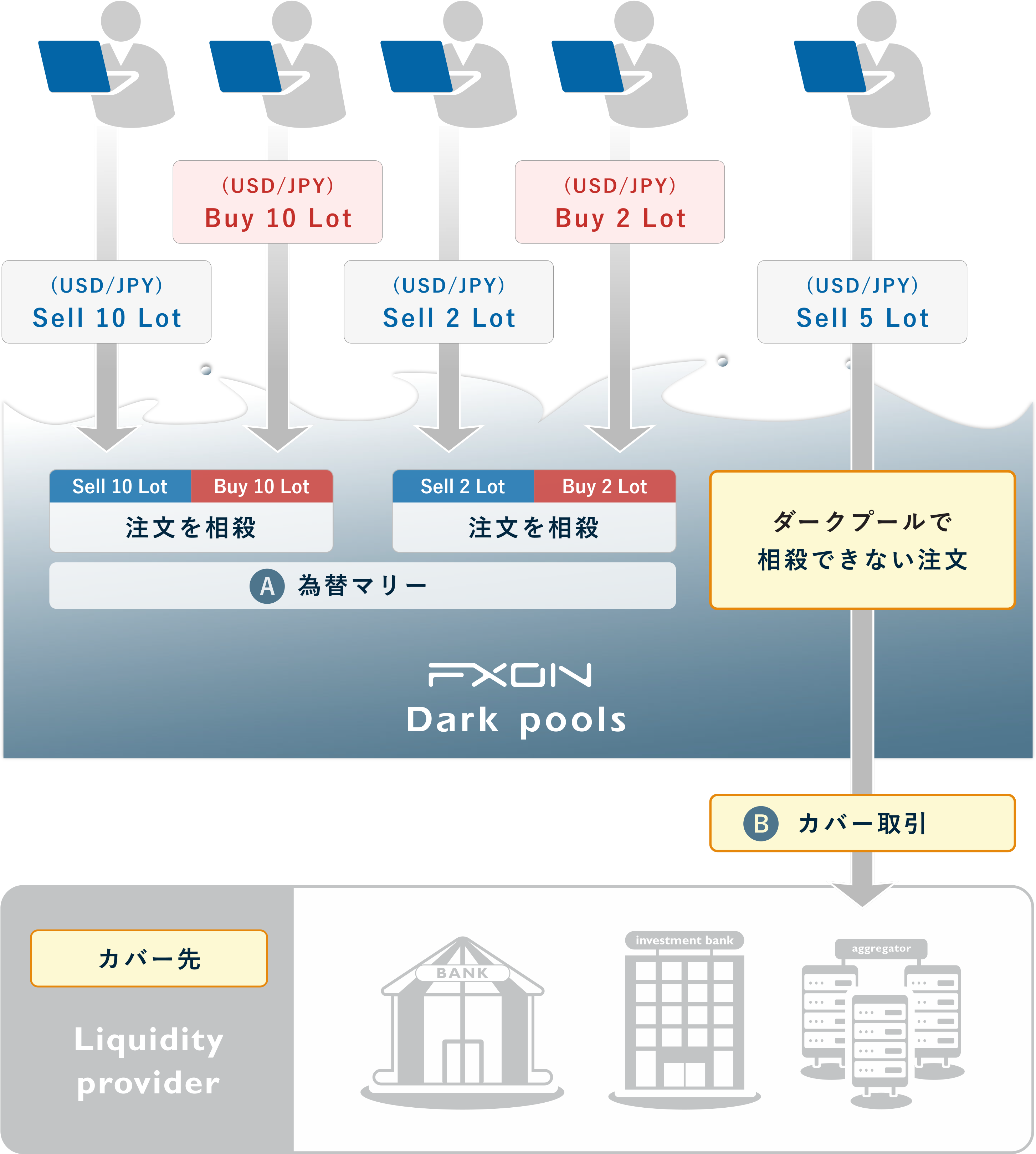

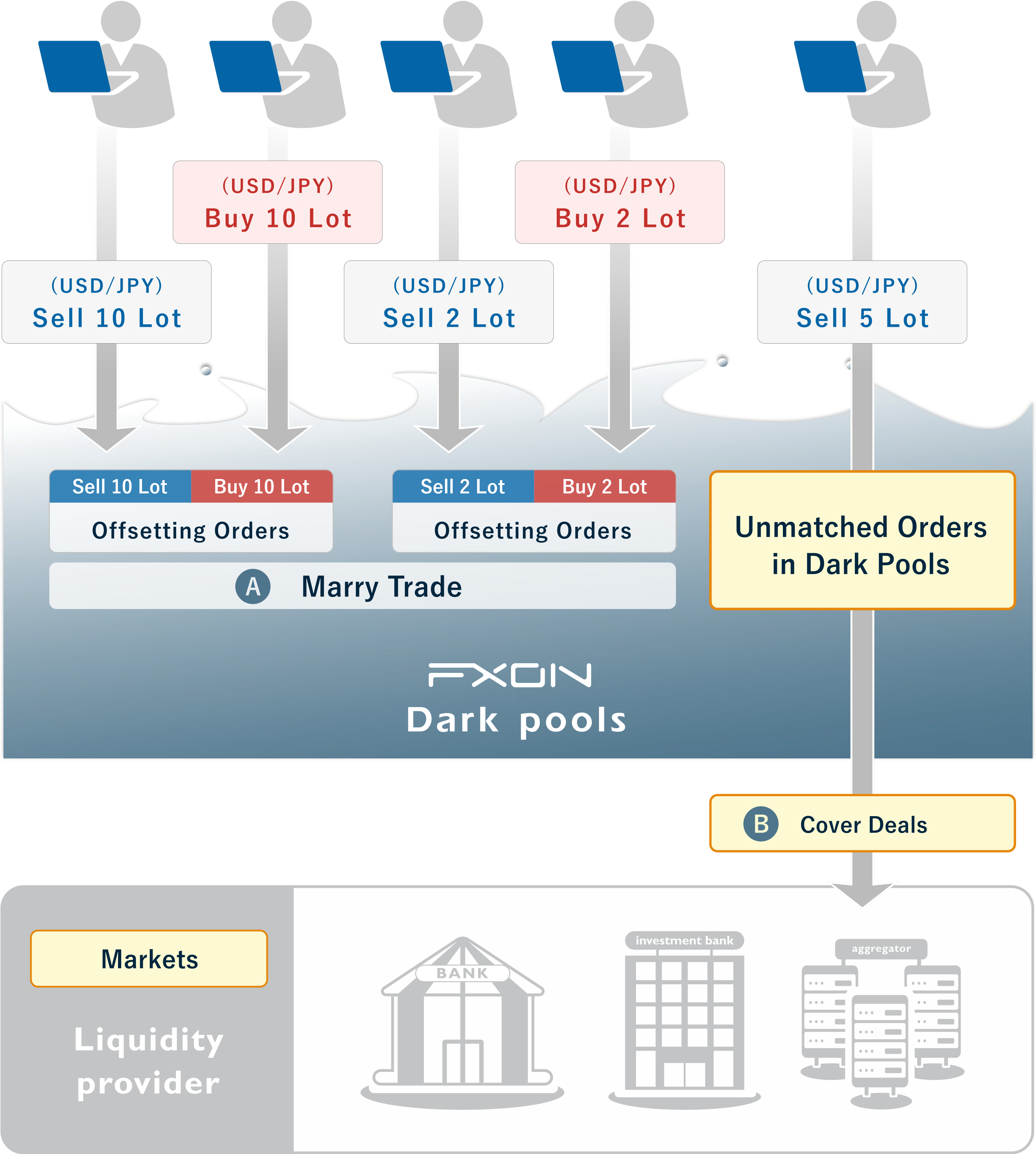

At FXON, for customer buy and sell orders, we have built a system that executes without human intervention for each product (forex pairs, cryptocurrencies, indices, stocks, metals, energies) and account type (Standard/Elite): (A) matching customer orders through our proprietary dark pools (hereinafter referred to as "order matching"), (B) executing cover trades with multiple liquidity providers and aggregators (hereinafter referred to as "LP") when customer order net positions reach a certain volume. This allows us to manage trading to suppress excessive market fluctuation risk related to customer positions without any conflicts of interest with customers in any trading.

<Order execution method at FXON's dealing desk>

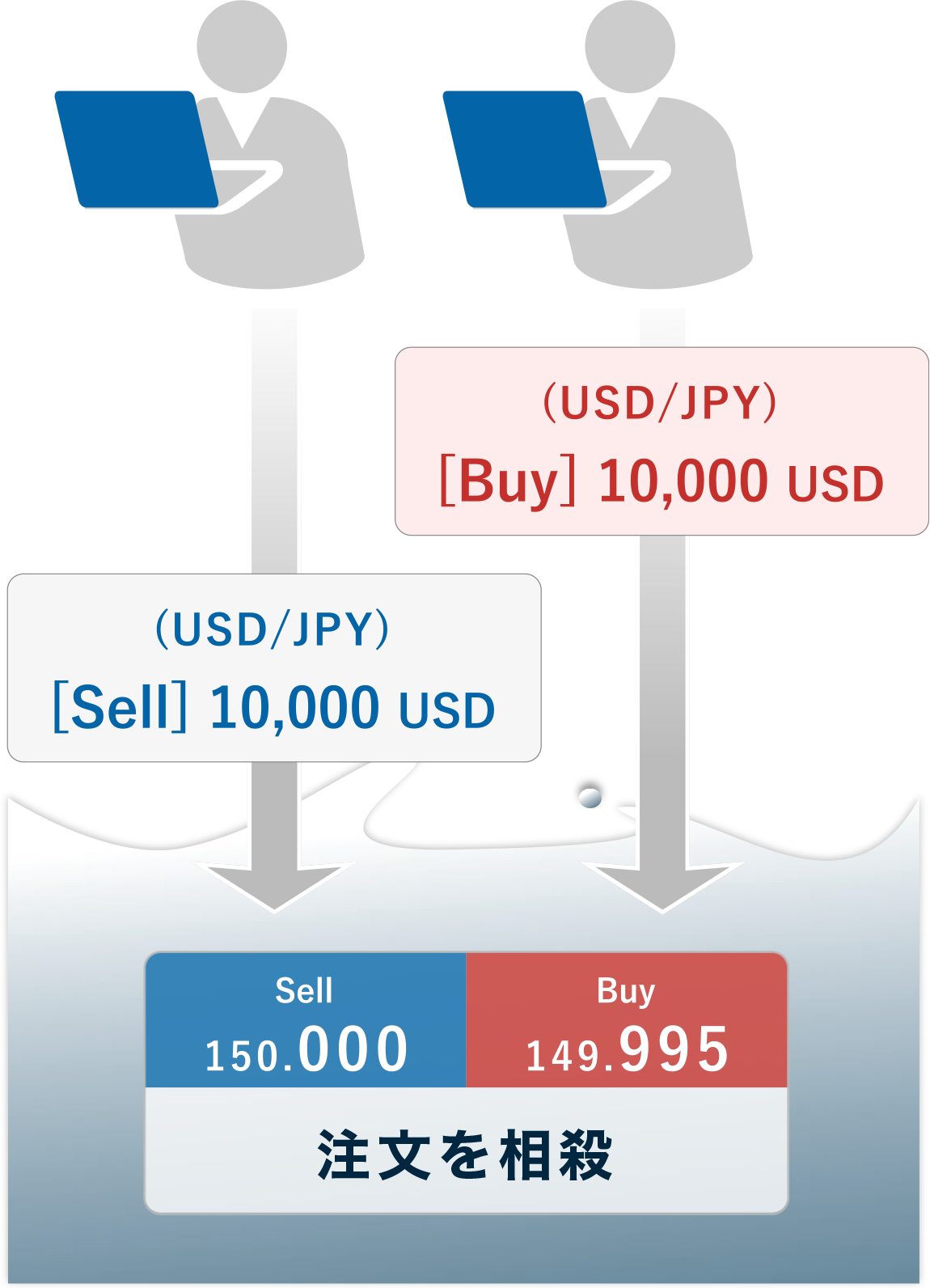

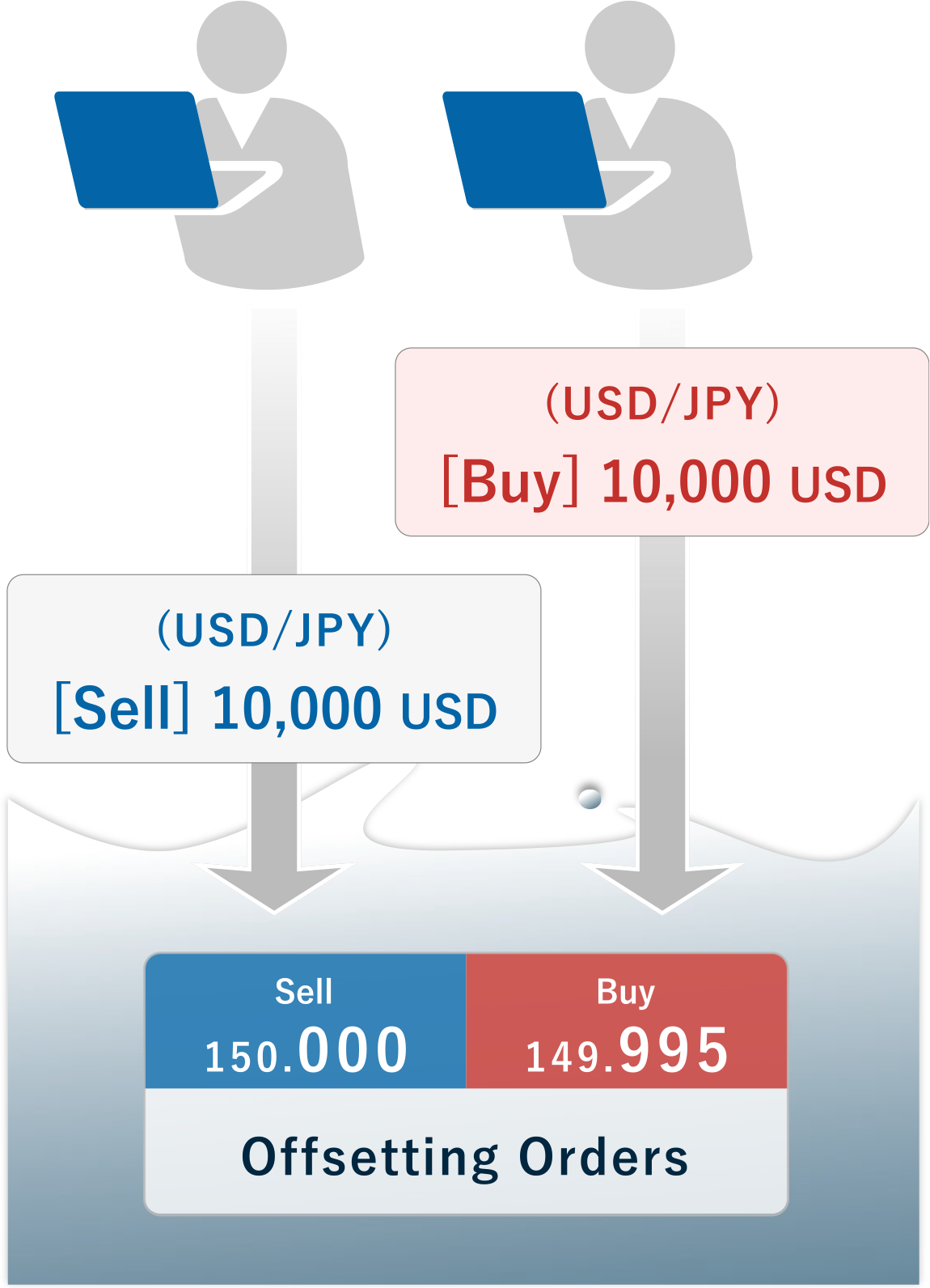

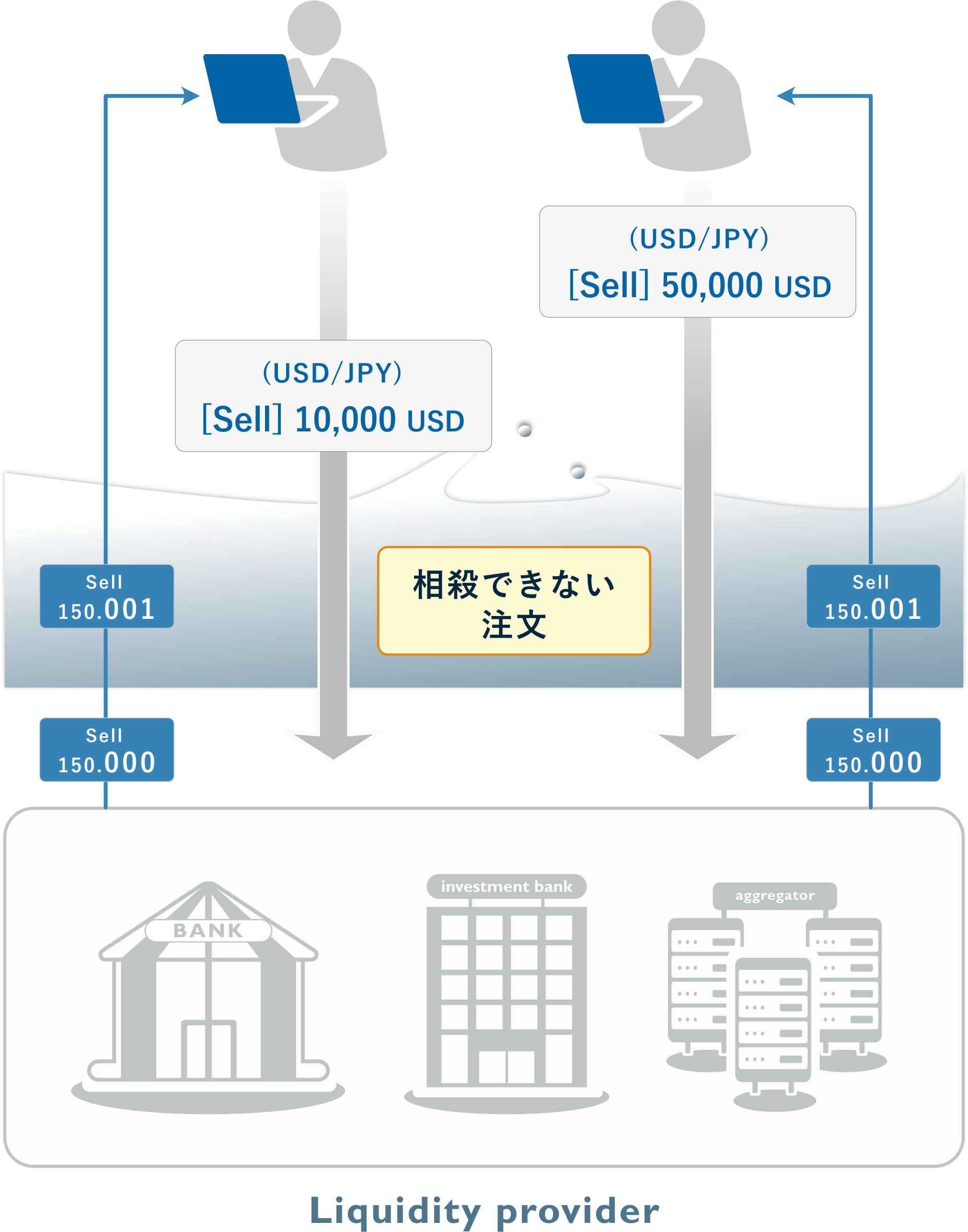

■ Order matching

Links sell orders and buy orders of the same symbol and offsets customer orders against each other. When receiving buy orders and sell orders in equal amounts, there is zero foreign exchange risk and no cover trade is performed. This allows us to avoid foreign exchange risk and profit conflict portions.

<Order method>

For example, if we receive buy and sell orders for 10,000USD (0.1Lot) at prices of 150.000(Sell)/149.995(Buy) for the USD/JPY currency pair and offset them through order matching in the dark pool. In this case, the difference is 0.005 yen, and our company's profit from this position offset becomes 100USD.

USD/JPY 150.000

10,000 USD

Buy order

USD/JPY 149.995

10,000 USD

Sell order

0.005

Difference

20,000

USD

100 USD

FXON's profit

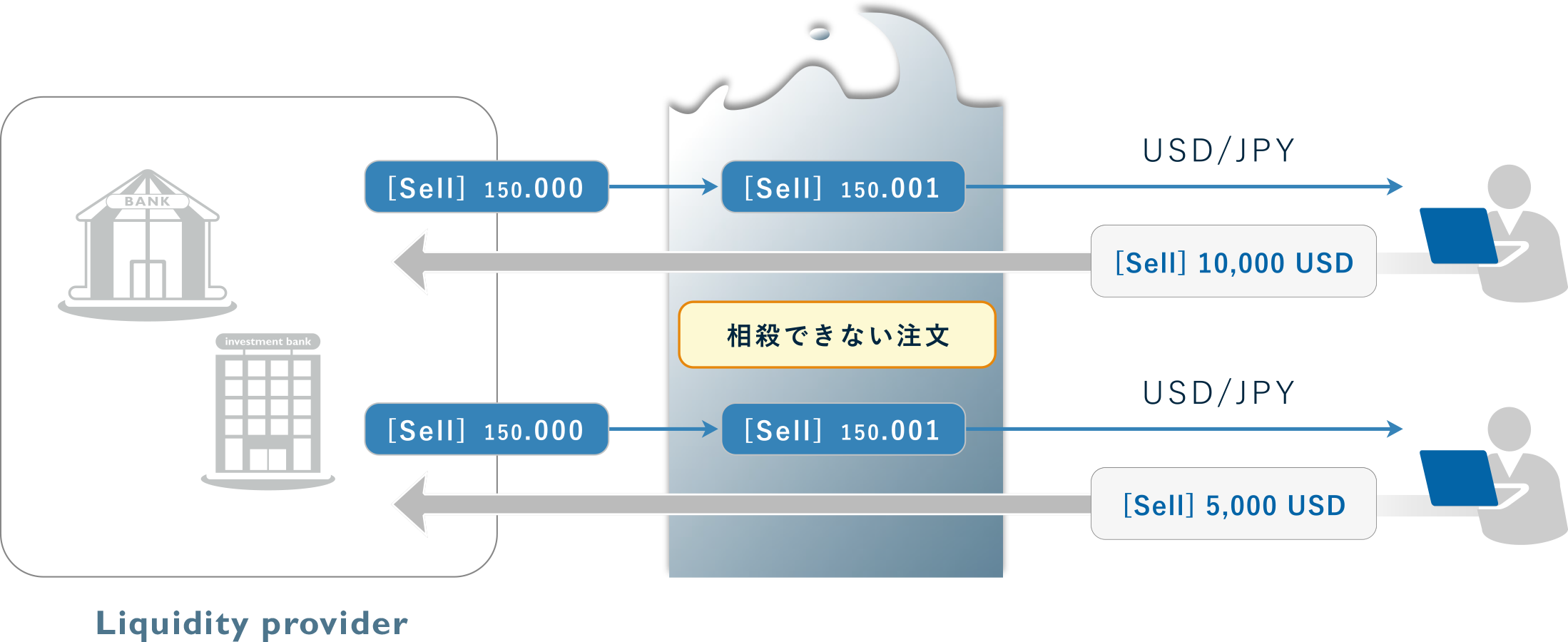

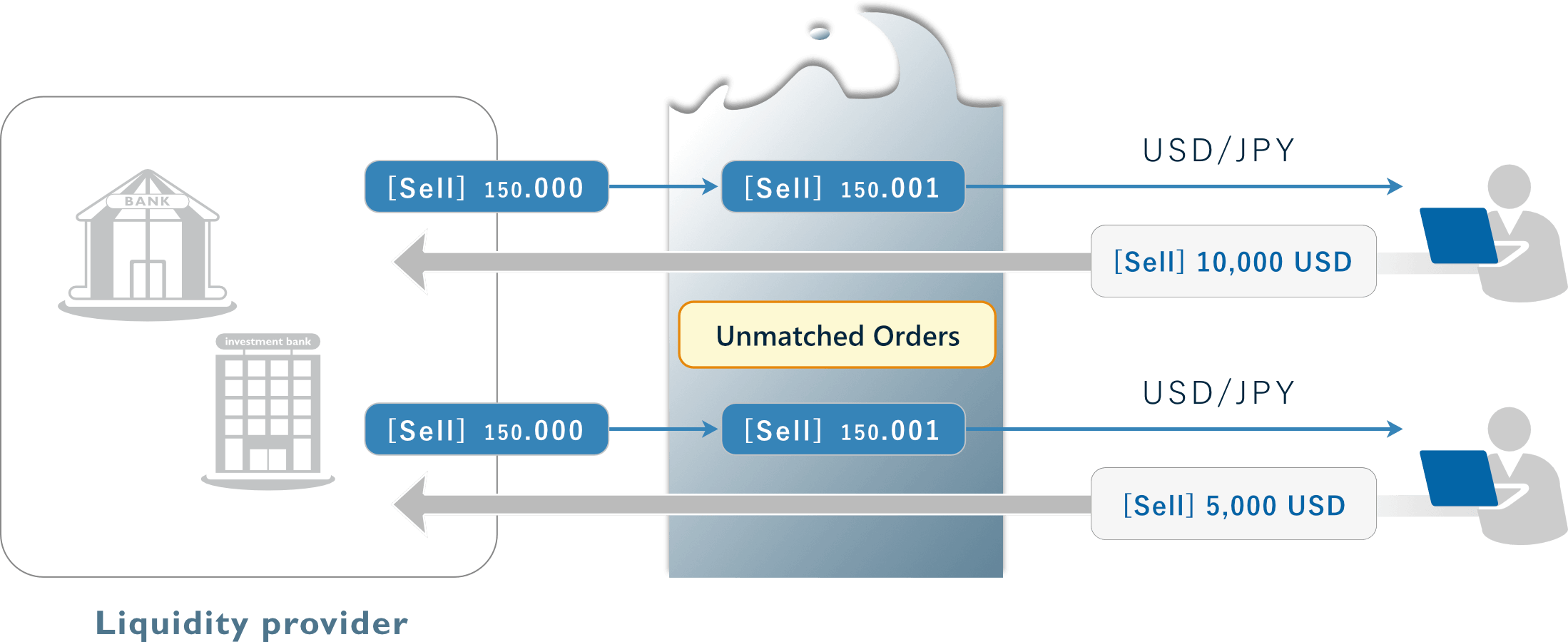

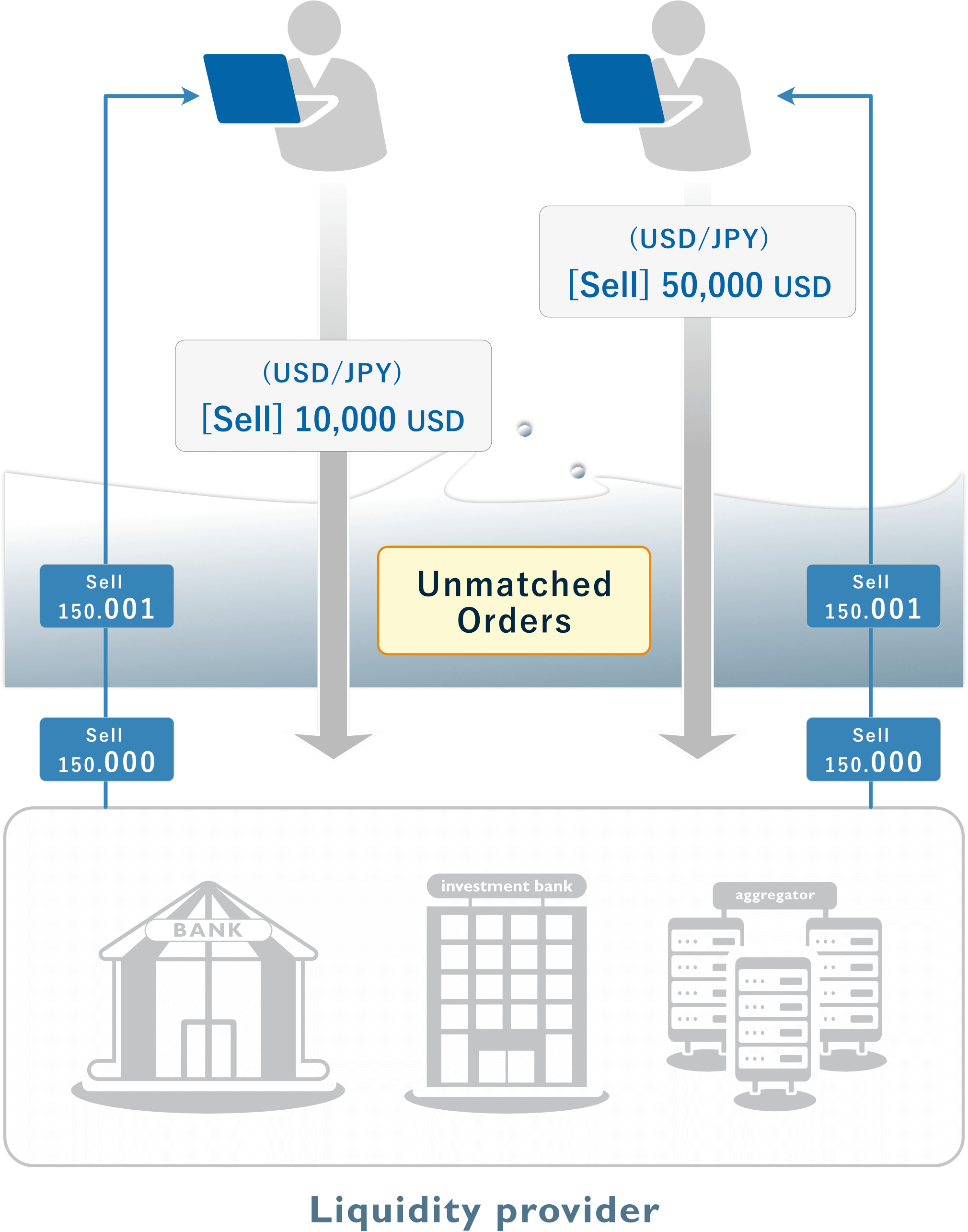

■ Cover trade

When customer trades cannot be offset through order matching, we perform cover trades with partnered LPs. This allows us to avoid foreign exchange risk and profit conflict portions.

<Order method>

For example, if we receive a buy order price of 150.000 yen for USD/JPY from an LP, and assuming our company executes a sell order from a customer at 150.001 yen after adding a markup of about 0.001 yen to the price provided by the LP. In this case, the difference is 0.001 yen, and our company's profit from this position offset becomes 15USD.

USD/JPY Sell

150.001 JPY

FXON's

offer price

USD/JPY Sell

150.000 JPY

LP's

offer price

0.001

Difference

$ 15,000

USD

$ 15 USD

FXON's profit

Order types

At FXON, we receive and execute customer orders in the following ways.

■ Market order

A market order is a method where you place an order without specifying a price, and the price is determined after the trade is executed. For buy orders, it's the lowest ask price, and for sell orders, it's the highest bid price. For symbols with large price fluctuations or products with low volume, execution may occur at unexpected prices due to low liquidity.

■ Limit order

A limit order is a method where you set a price you want to buy or sell at in advance, and the order is automatically executed when the rate reaches the specified price. There are buy limit orders and sell limit orders, where buy limit orders specify a price lower than current prices for buy orders, and sell limit orders specify a price higher than current prices for sell orders. This type of order is used when you want to place orders at desired prices in the same direction as the trend. With limit orders, you can execute trades at your desired price, but orders won't be executed until the specified price is reached if the market moves in a direction opposite to what was expected.

■ Stop order

A stop order is an order method that places buy or sell orders against the trend, opposite to limit orders which place orders with the trend. In stop orders, you specify a price higher than current prices for buying, and a price lower than current prices for selling. This order method is used for techniques such as aiming for trend reversals with counter-trend trading (trading in the opposite direction of the trend). Like limit orders, it has the advantage that trades will automatically execute when reaching desired prices even if you're not constantly watching the chart, as you can specify desired prices in advance.

■ OCO close order

An OCO close order is an order method where you place two settlement orders simultaneously for an open position, and when one order is executed, the other order is automatically canceled.With OCO close orders, you can set both take profit (T/P) and stop loss (S/L) at once, allowing for risk management even when away from the market, providing peace of mind. For example, if you buy USD/JPY at 1USD=150.000JPY, you can set to take profit at 1USD=151.000JPY and stop loss at 1USD=149.000JPY, allowing you to secure profits while preventing expansion of losses.

■ If-Done order

An If-Done order is an order method where you set take profit (T/P) or stop loss (S/L) when placing a new limit order (or stop order). For example, if USD/JPY is currently at 1USD=149.000JPY, you can set at once to execute a buy order when it reaches 1USD=150.000JPY and execute a sell settlement for profit when it reaches 1USD=151.000JPY. Similarly for stop loss settings, you can set stop loss settlement orders at the time of placing new orders.

■ If-Done OCO order (If Done, One Cancel the Other)

An If-Done OCO order, also called an IFO order, is an order method that combines an If-Done order with a settlement OCO order. If-Done OCO orders allow you to set both take profit (T/P) and stop loss (S/L) at once when placing a new limit order (or stop order), and when the order executes at the specified price, the preset take profit and stop loss settings become active. For example, you place a new order at 1USD=150.000JPY and set to take profit when it reaches 1USD=151.000JPY or stop loss when it reaches 1USD=149.000JPY. When either take profit or stop loss executes, the opposite order set is automatically canceled.